MemeCoin did not completely dominate the bull market in 2021, but it is now gaining popularity. This reflects the increasing internal competition in the cryptocurrency market to attract and retain users' interest. For example, concepts such as NFT, GameFi/SocialFi, etc., although initially more attractive than MemeCoin, ultimately become popular narratives more due to the ability of related projects to address specific market needs and conduct "off-chain user acquisition." Projects such as Axie Infinity and StepN have successfully attracted a large number of non-traditional crypto users into the market through unique earning mechanisms and innovative user interactions. However, the popularity of MemeCoin in this bull market is more "direct."

This shift in market dynamics is also affecting the fields of signal trading and on-chain data analysis. Signal trading and on-chain data analysis are important tools for cryptocurrency investors, providing insights into market dynamics and investor behavior. By utilizing these technologies, investors can gain a competitive advantage and make wiser decisions based on real-time data and actionable signals. They not only enhance investors' ability to discover trends and manage risks but also overall promote the exploration of hidden opportunities in the fast-paced cryptocurrency market.

This Bing Ventures article will introduce various analytical tools, covering primary market information platforms, secondary market sentiment analysis, and trading opportunity tools, and summarize the development trends they embody. Overall, we believe that the innovative direction at the tool level must be closely integrated with user interfaces and market access strategies. In the long run, protocols that can create real user value and promote widespread adoption through unique social dynamics and financial incentive mechanisms may dominate the market. For example, integrating elements of artificial intelligence and new user interaction modes may be key directions for future innovation, which can not only enhance user experience but also attract new market participants by creating unprecedented value.

Primary Market Tools

RootData

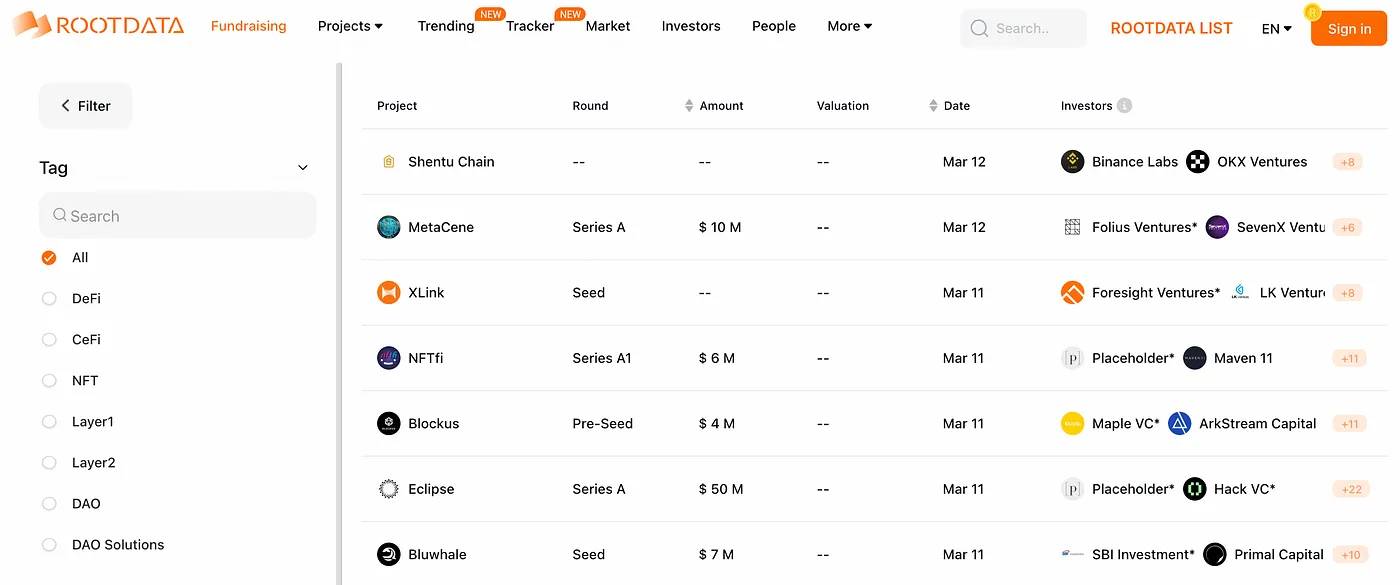

Funding Situation

RootData collects information on all market funding activities and ensures real-time updates of the information. Users can also choose to observe the funding performance of specific sectors based on different sectors.

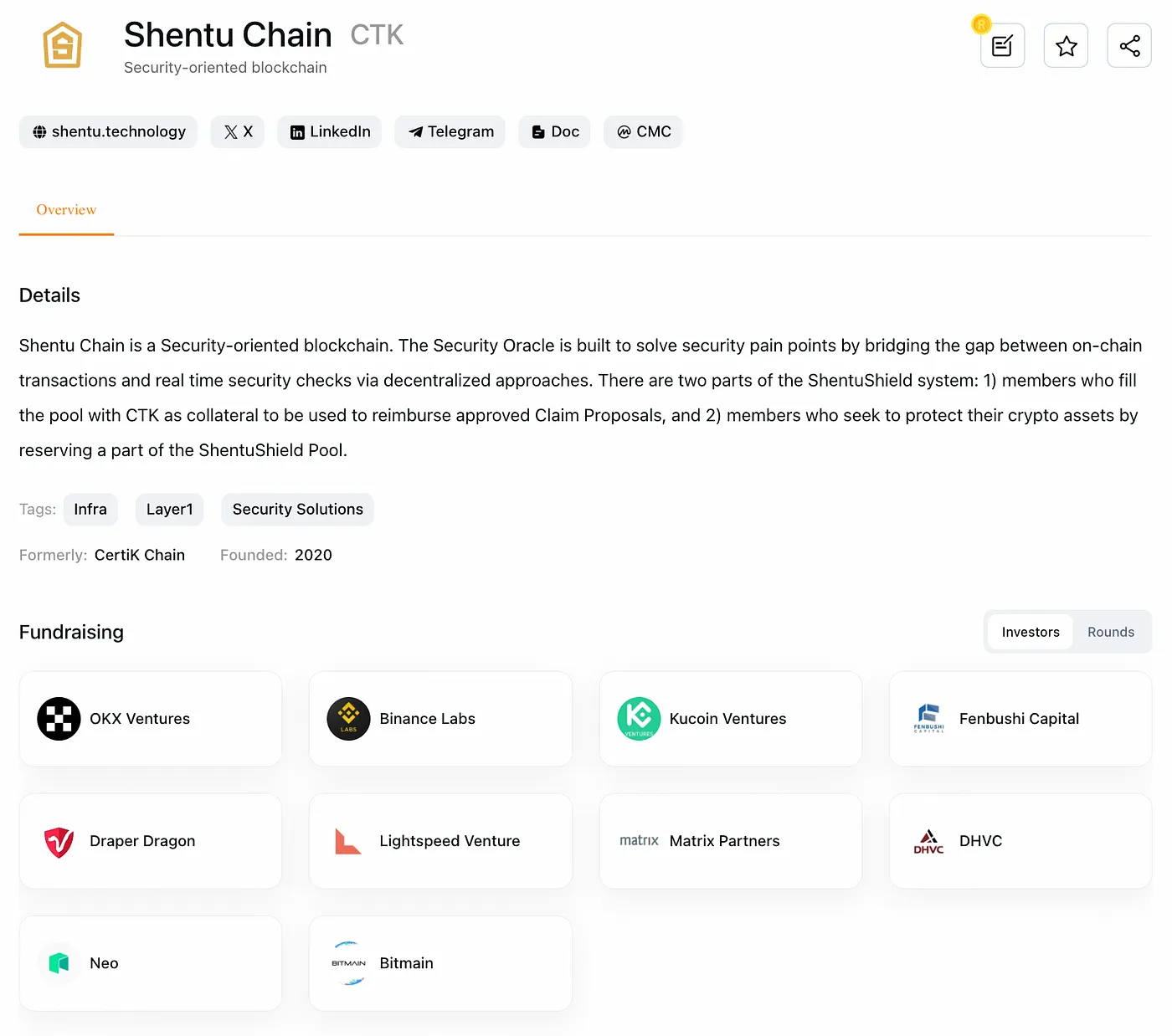

After entering the project interface, users can view detailed funding performance of the project, including which venture capital institutions have invested.

