Author: Karen, Foresight News

The Web3 social trading protocol friend.tech, which once became popular overnight, launched its V2 version during the May Day holiday. Despite the twists and turns experienced by its tokens, with a high opening, a low walk, and then a rebound, friend.tech once again became a hot topic thanks to its new feature, the paid group "Club," unique fee design mechanism, and an LP APY approaching 600% (even reaching 1400% yesterday).

The friend.tech V2 page continues the simple design style. Taking the official website as an example, the top features the Club and creator search box. The left navigation bar includes the wallet, activities, and Chat modules. The wallet displays held ETH, FRIEND, Keys, and mining rewards, among others. The activities page lists the key trading activities of followed creators. The Chat page aggregates Club and creator holders of Keys, facilitating user social interaction.

Core Feature of friend.tech V2: Paid Group Club

The paid group Club is the biggest highlight of friend.tech V2. Building on the monetization of the value of KOLs and creators in V1, it adds Club space, which is equivalent to a paid group. However, those who join the group later need to pay a higher price, and transactions are only supported by the friend.tech platform token FRIEND. Additionally, a 1.5% fee is charged for each transaction (more on this later). Key holders can also vote at any time to elect the chairman of their Club, who is responsible for managing the club and selecting moderators.

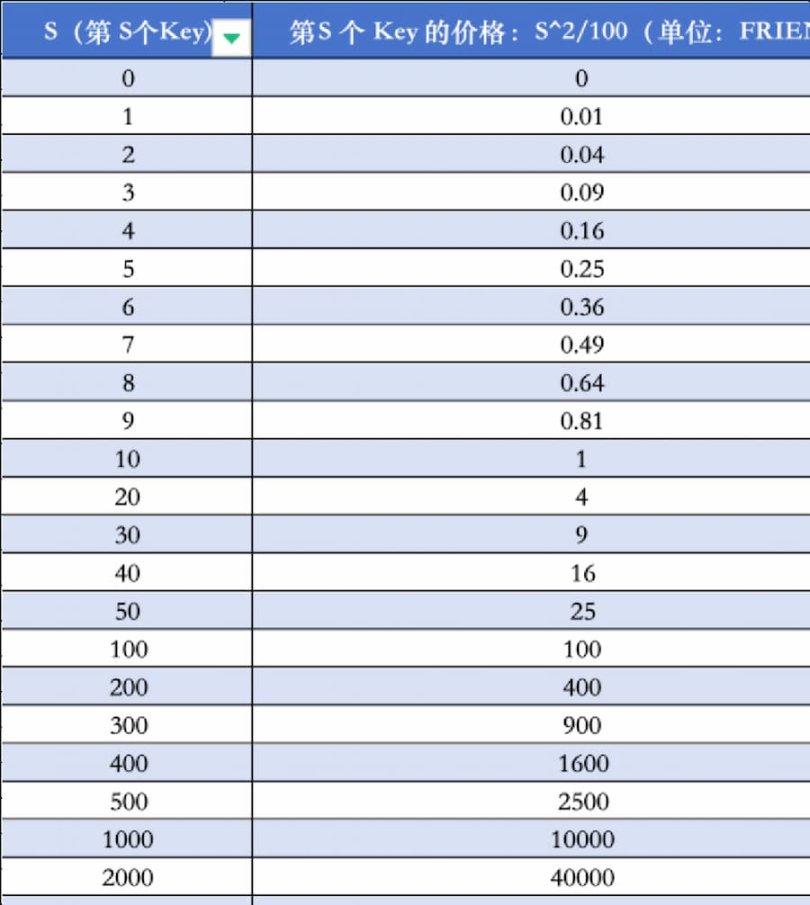

The price of Club Keys follows a specific formula. The price of the next Key is S^2/100 (valued in FRIEND), where S is the current quantity of Keys. The table below shows the price chart when the Sth Key is counted, for readers' reference.

