Author: @malloyberac3

Mentor: @CryptoScott_ETH

Introduction

Bitcoin has established the value foundation of cryptocurrency due to its non-inflationary nature, Ethereum triggered the ICO craze through smart contracts, and NFTs and Memecoins have attracted massive funds due to fair distribution. The continuous evolution of new technologies has expanded the audience for crypto applications, and the differences in emerging token issuance mechanisms further reflect the changing investment values of the audience.

Unlike traditional meme coins such as $DOGE, $SHIB, and $FLOKI attempting to integrate practical applications, the meme coin market has presented a new trend led by $BOME and $SLERF since the beginning of this year. From issuance to trading, many innovative applications worthy of attention have emerged around the meme coin ecosystem.

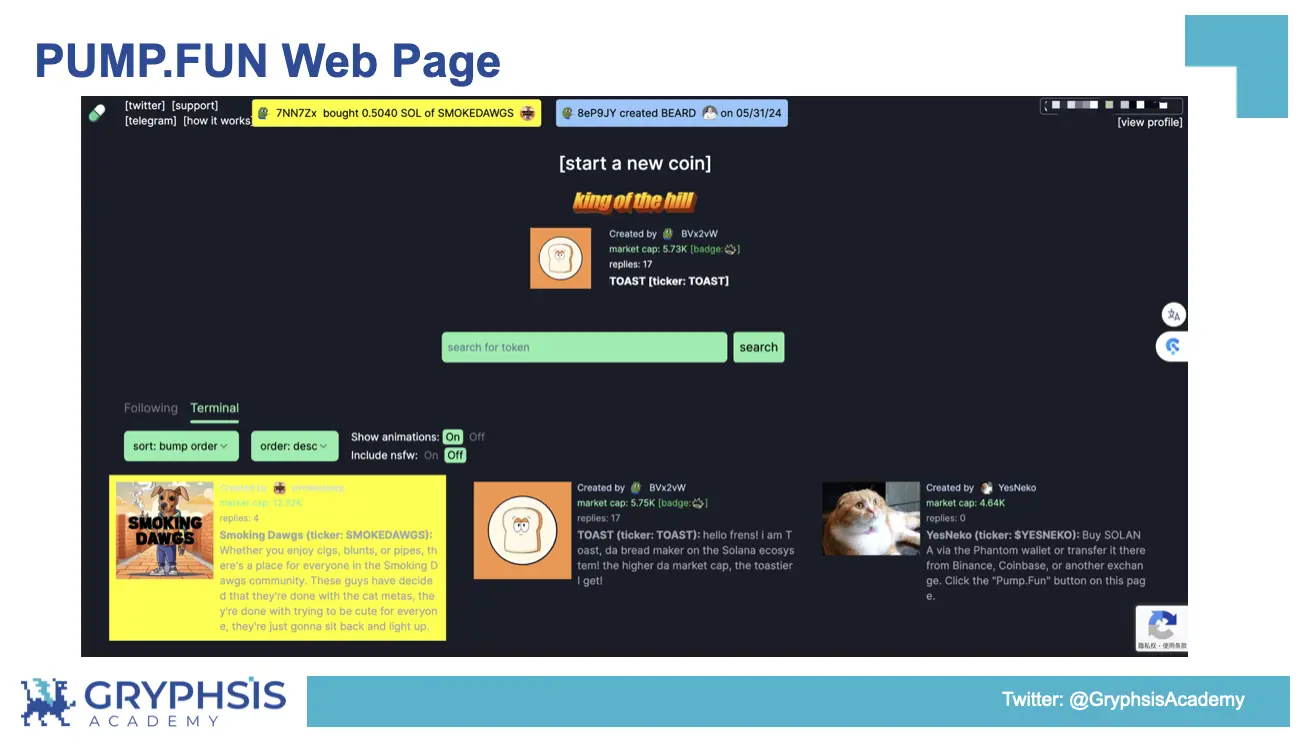

PUMP.FUN is a decentralized meme coin issuance platform where users only need to provide creativity to easily launch their own meme coin on the platform at a very low cost (0.02 sol). Users can also participate in tokens issued by others and witness the process of a meme coin gaining widespread attention.

As a phenomenon-level application in the race, PUMP.FUN has research value and is worth discussing repeatedly. The PUMP.FUN Dune board can provide explanations for the new trend in the race from the aspects of platform, user, product behavior, activity, and growth trends, and is worth long-term tracking.

1. Introduction to PUMP.FUN

1.1 A Comparison

Let's start with a comparison. In the author's view, the market performance of PUMP.FUN is very similar to that of FRIEND.TECH, which was launched last year. Both initially attracted attention in the on-chain Degen player circle on a small scale, and after gaining widespread attention, both the race and platform data showed a spiral upward trend. Both quickly established a high market share as industry pioneers, with real users and protocol revenue increasing day by day, and the FUD that is ever-present in the crypto world had almost no impact on their ecological status.

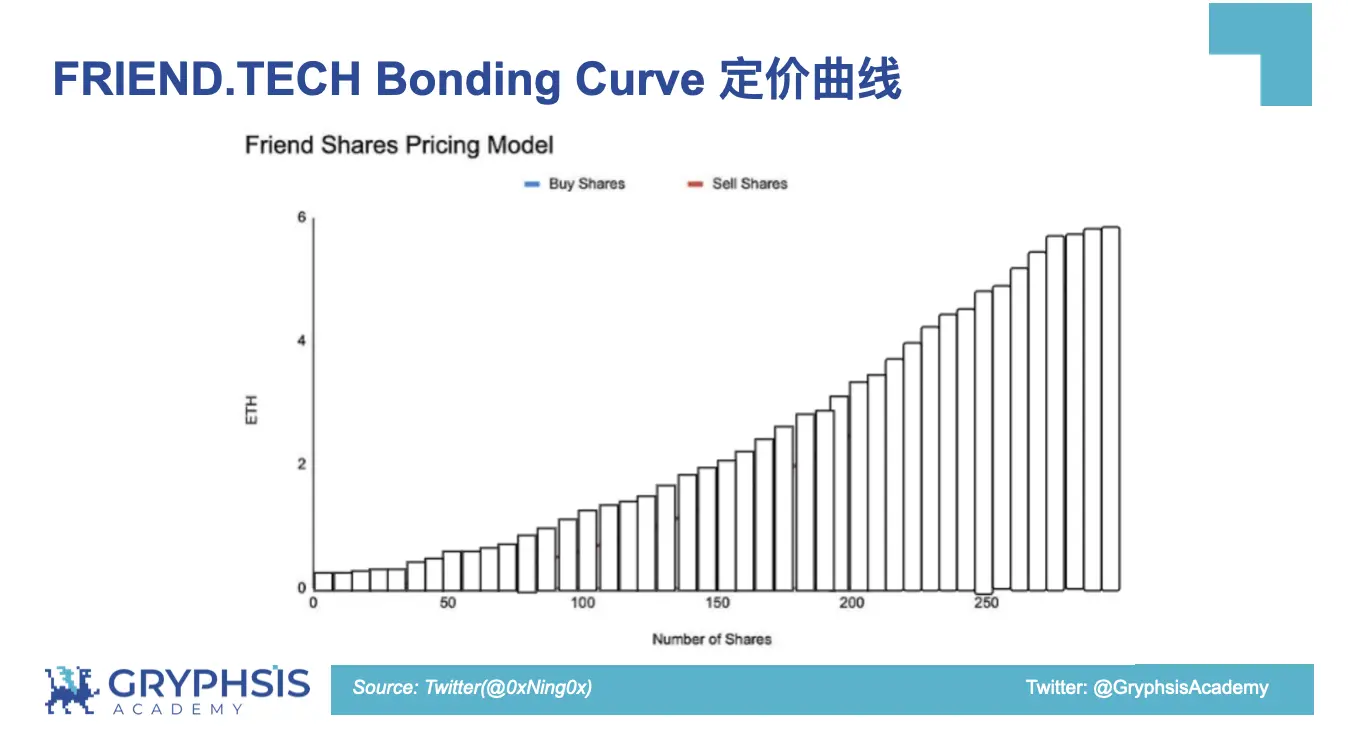

From a product design perspective, the two platforms are similar but still have some differences. Both platforms use the PAMM (Primary Automated Market Makers) mechanism for asset issuance to provide convenience to users, but their assets and specific pricing curves are different. Taking PUMP.FUN as an example (FRIEND.TECH is similar), PAMM is divided into two mechanisms: Fund-to-Mint and Burn-to-Withdraw. The former allows users to deposit their $SOL into the PAMM smart contract reserve pool, and the smart contract reserve pool mints an appropriate amount of meme coins based on the current pricing reported by the Bonding Curve and sends them to the user. The latter allows users to complete the withdrawal by selling meme coins to the PAMM smart contract. Unlike the meme coins on PUMP.FUN, FRIEND.TECH tokens have the characteristics of integer minting and theoretical "infinite issuance" (establishing social relationships). In addition, FRIEND.TECH assets represent users' social media accounts, while PUMP.FUN represents meme coins created by users.

The two projects have very different market entry and subsequent strategies. Behind FRIEND.TECH is the top crypto institution Paradigm, and the user incentive measures used by NFT market Blur and Ethereum Layer 2 network Blast in its investment portfolio have also been replicated to help FRIEND.TECH with user retention. The launch of FRIEND.TECH V2 with airdropped tokens and Club Key gameplay sparked a new round of market speculation. In contrast, PUMP.FUN adheres to the populist and fair launch nature of meme coins, with a difficult-to-research investment background, and even though it earns tens of thousands of dollars a day, it has not released any token plans and is quietly expanding its platform. For more in-depth research on FRIEND.TECH, please refer to the previous sharing: Friend Tech — Gryphsis Academy Sharing Session

1.2 PUMP.FUN Bonding Curve and Products

Since the project contract is not open source, the products launched by PUMP.FUN have only disclosed gameplay and fees, and the official website has not mentioned the specific mechanisms and product details used. In the research process, it is necessary to build a product model and compare and verify the data. The specific research on the PUMP.FUN Bonding Curve is as follows:

(1) Construction of product model

Compared to other race tokens, Memecoin is designed around community consensus and group trading sentiment. The total supply of tokens is generally large and fully circulated, which can be combined with different promotion strategies. The initial price will not be set too high, and the early price curve is steep, attracting funds through dramatic price fluctuations.