The interface has various filtering conditions, allowing users to select projects based on their own criteria such as progress, funding size, region, etc.

Signal Trading

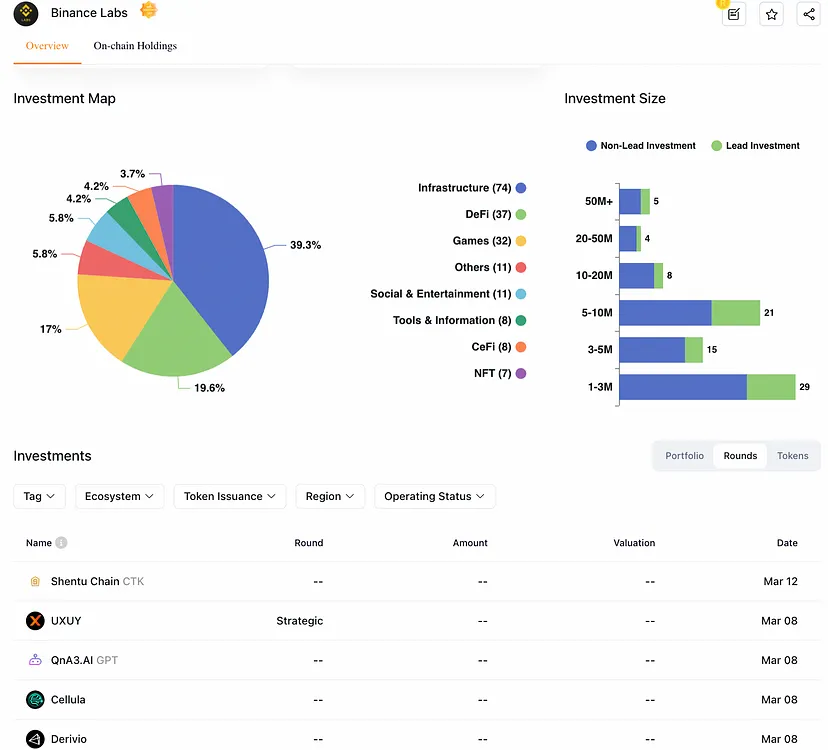

Users can judge or predict where the future market focus may be by viewing the investment intentions and trends of venture capital institutions in the current market.

Users can further understand the investment situation of various venture capitals, including their investment distribution and past projects they have invested in.

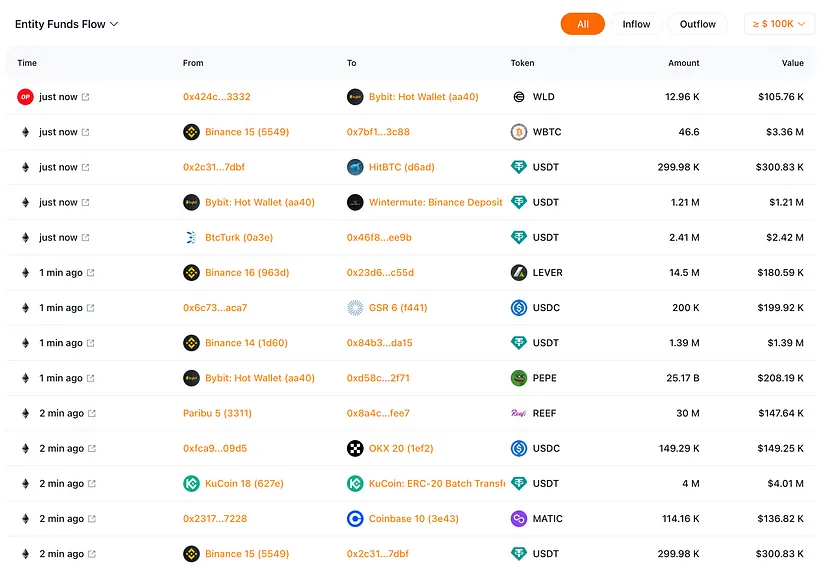

Institutional Wallet Transfer Situation

RootData also records the wallet transaction records of various entities (including: venture capital, exchanges, market makers, etc.), allowing users to understand the flow of funds of institutions through this information.

Signal Trading

The transfer of funds by institutions usually hides specific meanings or information. For example, DWF Lab, as both a venture capital and a market maker, often experiences violent price increases in projects it collaborates with. If a project is observed to deposit coins into DWF Lab's address, this is likely a strategic investment by DWF Lab; while if DWF Lab's address deposits coins into an exchange, it is likely a sign of reducing positions after the price increase. By analyzing these fund flows, market strategies and intentions can be revealed.

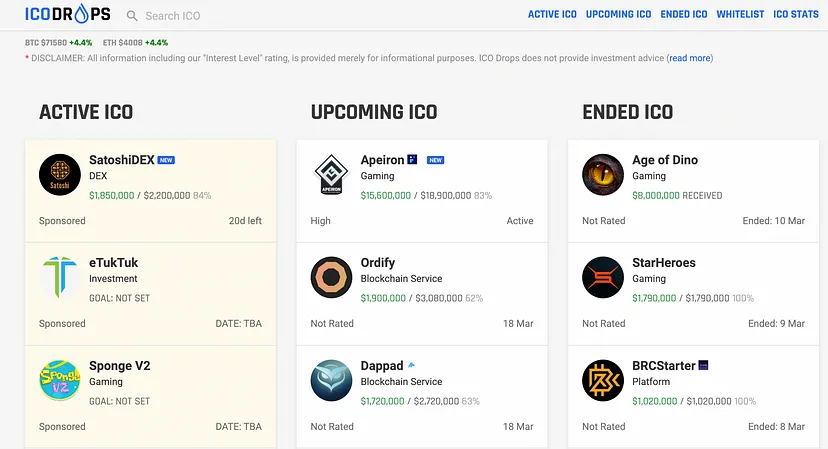

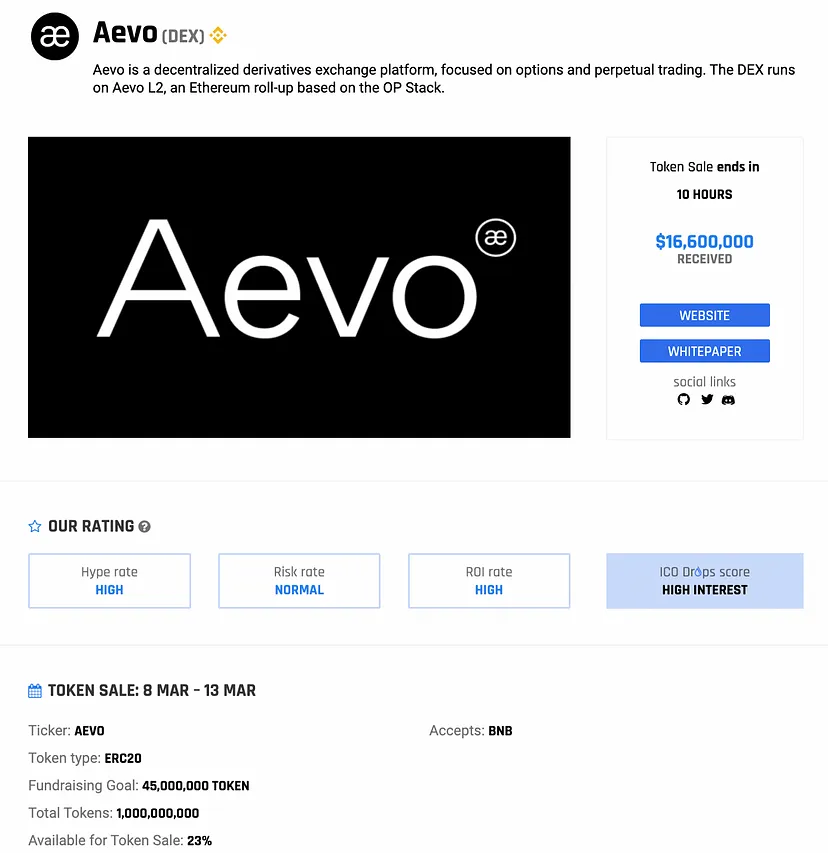

ICODrops

ICO Situation

ICODrops basically covers the ICO situation of future, current, and ongoing projects.

