Authors: Alex Xu, Lawrence Lee

Introduction

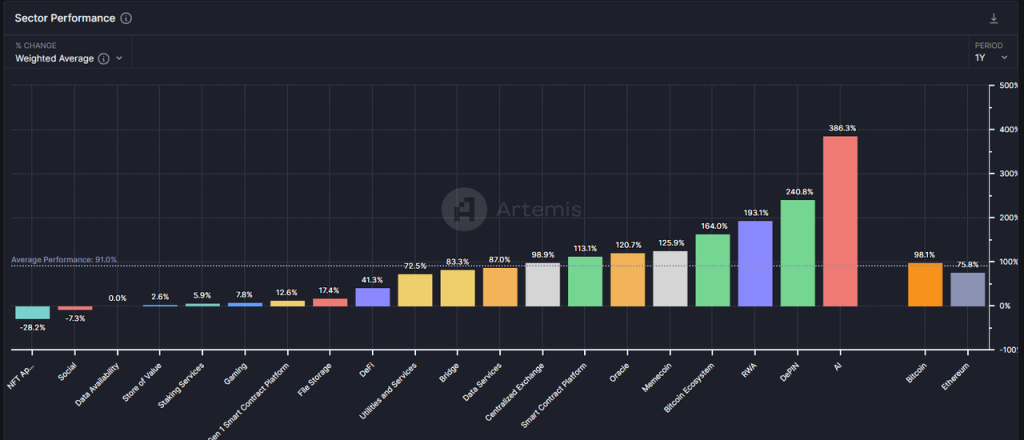

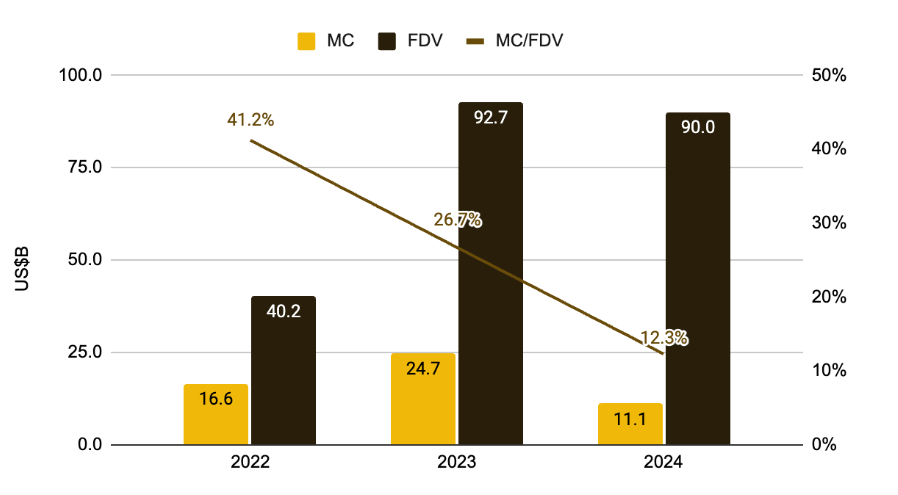

As one of the oldest tracks in the cryptocurrency field, the performance of the Defi track in this round of bull market is not satisfactory. The overall increase in the Defi sector over the past year (41.3%) not only lags far behind the average level (91%), but also lags behind Ethereum (75.8%).

Data source: artemis

And if we only look at the data for 2024, the performance of the Defi sector is also difficult to be optimistic, with an overall decline of 11.2%.

Data source: artemis

However, in the author's view, in the peculiar market background where altcoins fell sharply after BTC hit a new high, the Defi sector, especially its leading projects, may be experiencing the best layout moment since its inception.

Through this article, the author hopes to clarify the views on the value of Defi at the current moment by discussing the following questions:

- The reasons why altcoins have significantly underperformed BTC and Ethereum in this round

- Why now is the best time to focus on Defi

- Some Defi projects worth paying attention to, their sources of value, and risks

This article does not cover all Defi projects with investment value. The Defi projects mentioned in this article are only analyzed as examples and are not investment advice.

This article represents the author's interim thinking at the time of publication, and may change in the future. The views are highly subjective and may contain errors in facts, data, and reasoning. Criticism and further discussion from peers and readers are welcome.

The following is the main body of the article.

The mystery of the sharp decline in altcoin prices

In the author's view, the performance of altcoin prices in this round is not as expected, and the internal reasons in the cryptocurrency industry mainly include three aspects:

- Insufficient demand growth: Lack of attractive new business models, with most tracks' PMF (product market fit) being a long way off

- Excessive supply growth: Further improvement in industry infrastructure, a further reduction in the threshold for entrepreneurship, and excessive issuance of new projects

- Continuous unlocking of tokens from low-circulation and high-FDV projects, bringing heavy selling pressure

Let's take a look at the background of these three reasons separately.

Insufficient demand growth: The first round of the bull market lacks innovative narratives

In an article written by the author in early March, "Preparing for the bull market's main uptrend, my interim thinking on this round's cycle," the author mentioned that this round of bull market lacks business innovation and narratives of the same magnitude as Defi in 2021 and ICO in 2017. Therefore, the strategy should be to over-allocate to BTC and ETH (benefiting from the incremental funds brought by ETF) and control the allocation ratio of altcoins.

So far, this view is very accurate.

The lack of new business stories has led to a significant decrease in the inflow of entrepreneurs, industry investment, users, and funds, and more importantly, this situation has suppressed investors' overall expectations for industry development. When the market has not seen stories like "Defi will devour traditional finance," "ICO is a new innovative and financing paradigm," and "NFT is disrupting the content industry ecosystem" for a long time, investors will naturally vote with their feet and move to places with new stories, such as AI.

Of course, the author does not support overly pessimistic views. Although there is no attractive innovation in this round, the infrastructure is constantly improving:

- The cost of block space has dropped significantly, both from L1 to L2

- Cross-chain communication solutions are gradually becoming more complete, with a rich list of options

- User-friendly wallet experience upgrades, such as Coinbase's smart wallet supporting quick creation and recovery without private keys, direct access to cex balances, and no need to recharge gas, making the user experience closer to web2 products

- Solana's introduction of Actions and Blinks functions, which can publish interactions with Solana's chain to any common internet environment, further shortening the user's usage path

The above infrastructure is like water, electricity, coal, and roads in the real world. They are not the result of innovation, but they are the soil where innovation emerges.

Excessive supply growth: Excessive issuance of projects + continuous unlocking of high market value tokens

In fact, from another perspective, although the prices of many altcoins have hit new lows for the year, the total market value of altcoins has not fallen very badly compared to BTC.

Data: Trading view, 2024.6.25

As of now, BTC's price has dropped by about 18.4% from its high, while the total market value of altcoins (displayed as Total3 in the Trading View system, representing the total encrypted market value after deducting BTC and ETH) has only dropped by -25.5%.

Data: Trading view, 2024.6.25

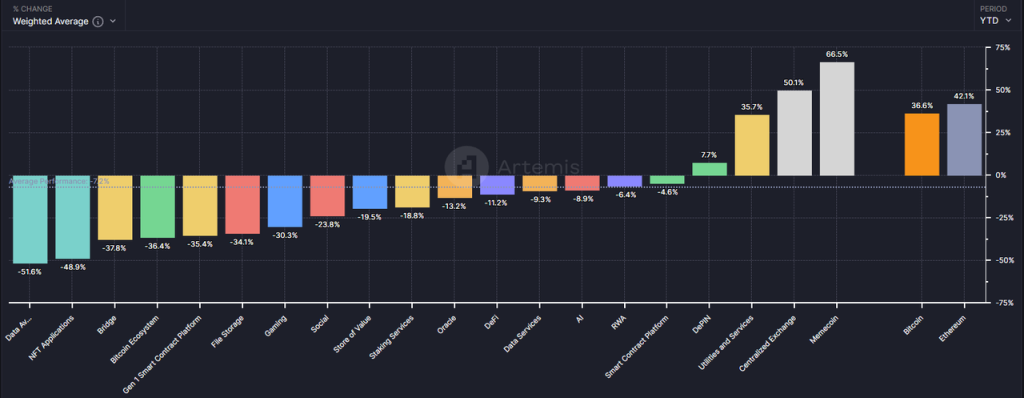

The limited decline in the total market value of altcoins is based on the background of a significant expansion in the total quantity and market value of new altcoins. From the following figure, we can intuitively see that the growth trend of the number of tokens in this round of bull market is the most rapid in history.

New Tokens by Blockchain, data source: https://dune.com/queries/3729319/6272382

It should be noted that the above data only counts the issuance data of tokens on EVM chains, with over 90% issued on Base chains. In fact, more new tokens are contributed by Solana, and most of the newly issued tokens, whether on Solana or Base, are meme tokens.

Among the high market value representative Meme tokens that have appeared in this round of bull market are:

- dogwifhat: 20.4 billion

- Brett: 16.6 billion

- Notcoin: 16.1 billion

- DOG•GO•TO•THE•MOON: 6.3 billion

- Mog Coin: 5.6 billion

- Popcat: 4.7 billion

- Maga: 4.1 billion

In addition to meme tokens, a large number of infrastructure-type tokens are also being issued or will be issued this year, such as:

Layer 2 networks:

- Starknet: Circulating market value 9.3 billion, FDV 71.7 billion

- ZKsync: Circulating market value 6.1 billion, FDV 35.1 billion

- Manta network: Circulating market value 3.3 billion, FDV 10.2 billion

- Taiko: Circulating market value 1.2 billion, FDV 19 billion

- Blast: Circulating market value 4.8 billion, FDV 28.1 billion

Cross-chain communication services:

- Wormhole: Circulating market value 6.3 billion, FDV 34.8 billion

- Layer0: Circulating market value 6.8 billion, FDV 27.3 billion

- Zetachain: Circulating market value 2.3 billion, FDV 17.8 billion

- Omni network: Circulating market value 1.47 billion, FDV 14.2 billion

Chain construction services:

- Altlayer: Circulating market value 2.9 billion, FDV 18.7 billion

- Dymension: Circulating market value 3 billion, FDV 15.9 billion

- Saga: Circulating market value 1.4 billion, FDV 15 billion

* The above market value data is from Coingecko, as of 2024.6.28

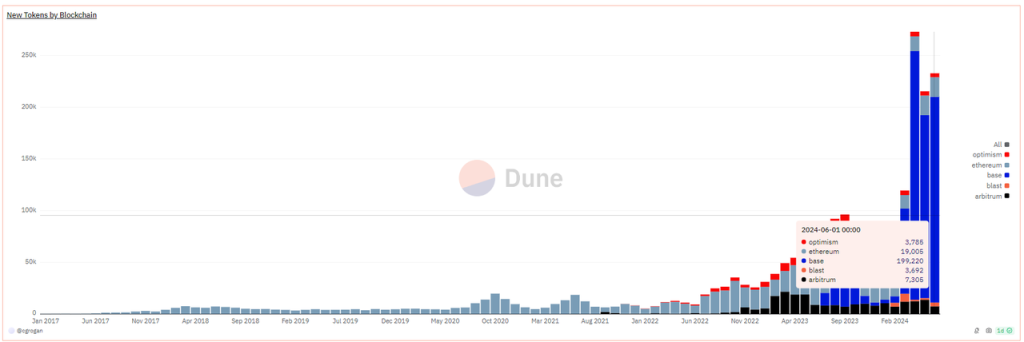

In addition, there are a large number of tokens that have already been listed facing a massive unlocking. Their common characteristics are low circulation ratio, high FDV, and early-stage institutional financing with low token costs.

