Author: QuickNode & Artemis

Compiled by: Felix, PANews

Key Points:

- Surge in Stablecoin Activity: The comprehensive impact of the approval and listing of spot Bitcoin ETFs, Bitcoin halving in April, outflow of fiat currencies due to severe inflation, and the recovery of DeFi led to a 42% increase in stablecoin user activity compared to the previous period.

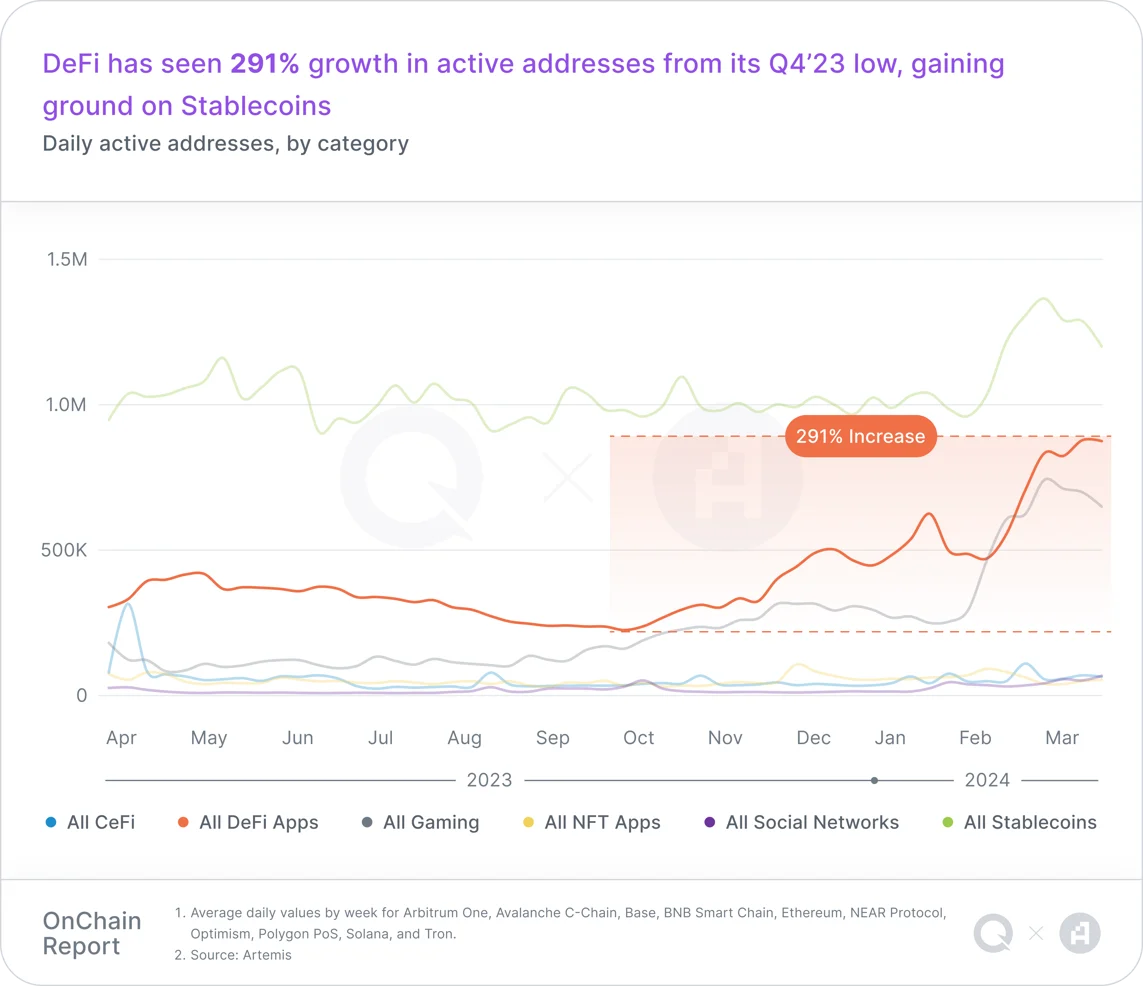

- Revival of "DeFi Summer": In the first quarter of 24, DeFi entered a new era characterized by optimism, risk awareness, and refined innovation. DeFi user activity increased by 291%, reigniting hopes for a "DeFi summer" in the market.

