Preface

With the release of technical documents, testnet token $CRED, and various memecoins, the AO ecosystem has attracted numerous active developers, demonstrating vast potential for development. In the rapidly developing field of blockchain technology, the AO protocol has become an ideal platform for large-scale data processing due to its significant advantages in high-concurrency processing and data storage.

After recognizing the project from a value perspective, how can users participate?

By participating in the AO testnet, readers can obtain AO tokens by depositing stETH and proactively enter the decentralized computing field. Through this report, you will learn how to participate in AO's staking activities, as well as the core features, development history, and future prospects of the AO project, helping you seize the opportunity in the new era of decentralized computing and witness and participate in this revolutionary technological advancement.

Project Overview

1. Overview of the AO Protocol

AO is a decentralized computing system inspired by the Actor-Oriented Paradigm, capable of supporting a large number of parallel processes, free from the typical limitations of current decentralized computing models. Its features include:

- Network verifiability and minimized trust requirements: Highly modular architecture, easy to integrate with existing smart contract platforms, allowing customization in computing resources, virtual machines, security mechanisms, and payment options.

2. Core Features of AO

- Single system image: Hosted on a heterogeneous node set in a distributed network, allowing any number of parallel processes to be coordinated through an open messaging layer.

- Unrestricted resource utilization: Supports computing operations of any size and form while maintaining the verifiability of the network itself.

- Modular architecture: Users can choose the most suitable virtual machine, message passing security guarantees, and payment options.

3. Key Functions of the AO Protocol

- Parallel processes: Supports running any number of processes (contracts) in parallel, inspired by the original actor model and Erlang.

- Resource utilization: Based on the delayed evaluation architecture of SmartWeave and LazyLedger (later referred to as Celestia), nodes can achieve consensus on program state transitions without executing any computations.

- Data storage: Through Arweave, AO processes can seamlessly load and execute data of any size and write it back to the network.

- Automatic contract activation: Allows contracts to have scheduled "cron" interactions, automatically waking up and executing computations at set intervals.

4. Key Development Milestones of AO

Since AO announced the launch of the testnet on February 27, 2024, the market response has been enthusiastic, with the price of AR coin rising significantly, attracting thousands of developers and a large number of users to actively participate. The release of the technical document Cookbook and the testnet token $CRED, as well as the hosting of the AO online hackathon, further promoted the development and improvement of the AO ecosystem. The AO subnetwork has now launched a fair token release plan, which is incubated by the AR ecosystem already listed on exchanges such as Binance/OKX, defined as a decentralized computing system. The relationship between AR and AO can be roughly understood as Fil and Difinity, responsible for storage and high-performance computing scenarios, respectively.

- Release of the technical document Cookbook: Includes concept explanations, operational principles, and development tutorials, with participation from the PermaDAO development guild for translation, providing English and Chinese versions.

- Release of the testnet token $CRED: As the native token of the AO testnet, obtained by completing bounty tasks.

- Hosting of the AO online hackathon Hack The Weave Hackathon: Lasting for 11 days, with multiple awards and a total prize pool exceeding $10,000.

- Launch of two AO memecoins—$WHAT and $TRUNK: Introduced by developers and community managers, supporting the exchange of $CRED for use in the decentralized exchange Bark.

- Gradual improvement of the AO social media app AO Twitter: Development features include chat rooms, setting avatars, bookmarking, etc., with plans to launch a MUD game in the future.

Participation in AO's Staking Activities

So, how can one participate in AO's staking activities? Next, we will guide you through step by step:

1. Current: Pre-launch phase (staking contract on the Ethereum chain)

- Staking features: Stake and withdraw at any time, earnings calculated every 5 minutes, distributed once every 24 hours (non-transferable), and more types of assets available for staking will continue to be opened.

- Awaiting launch: Mainnet application phase.

