原文标题:《Binance 赚钱效应指南:BNB 持有党 vs Alpha 积分党,如何实现收益最大化?》

原文作者:Viee,Biteye 核心贡献者

从 Launchpool 挖矿,到 Megadrop、HODLer 空投以及备受瞩目的 Alpha 积分体系下的 Web3 钱包 TGE 活动、Alpha 空投,Binance 的赚钱效应持续迭代,为不同风险偏好和资金体量的用户提供了机会。

然而,面对层出不穷的新活动,多数散户常常感到眼花缭乱,不知从何下手。本文旨在深度梳理 Binance 当前主流的四种赚钱活动类型——Binance 钱包 Alpha 空投/TGE、Launchpool、HODLer 空投及 Megadrop,详解各项活动的核心规则、参与流程及最新的收益情况。更重要的是,本文将在最后总结「稳健持有 BNB」和「积极刷 Alpha 积分」两大核心策略下的具体赚钱路径与技巧,帮助大家在 Binance 生态中高效掘金,实现收益最大化。

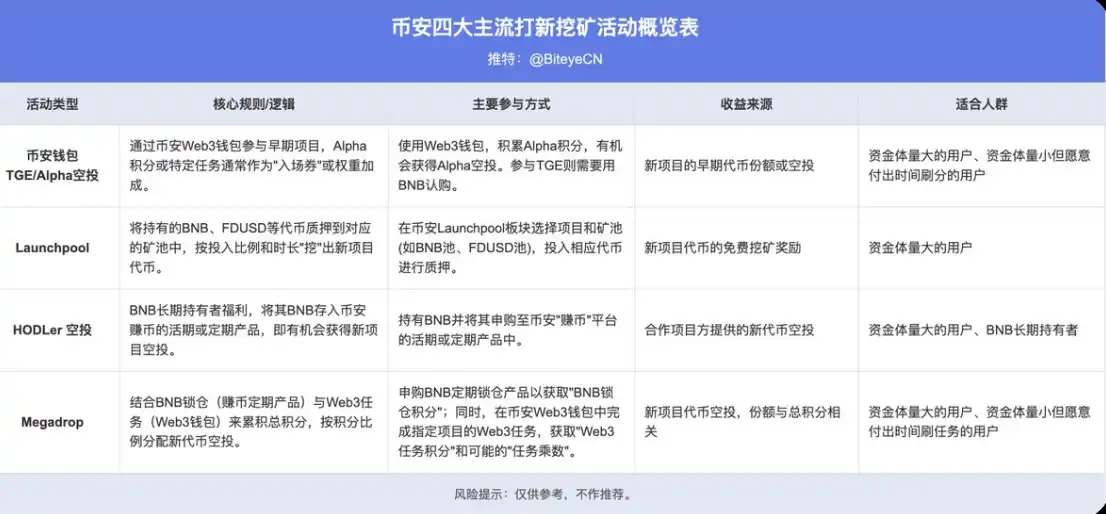

一、Binance 四大主流打新挖矿活动概览表

为了让大家对 Binance 当前主要的打新挖矿活动有一个快速的整体印象,我们通过下表对它们的规则和流程进行概括性对比:

接下来,我们将对每一项活动进行更详细的解析。

二、Binance 钱包 TGE 活动 & Alpha 空投:抢滩早期项目的「船票」

Binance Alpha 板块推出了两大核心高价值活动:代币生成活动(TGE)和 Alpha 代币空投。核心在于通过 Binance Web3 钱包,在项目代币公开发行(TGE)的初始阶段参与,甚至直接获得空投。这类活动与 Binance 的 Alpha 积分系统紧密相连,一个高 Alpha 积分的账户,往往能更容易获得参与资格。

2.1 核心规则与参与流程

用户通过 Binance Web3 钱包,满足 Alpha 积分门槛,获得认购或空投资格,流程如下:

2.2 Alpha 积分规则

积分由资产余额积分和交易量积分两部分组成。每日会在 UTC 时间 23:59:59 快照用户在 Binance CEX 主账户和无私钥钱包的资产余额,以及过去 24 小时内购买 Alpha 代币的金额,计算当日积分。积分采用滚动 15 天计算机制,每笔积分 15 天后过期。具体规则如下:

余额积分: 统计总资产余额,按阶梯给予积分。例如余额 $100-$1,000 每日 1 分,$1,000-$10,000 每日 2 分,$10,000-$100,000 每日 3 分,≥$100,000 每日 4 分。单日最高余额积分为 4 分(对应持仓 ≥ $100,000)。

交易量积分: 统计当日通过 Binance 平台或钱包买入 Alpha 代币的总额(卖出不计)。积分按照买入金额翻倍递增:买入 $2 记 1 分,$4 记 2 分,$8 记 3 分,$16 记 4 分,$32 记 5 分,以后每翻倍金额多 1 分。例如买入 $600 后又卖出 $500,仍按 $600 计算积分。5 月起 Binance 推出双倍积分活动,在 BSC 链上购买或使用限价单购买 Alpha 代币可使交易额按双倍计分,这一福利大幅降低刷分压力。

注意:当确认参与 Alpha 活动(例如 Alpha 空投或 TGE)时,Alpha 积分会立即被消耗。

2.3 Alpha 积分高效刷分技巧

以下策略基于社区经验总结,仅供参考,请注意成本和风险。

关键提示:

· 积分要求:门槛越来越高,最近几次空投积分要刷到 200 分以上才比较稳妥。

· 即买即卖: 购买后立即卖出 Alpha 代币,以控制风险,主要成本为交易滑点和手续费磨损。

· 多账号: 多账号低成本刷分可能比单账号高成本投入更具效益(需注意平台规则)。

· 双倍交易量活动: Binance 推出交易量翻倍等活动,可以通过在 BSC 链上购买 Alpha 代币或者挂限价单买入任何 Alpha 代币,注意挂限价单不一定能顺利买入。

交易操作 Tips:选择流动性大的池子;几分钟内价格上升趋势的币种;大交易量的交易可以进行拆分,比如 2000U 以上的交易,可以分成 4 笔;选择交易费用为 0.01% 和 price impact 小于 0.01% 的币种。也可以考虑使用限价单卖出,保证收益的同时还能赚取双倍积分。目前 B2,AIOT,MYX 和 ZKJ 不仅有积分奖励,还可以参与交易大赛:https://www.binance.com/zh-CN/support/announcement/detail/afa3aa4588404598b42950885355bef4