By entering the project page, users can view the token sale situation, including the sale time, some basic token economics information, and the allocation of the presale quota, etc.

Signal Trading

Essentially, ICO Drops allows users to view various primary market projects and gives them the opportunity to participate in whitelist lotteries, gaining access to the same primary market opportunities as venture capitalists.

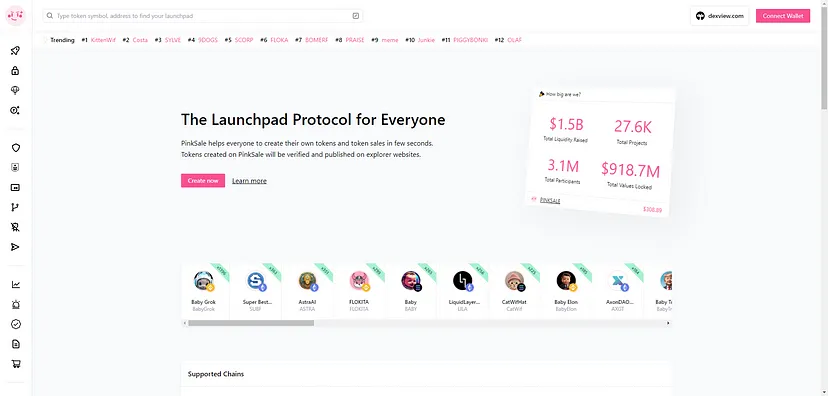

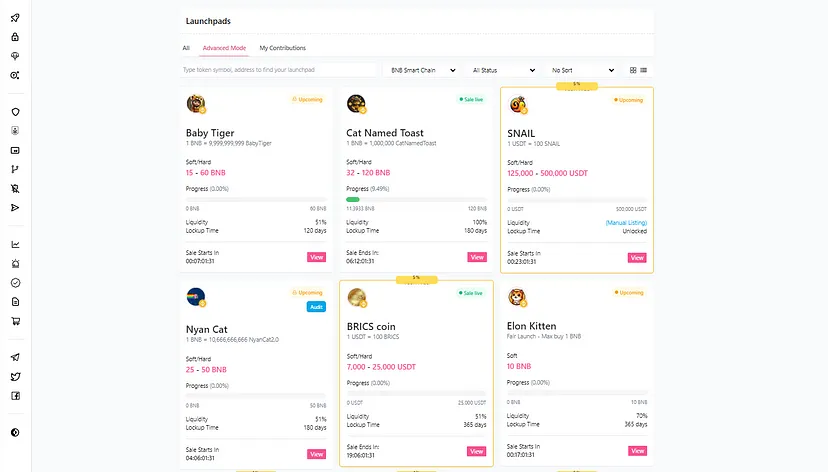

PinkSale

PinkSale is a protocol that connects projects and users, aiming to provide users with the ability to launch their own tokens and create their own initial token pre-sale, helping projects complete the early stage IDO. The project team does not need any coding knowledge, just a few clicks on the PinkSale page to design their own tokens and token launches.

PinkSale will include multiple additional features to help projects complete the entire token release. These features include: helping tokens list on PinkSwap and PancakeSwap, locking LP, and adding a vesting period to your tokens to increase investor trust.

Secondary Market Tools

Santiment

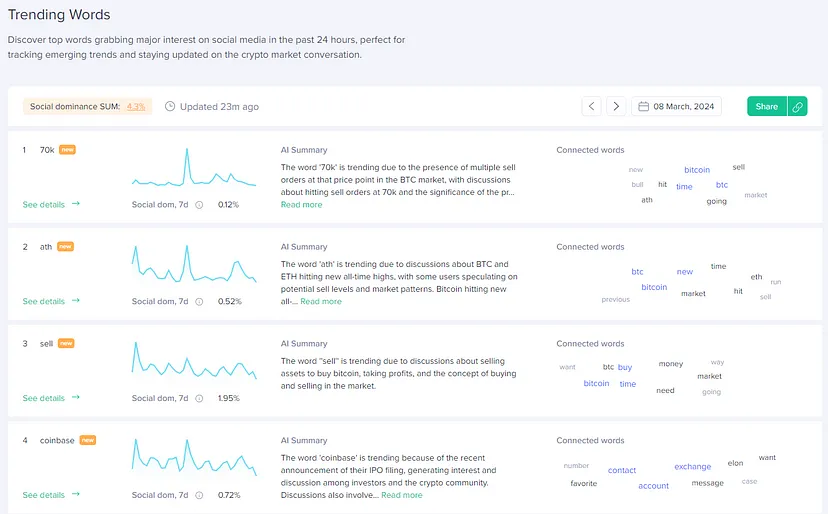

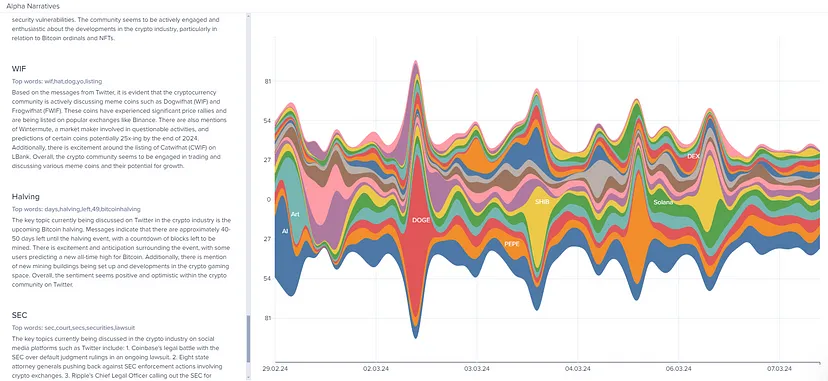

The information on Santiment mainly revolves around where the hotspots of cryptocurrencies are on the web. The project aims to eliminate information inequality within the Web3 community.

Web3 Network Keywords

Santiment can accurately reflect the hotspots of public attention by integrating the most searched keywords on the web through AI technology.

Describes the current market's Alpha narrative in a heatmap display.

Signal Trading

The platform mainly provides a macro concept to help users understand the current market hotspots and articulate where the current investment narrative lies.

