1. Introduction

With the advancement of technology and market adaptation, DeFi is expected to further change the traditional financial market structure, providing market participants with more efficient, secure, and transparent trading options. This Bing Ventures research outlook explores the potential continued impact of DeFi technology in the future, particularly in improving market inclusiveness, reducing transaction costs, and enhancing market efficiency, with a special focus on Pendle and premarket trading cases.

Pendle introduces traditional interest rate trading and financial derivatives to the blockchain through tokenization, innovating financial products that separate principal and yield, such as PT and YT. In this way, Pendle not only provides a flexible way of interest rate trading but also promotes liquidity and efficiency in the DeFi market. Pendle's technological practice separates principal tokens and yield tokens, allowing investors to independently manage assets based on their risk preferences and market predictions.

In traditional stock markets, premarket trading is usually limited to large institutional investors and high-net-worth individuals. However, in the context of Web3, premarket trading has transformed this pattern, allowing a broader range of investors to participate in premarket trading through smart contracts and decentralized trading platforms such as AEVO and Whales Market. This reform not only increases market transparency and security but also enhances the efficiency of capital utilization and overall market liquidity.

2. Pendle's Innovative Practice: Revolutionizing Interest Rate Trading

In the traditional financial market, interest rate trading has always been an important financial tool, influencing not only money supply and market liquidity but also directly affecting the formation of the interest rate curve. In Web3, with the development of blockchain technology and the rise of the DeFi ecosystem, interest rate trading is undergoing a thorough transformation. DeFi interest rate trading is no longer limited by the cumbersome procedures and geographical restrictions of traditional financial institutions but is conducted through smart contracts on decentralized platforms, providing users with more efficient and flexible financial services.

In this emerging DeFi interest rate trading field in 2024, Pendle is undoubtedly one of the pioneers leading the trend. Pendle tokenizes yield-generating assets into SY tokens, such as packaging staked ETH as SY-stETH, and then divides SY into principal and yield components, namely PT (Principal Token) and YT (Yield Token), enabling flexible management and optimization of interest income.

With the rise of the Restaking concept and the increasing scale of synthetic stablecoins, the interest rate swap market has also seen more new gameplay, expanding the potential growth space of the interest rate swap market. Taking Pendle as an example, we will explore these derived PT/YT new gameplay and their impact on the DeFi interest rate trading ecosystem and the outlook for future development.

Space of the Interest Rate Market

Taking the largest interest rate market, Pendle, as an example, it briefly gained attention in the interest rate market in 2021. At that time, people did not quite understand how Pendle's interest rate swaps could be applied in the blockchain market. However, in 2024, with the emergence of LRT and ETHENA, Pendle seems to have found a path that suits it best.