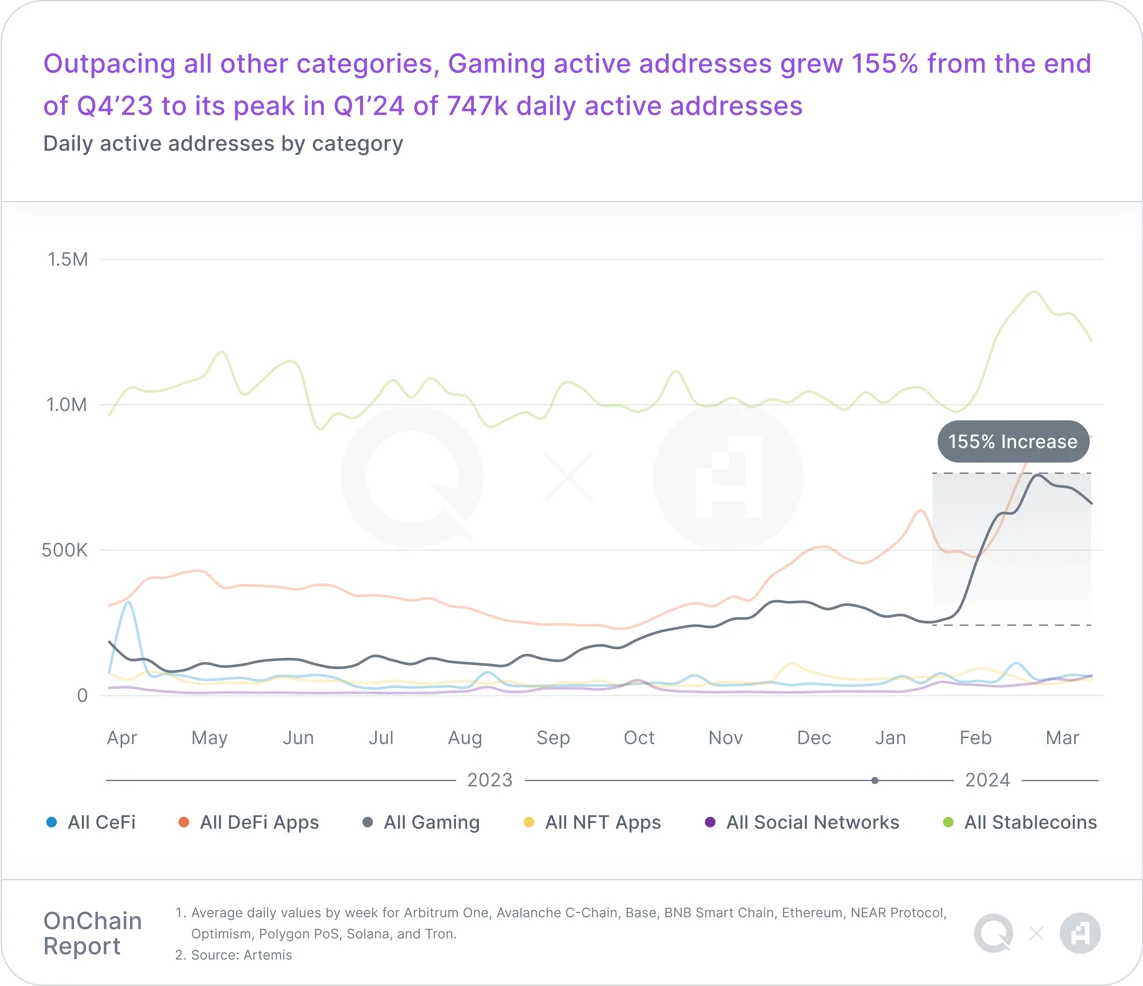

- Rise of Web3 Games: The number of active addresses increased by 155%, demonstrating the ability of Web3 to attract and retain a growing number of players.

- Rapid Expansion of Layer2s: The rapid expansion of Layer2s signifies a crucial step forward in Web3 scalability over the past 6 months. The significant increase in TVL on platforms like Base indicates continued interest in expanding on-chain liquidity in the market.

User Activity

Stablecoins

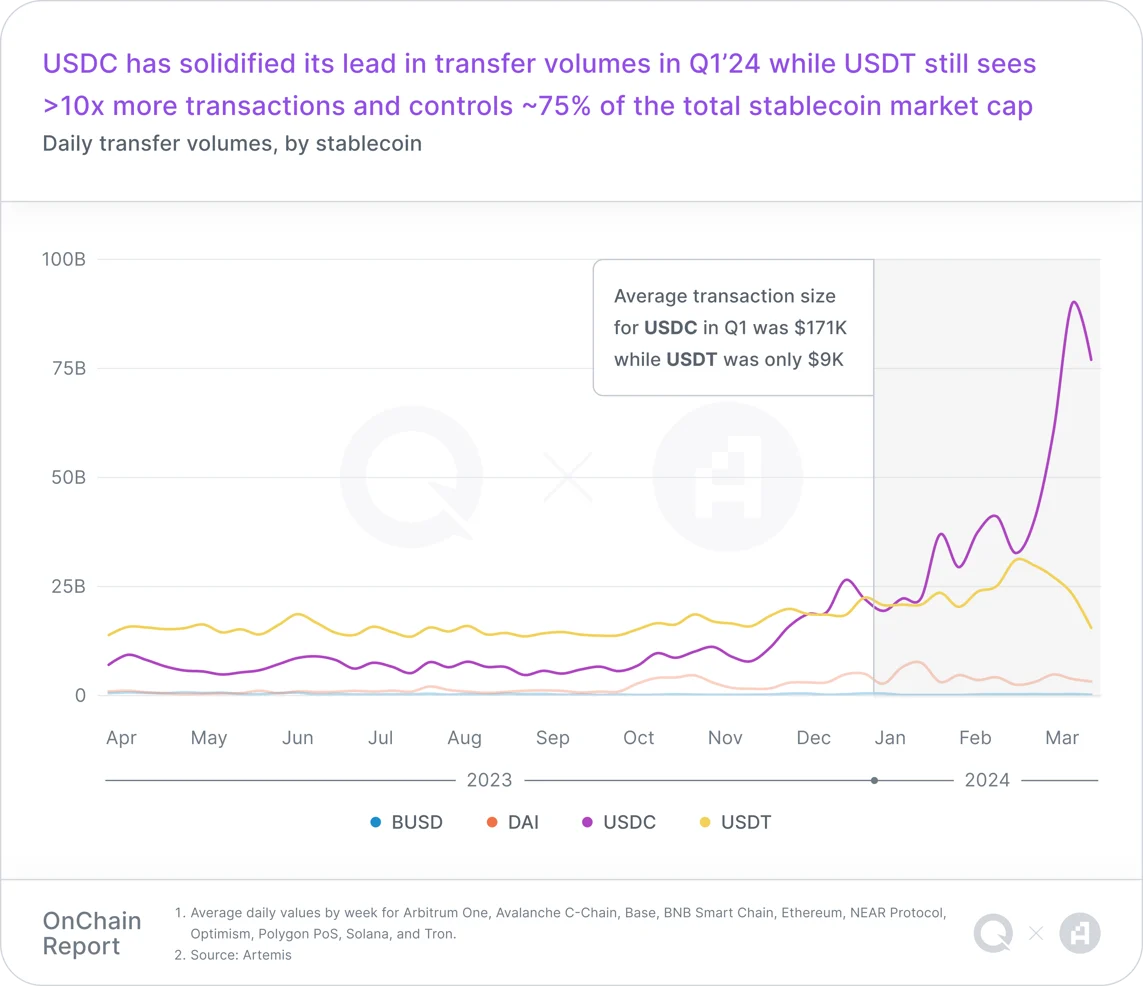

For five consecutive quarters, stablecoins have had the highest number of active addresses, accounting for over 41% of all daily active addresses (DAA). USDT continues to dominate the stablecoin market, representing approximately 75% of the total stablecoin market value. In the first quarter of 24, the market value of USDT exceeded $100 billion for the first time.

Despite processing over 10 times more transactions than USDC in the first quarter of 24, USDC leads in transaction volume and average transaction size.

DeFi

The number of daily active addresses in DeFi increased by 291% in the first quarter. This growth represents the resurgence of capital inflows and the emergence of new yield-generating protocols, which have driven the growth in user activity.