PUMP.FUN product:

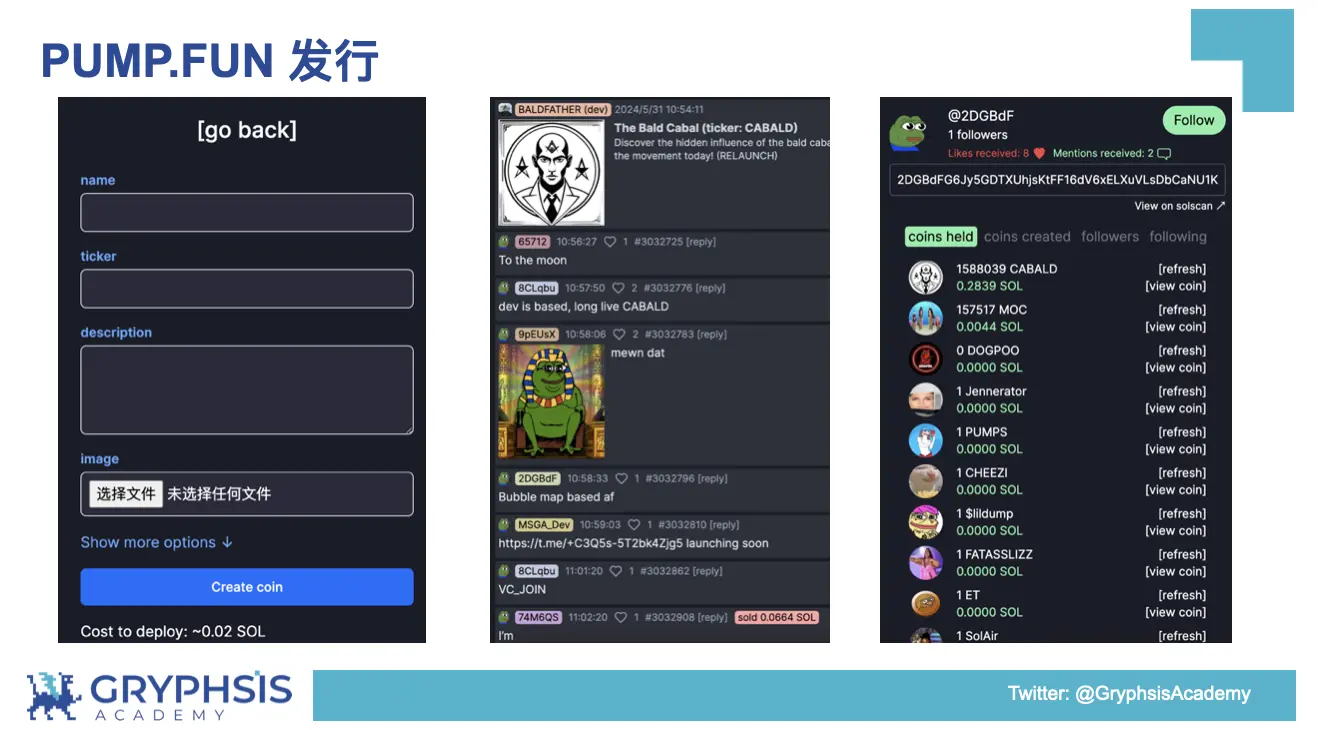

Users come up with a good idea, first choose a Ticker to be released on PUMP.FUN, and then easily create a new Memecoin with one click.

Other platform users continuously buy and sell Memecoin tokens on the pricing curve.

The new Memecoin further gains attention, and users can trade a brand new Memecoin created by a PUMP.FUN user, funded by other PUMP.FUN users, with a total supply of 1 billion tokens and an initial market value of $69k (410 $SOL) on Raydium.

Users only need to come up with a Ticker, upload an image, write a description, and with a small fee, they can easily create a Memecoin. Other users can trade this token, and when the fundraising limit is reached, the tokens will be sent to Raydium.

(2) Pricing curve

Unlike the pricing system of FRIEND.TECH, which only accepts integer inputs and outputs, the token pricing system on PUMP.FUN is a smooth curve. Unlike the theoretical infinite issuance of tokens on FRIEND.TECH, all Memecoins on PUMP.FUN share the same economic model, with a constant total supply of tokens. Users mint a portion of the tokens at a reasonable price on the Bonding Curve, and the remaining tokens form the LP pool with the raised funds.

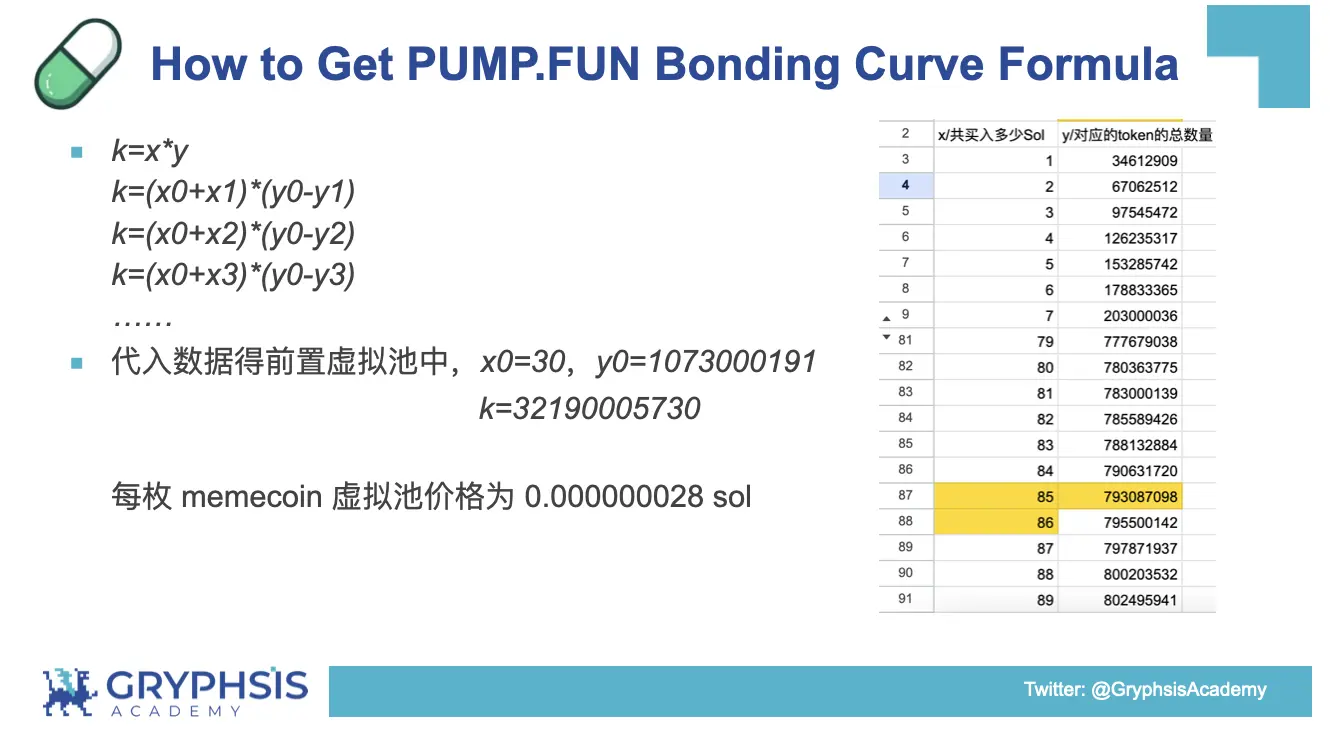

After analyzing the front-end code, the function call named virtualSolReserves, PUMP.FUN's pricing system has a pre-virtual pool, with x0 amount of $SOL and y0 total tokens in the virtual pool. By collecting data on the amount of $SOL purchased by platform users and the corresponding token data, and fitting it to the formula x*y=k, the pre-virtual pool is determined to be 30 $SOL and 1,073,000,191 tokens, with an initial k value of 32,190,005,730, and a price of 0.000000028 $SOL per token.

The calculation process is shown in the following image:

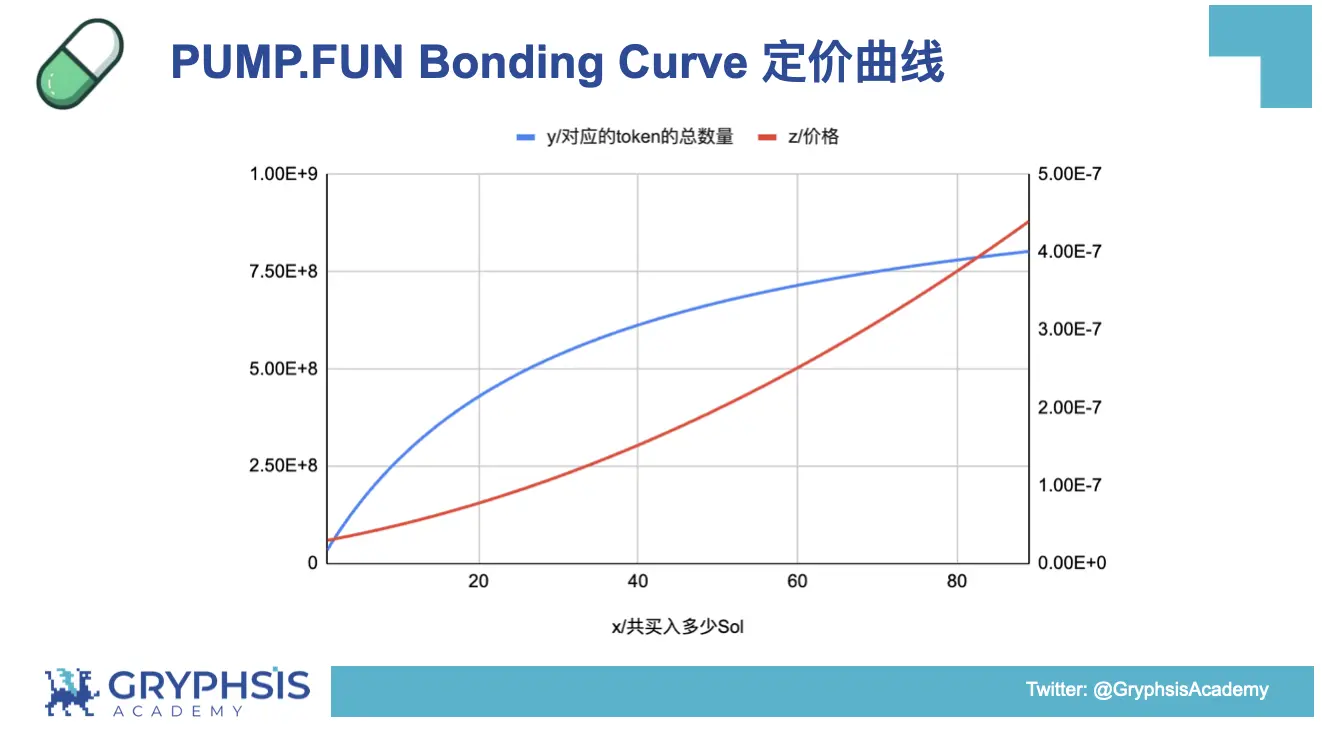

The joint curve pricing function is y=1,073,000,191 - 32,190,005,730/(30+x), where x is the amount of $SOL purchased and y is the corresponding token quantity. The derivative can be used to determine the price of each token. The following graph shows the function curve, with the blue line representing the pricing curve and the red line representing the price curve. Based on the curve, it is evident that it aligns with the steep characteristics of newly issued Memecoins.

