Preface

For a long time, the power of the global financial system has been held by a few institutions, while the core idea of cryptocurrency is to return this power to the public. This mission extends beyond the financial sector to various industries and applications in the Web3 ecosystem, such as gaming and art. Although the community is the cornerstone of this movement, many Web3 projects face challenges in long-term community rewards, leading to the eventual collapse of the projects.

In recent years, more and more projects have begun to focus on community rewards, recognizing the crucial importance of an active community for success. However, many of these projects still fail for three main reasons:

Ponzi scheme: relying on the continuous influx of newcomers, once new entrants stop joining, the token value will collapse.

Lack of actual value generation: relying solely on transaction fees of the token itself cannot create real value.

Lack of real-world rewards: the key to maintaining long-term community loyalty lies in the lack of visible real-world rewards in daily life.

With the development of blockchain technology and the improvement of regulatory systems, we are ready to introduce Real World Assets (RWA) into the Web3 ecosystem and use them to address the above pain points. Institutional investors are rapidly entering the Web3 field, with giants like Blackrock and HSBC leading the way. The blockchain industry is now more transparent, more regulated, and less volatile than ever before. The introduction of RWA brings new opportunities to the Web3 ecosystem, solving the problem of the lack of exponential growth in asset tokenization.

The project to be introduced in this article, Lingo, combines the real value generation of RWA with the exponential growth characteristics of token economics. By combining the mechanism of real value generation with a global partner reward ecosystem, Lingo is committed to providing a more exponential, user-friendly, and rewarding Web3 experience.

1. Basic Information

Lingo is the world's first community reward token, supported by real-world assets that generate real value for the ecosystem in a sustained and exponential manner.

1.1 Project Information

Project Name: Lingo

Official Website: https://lingocoin.io/

Twitter: https://x.com/lingocoins (171K followers)

Discord: https://discord.com/invite/lingo (95.3K members)

Litepaper: https://lingo.gitbook.io/litepaper

1.2 Token Information

Token Name: LINGO

Current Valuation: $300 million

The $LINGO token is the native token of Lingo, built on Base and Solana.

$LINGO is primarily a utility token and will also become a governance token later. Its purpose is to reward users with real-world rewards and vote for the next reward pool.

Users will have various ways to obtain $LINGO tokens:

- Upcoming airdrop events -> Please make sure to follow us on X to be the first to join

- Private round

- Community round (more details coming soon)

- Initial Exchange Offering (IEO)

2. Background of Lingo Project

2.1 Team Background

Lingo was founded by HM Rawat and David Amsellem, who previously created the globally leading high-end loyalty company John Paul, which was acquired by Accor Hotel Group for $150 million in 2016.

The Lingo team consists of former executives from companies such as Binance, Consensys, Booking.com, and CA Bank.

2.2 Financing and Partnerships

According to official information, the project achieved the following significant progress in mid-2023:

- Raised over $5.5 million in a bear market, with zero marketing budget.

- Signed contracts with over 100 Web3 Key Opinion Leaders (KOLs) and over 100 social celebrities, totaling over 300 million fans and a contract value of over $30 million.

- Secured second place in the Dubai World Blockchain Summit pitch competition.

- Confirmed partnerships with top CEX.

3. Business Value of Lingo

3.1 Pain Points of Web 3 Projects

Many Web3 projects fail to sustainably reward their communities, with the main issues being:

- Lack of genuine value creation in the token ecosystem.

- Communities lacking sustained rewards.

- Lack of incentive mechanisms to maintain community loyalty in the long term.

3.2 Solutions and Business Model of Lingo

Lingo drives a reward ecosystem supported by real-world assets generating cash flow, creating a sustainable growth value loop model.

- Real value is driven by a reward ecosystem supported by real-world assets generating cash flow.

- Exponential model: Lingo's reward model is not a vicious cycle but a virtuous one, aimed at creating continuously growing value over time.

- Real-life rewards: Sustained rewards that can be experienced in real life, from vacations to shopping to monthly tickets, etc.

