Source: Grayscale Research Team

Translation: Web3 Sniffing Observation, Coin World

Coin World reported that the Grayscale Research team stated in an article that in June, the Bitcoin and cryptocurrency market was under pressure due to selling pressure from multiple parties, but the fundamentals of the assets have hardly changed. Grayscale Research expects that the spot Ethereum exchange-traded products (ETP) will begin trading in the third quarter of 2024. It is believed that, in the absence of significant changes in the macroeconomic outlook, cryptocurrency valuations may recover in the coming months.

The full text is as follows:

In June 2024, the cryptocurrency market fell, partly due to the selling pressure of Bitcoin triggering a broader decline in investor risk appetite, but Grayscale Research maintains a constructive outlook for this asset class.

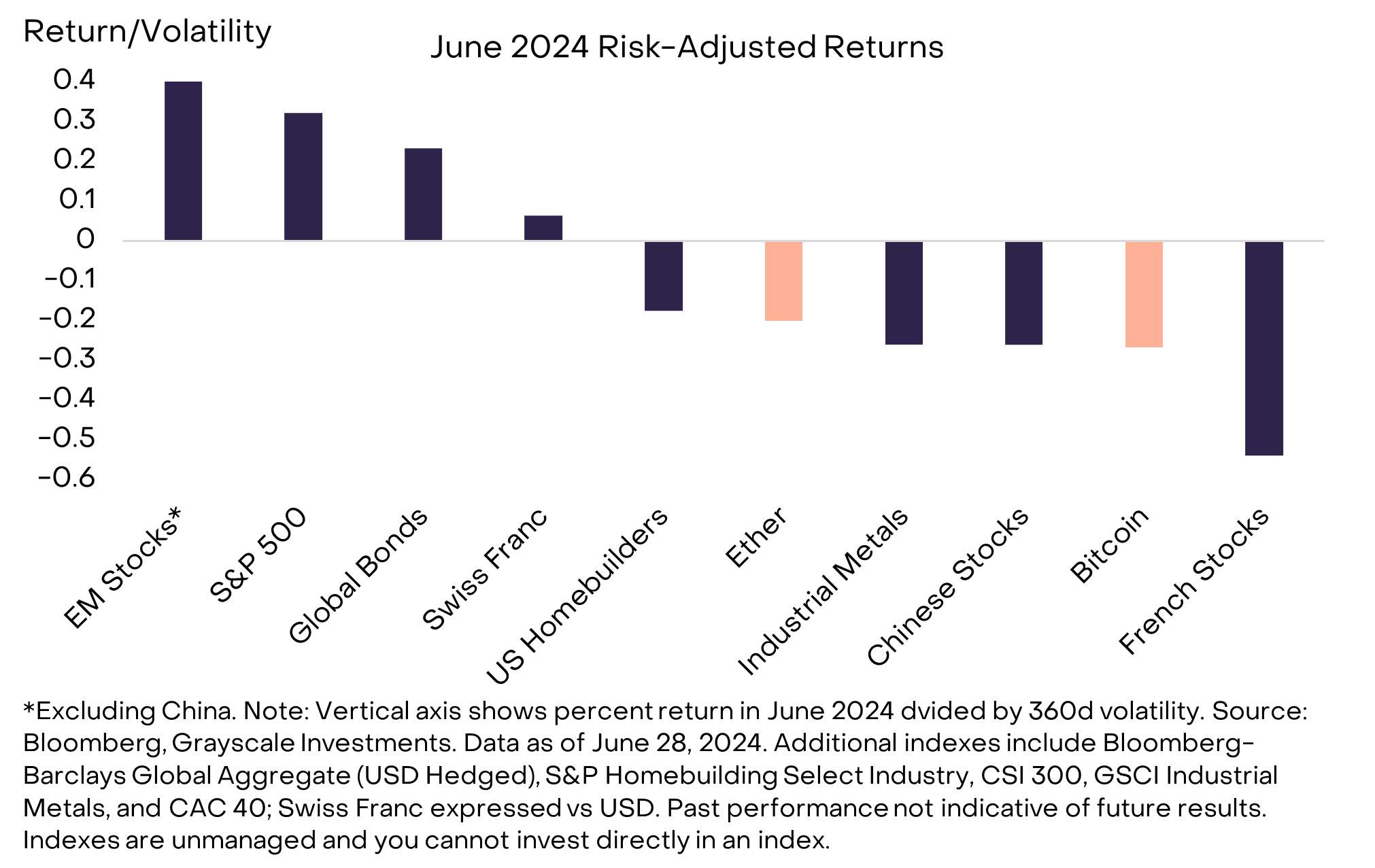

The returns of traditional assets varied in June as the market digested various new risks. Due to these risks, some market sectors performed poorly, including U.S. home builders (due to signs of a cooling housing market), the Chinese stock market and certain industrial metals (due to a renewed softening of the Chinese economy), and French stocks (due to potential government changes).