(3) Comparative Analysis of Cases

Users ultimately raised 85 $SOL, and in exchange, received 800 million Memecoin tokens, which aligns with reality.

The raised funds of 79 $SOL (with 6 $SOL used as listing fees) and an additional 200 million tokens were added to the initial liquidity pool and sent to Raydium. The final token supply is 1 billion, which aligns with reality.

Upon listing on Raydium, the price per token at the moment of fundraising completion was 0.00000041 $SOL, which is 14.64 times the initial virtual pool price, aligning with the actual situation.

Thus, the details of the PUMP.FUN product are clear. Users can spend 0.02 $SOL to easily launch a Memecoin. This Memecoin has an initial virtual market value of 30 $SOL, other users raised 85 $SOL to obtain 800 million tokens, PUMP.FUN then mints an additional 200 million tokens, which, combined, form a trading pair added to Raydium, ultimately listing with a market value of 410 $SOL** and a total token supply of 1 billion for the decentralized issuance of Memecoin.** Throughout the process, PUMP.FUN charges a 1% platform trading fee before listing on Raydium, as well as a "listing fee" of 6 $SOL during the listing process.

2. Why Pay Attention to PUMP.FUN

2.1 Why Pay Attention to Meme

For those outside the crypto world, Bitcoin has no practical use and exists solely for speculative trading. Its price surge only represents the success of its meme properties in spreading. In the Ethereum ecosystem under smart contracts, $UNI had no empowerment before the voting mechanism, and its investment logic, like that of Dogecoin, is based solely on industry recognition and the consensus of the crypto spirit. However, for crypto users who have experienced the Meme Season, the Summer of NFTs, and the frenzy of Memecoin pre-sales, they have a unique understanding of Memecoins that have no utility. The lack of mainstream narratives, the mismatch of funds over time, and the continuous pursuit of fair launches by crypto users investing in Memecoins have strengthened the reflexivity of the Memecoin market. For more viewpoints on memes, see the article on the public account: Deconstructing Memes, Why Have Memes Performed Excellently in This Cycle?

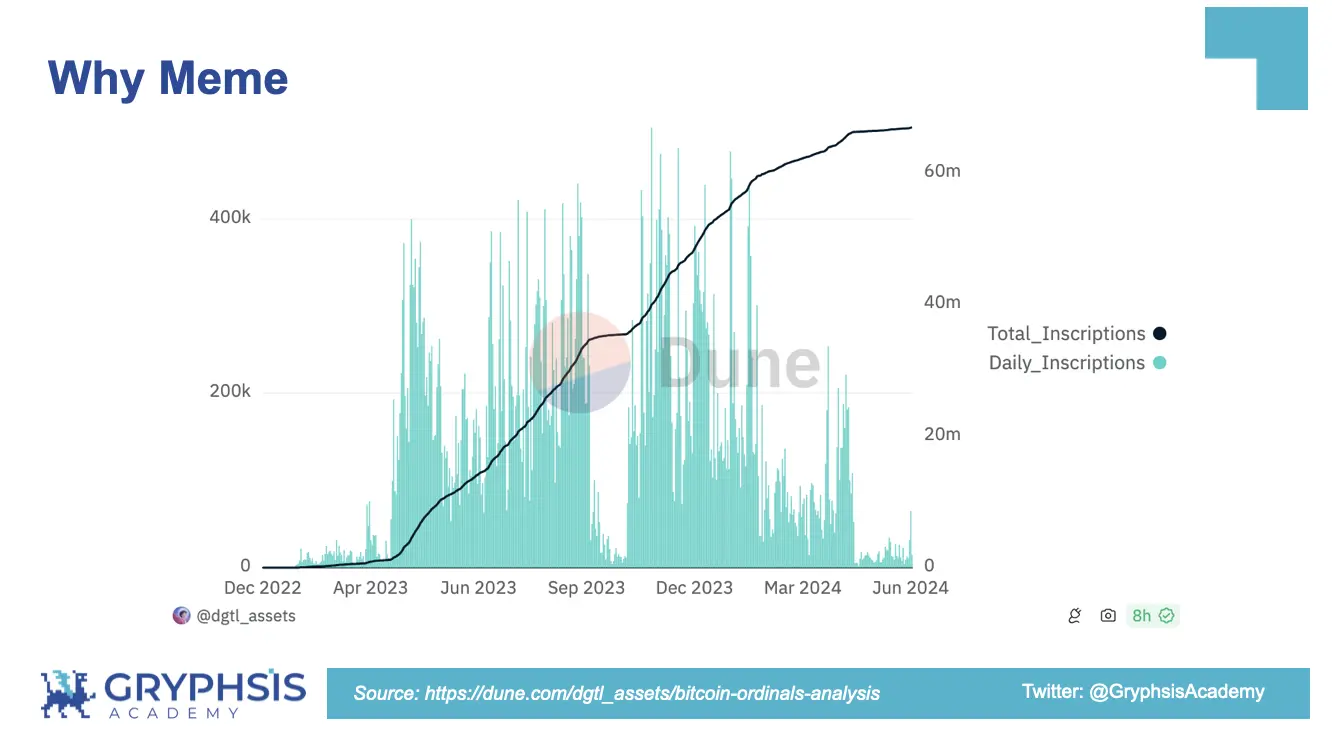

In November last year, $ORDI was listed on a top exchange, kicking off the Summer of NFTs, injecting new narratives into the market during the transition of the crypto cycle. Currently, the number of Bitcoin NFTs has exceeded 66 million, contributing over $470 million in fees.

The last time meme coin $GME gained market attention was three months ago. The recent activity of the protagonist of the GME event on social media has brought stocks and related cryptocurrencies back into the public eye. On the Solana chain, $GME has surged by up to 30 times, and related concepts have exploded on PUMP.FUN, showing an explosive growth in popularity.