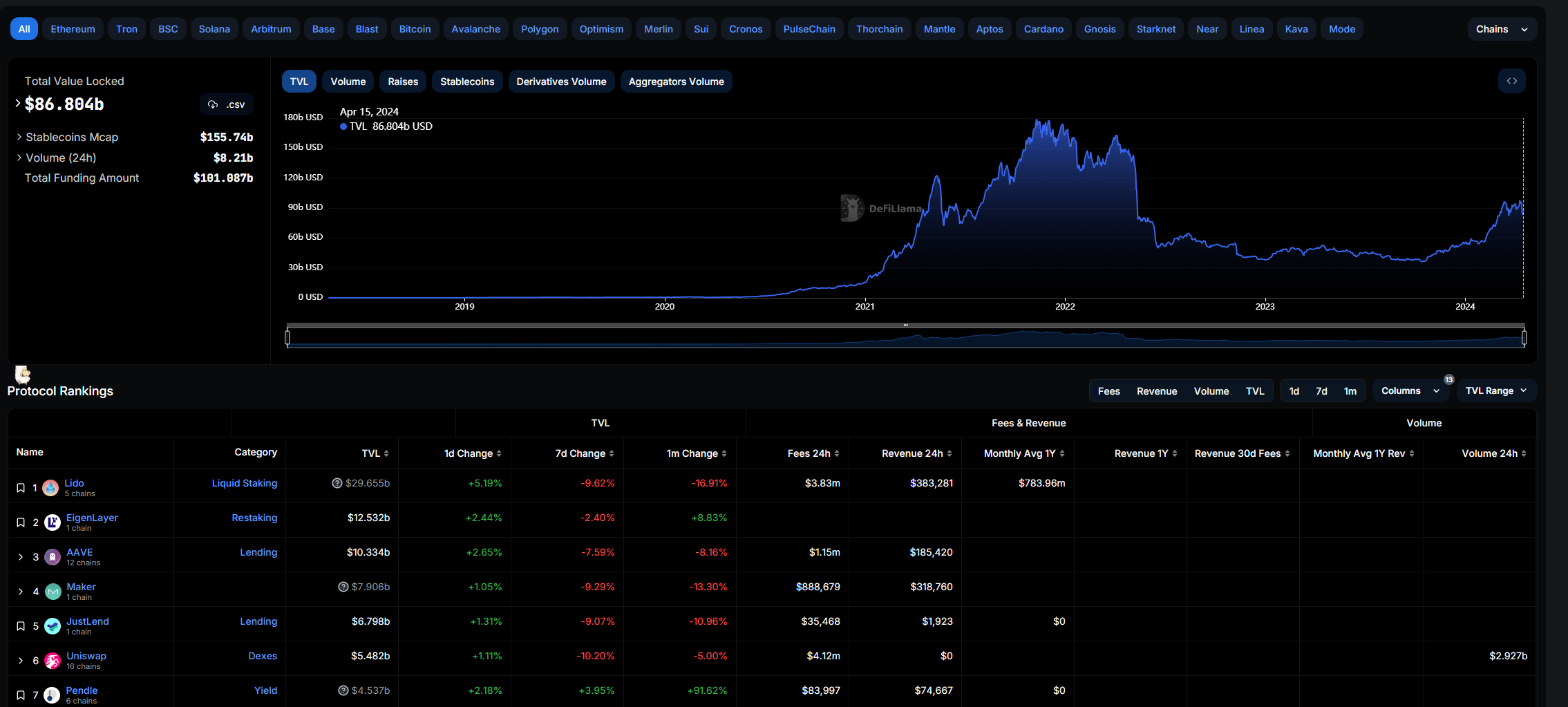

According to defillama data, Pendle's TVL has reached $86.884 billion, ranking 7th among DeFi protocols, with a 91.62% increase in TVL over the past month.