The softness of the demand side and narratives, combined with the excessive issuance of assets on the supply side, is the first time in the cryptocurrency cycle. Although project teams have tried to maintain valuations by further reducing the token circulation ratio at the time of listing (from 41.2% in 2022 to 12.3%) and gradually selling to secondary investors, the resonance of the two ultimately led to an overall downward shift in the valuation center of these cryptocurrency projects. In 2024, only a few sectors such as Meme, Cex, and Depin maintained positive returns among the major sectors.

The ratio of new coin MC to FDV, image source: "Low Float & High FDV: How Did We Get Here?", Binance research

However, in the author's view, the collapse of the valuation center of these high-market-value VC coins is a normal response of the market to various cryptocurrency anomalies:

- Batch creation of ghost town Rollups, with only TVL and bots but no users

- Financing through the renovation of terms, actually providing similar solutions, such as a large number of cross-chain communication services

- Entrepreneurship focused on hotspots rather than actual user needs, such as a large number of AI+Web3 projects

- Unable to find or simply not looking for a profit model, tokens have no value capture

The decline in the valuation center of these altcoins is the result of the market's self-repair, a benign process of bubble bursting, and a self-rescue behavior of funds voting with their feet and clearing the market.

In reality, most VC coins are not without value, they are just too expensive, and the market eventually brings them back to their rightful place.

Focusing on Defi at the Right Time: PMF Products, Emerging from the Bubble Period

Since 2020, Defi has officially become a category within the cluster of altcoins. In the first half of 2021, the most common projects in the Top 100 cryptocurrency market value rankings were Defi projects, with a dizzying array of categories, vowing to redo all the existing business models in traditional finance on the chain.

In that year, Defi was the infrastructure of public chains, with DEX, lending, stablecoins, and derivatives being the essential four-piece set for new public chains.

However, with the over-issuance of homogeneous projects, a large number of hacker attacks (self-theft), and TVL obtained through the Ponzi model quickly collapsing, the spiraling token prices spiraled back to zero.

Entering this round of bull market cycle, the price performance of most surviving Defi projects is also unsatisfactory, and primary investments in the Defi field are becoming increasingly scarce. Unlike the start of any bull market cycle, investors are most interested in the new stories that have emerged in this round, and Defi does not belong to this category.

However, it is precisely because of this that Defi projects emerging from the bubble are beginning to appear more attractive than other altcoin projects. Specifically:

Business Aspect: Mature business models and profit models, leading projects have moats

DEX and derivatives earn transaction fees, lending earns interest spread income, stablecoin projects earn stability fees (interest), and Staking services earn staking service fees, with clear profit models. The user demand for leading projects in each track is organic, and most have passed the user subsidy stage. Some projects still achieve positive cash flow even after deducting token emissions.

Cryptocurrency profit ranking, source: Tokenterminal

According to Tokentermial's statistical data, among the top 20 protocols with the highest profits as of 2024, 12 are Defi projects, categorized as:

- Stablecoins: MakerDAO, Ethena

- Lending: Aave, Venus

- Staking services: Lido

- DEX: Uniswap labs, Pancakeswap, Thena (revenue comes from front-end fees)

- Derivatives: dYdX, Synthetix, MUX

- Yield aggregation: Convex Finance

These projects have various moats, some from multilateral or bilateral network effects of services, some from user habits and brand, and some from special ecological resources. But in terms of results, the leading Defi projects in each track exhibit certain commonalities: stable market share, reduced competition from later entrants, and a certain pricing power for services.

The specific moats of individual Defi projects will be detailed in the project section of the third subsection.

Supply Aspect: Low emissions, high circulation ratio, small scale of tokens to be unlocked

As mentioned in the previous subsection, one of the main reasons for the continuous collapse of valuations of altcoins in this round is the excessive issuance of projects based on high valuations and the negative expectations brought by the massive unlocking of tokens entering the market.

However, due to the early launch time, most leading Defi projects have already passed the peak period of token emissions, and institutional tokens have been mostly released, with very low future selling pressure. For example, Aave's current token circulation ratio is 91%, Lido's token circulation ratio is 89%, Uniswap's token circulation ratio is 75.3%, MakerDAO's circulation ratio is 95%, and Convex's circulation ratio is 81.9%.

This not only indicates low future selling pressure but also means that anyone who wants to gain control of these projects can basically only purchase tokens from the market.

Valuation Aspect: Market attention and business data diverge, valuations fall to historical lows

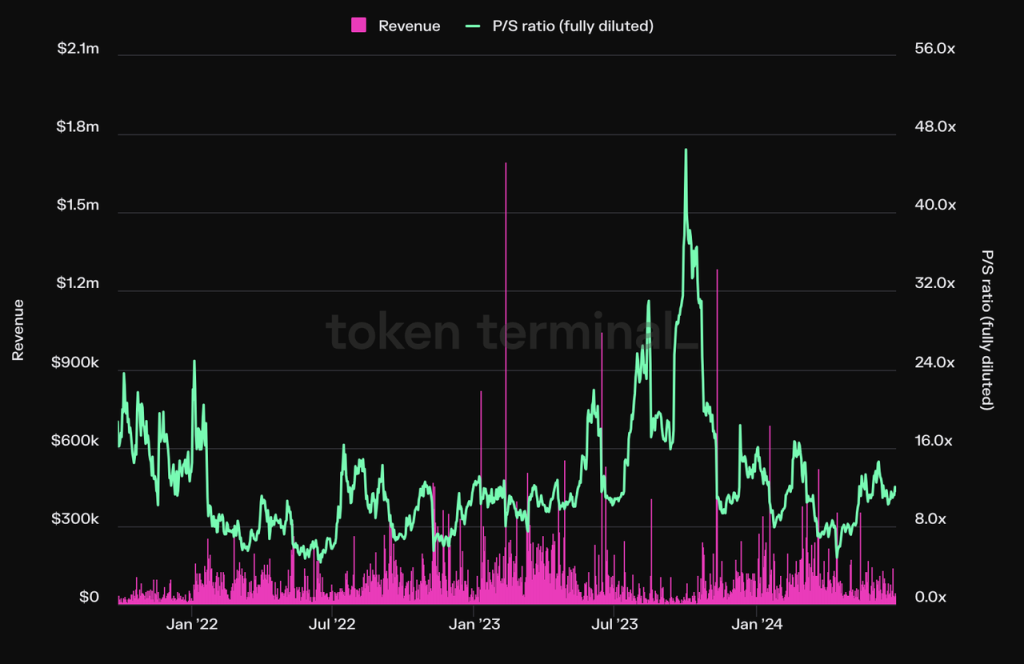

Compared to new concepts such as Meme, AI, Depin, Restaking, Rollup services, etc., the attention to Defi in this round of bull market has always been very thin, with flat price performance. On the other hand, the core business data of various leading Defi projects, such as trading volume, lending scale, and profit levels, continue to grow, forming a divergence between price and business, specifically reflected in the fact that the valuation levels of some leading Defi projects have reached historical lows.

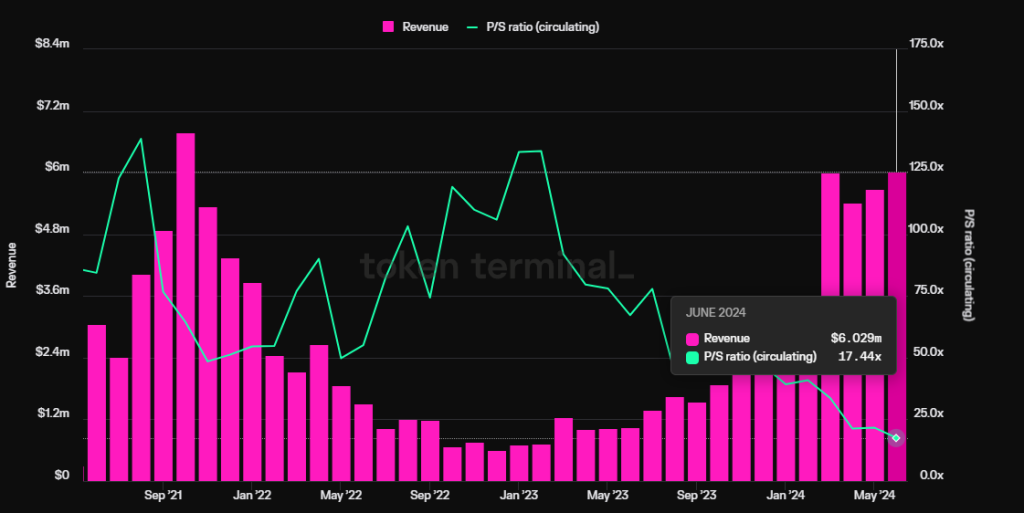

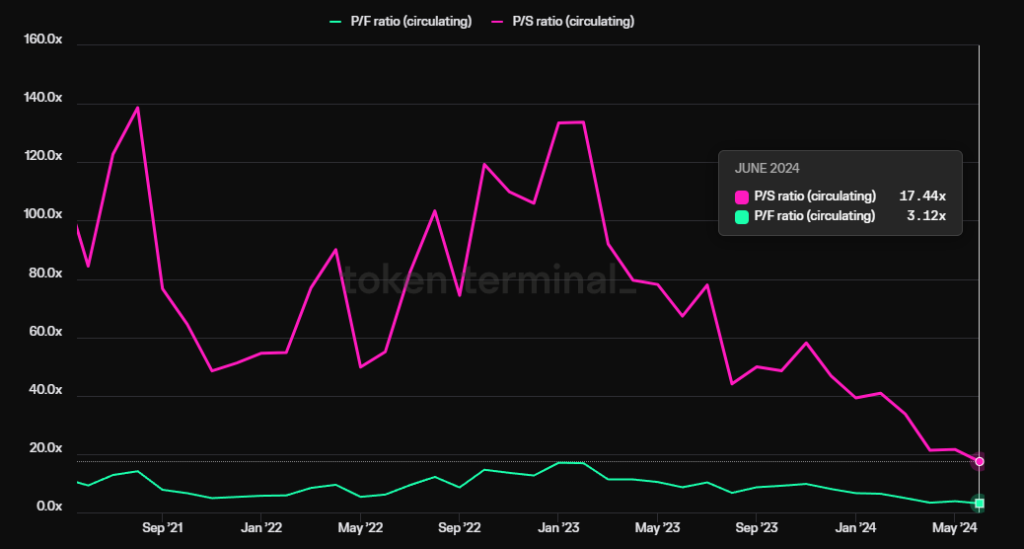

Taking the lending protocol Aave as an example, its quarterly income (referring to net income, not overall protocol fees) has surpassed the previous cycle's peak, reaching a historical high, while its PS (circulating market value / annualized income) has reached a historical low, currently only 17.4 times.

Data source: Tokenterminal

Policy Aspect: The FIT21 bill is favorable for Defi industry compliance and may trigger potential mergers and acquisitions

FIT21, the Financial Innovation and Technology for the 21st Century Act, aims to provide a clear federal regulatory framework for the digital asset market, strengthen consumer protection, and promote the United States' leadership in the global digital asset market. The bill was proposed in May 23rd and was passed with a high vote in the House of Representatives on May 22nd this year. After the bill is officially passed, it will become more convenient for both startups and traditional financial institutions to invest in Defi projects as the bill clarifies the regulatory framework and rules for market participants. Considering the recent embrace of cryptocurrency assets by traditional financial institutions represented by BlackRock (pushing for ETF listings, issuing national debt assets on Ethereum), Defi is likely to be a focus area for them in the coming years. The fate of traditional financial giants and mergers and acquisitions may be one of the most convenient options, and any related signs, even just the intention to merge, will trigger a revaluation of the leading Defi projects.

