The road cannot become narrower.

Written by: Zuo Ye

Crypto is doing payments, Fintech is doing stablecoins.

In the past year, the development of the cryptocurrency industry has been a two-way rush with traditional financial enterprises, Web 2.0 giants, and global politicians. Trump's air coin marked the end of crypto liquidity, while the reconciliation has just begun.

Advisors in Pakistan, crypto mining farms in Bhutan, and exorbitant financing in the Middle East ultimately became the last straw that overwhelmed retail investors, so let’s all go to the wishing pool to become turtles, perhaps we can still gain some infatuation.

The Era of Crypto Stagnation

Humans are strange creatures; when they used to pursue freedom in traditional times, now that they have freedom, they pursue tradition.

The only lesson humanity has learned is that it learns no lessons at all.

I still remember when the Bitcoin Spot ETF was approved, everyone thought Bitcoin would change the world. Of course, now it is believed that Bitcoin is merely a reflection of M2 assets, which neither reduces inflation nor preserves value. After being extracted by the ETF, it can no longer serve as a catalyst for the crypto bull market, becoming a dead end.

The only lesson humanity has learned is that it learns no lessons at all +1.

When Trump embraced air coins in his loyal crypto circle, the silence after the surge was not surprising. The self-rescue of PumpFun, the strike of Binance Wallet, or whether Boop is indeed Binance's CXO all turned into a farce, still the kind that cannot make money.

Image caption: The current landscape of crypto, image source: @zuoyeweb3

There is nothing new under the sun; cryptocurrency is in a state of stagnation.

First, the "civilization-level innovation" of Ethereum could not withstand the drop from 4000 to 1500, needing to rely on Risc-V to return to the L1 battle. If EVM can be completely revamped, why not just switch from PoS to PoW? Can Ethereum's bet on L1 and the addition of Risc-V really save itself?

Being commanded by the enemy is the most foolish behavior, but unfortunately, Solana is the commander this time. Solana's bet on L1 was before FTX and also after FTX.

Essentially, SVM L2 or expansion layers are also bloodsucking behaviors towards Solana; they are like barnacles on a whale, not something the whale does intentionally, but ETH L2 is a barnacle that Ethereum itself invited.

The market paradigm we were once familiar with is gone forever; ETH is not Money, Stablecoin is Money.

Secondly, ineffective information is infecting the entire market. KOL Summer will quickly turn into KOL Agency Summer, then CEX Summer. If you don’t believe it, just look at the grand occasion of this Dubai music festival; project parties, KOLs, and exchanges ultimately all lead to trading. The exchange itself is the point of transaction, and this is an unsolvable situation.

This is not a critique of KOLs but an acknowledgment of market rules. From the early community AMAs at three o'clock, to the community-based CoinHoo, and then to the historical battles of media, the peak of KOL popularity is also the endpoint. Leading to trading is the moment of clearing trust and influence.

However, this cycle also has new differentiation trends, although they are all ineffective information, generally divided into two categories:

Junk calls, sinking markets

Old money platforms, promoting existence

Next is the collapse and perseverance of VCs. Relying on dollar capital, VCs in Silicon Valley, the Middle East, and Europe are laying out the next stage, while the lonely Chinese VCs, continuously tortured by LPs and ROIs, have nothing to do with innovation. They are rapidly becoming market makers; since everything leads to trading, why not save steps and do it themselves?

True innovation was in Huqing Jiayuan before, and will be in Shenzhen Science Park in the future. Chinese founders need to find money in Silicon Valley and Wall Street, but truly market-satisfying projects will not be recognized by investors under the existing framework.

The crypto circle does not need FA; memes cannot be shorted.

The reason is simple: the trading path is too short. Exchanges are eyeing any traffic, preferring to waste time casting nets rather than missing out on opportunities. The only beneficiaries have become those who escaped the internet to CEX, where not only ByteDance is thriving, but also the feeding troughs of cattle and horses.

In 2018, the average tenure at Toutiao was only 4 months, while by 2024, the average tenure at ByteDance has risen to 7-8 months. However, more people still need to be sent into society; the big players in the crypto circle only look at top CEXs.

Today's bold statement: The beneficiaries of VCs are top school graduates, while the beneficiaries of CEXs are those eliminated from big companies. They bring not only expertise and impressive resumes but also deeper operational standards and decreased capital efficiency due to increased intermediary costs.

