撰文:许超,华尔街见闻

本周四,加密货币市场迎来年度最重要的 IPO 事件。

( 图片由豆包 AI 生成 提示词风口和危机)

Circle Internet Group——600 亿美元 USDC 稳定的发行商——将在纽交所上市交易。公司将发行 3200 万股 A 类股票,发行价区间为 27-28 美元, 预计最高募资 8.96 亿美元,股票代码为 CRCL。公司将在星期三晚间完成定价,并于次日开始交易。

此次 IPO 受到华尔街热捧。Circle 目标估值已从之前的 56.5 亿美元上调至 72 亿美元。贝莱德领投 10% 股份,Ark Investment 也表达了高达 1.5 亿美元的投资兴趣。

但在华尔街巨头争相入场的光鲜表象下,Circle 也面临结构性的挑战。

看似「完美」的印钞机模式

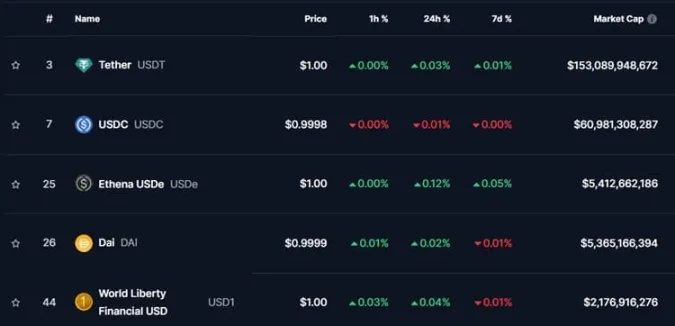

稳定币已悄然成为加密货币市场的支柱,并且与传统金融的关系日益密切。2024 年,稳定币交易额达到 27.6 万亿美元,比 Visa 和万事达卡的交易额总和高出近 8%。

目前稳定币总市值已达 2480 亿美元,Circle 的 USDC 占据 25% 的市场份额,仅次于 Tether 的 USDT 的 61%,总市值达 600 亿美元。Circle 的 EURC 在欧元支持的稳定币中位居榜首,市值为 2.24 亿美元。

Circle 的优势在于其监管合规性。

在美国,USDC 将自己定位为加密货币生态系统与传统金融之间的合规桥梁。在欧盟,MiCA 的实施——以及由此导致的 USDT 等不合规稳定币从主要受监管交易所下架——为 USDC 成为该地区领先的稳定币铺平了道路。

