1 token = 1 voting right governance mechanism has significant flaws, while the ve model has been battle-tested.

By Alex Liu, Foresight News

Governance Attack

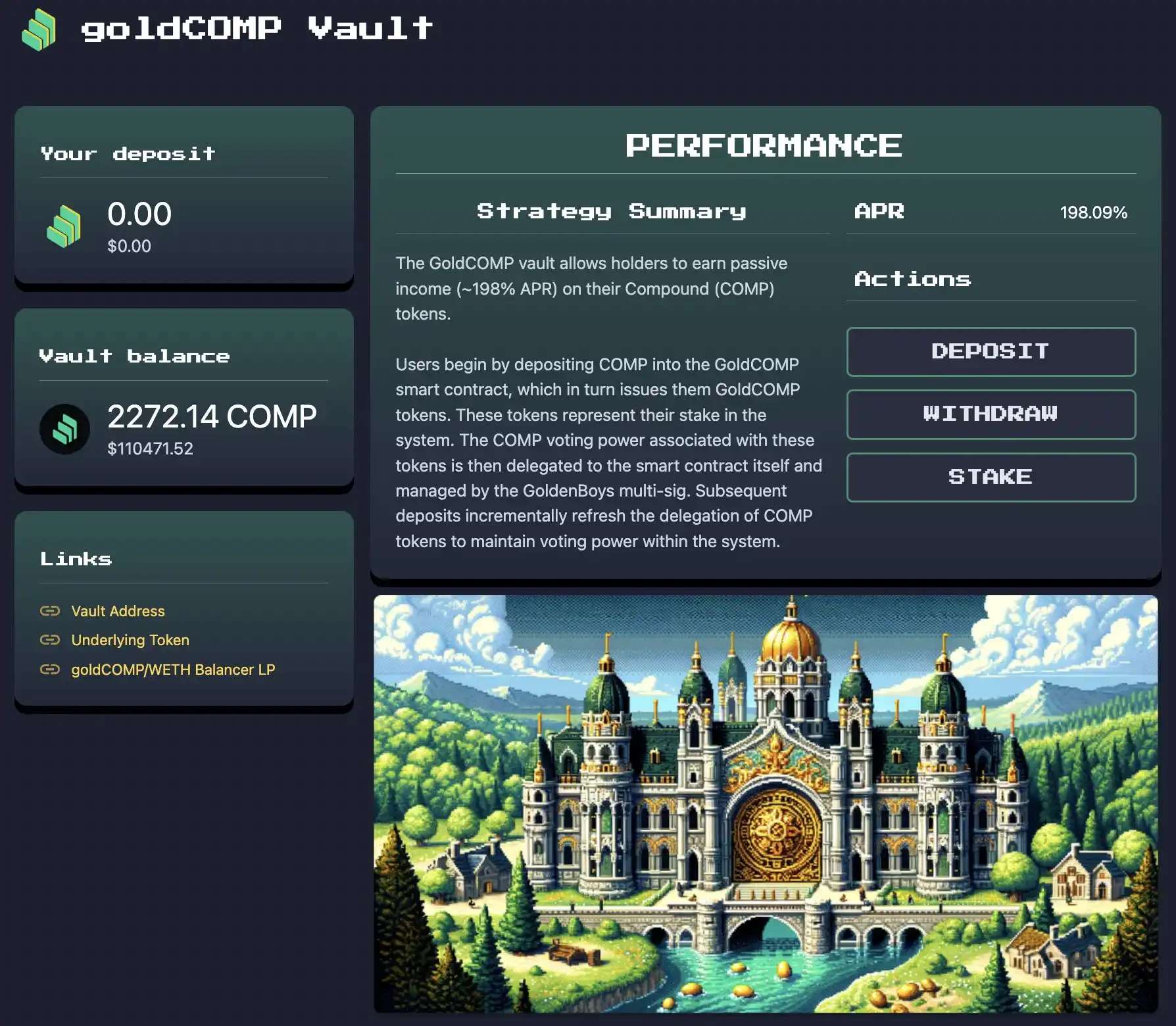

On July 29th, the lending protocol Compound barely passed Proposal 289 with 682,191 votes in favor and 633,636 votes against, allocating 5% of Compound protocol's reserve funds (approximately 499,000 COMP tokens worth about $24 million) to the "Golden Boys" yield protocol for a year.

Golden Boys yield pool

Community members accused the "Golden Boys" of being behind the proposal's passage. Compound Finance security advisor Michael Lewellen stated that several accounts accumulated a large number of tokens in the open market and forcibly reversed the result in the final stage. As a result of this operation's success, the tokens related to "Golden Boys" surged.

However, the proposal itself did not benefit the Compound protocol in any way; instead, it resulted in the loss of some control over reserve assets, thus being considered a "governance attack."

How does a governance attack occur? Why is the Ve token model capable of reducing the likelihood of such events?

1 token = 1 voting right vulnerability

For governance models like Compound's "1 token = 1 voting right," the flaws are quite evident. If the "private gain" obtained through governance proposals is greater than the "short-term holding cost of tokens sufficient to influence the number of proposal votes," governance attacks are likely to occur.

Here's a simple example: Suppose acquiring control of tokens worth $5 million from a project's treasury requires voting with governance tokens worth $30 million, and the governance process takes about 2 weeks. Then, the cost of "purchasing $30 million worth of governance tokens in the market, opening an equivalent short position for hedging, and then selling the tokens to close the short position after the proposal's result is determined" may only require $500,000.

Ve Solution

Ve stands for "vote escrow." Holding tokens directly under the ve token model, such as CRV, does not grant any voting rights. To have 1 full voting right for 1 CRV held, it is necessary to lock the tokens for 4 years to obtain 1 veCRV, while locking for 2 years results in only 0.5 veCRV.

Attackers are unlikely to lock tokens for 4 years, significantly increasing the cost of launching a "governance attack," addressing the vulnerability of "1 token = 1 voting right" and making it so that only long-term holders of governance tokens highly tied to the protocol's interests can participate in protocol governance.

Additionally, because ve token holders earn rewards by voting to determine token emissions for the protocol, the participation rate in governance activities such as voting is higher than in projects that do not use the ve model.

Time Weighting

In cases like the "governance attack" on Compound, where the proposal suddenly reached the minimum votes required for it to take effect at the last moment, the governance mechanism that allows for such sudden reversal of results is very immature and unfair—even if someone has the ability to change the result, they may not have the time to react and thus lose their voting rights.

Protocols like Curve have adopted a vote decay mechanism, where votes cast in the last minute carry no weight, specifically addressing the problem of last-minute result reversals without reaction time.

The proposal related to Compound's "governance attack" was ultimately canceled through negotiation and brought forth a proposal to allocate 30% of reserve earnings to stakers in the future. The "1 token = 1 voting right" governance mechanism has significant flaws, while the ve model has been battle-tested. To prevent the recurrence of similar events, perhaps veCOMP is already on the horizon?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。