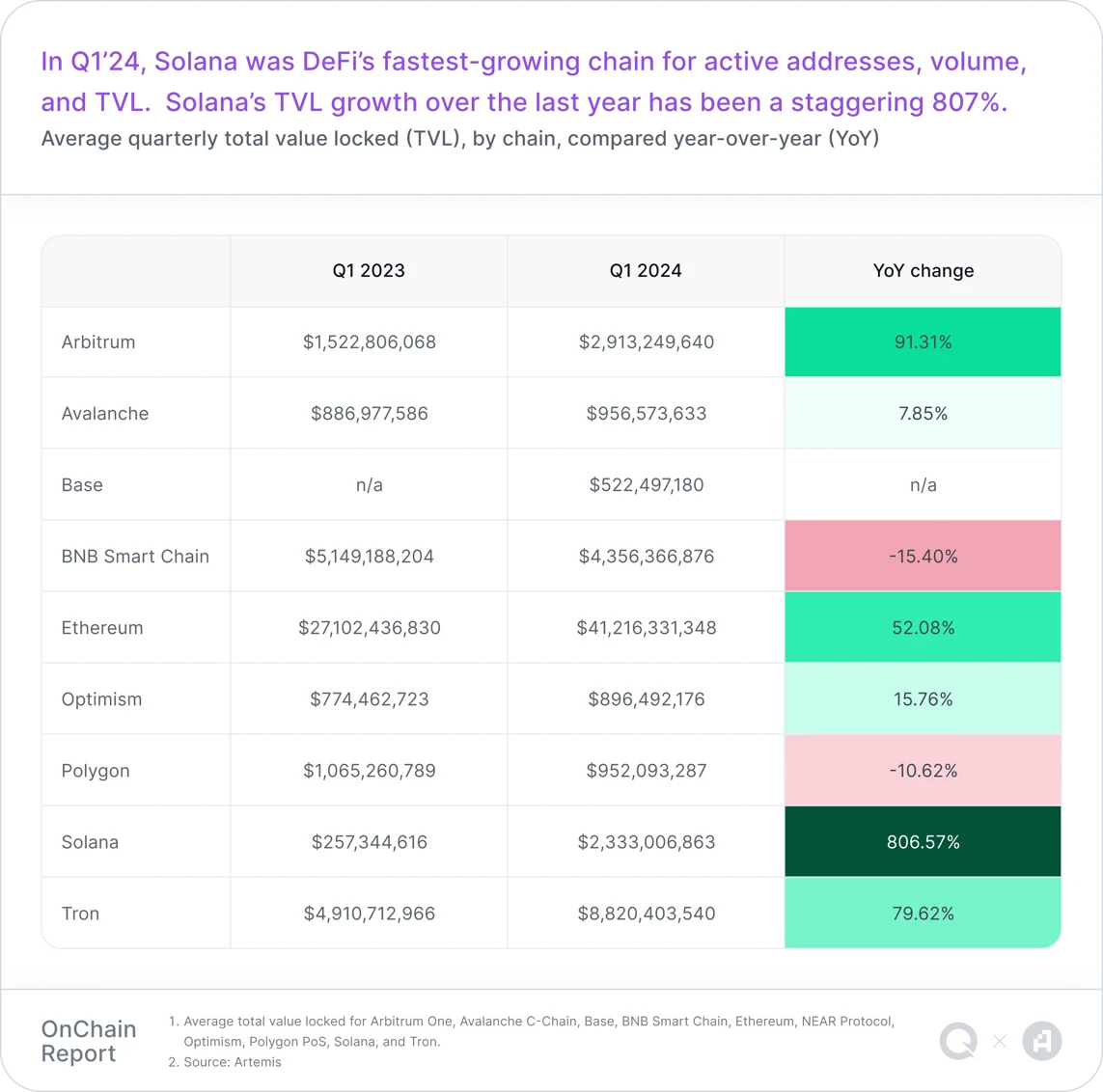

In the first quarter of 24, DeFi truly entered a new era, with a significant increase in developer and user activity, particularly on the Solana and Base networks. Staking, liquidity mining, restaking, and liquidity restaking have been catalysts for the recent explosive growth of DeFi, explaining why staking now accounts for a significant portion of DeFi TVL.

While stablecoins still dominate address activity, DeFi surpasses stablecoins in terms of transaction volume, with the average daily transaction volume nearing 7 million at the end of the quarter. The TVL of yield-generating protocols has steadily increased from $26.5 billion in the third quarter of 23 to $59.7 billion in the first quarter of 24. This rebound indicates a return of confidence and liquidity in the DeFi market.

Web3 Games

The Web3 gaming sector experienced significant growth, surpassing stablecoins in transaction volume and achieving the fastest year-on-year growth among Web3 categories. Compared to the fourth quarter of 23, the number of daily active addresses in Web3 games increased by 155% in the first quarter of 24, reaching a peak of 747,000. The transaction volume in the Web3 gaming sector grew by 370% year-on-year.

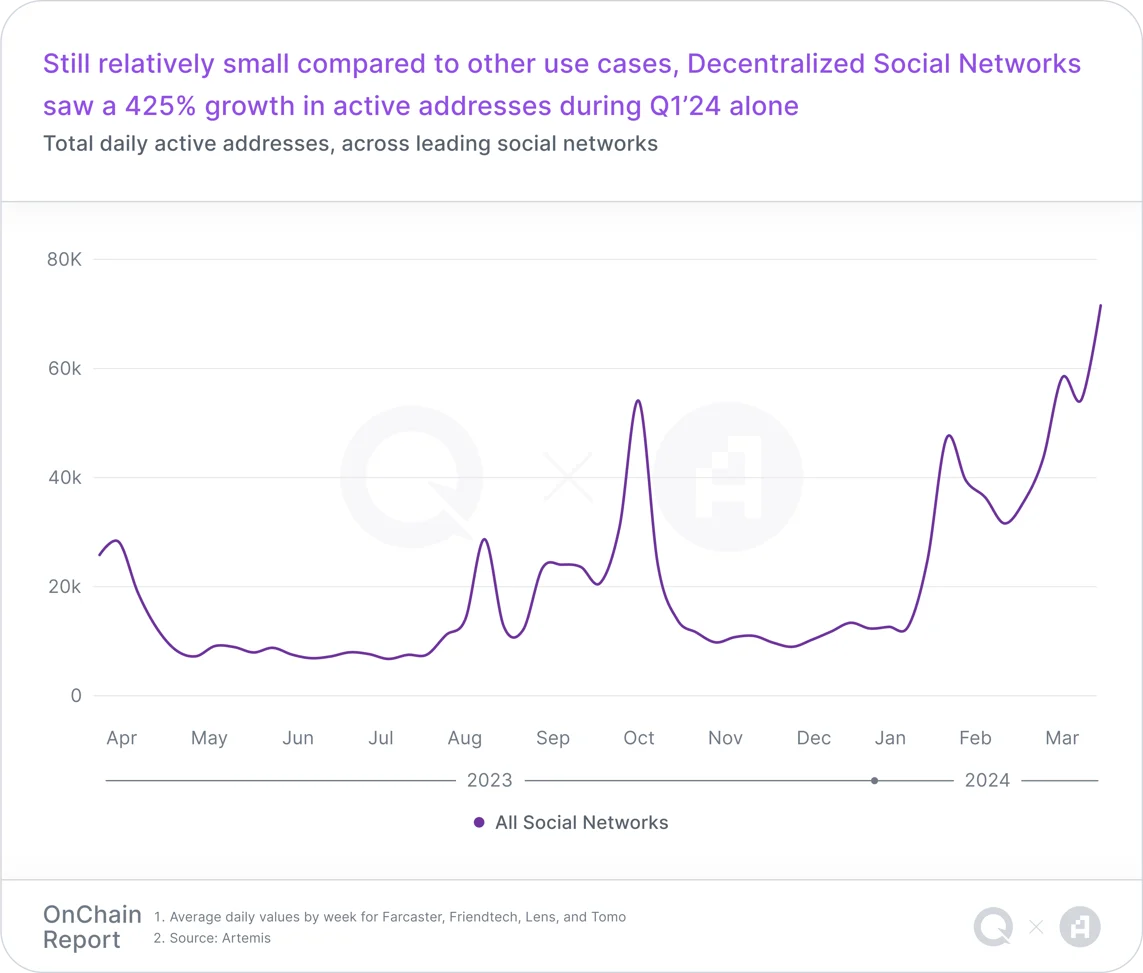

Decentralized Social Platforms

Decentralized social networks experienced rapid growth in the first quarter of 24, with a 425% increase in user activity. This indicates a growing market interest in blockchain-based social platforms. Mainstream platforms include Farcaster, Lens, friend.tech, and Tomo.

