作者:Weilin,PANews

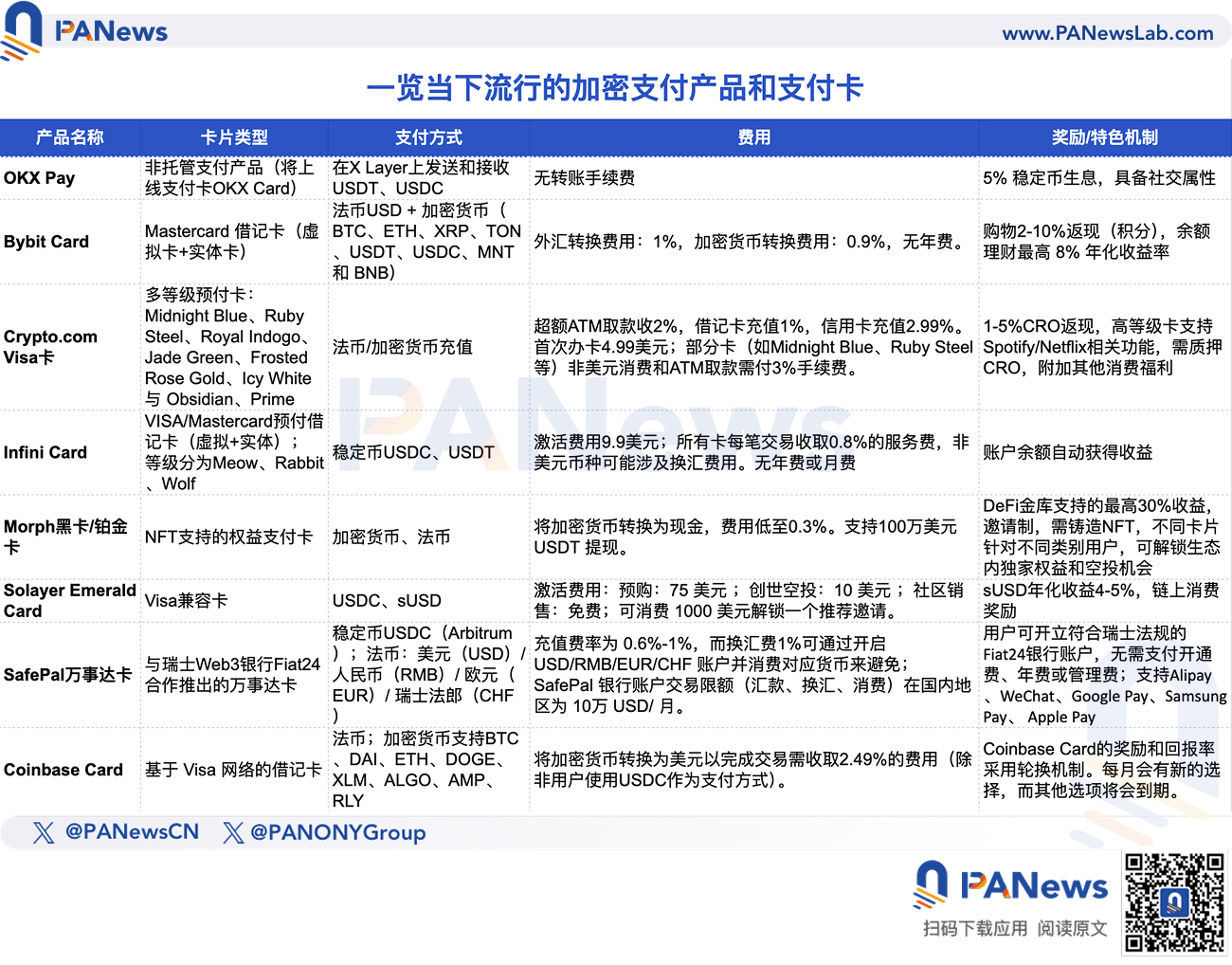

加密支付产品和支付卡(U卡)市场正在日益丰富,随着近期OKX Pay、Infini Card、Solayer翡翠卡等新产品陆续上线,叠加此前的Bybit Card、Crypto.Com Visa卡、Morph卡、SafePal万事达卡和Coinbase Card等,加密支付卡的讨论再度升温。

加密支付卡允许用户将加密货币(如比特币、以太坊)直接用于日常消费,类似传统借记卡或信用卡。它们可以实现即时将加密货币转换为法币(如美元、欧元),消除了商家接受加密货币的技术障碍,同时降低了使用加密货币的复杂性(如管理私钥或交易所的兑换)。一些Web3支付卡集成社交功能,例如通过消息发送加密货币作为红包礼物,未来,Web3支付卡还可能与更多DeFi协议集成,赋予用户更大的财务自由。

本文,PANews梳理了当前热度较高的多款Web3支付产品和支付卡,重点介绍它们的支付功能与奖励机制,这些信息主要来源于官网、官方社交平台以及项目负责人公开发布内容。

