Bitcoin whale address increased its holdings by 71,000 BTC, worth about $4.3 billion, when the coin price retraced to $54,200 on July 5th.

Authored by: 1912212.eth, Foresight News

Today, Bitcoin price steadily rose, briefly surpassing $63,000, while ETH also exceeded $3,300. Altcoins followed the overall market trend, with short positions liquidating up to $90 million in the past 24 hours.

A major bearish factor looming over the market has finally been erased: on July 13th, the balance of the Bitcoin address seized by the German government showed that its selling may have ended, marking the conclusion of the large-scale selling since mid-June. It's worth noting that the selling pressure from the 50,000 BTC caused BTC to drop from a high of $65,000 to near $53,500, triggering panic and setting a new low for the year, leading to a collapse in the altcoin market.

Meanwhile, the recently survived assassination attempt on Trump has made him globally popular due to the photo of him raising his arms. Following the event, the prediction market platform Polymarket's odds for Trump's re-election surged to 71%, reaching a recent high, far exceeding the 18% for the current president, Biden. Based on his recent stances during the election, if Trump were to win, it would undoubtedly be a major positive for the cryptocurrency market.

Trump previously expressed his love and understanding of cryptocurrencies during a meeting with Bitcoin mining representatives last month, stating that he would advocate for Bitcoin miners in the White House. He even mentioned on his social media platform, Truth Social, that Bitcoin mining might be the last line of defense against central bank digital currencies (CBDCs), and he hopes that all remaining Bitcoins are "MADE IN THE USA." Additionally, Palantir Technologies advisor Jacob Helberg told Reuters that Trump explicitly stated that Biden and Gensler's crackdown on cryptocurrencies would cease within an hour of Trump's second term in office.

It's worth mentioning that Trump is scheduled to attend the Bitcoin 2024 conference in Tennessee on July 27th and deliver a speech. If the probability of Trump's re-election continues to rise, the crypto market may anticipate an early "price in" rally for this potential positive development.

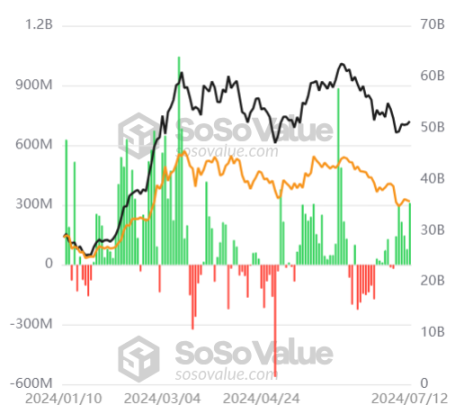

There has been no movement in the distribution of Mt. Gox's compensation. After months of persistent bearish sentiment in the market, the selling pressure has weakened, and the data for Bitcoin spot ETF has shown impressive performance. Since July 5th, the ETF data has shown net inflows, with a staggering total net inflow of $3.1 billion on July 12th. According to IntoTheBlock data, the Bitcoin whale address increased its holdings by 71,000 BTC, worth about $4.3 billion, when the coin price retraced to $54,200 on July 5th.

The approval of Ethereum spot ETF seems imminent. With the macroeconomic expectation of interest rate cuts increasing from one to two, and being brought forward to September, the future market trend is a topic of interest.

Ben Simpson, founder of the crypto education platform Collective Shift, stated that a "local bottom" for Bitcoin has been formed and it is now trending upwards. The price of Bitcoin has been impacted by a significant amount of forced selling, mostly from the German government's nearly $3 billion sell-off and the negative sentiment surrounding the repayment of about $8.5 billion to Mt. Gox creditors. The recent assassination attempt on former President Trump has had a positive impact on his re-election odds, and his support for cryptocurrencies has boosted positive sentiment for Bitcoin and crypto assets during this process.

Eugene Ng Ah Sio, a top trader on the Binance Futures platform with accumulated profits exceeding $28.65 million, stated on his social media platform that if the weekly, daily, and 4-hour candlestick charts for Bitcoin close above $60,000, there is a high possibility of a direct approach to $63,000. Conversely, if this level cannot be maintained, the upward momentum will stall, potentially marking the highest point for a considerable period of time. (Attempting to reclaim the range and failing)