Circle 的商业模式简单而诱人:公司发行与美元 1:1 锚定的 USDC 稳定币,将用户存入的 600 亿美元投资于短期美国国债,赚取无风险收益。

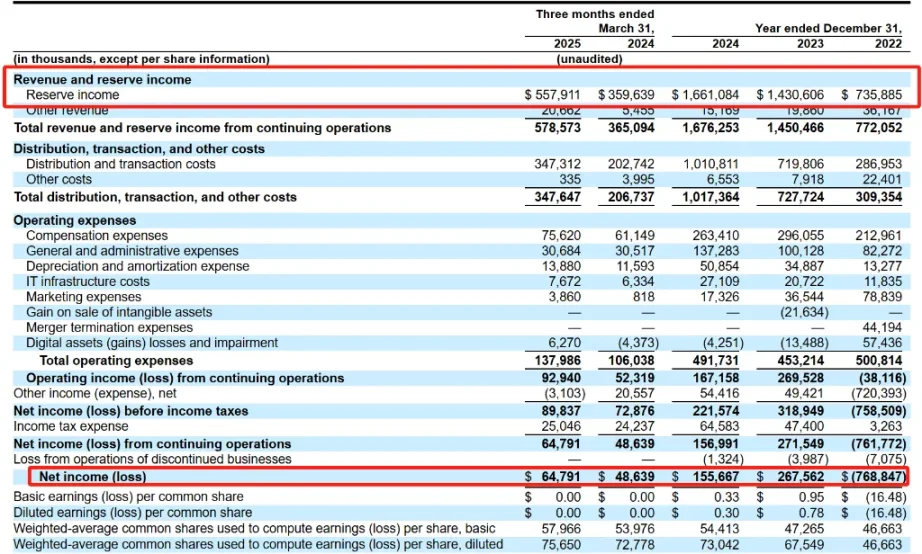

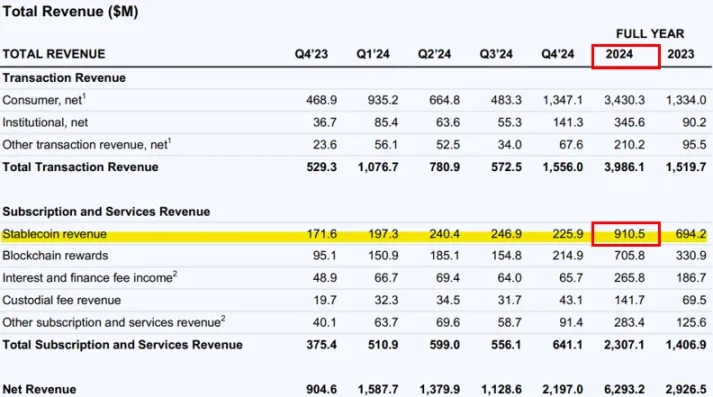

公司主要投资于美国国债(85% 由贝莱德的 CircleReserveFund 管理)和现金(10-20% 存于全球系统重要性银行)。这种模式利润丰厚,2024 年产生了约 16 亿美元的利息收入(「储备收入」),这占 Circle 总收入的 99%。

Coinbase「吸血」

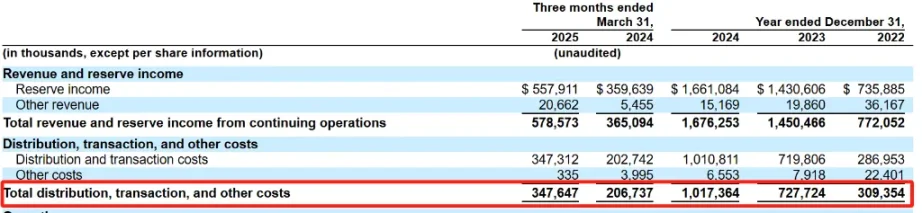

但看似「完美」的印钞机模式背后,Circle 的财务数据呈现出增长与压力的双重面貌:2024 年,Circle 总收入和储备收入达到 16.76 亿美元,同比增长 16%,较 2023 年的 14.50 亿美元稳步上升。

然而,净利润却从 2.68 亿美元下降至 1.56 亿美元,跌幅达 42%。

矛盾的财务数据背后,「分销、交易和其他成本」激增,Circle 与 Coinbase 的利润分配协议是主要影响因素。

Coinbase 和 Circle 的合作始于 2018 年:双方于 2018 年成立了 Centre Consortium,从而创建 USDC。2023 年,该联盟解散后,Coinbase 获得了 Circle 的股权,而 Circle 则完全控制了 USDC 生态系统。

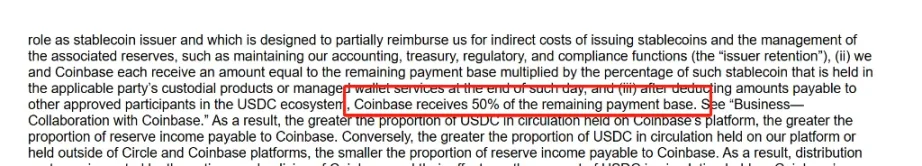

但这次分拆并没有终结双方现金流的分配,两家公司仍然瓜分了支持 USDC 的储备金利息收入。根据 Circle 的 S-1 备案文件,Circle 与 Coinbase 之间有以下收益分配协议:

-

Coinbase 平台上的 USDC:Coinbase 获得 100% 的储备收益。

-

非 Coinbase 平台上的 USDC:Coinbase 和 Circle 各获得 50% 的储备收益。

截至 2025 年第一季度,Coinbase 平台上的 USDC 占总流通量的约 23%。这一比例显示出 Coinbase 在 USDC 生态系统中的重要地位,并反映了其作为主要托管平台的角色。

根据 Coinbase 披露的数据,2024 年,Coinbase 从 USDC 相关业务中获利 9.08 亿美元,约占其净收入的 14.5%。

Coinbase 同时对 Circle 的业务合作对象拥有决定权。如果 Circle 想与第三方签署新的收益分成或分销协议,需要获得 Coinbase 的批准。

有分析人士认为,双方「紧密」的合作条款可能为 Coinbase 未来收购 Circle 打下基础。

隐藏的「致命」缺陷

除了高昂的「分销」成本外,Circle 看似「印钞机」的商业模式存在严重缺陷。

首先,Circle 营收非常依赖利率的表现。以 4.75% 回报率计算,600 亿美元的 USDC 大约可以收获 28.5 亿美元,这大约是 Circle 在不承担任何风险的情况下能获得的收益。

但当利率下降时,问题就出现了。维持这些收益的成本(就风险而言)会更高。承担过度风险可能非常诱人。还有来自竞争对手的压力,他们可能愿意牺牲大部分储备收入来换取市场份额。

与此同时,Circle 的表现还和波动剧烈的更广泛加密市场息息相关。

由于 Terra 和 FTX 平台的崩溃,Circle 在 2022 年亏损 7.688 亿美元;2023 年,在 Circle 合作伙伴硅谷银行破产后,USDC 抛售压力上升,直接导致 USDC 的市值减半(与 Coinbase 协议签订时间点)。