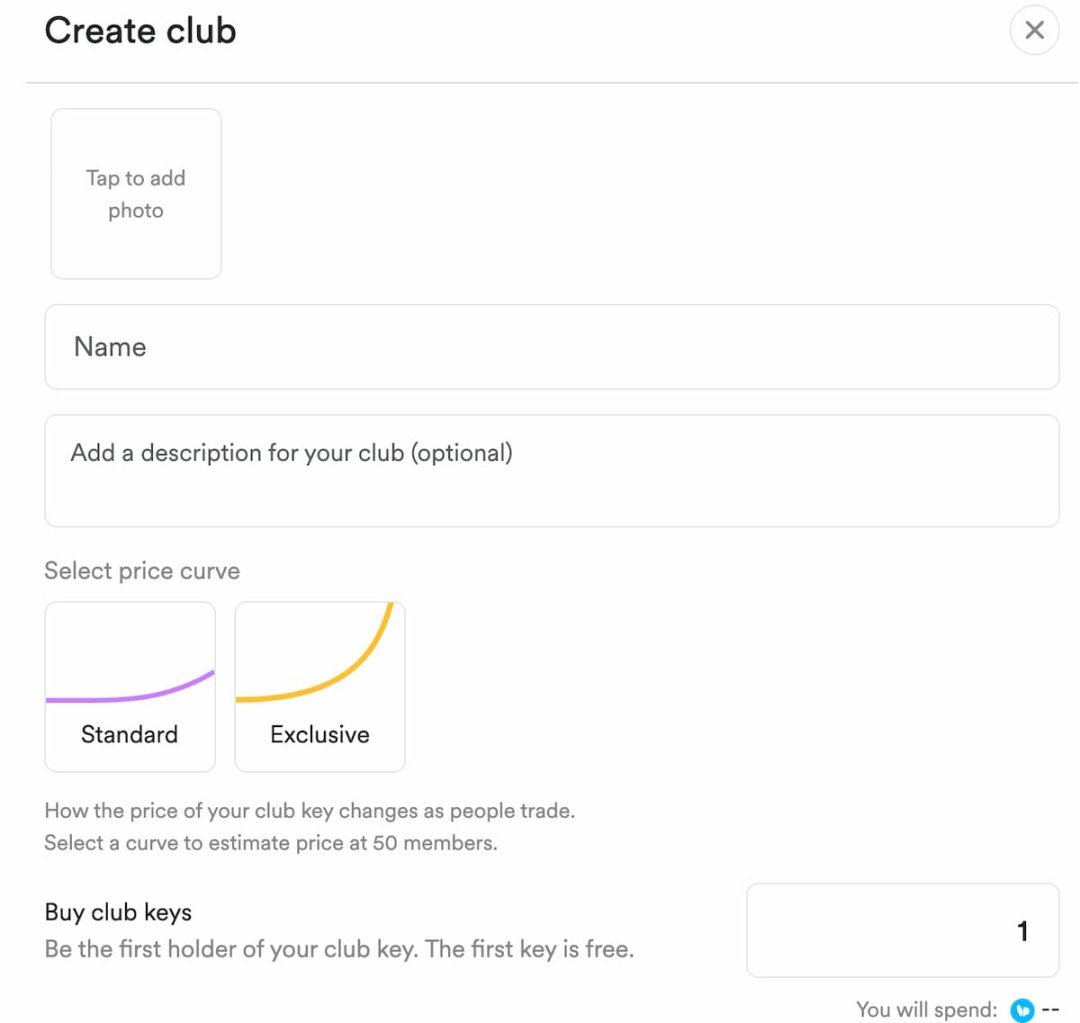

Anyone can create a Club on any topic. When creating, one can choose the standard curve (according to the above formula) or a dedicated curve equivalent to 10 times the standard curve price. If the standard curve is chosen, when a Club's membership reaches 50, the Key price is 25 FRIEND. If the dedicated curve is chosen, the Key price at this point is 250 FRIEND. It is worth noting that different Clubs can have the same name, so extra attention is needed during transactions.