Specific methods:

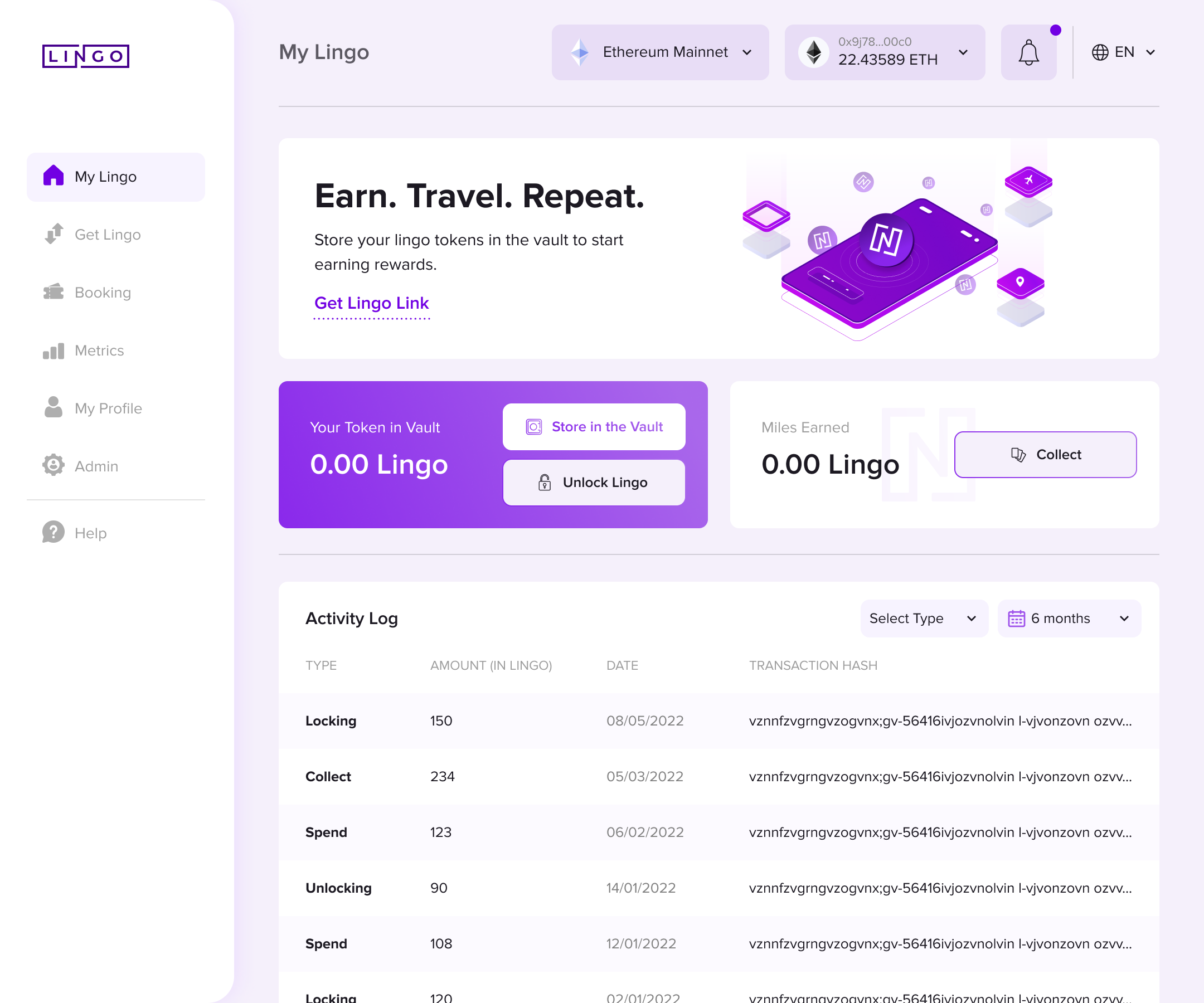

Lingo tokens have a fixed supply, and the fees generated from transactions are used to purchase cash flow assets (such as real estate). The income from these assets is used to repurchase Lingo tokens monthly and distribute them to the community in the form of loyalty points, which can be redeemed for rewards such as vacations, shopping, and tickets.