Source: defillama

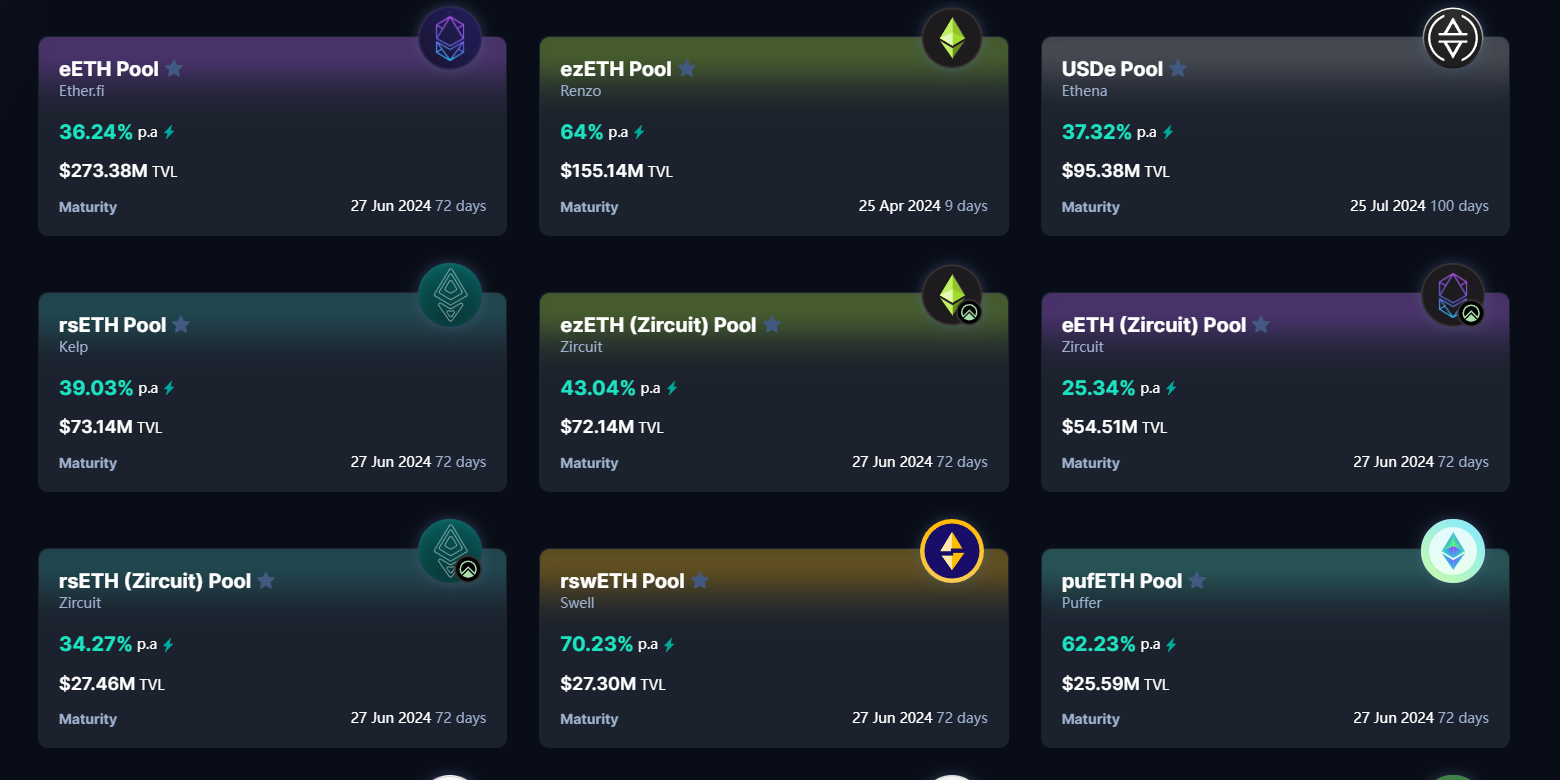

Looking at the products within the protocol, most of the TVL growth comes from LRT protocol tokens and synthetic dollars from Ethena, which align well with Pendle, amplifying users' returns. The growth in TVL is driven by the top narrative of this round of bull market, the Eigenlayer's point bonus in the Restaking race, PT/YT gameplay, and Ethena's high returns.

Source: Pendle

Based on the above content, it can be observed that the key factor for the potential incremental growth of Pendle's interest rate market lies in whether LRT and ETHENA can attract more market funds in the future to drive Pendle's growth.

New Gameplay of YT/PT

In the past, Pendle's main business was to serve users with interest-bearing assets, such as users who staked ETH on Lido and obtained stETH, enabling them to achieve satisfactory returns through the PT/YT features.

Now, Pendle has introduced new gameplay for PT/YT through Eigenlayer Points+Yield and the high-yield protocol of synthetic dollars from Ethena, generating new opportunities for PT/YT.

Points Exchange: Eigenlayer and the synthetic dollar protocol Ethena both have high expected airdrop rates for staking assets (such as ETH), which is the core criterion for airdrops. Through Pendle's collaboration with various projects that issue points, large funds can provide liquidity with reliable PT, while small funds can gamble for higher returns. This points exchange gameplay has allowed Pendle to achieve a significant increase in TVL during this bull market.

a) For example, staking ETH in Eigenlayer can earn eETH and points rewards. Pendle then divides eETH into PT (Principal Token) and YT (Yield Token). Buying YT means acquiring all the points rewards for potential future airdrops.

