In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities.

Authored by: Bitget Research Institute

Abstract

Today, the cryptocurrency market is still under pressure. Gary Gensler, Chairman of the U.S. Securities and Exchange Commission, testified at a Senate hearing that he expects the spot Ethereum ETF to receive full approval from the agency by the end of the summer. Highlights include:

Strong wealth creation sectors: ETH ecosystem projects, TON ecosystem tokens;

User hot search tokens & topics: Daddy, RWA Crypto;

Potential airdrop opportunities: Zircuit, MYX Finance;

Data Statistics Time: June 14, 2024, 4:00 (UTC+0)

I. Market Environment

Today, the cryptocurrency market is still under pressure, following the previous day's indication from the Federal Reserve that it expects to cut interest rates only once this year. Gary Gensler, Chairman of the U.S. Securities and Exchange Commission, testified at a Senate hearing that he expects the spot Ethereum ETF to receive full approval from the agency by the end of the summer. Subsequently, the price of Ethereum surged in early trading and then quickly fell below $3500 due to selling pressure. After the announcement of the Federal Reserve's policy meeting results, the market began to decline uniformly on Wednesday afternoon. The U.S. central bank maintained the federal funds rate range at 5.25%-5.50%, but according to the latest dot plot, it is expected to cut rates by 25 basis points only once in 2024. Currently, prices are hovering around the future results of interest rate cuts.

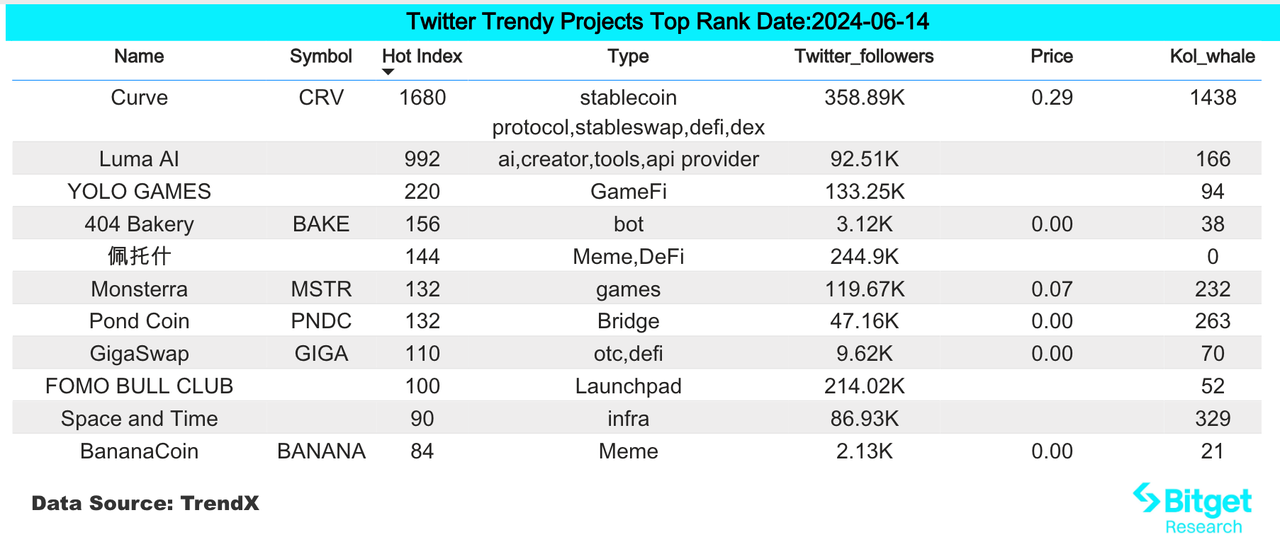

On the project side, Arkham stated that the price of CRV fell below the liquidation price of Michael Egorov, the founder of Curve, and all 9-digit loan positions in 5 protocols were liquidated. As of today, the price of CRV has risen by over 20% after the liquidation.