Historically, the initial user engagement of decentralized social networks tends to decrease as the novelty wears off. However, the gradual increase in active user numbers after the peak in the first quarter suggests that user engagement may become more stable over time, potentially signaling an increase in user acceptance.

NFT Market

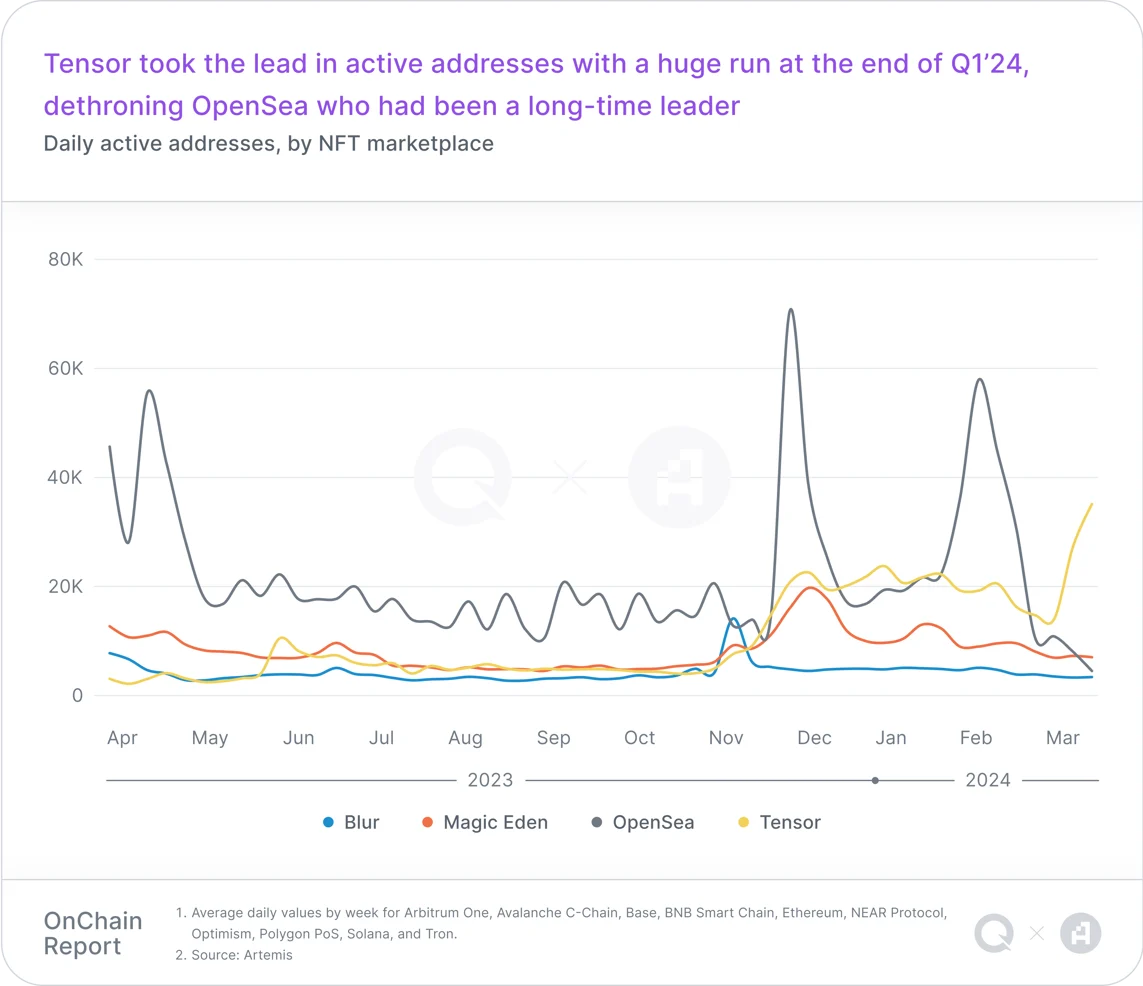

In 23, Ethereum dominated the NFT market in terms of trading volume, but in the first quarter of 24, the trading volume and activity of the Solana NFT market surged. Although OpenSea and Magic Eden historically held the leading positions in daily NFT active addresses and NFT transaction volume, this trend was surpassed by Tensor in the first quarter of 24, indicating a shift in user preferences and platform performance.