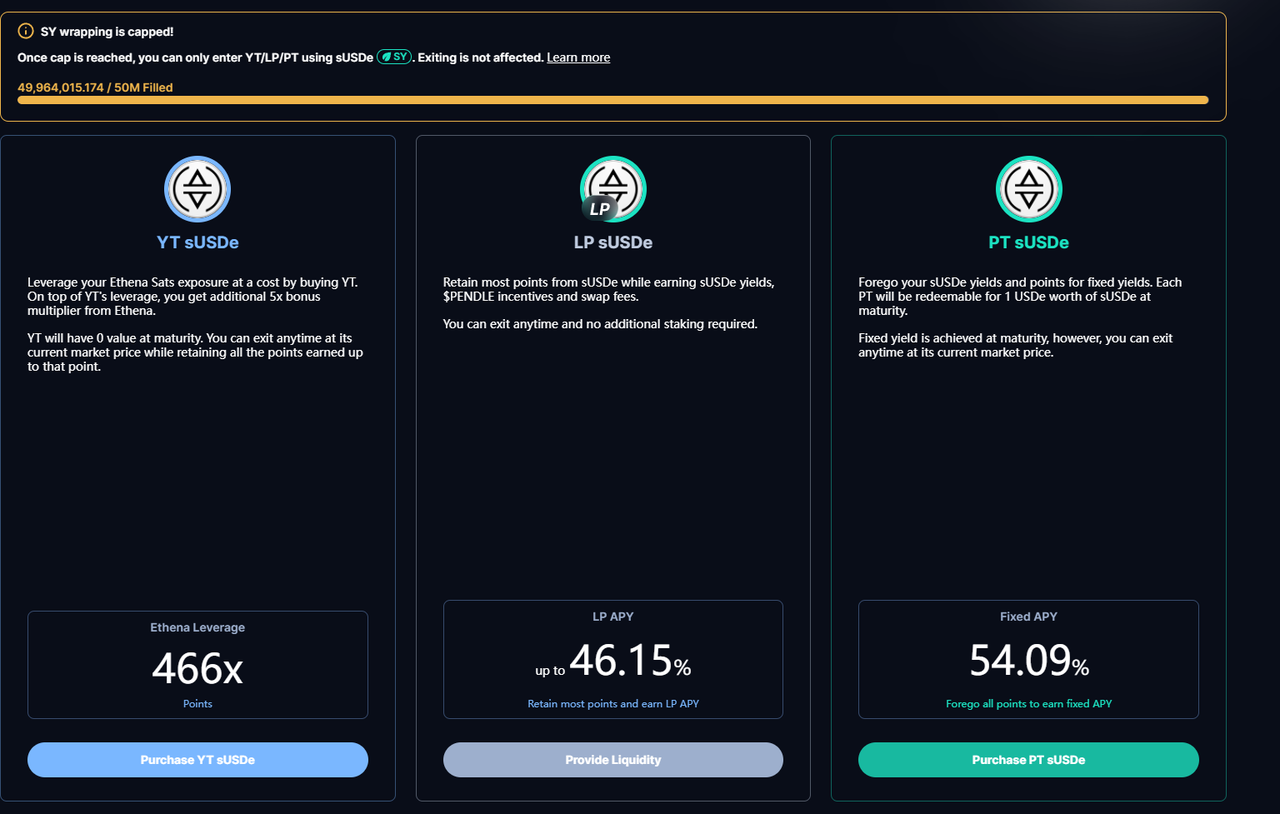

b) Taking Ethena's current rates on Pendle as an example: when participating in Pendle with sUSDe,

i) Exchanging sUSDe for YT sUSDe can earn 466x Pendle points.

ii) Exchanging sUSDe for LP sUSDe can earn an APY of 46.15% (floating rate) and points for holding sUSDe.

iii) Exchanging sUSDe for PT sUSDe can earn an APY of 54.09%.

c) Large funds can provide liquidity with reliable PT, while small funds can gamble for higher returns. The growth of Ethena's scale will drive Pendle's growth.

d) The collaboration between Ethena and Pendle can also be used for the LRT protocol, giving users more options to increase their returns. The development of the Restaking ecosystem will also promote Pendle's growth.

Funding Fee Swap: Assuming the future scale of the synthetic stablecoin protocol continues to expand in the context of a bull market, for example, with a continuous increase in users using ETHENA, there will be a large amount of sUSDe in the market. These sUSDe can then be split into YT sUSDe and PT sUSDe through an interest rate swap protocol. Users can profit by predicting the future trend of funding fees, for example, predicting a market shift from bearish to bullish. In a bear market, users can buy YT-sUSDe at a lower APY (bear market stablecoin APY tends to be lower) and sell at a premium in a bullish market, creating more opportunities for speculation.

Diverse Strategies: In the exchange of PT/YT, investors with different risk preferences can use different investment strategies. Through Pendle, traders can implement bullish strategies, risk hedging, and discounted long positions.

a) If the market is expected to increase returns, traders can buy YT to gain exposure to returns. Traders who go long on YT will benefit as returns increase.

b) On the other hand, if the market is expected to decrease returns, traders can hedge their risk by selling YT and receiving upfront payments.