In contrast, global bonds, emerging market stocks excluding China, and the S&P 500 index performed relatively well, and the Swiss franc—usually an indicator of rising international risks—also performed well. Bitcoin and Ethereum fell by about 10% each, placing them in the underperforming market sectors on a risk-adjusted basis.

Chart 1: Cryptocurrency valuations fell in June, with mixed performance of traditional assets

According to Grayscale Research, various sources of actual and expected selling pressure contributed to Bitcoin's decline this month. Bitcoin's weakness also seems to have affected other cryptocurrencies. The main sources of new selling pressure include:

Mt. Gox Estate: The trustee of the Mt. Gox bankruptcy estate announced on June 24 that Bitcoin and Bitcoin Cash repayments will begin in early July 2024. At the time of writing, the estate holds Bitcoin worth $8.9 billion. It is uncertain whether creditors will convert the proceeds into fiat currency and the timeframe for conversion.

German Government: A German government agency has begun liquidating Bitcoin confiscated in 2013. According to data provider Arkham Intelligence, wallets related to the German government sent nearly 4,000 Bitcoins (worth about $220 million) to exchanges in June.

U.S. Government: On June 26, the U.S. government sent 3,940 Bitcoins ($240 million) from a convicted drug dealer's wallet to the Coinbase Prime deposit account. The most recent confirmed sale by the U.S. government was in March 2023, when 9,861 Bitcoins worth $216 million were sold.

U.S. Spot Bitcoin ETP: In the latter half of June, these products experienced a net outflow of $581 million, after experiencing net inflows in May and early June.

In addition to these new sources of selling pressure, Bitcoin miners continued to reduce their holdings: according to Glassnode data, miners sold about 1,560 Bitcoins (about $100 million) in the past 30 days. On the other hand, it was reported that the publicly traded company Microstrategy purchased nearly 12,000 Bitcoins (worth $786 million) in mid-June, potentially supporting the price of Bitcoin.

