This article will review and sort out the changes of SATS.

Author: Alfred @gametorich

Since BTC rebounded from the bottom on July 5th, SATS has risen by more than 200%+, not only performing the best in the rune track, but also ranking among the top in the entire market rebound. The reason behind this is the significant changes in the fundamentals of SATS, combined with the long-term accumulation by the institutions. For at least the next two months, SATS is one of the key targets worth paying attention to in the BTC ecosystem. This article will review and sort out the changes of SATS.

1. SATS Confirmed to Act as Gas Fee

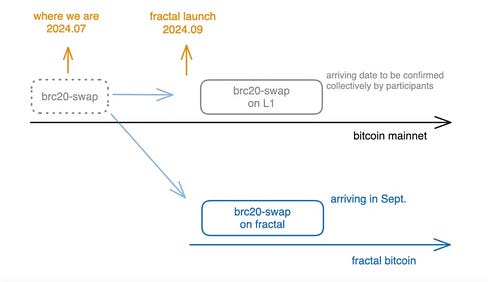

Unisat is currently developing the brc20 swap module and will push it to the Bitcoin mainnet and Unisat's second-layer network, Fractal Bitcoin, in the future. The release date of the swap on L1 is yet to be confirmed, but the Fractal swap is a product that will be completed within the expected timeframe and is planned to go live in September this year.

In an article introducing the Swap module on July 7th, Unisat explicitly stated, "By effectively integrating wallets, browsers, and exchange products, UniSat aims to provide a seamless and consistent experience for Bitcoin mainnet and Fractal Bitcoin. From the user's perspective, the main difference provided by Fractal Swap is the faster confirmation speed and lower overall cost on Fractal. Both are based on the brc-20 protocol and use brc-20 SATS as gas fees."

Source: Unisat Official

2. New Narrative Introduced by Unisat in this Round

1. Development of brc20 Swap

The core goal of brc20 Swap is to give other teams the opportunity to build their own exchange platforms based on UniSat's code. In the past, the trading of brc20 assets relied on centralized and asymmetric indexers. The launch of brc20 Swap will standardize and unify this process.

Most of the work on the current swap module has been completed, and the remaining work mainly includes:

(1) Assisting indexers other than UniSat Indexer to effectively identify and calculate the runes related to the exchange module.

(2) Ensuring that the calculation results submitted by Unisat are consistent with those of other teams to avoid accounting differences.

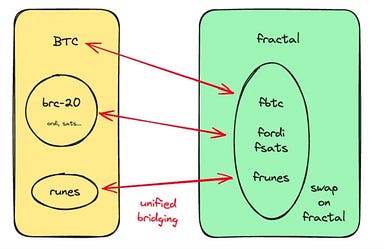

2. Building Fractal Bitcoin Network Based on brc20 Standard

The goal of Fractal Bitcoin is to expand the Bitcoin network using the brc20 standard. On Fractal Bitcoin, Unisat will provide a product, Fractal Swap, with the same functionality as the mainnet swap module, ensuring that projects on Fractal Bitcoin have good liquidity from the beginning. In subsequent iterations, BTC and other mainnet assets can also exist on Fractal Bitcoin as brc-20 wrapped assets, providing greater flexibility.

Source: Unisat Official

At the same time, Fractal Swap will implement a competitive rollup mechanism, which allows users to bundle their aggregated results into a sequencer, earning transaction fees (brc-20 SATS) generated by all transactions in the aggregation. This process is similar to miners submitting packaged transactions to the network and receiving block rewards. This further clarifies the position of SATS as the network gas fee.

3. Large-scale Airdrop of PIZZA Runes

The pizza rune was previously launched by UniSat to commemorate the 14th Bitcoin Pizza Day and was airdropped for free to platform users. Unlike previous publicly minted runes, users do not need to pay additional fees to claim them. UniSat will send the runes to users' wallets after the engraving is completed. At that time, there were over 200,000 addresses participating in the claim.

The previous conditions for claiming pizza were as follows:

(1) Addresses that have interacted with UniSat services within the last 3 months.

(2) Addresses holding more than 500 UniSat points.

(3) Addresses that have interacted with the brc 20-swap module.

(4) UniSat OG Pass holders are eligible to receive the rune.

Currently, pizza has become one of the most held assets in brc20 and rune assets.

Through these three new narratives, Unisat is striving to drive brc20 assets back to the focus of the BTC ecosystem.

3. Tracking SATS Data

1. Comparison of Holders and Market Cap

Among the popular brc20 assets, pizza has the most holders, but the chip concentration is the lowest. SATS has the highest proportion of first addresses and more holders, with higher chip concentration and holder consensus than ordi and rats, while the market value is lower than ordi.

Source: Cycle Capital, OKX Web3 Wallet

2. Chip Distribution

From the weekly chart, SATS has been declining since the rally at the end of February, lasting for 4 months. The bottom cost of 1000SATS for exchanges is around 0.00018. Currently, in the second week of the bottom's rise, it is challenging the previous dense trading area near 0.0003, with the next dense trading area around 0.0005.

Source: tradingview, okx

3. Contract Data

In the Binance contract data on July 17th, the account long/short ratio was 0.751, and the large account long/short ratio was 1.6425, indicating a higher proportion of bullish funds and a rapid rise in short positions within 24 hours. In the liquidation map, after breaking the short positions at 0.000225 and 0.00024, 1000SATS has not formed many new short positions above 0.00028.

Source: coinglass, binance

4. Conclusion

After the narrative update, SATS is different from other runes. SATS has become the gas fee for brc20 swap on the Bitcoin mainnet and the fractal network, providing a practical token use case beyond its meme properties in the BTC ecosystem. With the development and vigorous promotion of Unisat's products, its scale will rapidly expand in the future.

There are still expected time and price nodes. In the development process of the product, the Fractal network will officially go live in September. The real landing and use of SATS as gas fees will continue after September. In addition, in terms of the accumulation time and the extent of the rally on the candlestick chart, SATS has further price expectations in the coming months along with the overall market improvement.

The risk of SATS may come from its underlying fund properties and competition in the horizontal track. The funds behind brc20 are still mainly from the East, and the brc20 Bitcoin solution competes with the utxo+runes solution. Recently, the UTXO swap based on RGB++ also went live on the mainnet. In the medium term, attention should be paid to whether there is a conversion of funds between the two.

Translated by AICoin

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。