Three, On-chain Premarket Trading Platforms

Premarket often refers to "premarket trading" in the stock market, which refers to trading activities that take place before the official market opening. This type of trading mainly occurs in electronic trading systems rather than traditional stock exchanges. In premarket trading, investors can buy and sell stocks, but the trading volume is relatively small, and price fluctuations may be significant. The purpose of this type of trading includes taking advantage of the impact of important news or events released by companies to obtain better trading prices before the official trading begins.

When the premarket trading method is applied to Web3, investors use it to seek investment opportunities in high-profile projects through off-exchange trading before the token generation event (TGE). The main objects of these trades are mostly confirmed airdropped tokens from project parties, traded in the form of shares or points.

Source: https://edition.cnn.com/markets/premarkets

Iteration of Trading Methods in Web3 Premarketplace

Source: https://www.racent.com/blog/man-in-the-middle-attack

- In the early off-exchange trading, mainstream social platforms were commonly used for trading, such as Discord, Telegram, and WeChat, where a large number of matched trades took place. At this time, trading was mainly conducted through a "middleman" role, matching orders and finding buyers and sellers to ensure completion of the trade with collateral, with the "middleman" taking varying fees.

- However, this method clearly had many issues, the most common being the potential for misconduct by the "middleman." Since all trades were matched by the "middleman," the actual buy and sell prices were determined within a black box, potentially resulting in prices far from the actual seller, and there was also the risk of the "middleman" taking collateral and then running off with it.

- As the potential for misconduct by the "middleman" became known, KOLs and bloggers with a certain fan base began to act as "middlemen," using their credibility to continue matching trades and bringing buyers, sellers, and the "middleman" into the same group chat to ensure price transparency. This was the most common off-exchange trading method before the emergence of on-chain pre-marketplaces.

- The second phase of trading lasted for a long time but still had many issues, such as low trading efficiency, problems that could arise from purely manual processes, and the potential risks of the "middleman" role. This led to the emergence of two of the most representative on-chain pre-marketplaces: AEVO and Whales Market.