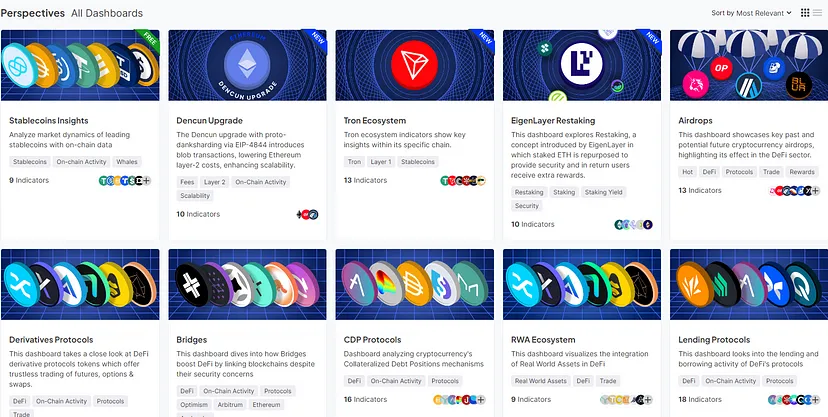

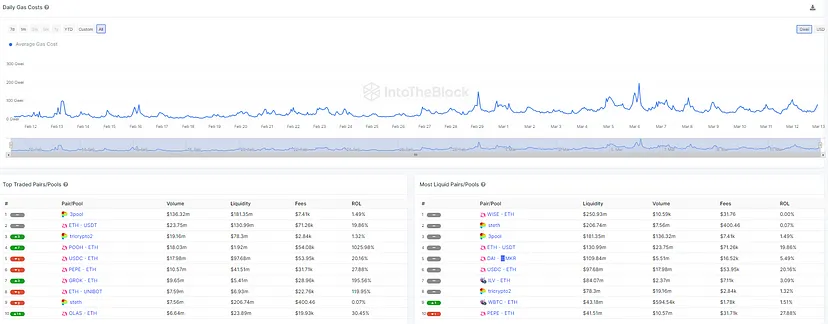

IntoTheBlock

IntoTheBlock primarily aggregates information on various DeFi projects, including project data and token trading situations.

Project Data

The platform integrates data performance of various current market focus sectors, allowing users to access the most up-to-date project information.

The information also includes the current network gas fee levels, trading pair performance of various DeFi projects, and more.

Signal Trading

The advantage of IntoTheBlock lies in its comprehensive information, allowing users to have a complete view of project data across all sectors and make corresponding strategic deployments based on the project information.

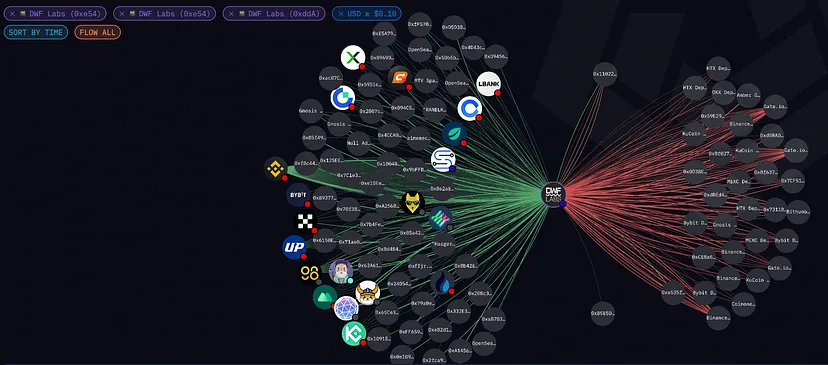

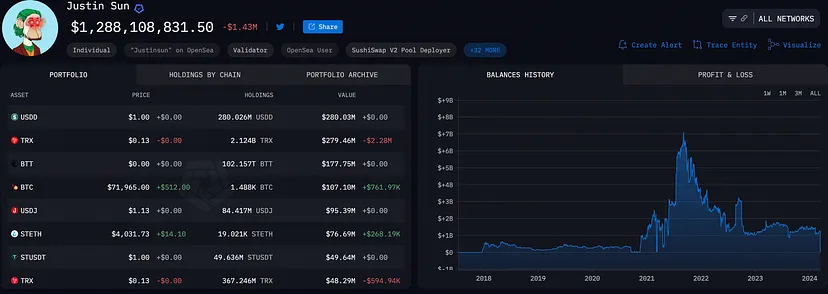

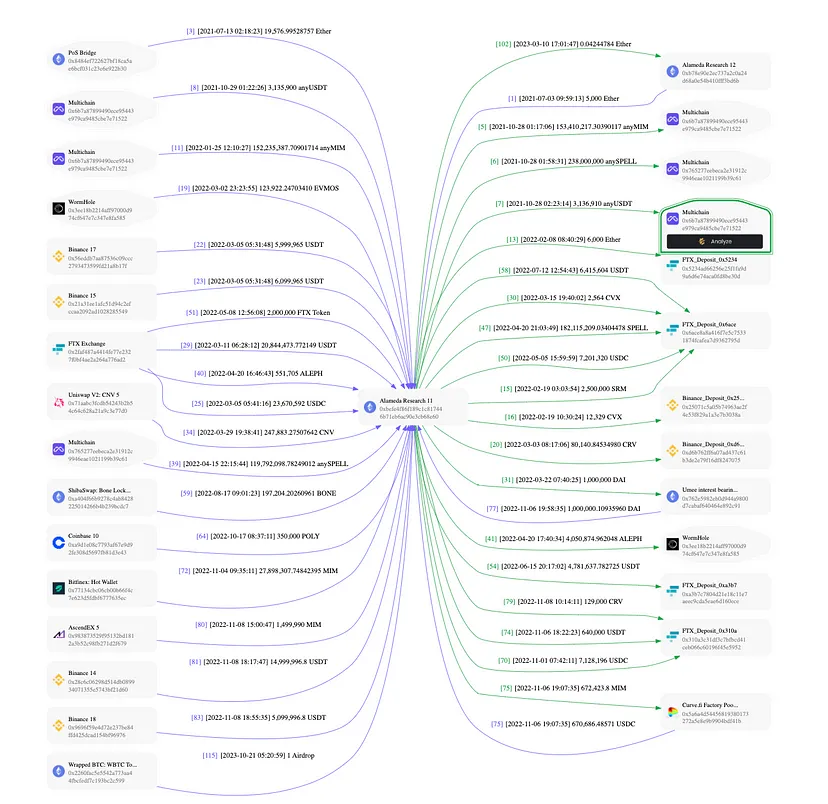

Arkham

Arkham is an on-chain data tracking platform focused on displaying on-chain data and systematically analyzing blockchain transactions and de-anonymizing them.

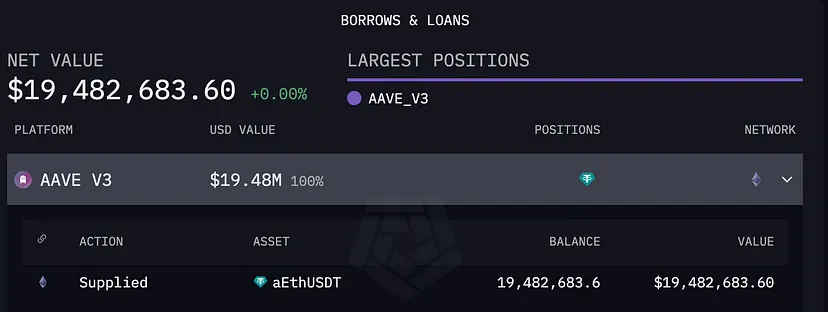

Visualizer

Arkham Visualizer allows users to track cross-chain fund flows in a visual way. Through this feature, users can use filtering functions to select the desired fund flows based on blockchain, time, currency, amount, and more, to clearly identify the inflow and outflow of funds.

The above is the fund flow of the DWF Lab wallet, clearly showing its wallet's interaction records with other addresses and understanding the institution's use of funds.

Signal Trading

Similar to RootData's concept, Arkham, through further visualization processing, presents wallet interaction records, allowing users to formulate trading strategies based on the Smart Money wallet's transfer records.