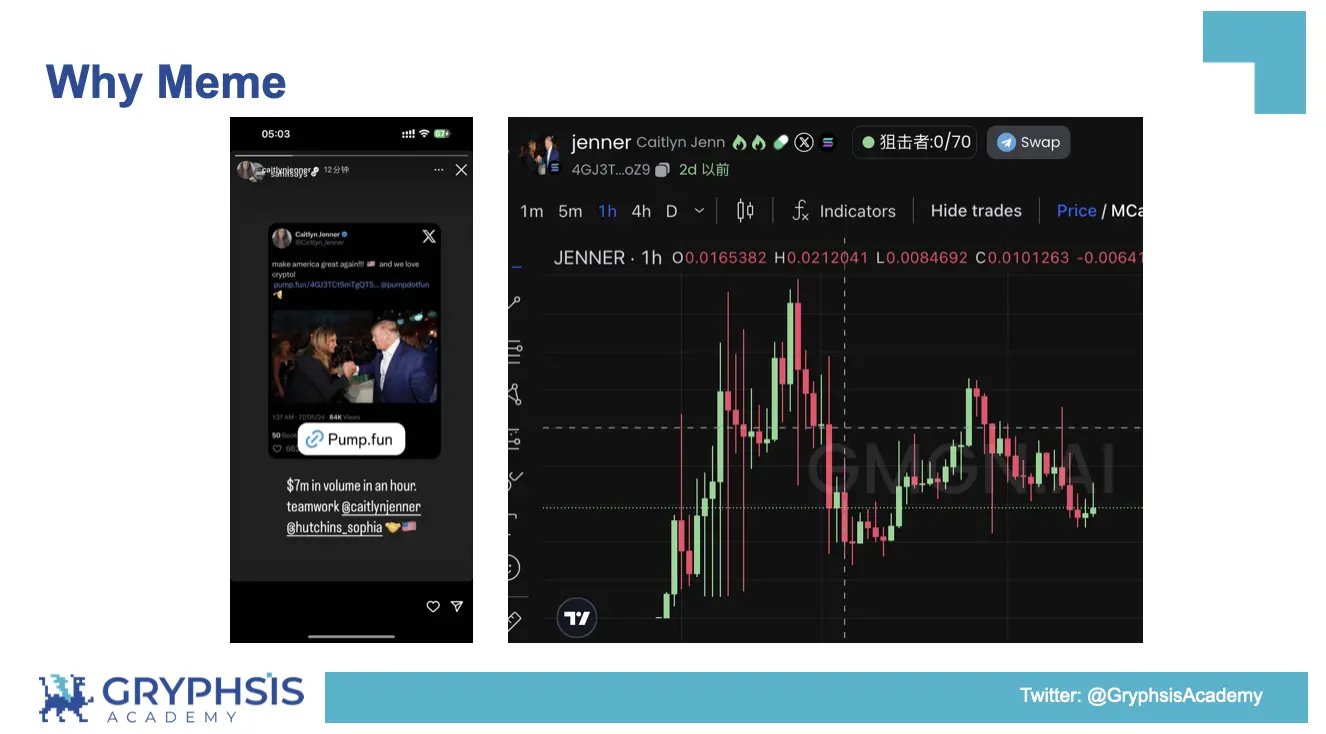

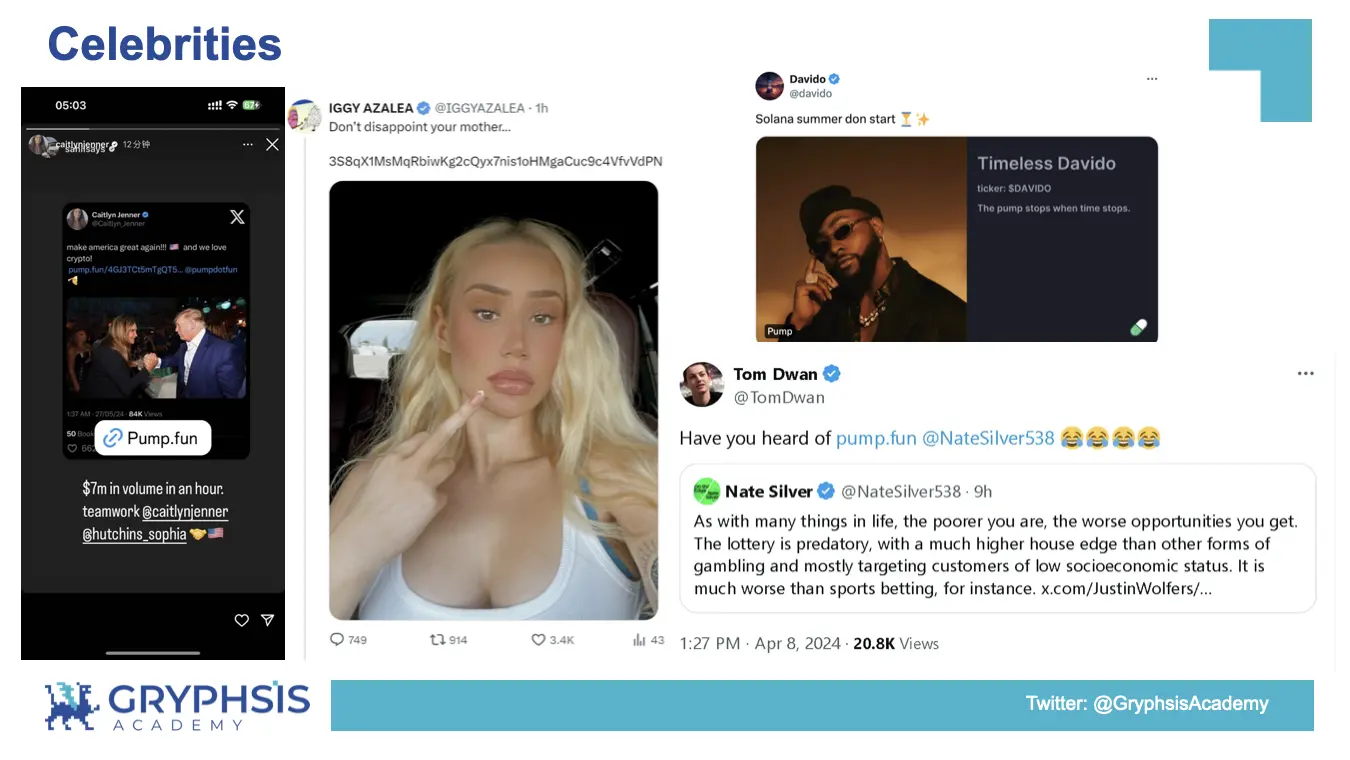

Celebrities issuing tokens on PUMP.FUN, in collaboration with industry insiders in the crypto community, further break the barriers. The token $JENNER released by the Kardashian family's Caitlyn Jenner has brought drama to the crypto world, achieving a 160-fold increase in one night, with a peak market value of $30 million.

Why pay attention to memes? Using the definition mentioned in the previous article, "Memes spread through imitation; any information that can be replicated through imitation can be called a meme." As humans who are essentially parrots, spreading memes is a phenomenon, a result, and a process of the evolving gene pool seeking order in chaos. In addition to the wealth effect of the Memecoin race, many crypto assets themselves also have meme properties, whether it's Bitcoin, which has built the value foundation of the crypto world, decentralized tokens issued through smart contracts, or celebrity coins based on simple logic.

2.2 PUMP.FUN Operating Data

The Memecoins handled by PUMP.FUN users and the platform undergo market logic validation, leading to a mirroring effect, continuously amplifying trading volume. All token information is labeled on PUMP.FUN, and the repeated mention of hot events has brought huge profits to the platform. After verification and construction, we believe that the amplified data results from the Dune dashboard can explain most of the phenomena of the new Memecoin business model established by PUMP.FUN. The Dune dashboard includes platform users, platform revenue, token creation status, and high-frequency trading activity, allowing for analysis of platform, user, product behavior, activity, and growth trends from a data perspective. Dune dashboard website: PUMP.FUN by Gryphsis Academy

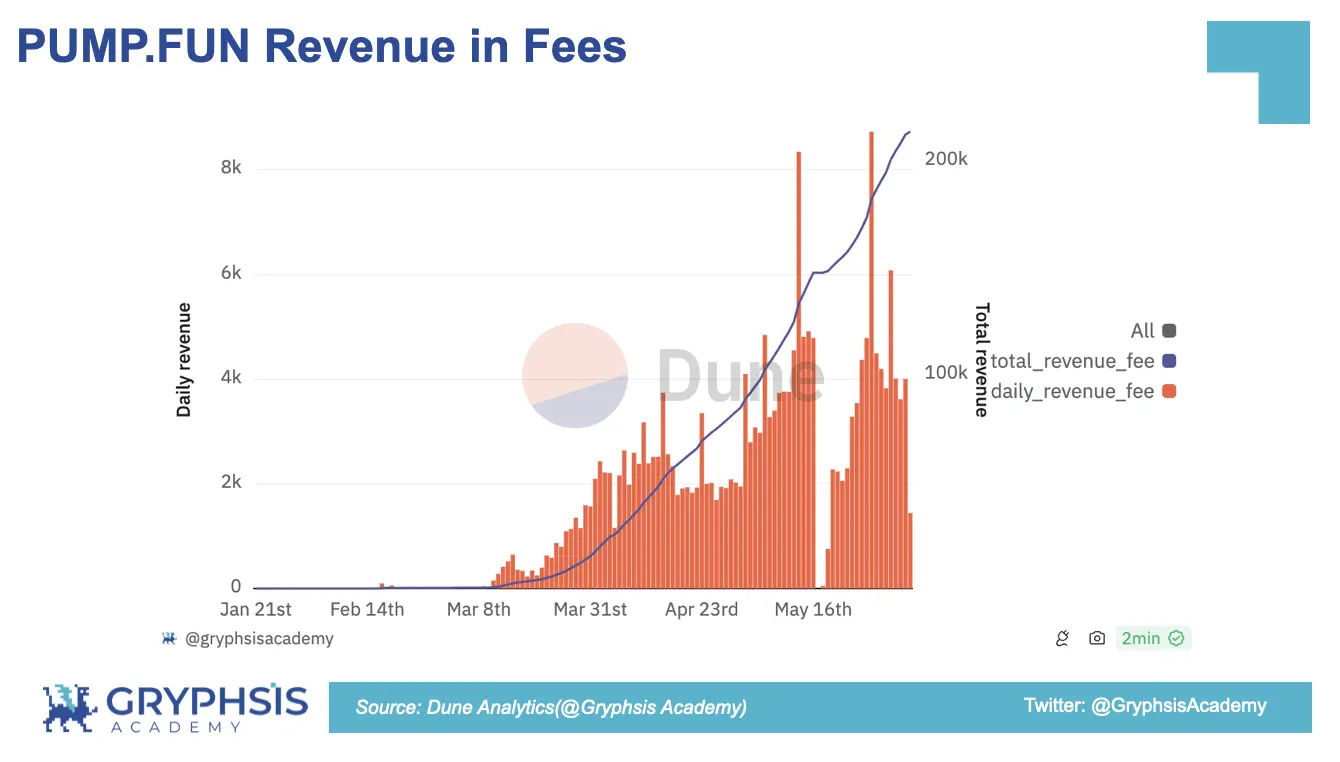

(1) Platform Revenue

According to the Dune dashboard, PUMP.FUN's platform experienced its first wave of growth in mid-March. As a player who did not occupy the ecological position earliest in the race, users gradually accepted the platform during this time. Several Memecoins selected by the platform also created many wealth stories, with $SC, launched on March 26, reaching a market value of over a billion within a few days. Other Memecoins created by users also had varying degrees of wealth effects due to being in the early stages. The platform's daily revenue reached 1,000 $SOL, and continues to grow.

PUMP.FUN experienced an explosive period from April to early May. The launch of $MICHI on April 8, breaking the $200 million market value, ignited market sentiment. The Memecoin narrative switched rapidly, with numerous mirror trading activities, from national coins brought by the Summer Olympics to religious coins, and then to Trump-themed coins. Approximately thousands of Memecoins are created and traded every day. **The platform's average daily revenue surpassed 2000** $SOL.

From mid-May to the end of May, on May 13, while GME stock surged, Memecoins created by users on PUMP.FUN also set a record for platform revenue, reaching **$1.2 million**. After experiencing attacks from former employees, PUMP.FUN briefly experienced a decrease in popularity, but then saw further breakthroughs after the creation of Memecoins by celebrities, bringing platform revenue back up to **$1 million**. After the breakthrough, the average daily revenue reached $700,000, and the total platform revenue reached nearly $37 million.