Public Chains

Layer2s and Sidechains

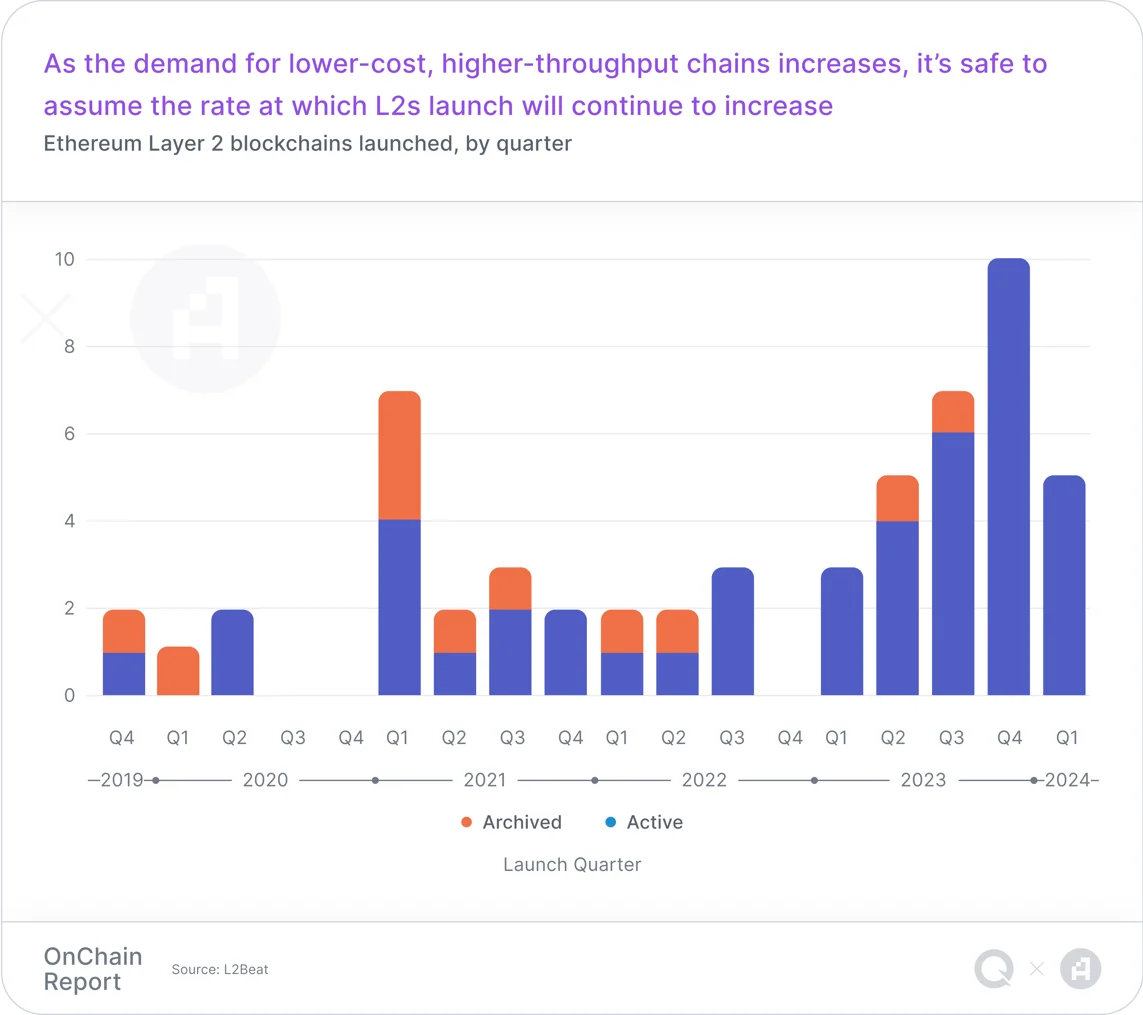

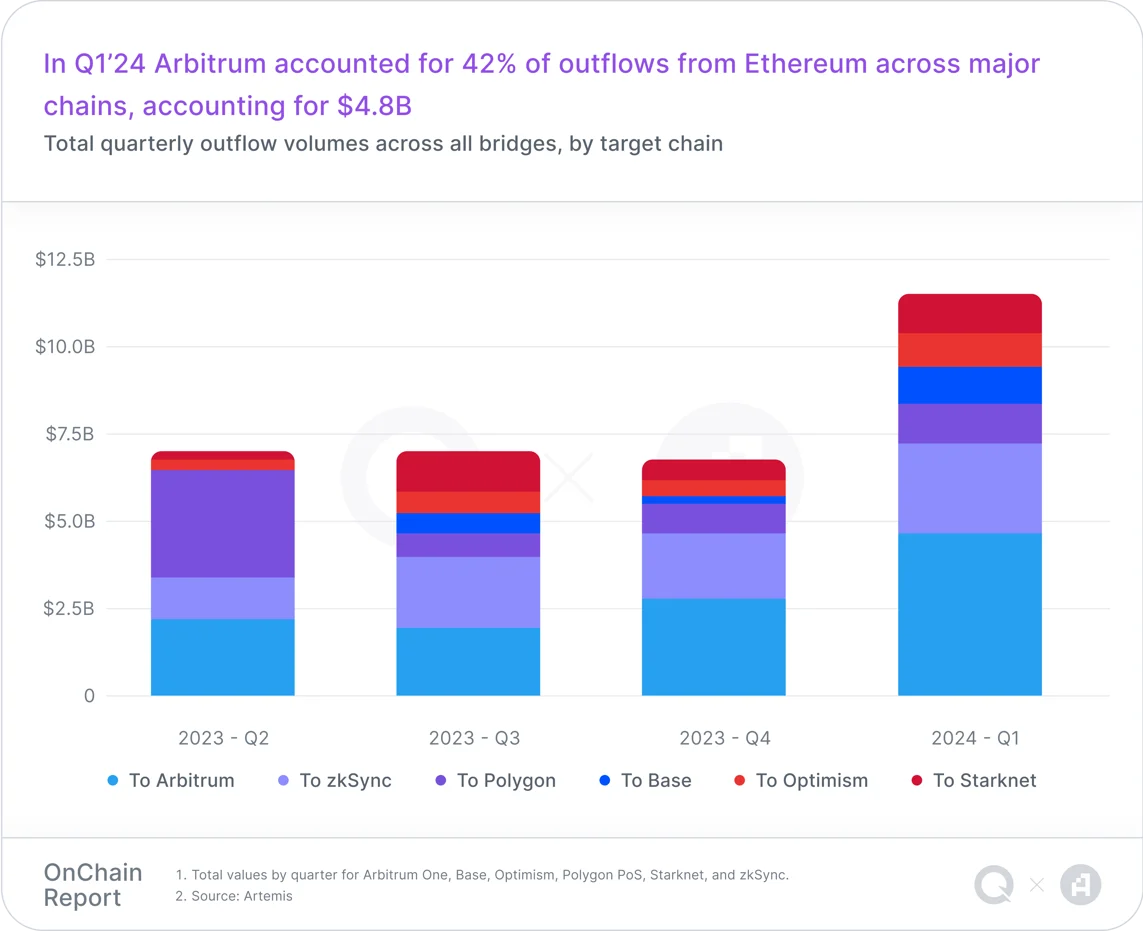

Layer2 solutions significantly improved blockchain scalability in the first quarter of 24, offering faster transaction speeds and lower costs to address key challenges such as congestion and high transaction fees on the main network. The Layer2 market continues to expand, with new chains launching every quarter.

Arbitrum

Despite fierce competition, Arbitrum accounted for 44% of the TVL among all Ethereum Layer2s, maintaining its leadership position in the long term.

In the first quarter of 24, Arbitrum experienced two significant events within a few days. The first event was the Ethereum network's DenCun upgrade on March 13, which reduced L2 transaction fees by 98%. According to Artemis data, the average daily transaction volume nearly doubled, increasing by 96.2%, while the average transaction fees decreased by 93.5% (i.e., the average Arbitrum transaction fees decreased from $0.3 to $0.01 almost overnight), with only a 62.6% decrease in revenue. In short, the Ethereum upgrade made Arbitrum more adaptable to mass market applications.

The second event was the large-scale token unlock of Arbitrum on March 16. Tokens worth $23.2 billion were unlocked, nearly doubling the circulation of ARB tokens. After the unlock, some whales sold off ARB (Note: According to Lookonchain monitoring, after the large-scale unlock, 11 whales collectively deposited 34 million ARB tokens worth about $58 million into exchanges), leading to a surge in daily active addresses and transaction volume, despite Arbitrum's TVL remaining relatively unchanged.