Next, the author will analyze the business situation, moat, and valuation of some Defi projects, using some Defi projects as examples.

Notable Defi Projects

1. Lending: Aave

Aave is one of the oldest Defi projects, having completed its financing in 2017. After transitioning from peer-to-peer lending (then called Lend) to a pool-based lending model, it surpassed the leading project Compound in the previous bull market cycle and is currently the leader in the lending track in terms of market share and market value.

1.1 Business Situation

For lending protocols, the most critical indicator is the active loan volume, which is the main source of income for lending projects.

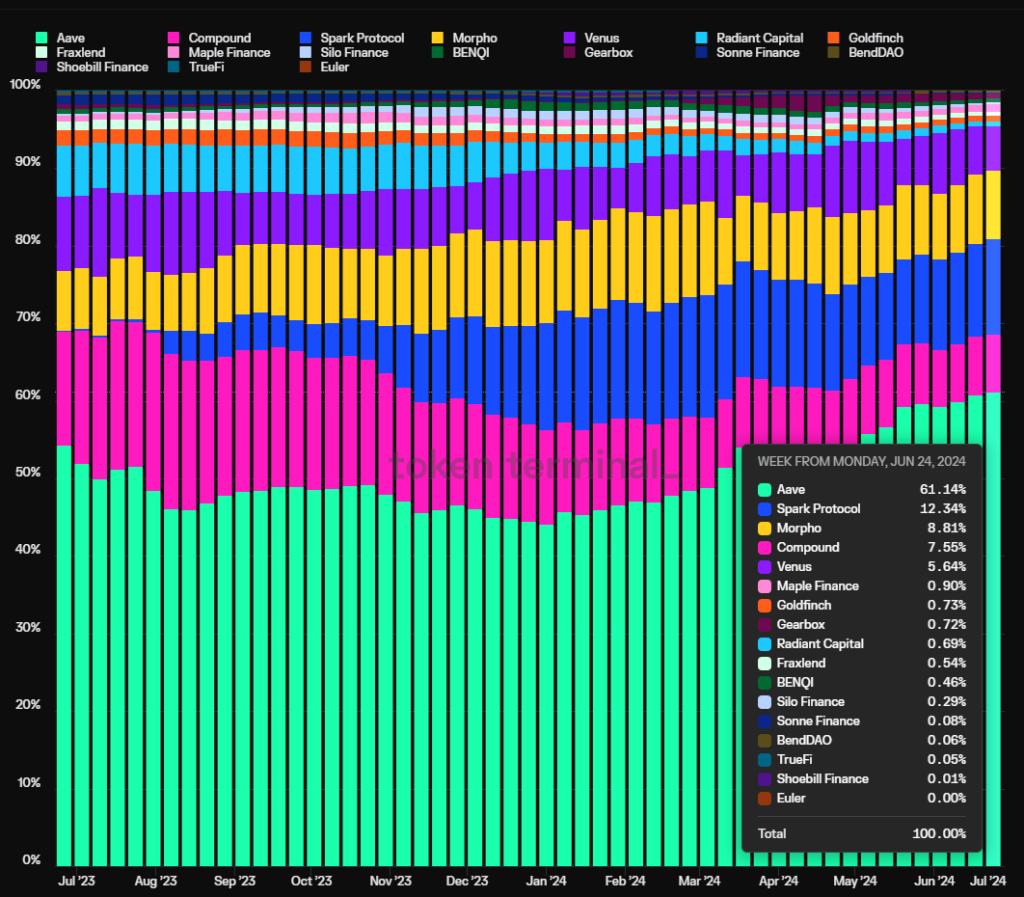

The chart below shows Aave's market share of active loan volume over the past year. Aave's share of active loans has been continuously increasing over the past six months, reaching 61.1% currently. In fact, this ratio may be even higher, as the chart duplicates the loan volume of the income optimization module deployed on Aave and Compound by Morpho.

Data source: Tokenterminal

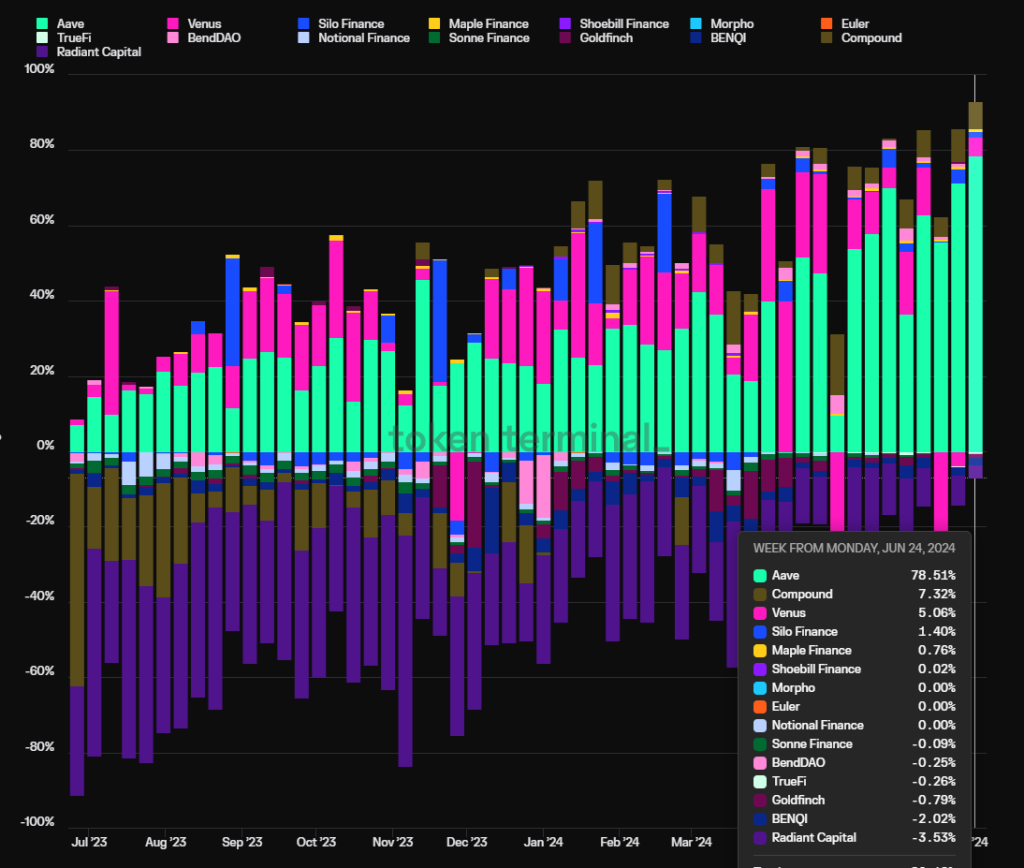

Another key indicator is the protocol's profitability, i.e., profit level. As seen in the chart below, Aave's protocol profit has already pulled away significantly from other lending protocols and has long since moved away from stimulating business through token subsidies, as seen with the Radiant protocol in the chart (purple portion represents it).

Data source: Tokenterminal

1.2 Moat

Aave's moat mainly consists of the following 4 points:

Continuous accumulation of security credibility: Aave has operated without any smart contract-level security incidents since its inception, which is a crucial factor for Defi users when choosing a lending platform, especially for large-scale users.

Bilateral network effects: Similar to many internet platforms, Defi lending is a typical two-sided market, where deposit and borrowing users are mutually dependent. The growth of one side's scale stimulates the growth of the other side's business, making it more difficult for later competitors to catch up. In addition, the more abundant the platform's overall liquidity, the smoother the inflow and outflow of liquidity for deposit and borrowing users, making it more attractive to large capital users, which in turn stimulates the growth of the platform's business.

Excellent DAO management level: Aave's protocol has fully implemented DAO-based management, which provides more comprehensive information disclosure and more extensive community discussions on important decisions compared to team-centric management models. In addition, Aave's DAO community is active and includes a group of professional institutions with high governance levels, including top VCs, university blockchain clubs, market makers, risk management service providers, third-party development teams, and financial consulting teams, with diverse sources and active governance participation. From the operational results of the project, Aave, as a latecomer in the pool-based lending service, has effectively balanced growth and security in product development and asset expansion, surpassing the leader Compound, with DAO governance playing a crucial role in this process.

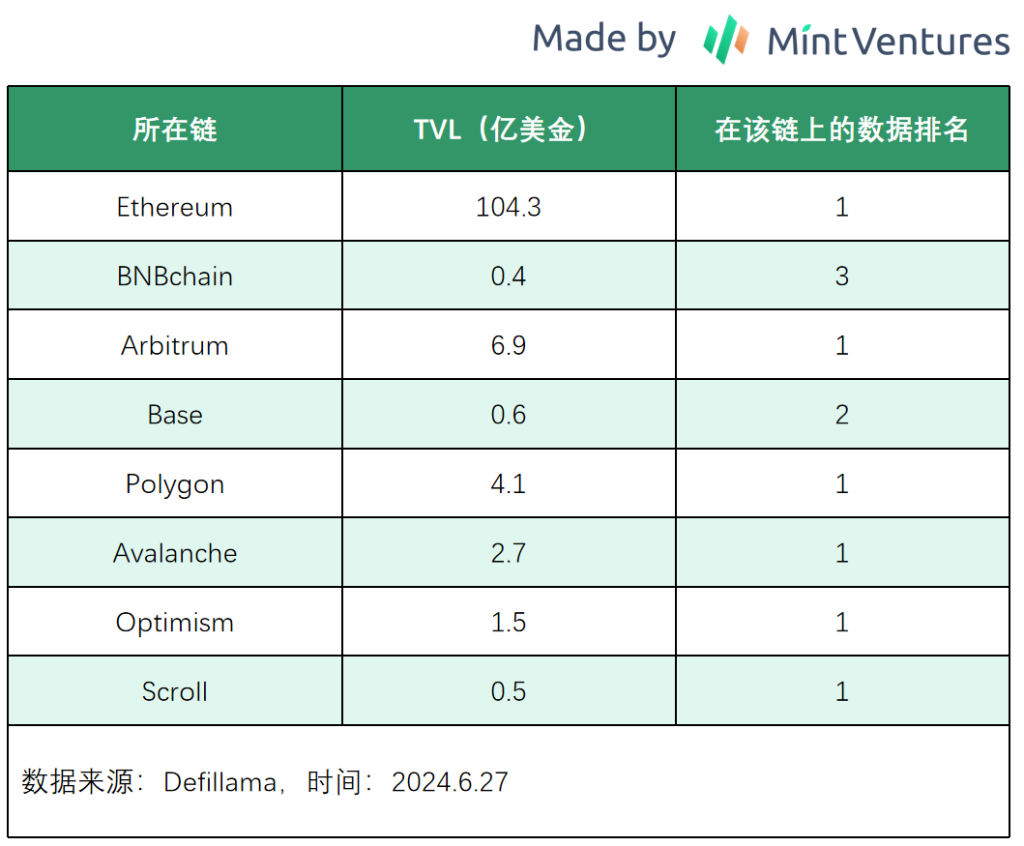

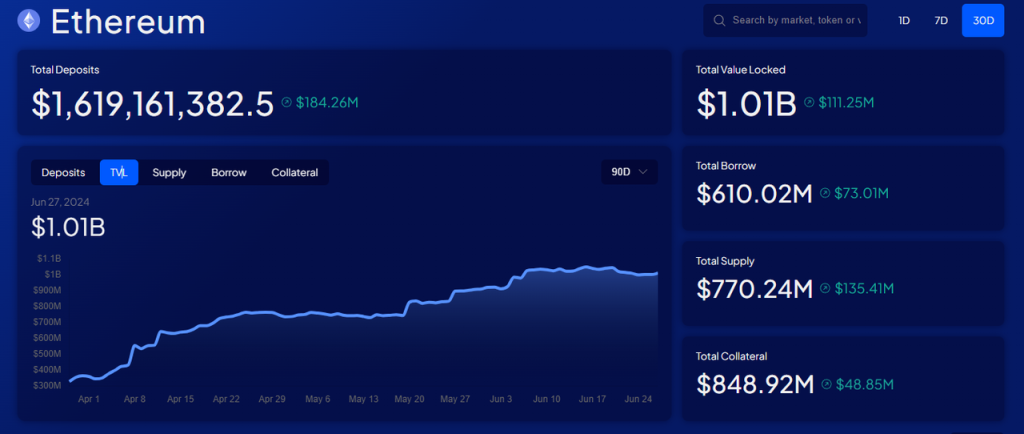

Multi-chain ecosystem positioning: Aave is deployed on almost all EVM L1\L2 chains and its TVL is at the forefront on each chain. In the upcoming V4 version of Aave, the interconnection of multi-chain liquidity will be realized, making the advantage of cross-chain liquidity more prominent. Specifically, see the image below:

In addition to EVM public chains, Aave is also evaluating Solana and Aptos, with the possibility of deployment on these networks in the future.

