Preface:

This is a non-traditional research report about @babylon_chain, as well as a milk article and warning about BTC restaking. This article was written on the 12th day after the Bitcoin halving, the XXth day of the outbreak of the BTC restaking track, and the XXXth day of the bursting of the BTC restaking bubble.

Without further ado, let's start with the conclusion: The BTC restaking track represented by Babylon will create a huge bubble in the Bitcoin ecosystem, and this restaking revolution originating from the Bitcoin ecosystem will have an impact no less than that of an inscription.

This article is dedicated to the feelings of many leek friends who, like me, want to take advantage of the Bitcoin restaking trend.

I. Causes of the Bubble

1) Transition of BTC from Value Storage to Income-Generating Asset

Since its inception, BTC has been regarded as digital gold for value storage. BTC holders have difficulty in obtaining excess returns such as DeFi, and BTC has become idle assets on the chain.

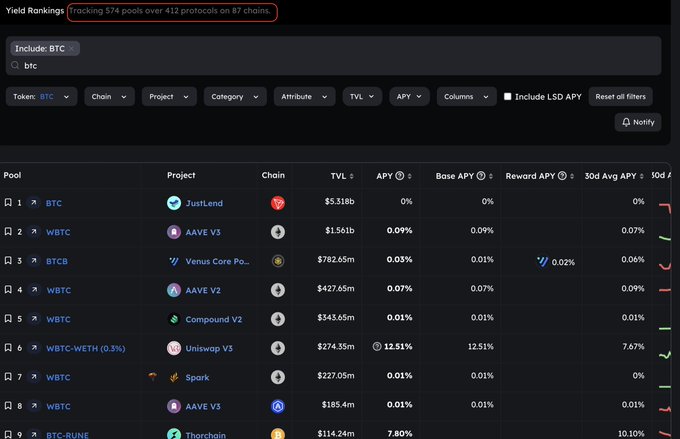

According to Defillama data, currently, the staking BTC is scattered across 87 chains, 412 protocols, and 574 liquidity pools. Without exception, all staking BTC has left the original Bitcoin chain, existing in some form of trust assumption encapsulation and bridging of BTC (such as WBTC, which is currently the most widely used and requires trust in a single entity institution, and BTC on side chains/L2, which requires trust in a multi-signature committee, etc.);

According to data provided by Messari researcher @NikhilChatu, the current scale of staking BTC exceeds $10 billion, with $4 billion earning returns at a rate between 0.01% and 1.25%. Staked BTC implemented through custody solutions all have more or less trust assumptions.

2) Awakening of Non-Custodial Bitcoin Solutions

The centralized custody risk has become a difficult mountain to cross on the path of Bitcoin staking, and non-custodial Bitcoin staking solutions have become a shortcut to cross this mountain. Non-custodial Bitcoin, also known as self-custody Bitcoin solutions, in short, allows BTC to generate income and appreciation without leaving the original Bitcoin chain, encapsulating, cross-chaining, or adding any trust assumptions.

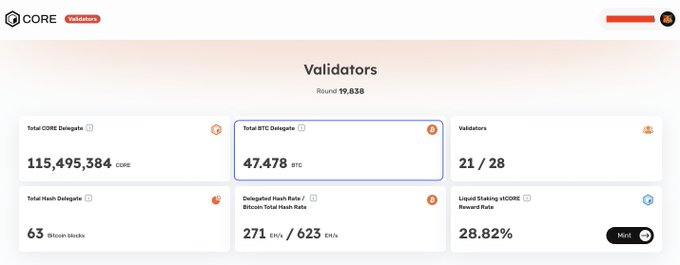

Currently, the only protocol that has achieved non-custodial Bitcoin on the mainnet is @Coredao_Org, while Babylon (another non-custodial Bitcoin staking solution) is in the testing phase and has not yet been launched on the mainnet.

At this point, BTC can achieve asset staking in a way that does not require trust and is more secure, whether it is through BTC staking mining or through restaking to provide security services for PoS subchains.