2. Process for Participating in the Pre-launch Phase

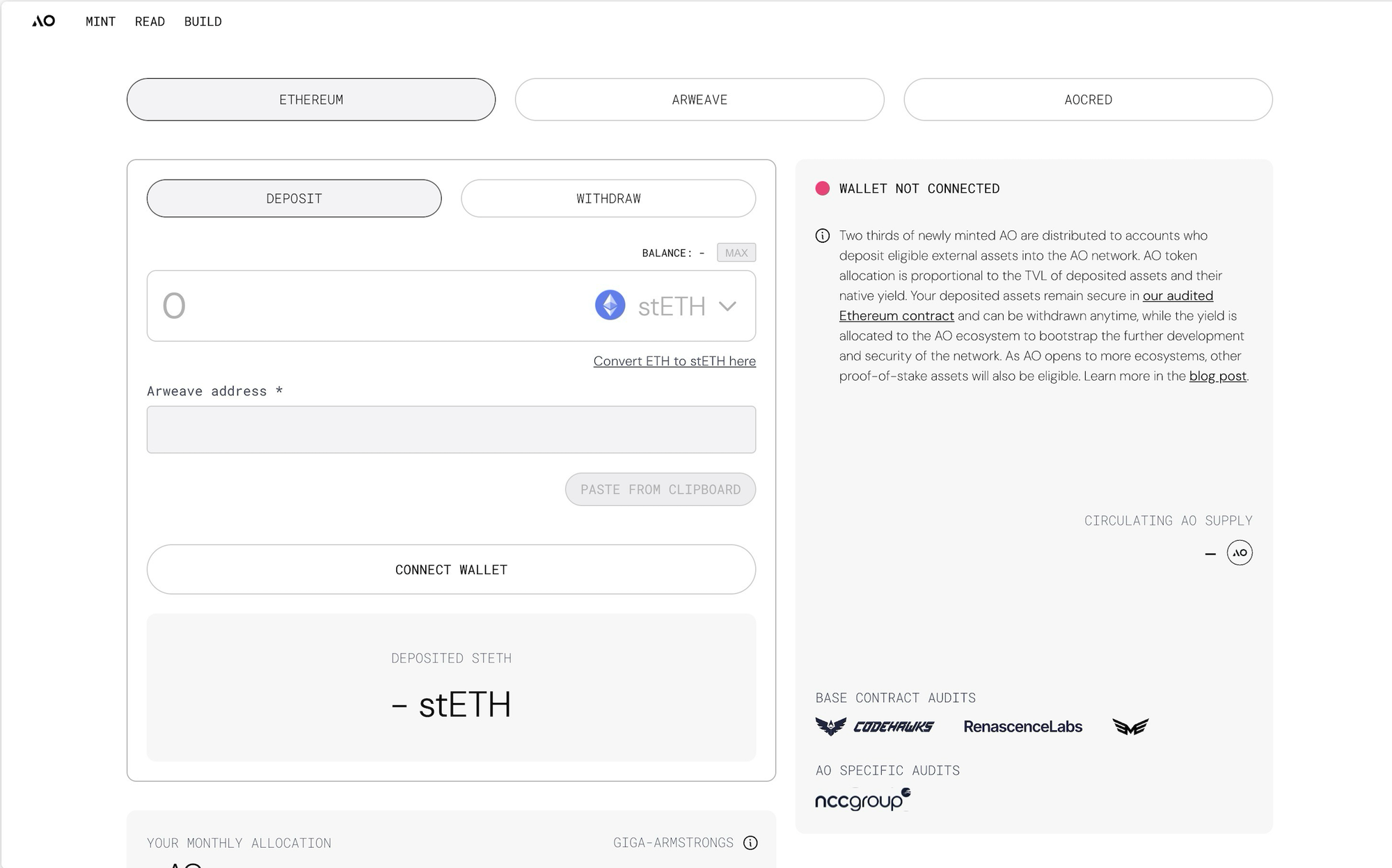

How to deposit stETH to obtain AO

- Start time: 11:00 AM on June 18, 2024 (Eastern Time, USA)

- Reward distribution: Rewards are distributed once a day, and it may take up to 24 hours to receive the first reward.