This creates a positive feedback loop:

- People claim free rewards in real life through a dedicated application.

- Naturally attract a larger community.

- Stimulate trading volume.

- Generate more fees.

- Purchase more real-world assets.

- Increase monthly repurchase pressure.

- Provide more rewards for the community.

In summary, Lingo generates permanent purchasing pressure through monthly repurchases, benefiting token holders. The real game-changer comes from the flywheel model: as the community grows and the trading of Lingo tokens increases, Lingo's real estate investment portfolio grows year by year.

Through these real estate investments, Lingo aims to maintain an ecosystem centered around Lingo tokens, using the returns from these investments to support the value of Lingo tokens through regular repurchases and to maintain a stable and robust economy within its platform, thereby achieving sustainable expansion. The existence of Lingo's model is to reward its community members.

3.3 How Lingo Generates Value

Lingo's value creation system is supported by RWA, such as short-term rentals and hotels. These assets generate income from their operations, which is used to drive the reward system.

Lingo selects RWA portfolios based on three main criteria:

- World-class cities and regions: Targeting major cities such as Paris, Dubai, Miami, etc.

- Long-term stable yield: Average target of 6%.

- Optimization for short-term rentals (ideally 7-9%, to increase practical value).

Preface

For a long time, the power of the global financial system has been held by a few institutions, while the core idea of cryptocurrency is to return this power to the public. This mission extends beyond the financial sector to various industries and applications in the Web3 ecosystem, such as gaming and art. Although the community is the cornerstone of this movement, many Web3 projects face challenges in long-term community rewards, leading to the eventual collapse of the projects.

In recent years, more and more projects have begun to focus on community rewards, recognizing the crucial importance of an active community for success. However, many of these projects still fail for three main reasons:

Ponzi scheme: relying on the continuous influx of newcomers, once new entrants stop joining, the token value will collapse.

Lack of actual value generation: relying solely on transaction fees of the token itself cannot create real value.

Lack of real-world rewards: the key to maintaining long-term community loyalty lies in the lack of visible real-world rewards in daily life.

With the development of blockchain technology and the improvement of regulatory systems, we are ready to introduce Real World Assets (RWA) into the Web3 ecosystem and use them to address the above pain points. Institutional investors are rapidly entering the Web3 field, with giants like Blackrock and HSBC leading the way. The blockchain industry is now more transparent, more regulated, and less volatile than ever before. The introduction of RWA brings new opportunities to the Web3 ecosystem, solving the problem of the lack of exponential growth in asset tokenization.

The project to be introduced in this article, Lingo, combines the real value generation of RWA with the exponential growth characteristics of token economics. By combining the mechanism of real value generation with a global partner reward ecosystem, Lingo is committed to providing a more exponential, user-friendly, and rewarding Web3 experience.

1. Basic Information

Lingo is the world's first community reward token, supported by real-world assets that generate real value for the ecosystem in a sustained and exponential manner.

1.1 Project Information

Project Name: Lingo

Official Website: https://lingocoin.io/

Twitter: https://x.com/lingocoins (171K followers)

Discord: https://discord.com/invite/lingo (95.3K members)

Litepaper: https://lingo.gitbook.io/litepaper

1.2 Token Information

Token Name: LINGO

Current Valuation: $300 million

The $LINGO token is the native token of Lingo, built on Base and Solana.

$LINGO is primarily a utility token and will also become a governance token later. Its purpose is to reward users with real-world rewards and vote for the next reward pool.

Users will have various ways to obtain $LINGO tokens:

- Upcoming airdrop events -> Please make sure to follow us on X to be the first to join

- Private round

- Community round (more details coming soon)

- Initial Exchange Offering (IEO)

2. Background of Lingo Project

2.1 Team Background

Lingo was founded by HM Rawat and David Amsellem, who previously created the globally leading high-end loyalty company John Paul, which was acquired by Accor Hotel Group for $150 million in 2016.

The Lingo team consists of former executives from companies such as Binance, Consensys, Booking.com, and CA Bank.