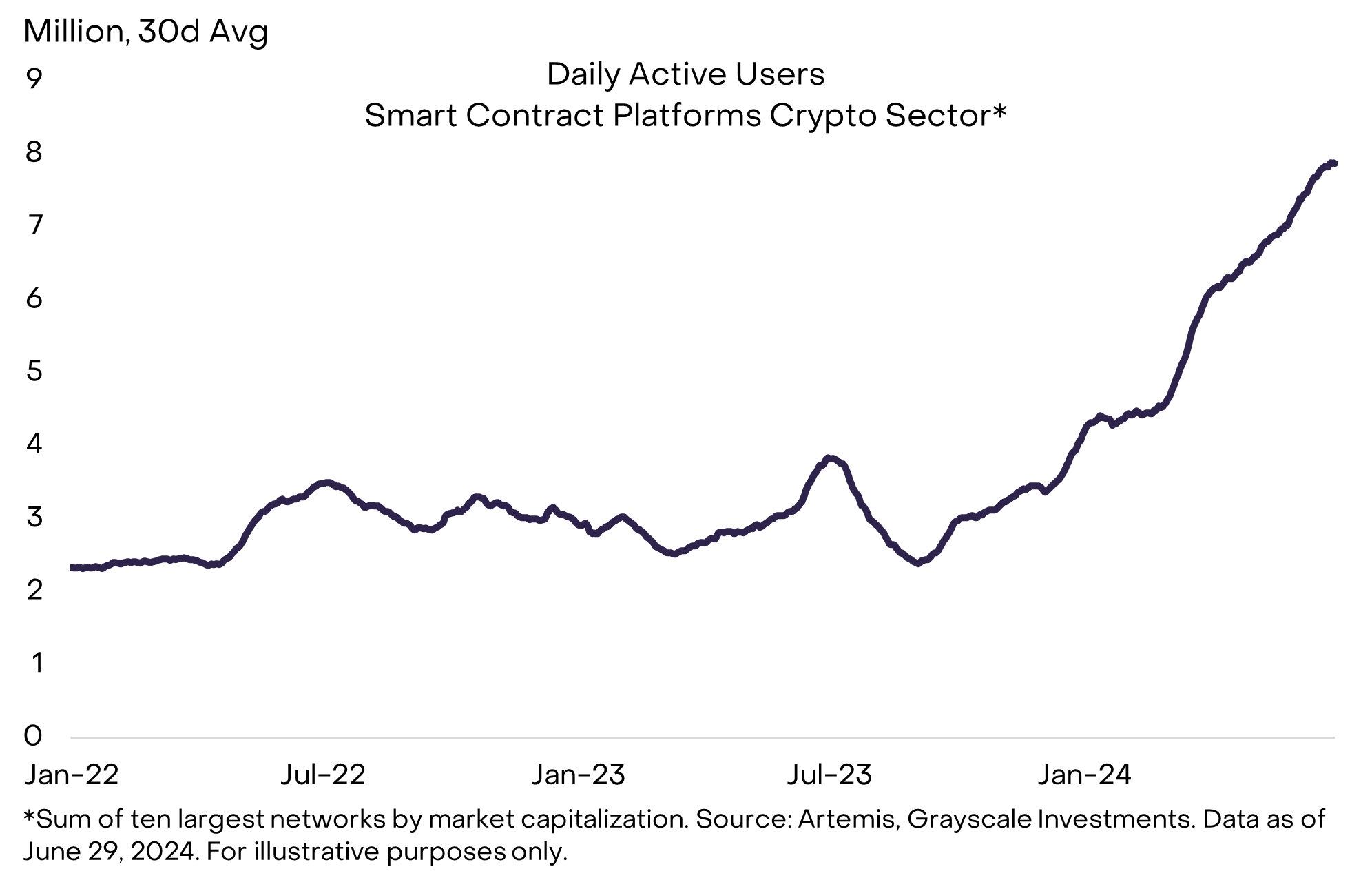

While these short-term capital flows may have temporarily affected the price of Bitcoin, we believe that the fundamentals of the asset have not changed significantly. For example, despite a moderate strengthening of the U.S. dollar, the market has factored in expectations of further Fed rate cuts this year and next to further alleviate consumer price inflation. In addition, adoption metrics for certain smart contract platforms show continued growth. For example, as shown in Figure 2, the daily active users of the top ten constituents of our smart contract platform cryptocurrency sector (by market capitalization) have continued to increase in recent months.

Chart 2: Growth of daily active users on major smart contract platforms

Furthermore, the approval of spot Ethereum ETPs for listing in the U.S. market seems to have made further progress. In late May, the Securities and Exchange Commission (SEC) approved 19b-4 form applications from several issuers to list these products on U.S. exchanges. On June 13, SEC Chairman Gensler stated that regulators may approve the remaining applications "at some point this summer." Although the timing remains uncertain, for the purposes of market analysis, Grayscale Research assumes that these products will begin trading in the third quarter of 2024.

Similar to the launch of the spot Bitcoin ETP in January 2024, the Grayscale Research team expects the new Ethereum products to generate significant net inflows (though lower than the Bitcoin ETP), potentially supporting the valuation of Ethereum and tokens within its ecosystem.