Introduction to Web3 Pre-marketplace Products

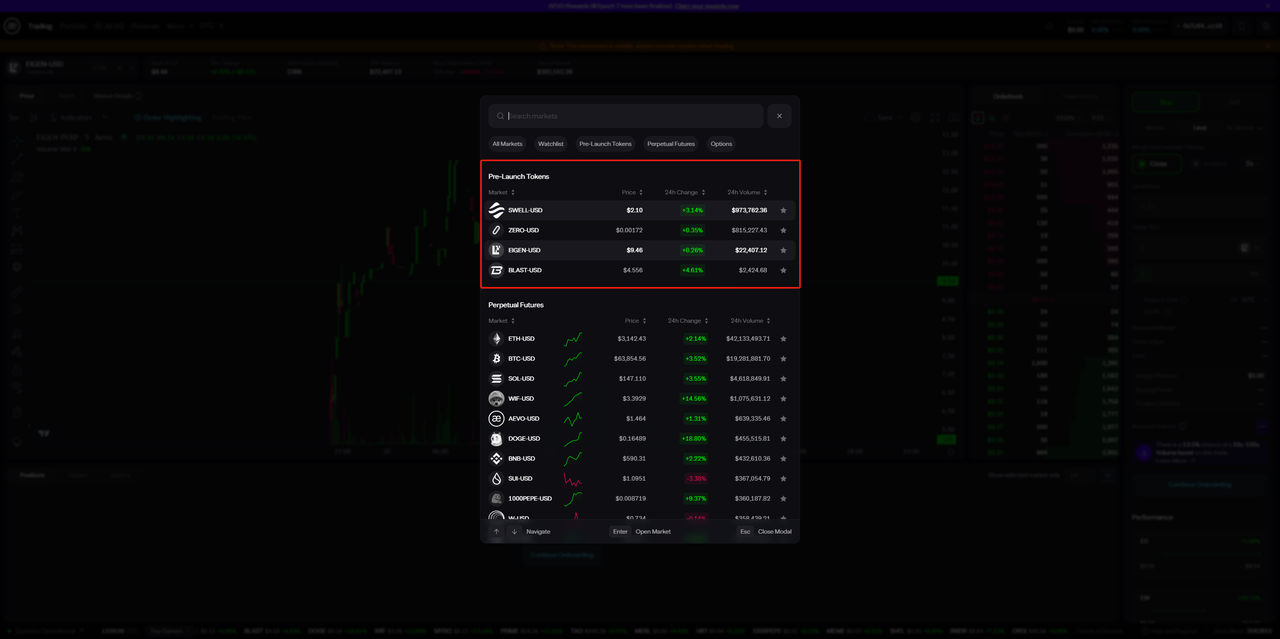

AEVO: AEVO is a decentralized options platform focused on options and perpetual trading, currently supporting the Optimism, Arbitrum, and Ethereum chains. AEVO has been commonly used for on-chain perpetual trading in the past, and recently introduced a section for Pre-Launch Tokens, allowing users to trade tokens before the token generation event (TGE).

a) Trading Process: Users can choose relevant tokens for perpetual trading in the Pre-Launch Tokens section, with most tokens supporting 1–2X leverage. The actual trading process is similar to normal perpetual trading, allowing for different strategies such as short or long positions.

b) Platform Data: As shown in the image, the token $SWELL from the Restake protocol Swell is currently priced at $2.1 on AEVO, with a 24-hour trading volume of $973,762, making it the top 24-hour volume token in the Pre-Launch Tokens section.

c) Platform Features:

i) Compared to traditional off-exchange trading on social platforms, AEVO's trading process is more formal, transparent, and secure.

ii) Supports users to go short or long with 1–2X leverage to generate profits.

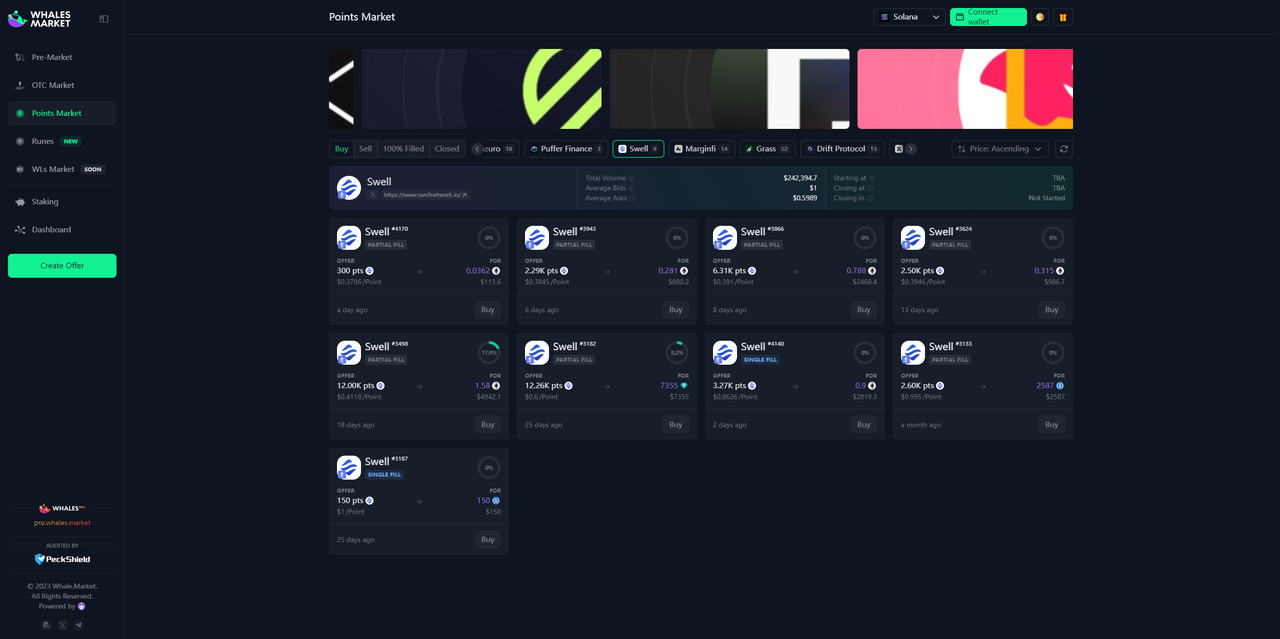

Whales.Market: Whales.Market is an off-exchange trading platform built within the Solana ecosystem, using smart contract technology to provide a secure, trustless environment for trading allocations, tokens, and NFTs before the TGE. Unlike AEVO, Whales.Market not only trades tokens but also allows trading of Points and NFTs, and will later open NFT whitelist trading.

