In the Crypto world, stablecoins are the cornerstone of DeFi, providing a stable trading medium for users to buy and sell without the need to exchange back to fiat currency.

Author: WOO

Key Points Summary

I. Market Hot Events

Wintermute: The market value of stablecoins has risen to $164 billion for the first time since 2022. -7.25

JD.com: Will issue a stablecoin pegged 1:1 to the Hong Kong dollar based on public blockchain. -7.24

Mt. Gox official documents state that over 17,000 creditors have been paid in BTC and BCH. -7.24

Mt. Gox creditors have received returned BTC, BCH, and ETH assets in their Bitstamp accounts. -7.25

Kraken CEO: Kraken has returned Bitcoin and BCH to Mt. Gox creditors. -7.24

On the 10th anniversary of the Ethereum ICO, the US SEC approved the official listing of Ethereum ETF for spot trading. -7.23

Binance Labs invests in Catizen.AI issuance platform PLUTO Studio. -7.23

Biden announces withdrawal from the 2024 US presidential election, Harris announces candidacy for vice president, or may be nominated as the Democratic presidential candidate on August 19. -7.22

II. Introduction to Popular Tracks (Stablecoin Track)

Importance: The total market value of stablecoins currently exceeds $164 billion, returning to the bull market level of 2022; stablecoins are the cornerstone of DeFi and an important medium for bridging Web2 and Web3 payments; stablecoin yield has become an important narrative in the 2024 stablecoin track; in March, USDT and USDC collectively issued $10 billion in stablecoins; the recent trend of stablecoins is relatively optimistic, with an increase in stablecoin inflows.

Key Points: Definition of stablecoins, related narratives of stablecoins, overall performance data of the track, types of decentralized stablecoins, key projects and analysis of the track

Potential Projects in the Track: Ethena, BitU, Midas, SPOT

I. Market Hot Events

1. Wintermute: The market value of stablecoins has risen to $164 billion for the first time since 2022. -7.25

2. JD.com: Will issue a stablecoin pegged 1:1 to the Hong Kong dollar based on public blockchain. -7.24

[Analysis of 1 and 2]

The stablecoin indicator is an important predictor of the future. According to DefiLlama data, the current total market value of stablecoins exceeds $164 billion, with USDT's total market value at $114.3 billion, accounting for over 69.71%. From December 2021 to May 2022, before the collapse of Luna, the market value of stablecoins steadily increased to over $180 billion during the bull market, and has now returned to the level of the previous bull market.

In December to early January, Tether issued $7 billion USDT. In March, Tether and Circle issued $10 billion in stablecoins within 30 days. However, stablecoin inflows slowed down after the halving of BTC. The recent market trend is relatively optimistic, with an increase in stablecoin inflows.

Decentralized stablecoins are considered to have the most native and orthodox encryption characteristics. After the collapse of UST earlier this year, Ethena's USDe, backed by American capital including Arthur Hayes, gained momentum, with APR reaching over 30%. Usual's USD0 also entered the market in an attempt to get a share.

Since 2022, Hong Kong has been paying attention to Web3 and has been clear about the regulatory direction of stablecoins. In December last year, the Hong Kong Monetary Authority once again issued a consultation paper on the proposed regulatory regime for stablecoin issuers. On July 18 this year, the Hong Kong Monetary Authority announced the list of sandbox participants for stablecoin issuers, with JD Coin Chain Technology (Hong Kong) Co., Ltd. prominently listed.

On July 24, JD.com announced the issuance of a Hong Kong dollar stablecoin. JD.com's foray into Web3 has sparked heated discussions. In the past few years, due to domestic regulatory reasons, major companies quickly withdrew from the cryptocurrency field after early involvement, mostly focusing on industrial blockchains and consortium chains, but consortium chains have been proven to be unworkable. Since 2022, Hong Kong's Web3 policy has been relaxed, but traditional giants are still cautious. Tencent's metaverse XR business and ByteDance's PICO metaverse both laid off employees last year and turned to the AI track. However, with the arrival of the bull market trend in the second half of last year, traditional giants have also begun to re-enter Web3. For example, Alibaba Cloud and Aptos cooperated to establish the Asia-Pacific developer community Alcove, Alibaba's AntChain launched the new Web3 brand ZAN, a former Ant employee created the parallel EVM public chain Artela, and Tencent invested in Wintermute, Immutable X, Chainbase, and others.