1.3 Valuation Level

According to Tokenterminal data, due to the continuous recovery of protocol fees and income, combined with the coin price still hovering at a low level, Aave's PS (circulating market value to protocol income ratio) and PF (circulating market value to protocol fee ratio) have both reached historical lows, with PS at 17.44 times and PF at 3.1 times.

Data source: Tokenterminal

1.4 Risks and Challenges

Although Aave's market share in the lending market continues to rise, a new competitor worth noting is the modular lending platform Morpho Blue. Morpho Blue provides a modular protocol for third parties intending to build a lending market, allowing them to freely choose different collateral, borrowing assets, oracles, and risk parameters to build a custom lending market.

This modular approach allows more market participants to enter the lending field and start providing lending services. For example, Gaunlet, a risk service provider for Aave, would rather interrupt its service relationship with Aave and launch its own lending market on Morpho Blue.

Image source: https://app.morpho.org/?network=mainnet

Data source: https://morpho.blockanalitica.com/

Since its launch over half a year ago, Morpho Blue has grown rapidly and has become the fourth largest lending platform in terms of TVL, following Aave, Spark (a MakerDAO-launched Aave v3 fork lending platform), and Compound.

Its growth on Base has been even more rapid, with a TVL of around $27 million in less than 2 months, while Aave's TVL on Base is around $59 million.

Data source: https://morpho.blockanalitica.com/

2. Dexs: Uniswap & Raydium

Uniswap and Raydium belong to the Ethereum camp's EVM ecosystem and the Solana ecosystem, respectively. Uniswap launched its V1 version on the Ethereum mainnet as early as 2018, but it was the V2 version launched in May 2020 that truly made Uniswap popular. Raydium, on the other hand, was launched on Solana in 2021.

The reason for recommending two different targets in the Dexs track is that they belong to the two largest Web3 ecosystems in terms of user base, namely the EVM ecosystem built around the king of public chains, Ethereum, and the rapidly growing Solana ecosystem, and each project has its own strengths and issues. We will now analyze these two projects separately.

2.1 Uniswap

2.1.1 Business Situation

Since the launch of the V2 version, Uniswap has almost always been the largest Dex in terms of trading volume share on the Ethereum mainnet and most EVM chains. In terms of business, we mainly focus on two indicators: trading volume and fees.

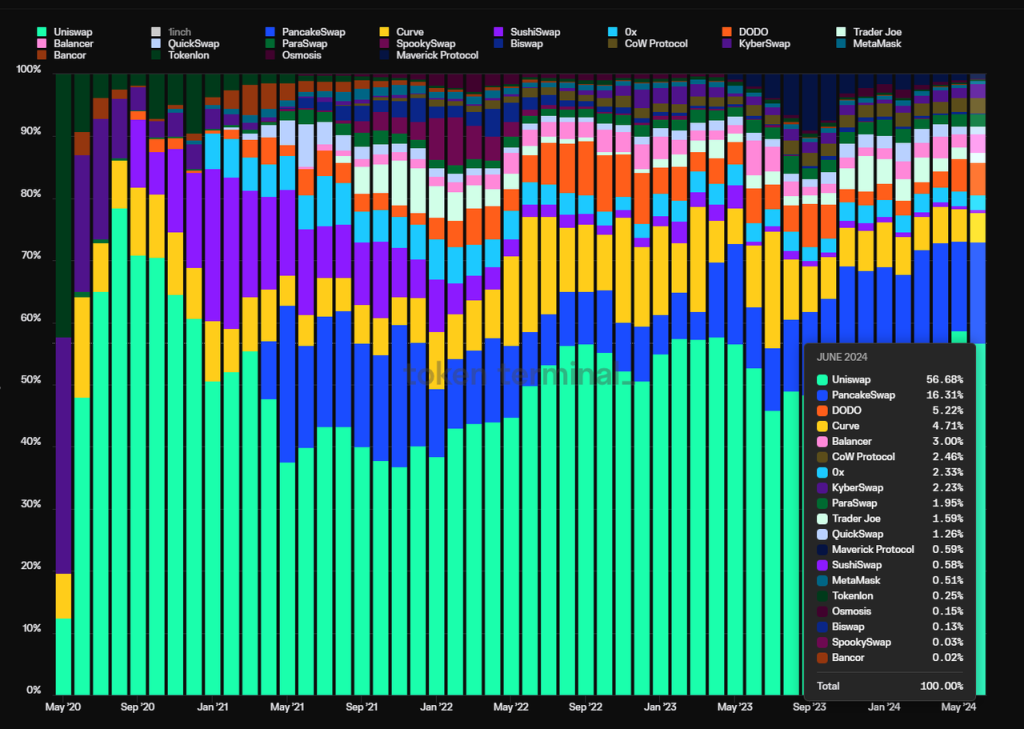

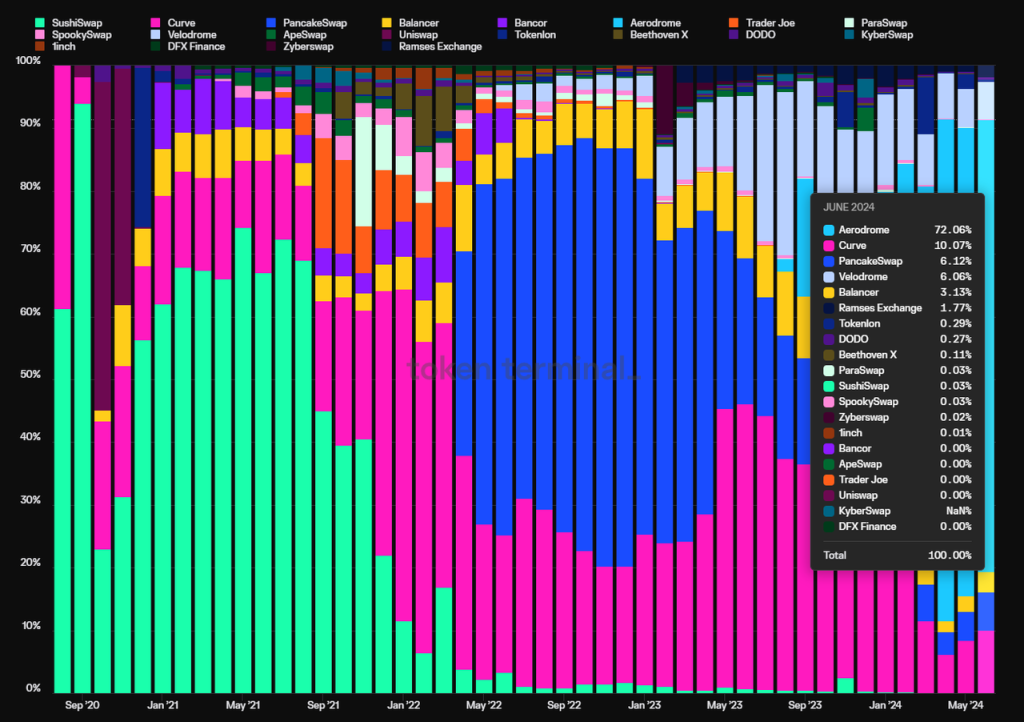

The chart below shows the monthly trading volume share of Uniswap V2 since its launch (excluding DEX trading volume on non-EVM chains):

Data source: Tokenterminal

Since the launch of the V2 version in May 2020, Uniswap's market share has fluctuated from a peak of 78.4% in August 2020 to a low of 36.8% during the peak of the Dex battle in November 2021, and has now risen to 56.7%, having endured fierce competition and established a strong position.

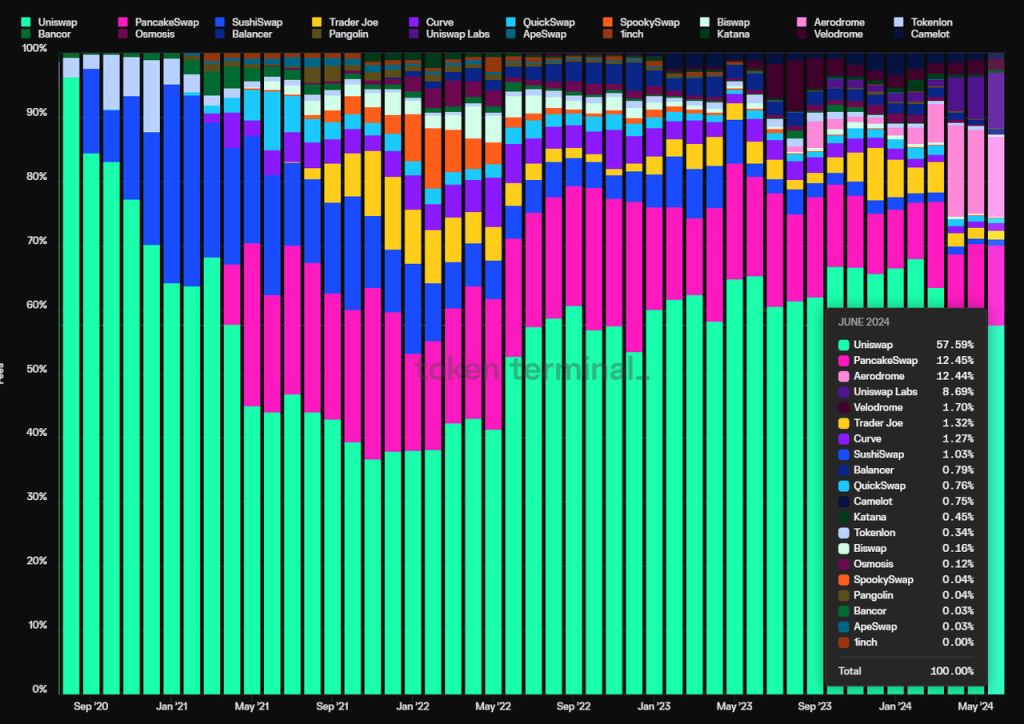

Data source: Tokenterminal

Uniswap's market share of trading fees has shown a similar trend, hitting a low of 36.7% in November 2021 and then rising to the current 57.6%.