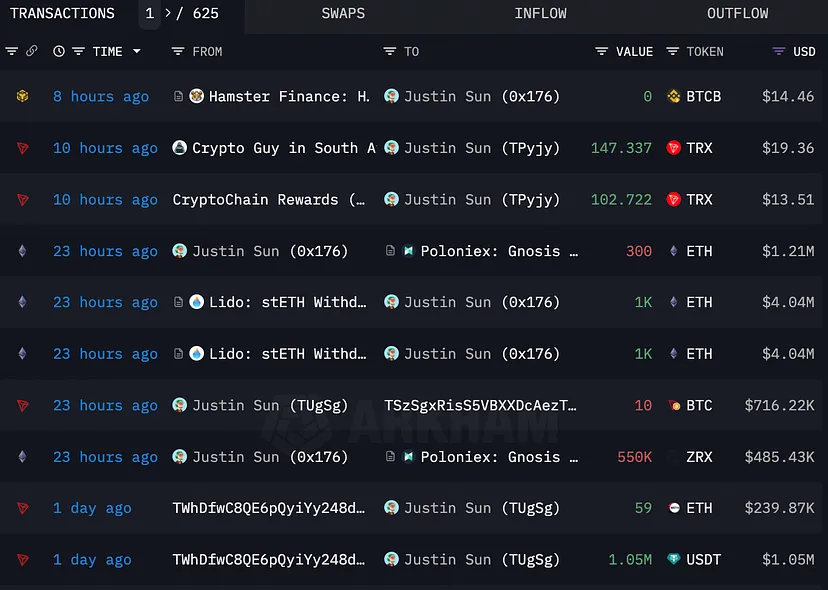

Dashboard

Arkham also provides a Dashboard feature, allowing users to monitor all on-chain transaction records of individual addresses. This information includes their holding performance, recent transaction records, and even usage records in DeFi.

Signal Trading

Similarly, users can decide on trading strategies based on large fund transfer records from the Smart Money wallet.

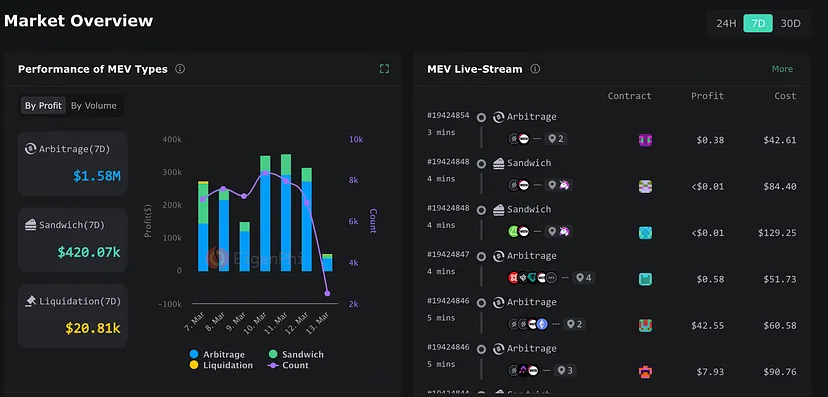

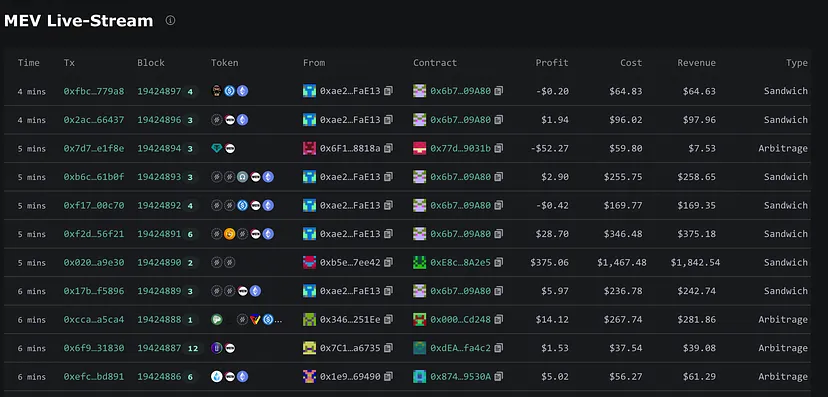

Eigenphi

EigenPhi is a research platform focused on MEV (Miner Extractable Value) data in DeFi. Its feature is the ability to identify and track on-chain MEV capture behaviors, such as arbitrage, sandwich attacks, liquidations, etc. While displaying the MEV market, EigenPhi also provides detailed information on each MEV transaction.

MEV Performance

The platform can provide actual trading volume and actual profit (gross profit after deducting miner fees) information for various MEV activities, including their proportions and growth. This allows users to have a very clear and comprehensive overview of the current MEV market. Users can see real-time information on the types of MEV involved in exchanges, contract addresses initiating MEV transactions, actual earnings and expenses, and more.

Signal Trading

The platform provides MEV research data for researchers and also provides ideas and references for MEV traders, knowing which project or blockchain is the most profitable for MEV transactions.

MetaDock

MetaDock aggregates various EVM blockchain browsers, eliminating the need to search for blockchain browsers and allowing users to query directly within the plugin.

Users can visualize the associated accounts and fund flow of the queried account by clicking on the Fund Flow tab in the browser's toolbar. Through the filter in the upper right corner, users can choose to display specific transfer addresses/entities or currencies.

Signal Trading

The program also facilitates users in tracking fund flows and is a primary source of trading information.

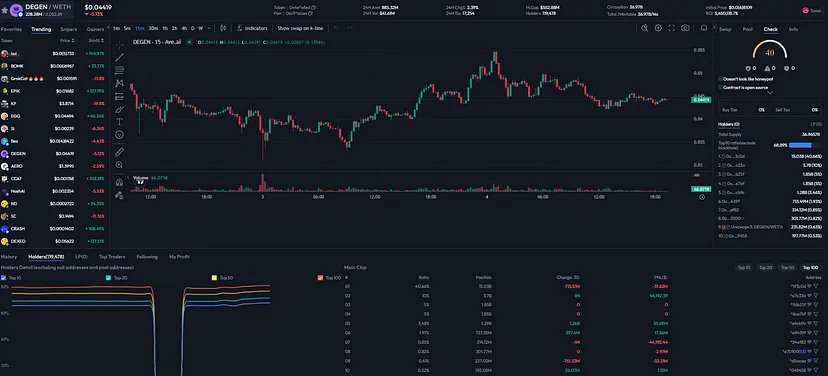

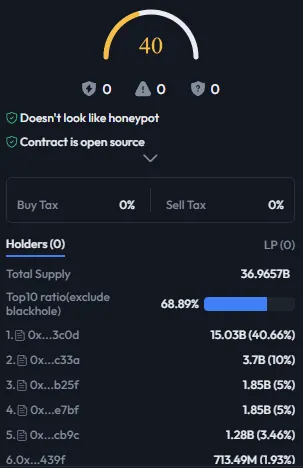

Ave.ai

Ave.ai is an all-in-one Web3 interaction terminal that aggregates protocols such as on-chain Dex, DeFi, Token, and NFT, aiming to provide a more secure fund, more professional data, and more convenient experience in Web3 interaction.

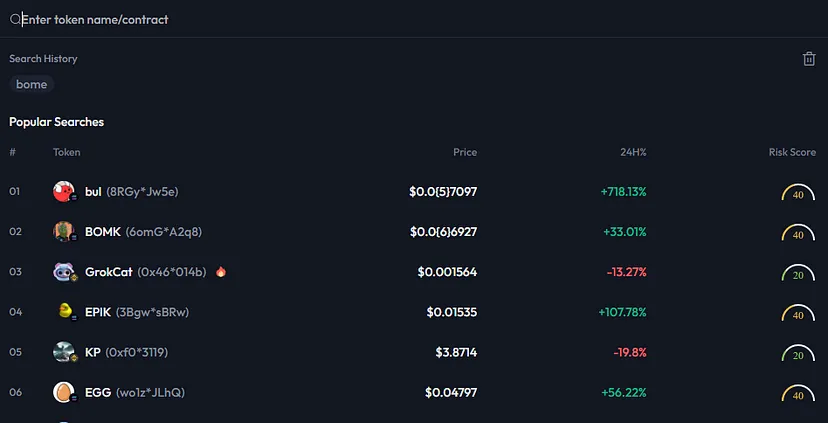

Search for Projects: After logging into your account, use the search bar at the top of the page to search for the crypto projects you want to analyze.