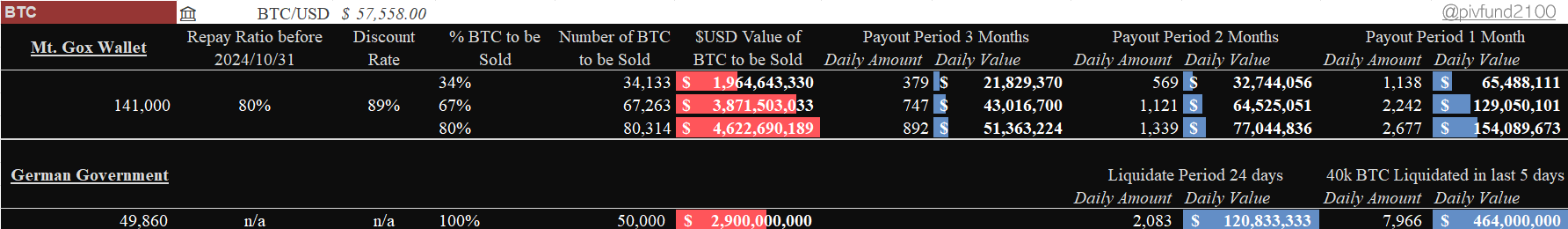

Trader T: Mentougou will be the next major seller, potentially bringing $46.2 billion in selling pressure before November.

Trader T predicted on platform X that after a strong sell-off by the German government for a week, Mentougou Mt. Gox will be the next strong seller. Mt. Gox is obligated to repay 14,100 BTC, and before November this year, the repayment ratio will not be less than 80%, with a discount rate of 89%. Therefore, Mt. Gox may sell up to 100,392 BTC before November. Given the dispersed ownership, the likelihood of a large-scale liquidation is low. In the worst-case scenario, if 80% of Mt. Gox's Bitcoin is sold, it could bring about $46.2 billion in liquidation pressure.

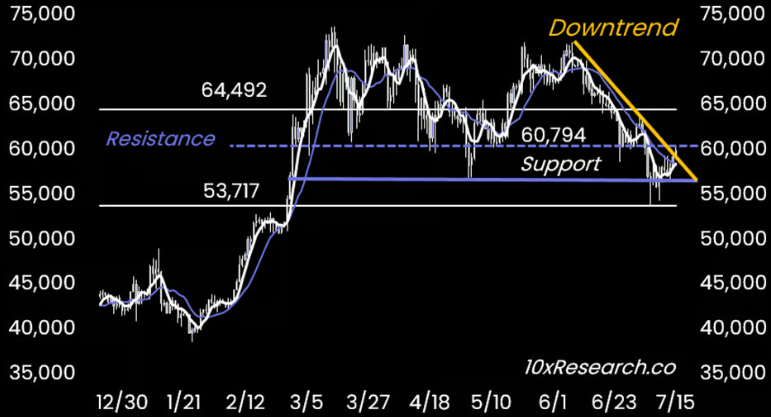

10x Research: Expecting larger-scale selling in the coming weeks and months.

Markus Thielen, founder of 10x Research, stated in a report that due to oversupply and a lack of stable market fundamentals, concerns persist, posing potential risks for mid-term traders. Last week, Bitcoin seemed to rebound from oversold levels before the release of the Consumer Price Index (CPI), which was expected to decrease. However, as this expectation was widely known and Bitcoin had already risen, the price could not be sustained. This trend of declining inflation may continue until October, when year-over-year data will be more challenging.

Despite experiencing a nearly 20% retracement from its low point during the sale of $3 billion worth of Bitcoin in the U.S. state of Saxony, it has withstood this test. However, larger-scale selling is expected in the coming weeks and months, which could further impact the market.

JPMorgan: Cryptocurrency market expected to rebound in August.

In its latest research report, JPMorgan stated that the cryptocurrency market is expected to rebound in August. Due to the liquidation of Mt. Gox and Gemini's creditors, as well as the sale of cryptocurrencies seized from criminal activities by the German government, the reserves of Bitcoin on major trading platforms have decreased over the past month, leading the bank to revise its estimated net inflow for the cryptocurrency market from $12 billion to $8 billion for the year to date. The report indicated that the liquidation activities should end this month, and the market will recover from August onwards.

Matrixport: Approval of Ethereum ETF seems imminent, and this time the market may not experience a "sell the news" event.

Matrixport analysis suggests that based on the S-1 filing submitted to the SEC, the approval of an Ethereum ETF seems imminent. Although the price of Ethereum has retraced from its rebound since May 20, 2023, when the SEC requested exchanges to resubmit Form 19b-4, the market position for ETH remains bullish. Futures traders are already anticipating the approval of an ETH ETF. This time, the market may not experience a "sell the news" event.

CryptoQuant: Expecting a quiet cryptocurrency market in the next 2-3 months, maintaining a long-term bullish view.

Ki Young Ju, founder and CEO of CryptoQuant, stated that Bitcoin miner capitulation is still ongoing. Historically, when the daily average mining value reaches 40% of the annual average, this ratio ends, but currently, this ratio is at 72%. It is expected that the cryptocurrency market will remain quiet in the next 2-3 months, maintaining a long-term bullish view, but avoiding excessive risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。