The vibrant era of the crypto circle, where everything competed and everyone just wanted to make money, is gone forever.

Sustained institutionalization has become the tight rein of the crypto circle; the crypto circle resembles the internet, and the internet resembles XXX.

Invention is the mother of demand

I do not FUD cryptocurrencies; a more accurate mindset is "confident in the crypto industry, very worried about my future." This is no longer a niche industry filled with opportunities for wealth; practitioners are being largely replaced by the internet and finance. Crypto OGs and grassroots promoters are either going to jail or becoming underlings, or after jail, becoming big shots or underlings. Baby is going to fight the tiger tonight.

Too much complaining can lead to a broken heart; we should not continue discussing VCs and exchanges. We either start over like Ethereum or explore new ecosystems. In every crisis in the crypto industry, new asset issuance methods emerge, such as ERC-20 supporting DeFi, and NFTs supporting BAYC. Now we have entered the stablecoin stage.

Note that the core of the last round of on-chain activities was Ethereum and lending, "Lego-style" amplifying capital efficiency, while this round of Ethereum and staking models has not replicated miracles. In our timeline, Tencent did not invent WeChat; instead, Xiaomi's Mi Chat rose.

Yield-bearing stablecoins (YBS) have become a new invention. They will create new demand, not because the demand for stablecoins cannot be met—USDT is doing just fine—but because YBS can be done this way. Ethena was invented, referencing the end of the dollar minting tax and the super cycle of stablecoins.

YBS will become a new form of asset issuance; this is an expectation. Drawing from psychological historiography, I have three predictions for the future, each pointing to a different future:

YBS becomes a new asset issuance method, Ethereum successfully changes its "core." ETH replaces BTC as the new crypto engine, and Restaking ETH becomes true Money;

YBS becomes a new asset issuance method, Ethereum falls into silence. YBS will be swallowed by dollar assets like government bonds, Fintech 2.0 becomes a reality, and Web 3.0 becomes a pipe dream;

YBS does not become a new asset issuance method, and Ethereum dies quietly. Then blockchain will "go coinless and keep the chain." Fintech 1.0 is PayPal replacing banks, Stripe is the electronic revolution of acquiring, so a coinless blockchain is at most Fintech 1.5.

To summarize, Fintech 2.0 is financial blockchain, and Fintech 1.5 is coinless blockchain technology.

Stablecoins are becoming a new asset issuance model, which is something no VC research report has ever predicted, and even Ethena itself has not thought of this. If we believe that the market itself is the optimal solution, the biggest problem with VCs and exchanges is not learning from Vitalik's obsession with technical narratives but rather not respecting market rules.

In the current landscape of the crypto circle, exchanges, stablecoins, and public chains are indeed the three giants. Binance, USDT, and Ethereum form the main cast, while others are suppliers and distribution channels around the three. Exchanges and public chains are relatively stable, and now the battle is focused on stablecoins. Not only are USDC, BlackRock, and others advancing, but the answer given on-chain is YBS, which is crucial and inescapable.

PS: The stability of exchanges refers to Binance's dominance, while the stability of public chains refers to Ethereum's revitalization; Solana is still on the way to replace it.