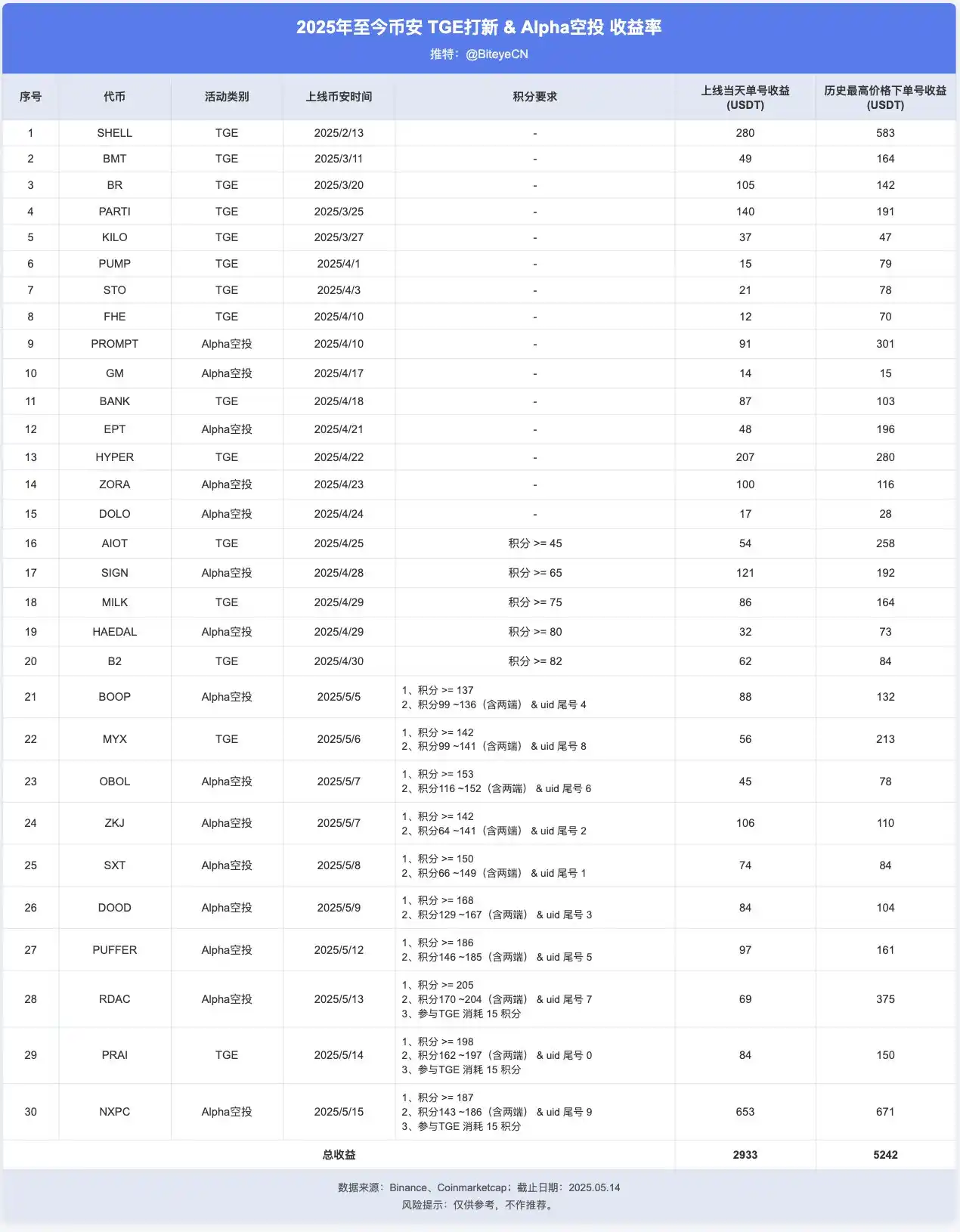

2.4 收益分析

下表测算了 Binance TGE 打新活动和 Alpha 空投的历史收益,其赚钱效应持续显著。例如,SHELL 项目上线当日的单号收益高达 280u,历史最高价下单号收益更是达到 583u;HYPER 项目上线当日单号收益为 207u,历史最高达 280u;PARTI 项目当日单号收益也有 140u。例如,假设一个满足条件的账户参与了上述所有项目,按上线当天价格计算的总收益约为 2933u,若能在历史高点卖出,收益则高达 5242u。但需注意,并非所有项目都有高回报,且空投数量和参与资格因项目而异。

三、Launchpool:稳健的质押挖矿

Binance Launchpool 允许用户质押其持有的 BNB、FDUSD、USDC 等代币,以「挖矿」的形式免费获得新项目的代币奖励。这是一种相对稳健,操作简便的赚币方式。

3.1 核心规则与参与流程

用户将符合条件的代币投入到相应的矿池中,根据投入比例和时长获得新代币奖励。

3.2 不同代币池收益对比与策略

BNB、FDUSD 收益优于 USDC:从下表可见,BNB 池的年化收益率(APY)通常具有竞争力,但需承担 BNB 本身的价格波动风险。稳定币池(FDUSD, USDC)则风险较低,本金价值稳定,适合风险厌恶型投资者,其 APY 有时甚至可能超过 BNB 池。其中,FDUSD 作为 Binance 主推的稳定币,在 Launchpool 活动中往往能获得与 BNB 池相近甚至更高的 APY,且有时分配额度更大。

资金分配:

· BNB 长期持有者: 将 BNB 投入 BNB 池是自然选择,实现「一鱼多吃」(享受 BNB 潜在涨幅+挖矿收益)。

· 稳健型投资者: 优先考虑 FDUSD 池,其次是 USDC 池。

· 资金量大者: 可适当分散到不同池子,或根据各池 APY 动态调整。

四、HODLer 空投:BNB 持有者的专属福利

HODLer 空投是 Binance 专为 BNB 长期持有者设计的一种被动福利机制。用户只需持有 BNB 并将其申购至 Binance 赚币的活期或定期产品,即有机会获得来自新项目的空投代币。

4.1 核心规则与参与流程

用户将 BNB 存入 Binance 的保本理财产品(包括定期或活期理财,或链上收益产品),Binance 会在活动期间对其 BNB 持仓进行随机快照,并根据持仓量发放相应数量的新币空投。这一机制确保了持币者无需频繁操作,也能分享到新项目上线的红利。流程如下:

4.2 收益分析

与此同时,Binance 的 HODLer 空投活动也为 BNB 的长期持有者带来了持续且可观的「被动收入」。在下表收益测算中,按照空投当天收盘价计算,BERA 项目实现了惊人的 328.5%APY,KAITO 和 LAYER 项目 APY 也分别高达 107.0% 和 106.1%;即便是近期如 SIGN 项目,APY 也达到了 55.9%。HODLer 空投不仅仅是小概率的惊喜,而是能够切实提升持币综合收益率的有效途径,进一步强化了 BNB 作为「金铲子」的价值感知。

五、Megadrop:BNB 锁仓 + Web3 任务组合玩法

Binance Megadrop 是一个结合了 BNB 锁仓(通过 Binance 赚币的定期产品)和 Web3 任务(通过 Binance Web3 钱包)的新型代币发行平台。可以将其视为 Binance 版的「交互空投」:一方面用户需要锁定一定数量的 BNB 在固定期限理财中,另一方面需使用 Binance 自带的 Web3 钱包完成指定链上任务,两者相叠加决定最终空投份额。

5.1 核心规则与参与流程

Megadrop 通过积分来分配奖励,每个用户的空投数量与其积分占比成正比。积分由两部分组成:

· 锁仓 BNB 积分: 用户将 BNB 订阅一定期限的定期理财,系统根据锁仓数量和期限长短计算积分。锁得越多、锁得越久,积分越高。

· Web3 任务积分及加成: 用户须在 Binance 钱包内完成项目相关的链上任务(通常是交互项目 DApp、桥接资产等),完成所有指定任务即可获得固定的基础积分奖励,以及任务完成倍率加成。