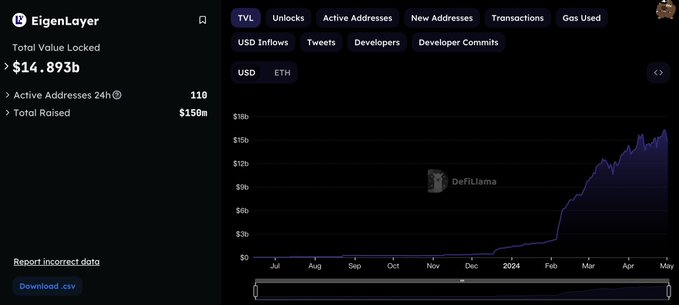

The leading protocol focusing on Ethereum restaking scenarios, @eigenlayer, currently has an on-chain TVL of up to $15 billion, accounting for 5% of Ethereum's circulating market value; with Bitcoin having a market value of over $1 trillion, unlocking 1.5% of it can leverage $15 billion. The non-custodial Bitcoin restaking track is currently a blank slate, like a baby in swaddling clothes, and Babylon, positioned in this track, has unique advantages.

——————Separator——————

However, at the same time, a bubble crisis about BTC restaking is quietly brewing.

The next chapter will explain why we embrace the bubble, and the reasons for considering it a bubble and why the bubble will burst will be discussed in the final chapter of the article.

II. Why Embrace the Known Bubble?

1) Narrative Drive

The main theme of this bull market cycle is the Bitcoin ecosystem, from the narrative of new Bitcoin assets (Ordinals BRC20, Atomicals ARC20, RGB++, Runes, etc.) to the explosion of various Bitcoin Layer 2 solutions (Merlin, Bouncebit, etc.), bringing users such fascinating narratives as new Bitcoin assets and Bitcoin smart contract scenarios. Babylon and CoreDAO bring leeks the narrative of non-custodial Bitcoin staking/restaking, clearly telling leeks that our technology can stake/restake your Bitcoin without transferring control of BTC on the Bitcoin chain, making Bitcoin an income-generating asset. This seed symbolizing love and freedom (enjoying the security and decentralization/trustlessness of the Bitcoin mainnet) begins to take root in the hearts of leeks. The narrative of non-custodial Bitcoin has sufficient appeal, just waiting for a round of Bitcoin sector rotation to irrigate it like spring rain.

CoreDAO has already launched non-custodial BTC staking on the mainnet. Here, let's briefly explain the implementation principle of non-custodial BTC staking using CoreDAO.

Non-custodial BTC, also known as self-custody or native staking, does not encapsulate, cross-chain, or add any trust assumptions to BTC, and relies solely on the native Bitcoin script language for implementation.

The core of the non-custodial BTC staking technology implementation is the application of CLTV time locks.

CLTV: OP_CHECKLOCKTIMEVERIFY (CLTV) is a specific opcode in the Bitcoin script language that allows conditions to be created based on time or block height, and until these conditions are met, Bitcoin cannot be spent from the transaction output.

The specific implementation process is as follows:

Users send Bitcoin from one address to another address with a time lock (the receiving address is derived from the user's main wallet private key, and the user has control over the assets at the address). In addition, the transaction needs to include an op_return output containing the following two pieces of information:

1) The address to which the staker wishes to delegate Bitcoin to CoreDAO's chain validators; 2) The address where the staker wishes to receive CORE token rewards.

After the time lock expires, the user can spend the UTXO.

At this point, native BTC staking is completed. Before the staking period ends, the user cannot spend Bitcoin. By staking natively, BTC participates in the consensus of the CoreDAO chain, providing an opportunity for BTC to earn CORE token rewards in exchange for their contribution to the CoreDAO chain consensus.

Babylon's non-custodial BTC implementation mechanism is similar to CoreDAO's, using time lock technology to set spending conditions and slash conditions for BTC. When users perform "BTC staking" on the Bitcoin mainnet, they are actually delegating BTC to Babylon's validator nodes through time lock technology, providing consensus for the Babylon chain to earn consensus rewards. If the validator nodes act maliciously, the non-custodial BTC, due to the previously set BTC UTXO slash conditions, will be sent to a burn address.

Babylon "upgrades" on the basis of CoreDAO by proposing the concept of BTC restaking. If non-custodial BTC staking can serve the consensus of Babylon, then this consensus service can also be extended to any PoS chain integrated with Babylon. In short, the act of delegating BTC to other PoS chains through Babylon as an intermediary layer to provide consensus services and earn consensus rewards is called Babylon's BTC restaking.

