With the rapid development of blockchain technology, the landscape of the cryptocurrency market is quietly changing. Investors' demand for transparency, efficiency, and decentralization is growing stronger, leading to a shift from centralized cryptocurrency trading to on-chain trading.

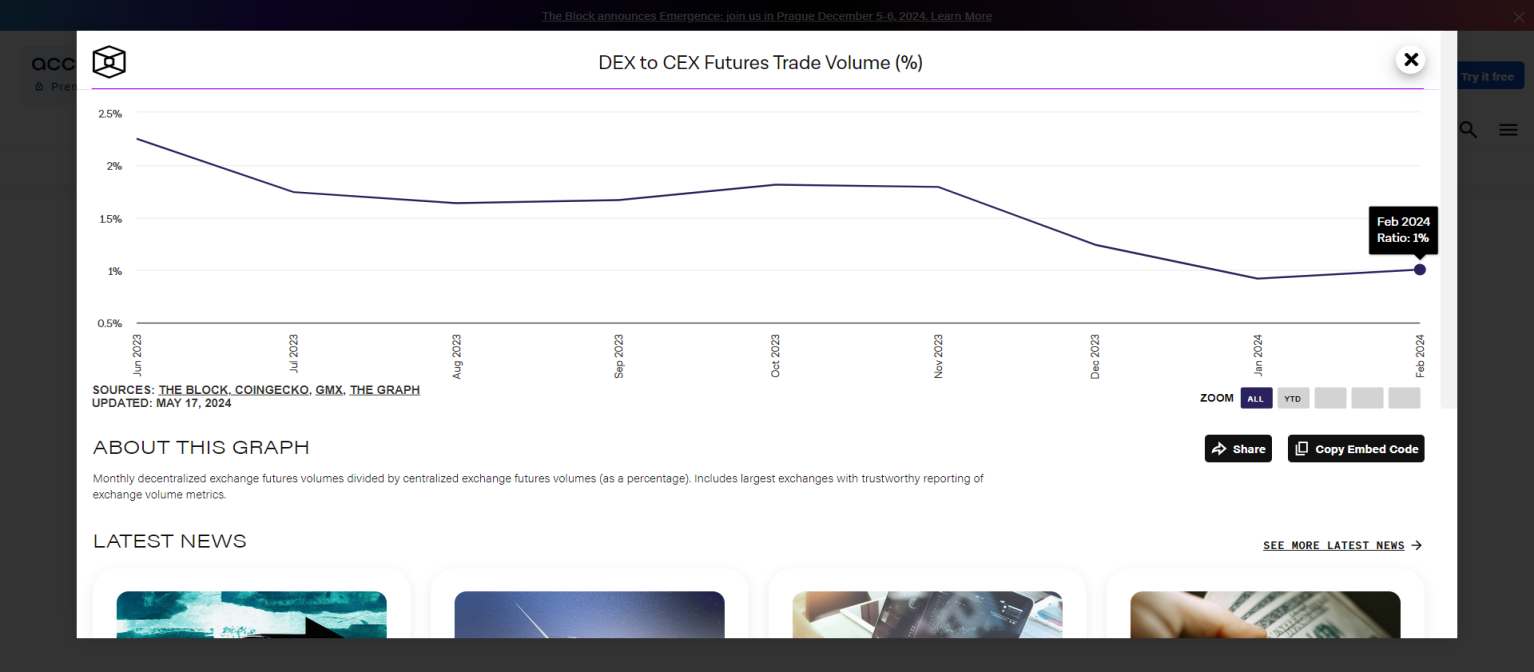

According to the latest data from Coingecko, the spot trading volume of centralized exchanges (CEX) and decentralized exchanges (DEX) has reached a ratio of 55:45, with a small difference. On the other hand, the total daily trading volume of cryptocurrency derivatives across the entire network has reached billions of dollars, with on-chain trading accounting for only 1%, leaving significant room for growth in on-chain derivative trading.

Source: The Block

After continuous iteration and optimization, the on-chain derivative track currently focuses on two main solutions:

The Vault model represented by GMX on Arbitrum and Hyperliquid, where LP serves as the counterparty for traders, and the trading price is determined by Oracle feed.