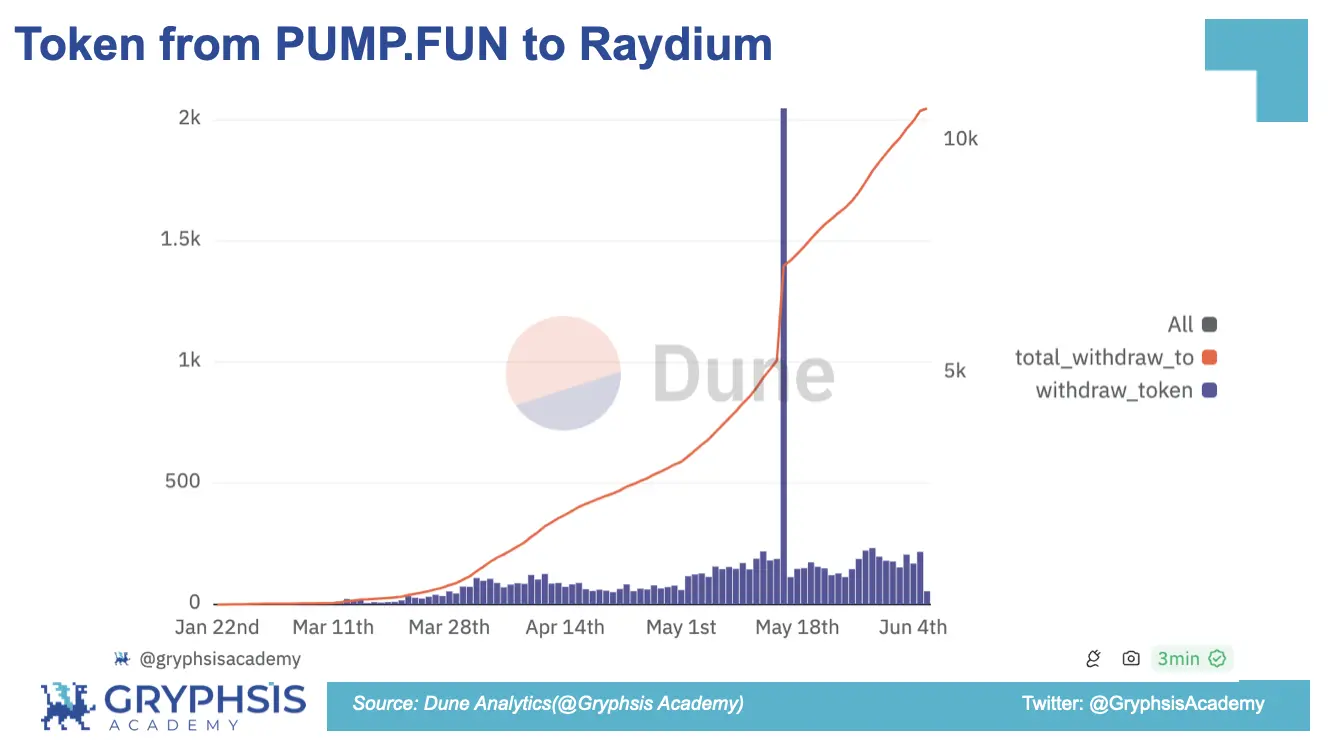

On May 16, due to the theft of wallet account permissions for creating trading pairs on the PUMP.FUN platform by former employees, a large number of Memecoins that completed fundraising were unable to be listed on Raydium, resulting in user losses of $2 million. PUMP.FUN took measures to reduce platform earnings to compensate for the users' losses.

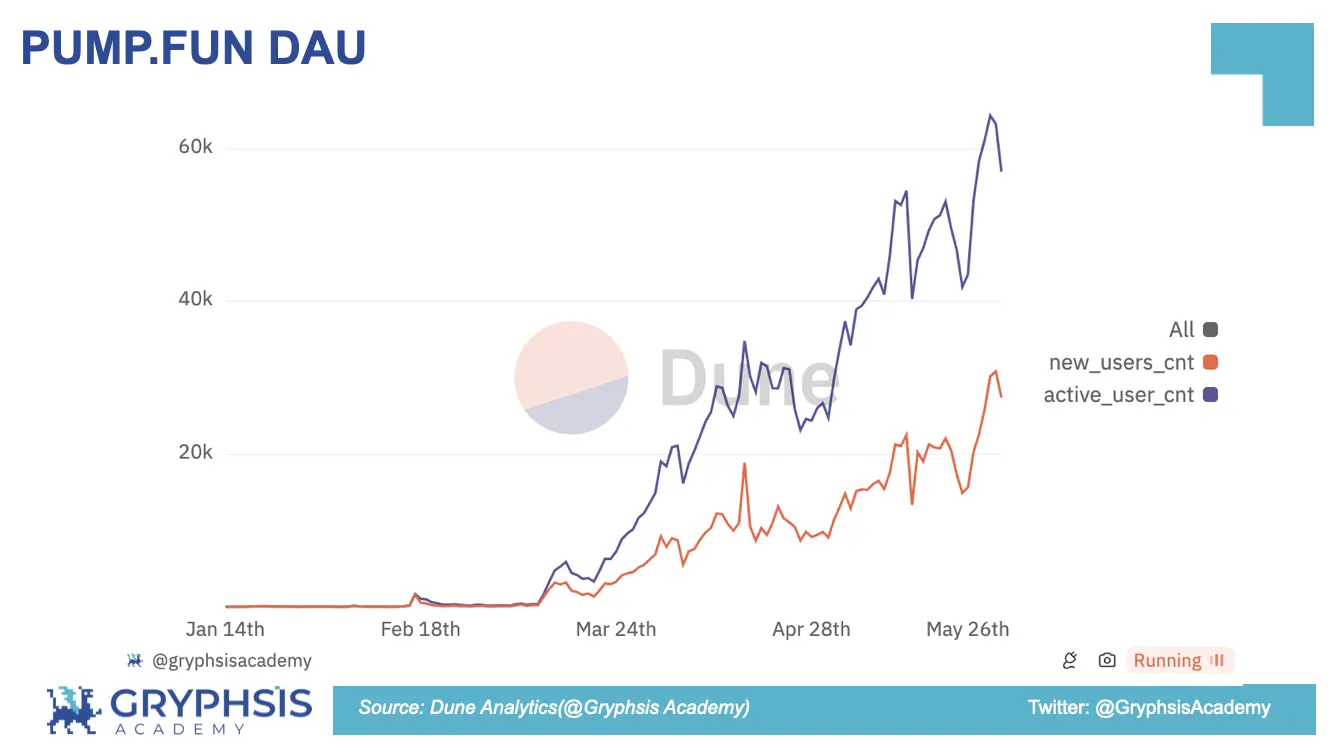

(2) User Growth

According to Dune data, the number of PUMP.FUN users is still in an upward trend, with occasional setbacks, but the user enthusiasm for the platform has not diminished. Before April 16, new users on the platform surged daily, gathering nearly 35,000 active users within a month, gradually establishing user habits nurtured by the platform, laying the foundation for subsequent retention. From late April to May, the daily addition of new users on the platform slowed down. After the celebrity effect broke through, the number of active users on the platform peaked at 64,378 on May 30. The daily addition of new users subsequently continued to slow down, indicating that the platform is likely to encounter its first user growth bottleneck.

(3) Memecoin Products

If we consider each user's participation in creating and trading Memecoins on PUMP.FUN as a platform product, the data related to platform products can reflect user behavior and facilitate improvements to address corresponding issues.

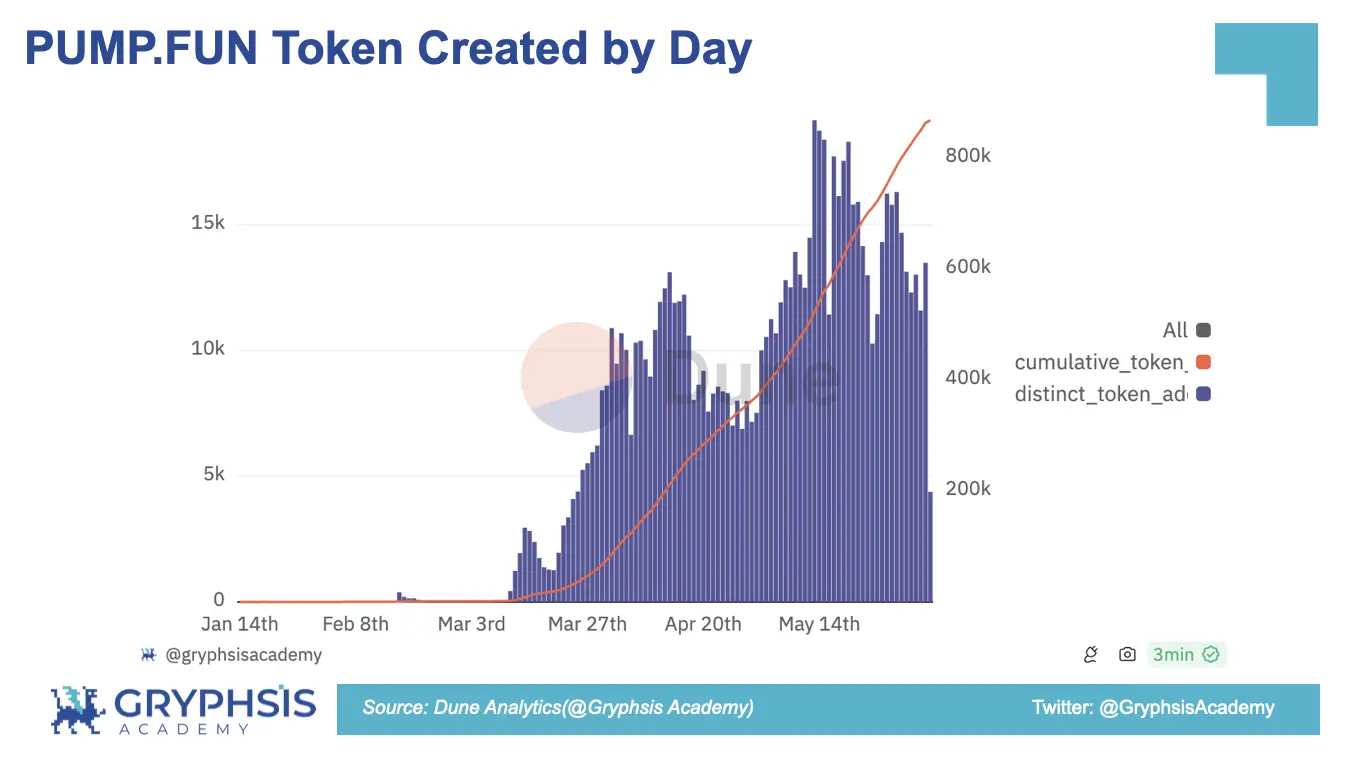

The number of Memecoins created on PUMP.FUN fluctuates with the number of active users. Since the platform's launch, a total of 862,988 Memecoins have been created, with an average of 15,000 new Memecoins added daily since May.