View Project Overview: The project overview page provides an overview of the project, including key indicators such as market cap, trading volume, and price performance. This page also includes charts showing the project's price trends.

The interface also displays smart contract audits to ensure security, as well as the proportion and addresses of top holders, making it easier for users to track the flow of smart money and understand whether the token is too concentrated or dispersed.

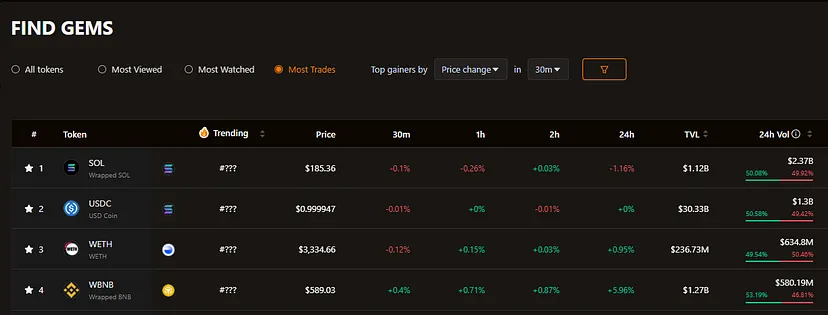

Birdeye

Birdeye is basically an extended version of CoinMarketCap, covering information on various meme coins. Users can view project prices, trading volumes, candlestick charts, and more.

- Find Gems: This feature mainly helps traders find and filter out potentially promising tokens. The user interface provides various filters such as "most traded," "most watched," and more. Users can also select "most profitable" to find suitable trading tokens.

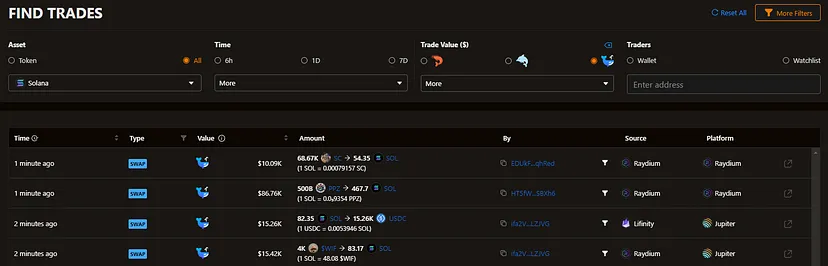

- Find Trades: This interface also records all on-chain transaction records. One of the most useful features is the ability to select trade amounts represented by "shrimp," "dolphin," and "whale." Tracking the fund flow of "whale" wallets is a way to track market intelligence.

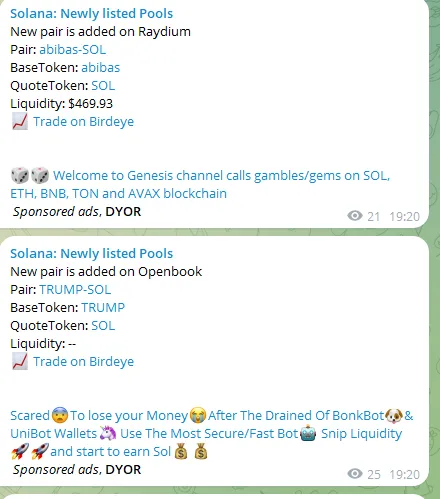

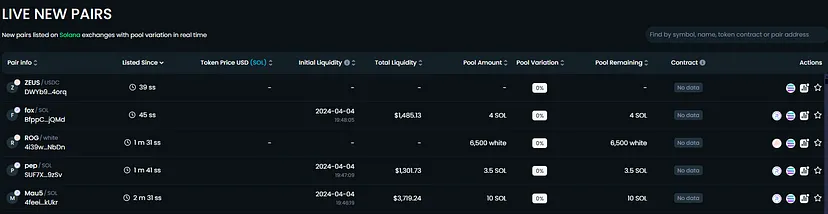

- Birdeye Bot: Provides instant access to price, trading volume, liquidity, and holder count information, meeting the real-time data needs of crypto traders. The new pair bot feature also notifies users of newly listed trading pairs in exchanges supported by Birdeye, providing early information that gives traders a competitive advantage in identifying potential investment opportunities.

Dextool

Dextool is essentially an aggregator for trading platforms and is also a major trading information platform for meme coins.

- Pair Browser

Users can search for any token and its available pairs on any supported DEX. For example, when searching for paired tokens on Solana, DEXTools will display a list of pools on Solana. Users can click on any pool to display detailed charts and analysis for that specific pool. This includes delving into pool transaction history, viewing reliability ratings given by other DEXTools users, and seeing the user's own position and interaction with the pool.

- Newly Listed Tokens

The interface displays newly created tokens on social media, allowing traders to receive trading information in real time.

- Multichart

Multichart allows users to set up to ten charts for any token pair on a given blockchain and exchange. Use filters to search for your chosen assets to narrow down by blockchain and exchange. DEXTools charts allow you to change time parameters and chart types, and provide a range of tools and indicators to support technical analysis.

- Rankings

The interface displays the most profitable or popular token pairs for traders to reference.

GeckoTerminal

GeckoTerminal is a DeFi and DEX aggregator, covering market data and prices for any token traded on over 900 DEX and 110 blockchains, created by the same team behind CoinGecko.

- Wide Coverage

GeckoTerminal's significant advantage lies in its broader support for blockchains and DEX, providing more comprehensive and in-depth information for some niche projects compared to other platforms. Its other features are roughly similar to Birdeye, Dextool, and others.

- Signal Trading for Ave.ai, Birdeye, Dextool, and GeckoTerminal

These three tools are very similar in nature and are also key tools in the recent meme coin craze, providing the fastest solutions for trading these speed-focused meme coins.

GMGN.ai

Gmgn.ai is a platform specifically for tracking smart money and Degen KOL trading records, clearly displaying the trading records of profitable smart money.

- Profitable Smart Money Wallets

The platform automatically tracks the most profitable smart money wallets and displays their holding records, token trading history, and other information, aiming to allow other traders to emulate trades.

- Real-time Trading Records

Real-time records of smart money wallet trading performance, ensuring that other traders receive timely information.

- Degen Bot

Connects to Telegram Bot with notification functionality, providing information on the latest token trading status.

Sniper Bot Product

Sniper Bot is an automation program set up to execute specific tasks at predetermined times. Such products are often used for participating in online trading, cryptocurrency sales, and trading, aiming to accurately capture the market. The main products and related performance in this sector can be referenced on this dashboard on Dune Analytics.

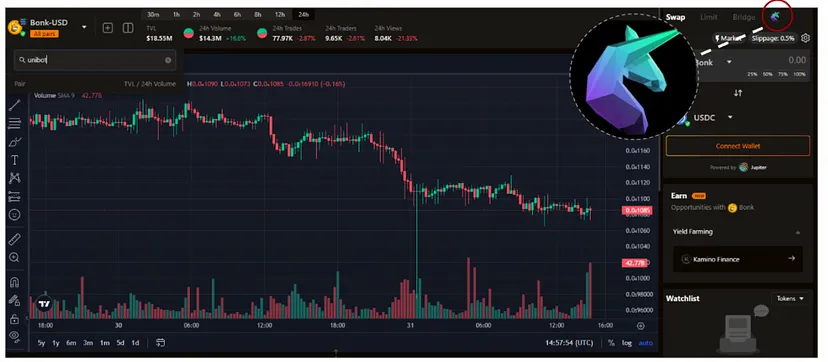

Unibot

Users can easily issue on-chain token trading instructions through interactive conversations with Unibot to complete various trading activities on Uniswap. This includes token exchange, copy trading, limit orders, and private transactions. In addition, Unibot also provides real-time Ethereum new token alert services, allowing users to conveniently add new tokens and quickly engage in sniper trading.