What's even more remarkable is that, except for a few months in 2020 (on the Ethereum mainnet) and at the end of 2022 (on the OP mainnet), during which Uniswap subsidized its own liquidity, it has not incentivized liquidity for the rest of the time, while most Dexs have continued to subsidize liquidity to this day.

The chart below shows the proportion of monthly incentive amounts for major Dexs. It can be seen that Sushiswap, Curve, Pancakeswap, and the ve(3,3) project Aerodrome on Base were once the projects with the largest subsidy amounts during the same period, but none of them managed to achieve a higher market share than Uniswap.

Data source: Tokenterminal

However, the most criticized aspect of Uniswap is that despite not spending on token incentives, the tokens also do not capture value, and the protocol has not yet activated the fee switch.

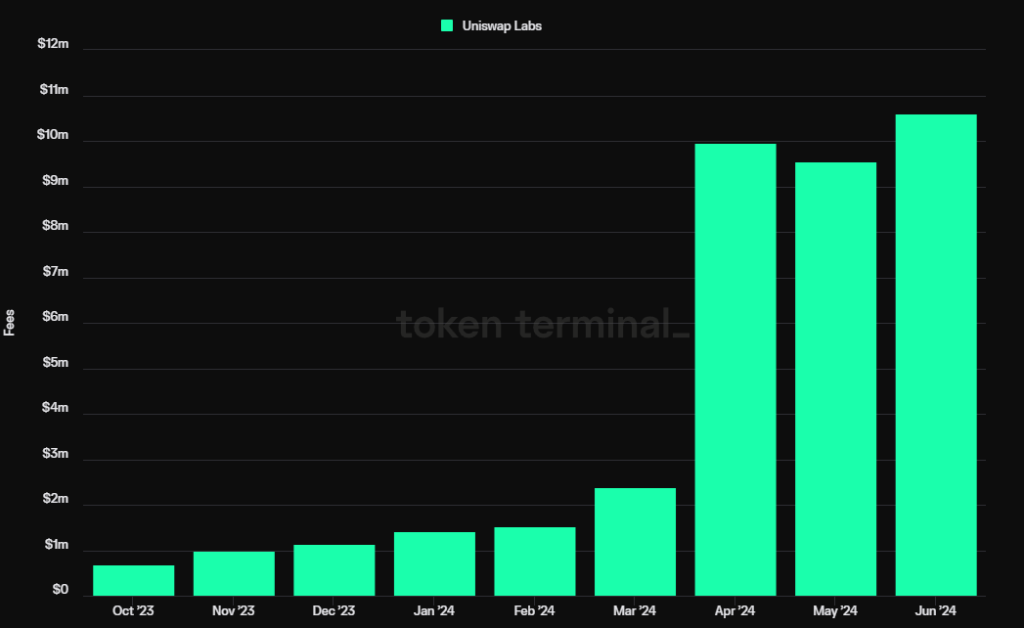

However, in late February 2024, Erin Koen, the developer and foundation governance lead of Uniswap, proposed an upgrade to the Uniswap protocol to enable its fee mechanism to reward UNI token holders who have authorized and staked their tokens. This proposal sparked much discussion in the community, and although it was scheduled for a formal vote on May 31st, it is currently delayed and has not yet been voted on. Nevertheless, the work to enable protocol fees and empower the Uni token has taken the first step, with the upgrade contract already developed and audited. In the visible future, Uniswap will have separate protocol income.

In addition, Uniswap Labs actually started charging users who trade using the official Uniswap frontend and Uniswap wallet in October 2023, at a rate of 0.15% of the transaction amount. The currencies subject to fees include ETH, USDC, WETH, USDT, DAI, WBTC, agEUR, GUSD, LUSD, EUROC, and XSGD, but stablecoin trades and WETH\ETH swaps are exempt from fees.

Just the frontend fees for Uniswap have already made Uniswap Labs one of the highest-earning teams in the entire Web3 space.

It can be imagined that when the Uniswap protocol fee is activated, based on the fee annualized in the first half of 2024, Uniswap's annualized fee would be approximately $1.13 billion. Assuming a protocol fee rate of 10%, the protocol's annualized income would be around $110 million.

After the launch of Uniswap X and V4 in the second half of this year, Uniswap is expected to further expand its market share of trading volume and fees.

2.1.2 Moat

Uniswap's moat mainly comes from the following three aspects:

- User habits: At the beginning of Uniswap's frontend fee implementation, many people thought it was not a good idea and that users would quickly switch their trading behavior from Uniswap's frontend to 1inch and other trading aggregators to avoid paying additional transaction fees. However, since the implementation of frontend fees, the income from the frontend has consistently increased, and its growth rate has even exceeded that of Uniswap's entire protocol fee income.

Data source: Tokenterminal

Bilateral Network Effects: Uniswap, as a trading platform, is a typical bilateral market. In understanding the "bilateral" nature of its business model, one perspective is that the two sides of this market are buyers (traders) and liquidity providers (LPs). The more active the trading on both sides, the more inclined LPs are to provide liquidity there, reinforcing each other. Another perspective on the bilateral nature is that one side of the market is traders, and the other side is the project team deploying initial liquidity for tokens. In order to make their tokens more easily accessible and tradable by the public, project teams tend to deploy initial liquidity in DEXs where there are more users and greater public awareness, rather than choosing relatively obscure second or third-tier DEXs. This behavior of project teams further reinforces the habitual trading behavior of users - new tokens are prioritized for trading on Uniswap, forming a mutually reinforcing "project team" and "trading user" bilateral market.

Multi-chain Deployment: Similar to Aave, Uniswap is actively expanding to multiple chains, and Uniswap's presence can be seen on EVM chains with significant trading volume, with its trading volume mostly ranking among the top few DEXs on those chains.

Subsequently, with the support for multi-chain trading upon the launch of Uniswap X, Uniswap's comprehensive advantage in multi-chain liquidity will be further amplified.

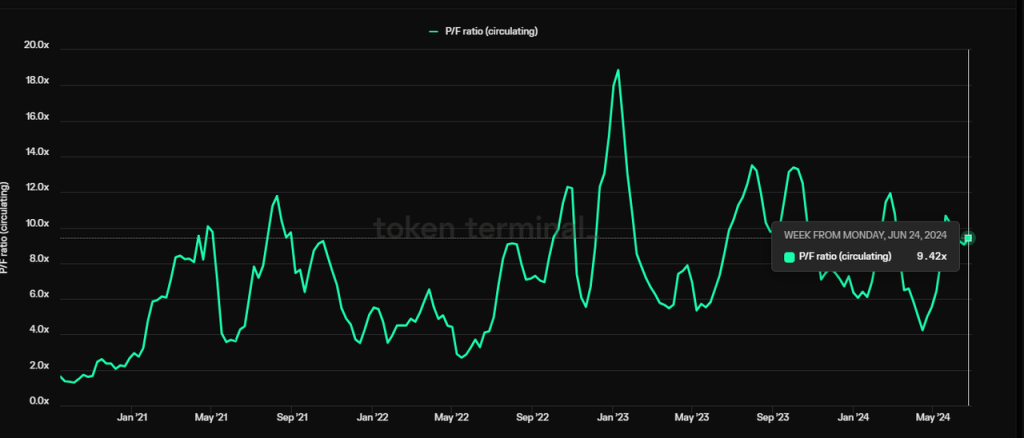

2.1.3 Valuation

By using the ratio of Uniswap's circulating market cap to its annualized fees, PF, as the main valuation standard, we find that the valuation of the UNI token is currently in a historically high percentile range, perhaps reflecting the upcoming fee switch upgrade in its current market cap level.

Data source: Tokenterminal

In terms of market cap, Uniswap's current circulating market cap is close to $6 billion, with a fully diluted market cap of up to $9.3 billion, which is also not low.

2.1.4 Risks and Challenges

Policy Risk: In April of this year, Uniswap received a Wells Notice from the SEC, indicating that the SEC will take enforcement action against Uniswap in the future. Of course, with the gradual progress of the FIT21 bill, DeFi projects like Uniswap are expected to obtain a more transparent and predictable regulatory framework in the future. However, considering that the voting and implementation of this bill will take a long time, the litigation from the SEC will exert pressure on the project's business and token prices in the medium term.

Ecological Position: DEXs are the foundational layer of liquidity, and previously their upstream was trading aggregators. Trading aggregators such as 1inch, Cowswap, and Paraswap can provide users with cross-chain liquidity comparison and find the best trading path, to some extent suppressing the downstream DEXs' ability to charge and price user trading behavior. Subsequently, with the development of the industry, wallets with built-in trading functions have become a more upstream infrastructure, and with the introduction of intent-based models in the future, DEXs as the source of underlying liquidity will become a layer that users are completely unaware of, which may further erode users' habitual use of Uniswap and enter a complete "comparison mode". Recognizing this, Uniswap is making efforts to move upstream in the ecosystem, such as vigorously promoting the Uniswap wallet and releasing Uniswap X to enter the trading aggregation layer, to improve its ecological position.

2.2 Raydium

2.2.1 Business Situation

We will also focus on analyzing Raydium's trading volume, fees, and the fact that Raydium, unlike Uniswap, has been proactive in protocol fees, having a good protocol cash flow. Therefore, we also consider Raydium's protocol income as a key factor to examine.

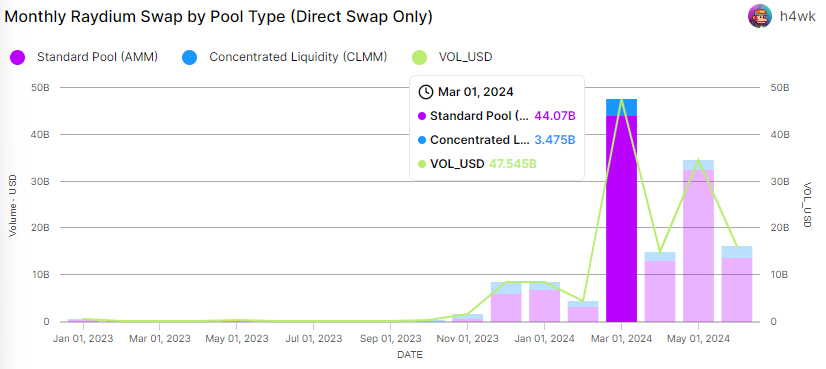

Let's start with Raydium's trading volume. Thanks to the prosperity of the current Solana ecosystem, its trading volume has taken off since October last year, reaching $47.5 billion in March, about 52.7% of Uniswap's trading volume for that month.

Data source: flipside

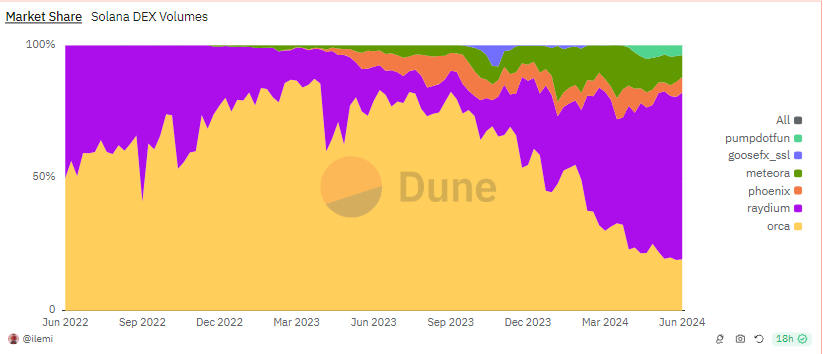

In terms of market share, Raydium's share of trading volume on the Solana chain has been climbing since September last year, currently accounting for 62.8% of the trading volume in the Solana ecosystem. Its dominance in the Solana ecosystem even exceeds Uniswap's position in the Ethereum ecosystem.