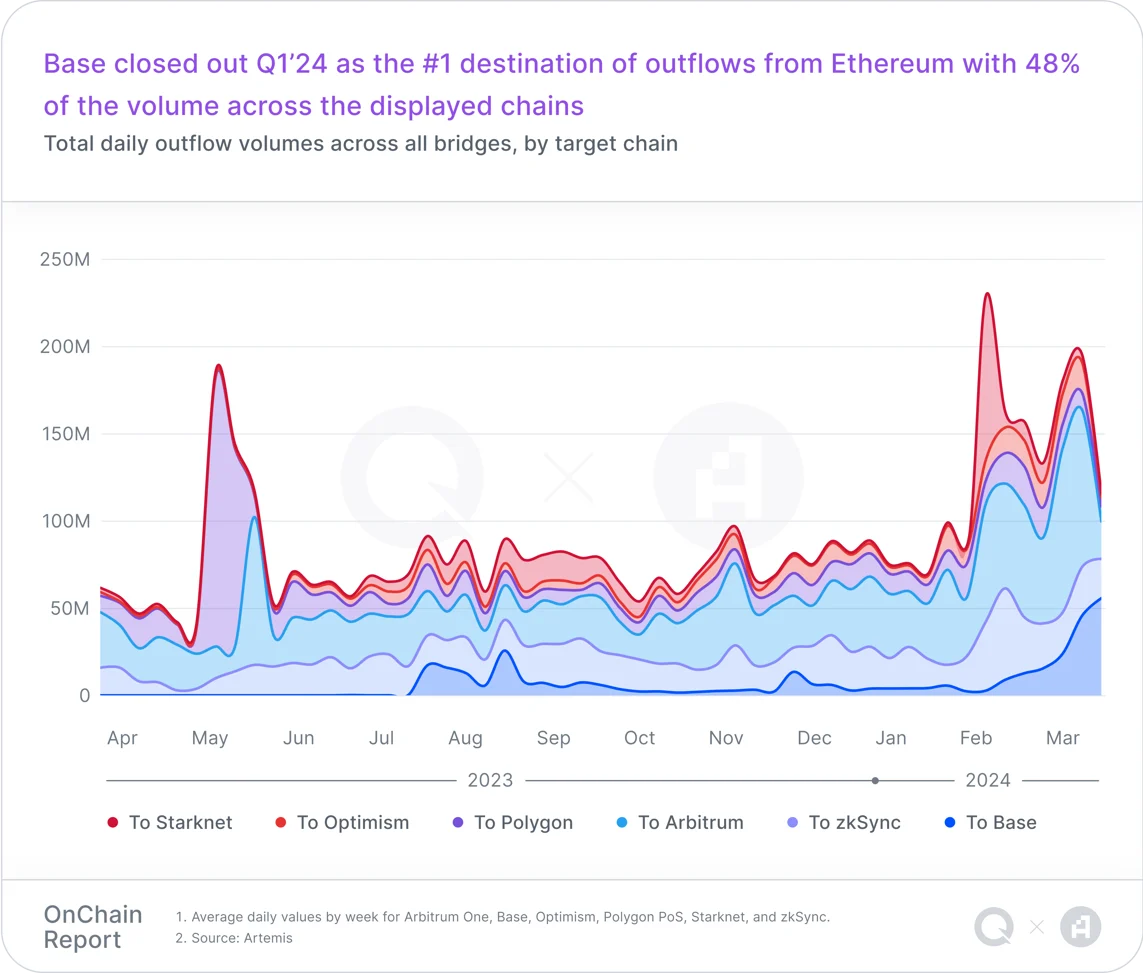

Base

Coinbase's new L2 network, Base, reached a significant milestone in the first quarter of 24, with a TVL exceeding $1 billion. After the Ethereum upgrade, the DEX daily trading volume in the Base ecosystem reached an all-time high in March, soaring by 487%, with daily trading volume surpassing $1 billion for the first time.

While Uniswap has been the largest DEX trading platform for Base so far, Base has become fertile ground for the development of emerging DEXs. In particular, Aerodrome has become the second-ranked DEX in terms of trading volume and TVL on the Base network. Base has also seen significant growth in decentralized social applications, with Farcaster achieving considerable success in the first quarter. Additionally, Memecoin is gradually being viewed as one of the ways to attract new users and gain community attention within the larger ecosystem.

Polygon

On February 23, Polygon released AggLayer v1 Mainnet, introducing the AggLayer for cross-stack communication. This tool aims to unify fragmented blockchains into a network consisting of zk-protected L1 and L2 chains, creating a seamless experience similar to a single chain.