总得分 = (锁定 BNB 得分 * Web3 任务乘数) + Web3 任务奖励。

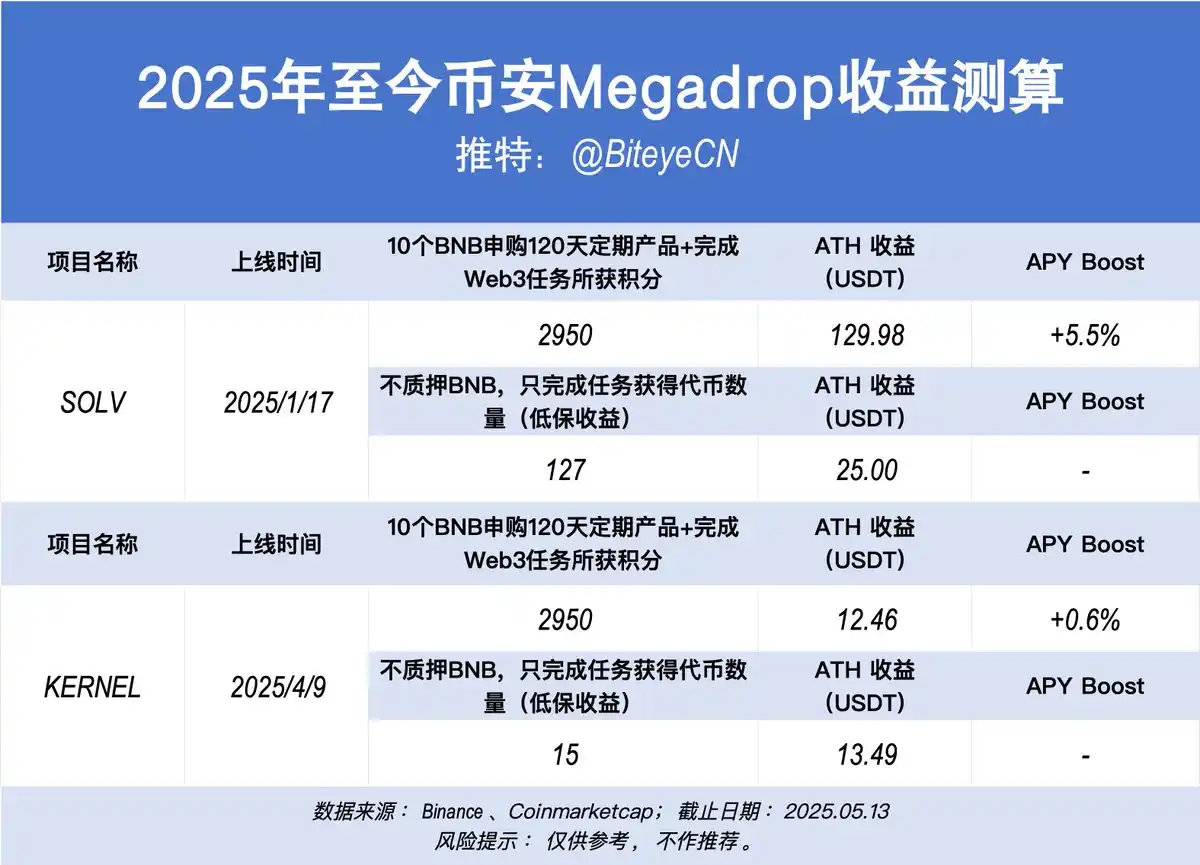

5.2 收益分析

下表测算了今年 2 期 Megadrop 收益率,从 SOLV 和 KERNEL 的历史数据看,完成 Web3 任务能提升最终获得的代币奖励和 APY 加成。如果不质押 BNB,也可通过做任务获得低保收益。

六、总结——两大核心策略,助散户高效掘金

面对 Binance 多样化的赚钱活动,可以根据自身的资金状况、风险偏好、时间精力以及对 BNB 的价值判断,选择适合自己的核心策略。以下总结两大主流策略及其赚钱路径:

6.1 策略一:稳健持有 BNB,但不喜欢刷分

适用人群: 适合看好 BNB 长期价值、愿意中长线持有的用户,不太喜欢花时间精力刷 alpha 积分。

主要收益来源:

· Launchpool 挖矿: 将持有的 BNB 参与每期新币挖矿,获得免费代币奖励。

· HODLer 空投: 将 BNB 存入 Binance Earn 理财,躺着领取不定期空投。

· Megadrop 任务: 利用持有的 BNB 参与 Megadrop 活动,锁仓一部分 BNB 并完成任务,获取项目上线前空投。

· BNB 本身升值及其他: 除上述「额外收益」外,BNB 作为 Binance 生态核心资产,其价格长期上涨也为持有者带来资本利得。此外,持有 BNB 还能享受交易手续费折扣福利。

组合参考路径:将大部分 BNB 存入 BNB Vault(或简单赚币活期),这样 BNB 每天有利息且同时可可用于 Launchpool 和 Megadrop。每逢 Launchpool 开始,用 Vault 中的 BNB 直接质押挖矿。同时,那些 BNB 依然计入 HODLer 快照,不影响后续空投。遇到 Megadrop 活动,选择其中一部分 BNB 转入定期(如大于 30 天)以赚取更多积分,同时用 BNB 钱包完成所有任务。活动结束拿到代币后,再将 BNB 解锁回 Vault。如此循环操作,实现一笔 BNB 资金三头获利:平时拿利息+空投,Launchpool 时薅新币,Megadrop 时做任务拿额外币。

6.2 策略二:「刷」Binance Alpha 积分,不持有或少量持有 BNB

适用人群: 本策略适合手上 BNB 不多甚至零持仓,但愿意通过频繁操作、小资金投入来获取收益的用户。换言之,就是所谓「Alpha 积分党」——以获取空投为目标,主动刷分换奖励。

主要收益来源:

· Alpha 空投: 通过刷高 Alpha 积分,抢先满足各种项目 Alpha 空投和 TGE 的资格要求,存在一个月内通过空投获利上千美元的可能性。但需要时刻关注规则门槛变化,收益也存在不确定性。

· 二级市场套利: 部分拿到的空投代币,若看好项目,可选择持有一段时间,待价格上涨后卖出获取更高收益。

· 预期成本与收益: 以目前行情估算,200 分基本能覆盖一月内的大部分 Alpha 空投资格,当然有时候的资格要求会超 200 分。假设当月有 9-10 个空投,每个空投价值 60u,合计也有大约 540-600u 收益,是能够覆盖刷分成本的(40u 左右)。如果能遇到像 NXPC 这样的大毛,单个项目收益飙升到 500u 以上。

6.3 策略三:好处全拿,持有 BNB 同时刷 Alpha 积分

对于大部分散户而言,将两种策略适度结合或许是更优的选择。例如,以一部分资金长期持有 BNB 作为「压舱石」,享受其稳健增值和基础福利;同时,以另一部分精力学习和参与 Alpha 积分相关的活动,博取更高收益。既持有一定 BNB 享受生态红利,又利用闲钱刷 Alpha 积分博取空投,两边的好处都拿。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。