II. Wealth Creation Sectors

1) Sectors that need to be closely monitored in the future: ETH Ecosystem Projects

Main reasons: Gary Gensler, Chairman of the U.S. Securities and Exchange Commission, testified at a Senate hearing that he expects the spot Ethereum ETF to receive full approval from the agency by the end of the summer;

Specific coin list:

ETHFI: In the current round of Ethereum ETF documents, it is stated that the ETF only allows Ethereum tokens and does not allow staking. This provision greatly reduces the attractiveness of the ETF to investors, so the Ethereum staking sector will see substantial benefits;

LDO: The leading LSD project in the ETH ecosystem, with a TVL of up to $34.4 billion and a valuation of less than $2 billion, is relatively undervalued;

SSV: The Ethereum staking infrastructure SSV Network is a decentralized staking infrastructure that allows everyone to access decentralized ETH staking simply and scalably. The total TVL displayed on the official website has exceeded $600 million, with over 150,000 ETH staked;

2) Sector changes: TON Ecosystem Tokens (TON, FISH)

Main reasons: Driven by the 900 million users on Telegram, the TON ecosystem has quietly grown, with its daily active addresses surpassing Ethereum. At the same time, the TON official announcement stated that it will launch enhanced pools on stonfi and dedustio, with rewards exceeding $1.8 million. The combined ecosystem rewards and user growth have made the ecosystem more prosperous.

Price increase: TON rose by 4.42% in the past 24 hours, and FISH rose by 7.02% in the past 24 hours;

Factors affecting future market:

Trading activity in the future: The major weakness of the Ton ecosystem is the relatively low number of active traders compared to other public chains, and the trading volume is not at the same level as other public chains. If the ecosystem rewards can stimulate trading activity, there is room for further price and liquidity increases.

Future support from Pantera for the Ton ecosystem: Dan Morehead, founder of Pantera Capital, mentioned on social media that Pantera recently made the largest investment in the history of the fund in Telegram's TON blockchain project, increasing attention to the Ton ecosystem. If project financing and product launches and other support can be implemented in a timely manner, the prosperity of the Ton ecosystem will come faster.

III. User Hot Searches

1) Popular Dapps

Orderly Network

The NEAR ecosystem trading protocol Orderly Network announced that it will airdrop 10% of the total token supply to early users (1 billion tokens), and NEAR traders need to bind their wallets before June 27. Users can now check airdrop allocations and bind wallets through the airdrop query website. Orderly is a full-chain derivative liquidity layer project that integrates full-chain derivative liquidity and provides liquidity and settlement support for any asset, any public chain, and any product interface.

2) Twitter

Curve

According to Arkham's monitoring, Curve founder Michael Egorov was liquidated for $140 million CRV. Yesterday morning, the price of CRV fell below his liquidation threshold, and all of his 100 million loan positions in 5 protocols were liquidated. Curve founder Michael Egorov tweeted, "The Curve Finance team and I have been solving the liquidation risk issue that occurred today. Many people know that all my loans have been liquidated, and my position size was too large for the market to bear, resulting in $10 million in bad debt. Only the CRV market on lend.curve.fi was affected, which had the largest position. I have already repaid 93% of the bad debt and plan to repay the rest soon." The Twitter community is still highly concerned.