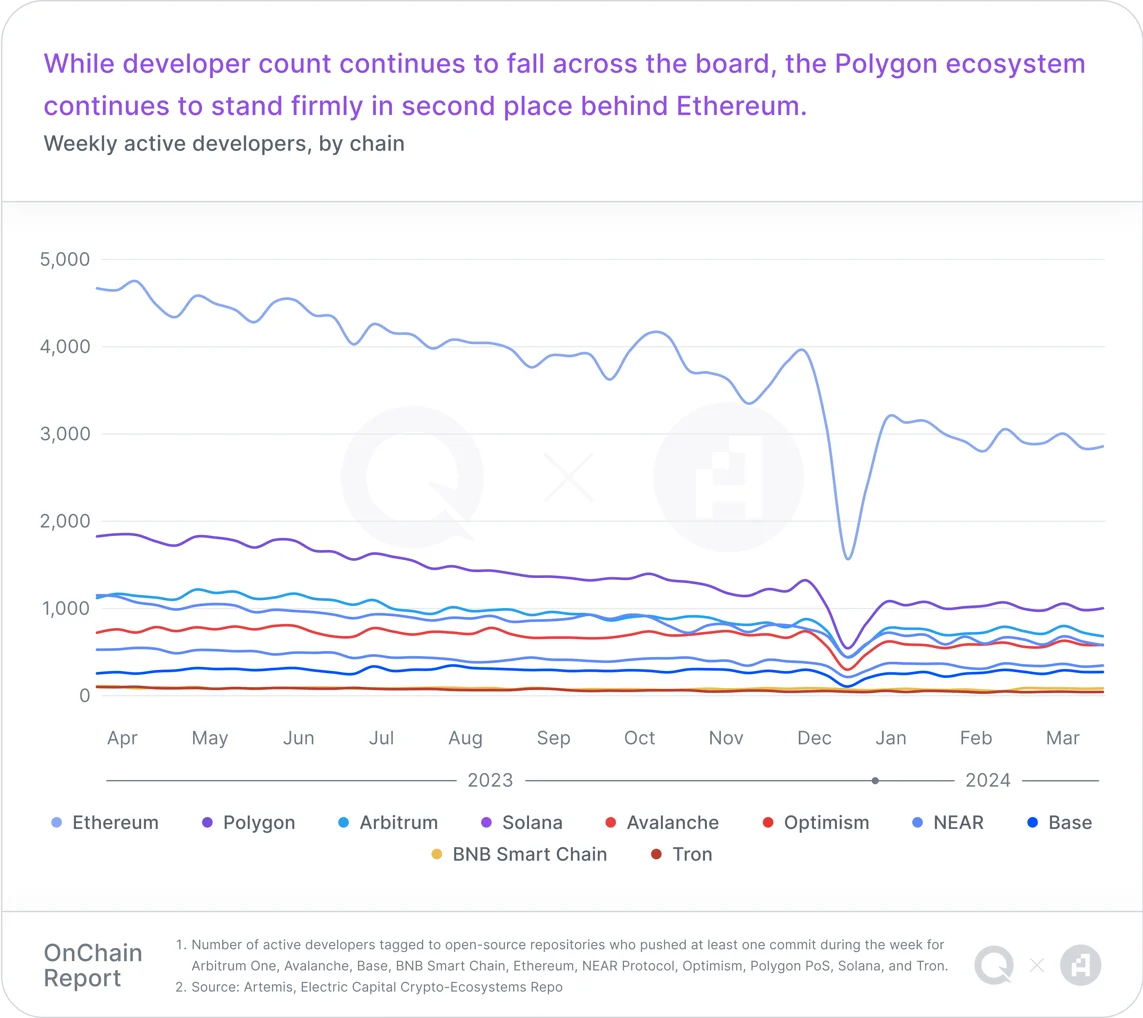

Additionally, Polygon is using its Chain Development Kit (CDK) to validate configurations for transitioning from sidechains to L2 networks. While the number of active developers on Polygon is declining, it still maintains the second position.

Solana

In the first quarter of 24, the Solana Foundation launched token extensions, providing a range of configurable features for stablecoin issuers such as GMO Trust and Paxos. Solana has gradually become a paradise for retail traders, DeFi innovators, NFT creators, airdrop opportunists, and Memecoin traders. The influx of new address activity led to a 180% increase in average daily DEX trading volume, reaching $12 billion.

Solana's revenue (in USD) soared by 597% quarter-on-quarter, rising from $7.1 million in the fourth quarter of 23 to $49.5 million in the first quarter of 24. The stablecoin market value within the Solana ecosystem also increased by 49.4% quarter-on-quarter, rising from $1.9 billion to $2.9 billion.