However, only JD.com has chosen stablecoins, targeting the payment track. Because stablecoins with payment attributes are the simplest but also very profitable business line, once compliant, they will be accessible to more ordinary users. In fact, Hong Kong's Web3 policy is very strict. Many exchanges' applications for Hong Kong compliance licenses were rejected in the middle of the year, and even compliant exchanges' trading performance was not good. The compliance cost for stablecoin issuers is extremely high. It can be seen that JD.com has spared no effort to try to overtake in the Web3 competition among traditional giants.

3. Mt. Gox official documents state that over 17,000 creditors have been paid in BTC and BCH.

4. Mt. Gox creditors have received returned BTC, BCH, and ETH assets in their Bitstamp accounts.

5. Kraken CEO: Kraken has returned Bitcoin and BCH to Mt. Gox creditors.

[Analysis of 3, 4, 5]

Founded in 2010, Mt. Gox was the world's largest Bitcoin exchange at the time. In 2014, Mt. Gox was hacked, resulting in the theft of 850,000 BTC, worth about $480 million at the time, and subsequently filed for bankruptcy. In 2023, Mt. Gox opened a repayment window and announced a "repayment plan" in May this year, but stated that it would not immediately sell Bitcoin.

Currently, Mt. Gox has recovered 140,000 BTC (about $9 billion) and the potential selling pressure has caused some degree of panic in the market. On June 24, the trustee of Mt. Gox announced that the repayment of BTC and BCH would begin in July this year, involving crypto assets worth as much as $9 billion. As a result, the crypto market staged a "dive" market, with Bitcoin briefly falling below the $60,000 mark.

It is reported that Mt. Gox has a total of 127,000 creditors (Japanese users account for less than 1%), and it needs to repay 142,000 BTC (currently worth about $8.58 billion) and 143,000 BCH (worth about $53.31 million) to the creditors.

However, the impact of Mt. Gox's selling may be exaggerated, as it is not a one-time payment of all assets. Its repayment plan includes basic and proportional repayments. The basic repayment allows the first 200,000 yen claimed by each creditor to be paid in yen, while the proportional repayment provides two flexible options for creditors, namely "early lump sum repayment" or "mid-term and final repayment". The deadline for basic repayment, early lump sum repayment, and mid-term repayment is set for October 31, 2024, but creditors may have to wait five to nine years for a higher proportion of compensation. At the end of 2023, several Mt. Gox creditors reported receiving the first repayment in yen, and the upcoming repayment plan will be the first time Mt. Gox has repaid in the form of BTC and BCH.

At the same time, the payment compensation time for creditors from various exchanges also varies. BitGo may take up to 20 days for payment, while the payment process for Kraken and Bitstamp may take up to 90 days. In addition, it is uncertain whether individual creditors who bought BTC early will sell BTC. Overall, Mt. Gox's selling or underperformance is not expected to put too much pressure on the market.

- On the 10th anniversary of the Ethereum ICO, the US SEC approved the official listing of Ethereum ETF for spot trading. -7.23

VanEck first disclosed its plan to apply for a US spot Ethereum ETF in 2021, but later withdrew. Applications for spot Ethereum ETFs began in the second half of 2023, including from Grayscale, JPMorgan, Galaxy, BlackRock, Fidelity, Hashdex, VanEck, ARK, 21Shares, and others. Perhaps due to the SEC's busy schedule in approving Bitcoin ETF-related matters, it repeatedly postponed making a decision on Ethereum spot ETFs until a turning point in March.

Between March and April this year, the SEC sought public opinion on the spot Ethereum ETFs of various issuers, and Grayscale and Coinbase also negotiated with the SEC to discuss rule changes for launching spot Ethereum ETFs. Starting in May, issuers such as ARK Invest, 21Shares, Fidelity, Grayscale, and Franklin Templeton removed the "Ethereum staking" service from their ETF applications, while CoinShares and Valkyrie stated that they would not apply for a spot Ethereum ETF, mainly due to the lack of staking. Subsequently, Ethereum ETFs were approved and put on track. Therefore, none of the Ethereum ETFs offered staking.

The Block data shows that on the first day of trading on US exchanges, the total trading volume of 9 Ethereum spot ETFs exceeded $1.019 billion. Grayscale Ethereum Trust (ETHE) led with a trading volume of $456 million, accounting for nearly half of the total trading volume; it saw a net inflow of $106.6 million on the first day, but net outflows on the following two days, with net outflows of $133 million on the 24th and $152 million on the 25th.