a) Trading Process: Users can choose different assets for trading on Whales Market, with clear information on purchase quantity, unit price, total price, and other relevant data on the purchase page. The buying and selling parties execute peer-to-peer trades on-chain, with collateral locked in smart contracts and released to the parties after successful settlement. The process of determining whether a trade is completed often requires manual review, simplifying the trading process, transparent pricing, and significantly reducing the risk of financial loss due to fraudulent activities.

b) Platform Data: Using $SWELL as an example, the Total Volume in Whales Market on the same day was $242,394. However, Whales Market supports a much wider range of off-exchange trading assets compared to AEVO.

c) Platform Features:

i) Security: Matches orders transparently through smart contracts to ensure the security of user funds.

ii) Asset Diversity: Supports trading of various assets such as NFTs and protocol Points.

iii) Enhanced User Experience: When a user is unable to purchase a large order, they can choose to purchase a certain amount of shares and pool with other buyers.

Current Challenges

The evolution from high-risk off-exchange trading with intermediaries as guarantors to platforms completing trades through smart contracts is a crucial step for the entire premarket. However, we cannot ignore the current challenges.

Source: People Matters

- Liquidity Crisis: Most Pre-Launch Tokens currently face the risk of insufficient liquidity. Even the largest trading volume token, Swell, on AEVO has a 24-hour trading volume of less than $1 million, leading to significant price fluctuations due to low liquidity, resulting in high risk. This also prevents whales with substantial funds from participating in trading with large positions. In theory, the higher the total trading volume, the closer the price is to a reasonable value.

- Risks from Centralized Mechanisms: Taking Whales Market as an example, a recent popular BTC NFT "RuneStone" trade revealed risks associated with centralization. Due to the huge trading volume of this NFT and its transfer on the BTC chain, there is a need for extensive manual review to verify whether the NFT has been received, whether the gas fees for the transfer are sufficient, and other issues. Additionally, the varying arrival times of the NFT airdrop have led to multiple users encountering problems during settlement. These factors have made the order completion process more complicated, and centralized review still presents issues.

- High Risk of Premarket Trading: Premarket trading involves many uncertainties, which may arise from sellers, platforms, or changes in airdrop standards by protocols, all of which can lead to losses. Investors need to face challenges higher than those in secondary market trading and require advanced expertise in token pricing, resulting in high risk.

- Low Capital Efficiency: Off-exchange trading often requires collateral to lock in orders, and the actual settlement date for most projects is some time after the order is locked. During this period, the collateral needs to remain locked, significantly reducing capital efficiency.

Four, Technological Integration: Interaction and Impact between DeFi and Traditional Markets

Despite facing numerous challenges during the bear market, we believe that the DeFi sector still holds unlimited potential and opportunities in the future. With the continuous emergence and innovation of new gameplay from protocols such as Pendle, Ethena, and Eigenlayer, DeFi will further expand its boundaries, providing users with more diversified services and flexible asset management tools. Additionally, with ongoing innovation, we will see more gameplay based on PT/YT, and the good collaboration with LRT has opened up a higher ceiling for interest rate swaps.

We look forward to seeing more applications of interest rate swaps, reaching a future where everything can be exchanged for interest rates, bringing innovative products and services to users. However, it is important to remain cautious of the risks. Behind the continuous yield farming in LRT, there are still risks, as most protocols are highly interconnected and have a large volume, making the impact of hacking attacks or protocol misconduct extremely concerning. The continuous innovation in DeFi has created a fertile ground, and interest rate swaps are the valuable seeds on this ground, full of possibilities.

Innovative Practices of Pendle

Pendle's model of separating financial products into PT and YT (Principal Token and Yield Token) has provided investors with a new way to flexibly manage and optimize interest rate returns during the bull market. This innovative practice has not only improved market liquidity but also introduced a new way of turnover, automating asset management and trading through smart contracts. While providing an efficient trading mechanism, this model also demands higher expertise and risk management capabilities from market participants. For example, the separation of PT and YT may lead to investors making investments without fully understanding their structure, increasing market speculation and instability.