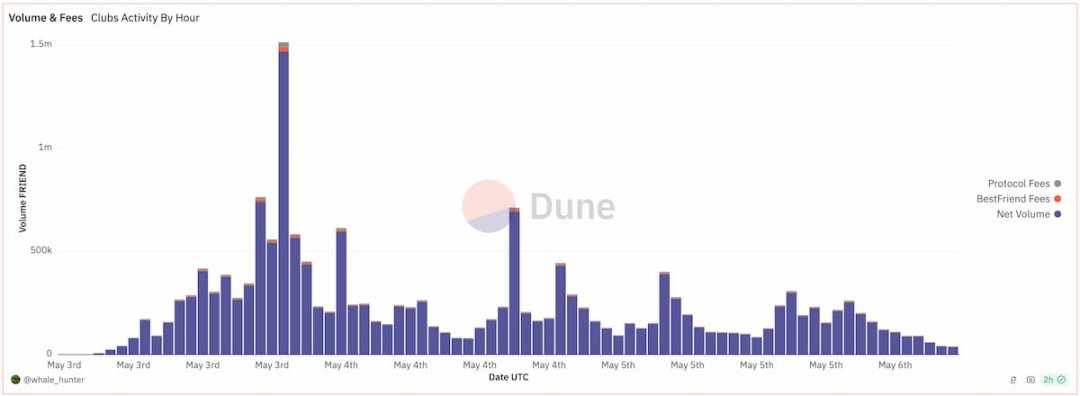

According to Dune data, as of the drafting on May 6th, the number of friend.tech platform Clubs has exceeded 110,000, with over 61,592 Club members, over 450,000 transactions, and a total Club transaction volume close to 17 million FRIEND. Within 24 hours, friend.tech has generated a total fee of $820,000.

Source: Dune

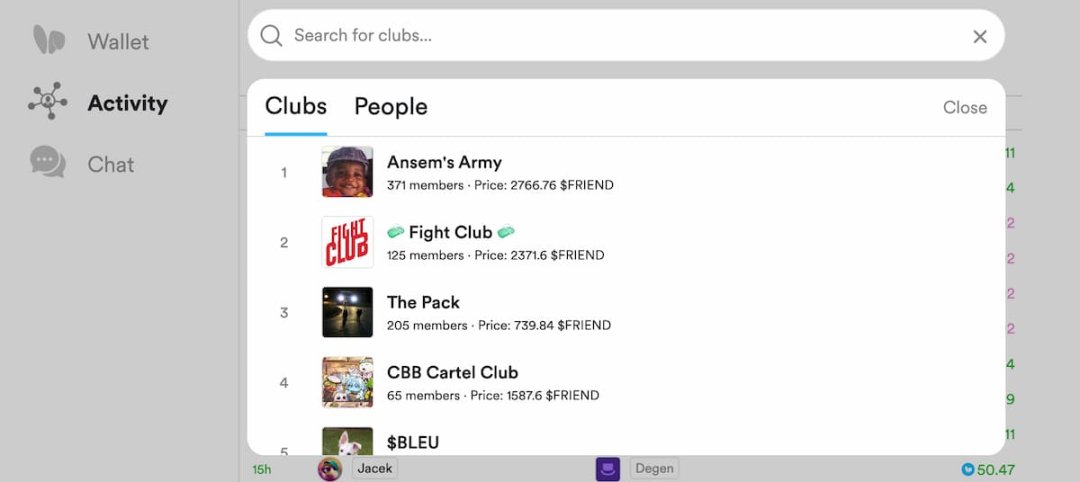

In terms of Club market value, the top two friend.tech Clubs are "Ansem's Army" created by trader Ansem: #59528, with a Key price of 2766 FRIEND and 371 members, and "Fight Club" created by friend.tech founder Racer: #1, with a Key price of 2371 FRIEND and 125 members.