Currently, the consensus on Ethereum in the traditional market is not as strong as for Bitcoin. Due to the lack of staking rewards, there is also no demand for Ethereum ETFs among industry insiders, so the buying pressure is relatively weaker than for Bitcoin. And due to the more than 10x management fee difference of Grayscale Ethereum Trust, there is still arbitrage space, but with Grayscale splitting off a low-fee mini trust, the selling pressure may decrease.

- Binance Labs invests in Catizen.AI issuance platform PLUTO Studio. -7.23

There is a rumor that VCs are all looking at the TON ecosystem, but can't make a move. That's because projects on TON usually have a cycle of only 2 months, and if VCs lock in for 2 years, they naturally can't make a move. Therefore, it can be seen that Binance has chosen the game development company behind Catizen. The Pluto team comes from Web2 and has over 10 years of experience in Web2 mini-game development.

I think Catizen is TON mini-game 2.0, surpassing the boring "clicking" and truly becoming a game. This game is currently the No. 1 on TON. On July 24th, Telegram CEO Pavel Durov stated that Catizen has over 26 million players and has earned $16 million through in-app purchases. This number of users and revenue-generating ability is rare in the current Web3 world.

- Biden announces withdrawal from the 2024 US presidential election, Harris announces candidacy for vice president, or may be nominated as the Democratic presidential candidate on August 19. -7.22

During the competition between Biden and Trump, Trump won important public opinion in the United States due to his ear injury and shouting "Fight" under the American flag, and even Elon Musk expressed his support for him on Twitter. Trump also received praise from the crypto industry for his involvement in Crypto (issuing NFTs), making crypto-friendly statements, and issuing crypto-friendly policies. Messari CEO Ryan Selkis even resigned due to his extreme statements in support of Trump.

However, after Biden announced his withdrawal from the presidential race, Harris, who may become the first black female president of the United States, received very high support, and polls showed that Harris's support rate was higher than Trump's. However, Harris refused to attend the Bitcoin 2024 conference hosted by Bitcoin Magazine, so the prediction market Polymarket still shows a significant lead in support for Trump. It is worth noting that driven by the US election, Polymarket's trading volume in July exceeded $275 million, reaching a historical high.

In addition, the US election has played an important role in promoting political meme coins on Solana.

II. Introduction to Popular Tracks (Stablecoin Track)

2. Basic Introduction to the Track

2.1 What is a stablecoin?

A stablecoin is a special type of cryptocurrency whose value remains constant over time, unlike other cryptocurrencies that are highly volatile. Stablecoins are typically pegged to another more stable asset to achieve stability, and can also be uncollateralized pure algorithmic stablecoins.

Stablecoins are divided into centralized and decentralized stablecoins, both of which first appeared in 2014. The earliest centralized stablecoin was Tether, established by core members of Bitfinex in the Cayman Islands, and issued USDT. Currently, USDT has the highest market value and is the most widely used stablecoin. There are currently nearly 50 types of centralized stablecoins, including USDT, USDC (Circle), FDUSD (First Digital), PYUSD (PayPal), TUSD (TrueUSD), USDY (Ondo), BUSD (Binance), GUSD (Gemini), and more.

Decentralized stablecoins are issued and governed in a decentralized form and are pegged 1:1 to the US dollar without the need for intervention from centralized institutions/entities. Decentralized stablecoins are considered the "holy grail" of financial technology. The earliest decentralized stablecoin also appeared in 2014, which was BitUSD issued by bitShares. However, after 4 years of issuance, BitUSD also decoupled from the US dollar and has since declined. Terra/Luna's UST is the most famous decentralized stablecoin in the last bull market, but it fell into a death spiral and caused huge damage to the industry.

The performance of stablecoins varies greatly, depending on the type of collateral they support.

2.2 Narrative

In the Crypto world, stablecoins are the cornerstone of DeFi, providing a stable trading medium for users to buy and sell without the need to exchange back to fiat currency.

The narrative of stablecoins mainly focuses on their characteristics, namely "stability" + "coin". Typically, stablecoins are much less volatile than other cryptocurrencies such as BTC and ETH, and as a cryptocurrency, they have the characteristics of "peer-to-peer electronic payments" envisioned by Satoshi Nakamoto. Decentralized stablecoins also have the advantage of resistance to censorship in encryption. For algorithmic stablecoins, they are more in line with the spirit of encryption and the ideal of decentralization.