OKX Pay

4月28日,OKX正式推出OKX Pay首个版本,是实现非托管与合规融合的支付应用,内嵌于OKX App 中。该产品由内部开发8-9个月,经历4个版本内部迭代,目前是点对点支付,未来还将与万事达合作上线支付卡OKX Card。目前,OKX Pay有5%的稳定币生息收益,限时进行,后续会接入更多的链上生息协议,举办更多的活动。

OKX Pay还集成了社交功能,例如内置消息功能以便与他人沟通,以及将加密货币作为个性化礼物发送。

根据官方介绍,OKX Pay轻松实现非托管,便捷完成支付,旨在让用户在Web3支付应用中,拥有如同Web2应用般顺滑的使用体验。OKX Pay采用了私钥分片管理的方式,将私钥一分为二,一半存储在用户的Passkey中,另一半则由OKX存储。OKX Pay将专注于稳定币支付,首期支持USDT和USDC,未来也将逐步接入更多稳定币。OKX Pay的核心,是实现了无需用户自行管理私钥的非托管体验——这一直是阻碍许多人参与加密领域的重要门槛。在合规层面,OKX Pay通过实名认证(KYC)、反洗钱(AML)和多重签名(Multisig)等机制,保障用户及资产的安全。

Bybit Card

Bybit Card 是一款Mastercard加密货币借记卡,方便用户轻松快捷地访问加密货币资金,随时随地使用加密货币。支持虚拟卡和实体卡,目前面向 EEA(欧洲经济区) 和 CH(瑞士)地区、AIFC(阿斯塔纳国际金融中心)、澳大利亚、巴西和阿根廷的用户开放。

交易的外汇转换费用为1%(在万事达卡汇率基础上),加密货币转换费用为0.9%(在现货交易费用基础上),无年费。

用户可选择使用加密货币或法币余额支付。支持的法币包括:USD;支持的加密货币包括:BTC、ETH、XRP、TON、USDT、USDC、MNT和BNB。

通过这款借记卡,用户可以即时使用从Bybit全线交易产品中赚取的收益支付购物花费。购买时,用户可以享受 2-10% 的返现(通过积分),具体取决于 Bybit VIP 等级。开启“自动理财”,卡片余额立享最高 8% 年化收益率,无需在账户间划转资金。

据官方介绍,目前超过9000万商户支持使用 Bybit 加密货币借记卡。Bybit 加密货币借记卡支持EMV 3D安全,是一种先进的防欺诈技术,可在进行在线支付时进行消费者身份认证。

Crypto.com Visa卡

Crypto.com Visa 卡是预付卡,类似于借记卡,需要储值。用户可以使用银行账户转帐,或以其他信用卡或者加密货币钱包等为Crypto.com Visa卡储值。

开卡时,Midnight Blue Crypto.com Visa卡不需进行CRO质押或 CRO Lockup 即可使用。如果想要申请Ruby Steel、Royal Indogo、Jade Green、Frosted Rose Gold、Icy White 与 Obsidian Crypto.com Visa 卡,用户需锁定CRO达365天。

Crypto.com Visa 卡无年费,用户在消费时可获得1-5%的CRO(Crypto.com原生代币)返现,高级卡提供更高比例。

所有付款卡回馈均以CRO支付,并存入用户在 Crypto.com App中的加密货币钱包。每笔符合资格的交易都会立即产生CRO回馈金。消费回馈金将以等值美元进行回馈。 Royal Indigo、Jade Green、Ruby Steel 等级持卡人享有的Spotify与Netflix消费回馈金,将于付款卡开卡六个月后失效。

在费用方面,超出每月免费ATM取款限额的部分需支付2%的费用,借记卡充值收取1%手续费,信用卡充值收取2.99%手续费。首次订购Midnight Blue Crypto.com Visa 卡需支付4.99美元;对于Midnight Blue、Ruby Steel、Royal Indigo和Jade Green Cards,所有非美元购买和ATM取款需支付3%的费用。

Infini Card

Infini Card是一款由Infini提供的VISA/Mastercard预付借记卡,旨在为用户提供透明、低成本的解决方案。使用Infini Card,用户可以直接用他们的稳定币与全球数百万商家进行交易。

Infini Card无年费或月费。Infini账户余额自动获得收益。支持全球线上和线下商家的支付。卡片可添加至Apple Pay、Google Pay和Alipay。

Infini Lite卡(Meow)是一款低费用虚拟卡,属于Mastercard网络,适用于日常开支。它可以用于Uber、WeChat、Alipay等多个平台。

Infini Tech卡(Rabbit)是一款针对订阅支付的虚拟卡,属于Visa网络,定位更侧重于美元商户。支持X、ChatGPT、OpenAI和开发者工具。非美国商户或非美元交易的费用为固定1%加 0.50 美元,同样设有0.01美元的最低费率门槛。