In addition to Clubs, friend.tech has stated that it will also introduce new features such as Keydrops, Memeclubs, and Pinned Rooms to bring users a more diverse social experience. Just the Memeclubs alone is enough to excite and inspire the community.

Platform Economy and Token Distribution

At the time of the V2 airdrop, friend.tech allowed each point to be exchanged for 1 FRIEND. However, initially only 10% of FRIEND could be claimed, and the remaining 90% could be claimed after joining a Club and following 10 people. This greatly incentivizes platform activity in the short term, but has also been criticized by the community.

friend.tech has not enabled token transferability and currently only offers token exchange and FRIEND/ETH liquidity provision services on its own platform (DEX "Bunnyswap" https://www.friend.tech/lp). Due to the very high liquidity provision returns on the friend.tech platform (currently close to 600%), the FRIEND/ETH liquidity currently amounts to nearly $47 million.

On friend.tech, users need to deduct a 1.5% exchange fee when exchanging in the FRIEND/ETH pool, and also need to pay 1.5% when trading Club Keys. These fees are shared by LP providers (in the form of FRIEND). In addition, within the next 12 months, friend.tech will allocate 12 million FRIEND as incentives to LP providers.

Therefore, providing FRIEND/ETH liquidity on friend.tech can yield three types of returns, including a 1.5% exchange fee (current APY is 1071%), a 1.5% Club Key transaction fee (current APY is 202%), and sharing 12 million FRIEND incentives (current APY is 135%).

Regarding token distribution, friend.tech has stated that its investors have agreed to waive the right to sell tokens to users, and the tokens will be controlled by users. This will include the distribution of points from risk investors such as Paradigm to users.

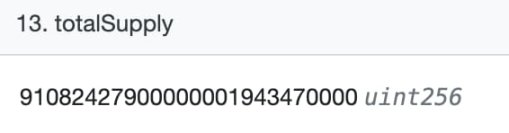

However, friend.tech has not disclosed detailed token supply details, which has also raised questions in the community. According to the BaseScan page, the current maximum total supply is 91,082,420 FRIEND, and the contract details show that the token has no upper limit. The official LP page of friend.tech shows a circulating supply of 79.1 million FRIEND (combining claimed airdropped tokens and token incentive releases), with a circulating market value of $204 million (calculated based on the price of FRIEND at $2.65 at the time of drafting).

However, in August last year, when friend.tech first launched the platform, it announced plans to distribute 100 million points over 6 months (every Friday). Based on the current exchange rate of 1 point for 1 FRIEND, the airdrop amount is 100 million, and then adding the 12 million FRIEND incentives allocated to LP providers over the next 12 months, the total supply is at least 112 million tokens.

Who are the FRIEND holders and LP providers?

