In the simplest way, take you to understand the classic strategy.

OKX, in collaboration with the high-quality data platform AICoin, has initiated a series of classic strategy research, aiming to help users better understand and learn different strategies through data testing and analysis of strategy characteristics, and to avoid blind use as much as possible.

Dollar-cost averaging strategy is one of the most classic strategies in strategy trading. In layman's terms, strategy trading is a tool that helps users to automatically trade, with advantages such as reducing risks and simplifying operations compared to manual trading. Dollar-cost averaging strategy is a method of regular and fixed amount trading, which spreads the risk of a one-time investment in the market and smoothens the trading costs. By persistently adhering to fixed amount trading over the long term, the compounding effect of time is utilized to achieve the goal of profit.

The first issue introduces the dollar-cost averaging strategy and uses two major data models to test the BTC dollar-cost averaging strategy:

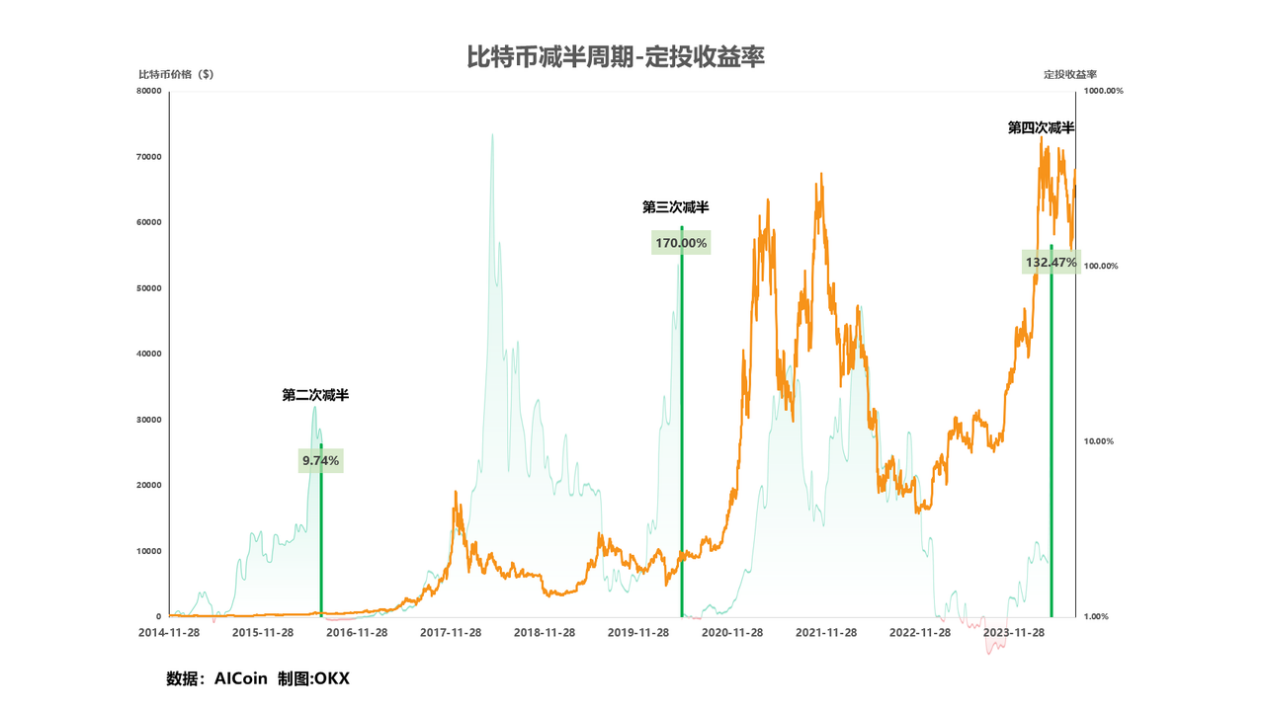

1) Analyzing the returns generated by dollar-cost averaging in different halving cycles since the birth of Bitcoin.