In the past two years, stablecoins have been seen as a bridge connecting Web2 and Web3. Compared to traditional cross-border payment methods such as SWIFT, stablecoins have higher cost and settlement efficiency. In Africa, USDT and Binance P2P are very popular. The African continent is vast and fragmented, with close ties to overseas, making cross-border payments very popular, and stablecoins are an important payment and settlement currency. For example, the Tron version of USDT dominates in emerging markets, with market shares exceeding 70% and even 80% in regions such as South America, Africa, and Turkey. Payment giant PayPal has over 430 million users and holds a 40% market share in the payment market, and its stablecoin PYUSD has a huge influence in Web2. JD.com targeting a Hong Kong dollar stablecoin is also targeting the blue ocean market of compliant stablecoins and payment combined with cross-border payments.

In addition, in these developing countries, due to the severe inflation and currency devaluation caused by the flooding of the US dollar and the Fed's interest rate hikes, stablecoins are a very good hedge against inflation and currency devaluation, which is in line with Satoshi Nakamoto's original idea of resisting central banks when designing Bitcoin. ```

In the narrative of decentralized stablecoins, MakerDAO's DAI takes the lead. The name "DAI" was chosen because the founder understands Chinese, and it means "loan," while another alternative currency name was "JIAO," which was the world's earliest "officially" issued paper money during the Northern Song Dynasty. At the same time, DAI is also a tribute to the founder of the precursor of digital currency, B-money, David Chaum.

However, so-called stablecoins are typically not stable, whether they are centralized stablecoins or decentralized stablecoins. In March 2023, the bankruptcy application of a Silicon Valley bank led to a partial freeze of Circle's cash reserves in the bank, causing a decrease in market trust in USDC, leading to large-scale runs and sell-offs, and the USDC price briefly dropped to $0.878. The USDC's deviation from its peg led to DAI, FRAX, MIM, and other decentralized stablecoins also experiencing a certain degree of deviation.

LUNA's collapse took the market 2 years to digest, and this year the overall market trend has been good, leading to a wave of innovation in stablecoins, bringing decentralized stablecoins back into the spotlight. This year, with the iterative upgrade of the asset yield model, the narrative of interest-bearing stablecoins has become the mainstream paradigm in the market. Some well-known examples include Ethena's USDe, Blast's USDB, Ondo's USDY, Mountain Protocol's USDM, and Lybra's eUSD. The revenue sources for these stablecoins are more diversified, including US Treasury bonds, Ethereum staking rewards, and structured strategy returns.

However, stablecoin performance is an important indicator of a bull market, as it signifies the movement of off-chain funds and their attitude and sentiment towards the crypto market.

2.3 Overall Data Performance

According to DefiLlama and Wintermute data, the total market value of the stablecoin industry (including hundreds of tokens) has surged to over $1.64 trillion for the first time since the collapse of Terra in May 2022, returning to the levels of the previous bull market. Wintermute stated that this "indicates that investors' optimism is increasing, supporting bullish prospects. The increase in stablecoin supply indicates that funds are being deposited into the on-chain ecosystem to generate economic activity, whether through direct on-chain purchases catalyzing price appreciation or through yield-generating strategies that improve market liquidity. This activity will ultimately promote positive on-chain growth."

Centralized Stablecoins

Currently, the market value of fiat-collateralized stablecoins is $1,519.9 billion (accounting for 92.4% of the stablecoin market), returning to the levels of the previous bull market.

Affected by the bankruptcy of the Silicon Valley bank, the market value of USDC has shrunk, while USDT's share has reached 75.2%.

Decentralized Stablecoins

There are currently over 100 types of decentralized stablecoins on the market, with a total market value of $118.9 billion, which has not yet returned to the $30 billion level of the previous bull market. Among them, MakerDAO's DAI dominates with a 43.55% share, with a market value of $51.81 billion.

Since the beginning of this year, Ethena's USDe has performed the best, with a market value exceeding $33 billion, making it the second-largest decentralized stablecoin. The market value of other decentralized stablecoins has not exceeded $10 billion.

In the $118.9 billion market of decentralized stablecoins, stablecoins with a volume of $91.31 billion are on the Ethereum mainnet, accounting for 76.79%, with DAI accounting for 51.33%.

It is worth noting that among the top ten decentralized stablecoins by market value, the second-ranked USDe with a market value of $33 billion is all on the Ethereum mainnet, while the sixth-ranked USDY with a market value of $3.38 billion is on Blast. Other leading protocols are mainly multi-chain.

The market value of algorithmic stablecoins is $14.7 billion, accounting for 12.35% of the total market value of decentralized stablecoins. However, since the collapse of Luna, algorithmic stablecoins have been struggling and are still showing a downward trend. Currently, well-known projects include USDD launched by Justin Sun (market value of $737 million) and FRAX, with the market value of other algorithmic stablecoins not exceeding $1 billion.