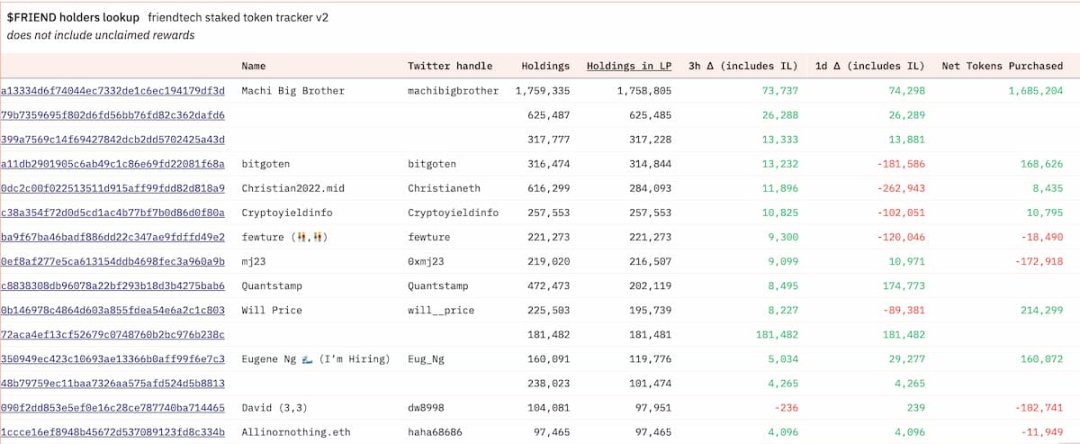

According to Dune data compiled by @willprice, the address providing the most liquidity on friend.tech belongs to Taiwanese singer Huang Licheng, who has provided 1.7588 million FRIEND in liquidity (purchasing nearly 800,000 FRIEND on May 7th for 661 ETH at a price of 2.57). The next is the address starting with 0xe3879b, which provides 625,500 FRIEND in LP and also provides 263 ETH and 42,552 PRIME in Aerodrome ETH/PRIME liquidity. Ranking fourth, fifth, and sixth are users @bitgoten, Christian2022.eth (partner at NextGen Digital Venture), and Cryptoyieldinfo, respectively. NFT KOL dingaling also holds over 410,000 FRIEND but has not yet staked.

What is the upside potential for FRIEND?

In the context of the recent controversy surrounding token airdrops, friend.tech's 100% distribution to the community has been relatively successful, giving FRIEND practical utility in Club payments. It can be imagined that as Clubs increase and develop, the amount of FRIEND tokens paid by users will also increase. These tokens are essentially locked in the system, forming a stable value support. Additionally, friend.tech provides generous rewards for LP, which will also attract more FRIEND token liquidity locking.

As mentioned earlier, friend.tech has not yet enabled token transferability, meaning CEXs have no way to list FRIEND tokens. The only way to obtain FRIEND is to claim the airdrop or buy FRIEND with ETH on the friend.tech platform. Users can also combine FRIEND and ETH to provide LP and earn rewards.

So what would happen if friend.tech enabled token transferability? I believe this would greatly increase the liquidity of FRIEND and further drive FRIEND into a price discovery phase. However, this may also lead to the cancellation of the platform's original 1.5% exchange fee mechanism, thereby reducing LP rewards. However, in the long run, widespread token circulation will help increase its market awareness and value stability.

DeFi researcher Ignas has put forward an insightful point, hoping that FRIEND will not enable transferability, but instead create a wrapped FRIEND, wFRIEND, which exchanges can list without affecting the functionality of the original token. However, I personally believe that fundamentally there won't be much difference, as once wFRIEND is listed on an exchange, on-chain traders can still buy wFRIEND from the exchange and then unwrap it to provide liquidity. Therefore, the key is how friend.tech balances token liquidity, transferability, and platform functionality to achieve long-term value growth for the FRIEND token.

Of course, while observing the trading data for FRIEND, I noticed an interesting sign. In the first two to three days after the token was listed, although the amount of buy orders was significantly higher than sell orders, the number of buy orders was much lower than sell orders. These trades, with individual buy order amounts reaching thousands or even tens of thousands of dollars, were quite common. Based on the 24-hour data from a specific moment on May 5th, although the total transaction amount for buy orders was 15% higher than sell orders, the number of buy orders was 70% lower than sell orders. However, starting from yesterday, there have been multiple buy orders with very small amounts, even less than $0.01, which have balanced the number of buy and sell orders. These trades are likely to be wash trading executed by bots, and the motive behind them is unclear. It's difficult to determine if this is for a specific purpose. This phenomenon undoubtedly adds a hint of mystery and uncertainty to FRIEND. However, as of 5:15 PM on May 7th, the number of buy order participants for FRIEND continues to decrease, accounting for only 1/10 of the sell order participants, with no significant difference in transaction volume.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。