In our crypto community, although there are various innovations in technologies and application scenarios, the most significant impact for us "old leeks" is still the innovation in asset issuance methods.

Almost every new asset issuance method brings about a wave of wealth effects.

Today, let's review the characteristics of historical asset issuance methods:

POW

When our cryptocurrency dragon, Bitcoin, first appeared, the issuance method was PoW (proof of work). In the early days, all tokens followed this model, including Litecoin, Dogecoin, and early Ethereum.

The advantage of this method is that as long as the work method follows a unified standard (usually involving mathematical calculations), anyone can join.

In the early stages of the project, the coverage is high and the barrier to entry is low.

Of course, as the project gains popularity, the barrier to entry in the later stages is also not low. Not only do you need to compete in hardware, but also in electricity costs and operational capabilities.

Although this issuance method is relatively user-friendly, it is difficult for the project party to raise funds.

Private Placement

This method has actually been in operation in traditional industries for many years, and there is no fundamental difference between private placements in the crypto industry and traditional private placements. Investors and project parties negotiate favorable conditions.

However, most projects do not issue tokens during private placements, so the Simple Agreement for Future Tokens (SAFT) has evolved from equity investment.

SAFT stands for Simple Agreement for Future Tokens, and this method is highly compliant. Nowadays, most mainstream projects use this method for fundraising.

However, this method is mainly suitable for professional financial investors, and the barrier to entry for retail investors is still relatively high.

IXO

Here, IXO refers to various derivative forms of ICO/IDO/IEO.

Let's start with ICO (Initial Coin Offering), which is the first public issuance of digital currency.

ICO, the initial token issuance, originated from the concept of Initial Public Offering (IPO) in the stock market and is the first token issuance of blockchain projects.

Earlier ICOs were similar to private placements, where project parties had to prepare a lot of project materials to introduce the project to investors. However, recent ICOs have been distorted by Solana, where project parties can just post a tweet with an address.

This was also covered in our previous videos on Solana's marketing for price increases.

As the gameplay deepens, ICO has evolved into IDO and IEO.

IDO stands for Initial DEX Offering, which refers to the first token issuance based on decentralized exchanges (DEX).

In simple terms, if the project party creates a pool on Uniswap or other DEX, it becomes an IDO. Currently, the mainstream method for many projects is IDO.

IEO stands for Initial Exchange Offerings, which is similar to IDO. If the project party initially lists on a centralized exchange (CEX) instead of a DEX, it becomes an IEO.

The barrier to entry for IEO is higher than DEX because anyone can create a pool on DEX, while centralized exchanges still conduct some review of projects. Most tokens issued through IEO have raised some funds through private placements.

Airdrop

Many crypto projects conduct coin issuance through Airdrops when they need an active community.

Those who frequently follow crypto are certainly familiar with this concept, which is essentially free tokens!

However, this method has become increasingly difficult. On one hand, many project parties are cracking down on "witches," making it harder to expand profits through technical means. Additionally, some projects' airdrop rules have become increasingly opaque. For example, the founder of the Taiko project even refused to disclose the rules:

Currently, this method of issuance has led to increasing conflicts between project parties and users, and has even evolved into a battle between opponents. The first thing most people do after receiving an airdrop is to sell, fearing that they will not be able to sell at a good price if they wait too long.

Fair Launch

It is precisely because of the increasing antagonism between project parties and users through airdrops that the fair launch model became popular in 2023, with the notable asset being Mingwen.

In this method, project parties and retail investors compete for chips and shout together after the competition.

However, this seemingly fair method, although fair on the surface, was ultimately killed by scientists.

A large number of chips from many projects were taken by scientists, who became the actual market manipulators, with even more chips than the project parties. At the same time, this method does not allow projects to raise funds, and it is impossible to rely on scientists who hold a large number of chips to build the project.

Node Sale

As we enter 2024, an increasing number of projects are issuing tokens through node sales.

Because a decentralized network itself requires a large number of nodes, in the era of POW, users' mining machines were actually nodes.

However, in this method, project parties cannot raise funds, as the money users spend on purchasing mining machines goes to production companies unrelated to the project.

The essence of the node sale model is that the project party officially sells nodes, allowing them to raise funds, while users can also participate in project construction and earn returns.

This method may become the mainstream method for many crypto projects in the future, and it is better than the various methods mentioned earlier.

Issuance Method | Decentralization | Entry Barrier | Fundraising --- | --- | --- | --- POW | Yes | Low | None Private Placement | No | High | Yes IXO | No | Low | Yes Airdrop | No | Low | None Fair Launch | Yes | Low | None Node Sale | Yes | Low | Yes

Which projects are currently using the node sale method?

This year, the more prominent projects are: XAI, Aethir, and Sophon.

XAI

The recent node sale market trend can be said to have been led by XAI.

XAI is a project listed on Binance in January this year. This project is the offspring of Arbitrum and is a Layer3 project for gaming.

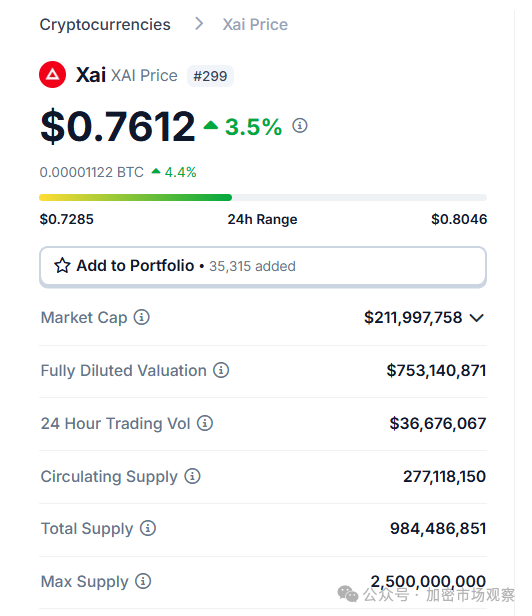

This project sold 35,155 nodes, raising 13,080 ETH. At the time, this amounted to raising $400 million based on the Ethereum price.