2.4 Types of Decentralized Stablecoins

Decentralized stablecoins are mainly divided into crypto-collateralized stablecoins and uncollateralized pure algorithmic stablecoins. The performance of stablecoins is mainly influenced by the collateral. Based on the collateral, decentralized stablecoins can be divided into over-collateralized stablecoins, algorithmic stablecoins, hybrid algorithmic stablecoins, and Delta-neutral stablecoins.

Over-Collateralized Stablecoins

Over-collateralized stablecoins are a common type of decentralized stablecoin, with assets typically coming from BTC, ETH, and other cryptocurrencies. An example of this type is MakerDAO's DAI, which deposits ETH and other ERC20 tokens into a smart contract and automatically issues DAI at a certain collateral ratio, acting as a "decentralized central bank." The advantage of this type is relative stability in investment, but having too many collateral assets can also reduce capital efficiency and may trigger liquidation when collateral assets fluctuate significantly. Currently, MakerDAO is also exploring the possibility of using RWA as collateral.

Algorithmic Stablecoins

Algorithmic stablecoins maintain their fixed price based on market demand and supply without actual collateral support, and are anchored to the US dollar based on mathematical formulas and incentive mechanisms. These stablecoins use algorithms and smart contracts to automatically manage the supply to maintain price stability. There are three types of algorithmic stablecoins: Rebase (elastic supply mechanism), Seigniorage (seigniorage tax), and Fractional Stablecoins. Ampleforth uses Rebase, with no supply limit, adjusting the supply based on market demand to balance the price. When the price is above $1, the supply increases, and when the price is below $1, the supply decreases.

The seigniorage tax mechanism uses a dual-token model, usually consisting of a stablecoin and a governance token. Terra's UST and LUNA are designed this way. UST is anchored 1:1 to the US dollar, and users can destroy $1 worth of LUNA in the market to mint 1 UST, and vice versa. If UST exceeds the pegged price, users can exchange $1 worth of LUNA for more than $1 worth of UST and sell it for profit. If UST is below the pegged price, users can exchange 1 UST for $1 worth of LUNA. Under the seigniorage tax mechanism, the platform maintains the dynamic stability of stablecoin prices by encouraging users to actively arbitrage.

Hybrid Algorithmic Stablecoins (Fractional Stablecoins)

The third type of algorithmic stablecoin is Fractional Stablecoins, also known as hybrid algorithmic stablecoins, which use a combination of algorithms and collateral, with the collateral ratio usually being less than or equal to 100%. This approach allows users to support stablecoins with a total value of less than the US dollar or cryptocurrencies, increasing capital efficiency. If the stablecoin price exceeds $1, the algorithm system will automatically create more stablecoins until the price falls back to $1. If it drops below $1, the stablecoin will be considered over-collateralized, and the algorithm will destroy the excess stablecoins. Frax is an example of this type.

Delta-Neutral Stablecoins

Delta-Neutral Stablecoins are a portfolio risk management strategy that achieves delta neutrality by longing an equal amount of spot and shorting an equal amount of futures contracts to earn income from funding rates. Ethena is a representative of this type.