The order book model represented by dYdX, with off-chain matching and on-chain settlement, such as AEVO and Vertex.

Of course, with the development of the DEX market, many projects commonly combine these two approaches to further enhance user trading experience, optimize trading depth and liquidity, and provide stable spot asset trading quotes and decentralized leveraged contract products. For example, Drift Protocol, based on the Solana ecosystem, has performed well in the recent market, attracting significant attention from users and achieving substantial increases in total value locked (TVL) and user numbers.

This article will delve into the core mechanisms and technical features of Drift Protocol, a Solana-based on-chain derivative protocol, and explore how it addresses the risks faced by on-chain derivative trading, providing traders with a secure and trustworthy on-chain trading environment.

About Drift Protocol

Drift Protocol is an open-source decentralized trading platform built on Solana, established in 2021, primarily providing users with a low slippage, low-cost, and efficient trading experience. Currently, Drift Protocol mainly offers four products: spot trading, perpetual contract trading, lending, and passive liquidity provision. The goal of Drift Protocol is to enhance capital efficiency while protecting user assets by establishing a complex cross-margin risk engine, and to become a liquidity layer for derivatives and spot trading in the Solana ecosystem.

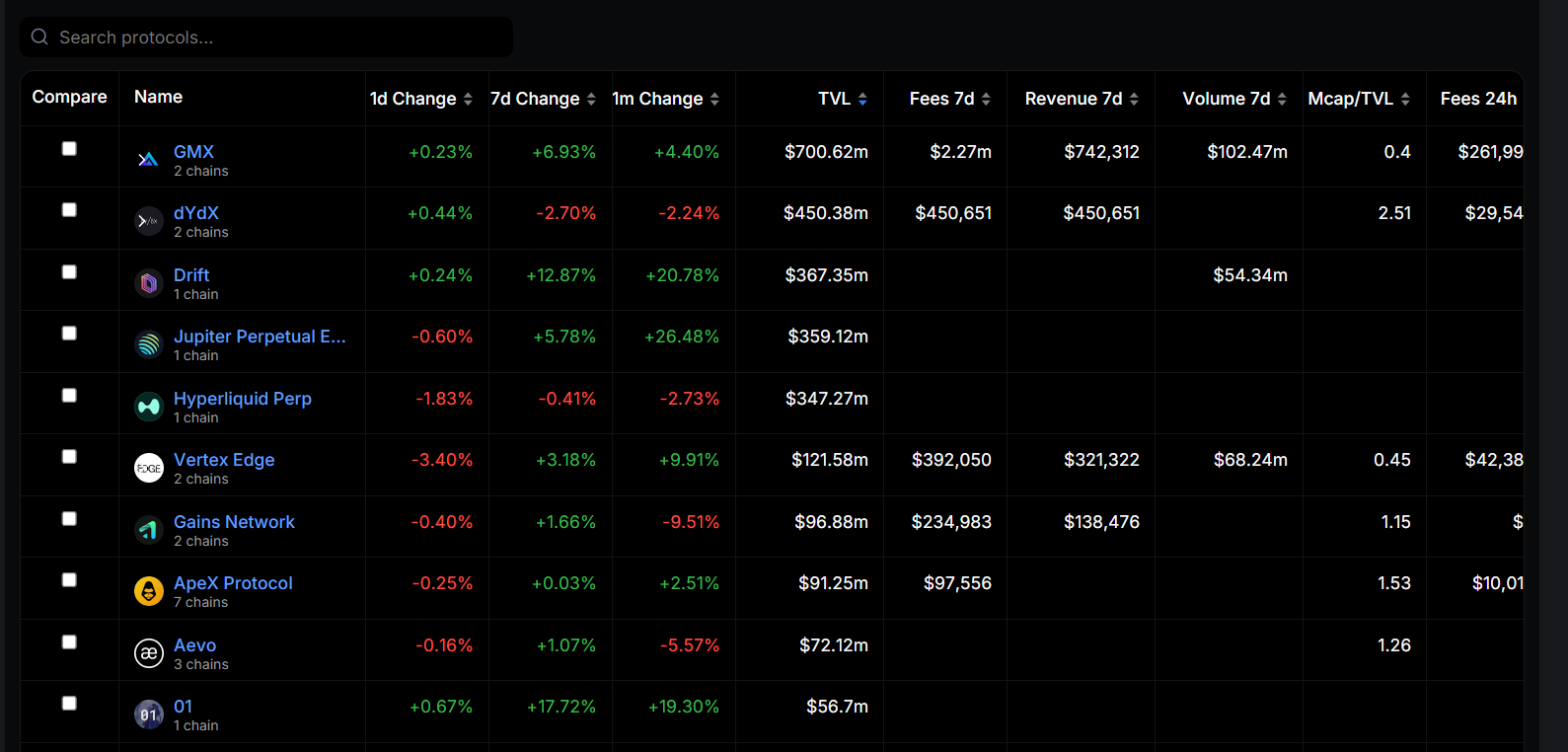

Drift Protocol launched its V2 version in January 2022, adopting a new hybrid liquidity solution, resulting in significant improvements in trading volume and user experience. On May 16, 2024, Drift Protocol initiated an airdrop, distributing 12% of the total supply to early users and supporters, leading to sustained breakthroughs in TVL and trading volume. According to DeFillama data, Drift's TVL currently ranks third among all on-chain derivative platforms, making it a noteworthy dark horse in the race.

Source: DeFillama

For traders, transaction fees are a crucial metric in cryptocurrency derivative trading. Drift Protocol has the advantage of low transaction fees, helping users reduce trading costs and gain more profits. Currently, the taker fee for perpetual trading of BTC, ETH, and SOL on Drift Protocol is only 0.025%. If an investor pledges 10K USDC in Drift Protocol's Insurance Fund, the fee can be reduced to 0.01%. For other currencies, Drift Protocol's trading fees range from 0.03% to 0.1%. Coupled with Drift Protocol's official commission discounts and rewards, the trading fees are superior to most CEX exchanges.