Only 10,707 of these can be launched on Raydium for broader trading, indicating that the majority of the platform's revenue relies on transaction fees, with a relatively small portion from token creation and listing fees.

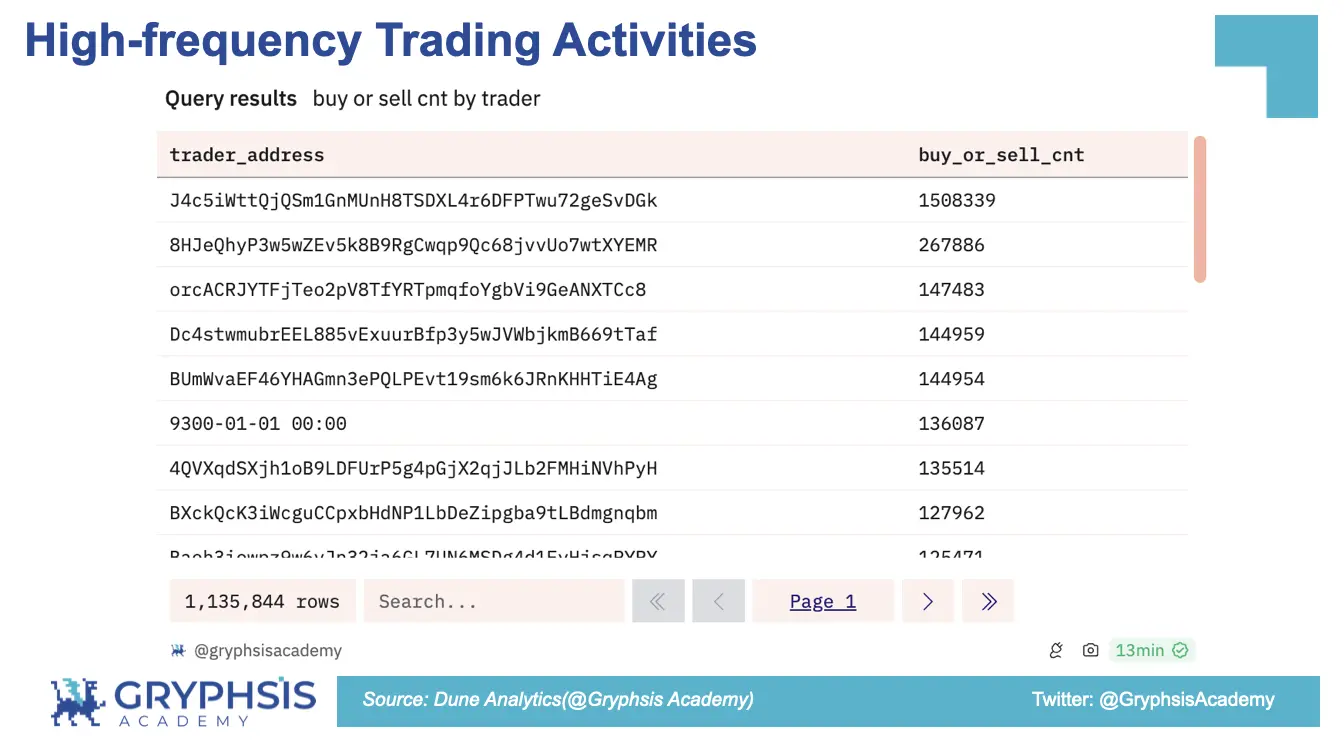

Currently, PUMP.FUN has not disclosed financing information and is still in an upward trend. Dune data shows a high frequency of trading behavior, suggesting the possibility of volume manipulation.

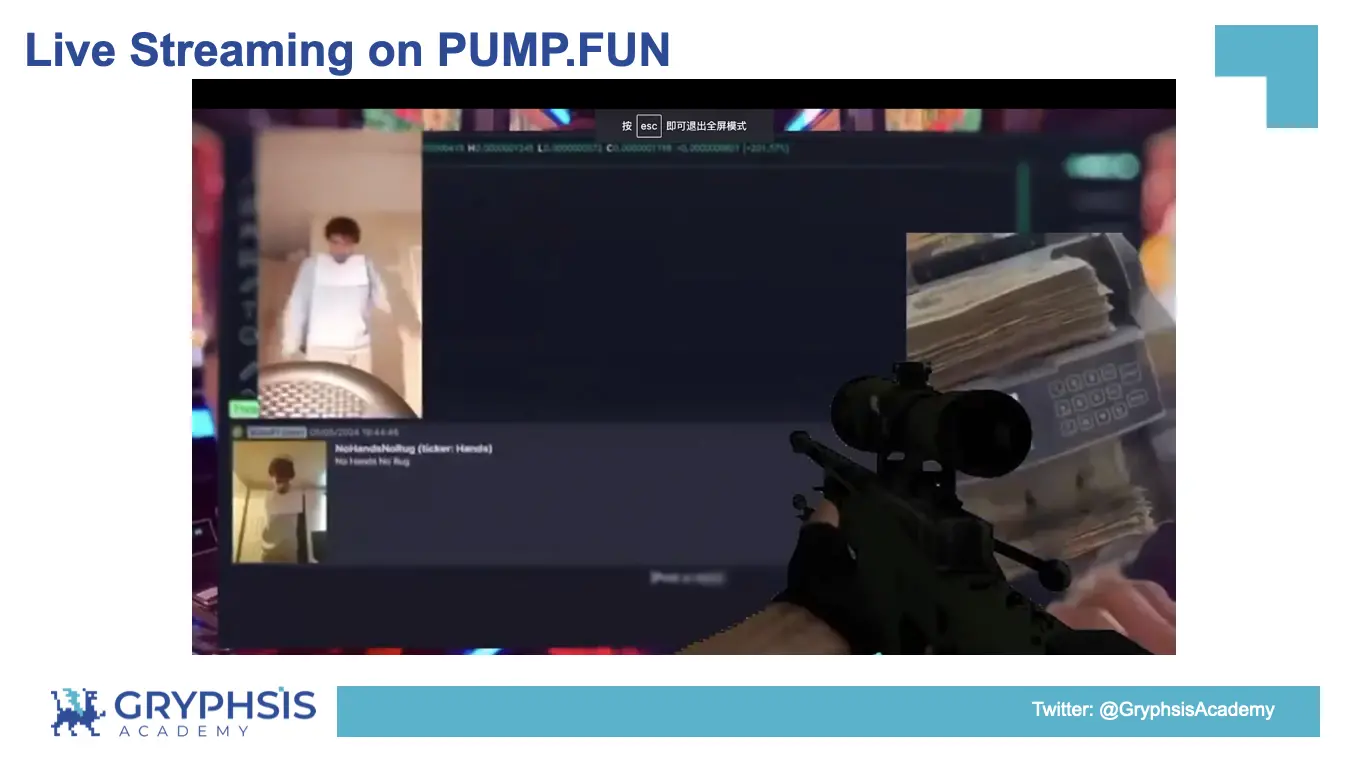

The platform has also added live streaming functionality to showcase the issuance and operation of emerging Memecoins in a live and video format, providing a suitable way for traffic and fund breakthroughs.

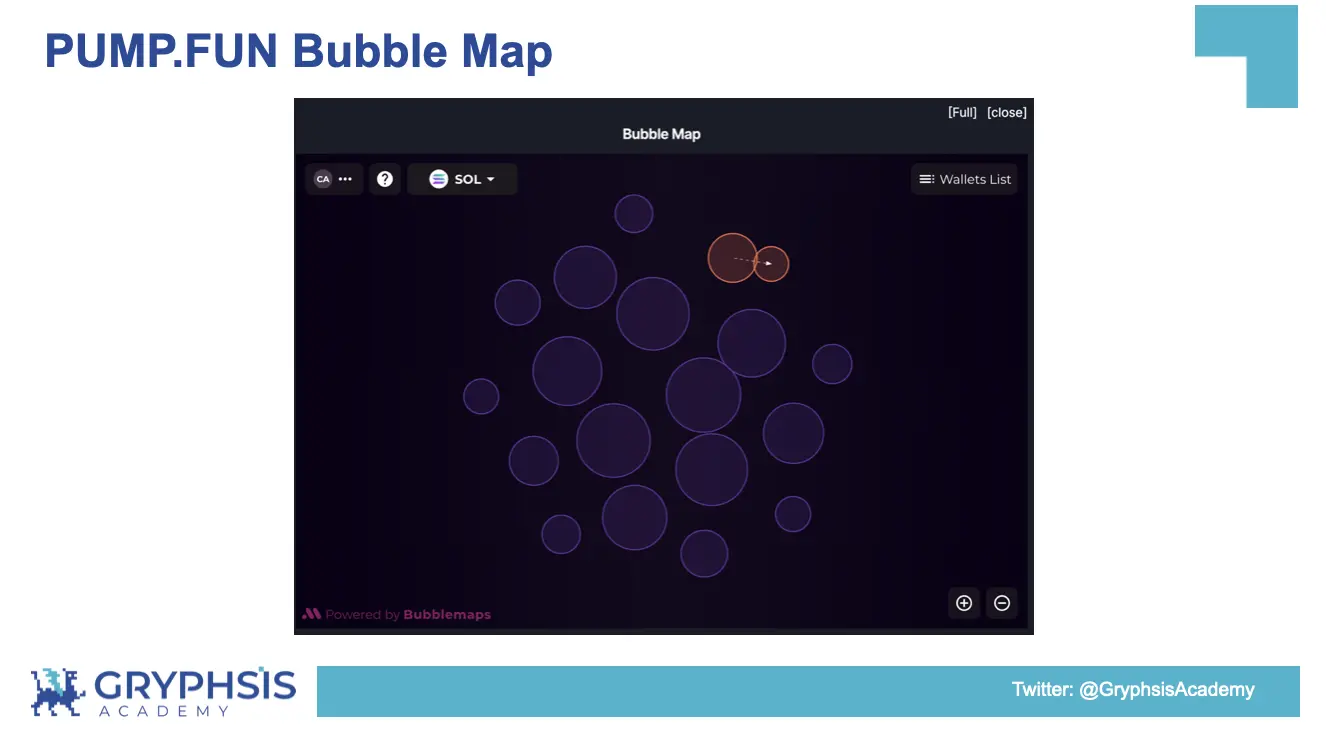

PUMP.FUN has also partnered with @bubblemaps to view the relationship bubbles of traders, check the association of token holding wallets, and determine if they are targeted by Dev's burning token wallets, reducing the possibility of rug pulls. The effectiveness of the platform's new features still needs to be verified through data, and the rapid changes in Memecoin narratives and the launch of new features also reflect the team's ability to adjust in a timely manner.