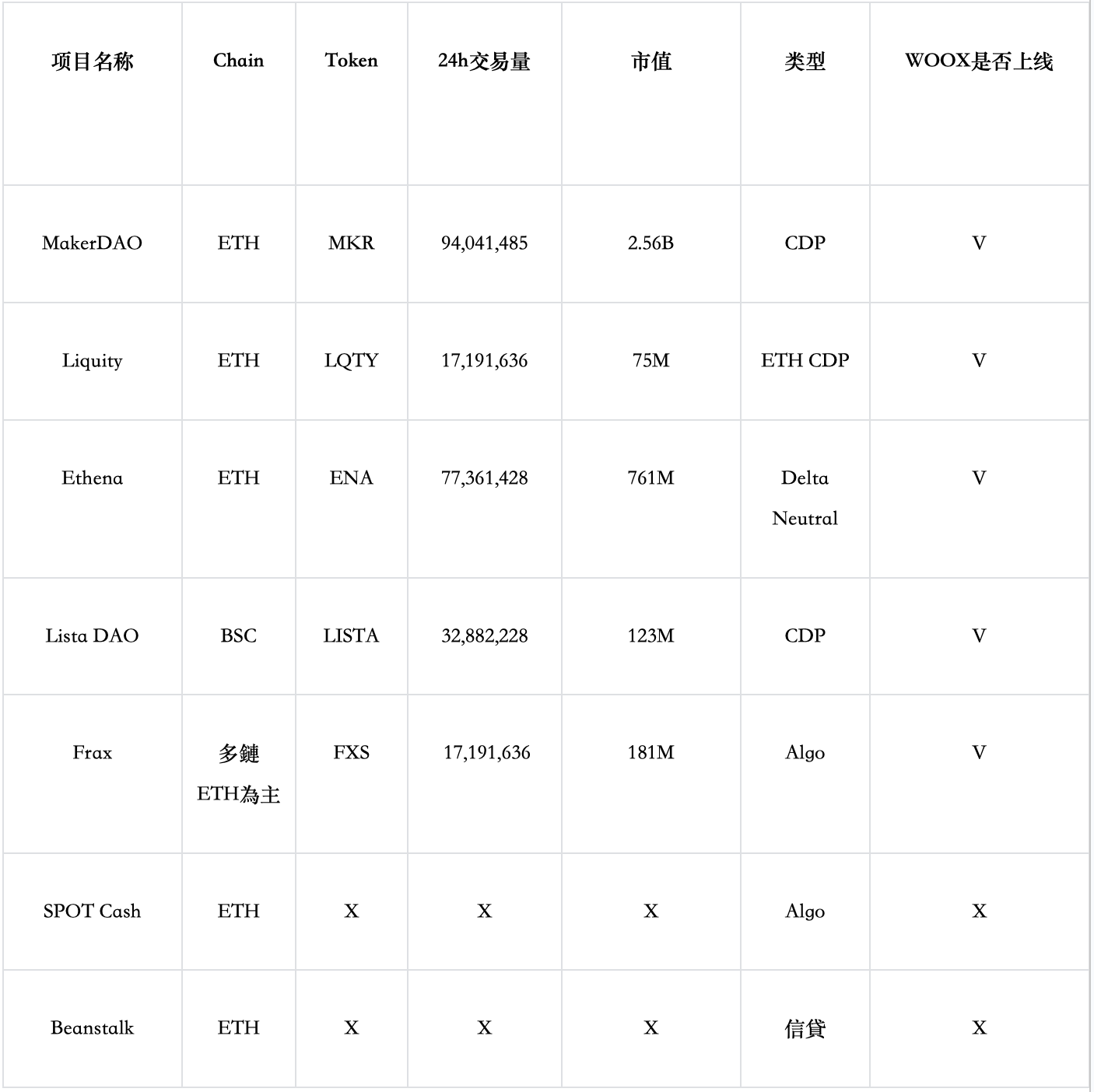

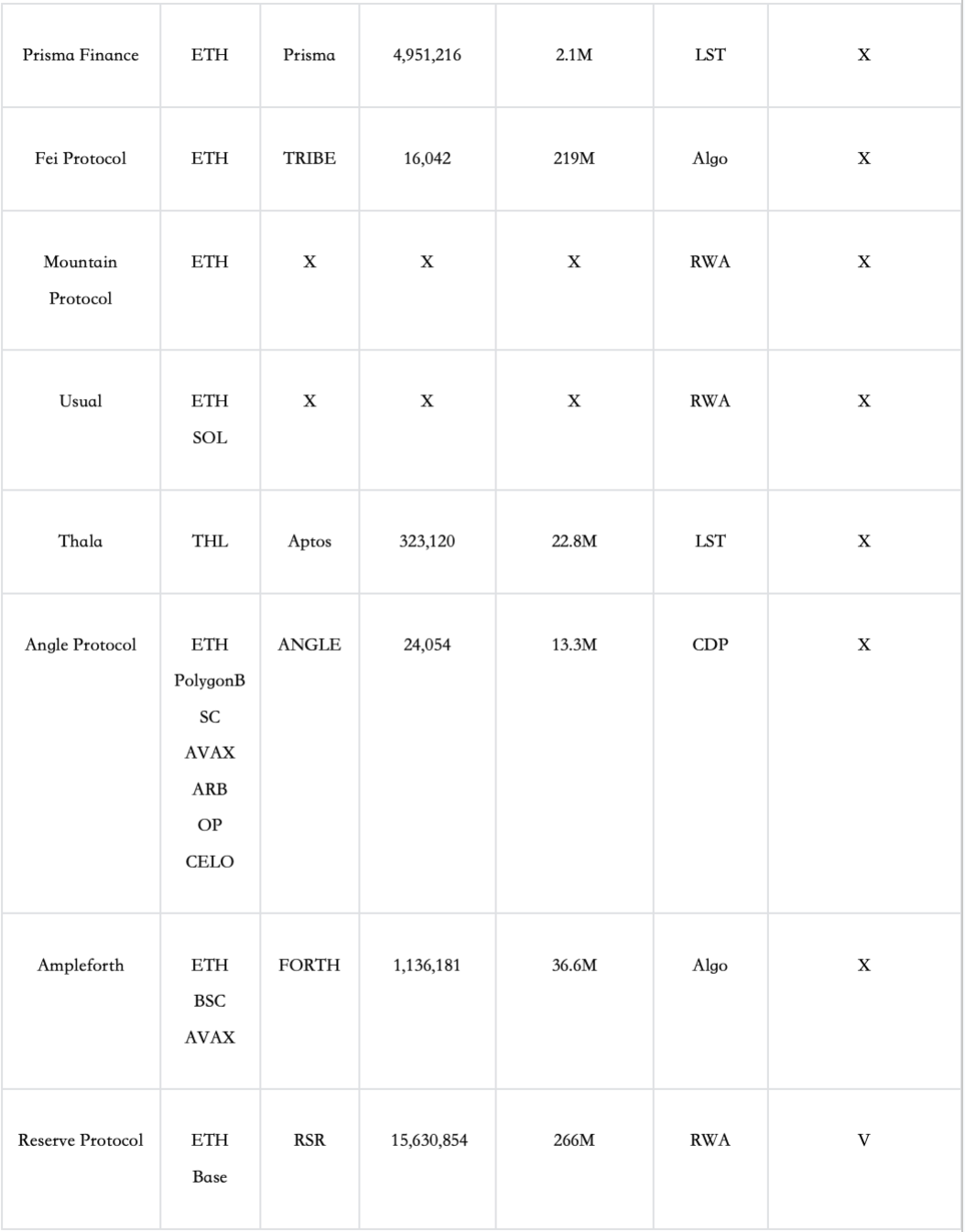

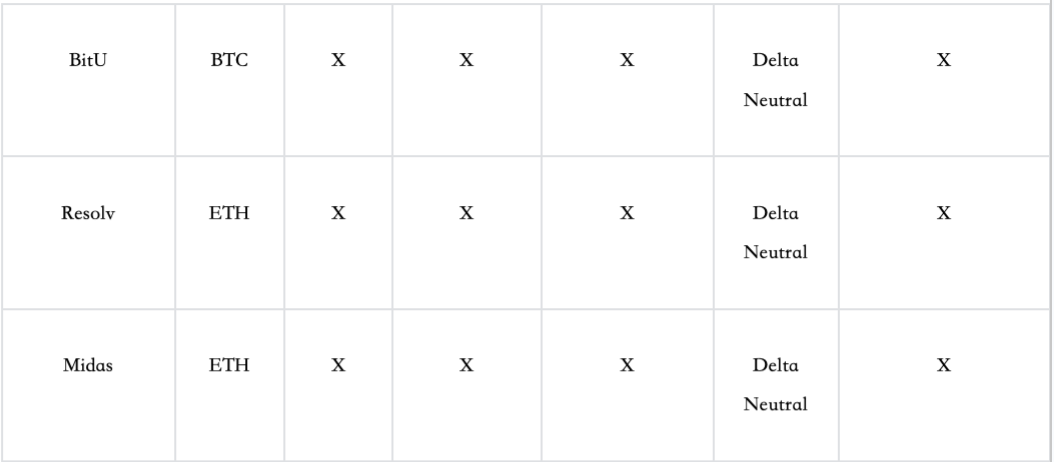

III. Track Ecology

IV. Key Project Analysis

1) Project Name: Ethena

Website: https://ethena.fi/

Twitter: https://x.com/ethena_labs

Introduction: Ethena is a synthetic USD stablecoin protocol built on Ethereum, providing a "synthetic dollar" USDe through a Delta-neutral strategy.

Ethena's synthetic USD stablecoin USDe provides a native, scalable currency solution through triangular hedging of Ethereum and Bitcoin collateral. USDe is fully collateralized (with the risk of collateral failure) and can be freely combined in decentralized finance (DeFi). Users can also choose to stake USDe, earn sUSDe, and receive protocol revenue sharing.

Features:

- Collateral yield from assets like LST (1x long, Beta value +1)

- Opening futures and perpetual contract short positions for basis and funding rate arbitrage (1x short, Beta value -1)

- USDe's revenue change mainly comes from basis arbitrage

- Ethena has introduced an insurance fund to subsidize returns during negative rates

Recent Updates:

The treasury is currently at an all-time high, with total assets reaching $45 million.