Data source: Dune

The reason why Raydium's market share has risen from less than 10% during the low period to over 60% now is mainly due to the current meme trend in this bull market cycle. Raydium uses a combination of two liquidity pools, divided into standard AMM and CPMM. The former is similar to Uni V2, with evenly distributed liquidity, suitable for high-volatility assets, while the latter is similar to V3's concentrated liquidity pool, where liquidity providers can customize the range of liquidity, making it more flexible but also more complex.

On the other hand, Raydium's competitor Orca has chosen to fully embrace the concentrated liquidity pool model similar to Uni V3. For meme projects that need to produce and configure large amounts of liquidity daily, Raydium's standard AMM model is more suitable, making Raydium the preferred liquidity venue for meme tokens.

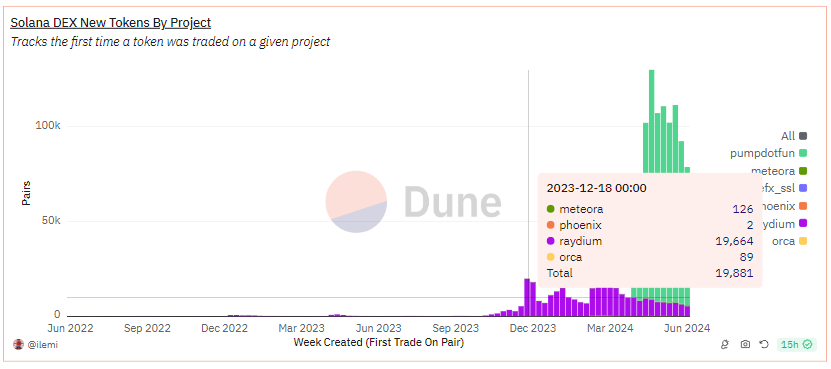

Since November of this year, Solana has been the largest meme incubation base in this bull market cycle, with hundreds to thousands of new memes being born every day. Meme has become a core driving factor for the prosperity of the Solana ecosystem, igniting Raydium's business takeoff.

Data source: Dune

As shown in the chart, in December 2023, Raydium had 19,664 new token additions in a week, while Orca had only 89 during the same period. Although theoretically, Orca's concentrated liquidity mechanism can also choose to "fully configure" liquidity to achieve a similar effect to traditional AMM, this is still not as direct and simple as Raydium's standard pool.

In fact, Raydium's trading volume data also proves this point, with 94.3% of the trading volume coming from the standard pool, with the vast majority of this volume contributed by meme tokens.

Furthermore, as a bilateral market, just like Uniswap, the more retail investors there are on Raydium, the more meme project teams tend to deploy initial liquidity on Raydium, which in turn also prompts users and tools that serve users (such as various dog-catching TG bots) to choose Raydium for trading, further widening the gap between Raydium and Orca through this self-reinforcing cycle.

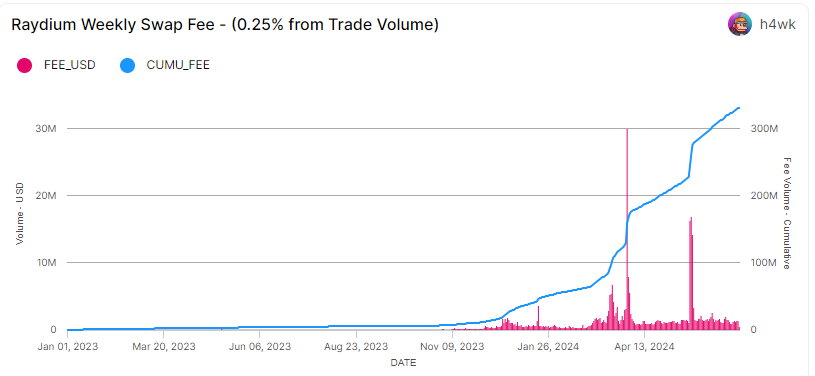

From the perspective of transaction fees, Raydium generated approximately $300 million in transaction fees in the first half of 2024, which is 9.3 times the total transaction fees generated in 2023 for Raydium.

Data source: flipside

The standard AMM pool fee rate for Raydium is 0.25% of the trading volume, with 0.22% going to LPs and 0.03% used for repurchasing the protocol token Ray. The CPMM fee rate can be freely set at 1%, 0.25%, 0.05%, and 0.01%, with LPs receiving 84% of the transaction fees, and the remaining 16% allocated with 12% for Ray repurchase and 4% deposited into the treasury.

Data source: flipside

The protocol income used for repurchasing Ray in the first half of 2024 is approximately $20.98 million, which is 10.5 times the total amount of Ray repurchases in 2023.

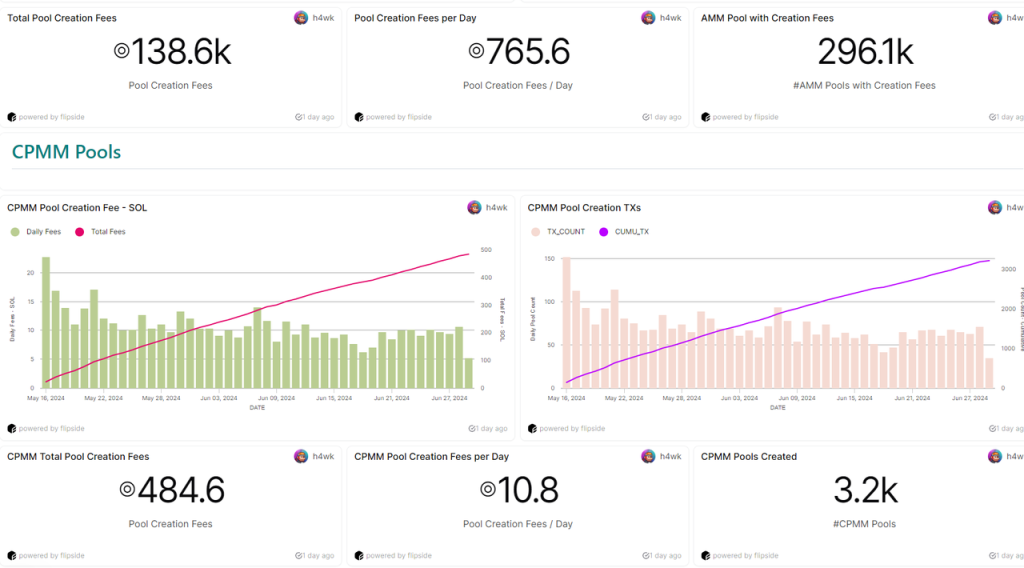

In addition to the revenue from transaction fees, Raydium also charges for the creation of new pools. Currently, the fee for creating a standard AMM pool is 0.4 SOL, and for creating a CPMM pool, it is 0.15 SOL. Raydium currently receives an average of 775 SOL in pool creation fees per day (calculated at a price of 6.30 SOL, approximately equivalent to $10.8 thousand USD). However, this portion of the fees is not allocated to the treasury or used for Ray repurchases, but is used for protocol development and maintenance, essentially serving as team income.

Data source: flipside

Like most DEXs, Raydium currently offers incentives for DEX liquidity. Although the author did not find data tracking the continuous incentives amount, an approximate estimate of the incentive value for the currently incentivized liquidity pools can be obtained from the official liquidity interface.

Based on the current liquidity incentives provided by Raydium, approximately $48,000 worth of incentives are paid out each week, mainly in the form of Ray tokens. This amount is far less than the protocol's weekly income of nearly $800,000 (excluding pool creation income), indicating that the protocol is in a positive cash flow state.

2.2.2 Moat

Raydium is currently the DEX with the largest market trading volume on Solana. Compared to its competitors, its main advantage comes from the current bilateral network effects, similar to Uniswap, benefiting from the mutual reinforcement of business on both ends - traders and LPs, as well as the mutual reinforcement of project teams and trading users on both ends. This network effect is particularly prominent in the meme asset category.

2.2.3 Valuation

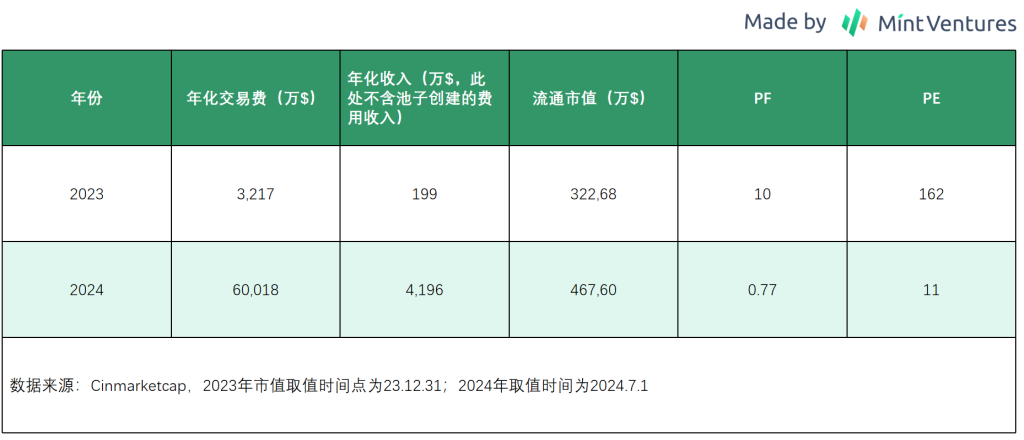

Due to the lack of historical data before 2023, the author only compares Raydium's valuation data for the first half of this year with the valuation data for 2023.

Despite the surge in trading volume this year, although the price of Ray has increased, the valuation comparison still shows a significant decrease compared to last year, and its PF is at a relatively low level compared to DEXs like Uniswap.

2.2.4 Risks and Challenges

Despite Raydium's strong trading volume and revenue performance in the past six months, its future development still faces many uncertainties and challenges, specifically:

Ecological Position: Similar to Uniswap, Raydium also faces ecological positioning issues. In the Solana ecosystem, aggregators such as Jupiter have a greater influence, with trading volume far exceeding that of Raydium (Jupiter's total trading volume in June was 28.2 billion, while Raydium's was 16.8 billion). In addition, meme platforms like Pump.fun, gradually replacing Raydium as the launch platform for projects, with more memes being launched through Pump.fun rather than Raydium, despite the current cooperation between the two. If this situation is not improved in the long term, if Pump.fun or Jupiter, located upstream in the ecosystem, builds its own DEX or turns to competitors, it will have a significant impact on Raydium.

Market Trend Shift: Before the current meme trend on Solana, Orca's market share of trading volume was 7 times that of Raydium. This time, Raydium's standard pool, due to its friendliness to meme projects, has allowed Raydium to regain market share. However, it is difficult to predict how long the meme trend on Solana will continue, and whether the future on-chain will still be dominated by meme tokens. When the types of trading assets in the market shift, Raydium's market share may face challenges again.

Token Emission: Raydium's token currently has a circulation ratio of 47.2%, which is not particularly high compared to most DeFi projects. The future selling pressure from unlocked tokens may put pressure on the price. However, considering that the project currently has good cash flow, selling tokens is not the only option, and the team may also choose to burn the unlocked tokens to dispel investor concerns.

High Centralization: Currently, Raydium has not yet initiated a governance process based on the Ray token, and the project's development is entirely controlled by the project team. This may result in the profits that should belong to token holders not being distributed, such as the unresolved distribution of Ray tokens repurchased by the protocol.