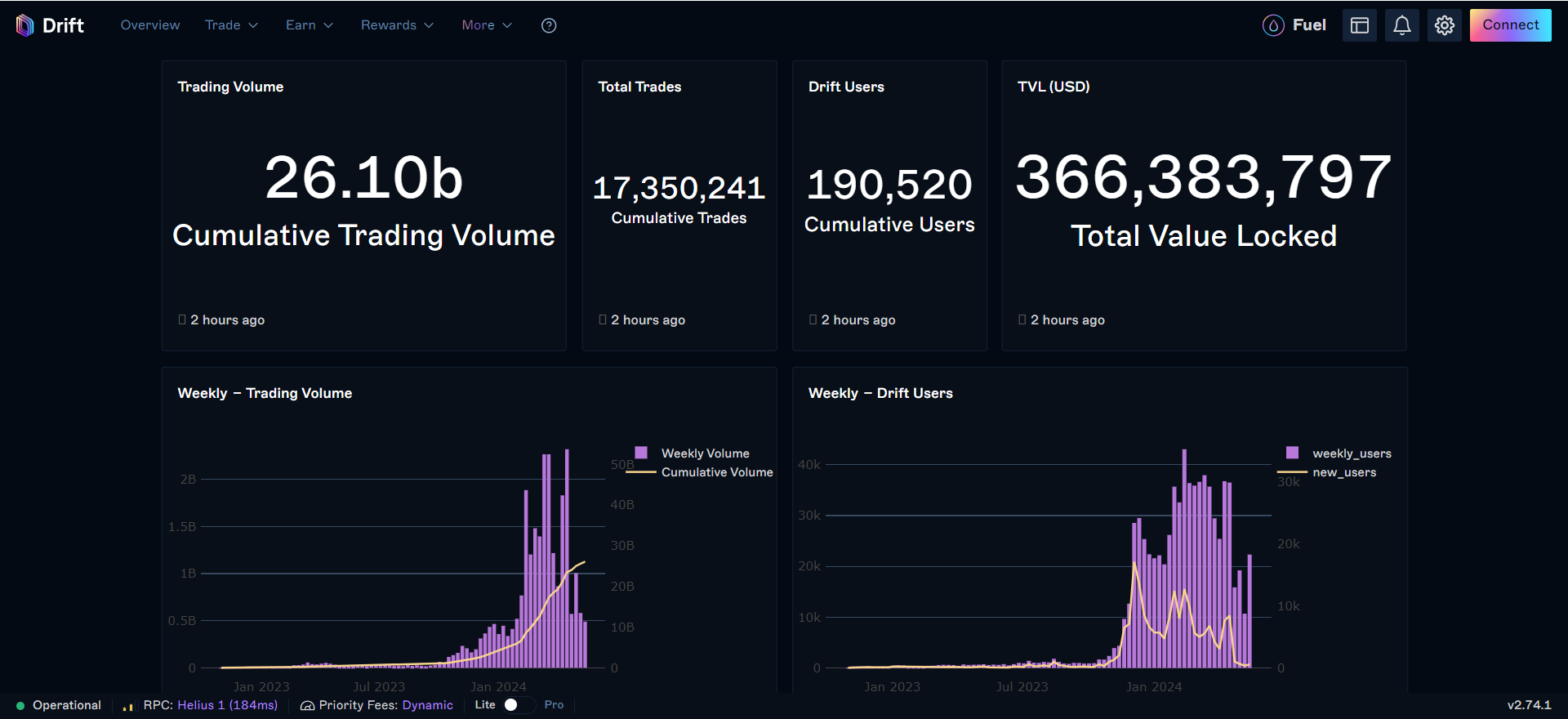

According to official data, Drift Protocol has accumulated a trading volume of $26 billion, processed over 17 million transactions, and attracted over 190,000 users, achieving explosive and sustained growth in the recent period.

Source: Drift

Drift Protocol's project advisor, Arthur Hayes, is the CFO of BitMEX and the CIO of Maelstromfund. Drift has also attracted capital attention, securing two rounds of funding. The seed round raised $3.8 million from investment institutions including Multichain Capital and Jump, while in October 2023, Drift secured $23.5 million in Series A funding from undisclosed institutions.