外部竞争压力陡增

由美元支撑的普通稳定币没有任何进入门槛。提供商需要比竞争对手更具创造力,才能使其稳定币成为行业标准。

ARK 认为,到 2030 年,稳定币的规模将从目前的约 2500 亿美元增至 1.4 万亿美元。这可能取决于稳定币发行方同意以「激励」的形式分享多少「浮动收益」,以赢得或抢占市场份额。

随着监管环境明朗化,Circle 可能面临更激烈的竞争。亚马逊、谷歌等科技巨头可能推出自有稳定币,而美国银行、花旗和摩根大通等银行也在探讨联合发行稳定币。

PayPal 已经推出自有稳定币,并计划将大部分储备收益返还给用户。这种「竞相让利」的趋势可能压缩整个行业的利润空间。

IPO 时机再合适不过

尽管面临内外各种问题,Circle 的 IPO 时间点可谓「恰逢其时」

支持者认为,稳定币正在成为事实上的数字美元——尤其是在美国对央行数字货币(CBDC)日益敌视的环境下。稳定币的潜在市场涵盖全球汇款、机构支付和 DeFi 整合。Circle 所构建的基础设施和监管定位可能会使其占据先机。

正如 Balthazar Capital(一家在加密货币相关股票方面拥有大量投资的资产管理公司)的创始人 Benjamin Billarant 所评论的那样,

Circle 的 IPO 时机再合适不过了。我们已经到达了稳定币被主流采用的关键转折点。《GENIUS 法案》一旦通过,将提供释放其全部潜力所需的监管透明度——而 Circle 凭借其合规优先的理念,拥有独特的优势来利用这一机遇。

事实上,美国迄今为止最全面的稳定币法案——由两党共同制定的《GENIUS 法案》已于 5 月 21 日在参议院获得通过,目前正在众议院审议。这对于 Circle 的 IPO 来说无疑是个绝佳的时机。

72 亿美元的高估值也在讲述类似的「故事」(Circle PE 估值已超信用卡巨头 Visa):USDC 只是代币化的开始。

虽然 Circle 目前依赖于加密货币市场的需求,但未来稳定币将作为一种比目前提供的支付方式更顺畅、更高效的支付方式席卷全球。

除了在家订购披萨或从国外购买商品之外,还有可能在同一轨道上构建新的应用程序和金融产品。随着特朗普政府推动稳定币进入主流,这一切都将扩大对 USDC 的需求并产生更多的费用收入。

72 亿美元的估值是否合理?市场最终将给出答案。但有一点可以确定:在从「轻松」的利率驱动收益转向更具挑战性的产品驱动收入的过程中,Circle 能否及时转型将决定其长期命运。

大股东卖,华尔街买

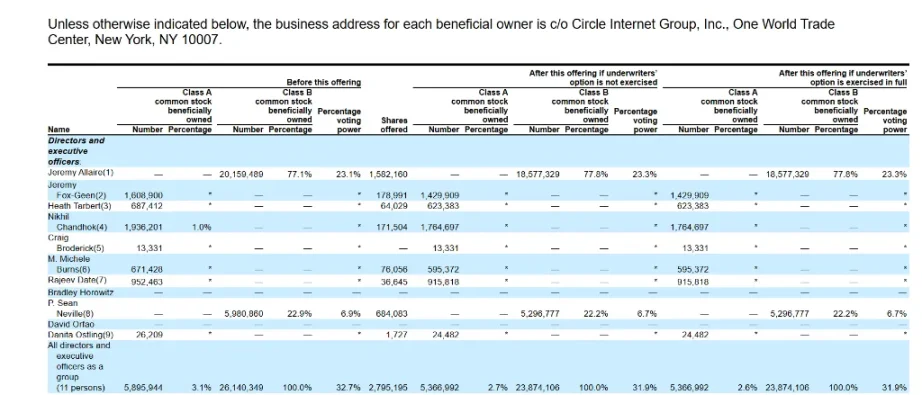

值得玩味的是,Circle 现有股东正利用此次 IPO 大规模套现。

根据招股书信息,Circle 现有股东出售的股份占总发行量的 60%,远高于典型科技 IPO。

根据公司招股书,Circle CEO Jeremy Allaire 将出售其 8% 的股份,多家知名风投公司也计划减持约 10% 的股票。虽然内部股东仍保留大量持股,但大规模套现可能向市场传递复杂信号。

在科技公司 IPO 中,来自现有股东的发行量超过公司发行量的情况极为罕见。

Meta 是少数例外之一。这家社交网络在 2012 年大规模 IPO 中筹集了当时创纪录的 160 亿美元,其中 57% 的股份是由现有股东出售的。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。