3. Staking: Lido

Lido is a leading liquidity staking protocol on the Ethereum network. The launch of the beacon chain at the end of 2020 marked the official start of Ethereum's transition from PoW to PoS. Since the withdrawal function for staked assets was not yet available at that time, staked ETH would lose liquidity. In fact, the Shapella upgrade, which allowed for the withdrawal of staked assets on the beacon chain, occurred in April 2023, meaning that users who were the earliest to stake ETH had been unable to access liquidity for two and a half years.

Lido pioneered the liquidity staking track. Users who deposit ETH into Lido receive stETH tokens issued by Lido. Lido incentivized deep stETH-ETH LP on Curve, providing users with a stable service for "participating in ETH staking to earn rewards and being able to withdraw ETH at any time." It quickly developed and gradually became a leader in the Ethereum staking track.

In terms of its business model, Lido allocates 10% of its staking income, with 5% distributed to staking service providers and 5% managed by the DAO.

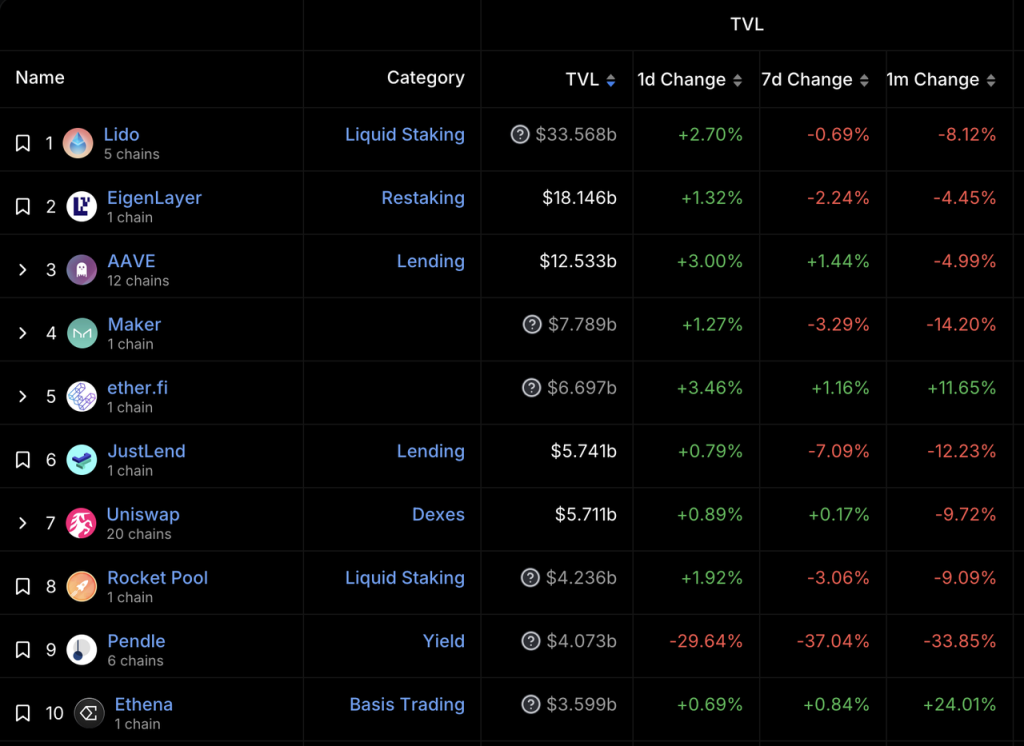

Lido's main business currently is ETH liquidity staking services. Previously, Lido was also the largest liquidity staking service provider on the Terra network and the second largest on the Solana network. It also actively expanded its business to other chains such as Cosmos, Polygon, and others. However, Lido wisely shifted its focus entirely to ETH network staking services. Currently, Lido is the leader in the ETH staking market and has the highest Total Value Locked (TVL) among DeFi protocols.

Source: DeFiLlama

With the deep stETH-ETH liquidity incentivized by a large amount of $LDO rewards and investment support from institutions such as Paradigm and Dragonfly in April 2021, Lido surpassed its main competitors at the time - centralized exchanges (Kraken and Coinbase) by the end of 2021, becoming the leader in the Ethereum staking track.

Lido spent approximately $280 million in total to incentivize stETH-ETH liquidity from 2021 to 2022. Source: Dune

However, discussions arose about whether Lido's dominant position would affect the decentralization of Ethereum. The Ethereum Foundation internally discussed the need to limit a single entity's staking share to no more than 33.3%. Lido's market share reached a high of 32.6% in May 2022 and has since fluctuated between 28% and 32%.

Historical market share of ETH staking. (The light blue block at the bottom represents Lido). Source: Dune

3.2 Moat

Lido's business moat mainly consists of the following two points:

Long-term market leadership brings stable expectations, making Lido the preferred choice for whales and institutions to enter ETH staking. Users such as Justin Sun, Mantle before issuing its own LST, and many whales are all Lido users.

Network effects brought by the widespread use cases of stETH. stETH has been fully supported by leading DeFi protocols as early as 2022, and subsequently developed DeFi protocols have been trying to attract stETH (such as the once popular LSTFi project in 2023, as well as Pendle and various LRT projects). The position of stETH as the basic income asset of the Ethereum network is relatively stable.

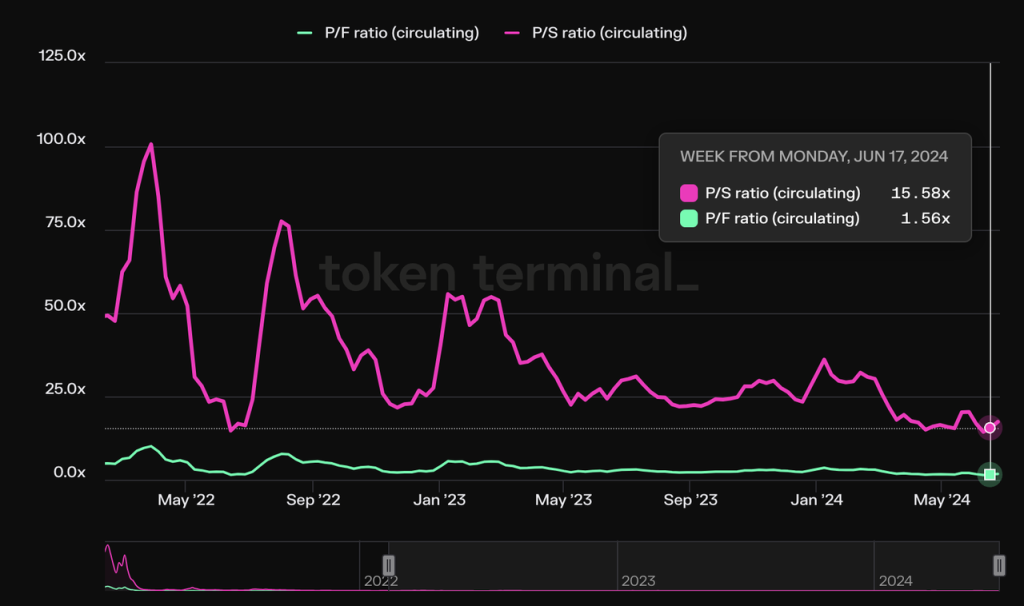

3.3 Valuation Level

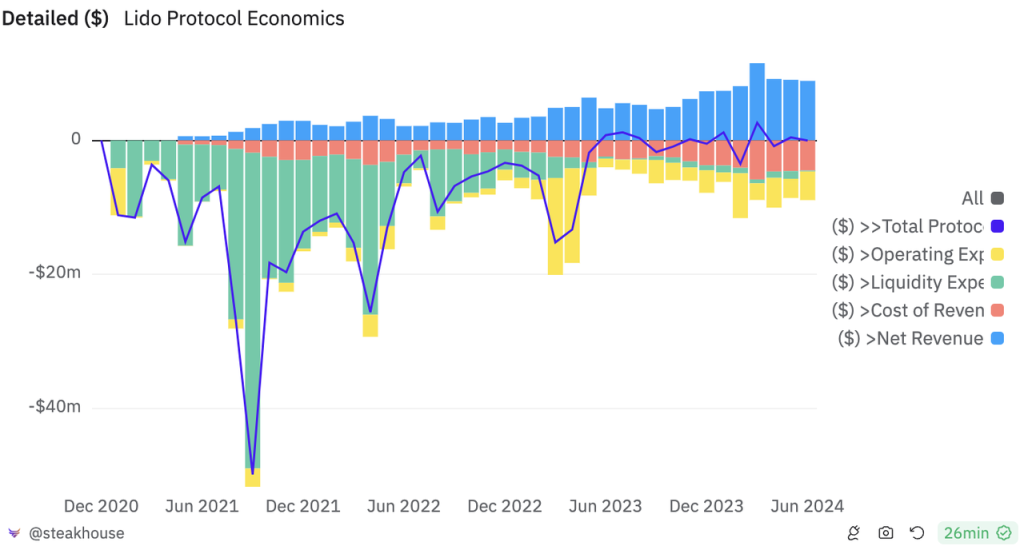

Although Lido's market share has experienced a slight decline, Lido's staking scale continues to rise with the increase in ETH's staking ratio. In terms of valuation indicators, Lido's Price-to-Sales (PS) and Price-to-Free Cash Flow (PF) have recently hit historical lows.

Source: Token Terminal

With the successful launch of the Shapella upgrade, Lido's market position has stabilized, and the profit indicator reflecting "revenue - token incentives" has also performed well, accumulating a profit of $36.35 million in the past year.

Source: Token Terminal

This has also sparked community expectations for adjustments to the $LDO economic model. However, the actual leader of Lido, Hasu, has repeatedly stated that the current community treasury income cannot sustain all of Lido DAO's expenses in the long term compared to the current spending.

3.4 Risks and Challenges

Lido faces the following risks and challenges:

Competition from newcomers. Since the launch of Eigenlayer, Lido's market share has been declining. Any new project with a sufficient token marketing budget could become a competitor to Lido, which has a leading advantage but has a token that is close to full circulation.

Some members of the Ethereum community, including the Ethereum Foundation, have long-term concerns about Lido's high market share in staking. Vitalik previously wrote specifically about this issue and outlined various solutions, but did not express a clear preference for any solution in the article. (Mint Ventures specifically analyzed this issue in a dedicated article in November last year, and interested readers can refer to it for more information).

In June 28, 2024, the SEC explicitly defined LST as a security in its charges against Consensys, stating that the act of minting and purchasing stETH was "issuing and selling unregistered securities" by Lido. Consensys is also suspected of "issuing and selling unregistered securities" for providing users with the service of staking ETH to Lido.

4. Perpetual Contract Exchange: GMX

GMX is a perpetual contract trading platform that officially launched on Arbitrum in September 2021 and on Avalanche in January 2022. Its business is a bilateral market: on one side are traders who can engage in leveraged trading of up to 100x, and on the other side are liquidity providers who offer their assets' liquidity for traders and act as counterparties to the traders.

In terms of its business model, GMX generates income from trading fees charged to traders, ranging from 0.05% to 0.1%, as well as funding fees and borrowing costs. GMX allocates 70% of its total income to liquidity providers, with the remaining 30% distributed to GMX stakers.