Currently, Unibot generates income in two main ways: robot trading fees and native token UNIBOT trading tax.

The former, Unibot charges a 1% fee for each transaction, with 40% allocated to token holders. The latter refers to a 5% tax on all UNIBOT token transactions, with 1% of the trading volume allocated to token holders, and token holders must have a balance of more than 50 UNIBOT to qualify for income sharing rewards.

Unibot on Solana

Unibot has recently launched a similar Telegram Bot on the Solana platform. Leveraging its advantage as a veteran project, the project has the following prominent features:

Built-in cross-chain bridge for ETH and SOL: Basically merging the original Unibot on Ethereum with the one on Solana, becoming the first Bot project to support both chains simultaneously.

Collaboration with trading data aggregator platform Birdeye: Seamlessly supporting all project trades displayed on Birdeye, which I believe is the ultimate feature to enhance user experience and a crucial turning point for UniBot's success in the Solana market.

Unibot on Base

Following the significant reduction in transaction fees after the Cancun upgrade, Base has become another popular public chain platform after Solana. As a seasoned Sniper Bot, Unibot's trading volume on the Base platform has also increased.

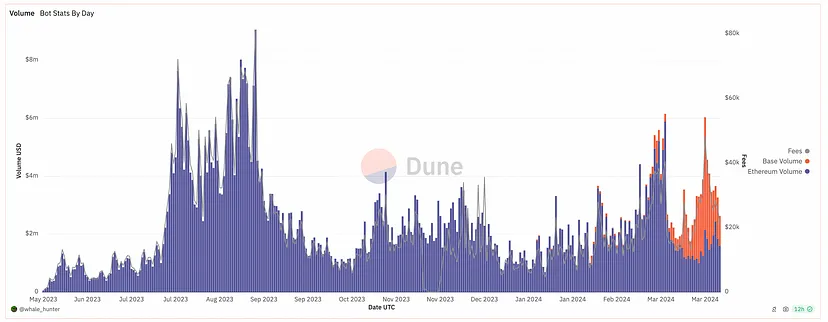

Protocol Performance

It can be seen that Base has replaced Ethereum as the preferred public chain for trading meme coins. Its trading volume peaked at $3.88 million on March 30, accounting for more than 60% of the project's revenue.

Banana Gun

Banana Gun provides two main services: trading and sniping. Through the trading function, users can securely purchase tokens listed on the blockchain. The sniping function allows users to be the first to purchase new tokens upon release. Banana Gun also supports Ethereum, Solana, Blast, and Base. Here are some detailed explanations of its features:

First Bundle or Fail (FoF): Aims to make the first purchase (0 block) at the start of trading, requiring at least 10 wallets to participate to be effective. Not applicable to MEV or Deadblock releases.

FoF Backup: If the FoF function does not trigger during MEV or Deadblock releases, the backup function will make a purchase in the next available block and use a backup miner fee.

Slippage: Allows price fluctuations in the range of 0-99% in issuances without a maximum trade limit. Setting it to 100 is equivalent to "infinite" slippage.

Degen Mode: After enabling this feature, users can purchase trades as "honey pots" to deter zombie users. If this setting is enabled, the robot will ignore security tax settings and can purchase even if the token cannot be sold.

Max Transaction or Revert: Limits purchases to the maximum expenditure. If the maximum transaction amount for the token exceeds this amount, the transaction will be reverted.

Minimum (MinToken): Sets the minimum token quantity or percentage for purchase. If the maximum expenditure cannot meet this minimum value, the transaction will fail.

Rug Protection (Anti-Rug): Attempts to sell tokens when taxes exceed security settings or there are signs of fraud.

Transfer on Blacklist: If a user's wallet is blacklisted, this feature will transfer the tokens to a designated "transfer wallet."

Pre-Approve: Automatically approves tokens after sniping for faster selling.

Snipe Settings: Allows adjustment of current snipe settings without affecting other pending or future snipes.

Robot Trading Fee: Using the robot service provided by Banana Gun incurs fees: (1) 0.5% fee for manual purchase transactions; (2) 1% fee for automatic snipe transactions. 50% of all robot trading fees collected are allocated to token holders. This also provides passive income for holders, incentivizing the use of robots for trading.

Additional Cashback: Users who engage in robot trading are entitled to additional cashback. The cashback amount is calculated using the formula: paid fee * multiplier, where the multiplier ranges from 0.05 to 1. This means the cashback amount can be up to 100% of the paid fee, depending on the random multiplier value.

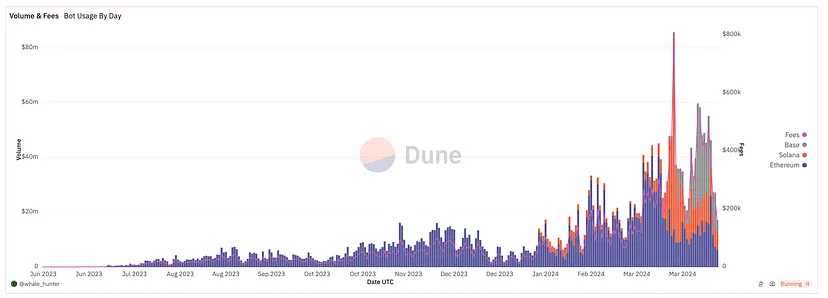

Protocol Performance

Similarly, Base's trading volume has surpassed that of Solana and Ethereum, reaching a peak of $35 million on March 29.

BonkBot

BONKbot is a Telegram trading bot based on the Solana network, allowing users to trade in the simplest and fastest way possible. The token used for the project is $BONK, which was initially released as a free airdrop to the Solana community on Christmas 2022. Since then, the adoption of $BONK has grown exponentially, with its use covering DeFi, gaming, payments, and other areas. As the official partner of the $BONK community, BONKbot provides users with a range of features:

Minimum Holding Value: Users can set the minimum holding value displayed in their investment portfolio. Tokens below this threshold will be hidden. This feature is particularly useful when users do not want to sell certain tokens, even in the event of investment failure (commonly known as being "bagged"). Click to edit.

Auto-Buy: When users paste a token address, the system immediately executes a purchase without the need for confirmation.

Button Configuration: Users can customize the buy and sell buttons on the dashboard. When buying or selling tokens, simply click each button to edit.

Slippage Configuration: Users can customize the slippage settings for buying and selling. Slippage is the difference between the trading price and the execution price, and proper configuration can help users better control trading costs. Click to edit.

MEV Protection: BONKbot has partnered with Jito Labs to provide users with advanced MEV protection, which defaults to accelerating transactions and defending against front-running attacks. MEV protection offers two modes for users to choose from: ```

- Turbo Mode: In this mode, trades are sent through Jito to ensure front-running protection at the fastest speed. If regular transfer speed is faster, the trade will not trigger MEV protection.

- Secure Mode: This mode ensures trade protection in any situation, even if it means the trade speed may slow down. Users can increase the bribe amount to expedite trade speed.

When enabling MEV protection, users can independently choose the above modes and determine the priority of trades: medium, high, or very high. For advanced users requiring more precise control, BONKBot also offers options to customize trade priority.

SolTrading Bot

SolTradingBot is another simulation platform similar to BONKBot. It also uses the Telegram Bot approach, but it has some unique features, such as:

DEX Integration:

Integration with major DEXs: SolTradingBot has integrated with Jupiter, Orca, and Raydium, the leading decentralized exchanges on Solana.