2.2 Financing and Partnerships

According to official information, the project achieved the following significant progress in mid-2023:

- Raised over $5.5 million in a bear market, with zero marketing budget.

- Signed contracts with over 100 Web3 Key Opinion Leaders (KOLs) and over 100 social celebrities, totaling over 300 million fans and a contract value of over $30 million.

- Secured second place in the Dubai World Blockchain Summit pitch competition.

- Confirmed partnerships with top CEX.

3. Business Value of Lingo

3.1 Pain Points of Web 3 Projects

Many Web3 projects fail to sustainably reward their communities, with the main issues being:

- Lack of genuine value creation in the token ecosystem.

- Communities lacking sustained rewards.

- Lack of incentive mechanisms to maintain community loyalty in the long term.

3.2 Solutions and Business Model of Lingo

Lingo drives a reward ecosystem supported by real-world assets generating cash flow, creating a sustainable growth value loop model.

- Real value is driven by a reward ecosystem supported by real-world assets generating cash flow.

- Exponential model: Lingo's reward model is not a vicious cycle but a virtuous one, aimed at creating continuously growing value over time.

- Real-life rewards: Sustained rewards that can be experienced in real life, from vacations to shopping to monthly tickets, etc.

Specific methods:

Lingo tokens have a fixed supply, and the fees generated from transactions are used to purchase cash flow assets (such as real estate). The income from these assets is used to repurchase Lingo tokens monthly and distribute them to the community in the form of loyalty points, which can be redeemed for rewards such as vacations, shopping, and tickets.

This creates a positive feedback loop:

- People claim free rewards in real life through a dedicated application.

- Naturally attract a larger community.

- Stimulate trading volume.

- Generate more fees.

- Purchase more real-world assets.

- Increase monthly repurchase pressure.

- Provide more rewards for the community.

In summary, Lingo generates permanent purchasing pressure through monthly repurchases, benefiting token holders. The real game-changer comes from the flywheel model: as the community grows and the trading of Lingo tokens increases, Lingo's real estate investment portfolio grows year by year.

Through these real estate investments, Lingo aims to maintain an ecosystem centered around Lingo tokens, using the returns from these investments to support the value of Lingo tokens through regular repurchases and to maintain a stable and robust economy within its platform, thereby achieving sustainable expansion. The existence of Lingo's model is to reward its community members.

3.3 How Lingo Generates Value

Lingo's value creation system is supported by RWA, such as short-term rentals and hotels. These assets generate income from their operations, which is used to drive the reward system.

Lingo selects RWA portfolios based on three main criteria:

- World-class cities and regions: Targeting major cities such as Paris, Dubai, Miami, etc.

- Long-term stable yield: Average target of 6%.

- Optimization for short-term rentals (ideally 7-9%, to increase practical value).