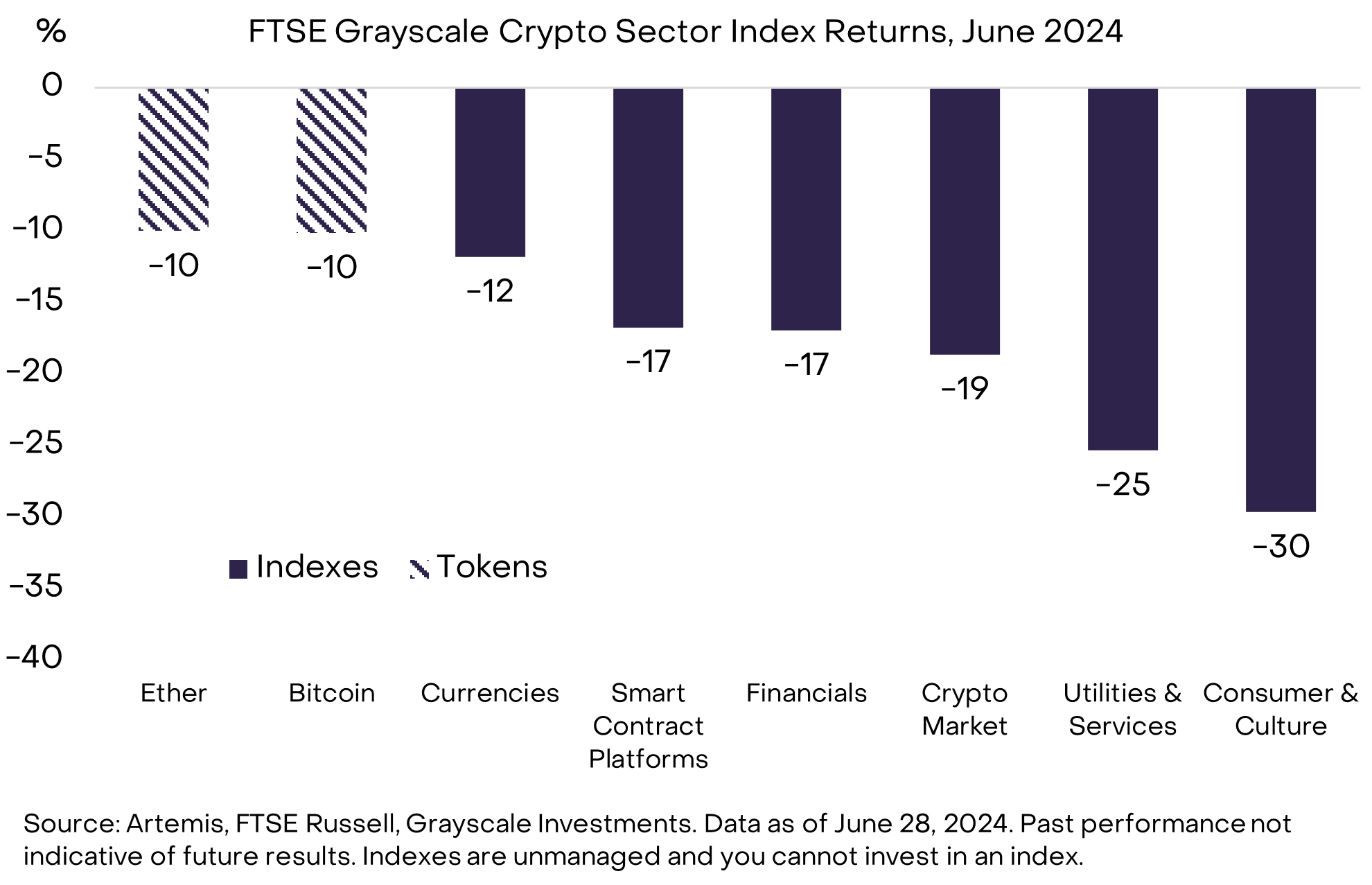

Although both Bitcoin and Ethereum fell last month, they outperformed the broader cryptocurrency market, which is measured by the FTSE Grayscale Cryptocurrency Sector Index series (see Figure 3). Our Cryptocurrency Sector Market Index (CSMI)—measuring the performance of the entire digital asset market—fell by 19% in June. The worst-performing market sector this month was the consumer and cultural cryptocurrency sector, mainly due to the weakness of memecoins (tokens primarily used for entertainment value and related to internet culture). The currency cryptocurrency sector, including Bitcoin, and the financial cryptocurrency sector performed relatively well.

Chart 3: General decline in the cryptocurrency industry

Although most token prices fell in June, a notable exception is Toncoin (TON), which is the third-largest asset in our smart contract platform cryptocurrency sector (by market capitalization) and will be a component in the next quarter. The TON blockchain is integrated into Telegram's secure messaging app, with the potential to leverage Telegram's 900 million monthly active users, making it an attractive platform for app developers. Partly driven by its Open League token incentive program and the increasing popularity of Telegram games, the network's daily active users increased from an average of 27,000 in January to over 400,000 in June.

In addition, Tether's USDT stablecoin went live on the TON network in April 2024 and was quickly adopted. In March, the Financial Times reported that Telegram is considering an initial public offering (IPO), which we believe could have an impact on the value of public blockchain tokens integrated with applications.

Despite the setbacks encountered by the cryptocurrency market in June, Grayscale Research remains optimistic about the valuation prospects for the remainder of the year. In our view, the overall macro backdrop is favorable for the cryptocurrency asset class, with economic growth, potential Fed rate cuts, and a strong stock market being supportive factors. While a U.S. economic recession could put pressure on the cryptocurrency market, a slow but positive growth period remains the central scenario for the economy.

Furthermore, the approval of Ethereum ETPs may help more investors understand the concepts of smart contracts and decentralized applications, thereby recognizing the potential of public blockchains in transforming digital commerce.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。