Participation steps

- Go to the minting page on the AO website.

- Click on the Ethereum tab and connect your Ethereum wallet (Metamask or Rabby).

- Enter your Arweave wallet address where you want to receive AO tokens.

- Deposit stETH into the staking contract by entering the amount you want to provide. (These tokens will be held in a trustless contract on Ethereum and can be withdrawn at any time. If you don't have stETH in your wallet, you will need to exchange other tokens for some stETH before depositing.)

- Sign the transaction in your ETH wallet to deposit stETH into the contract.

- You will receive AO tokens directly into your specified Arweave wallet.

stETH staking interface Source: AO official website

3. Earnings Estimation

Valuation upon launch: By the time it launches on February 8, 2025, the circulation will be fixed at 15%. Considering the possibility of a bull market, different estimations have been made for the APR. At the same time, considering the potential appreciation of the AR token itself, the proportion of $AO market value to $AR may relatively decrease, providing a larger APR space.

Factors Affecting Earnings

- Release amount: Refers to the amount of $AO obtained based on the proportion of total staked funds provided by the official.

- Total staked amount: Currently around $100 million, which may increase in the future.

4. Subsequent Opportunities

In the subsequent phase, after the permissionless ecosystem financing bridge is continuously opened, developers can attract users to deposit assets in their applications to obtain corresponding AO token rewards. This provides developers with a permissionless long-term source of income without the need to apply for grants or external investment.

Permaweb Ecosystem Development Association: Some organizations and builders will share the native income generated by assets stored in the bridge. The funds will gradually decrease over time, consistent with the decay rate of network minting, supporting the network's guidance while retaining the characteristics of neutral shared protocols.

Through this comprehensive introduction to staking activities, readers can practically participate in AO's staking plan and enjoy the security and returns brought by decentralized computing and storage.

Why Choose to Participate and Stake in AO?

After in-depth analysis of the technical components and working principles of AO, we look forward to the unlimited potential brought by its unique advantages in the field of decentralized computing. The detailed analysis will be further explained in the third part.

Technical Analysis

1. Components of AO

The AO system consists of three core units:

1.1 Messenger Unit

- Function: Responsible for message communication, delivering messages to the compute unit, and coordinating the output of computations.

- Role: Ensures efficient information exchange between actors, a key aspect of the system's parallel processing.

1.2 Scheduler Unit

- Function: Responsible for scheduling and message ordering, and uploading messages to Arweave.

- Role: Manages message priority and sequence to ensure overall coordination of the system and persistent data storage.

1.3 Compute Unit

- Function: Responsible for processing computations and uploading computation results to Arweave.

- Role: Executes specific computational tasks, representing the core computing capability of the system.

2. Working Principle of AO

AO is orchestrated through blockchain technology, where each unit can function as a horizontally scalable subnet to execute a large number of transactions. This design allows the system to achieve high-performance computing, theoretically providing nearly unlimited computational power. Key points include:

- High concurrency: The actor model allows a large number of parallel processes to run simultaneously, greatly enhancing the system's processing capacity.

- Distributed architecture: Each unit operates independently but achieves overall consistency through message passing and coordination by the scheduler unit.

- Decentralized storage: Data and computation results are permanently stored through Arweave, ensuring data security and reliability.

3. Core Objectives of AO

The core objective of AO is to achieve trustless and collaborative computing services without any practical scale limitations. This provides a new paradigm for applications combining blockchain technology. Compared to other high-performance blockchains such as Solana, Aptos, and Sui, AO has the following advantages:

- Large-scale data storage: AO supports the storage of large amounts of data, such as AI models, giving it a significant advantage in handling big data and AI applications.

- High concurrency processing: Unlike Ethereum, which can only use a single shared memory space, AO allows any number of parallel processes to run simultaneously and collaborate with other units through message passing, without relying on centralized memory space.