On July 24th, it announced plans to allocate a portion of its $235 million USDT stablecoin collateral and $45 million reserve fund to income-generating RWA products. BlackRock BUIDL issuers Securitize and Steakhouse Financial have applied to the Ethena governance committee for funding from the Ethena reserve fund.

Securitize stated that BUIDL would enable the Ethena reserve fund to invest in US Treasury-backed products, proposing to allocate $34 million from the $45 million reserve fund.

On July 23rd, Scroll announced the integration of Ethena, introducing USDe to Scroll.

On July 9th, options protocol Lyra announced a collaboration with Ethena Labs to launch the sUSDeBULL strategy, earning principal-protected returns through an automated long call spread strategy for sUSDe. The fund pool has a limit of 10 million sUSDe.

3) Project Name: BitU

Website: https://www.bitu.io/

Twitter: https://x.com/bitu_protocol

Introduction: BitU is a native-collateralized stablecoin protocol that uses off-chain liquidity and efficiency to provide higher returns (ALMM). Currently, it only allows whitelisted users to collateralize BTC to mint the stablecoin $BITU, with a minimum collateral ratio of 200% and a liquidation ratio of 110%.

Features:

- Can be considered as the Bitcoin version of Ethena

- Revenue comes from lending + Delta-neutral strategy. The protocol maps users' collateralized assets to centralized exchanges and lends funds to market makers and hedge funds. The ALMM strategy uses Ceffu's off-chain settlement solution MirrorX to generate income.

- Collateralizing $BITU yields $sBITU, passively earning rewards generated by ALMM, which are generally distributed monthly.

- Selected for Binance Labs MVB Season 7

Recent Updates:

- On July 1st, it announced listing on the Math Wallet dApp Store.

- On June 27th, TVL was displayed on DefiLlama, with the current TVL at $21.35 million.

- On June 14th, it announced a collaboration with CeffuGlobal to enhance user security using their off-chain settlement engine.

3) Project Name: Midas

Website: https://midas.app/

Twitter: https://x.com/MidasRWA

Introduction: RWA project, an asset tokenization platform that provides access to on-chain institutional-grade assets for investment. Through Midas, investors can access on-chain investment-grade securities and utilize a full suite of DeFi applications through permissionless ERC-20 tokens.

Features:

- Purchase the stablecoin mBASIS by sending USDC to the Midas platform, which is then held in custody by Fireblocks. The minimum initial purchase amount is 120,000 USDC.

- Uses a Delta-neutral strategy, holding spot positions in high-liquidity assets like BTC or ETH and shorting in the futures market.

- The fund allocation of mBASIS is more diverse, distributed to the top 20 altcoins and US Treasury bonds. If interest rates turn negative, the project will seamlessly convert assets to mTBILL (US Treasury bonds), ensuring that mBASIS's yield remains higher than the TBILL rate.

- Currently, the APY is approximately 10%, with a management scale of 1M.

- US residents are not allowed to use the platform.

Recent Updates:

- On July 24th, it announced a collaboration with MetaWealth to provide compliant institutional-grade RWA and structured products to a wide audience, starting with commercial real estate.

- mBASIS, newly launched on June 21, has made limited progress.

4) Project Name: SPOT

Website: https://www.spot.cash/

Twitter: https://x.com/SPOTprotocol

Introduction:

Ampleforth's decentralized algorithmic stablecoin, created by reorganizing the volatility of its collateral asset (AMPL) into two derivative assets.

The AMPL protocol can automatically adjust the token quantity of AMPL in all user wallets. When the market price of AMPL is higher than $1, the token balance in wallets automatically increases, effectively issuing more tokens to all wallets in proportion. When the market price of AMPL is lower than $1, the token balance in wallets decreases proportionally.

SPOT is a low-volatility derivative of AMPL, serving as a stablecoin. stAMPL is a high-volatility derivative of AMPL.

Features:

- On July 8th, Coinbase provided strategic financing of $1 million.

- It has a close relationship with the Coinbase ecosystem, and founder Brian Armstrong referred to it as the next generation stablecoin.

- Not a stablecoin in the traditional sense, as it does not always maintain price stability. It is low-volatility and aims to utilize a fully decentralized mechanism to resist inflation.

Recent Updates:

- On July 20th, announced the opening of the SPOT/USDC stablecoin pool on Aerodrome.

- Prior to receiving financing from Coinbase, it had a very low Twitter presence. After receiving financing, it announced the issuance on Base and the opening of a new pool mentioned in the first point.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。