Core Mechanism of Drift Protocol

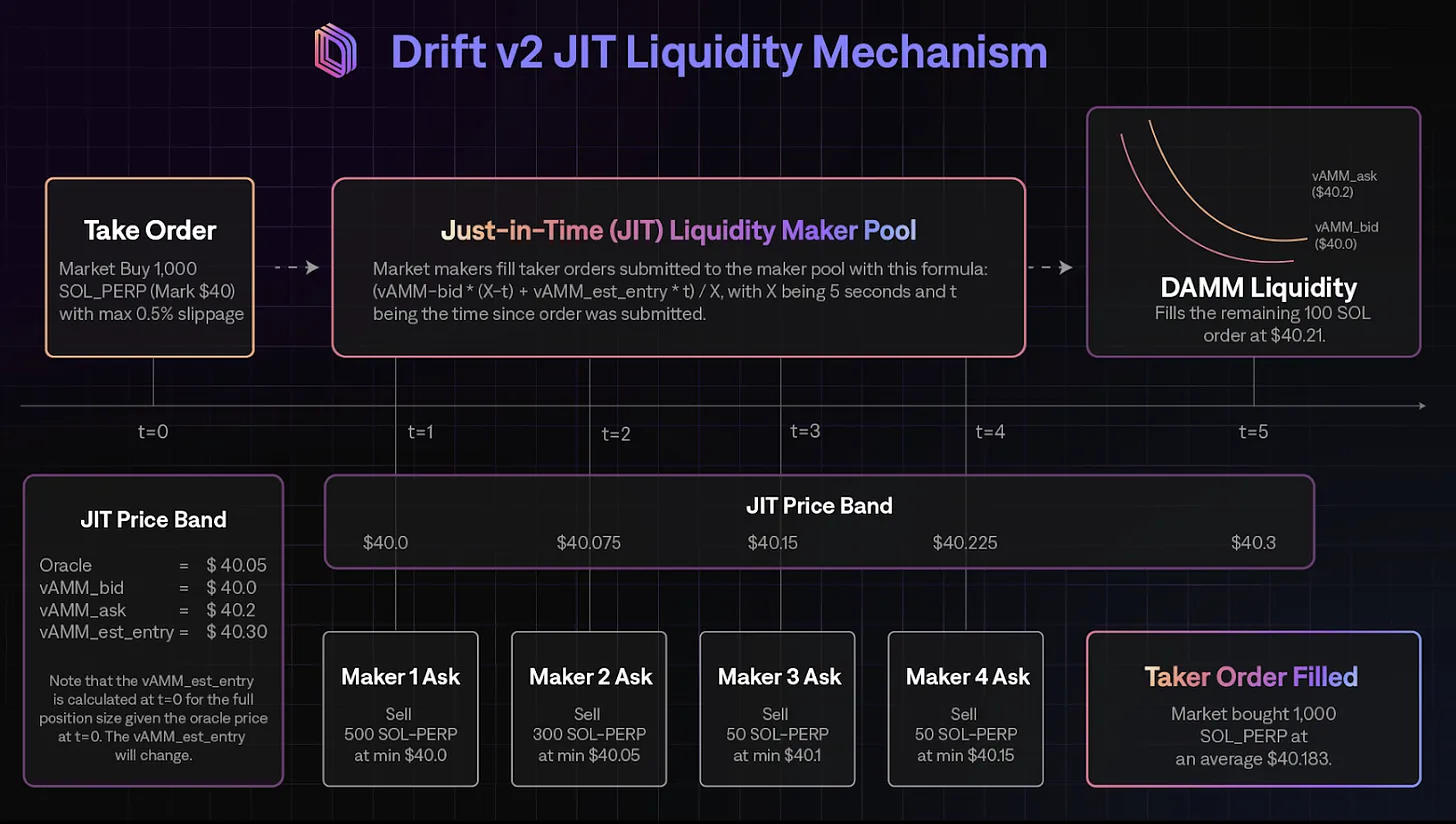

Different from common on-chain derivative trading solutions represented by Hyperliquid and dYdX, Drift V2 adopts a hybrid liquidity mechanism, integrating and optimizing the two solutions to provide more collateral and reduce risk. Drift Protocol V2 mainly consists of four types of liquidity assurance to provide traders with the best prices when executing orders:

Just-in-Time (JIT) Auction Liquidity

vAMM Liquidity

Decentralized Order Book Liquidity

Market Making Vaults

Just-in-Time (JIT) Auction Liquidity

When a user (taker) submits a market order, it automatically triggers a personalized Dutch auction with specific start and end prices and duration. The auction forces market participants to compete to meet the user's demand at a price better than or equal to the current auction price. If no market maker participates after the initial window (about 5 seconds), the user can complete the transaction on Drift's AMM.

JIT auction is a supplementary liquidity mechanism that allows market makers to provide instant liquidity. Through this "just in time" approach, traders can experience zero slippage in their transactions.

vAMM Liquidity

Drift's vAMM serves as the designated liquidity provider for trading. If a market order is not executed by JIT and meets the trigger price for vAMM execution, the trade will be executed by the vAMM pool.

In Drift V2, it includes Backstop AMM Liquidity (BAL), where users can add liquidity to specific pools and receive a share of the fees. BAL further supplements vAMM liquidity and reduces slippage, improving order execution quality.

vAMM provides continuous liquidity for all traders. Even without external market makers, Drift Protocol can support new markets without relying on external market makers to guide liquidity (although there is additional risk of unsettled P&L immediately available).

The protocol design also incorporates various safeguards, such as limiting risk exposure, effective market making, income pool utilization, and insurance fund rules, to mitigate and isolate risks of individual markets. vAMM requires reliable oracles for the underlying assets of perpetual market spot reference, for example, Drift's SOL-PERP perpetual market will reference the SOL/USD spot oracle for price reference and combine other channels to ensure price accuracy.