3) Google Search & Regions

Global Perspective:

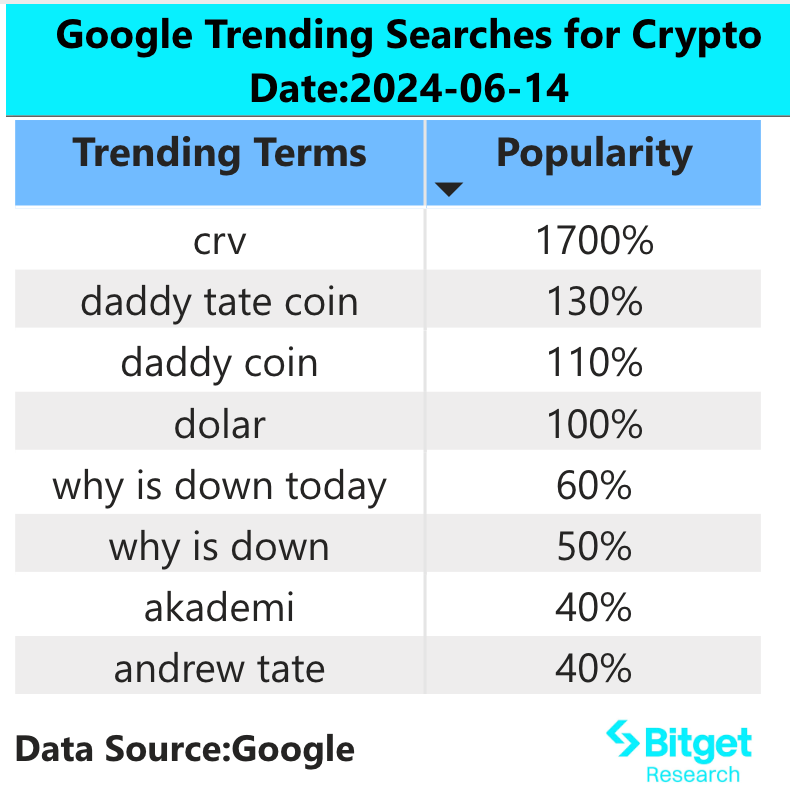

Daddy: Yesterday, blockchain data visualization company Bubblemaps tweeted that before Andrew Tate promoted DADDY on X, insiders bought 30% of the total token supply at the time of issuance, currently valued at over $45 million. The core hype is driven by the struggle between Andrew Tate and Ansem, both of whom have promoted the Daddy token in the community. Currently, there is relatively high attention on Twitter.

Regional Hot Searches:

(1) In the Asian region, RWA Crypto stands out, as the crypto market released FOMC and CPI data simultaneously yesterday, and there was relatively strong risk aversion before the data came out.

(2) In Europe and the United States, there is a focus on meme token projects, mainly focusing on FLOKI. In recent days, the overall market has declined, and MEMECOIN is one of the few places with wealth creation effects and topics.

(3) The CIS region has a wide range of focuses, including projects such as Taiko, Aevo, and Uniswap;

IV. Potential Airdrop Opportunities

Zircuit

Zircuit is a Layer2 public chain project based on zkRollup and AI integration, invested in by Pantera and Dragonfly. The current TVL of the project has exceeded $1.1 billion. Zircuit's ecosystem is gradually improving and includes functions such as staking, cross-chain bridges, and browsers. Users can also qualify for airdrops by participating in ecosystem construction and community interaction.

Specific ways to participate: 1) Participate in staking to earn points by entering the staking page (https://stake.zircuit.com/); 2) Participate in deploying nodes to earn points (https://build.zircuit.com/build).

MYX Finance

MYX Finance is a decentralized derivatives exchange using the MPM model, incubated by D11 Labs, and employing intelligent fees and risk hedging mechanisms to ensure protocol stability and provide sustainable high returns.

In November 2023, MYX announced the completion of a $5 million seed round financing at a valuation of $50 million, led by HongShan (formerly Sequoia China), with participation from Consensys, Hack VC, OKX Ventures, Foresight Ventures, Redpoint China, HashKey Capital, GSR Markets, Alti5, Leland Ventures, Cypher Capital, Bing Ventures, and Lecca Ventures.

Specific operations: At the user operation level, there is not much difference from a general derivatives DEX. Users can trade, provide LP, and so on. The project currently integrates Linea and Arbitrum, and users can increase activity on the Linea chain to potentially receive Linea airdrops in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。