两种卡的激活费用为9.9美元,无年费或月费。佣金费用方面,所有卡每笔交易收取0.8%的服务费,非美元币种涉及换汇相应费用。

即将推出的第三类卡Infini Global卡(Woof)可添加至Apple Pay和Google Pay,并且可以申请实体卡。

Morph黑卡和铂金卡

根据官网介绍,Morph Black Card(Morph 黑卡)是加密货币用户的身份象征,提供高收益资产策略、无限提款选项、低转换费用和传统银行服务,以及Morph生态系统福利,包括代币空投、活动参与权。专为黑卡持有者设计的独家高收益DeFi金库,用户可享有最高30%的资产收益率。将加密货币转换为现金,费用低至0.3%。支持 $1M USDT 提现。获取需邀请制或白名单,需铸造NFT。

相比于黑卡面对高净值用户和“鲸鱼”,Morph Platinum Card(铂金卡)面向更加大众化的用户。DeFi收益为基础收益,铂金卡也需要铸造相应NFT。

根据官方介绍,Morph卡的持有者可以享受生态内多种独家权益和未来空投权益。

Solayer翡翠卡

Solayer Emerald Card(翡翠卡)集现实世界消费、链上奖励和完全去中心化金融于一体,是一款与Visa兼容的支付卡。面向超过40,000名用户开放,并全面支持Apple Pay、Google Pay以及Visa全球网络。

官方介绍,使用USDC像现金一样消费,可以赚取链上奖励,体验加密货币的现实世界实用性。用户可以在全球范围内的ATM提取当地现金。存入USDC可立即消费,或选择sUSD——一种由国债支持的稳定币,年化收益率4-5%。用户可以即时铸造/赎回 sUSD(无锁定期,无最低限额),支付卡非托管,旨在实现消费与储蓄无缝切换 。

翡翠卡基于Solayer的InfiniSVM构建,这是一个硬件加速的Solana虚拟机(SVM),提供 Visa 级别的吞吐量,同时实现真正的链上执行。

目前,该卡的邀请制等待列表现已开放,官方已经为创世空投和社区销售的 40,000 名用户开放了服务。激活费用:预购:75美元;创世空投:10美元;社区销售:免费。如果用户想跳过等待,可以消费1,000美元解锁一个推荐邀请。

值得关注的是,这一次营销,Solayer还直接玩起了慈禧太后爱收藏翡翠的梗,实现营销“出圈”。

SafePal万事达卡

SafePal的加密支付卡是与瑞士Web3银行Fiat24合作推出的万事达卡(Mastercard),旨在为用户提供便捷的加密货币消费和法币转换服务。该万事达卡支持直接使用稳定币USDC(Arbitrum)进行充值,并在绑定支付宝、微信进行线下/线上场景的日常消费,还可用于Twitter、Telegram等海外热门平台的会员订阅服务。没有开卡费,管理费或年费、月费。

这款卡支持美元(USD)/ 人民币(RMB)/ 欧元(EUR)/ 瑞士法郎(CHF)四种货币,可以开启USD/RMB/EUR/CHF账户并充值资金,消费这些货币无需换汇费;SafePal万事达卡充值费率为0.6%-1%,而换汇费1%可通过开启USD/RMB/EUR/CHF 账户并消费对应货币来避免:譬如在国内消费用 RMB 账户,开通 GPT、Twitter会员用美元等账户,免去1%换汇费。SafePal银行账户交易限额(汇款、换汇、消费)在国内地区为 10万 USD/ 月。

Coinbase Card

Coinbase Card是一款由 Pathward, N.A.公司发行、基于Visa网络的借记卡,只针对夏威夷以外的美国用户。允许用户在全球范围内使用加密货币或美元进行消费。卡片费用根据实时汇率结算。

支持现金和加密货币BTC、DAI、ETH、DOGE、XLM、ALGO、AMP、RLY。Coinbase会自动将所有加密货币转换为美元,以用于购物和ATM 取款。美国用户可通过日常消费快速积累加密货币奖励。

公开测评显示,将加密货币转换为美元以完成交易需收取2.49%的费用(除非用户使用USDC作为支付方式)。

Coinbase允许持卡人从多种加密货币中选择,每种加密货币对应特定的回报百分比。以下过去的一些回报率示例:Cosmos:14.04%,以太坊:2.09%,波卡(Polkadot):10.2%,Solana:6.51%。Coinbase Card的奖励和回报率采用轮换机制。每月会有新的选择,而其他选项将会到期。

MetaMask即将推出支付卡

小狐狸钱包MetaMask联合万事达也即将推出自己的支付卡。4月29日,金融科技公司CompoSecure、Baanx与MetaMask联合推出支付卡“MetaMask Metal Card”,计划于第二季度全球上市。该卡支持用户直接从MetaMask自托管钱包进行支付,无需预充值或通过中心化交易所转换法币,所有交易通过智能合约在5秒内完成授权。用户必须将加密货币存储在Linea网络上。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。