Decentralized Order Book Liquidity

Drift's decentralized order book is supported by Keeper Bot robots. Keeper robots are responsible for recording, storing, matching, and executing submitted limit orders. Each Keeper robot has its own off-chain order book. Orders are sorted by attributes such as price, time, and position size. When an order reaches the trigger price, the Keeper submits the trade to counter the DAMM. In return, the Keeper earns trading fees based on a mathematically determined ratio.

If buy and sell orders have exactly the same parameters, the Keeper can match them directly without going through vAMM, maximizing efficiency.

Market Making Vaults

Market Making Vaults is a delta-neutral market making and liquidity provision strategy. By integrating Circuit's Market Making Vaults, Drift Protocol further enhances liquidity and trading experience, capturing more profits for liquidity providers.

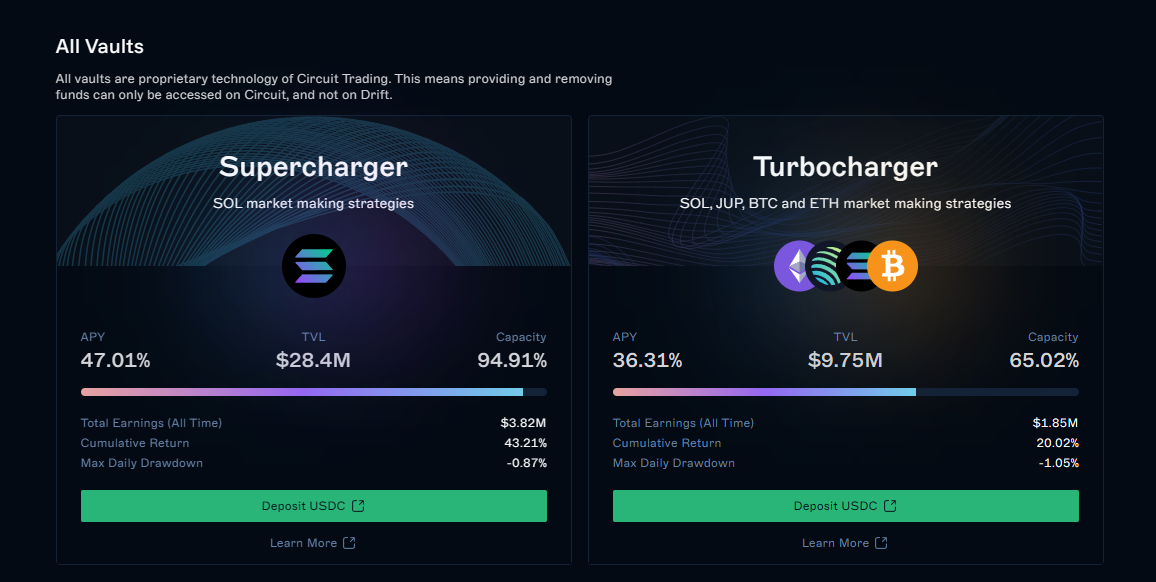

This strategy generates returns unrelated to the overall market performance by hedging the price fluctuations of the underlying assets. Users can deposit USDC into Vaults and earn returns based on the market making activities executed by Circuit on Drift Protocol. Currently, Supercharger Vaults APY reaches 47.06%, and Turbocharger Vaults APY is 36%.

Introduction to Drift Protocol Features

Perpetual Trading

Open the official website and log in using the Phantom wallet.

After logging in, you can enter the perpetual contract trading interface. First, you need to activate your account and deposit assets. Click "Depoist" on the page to activate. Activating the account requires a small amount of SOL.

You can switch between the professional version "pro" and the lite version "Lite" at the bottom left of the page, and also set RPC and trading gas settings.

After depositing assets, you can select the trading pair, enter the price, and leverage to place an order. The maximum leverage ratio currently can reach up to 20x. The trading pairs include most mainstream currencies.

Spot Margin Trading

Select "Trade—Spot" from the top-left menu to enter the spot margin leverage trading page. Drift provides a maximum leverage ratio of 5x, and for stablecoin pairs like USDT-USDC, it offers a maximum leverage ratio of 10x.