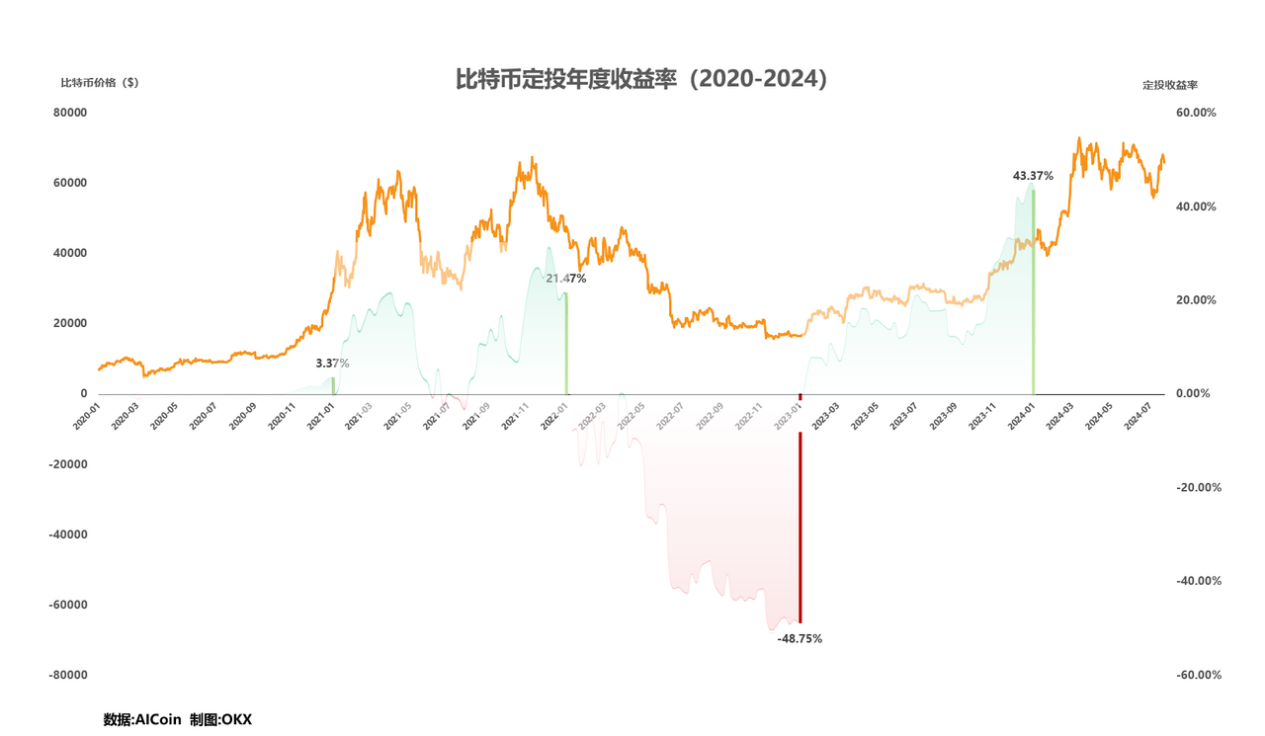

2) Analyzing the returns generated by annual dollar-cost averaging in the past four years.

This issue's data test will use a time-based dollar-cost averaging strategy model, with the standard being: dollar-cost averaging every Monday at 0:00 (UTC+8), with an investment amount of 0.1 BTC. Before each dollar-cost averaging, the profit from the previous dollar-cost averaging will be settled, leaving the total principal invested previously.

In summary, the dollar-cost averaging strategy is a long-term trading strategy suitable for ordinary traders, which can effectively smooth market fluctuations, cultivate disciplined trading habits, but also requires traders to have a certain level of patience and long-term vision.

Pros and Cons Comparison

In general, the dollar-cost averaging strategy is a long-term trading strategy suitable for ordinary traders, which can effectively smooth market fluctuations, cultivate disciplined trading habits, but also requires traders to have a certain level of patience and long-term vision.

Model One

Analyzing the returns generated by dollar-cost averaging in different halving cycles since the birth of Bitcoin

Note: Due to the setting of the backtesting system, the transaction amount includes the total cost of buying and selling BTC, such as buying 0.1 BTC on the first dollar-cost averaging day, and selling 0.1 BTC while buying 0.2 BTC on the second dollar-cost averaging day, and so on.

Model Two

Analyzing the returns generated by annual dollar-cost averaging in the past four years

Note: Due to the setting of the backtesting system, the transaction amount includes the total cost of buying and selling BTC, such as buying 0.1 BTC on the first dollar-cost averaging day, and selling 0.1 BTC while buying 0.2 BTC on the second dollar-cost averaging day, and so on.

Analysis and Conclusion

Model One's dollar-cost averaging strategy is based on the Bitcoin industry cycle, spanning four industry cycles from the initial reward of Bitcoin to the third halving. The number of dollar-cost averaging times, transaction amount, and return rate vary in each cycle. Model One shows that as time passes and the price of Bitcoin rises, the dollar-cost averaging returns significantly increase, failing to capture the maximized returns. For example, the return rate for the second cycle is 9.74%, while the return rate for the third cycle jumps to 170.03%. Model One is suitable for long-term traders to gradually accumulate Bitcoin through dollar-cost averaging over a long time span, smoothing market fluctuations, and ultimately obtaining significant long-term returns. Although the win rate fluctuates in each cycle, it remains above 50% overall, showing high stability and risk resistance. Despite the high return rate, mainly due to the significant price fluctuations of Bitcoin itself, the robustness is somewhat lacking, so attention needs to be paid to the impact of market fluctuations on returns.