4.1 Business Situation

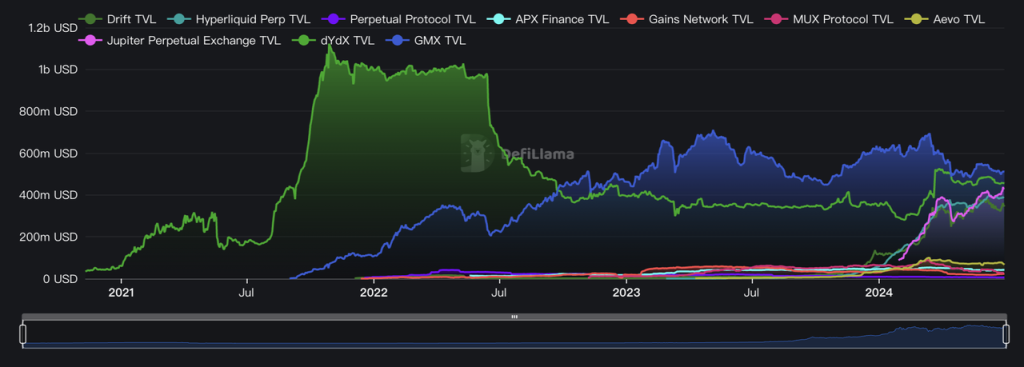

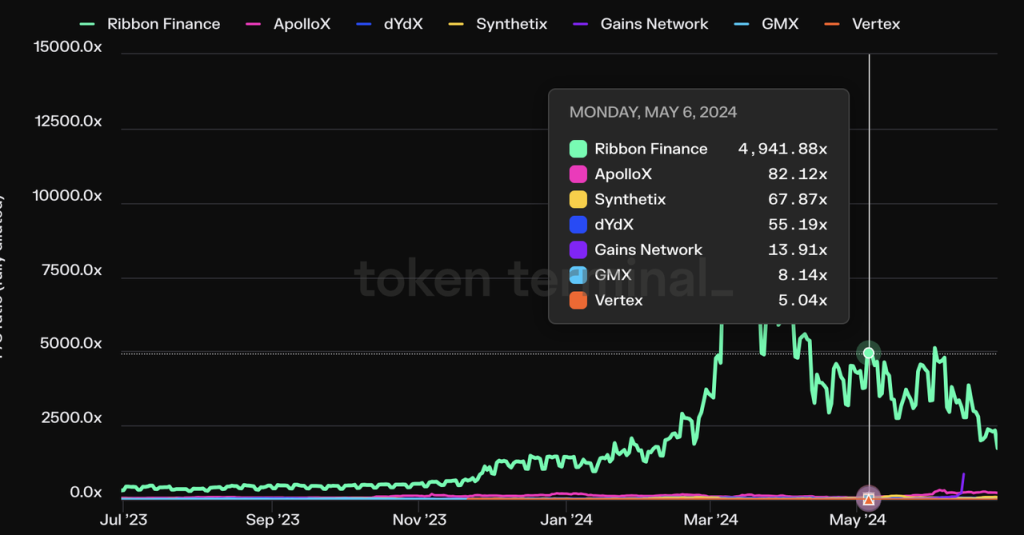

In the field of perpetual contract trading platforms, the data on trading volume is not very representative due to the frequent emergence of new projects with retroactive airdrops (such as Aevo, Hyperliquid, Synfutures, Drift, etc.), and the widespread existence of similar trading mining incentives in old projects (such as dYdX, Vertex, RabbitX). Therefore, we will use TVL, PS, and profit indicators to compare GMX with its competitors.

In terms of TVL, GMX currently ranks first. However, established derivative protocols such as dYdX, Jupiter Perp with a large influx of traffic on Solana, and the unreleased Hyperliquid also have TVL in the same range.

Source: DeFiLlama

From the PS indicator, among projects that have issued tokens, focus on perpetual contract trading, and have a daily trading volume of over $30 million, GMX has a lower PS indicator, only higher than Vertex, which still has high trading mining incentives.

In terms of profit indicators, GMX's profit over the past year is $6.5 million, which is lower than DYDX, GNS, and SNX. However, it is worth noting that this is largely due to GMX releasing all of the 12 million ARB tokens it received (equivalent to an average of about $18 million based on the price of ARB during the period) during the STIP event on Arbitrum from November last year to March this year, leading to a significant decrease in profit. The slope of the profit accumulation shows GMX's strong profit-making ability.

4.2 Moat

Compared to other DeFi projects mentioned above, GMX's moat is relatively weak. The frequent emergence of new derivative exchange projects in recent years has largely impacted GMX's trading volume, making the track quite crowded. However, GMX's main advantages include:

Strong support from Arbitrum. As a native project of the Arbitrum network, GMX contributed nearly half of the TVL on the Arbitrum network at its peak. Almost all new DeFi projects on Arbitrum at that time were "developed for GLP." In addition to gaining exposure from Arbitrum's official exposure, GMX also received a large number of ARB tokens (initial airdrop of 8 million tokens, STIP 12 million tokens) in various ARB incentive activities, enriching GMX's treasury and providing valuable marketing budget.

Positive image brought by long-term industry leadership. GMX led the narrative of "real yield DeFi" from the second half of 2022 to the first half of 2023, which was a rare highlight in the DeFi field during that bearish market period. GMX took this opportunity to build a good brand image and accumulate many loyal users.

Some degree of economies of scale. Platforms like GMX benefit from economies of scale because only with a large LP scale can larger trading orders and higher open interest be accommodated, and higher trading volume can in turn provide higher returns to LPs. As a leading on-chain derivative trading platform, GMX benefits from this economies of scale. For example, the well-known trader Andrew Kang has opened long and short positions of up to tens of millions of dollars on GMX. At that time, GMX was almost his only choice for opening such large position orders on-chain.

4.3 Valuation Level

GMX is currently fully circulated. In the previous section, we conducted a horizontal comparison with peers, and GMX currently has the lowest valuation among mainstream derivative trading platforms.

In comparison with historical data, GMX's revenue situation is relatively stable, and the PS indicator is historically in a moderately low position.

4.4 Risks and Challenges

Strong competitors. GMX's competitors include not only established but still active DeFi protocols like Synthetix and dYdX, but also emerging protocols. AEVO, a coin swap protocol, and the unreleased Hyperliquid have both gained considerable trading volume and exposure in the past year. Jupiter Perp, which has a large influx of traffic on Solana, has achieved a TVL close to GMX and surpassed GMX's trading volume using a mechanism almost identical to GMX's. GMX is also preparing to expand its V2 version to Solana, but overall, the competition in the track is very fierce, and there is no relatively certain pattern as in other DeFi tracks. Common trading mining incentives in the industry also reduce user switching costs, and user loyalty is generally low.

GMX uses oracle prices as the basis for transactions and settlements, which poses the risk of oracle attacks. In September 2022, GMX on the Avalanche network lost $560,000 due to an oracle attack on AVAX. Of course, for most assets that GMX allows trading, the cost of an attack (manipulating the price of the corresponding token on a CEX) is far greater than the potential profit. GMX's V2 version has also made targeted efforts to address this risk with isolated pools and trading slippage.

5. Other Notable DeFi Projects

In addition to the aforementioned DeFi projects, we also researched other notable DeFi projects, such as the established stablecoin project MakerDAO, the emerging star Ethena, and the leading oracle provider Chainlink. However, due to space limitations, we cannot present all of these projects in this article. These projects also face many issues, such as:

MakerDAO, despite still being the leading decentralized stablecoin project and having a large number of "natural holders" who hold DAI just like they hold USDC and USDT, has seen its stablecoin scale stagnate, with a market value only about half of its previous high. Its collateral largely consists of off-chain dollar assets, gradually undermining the decentralized credit of its token.

In stark contrast to MakerDAO's DAI, the stablecoin USDe from Ethena has seen rapid growth, reaching $3.6 billion in about six months. However, Ethena's business model (a public fund focused on perpetual contract arbitrage) still has a clear ceiling. The significant expansion of its stablecoin is based on the premise that secondary market users are willing to buy its token ENA at a high price, providing substantial subsidies to USDe. This somewhat Ponzi-like design is susceptible to negative spirals in business and token price when market sentiment is poor. The key turning point for Ethena's business lies in USDe one day becoming a decentralized stablecoin with a large number of "natural holders," at which point its business model will have completed the transition from a public arbitrage fund to a stablecoin operator. However, considering that most of USDe's underlying assets are held in arbitrage positions on centralized exchanges, USDe lacks both "decentralized anti-censorship" and "strong credit institution endorsement," making it difficult to replace DAI and USDT.

Chainlink is preparing to usher in a wave of hidden but massive narratives after the DeFi era, namely the RWA narrative driven by financial giants embracing Web3, represented by BlackRock. In addition to pushing for the listing of BTC and ETH ETFs, BlackRock's most noteworthy move this year is the issuance of a Build-coded US Treasury bond fund on Ethereum, which surpassed $380 million in fund size within 6 weeks. The subsequent experiments of traditional financial giants in on-chain financial products will continue to face issues of tokenization of off-chain assets, as well as on-chain and off-chain communication and interoperability. Chainlink has been at the forefront of exploration in this area, such as in May of this year when Chainlink completed a pilot project for "Smart NAV" with the Depository Trust & Clearing Corporation (DTCC) and several major financial institutions in the United States. The project aims to establish a standardized process to collect and disseminate fund net asset value (NAV) data on private or public blockchains using Chainlink's interoperability protocol CCIP. In addition, in February of this year, asset management company Ark Invest and 21Shares announced the verification of holdings data through the integration of Chainlink's reserve proof platform. However, Chainlink still faces the issue of disconnecting business value from the token, as the Link token lacks value capture and rigid use cases, making it difficult for holders to benefit from the business growth of its parent company.

Conclusion

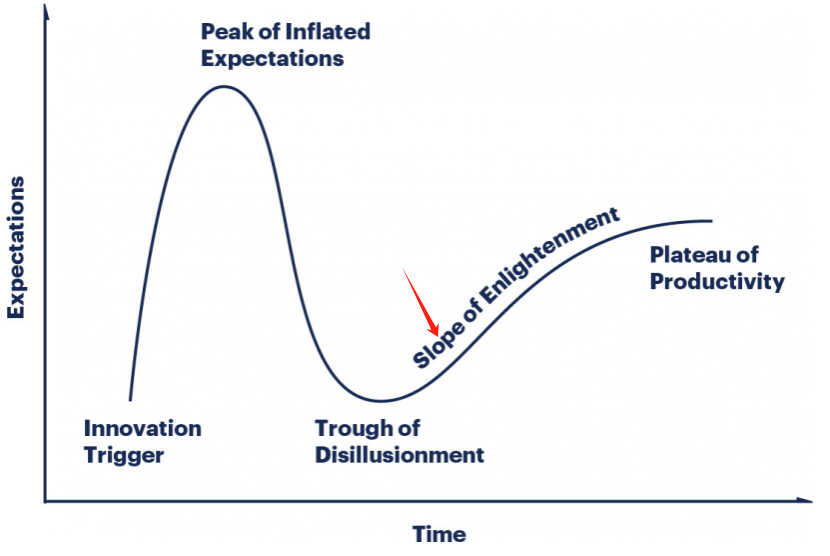

Just like the development process of many revolutionary products, after its emergence, DeFi also went through the narrative fermentation of the year 2020, the rapid bubble of asset prices in 2021, the disillusionment stage after the bursting of the bubble in the bear market of 2022, and is currently emerging from the trough of narrative disillusionment with the full validation of product PMF, constructing its intrinsic value with actual business data.

The author believes that as one of the few tracks in the crypto field with a mature business model and continuously expanding market space, DeFi still has long-term attention and investment value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。