Funding Review

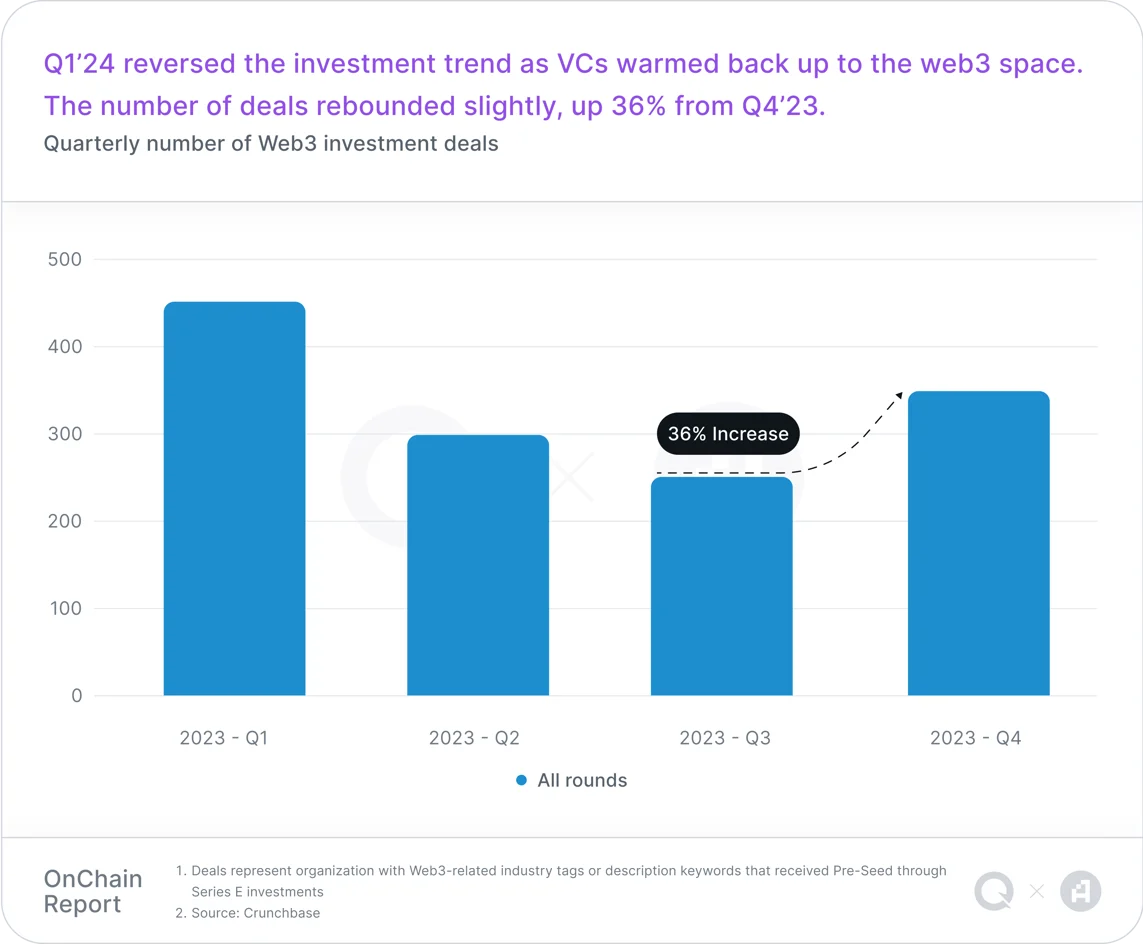

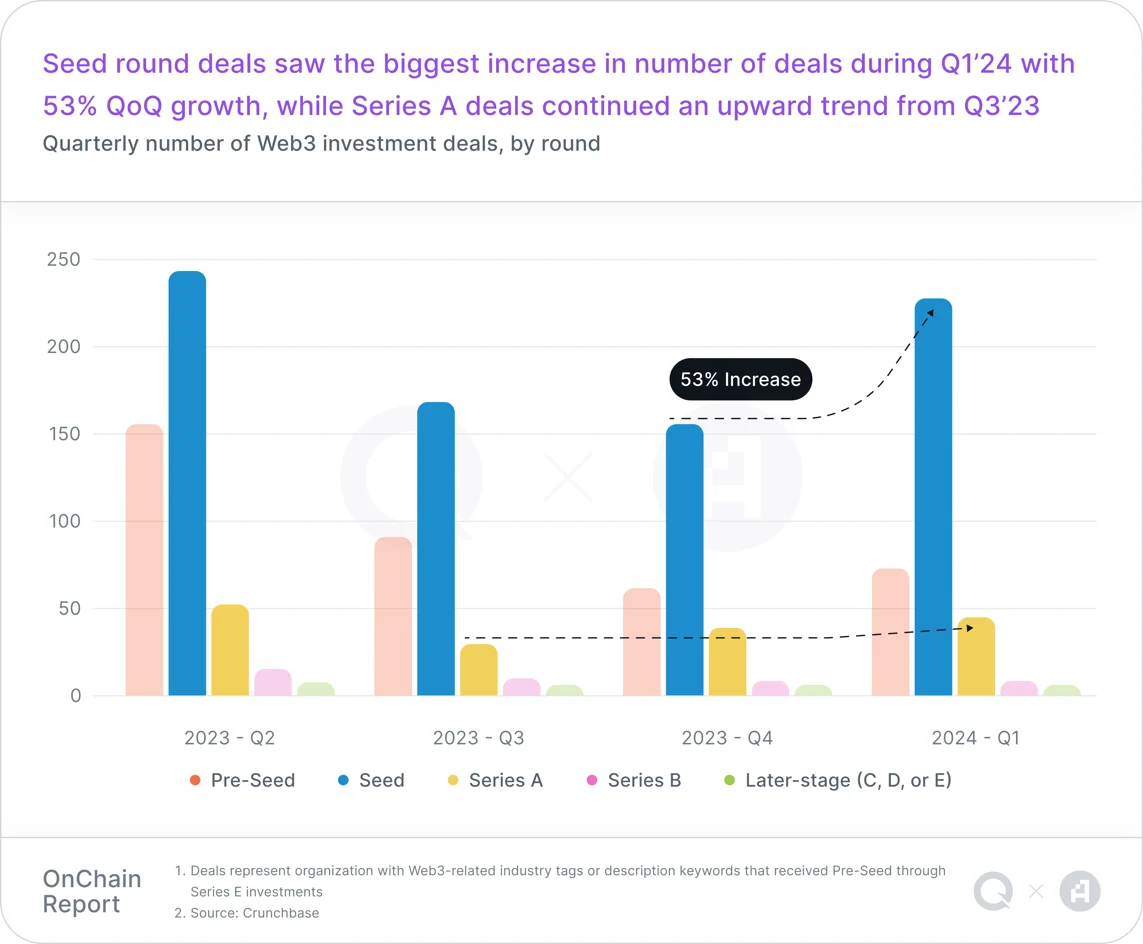

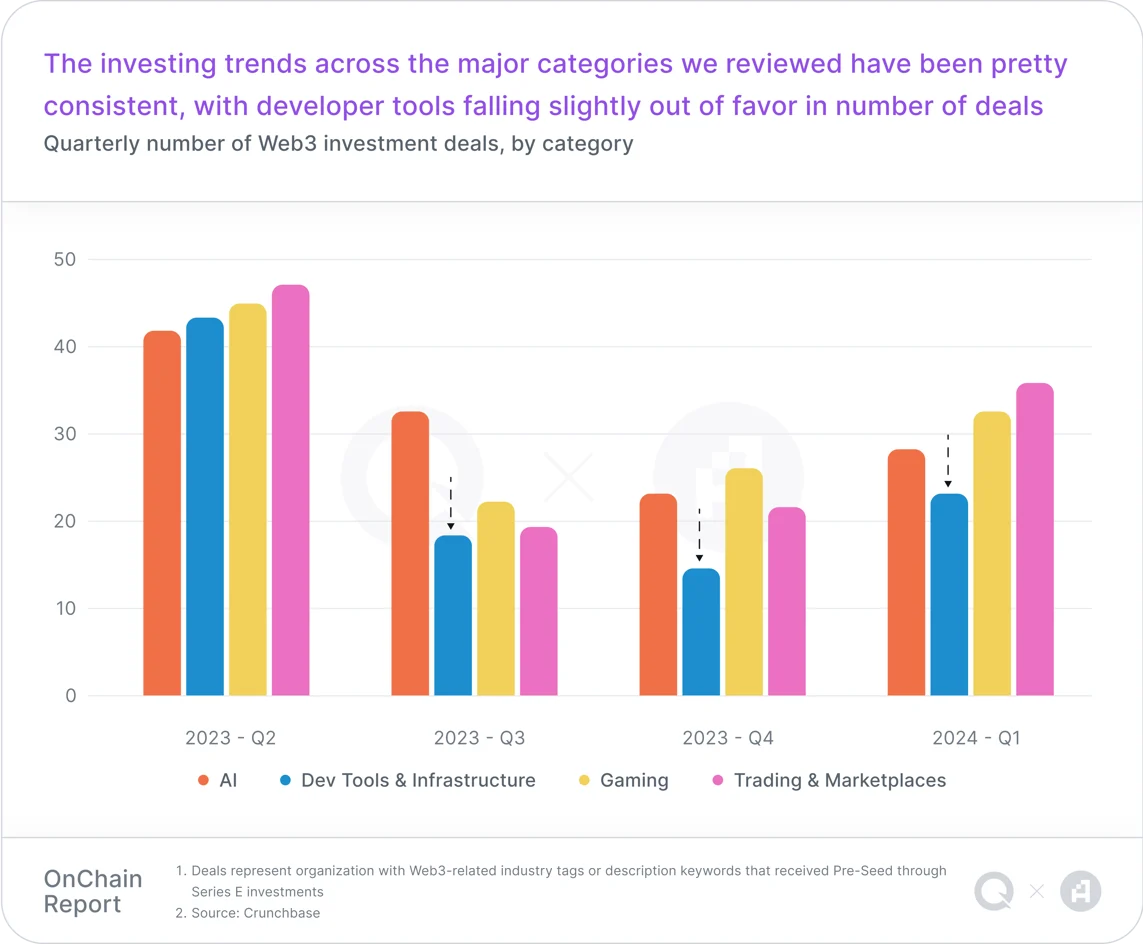

In addition to a 36% quarter-on-quarter increase in the number of fundings, the total funding for Web3 increased by 55% compared to the fourth quarter of 23. Seed round funding saw the most significant increase, rising by 53% quarter-on-quarter. The funding amounts for Series A and seed rounds significantly increased, nearly doubling from the previous quarter. Among the funding categories, the AI field was the most popular, indicating a strong market interest in exploring how AI can become a key value driver for Web3.

In contrast, funding and the number of fundings in developer tools and trading sectors only saw slight increases, indicating cautious investor attitudes, possibly due to the uncertainty or lower short-term returns in these sectors.

Overall, the growth trend in the Web3 venture capital market has recovered, highlighting a strategic shift by venture capitalists towards industries they believe will have a significant impact and drive the evolution of the blockchain landscape.

Related Reading: Crypto Market Outlook for Q2: Bullish on Bitcoin, Focus on Re-staking, AI, and Modularization

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。