4. Comparison between AO and Ethereum (ETH)

AO Computer and Ethereum EVM have their respective advantages in architecture design, computing model, consensus mechanism, computational logic, redundancy issues, parallel computing and collaboration, and practicality. AO Computer excels in high concurrency, distributed computing, and data storage, suitable for applications requiring large-scale data processing and high concurrency. However, Ethereum EVM still has significant advantages in smart contract execution and Turing completeness, and has been widely applied and validated.

Therefore, AO Computer and Ethereum EVM are more like complementary technologies rather than competitors. AO Computer can serve as a strong complement to Ethereum, leveraging its unique advantages in specific scenarios, but is not yet sufficient to completely replace Ethereum EVM. In the future, as blockchain technology continues to evolve, AO Computer and Ethereum will continue to play important roles in their respective fields, jointly driving the advancement of decentralized technology.

Token Economics

AO is a subnet of the AR Network, playing the role of the application layer in its ecosystem. AR currently has a market value of $1,843,104,239 and is listed on major exchanges such as Binance/OKX (excluding Coinbase). AO Token ($AO) is distributed entirely through AR holding airdrops and ETH staking.

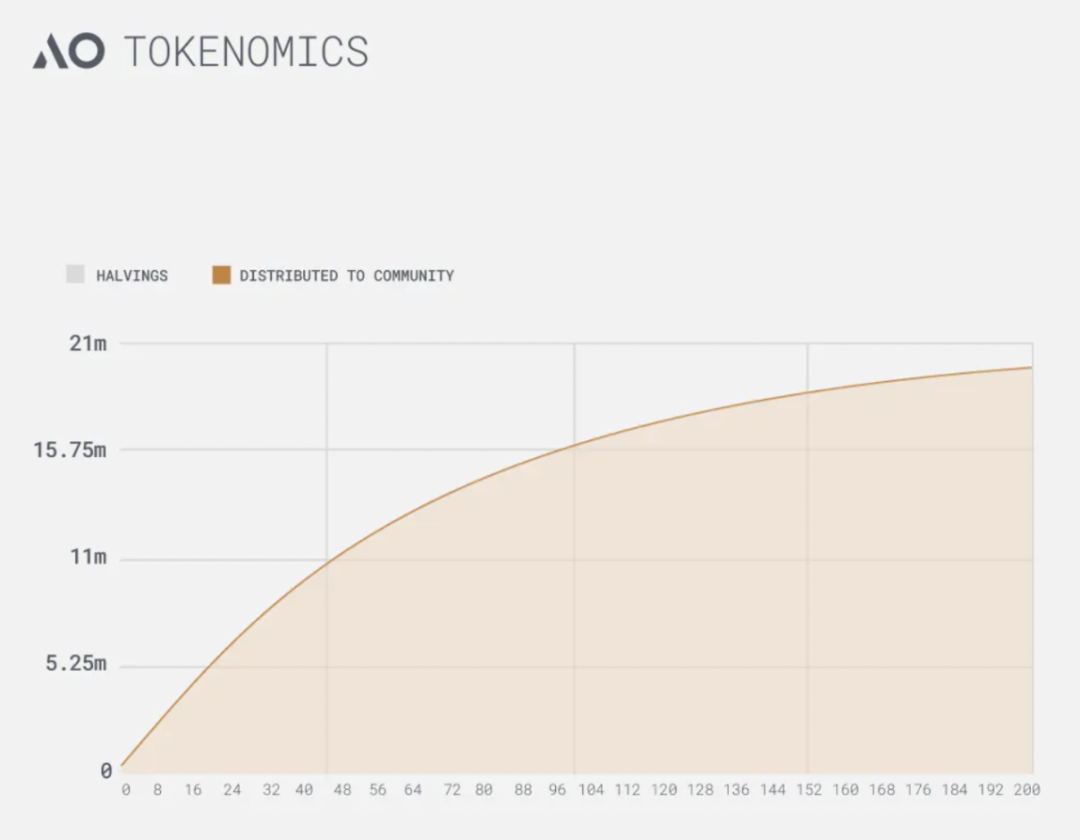

AO has no ICO/pre-allocation, with a total supply of 21 million, halving every 4 years. AO is distributed every 5 minutes, with a monthly distribution of 1.425% of the remaining supply. As of June 13, 2024, the circulating supply of AO is 1.0387 million.