Overall, after the platform's launch, PUMP.FUN ignited the market and, without institutional endorsement, satisfied user needs through the Bonding Curve mechanism. The platform also relied on the wealth effect brought by users issuing Memecoins to drive traffic and promotion. Subsequently, the rapid switch of Memecoin narratives and the severe user PVP phenomenon did not structurally affect data growth, but instead continued to break through due to several hot events. In the future, external competing platforms may encounter growth bottlenecks, but for applications that occupy advantageous ecological positions, there are only more choices, not fewer.

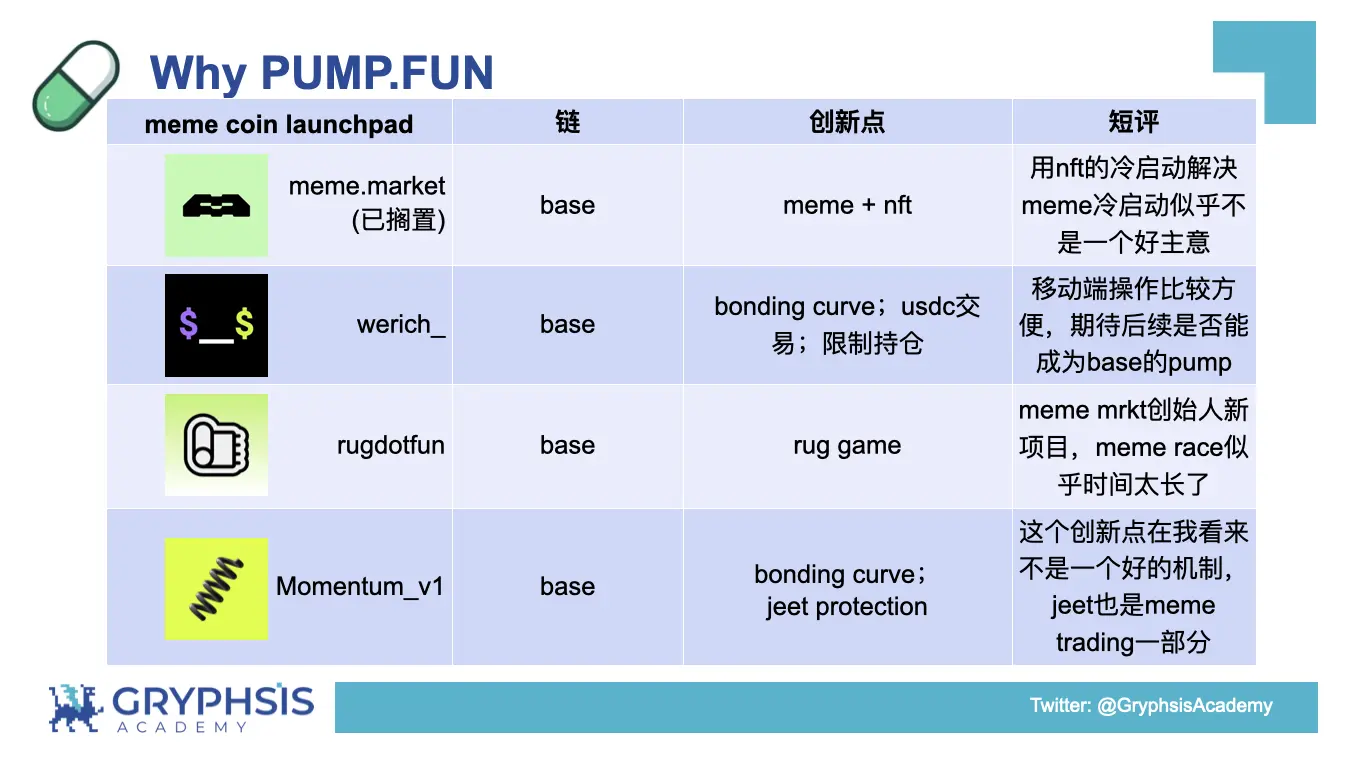

#### **2.3 Competitive Comparison**

Compared to other Memecoin Launchpad competitors, PUMP.FUN is better able to build the underlying value of Memecoins based on community consensus and collective trading sentiment. As of the completion date of this article on June 6, PUMP.FUN has **16 tokens with a market value exceeding $3 million, with the $SC token having the highest market value of $300 million**.

The outstanding performance of PUMP.FUN compared to the weakness of other competitors can be attributed to its product and ecological support.

(1) Unlike other competitors that provide users with a calm and static experience, visiting the PUMP.FUN website gives the most immediate impression of pulsating numbers and dynamic visuals. The high-saturation design stimulates users' senses, evoking emotions similar to those experienced in Memecoin trading—enthusiastic and magical. The gameplay introduction consists of only five simple sentences, in line with the short and quick nature of Memecoin trading users. However, other pages provide detailed information about the tokens, facilitating the rapid formation of community consensus among new buyers. The platform's logo is a small green pill, seemingly expressing a healing pill that is addictive, causing users to be unable to resist.

(2) Unlike PUMP.FUN, which is backed by the Solana ecosystem, meme.market / werich_ / rugdotfun / Momentum_v1 have chosen to develop on the Base chain. However, on the Base chain, funds and attention have been diverted by FRIEND.TECH and Farcaster, and Memecoins, with the help of the Socialfi platform, have already solved the problem of cold start. The $DEGEN and $FRIEND token market values are significant and can provide imagination space for other Memecoins on the two platforms. In the Memecoin Launchpad race on the Base chain, users have become accustomed to the echo wall constructed by FRIEND.TECH and Farcaster through social patterns, and funds and traffic have been almost completely divided.

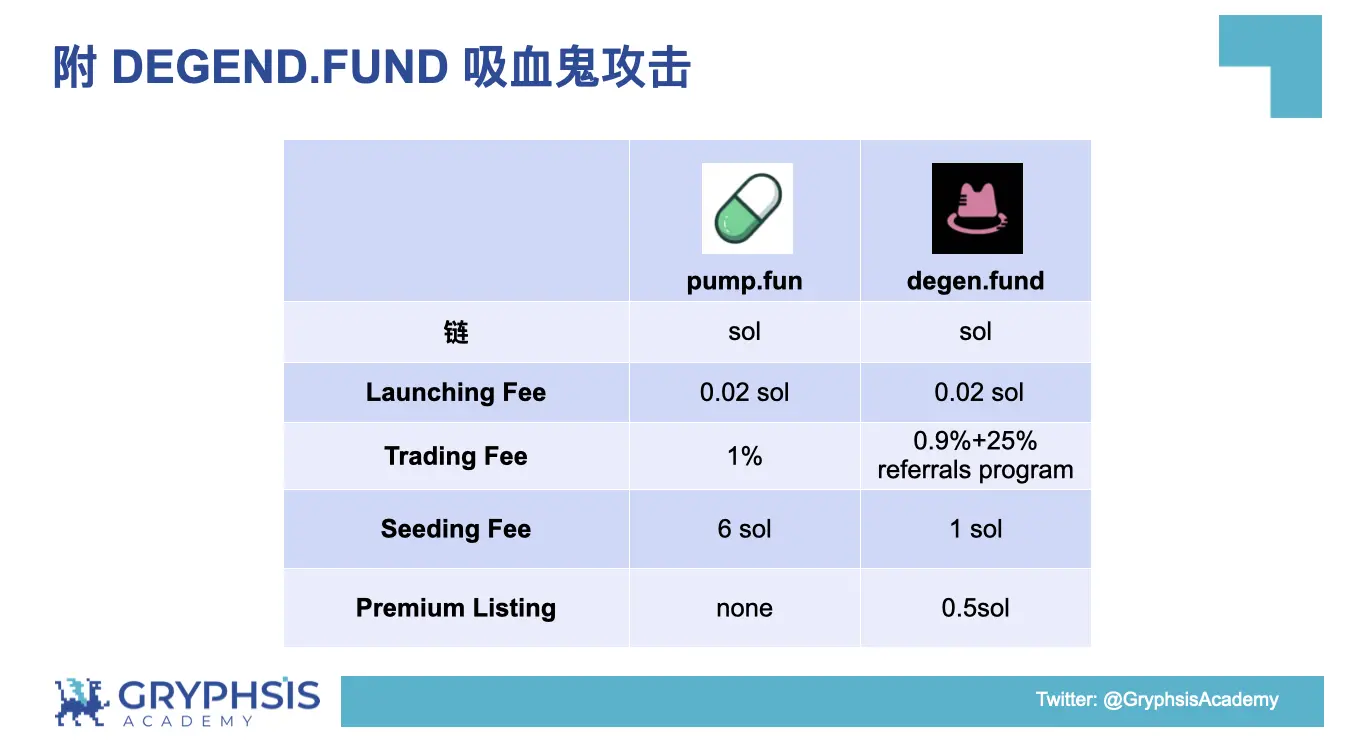

(3) During the attack on PUMP.FUN, DEGEN.FUND launched on Solana. Similar bonding curve and attempts to attract the market with cheaper platform fees did not sustain enough scale. The $IYKYK token, as a leading speculative target, returned to a subdued state after short-term speculation by on-chain players.

3. How to Participate in PUMP.FUN

For this new subfield of Memecoin Launchpad, PUMP.FUN should be the subject of investment research and deep involvement. We categorize the platform's users into three roles: Memecoin Creator, Memecoin Trader, and Memecoin Opportunist. The roles can be fluid, and users may make different opportunity choices when facing the same Memecoin in role transitions.

