Authored by: Nancy, PANews

To this day, it is no longer new for Wall Street giants to enter the cryptocurrency space. In areas such as ETFs, RWAs, and derivatives, the presence of mainstream institutions is becoming increasingly clear. What the market truly cares about has already shifted from whether to enter the market to how to position themselves.

Recently, Goldman Sachs disclosed its cryptocurrency allocation exceeding $2.3 billion. Although this still represents a "small position" in its overall asset portfolio and has significantly decreased compared to before, the structure of its holdings is quite meaningful. Despite the vast difference in market capitalization, Goldman Sachs maintains a near-equal exposure to BTC and ETH.

This detail may carry more significance than the size of the holdings themselves.

On Par with BTC, Goldman Sachs Casts a Confidence Vote in ETH

At a time when Ethereum prices continue to be pressured and market sentiment has clearly cooled, the latest disclosed holding structure from Goldman Sachs releases signals that differ from the market sentiment.

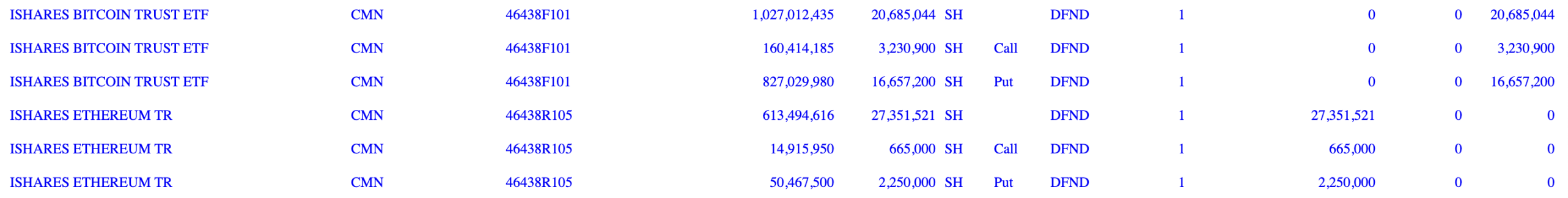

According to the disclosure in the 13F filing, as of Q4 2025, Goldman Sachs indirectly holds approximately $2.361 billion in cryptocurrency assets through ETFs.

In the context of its overall portfolio, this allocation is not prominent. During the same period, Goldman Sachs' overall investment portfolio reached $811.1 billion, with the exposure to cryptocurrency assets weighing in at only about 0.3%. For traditional financial giants managing several hundred billion or even trillions of dollars, such a proportion can only be seen as a trial run. In the view of mainstream players, cryptocurrency remains an alternative asset rather than a core allocation. A small percentage of participation can meet client demands and maintain market engagement while strictly controlling risk in a volatile environment.

What is truly noteworthy is not the scale, but rather the structure and direction of the holdings.

In the fourth quarter of last year, the overall cryptocurrency market corrected, and significant net outflows occurred in spot ETF products. Goldman Sachs also followed suit by reducing positions, with holdings in Bitcoin spot ETF and Ethereum spot ETF decreasing by 39.4% and 27.2% respectively. At the same time, it opened positions in XRP ETF and Solana ETF, beginning to slightly test the waters of the second-tier assets.

At the end of the quarter, Goldman Sachs held approximately 21.2 million shares of spot Bitcoin ETF, with a market value of about $1.06 billion; 40.7 million shares of spot Ethereum ETF, valued at about $1 billion; and allocated approximately $152 million in XRP ETF and $109 million in Solana ETF.

In other words, nearly 90% of the cryptocurrency exposure remains concentrated in the two core assets, BTC and ETH. Compared to some aggressive asset management firms or crypto-native funds, Goldman Sachs’ strategy is clearly more conservative, with liquidity, compliance, and institutional acceptance still prioritized in its allocation logic.

But of greater significance is the almost equal weighting between BTC and ETH.

Currently, Bitcoin's market capitalization is about 5.7 times that of Ethereum, yet Goldman Sachs has not weighted its allocation by market capitalization but has allowed ETH and BTC to stand on almost equal footing. This indicates that within its asset framework, Ethereum has been elevated to the status of a secondary strategic cryptocurrency asset. Moreover, when it reduces its holdings in Q4 2025, the ETH position was reduced by 12% less than the BTC position. To some extent, this represents an over-allocation confidence vote.

This preference is not a fleeting decision.

Over the past few years, Goldman Sachs has continuously made moves in various businesses surrounding asset tokenization, derivative structure design infrastructure, and OTC trading, with many of these areas being highly related to the Ethereum ecosystem.

In fact, as early as a few years ago, Goldman Sachs' research department publicly predicted that in the coming years, there was a possibility for ETH to surpass BTC in market capitalization, citing its network effects and ecological application advantages as a native smart contract platform.

This judgment continues to this day. In the "Global Macro Research" report released last year, Goldman Sachs reiterated that from the perspectives of real use, user base, and technological iteration speed, Ethereum has the potential to become the core carrier of mainstream cryptocurrency assets.