Babylon acts as an intermediary layer between the Bitcoin network and other PoS chains integrated with Babylon, aggregating important transactions on PoS chains (such as staking, unstaking, double spending, transaction review, etc.) and publishing them to the Bitcoin network through timestamps. Based on timestamp services, the time required for PoS chain consensus asset unstaking will be significantly shortened (from weeks to hours).

According to information provided by Messari, Babylon has currently partnered with 45+ projects, including popular Cosmos ecosystem chains such as @cosmoshub, @injective, @SeiNetwork, AI & DePin chains, Bitcoin L2 chains, and more. This means that through Babylon's BTC restaking service, users can have their BTC assets on the Bitcoin chain work in multiple ways (providing consensus services for multiple PoS chains) without leaving the original Bitcoin chain, in a non-custodial and trustless manner, and receive multiple salaries (consensus incentives from different PoS chains).

2) Demand-Driven

The Bitcoin ecosystem has been a continuous narrative in this bull market cycle, from the battle of new Bitcoin ecosystem assets to the hundred-chain war of Bitcoin L2. It is difficult to say that these are driven by actual demand, but rather by the demand driven by hype and conceptual speculation.

The non-custodial BTC restaking track represented by Babylon is closer to a narrative driven by actual demand. BTC has always been considered a reserve of value in the crypto world, but there has not been a widely accepted asset staking solution in the market. The reason for this can be attributed to the lack of sufficiently decentralized, trustless, and secure solutions to achieve BTC DeFi returns.

When Babylon's more decentralized and secure Bitcoin self-custody solution is market-validated as stable and viable, and can earn stable BTC restaking returns, we can make an optimistic assumption. We have reason to believe that large holders will be willing to put their idle BTC in cold wallets to "work and earn money," and the behavior of large holders can also drive FOMO among small retail investors.

3) Institutional-Driven

After discussing narrative-driven and demand-driven factors, let's take a look at Babylon's financing situation.

In December 2023, Babylon announced the completion of a $18 million financing round led by Polychain Capital and Hack VC, with participation from Framework Ventures, ABCDE Capital, IOSG Ventures, Polygon Ventures, and OKX Ventures. In February 2024, Binance Labs announced a round of financing for Babylon, with the specific amount unknown.

From Binance Labs' financing of the BTC restaking track, it can be seen that Babylon is a very important part of Binance's entry into the Bitcoin ecosystem. Binance Labs has announced financing for projects such as Babylon, @StakeStone, @bouncebit, and others. Binance undoubtedly sees the huge potential of this specific track in the Bitcoin ecosystem.

III. Without Exception, the Bubble Will Eventually Burst

The BTC restaking track represented by Babylon is leading the direction of the next narrative in the Bitcoin ecosystem. With multiple driving factors, the bubble will continue to grow, and a massive amount of idle Bitcoin assets will be unlocked. However, the bubble will eventually burst when market sentiment is at its peak, with large holders reaping profits and retail investors waking up from their dreams.

1) Risk Accumulation Under the Nesting Mechanism

As mentioned earlier, through Babylon, BTC restaking can provide consensus services for multiple PoS chains and earn multiple consensus rewards. But risk and return are directly proportional, and for every additional return, there will be an additional slash risk. Under the mechanism of multiple nested slashes, the risk will be infinitely amplified.

2) From Demand-Driven to Demand Slump, Negative Economic Cycle Emerges

The demand for BTC restaking comes from BTC holders being able to earn substantial restaking returns in a more secure manner. During a downward cycle, the decline in the prices of consensus incentive tokens on the consumption chain will lead to a sharp reduction in restaking returns. At this point, there will be a trade-off.

If the potential slash risk is greater than the potential restaking returns, there will be a wave of BTC unstaking, a crisis of trust will spread, large holders will flee, and retail investors will follow suit. Demand will tend to slump, and a negative economic cycle will emerge.

Conclusion

Finally, from an emotional perspective, assuming that Babylon's lifecycle also follows Warren Buffett's famous saying: "Be fearful when others are greedy, and be greedy when others are fearful." At least for now, it is far from the time when others are greedy.

BTC restaking will create an unprecedented bubble in the Bitcoin ecosystem, but before the bubble bursts, please feel free to embrace it.

The content of this article is purely fictional. Any resemblance to actual events is purely coincidental.

End of the article.

Written on the 12th day after the fourth Bitcoin halving.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。