By default, the margin is not enabled and users who want to use leverage can enable the margin mode through settings. Before enabling the margin mode, you need to set up a sub-account. The funds in each sub-account are independent and do not affect the main account or other sub-accounts. The activated funds will be refunded when the activated sub-account is deleted.

Click the settings icon in the top right corner to enter the Settings page, then select Margin/Leverage to make the settings.

After completing the settings, you can choose the corresponding leverage ratio for margin trading.

Swap Trading

Drift Protocol also provides Swap spot trading in cooperation with Jupiter. Similarly, Swap trading can also provide a maximum leverage ratio of 5x and requires the opening of a sub-account.

Insurance Fund and Market Maker Fund

By depositing funds into the insurance fund, users can earn fees from perpetual trading, borrowing, and liquidation, ensuring the protocol's solvency. Pledgers can receive rewards from the income pool, with the current USDC APR yield reaching around 37%.

The Market Maker Fund is a delta-neutral market maker and liquidity provision strategy provided by Circuit, significantly increasing investors' yield, with a 7-day redemption period for deposited funds.

Drift Draw Rewards

Drift Draw is a lottery activity where Takers can receive up to 10 tickets for every $1 traded. A draw takes place every Monday at 2:00 PM UTC, and one of the three prize pools is randomly selected to distribute to the winning users. Three lucky users will be randomly selected to win the top prize, and an additional 30 users will receive special consolation prizes. The current prize pool for the next draw is as high as $280,000.

Token Economics

The primary purpose of the DRIFT governance token is to give Drift users actual ownership of the protocol and provide them with rights such as speaking and voting in the future development of the Drift DAO. By distributing power and decision-making throughout the ecosystem rather than centralizing it, Drift ensures sustainable and healthy development with the most active participants.

The total supply of DRIFT is 1 billion, with 53% allocated to the community, including 43% for ecosystem development and trading rewards, and 10% for Launchpad airdrops; 25% for protocol development; and 22% for protocol contributors.

On May 16th, $DRIFT officially started its airdrop, distributing 120 million tokens to over 150,000 early users and supporting users to stake $DRIFT in the protocol as collateral. The airdrop deadline is August 17, 2024. The launch of the $DRIFT token has garnered widespread attention in the industry, and the token $DRIFT has already been listed on mainstream CEX exchanges such as Coinbase, Gate.io, KuCoin, and Huobi.

Potential of Drift in the Future

The recovery and continued prosperity of the Solana ecosystem have brought more liquidity and users to the chain, as well as increased trading demand. According to Coingecko's data, 4 out of the top ten DEXs are native to the Solana ecosystem, with Jupiter, Orca, and Raydium ranking first, third, and fourth, respectively. This indirectly reflects that on-chain trading on Solana has surpassed ETH, becoming the most active public chain.

By adopting a core mechanism that integrates liquidity, Drift Protocol has already demonstrated its enormous potential, achieving significant increases in TVL, trading volume, and user numbers. Currently, Drift is the leading derivatives protocol on Solana in terms of TVL and trading volume. In the future, Drift is likely to become the liquidity layer for the entire Solana ecosystem, powering the ecosystem.

Furthermore, Drift's support for the Solana ecosystem has been very rapid. Currently, popular tokens in the Solana ecosystem such as WIF, W, TNSR, and KMNO can all be traded as contracts on Drift. This also indirectly indicates that Drift's support for popular tokens in the Solana ecosystem has been very fast, and this ability to keep pace with the market is a key factor in achieving rapid user growth. As the bull market arrives, the cryptocurrency market will once again experience rapid growth, presenting an important opportunity for Drift to achieve a breakthrough.

Final Thoughts

The bull market is just beginning, and in the future, leveraging Solana's efficient and low-cost infrastructure, as well as the active on-chain users and trading, Drift will continue to capture more liquidity and trading demand, grow strongly with the entire ecosystem, and even surpass EVM-based derivatives protocols, although this is yet to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。