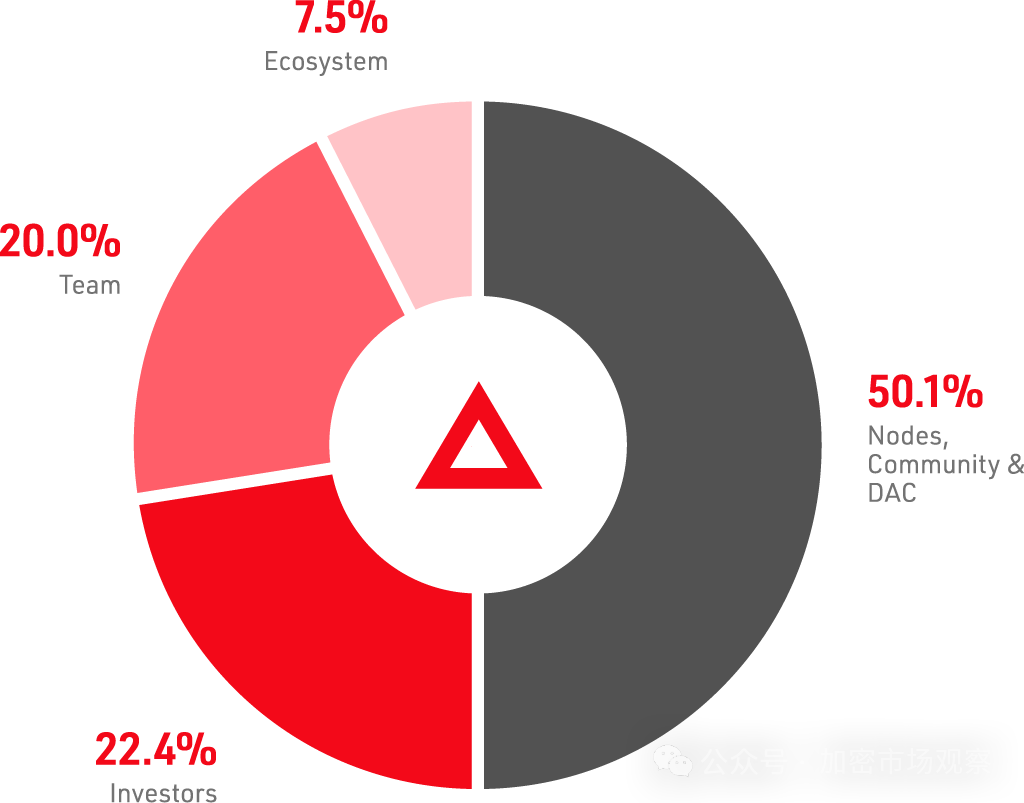

In the token economics of this project, 85% of the tokens released are used for node rewards, totaling about one billion tokens. Based on the recent market value of $0.76, the average floating profit for node investors is approximately 20 times.

Investors and the team both have a 6-month lock-up period. After mining for a few months, shouldn't node investors have already recouped their investment before other investors unlock their tokens?

Actually, not quite. After mining the tokens, node investors do not immediately receive the tokens. Instead, they receive esXai, which takes 180 days to convert into Xai. There are two options for conversion: if converted in 15 days, only 25% of Xai can be obtained. If converted in 90 days, 62.5% of Xai can be obtained.

Aethir

You should be familiar with the Aethir project. It was previously introduced when discussing AI depin, and it is also a leading project in AI computing power.

Aethir started selling nodes to the public in March this year and has sold 74,040 nodes, raising 41,627 ETH, which was equivalent to $130 million at the time.

Aethir's release rules are not clear, but it is stated that there is a 4-year release period. The node rewards account for only 15% of the total, with an expected annual yield of around 5% to 7% in the first year.

The main reason for this is that Aethir has reserved a large portion of the rewards for mining providers.

Sophon

Sophon is a modular blockchain project that received a $10 million investment from OKX in March this year.

Sophon has sold 121,261 nodes, raising 31,087 ETH, equivalent to $96 million.

As you can see, since the introduction of the node sale fundraising method, doesn't private placement seem less appealing?

Final Returns Test the Project's Strategy

However, the node sale is still a new issuance model. XAI, as the first project in this round, has not yet reached the 6-month unlock period for node investors. However, based on the calculation of redeeming 62.5% of XAI tokens in 90 days, node investors should have already recouped their investment.

The tokens for Aethir and Sophon have not been officially issued yet, so this model is still in its early stages. Essentially, it is similar to private placement, but through the node sale model, the investment barrier is lowered, and the project's infrastructure is also developed.

The node sale phases for XAI/Aethir/Sophon have already ended. The recent star project still selling nodes is CARV. Interested individuals can search for relevant information.

In the many years of development in the crypto industry, it seems that the token issuance model of node sales this year is indeed more suitable for crypto than other methods.

The original ICO launched directly on the public chain cannot meet the long-term needs of business development, and users are easily exploited by the project party. Airdrops, which involve sending tokens directly to users' wallets for free, have caused conflict between users and project parties. Private placements have a high entry barrier, which contradicts the characteristic of widespread participation in decentralized crypto.

Only through the node sale model can users obtain better fundraising conditions than private placements, and project parties can also complete infrastructure development. Why wouldn't they take advantage of this opportunity?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。