When calculating the scale of inflowing funds, why do various institutions attach such importance to southbound funds?

Produced by | OKG Research

Author | Hedy Bi

The approval of Bitcoin spot ETF is no longer a novelty. According to Reuters yesterday, at least three offshore Chinese asset management companies will soon launch Hong Kong virtual asset spot ETFs (Bitcoin spot and Ethereum spot ETFs). The strong support of the Hong Kong government for Web3 and frequent policy benefits have become the industry's expected consensus. The European Cloud Chain Research Institute observed that the approval of the Hong Kong Bitcoin and Ethereum spot ETFs did not cause a great sensation in the market as when the Bitcoin spot ETF was approved in the United States. However, when we were asked by the media, we learned that the focus of everyone was more on how much capital it would bring and its deeper significance. In this article, the author discusses the following questions from the perspective of "Hong Kong stock traders":

1. When calculating the scale of inflowing funds, why do various institutions attach such importance to southbound funds?

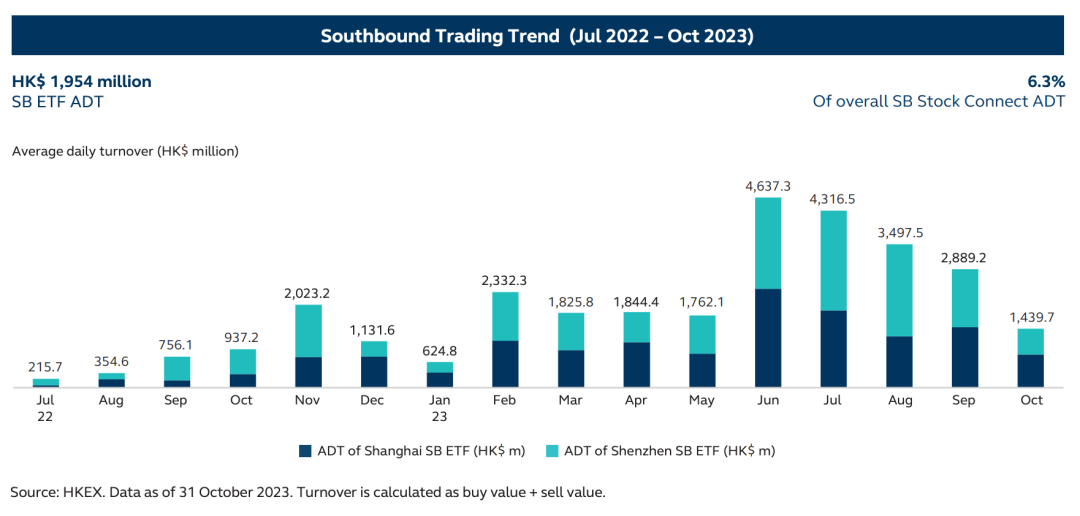

Since July 2022, ETFs have been included in the "Stock Connect" for the first time. This plan allows investors from mainland China and Hong Kong to buy and settle stocks listed on each other's markets through their respective securities exchanges and clearing houses, thus creating southbound funds (from mainland China to Hong Kong) and northbound funds (from Hong Kong to mainland China).

If southbound funds are approved, the virtual asset market represented by Bitcoin will become a new financial market for China and the United States. According to public data from the China Securities Regulatory Commission, as of December 31, 2023, although there are only 8 southbound qualified ETFs available for mainland investors to choose from, their daily trading volume reached as high as 108.3 billion RMB (approximately 15 billion USD), which means that 5% of the qualified ETFs available for southbound funds attracted 16% of the capital inflow to the Hong Kong Stock Exchange (RMB channel).

However, we also noticed that the number of qualified ETFs entering the Hong Kong ETF market through the Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect channels is quite limited. In addition, the Hong Kong Securities and Futures Commission proposed in its 2024 outlook to consolidate Hong Kong's position as the world's leading offshore RMB center through "Interchange Connect," "HKD-CNY dual counter model," and dual counterparty mechanism. Considering the current attitude of the mainland towards virtual asset trading, after communicating with relevant financial markets in Shanghai and Hong Kong as well as industry insiders in Web3, the European Cloud Chain Research Institute concluded that the possibility of the Hong Kong Bitcoin and Ethereum spot ETFs being approved for opening to mainland investors in the short term is extremely low. According to the comprehensive opinions of various regulatory agencies and industry insiders, we believe that under the current circumstances, mainland residents cannot invest in Bitcoin and Ethereum spot ETFs through the Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect channels.