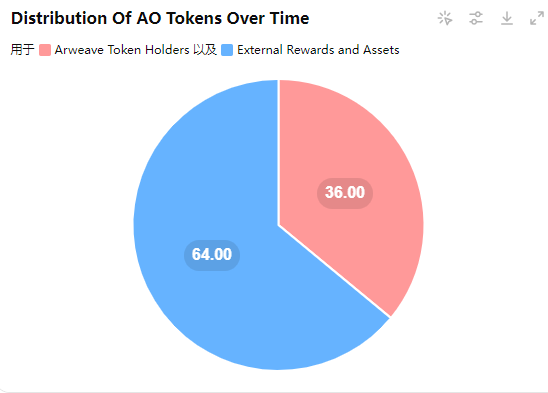

Token Distribution

- Approximately 36% (100% for the first 4 months + 33.3% thereafter) of AO tokens are minted over time by Arweave token holders, with their tokens incentivizing the security of the underlying layer of AO—Arweave.

- Approximately 64% of AO tokens are minted over time to provide external incentives and bring assets into AO to stimulate its economic growth.

AO Token Distribution Composition Source: AO

Distribution Method

AO Token Unlock and Release Mode Source: AO

- AO started distribution from February 27, 2024, 13:00 EST, with 1.0387 million $AO distributed to AR holders before June 18.

- Retrospective airdrop (completed): 100% AO distribution during the period from February 27, 2024, 13:00 EST, to June 18, 2024, 11:00 EST (Block 1372724) (AR holders received airdrops based on their balances).

- Transition phase: Phase 1 airdrop (starts from June 18, 2024, 11:00 EST)

- * Accounts for 10% of the total AO supply (315-103.87= 211.13 million $AO), ending around February 8, 2025, and unlocking AO.

- AR holding mining: Holding AR on-chain entitles recipients to a total of 33.3% of AO distribution, allocated based on the percentage of AR held relative to the total AR supply.

- ETH mining: Staking stETH entitles recipients to a total of 66.6% of AO distribution, allocated based on the percentage of stETH staked relative to the total stETH supply.