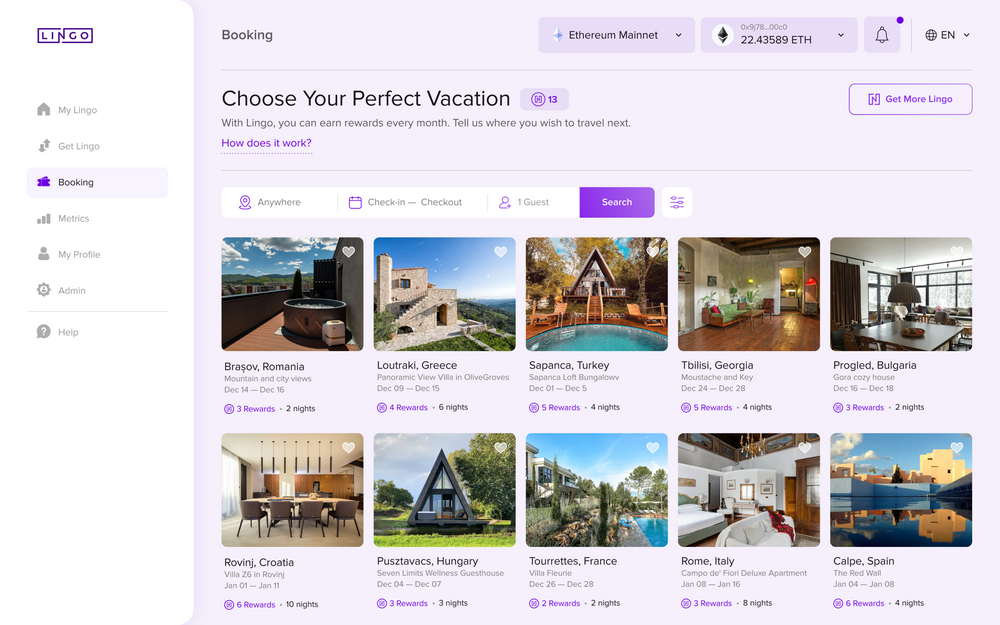

4. Introduction to Lingo's Products

4.1 Key Product Features

Lingo's platform will have the following core features:

- Mortgage platform with Web2 and Web3 authentication

- Automatic distribution of rewards driven by real-world assets

- Integrated reward store, including shopping, booking engine (over 100,000 hotels), and experiences

- Direct booking of rewards using the platform's native token

- Enhanced reward experience through gamification system

Booking System

Lingo will develop a dAPP for hotel bookings. The first version will integrate over 100,000 hotels worldwide, available for booking using $LINGO.

Revenue System

Revenue is supported by the RWA system and can be viewed and managed within the system.

Security and Others

Lingo's smart contracts have undergone comprehensive auditing by Hacken, with an overall score of 9.5/10 and a security score of 10/10.

In the next product iteration, Lingo plans to create a DAO to allow the community to vote to support future real estate investments and rewards.

5. How to Participate in Lingo

Lingo Airdrop Event

Lingo has launched an airdrop event, offering various flight tickets and token rewards, with a simple way to participate.

They have launched the Airdrop Islands page, a relatively mature gamified airdrop. The page features 5 unique islands, where completing tasks earns points to earn LINGO tokens.

- Participation link: https://lingoislands.com/?invite=1P0LH

- Verify Twitter and email on Ape Rock to receive a boarding pass and enter the airdrop game. Complete tasks on other islands to earn points.

- Every account with a boarding pass is eligible for the whitelist of Lingo's public presale.

6. Operational Updates

6.1 Roadmap

1-3 years:

- Establish a top-tier Web3 reward community (target: 300,000, current: 130,000).

- Integrate 100,000 hotels in the reward store.

- Achieve listing on Tier-1 exchanges.

- Enlist mainstream celebrities (over 100 individuals).

- Introduce gamification mechanisms in the reward store.

- Create a DAO for RWA and reward decisions.

3-5 years:

- Expand the reward model to airlines, clubs, shopping, etc.

- Introduce a cashback model with ecosystem partners.

- Increase ambassador coverage from 300 million to 1 billion people.

- Attract 1 million Web2 users to join the ecosystem.

5-7 years:

- Diversify RWA into lifestyle acquisitions.

- Launch Lingo B2B rewards in collaboration with top companies.

- Collaborate with global real estate funds to integrate institutional portfolios into Lingo's RWA pool.

- Establish Lingo as the first mainstream brand in the crypto space (Web3's Nike/Redbull).

Other

What is RWA?

RWA (Real-World Assets) refers to the digitization and tokenization of real-world assets such as real estate, precious metals, stocks, and bonds using blockchain technology, enabling these assets to be traded and managed on blockchain networks. The introduction of RWA allows traditional assets to leverage the transparency, security, and decentralization of blockchain, increasing the liquidity and accessibility of assets.

Key features of RWA include:

- Transparency: All transaction records are publicly accessible, increasing the transparency of asset transactions.

- Security: Blockchain technology provides tamper-resistant transaction records, enhancing the security of asset management.

- Liquidity: By tokenizing real-world assets, trading becomes more convenient, increasing the liquidity of assets.

- Accessibility: Through blockchain technology, more people can participate in asset trading and management, reducing entry barriers.

RWA has a wide range of applications, including but not limited to real estate investments, precious metal trading, and stock and bond trading. By introducing these traditional assets to the blockchain, investors are provided with more choices and more efficient trading methods.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。