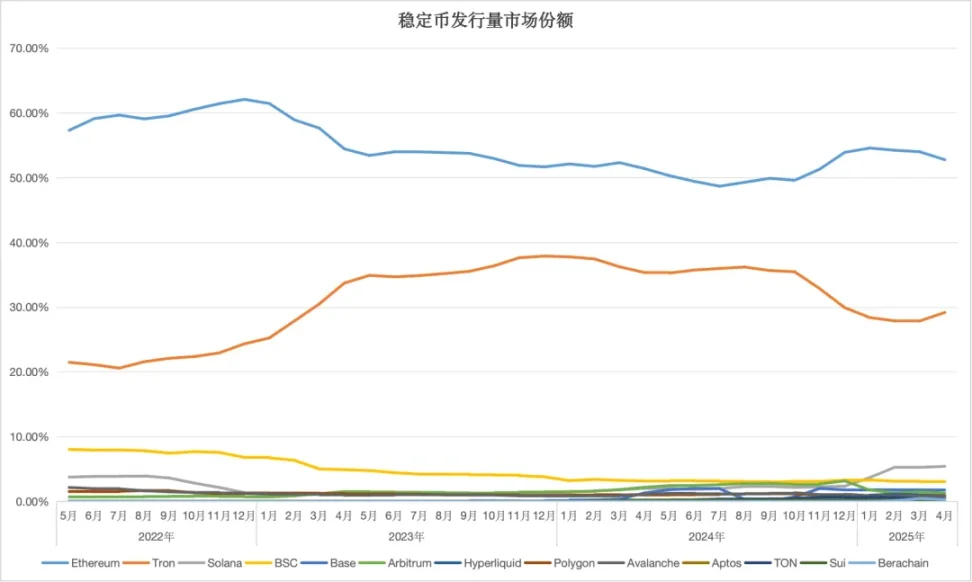

Image caption: Issuance volume of the stablecoin market, image source: @zuoyeweb3

In today's market landscape, Ethereum and Tron are the two giants, but Solana has not given up on catching up, especially since Ethereum has not been completely defeated. We can always hear news of Solana DEX trading volume surpassing that of the Ethereum ecosystem, but in terms of real asset issuance volume, ETH + ERC-20 USDT still firmly holds the lead.

This is also the main reason I believe Ethereum's fundamentals are sound. The price expectation for ETH is 10,000, while for SOL it is 1,000; the bases are completely different.

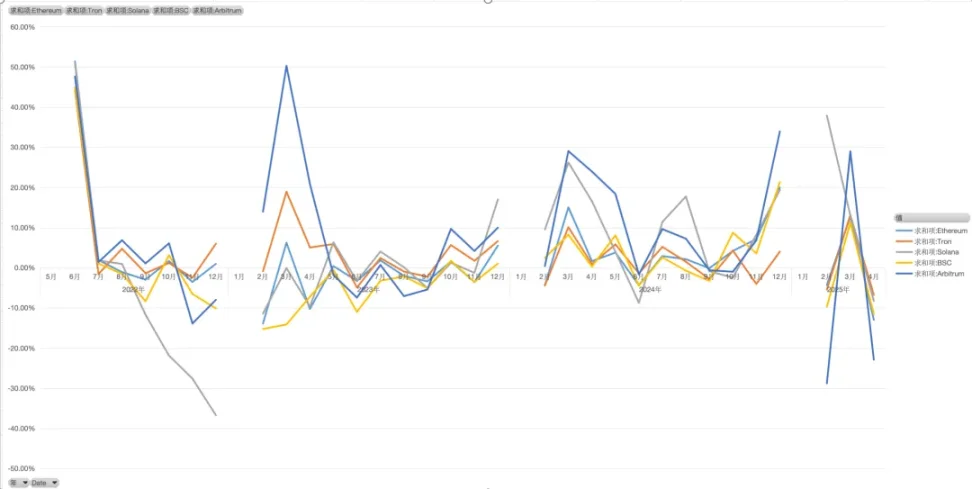

Image caption: Growth rate of stablecoins, image source: @zuoyeweb3

Especially when comparing the growth rates of various chains, we can find that they are basically in sync. Except for Solana, which was close to death in 2022, during other times, everyone has remained consistent with Ethereum. We can conclude that, in terms of correlation, stablecoins across chains have not emerged with independent trends; they are still an overflow from Ethereum.

This indicates the importance of pairing Ethereum with stablecoins, while the importance of YBS lies in re-anchoring. With a stablecoin market value of 230 billion, USDe and other YBS are still just "others."

Still, YBS must become a new asset issuance method to transmit the asset attributes of ETH to the monetary level; otherwise, the spring of RWA will be the winter of the crypto circle.

Conclusion

Ethereum only has a technical narrative; users only embrace stablecoins.

We hope users embrace YBS, not USDT. This is the current situation and also the divergence between us and the market.

Pursuing niche is a very popular thing; just look at the continuous tail lights and the LABUBU spread across the world. A brief mention of blockchain payments: there is no problem with payments, but before the mainstreaming of YBS supported by crypto-native assets, pushing blockchain payments is "results before reasons," meaning payments should be the direction of YBS.

Cryptocurrencies should not become Fintech 2.0; the road cannot become narrower.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。