AO Ecosystem Development

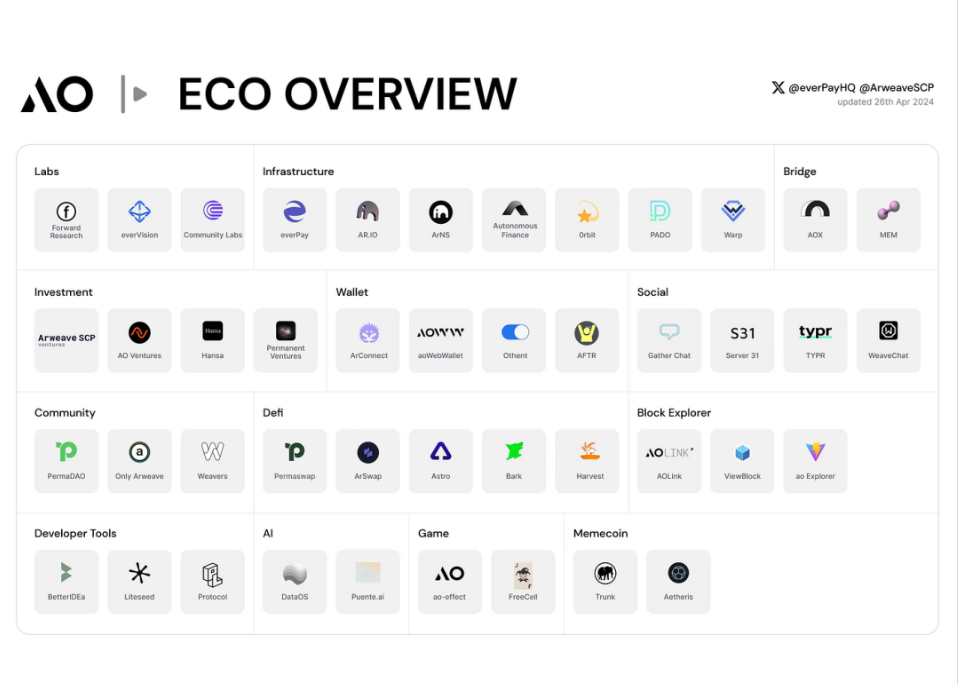

AO Ecosystem Overview

AO Ecosystem Overview Composition Source: everpayHQ(x) / ArweaveSCP(x)

From the AO ecosystem overview and the main protocol content, the AO ecosystem covers multiple domains, forming a relatively complete blockchain ecosystem. By introducing a wide range of protocols and tools, it has built a multifunctional, interconnected blockchain ecosystem covering various areas from infrastructure, decentralized finance, social applications, games to prediction markets. Its comprehensive and diverse services can meet the needs of different users and developers, driving its ecosystem's prosperity and value creation.

Project Advantages

As a new project in the field of decentralized computing and decentralized applications (DApps), AO demonstrates unique advantages and development potential compared to other Layer 1 blockchain projects, thanks to its advanced decentralized computing and extensive data storage capabilities.

Risk Analysis

1. Security of Smart Contracts

1.1 Code Quality and Contract Logic

- Contract Address: Link to Etherscan

Audit reports show that AO's Ethereum smart contract code has high quality and clear logic, following best practices with no apparent vulnerabilities. This provides a strong foundation for the project's technology.

1.2 Key Findings and Recommendations

Permission Control: Stricter control of access permissions for critical functions is needed to ensure that only authorized users can execute important operations. Unauthorized access could lead to malicious exploitation of the contract.

Boundary Condition Handling: Some functions do not sufficiently handle exceptional cases, requiring additional boundary condition checks to ensure the contract's stability in various exceptional situations.

Dependency Library Versions: It is recommended to use the latest versions of dependency libraries to prevent security issues arising from known vulnerabilities.

2. Permission Dependencies and Trust

2.1 Upgradability Permissions

The contract's upgradability permissions are retained, allowing the project team to upgrade and modify the contract later on. While this design is flexible, it also increases reliance on trust in the project team. If the project team makes mistakes or engages in malicious behavior, the security and stability of the contract will be threatened.

2.2 Privileged Functions

The open access to the Supercomputing Foundation allows tokens to be returned to the original owner in the event of a security incident. This privilege enhances the project's security in emergency situations but also reflects a certain degree of centralized control. In the context of decentralization, the balance between this risk and security needs to be considered.

Conclusion

The AO project demonstrates high stability and security at the technical level, but permission control and boundary condition handling need further strengthening. Additionally, the project team should carefully manage the upgradability permissions of the contract to avoid triggering a crisis of trust. AO has no private placement or any entity investment quota, and it is released through fair distribution, giving it a certain advantage in compliance. However, with regulatory environments becoming increasingly strict globally, projects including AO need to closely monitor to ensure ongoing compliance with local regulatory requirements. The token's fair release plan has been recognized and listed on exchanges such as Binance and OKX, indicating a strong foundation in compliance and market recognition. However, ongoing attention to global regulatory trends is necessary to ensure the project remains within a legal and compliant framework.

Contributors: Mat / Riffi / Sylvia

Editing and Proofreading: Punko

Special Thanks: Thanks to the above contributors for their outstanding contributions to this content.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。