3.1 Memecoin Creator

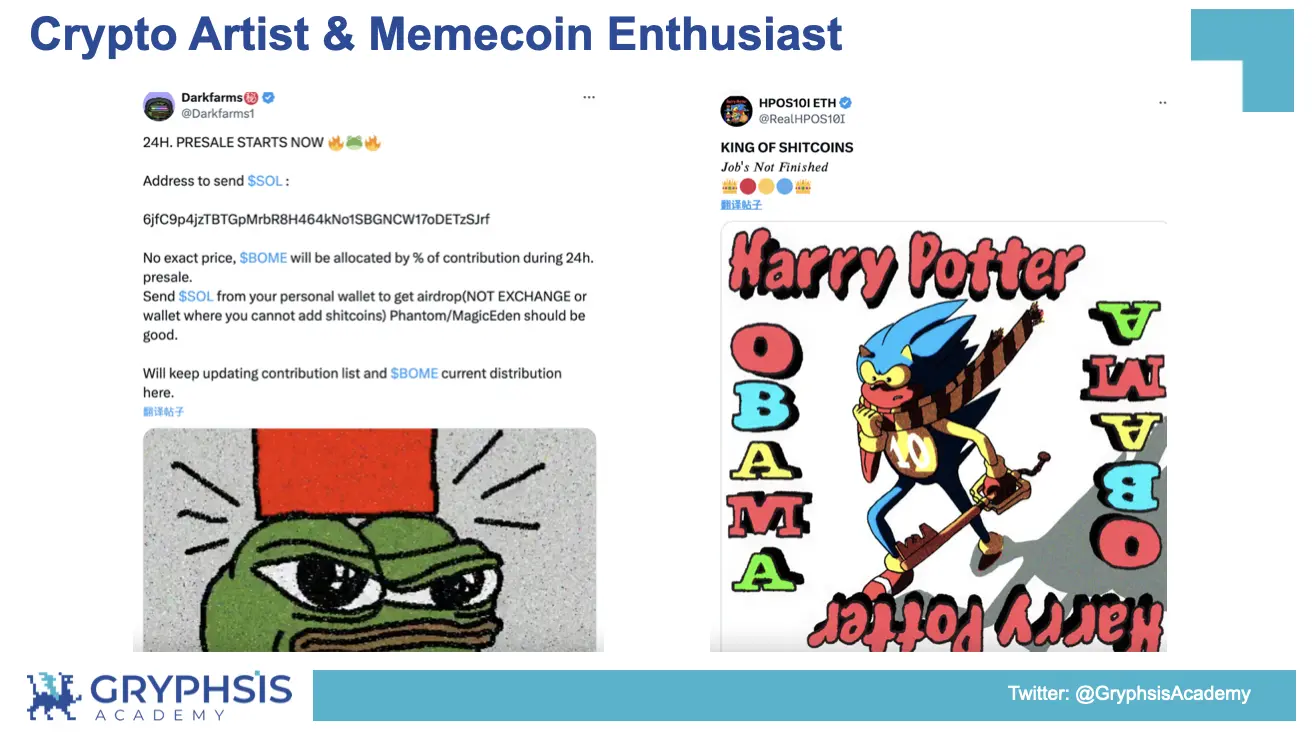

The Memecoin Creator can be a crypto artist, an early evangelist of Memecoin narratives, a project party using the platform for promotion, or even a celebrity after breaking through. As the role responsible for releasing/discovering new Memecoins worthy of trading, they need to have a certain knowledge of communication and influence. A good Memecoin Dev can collaborate with social media to select strong-performing tickers for the market. Even a Dev who is not very sensitive to the market, with the help of PUMP.FUN, can reduce trial and error costs. If you have a special identity like Caitlyn Jenner and Iggy Azalea, the decentralized issuance platform PUMP.FUN can help you bypass intermediate processes and quickly bring enough funding and traffic support to your token.

Crypto-native crypto artists and Memecoin enthusiasts can reduce token issuance costs with PUMP.FUN after selecting good tickers.

Early discoverers use cognition and influence to form new Memecoin narratives for specific Memecoins, and the communities formed under these narratives have the opportunity to further break through.

Celebrities issuing tokens on PUMP.FUN, interacting across circles and participating in the Memecoin craze with crypto users, is the latest breakthrough in the crypto concept. Compared to FRIEND.TECH, celebrity tokens and NFT assets can be one of the products of celebrity IP. Tokenizing social relationships will not attract people with a certain influence, as their public social resources are abundant, and private social relationships satisfy their own needs.

3.2 Memecoin Trader

As the most active player on the chain recently, the Memecoin Trader needs to track wallets, use tools, and follow social media while building their own trading strategy to profit in the high-risk, high-reward game. Compared to other risky assets, profits from Memecoin trading are more unstable, with generally low win rates, and the platform's characteristics lead to an increasingly fast trading pace, increasing the probability of losses.

The experience of Memecoin Traders on PUMP.FUN has made the author realize that, in addition to the need for a constantly improving trading system, the power from the team is also crucial. Even on-chain players facing huge opportunities need the cooperation of community members, and the community consensus formed from trading ultimately returns to the consensus of the trading target. Below is a replay of the process of @0xSunNFT and community members reviewing the issuance of the $MOTHER token by celebrity Iggy Azalea.

3.3 Memecoin Opportunist

Whether it's arbitraging targets as an on-chain scientist or high-frequency trading bots seeking alpha opportunities, Memecoin Opportunist is a subject that smart wallets should focus on. It's worth considering how to choose the right strategy as a Memecoin Opportunist on PUMP.FUN. Using a Texas Hold'em analogy, when the table is hot, entering the pot is advisable. You can choose a sniping bot strategy with good market liquidity to increase participation and amplify profits. When the table is not so hot, or the market is relatively at the bottom or stable, a reverse sniping strategy can be chosen to maintain sensitivity to the market while generating income.

(1) Sniping Strategy for Memecoin Opportunist

Every time a new Memecoin is launched on PUMP.FUN, the snipe bot completes the first few buy transactions within a few seconds after filtering through indicators. Because the entry position is low enough and the initial pricing curve is steep, this strategy has captured several significant gains in the past few months.

From left to right, the highest market value of $DONALDCAT is $15 million, $JAPAN is $5 million, and $NIGI is $12 million.

The sniping bot strategy requires a high sensitivity to market sentiment. Unlike the Solana Sniper Bot that ordinary users may use, there are no contracts available for sniping on PUMP.FUN. Instead, it involves sniping the issuance of tokens, requiring clear monitoring of user interactions with the Solana chain and the platform, and the ability to isolate tokens issued by Devs with rug behaviors. After sniping, parameters for adjusting stop-loss or take-profit should be set, and backtesting data should be used to adjust the capital used for sniping.

(2) Reverse Sniping Strategy for Memecoin Opportunist

The sniping bot strategy depends more on the overall market conditions, and while it increases opportunities, it also requires capital. Similarly, competitors using the same strategy will continue to emerge, further compressing profit margins. As the process of mutual competition unfolds, the number of Memecoins that can be run out of also gradually decreases. The emergence of the reverse sniping strategy for Memecoin Opportunist is a response to this market change. The specific implementation is as follows:

- Regularly summarize market hotspots and build a token issuance material library

- Test the sniping behavior of the snipe bot, organize the bot's strategy (ticker, amount, time, etc.)

- Automate the token issuance process and build a reverse sniping process

- Adjust parameters to increase capital utilization.

The reverse sniping strategy takes advantage of PUMP.FUN's low-cost token issuance feature. In the actual process, a well-adjusted reverse sniping strategy can bring single-time returns ranging from 2% to 20% in a very short time.

The construction of parameters requires analysis of the sniping bot's address behavior. Imitations of short-term hotspots in the market will continuously trigger signals for the strategy. Automating the entire process of the reverse sniping strategy is key to increasing capital utilization and expanding profits. The reverse sniping strategy can achieve low-risk arbitrage while not only low-cost selecting good Memecoin narratives but also potentially gaining future airdrops.

The BSC chain attracted traffic and completed the initial layout of the Meme track through the Meme-Innovation-Program activity. The Base chain is currently launching the Base Onchain Summer event under the leadership of its founder, and Base's Memecoin will undoubtedly receive a biased flow of traffic. Public chains organize campaigns to lay out Memecoin and related tracks, and PUMP.FUN, as a unicorn application in the emerging track, is currently only running on Solana. While believing in the PUMP.FUN team and product, the track participation strategy should also consider the hot cycle. In the author's view, the way institutions enter the market has almost been determined. Whether it is strong acquisition at a low point or participating in construction as an investor, the leading track, whether in the primary or secondary market, will return to its rightful value. Therefore, the author believes that adopting the Memecoin Opportunist reverse sniping strategy is the best way to lay out the entire track through PUMP.FUN in advance.

4. Conclusion

From Ethereum to Solana, from Shiba Inu to frogs, from crypto enthusiasts to the celebrity effect, people's pursuit of traffic hotspots never stops. From the sloth burning the pool to the innovative issuance and trading by PUMP.FUN, people continue to explore the decentralization and fair mechanisms of Memecoin. As the leading project in the emerging track, PUMP.FUN's extremely low-cost issuance model has completely changed the ecology of Memecoin. The application ecosystem it has built meets the needs of users and is a unicorn project in the crypto field. Even the most Crypto Native narrative application has not yet released its own platform token. What kind of economic flywheel it will ultimately form requires pioneers in the track to continue exploring.

According to Defillama, the PUMP.FUN protocol, as a Memecoin issuance platform on Solana, has monthly revenue exceeding Uniswap Labs, making it the fourth-largest protocol in all blockchain networks. Faced with this unicorn application that has no additional disclosure of information, we need to figure out what it really is. Some may think it's a large casino, while others may see it as another platform for liquidity-depleted PVP in the crypto world. The author believes that in addition to the above characteristics, it should be a revolutionary product for new crypto assets, embodying the spirit of decentralization in an extremely low-cost way. Just as Bitcoin rewarded early miners and evangelists, why can't Memecoin reward users who discover its value through the gaming process? Is it just because Bitcoin consumes electricity while PUMP.FUN consumes brainpower and physical strength?

"Before learning to construct, do not take what has been deconstructed as the final answer to the problem." Faced with the surging wave of Memecoin reform in the crypto MATRIX world, the author will swallow the green pill of PUMP.FUN with a peaceful mindset.

References:

[1] https://foresightnews.pro/article/detail/59863

[2] https://messari.io/report/analyst-discussion-pump-fun

[3] https://www.theblockbeats.info/news/53703

[4] https://x.com/lukema95/status/1788858814420382121?t=A2CvlJFGTTlxko7Ymtpojw&s=05

[5] https://mp.weixin.qq.com/s/JwqVcjY0ENUFFk9oI79VfQ

[6] https://www.youtube.com/watch?v=losZU4qcs-M&t=4s

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。