Despite recent divergences in price and fundamentals for Ethereum, Goldman Sachs maintains a relatively positive assessment. It noted that Ethereum's on-chain activities depict a different scene, with the number of new daily addresses reaching 427,000 in January, a record high, far exceeding the daily average of 162,000 addresses during the DeFi summer of 2020. Simultaneously, the number of daily active addresses reached 1.2 million, also setting a record high.

Perhaps in the asset logic of Wall Street institutions, Bitcoin has become a macro hedging tool, while Ethereum bears a structural narrative of on-chain finance and application ecology. The two represent different dimensions of allocation logic; the former leans towards value storage, while the latter bets on infrastructure and network effects.

Goldman Sachs' Turnaround, Wall Street’s Hesitation and Entry

Goldman Sachs is also a "latecomer" in the cryptocurrency realm.

If we stretch the timeline, this typical traditional financial institution’s path to entry has not been aggressive, taking a "compliance first, gradual trial" approach.

As early as 2015, Goldman Sachs submitted a patent application for a securities settlement system based on SETLcoin, trying to explore the optimization of the clearing process using blockchain-like technology. At that time, Bitcoin had not yet entered the mainstream horizon; this was more a curiosity at the technical level rather than recognition at the asset level.

In 2017, when Bitcoin prices soared to historical highs, Goldman Sachs once planned to set up a cryptocurrency trading desk to provide Bitcoin-related services; in 2018, it hired former crypto traders to prepare a Bitcoin trading platform. By then, Goldman Sachs had already begun to engage with this emerging market on a direct basis.

However, the real shift in attitude occurred in 2020. That year, during a client-facing conference call, Goldman Sachs explicitly stated that Bitcoin could not even be considered an asset class, as it generates no cash flow and cannot effectively hedge inflation. This public bearish stance sparked considerable controversy in the market.

Goldman Sachs began including Bitcoin in its weekly asset class report in 2021

One year later, Goldman Sachs' position shifted rapidly. In 2021, against the backdrop of rising institutional client demand, Goldman Sachs reinstated its cryptocurrency trading desk, began trading Bitcoin-related derivatives, and collaborated with Galaxy Digital to launch Bitcoin futures trading products. By 2022, Goldman Sachs completed its first cryptocurrency OTC trade and expanded its digital asset team. By 2024, it not only invested in several crypto firms but also officially entered the cryptocurrency spot ETF market.

A true comprehensive acceptance has manifested in the last two years.

In March 2025, Goldman Sachs first mentioned cryptocurrencies in its annual shareholder letter, acknowledging increased competition in the industry and positing that clearer regulations would drive a new round of institutional adoption. Areas such as tokenization, DeFi, and stablecoins would witness growth driven by new regulations. Recently, its CEO David Solomon has publicly confirmed that the firm is increasing its research and investment in tokenization, stablecoins, and prediction markets.

This script of transformation is not uncommon among traditional old-money entities.

For example, in 2025, Anthony Scaramucci, founder of SkyBridge Capital, admitted that although he had contacted Bitcoin as early as 2012, it took a full eight years before making his first Bitcoin investment, as he initially did not understand it and was full of doubts. It was only after he seriously researched blockchain and Bitcoin mechanisms that he realized this was a "great technological breakthrough." He even stated that as long as one "does some homework," 90% of people would lean towards Bitcoin.

Today, SkyBridge Capital holds a large amount of Bitcoin and invests about 40% of client funds in digital assets. In the recent bear market atmosphere, Scaramucci revealed that the firm had built positions in Bitcoin at $84,000, $63,000, and the current range, describing buying Bitcoin in a downtrend as "like catching a flying knife," but still firmly bullish in the long term.

These elite investors on Wall Street always prioritize risk in their decision-making core, typically opting to scale allocations only within controllable risks.

Moreover, the decision-making cycle of institutions also dictates that the real capital entry is a long-distance race.

According to Bitwise Chief Investment Officer Matt Hougan's recent disclosure in an interview, the next batch of potential buyers still consists of financial advisors, large brokerages like Morgan Stanley, family offices, insurance companies, and sovereign nations. The average client of Bitwise requires eight meetings before allocating assets. Typically, we meet once a quarter, so "eight meetings" means a decision-making cycle of up to two years. Morgan Stanley will not approve a Bitcoin ETF until Q4 2025; their "eight meetings alarm" has just begun, and real capital inflows may not materialize until 2027. This is reminiscent of the situation with the launch of the gold ETF in 2004, where capital inflows increased year by year, taking a full eight years to reach the first peak. Most of the funds managed by professional investors do not currently hold Bitcoin.

The movement of cryptocurrency assets from marginal to mainstream is inherently a slow and winding process. When former bears begin to hold in a compliant manner and skeptics transition to long-term allocators, the real changes occurring in the cryptocurrency market may not lie in the price movement, but in the upgrade of participant structures.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。