Model Two's dollar-cost averaging strategy is based on the annual period, analyzing the annual dollar-cost averaging returns from 2020 to 2023. The number of dollar-cost averaging times per year is fixed at 52, and the total amount of holdings remains around 5.2 BTC. The return rate of annual dollar-cost averaging fluctuates significantly, for example, the return rate for 2021 is 21.47%, while 2022 saw a negative return of -48.75%. This indicates that the annual dollar-cost averaging strategy is significantly affected by short-term market fluctuations. Model Two highlights that even in the short term (such as one year), the dollar-cost averaging strategy faces the risk of negative returns, suitable for traders who observe the market performance in the short term, and can quickly assess the market situation and adjust trading strategies through annual dollar-cost averaging. Despite the significant return rate fluctuations, the win rate remains above 50%. Overall, although there have been positive returns in recent years, the return rate level is lower than that of Model One, and the short-term win rate and return rate are not as robust as the long-term strategy.

From the perspective of returns and risks, Model One, although achieving extremely high return rates in some cycles, needs to bear the significant risk of Bitcoin's large price fluctuations, meaning high returns come with high risks. Model Two shows that the annual dollar-cost averaging strategy has significant volatility in the short term and is not suitable for conservative traders pursuing stable returns, meaning short-term strategies are full of uncertainty. In conclusion, the dollar-cost averaging strategy is more suitable for long-term trading and traders with the ability to withstand market fluctuations and have a long-term trading vision. Among the two models, the long-term dollar-cost averaging strategy demonstrated in Model One is more suitable due to its higher win rate and return rate across multiple cycles. In summary, although the dollar-cost averaging strategy is relatively robust, different models of dollar-cost averaging strategies will also produce significant differences, both in terms of risk and return, so users need to further distinguish when using dollar-cost averaging strategies.

OKX&AICoin Dollar-Cost Averaging Strategy

The dollar-cost averaging strategy, also known as the dollar-cost averaging (DCA) strategy, is one of the most direct trading strategies. OKX's dollar-cost averaging strategy makes the implementation of the DCA strategy simpler, supporting the purchase of about 20 different types of cryptocurrencies. Users can use their USDT balance to dollar-cost average a single cryptocurrency at selected time intervals, or dollar-cost average multiple cryptocurrencies simultaneously in different proportions according to their preferred trading combinations, thereby averaging their purchase prices.

Currently, OKX's dollar-cost averaging strategy has added new features such as pause and restart, switching trading pairs, setting price ranges for the dollar-cost averaging cryptocurrency (i.e., allowing users to set a price range for each dollar-cost averaging cryptocurrency pair, and only execute dollar-cost averaging operations within the price range), editing parameters, and viewing history, to help users conduct dollar-cost averaging strategy trading more conveniently and efficiently.

How to access OKX's strategy trading? Users can access the "Strategy Trading" section through the OKX APP or the official website, then click on "Strategy Plaza" or "Create Strategy" to start the experience. In addition to creating strategies on their own, the Strategy Plaza currently also provides "High-quality Strategies" and "Strategies with Followers", allowing users to copy strategies or follow strategies.

OKX's strategy trading has multiple core advantages such as easy operation, low fees, and security protection.

In terms of operation, OKX provides intelligent parameters to help users set trading parameters more scientifically, and provides graphic and video tutorials to help users quickly get started and become proficient. In terms of fees, OKX has comprehensively upgraded its fee rate system, significantly reducing user trading fees. In terms of security protection, OKX has a security team composed of top global experts, providing bank-level security protection.

Currently, OKX's strategy trading provides convenient and diversified strategy types, mainly including:

• Grid Strategy: Spot Grid, Contract Grid, Infinite Grid

• Dollar-Cost Averaging: Contract DCA, Spot DCA, Dollar-Cost Averaging Strategy

• Composite Arbitrage: Hoarding Treasure, Bottom Fishing, Top Escaping, Arbitrage Order

• Large Order Splitting: Iceberg Strategy, Time-weighted Strategy

• Signal Trading: Signal Strategy

Among them, grid-type and periodic purchase hoarding treasure-type strategies are the simplest and most user-friendly. Meanwhile, arbitrage order, iceberg strategy, and time-weighted strategy are more suitable for high-net-worth users, as using these strategies requires facing more complex risk situations.

In addition, AICoin also provides users with a variety of strategy trading options, allowing users to understand the current market more quickly and intuitively. Users can find the "Custom Indicators/Backtesting/Live Trading" option in the "Market" section on the left sidebar of AICoin's product. Click here and search for "Dollar-Cost Averaging" in the "Community Indicators" to find the code for the dollar-cost averaging strategy.

Disclaimer

This article is for reference only, representing the author's views and not OKX's position. This article does not intend to provide (i) trading advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may experience significant fluctuations. You should carefully consider whether trading or holding digital assets is suitable for your financial situation. For your specific situation, please consult your legal/tax/trading professionals. Please be responsible for understanding and complying with applicable local laws and regulations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。