On-chain Premarket Trading Platforms

Through decentralized platforms like AEVO and Whales Market, premarket trading has brought traditional stock market pre-market trading into the Web3 world, allowing a broader group of investors to participate in token trading for high-demand projects. This trading method increases accessibility and transparency while reducing the intermediary risks associated with traditional off-exchange trading. Although on-chain platforms reduce the risk of malicious intermediaries, new technological challenges and the possibility of operational errors still exist. For example, smart contract vulnerabilities or operational mistakes could lead to fund losses, especially in complex trading logic and high-value transactions.

In this current bull market, we have seen many projects issuing tokens while market liquidity is abundant, and this phenomenon is expected to continue. The pre-TGE trading process is also essential, and the premarket gameplay will become more well-known. Additionally, we can expect positive developments in premarket trading in the future:

source:RISMedia

- Higher Decentralization: As platforms continue to refine their rules, future premarketplaces may emphasize decentralization. This means that premarketplaces will reduce the need for human involvement, increasing transaction speed while becoming more decentralized.

- Broader Asset Coverage: Future premarkets may support a wider variety of asset trading, pioneering diverse asset trading, similar to how Whales Market began supporting protocol Points, NFTs, and other asset trading. This will provide investors with more diversified investment choices and promote greater liquidity and trading activity for more assets.

- Smarter Trading Experience: Future premarketplaces may utilize smart contracts and AI to provide a more intelligent trading experience. For example, using AI to estimate project price ranges, lowering user participation barriers, and providing personalized trading advice to improve trading efficiency and user experience.

Based on the current innovative trends of Pendle and premarket, the following interesting and innovative gameplay can be derived, closely following existing trading mechanisms and market structures:

1. Dynamic Interest Rate Swap Protocols

Pendle's PT and YT mechanism can further develop into dynamic interest rate swap protocols, allowing users to dynamically adjust their interest rate swap contracts based on market conditions. This protocol can combine real-time market data and AI prediction models to automatically adjust interest rate levels, enabling users to achieve optimal interest rate returns in market fluctuations.

- Core Mechanism: Real-time monitoring of market changes and automatic adjustment of interest rate levels through smart contracts and AI models.

- Advantages: Increased flexibility in investment returns, reducing the cumbersome manual adjustment of interest rates by users.

- Risk Management: Requires high-precision market prediction models and robust smart contract code to avoid prediction errors and contract vulnerabilities.

2. Decentralized Cross-Platform Arbitrage Tools

Using on-chain trading platforms in premarket, decentralized cross-platform arbitrage tools can be developed. These tools allow users to engage in arbitrage trading between different DeFi platforms, automatically identifying and executing price differential trades through smart contracts to achieve risk-free arbitrage.

- Core Mechanism: Using smart contracts to monitor price differentials across multiple trading platforms and automatically execute arbitrage trades.

- Advantages: Improves market efficiency, reduces price differentials, and provides risk-free profit opportunities.

- Risk Management: Requires real-time data synchronization and low-latency trade execution to prevent arbitrage trade failures.

3. Smart Contract Insurance Mechanisms

Introducing smart contract insurance mechanisms in Pendle and premarket trading to provide users with trading insurance services. When smart contracts fail or the market experiences abnormal fluctuations, the insurance mechanism can automatically compensate users for losses, safeguarding user funds.

- Core Mechanism: Setting insurance conditions through smart contracts to automatically execute compensation when specific events are triggered.

- Advantages: Increases user confidence, encourages more users to participate in DeFi trading.

- Risk Management: Requires sufficient insurance fund pools and clear compensation conditions to prevent misuse and insufficient funds.

4. Multi-Layer Staking of Synthetic Assets

Based on Pendle's PT and YT mechanism, a multi-layer staking mechanism can be developed, allowing users to stake income-generating assets at different levels to receive varying levels of returns and rewards. This mechanism can attract more funds to participate in staking, enhancing overall market liquidity.

- Core Mechanism: Users can stake assets at different levels, with each level corresponding to different returns and rewards.

- Advantages: Provides diversified investment choices, attracting investors with different risk preferences.

- Risk Management: Requires clear level divisions and calculation methods for returns to prevent management difficulties due to complex staking levels.

These examples reveal how new trading mechanisms in the cryptocurrency bull market bring both efficiency and transparency, while also introducing new risks and challenges. The cases of Pendle and premarket demonstrate that the integration of DeFi technology with traditional markets is driving financial product innovation. For example, combining AI with intelligent trading systems can provide more personalized and efficient trading strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。