Enhanced liquidity access: Users can access extensive liquidity pools on these DEXs to efficiently execute trades at the best prices.

Diverse token opportunities: Provides a wide range of trading options from established cryptocurrencies to emerging projects.

Multi-DEX strategy: Allows users to leverage the unique advantages of each DEX platform to optimize trades.

BTCBot.pro

Solana and ETH use an account model, while BTC uses the UTXO model, resulting in significant differences in related assets and ecosystems. In this section, we will elaborate on the functional innovations of BTCBot.pro and the potential impact on users and the industry.

BTCBot.pro is a Telegram Sniper Bot product for the BTC ecosystem, launched on December 23, 2023, focusing on engraving and trading BRC-20 tokens, and introducing practical features to address current issues in the BTC field.

Due to the significant differences between the BTC ecosystem and the ETH EVM and Solana ecosystems, the overall design logic also differs significantly. The BRC20 field is currently divided into primary and secondary markets, where the primary market in the BTC ecosystem refers to the issuance of BRC20 tokens, and the secondary market refers to the trading of BRC20 tokens.

BRC20 Sell Order Function

Before BRC20 tokens are listed on platforms such as OKX or Unisat for sale, they need to undergo a minting process. For example, if you want to sell 2000 $abcd (a BRC20 token), you need to convert 2000 $abcd into an engraving and set a price for this engraving, then list it on the trading platform. Placing a limit sell order does not incur any fees; users only need to pay the gas fee for minting.

On BTCBot.pro, when users use the "limit sell" function, they can list the order on Unisat and OKX simultaneously at no additional cost, increasing the probability of the sell order being executed.

BRC20 Limit Buy Order Function

This is the first time the limit buy order function has been introduced in the BRC20 field. Its buy order function has the following four characteristics:

Zero Cost: After setting the price and purchase quantity, users can modify or cancel the limit buy order at any time without incurring any gas fees. Similar to the sell order function, the buy order function is also applicable to Unisat and OKX markets, with the buy order function already available on Unisat.

Slippage Control: When the price of a token falls within the user's set buy order range, the trade will be triggered. However, the BTC gas fee at the time of order execution will affect the token's overall price. For example, if a token quantity is 100 and the price is $1 each, but the current trade requires a $9 gas fee, BTCBot.pro will automatically calculate the comprehensive cost as (100+9) ÷ 100 = $1.09, resulting in a 9% trade slippage. Users can set their desired slippage to avoid increasing the overall cost of token purchase. The larger the token quantity, the smaller the trade slippage.

This "slippage setting" is unique to the BTC ecosystem and differs from the slippage in platforms like Uniswap that use the AMM mechanism. In the AMM mechanism, the size of the liquidity pool affects the slippage, while in the BRC20 field, the BTC transaction gas fee affects the slippage. Through the slippage setting, users can filter out the orders they truly need and effectively control the overall cost.

Order Book Management: Most current BRC20 trading platforms cannot use the limit buy order function, which hinders market makers or institutional participants from effectively managing the order book and forces them to manage orders only through market orders. The limit buy order function can solve this problem, allowing project teams or market makers to manage the order book on BTCBot.

Automatic Matching: In BTCBot.pro, users can see the amount and quantity of limit buy orders. Holders (sellers) can observe the order depth and choose the price at which to sell, while buyers can obtain lower-cost chips by placing bids. In BTCBot.pro, buyers and sellers can automatically match trades.

Evolution of Cryptocurrency Trading Tools: Technological Innovation and User Experience Optimization Driven by Market Demand

In terms of product features and trends in signal trading and on-chain data analysis, we have noticed several key points:

- Increased Demand for Real-Time and In-Depth Information: With dynamic market changes, investors have significantly increased their demand for real-time and comprehensive market information. For example, RootData and ICODrops provide real-time updates on fundraising and ICO situations, helping investors stay updated on primary market dynamics.

- Diverse Analysis Tools: There are various analysis tools in the market, covering fundraising information in the primary market to sentiment analysis and trading opportunities in the secondary market. For example, Arkham provides visual tracking of on-chain data, while Santiment integrates search keywords from the web using AI technology to reflect market trends.

- User-Friendly Interface and Ease of Operation: Product design tends to be operable without a deep technical background, such as PinkSale's token launch platform, where users can design and launch their own tokens with just a few clicks. This design trend enables a wider range of users to easily access and utilize these tools.

- Integration and Interoperability: Many tools are evolving towards broader integration and platform interoperability. For example, MetaDock aggregates multiple blockchain browsers, simplifying user query steps, while Unibot's cross-chain bridge function supports interoperability between Ethereum and Solana.

- Insights into Trading Strategies and Opportunities: Tools not only provide data but also offer insights to guide investment decisions. For example, by analyzing the flow of funds in institutional wallets, RootData and Arkham help users gain insights into market strategies and trading opportunities.

- Enhanced Security and Transparency: As investors' demands for security and transparency increase, more platforms are emphasizing these features. For example, Ave.ai displays smart contract audits in project overviews to ensure security.

- Automation and Robotization Features: Market trends show that automated and robotized trading features are becoming increasingly popular. These features not only improve trading efficiency but also enable quick responses to market changes, such as the sniper and trading functions provided by Sniper Bot and Banana Gun.

In summary, these product features demonstrate the growing market demand for efficient, real-time, user-friendly, and highly integrated trading and analysis tools. Additionally, we have summarized several underlying trend changes in the cryptocurrency field. We can delve deeper into the analysis from the following perspectives:

1. Accelerated Market Information Flow and Transparency Demand:

The dynamics and complexity of the market require investors to quickly receive and process information. The widespread availability of real-time update features reflects the market participants' high demand for speed and timeliness. For example, tools like RootData and ICODrops with real-time data updates indicate the continuous growth in the market's demand for transparency and timely information.

Behind this demand is the pursuit of market participants to avoid information asymmetry and improve trading decision efficiency. The instability and high volatility of the crypto market make timely information retrieval crucial.

2. Parallel Advancement of Decentralization and Integration:

With the development of multi-chain and cross-chain technologies, there is an increasing market demand for tool integration, as users expect to manage multi-chain assets and trades through a single platform. For example, the cross-chain operation features provided by Unibot and MetaDock reflect the high demand for operational convenience and resource integration in the market.

This trend indicates that while decentralization is a core feature of blockchain, user experience and functional integration are still key factors driving technological adoption.

3. User Interface and Operational Simplification:

The diversity of investors and user groups is driving the demand for simplified operational interfaces. Platforms like PinkSale allow users without a deep technical background to participate in token creation and presale, indicating that the market is moving towards greater popularization and democratization.

Behind this change is the widespread adoption of technology and the improvement in education levels, enabling non-technical users to participate in the previously complex activities of the crypto economy.

4. Building Security and Trust:

As the crypto market expands, security issues are becoming increasingly prominent. More platforms are emphasizing smart contract security audits and transparency, such as Ave.ai's security display. This indicates that the market is moving towards building a higher level of trust and security assurance.

The driving force behind this trend is the multiple security incidents and fund losses in the market, prompting industry participants and users to pay more attention to security measures.

5. Wide Application of Intelligence and Automation:

The widespread adoption of automation tools such as Sniper Bot and robotized trading functions reflects the market's demand for efficiency and responsiveness. Automation tools can quickly respond to rapidly changing markets, which is crucial for capitalizing on market opportunities.

The driving force behind this trend is technological advancement, particularly the application of artificial intelligence and machine learning in trading strategies, which improves the success rate and efficiency of trades.

In conclusion, the changes in these underlying trends reflect the maturation of the cryptocurrency market, while also indicating the dynamic balance between technological development, market demand, and user experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。