However, the funds obtained through the Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect channels can only be returned through the local settlement system along the original route, that is, through the RMB funds of the Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect, and will not remain in the Hong Kong market in other asset forms, which also means that offshore RMB is not within the channel of the Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect.

2. U.S. Bitcoin ETF vs. Hong Kong ETF, does Hong Kong still have attractiveness?

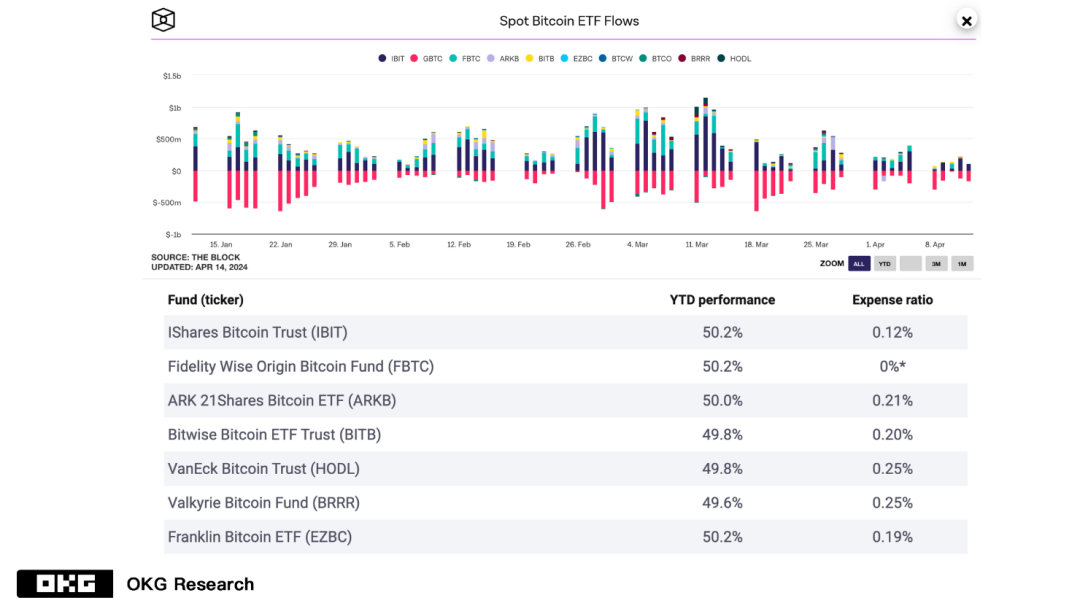

We noticed that Eric Balchunas, a senior ETF analyst at Bloomberg, believes that 500 million USD would be a rather optimistic figure. However, we firmly believe that the potential of the Hong Kong virtual asset ETF market far exceeds this figure. This article will analyze the risk preferences of Hong Kong ETF investors, the situation of the Hong Kong virtual asset market before the announcement of the news, and the setting of ETFs in the two places from three aspects:

Eric Balchunas compared the size of the ETF market and indeed found an interesting phenomenon. Among the top ten ETFs in Hong Kong, the ETF ranked first by AUM accounts for 54% of the total AUM, while in the United States, it is 20%. This means that the distribution of investors in the Hong Kong ETF market is uneven, with over 50% of investments concentrated in the top.

In addition, the ETF ranked first by AUM in the Hong Kong market is also the SPDR GOLD TRUST, which is used as a comparison by Bitcoin investors, with an AUM of approximately 69.8 billion USD, while the ETF ranked first in the U.S. ETP market is based on the S&P500, with an AUM of approximately 518.7 billion USD, and the AUM of SPDR GOLD TRUST accounts for 13.5% of the first place in the United States. Therefore, it can be concluded that the head effect of the Hong Kong ETF market is more significant, and compared to U.S. ETF investors who prefer to invest in U.S. stocks (such as those based on the S&P500), Hong Kong investors have a greater interest in investing in gold. This indicates that investors in the two markets have different understandings of risk preferences and economic cycles. The Hong Kong market will have a greater acceptance of Bitcoin as "digital gold".

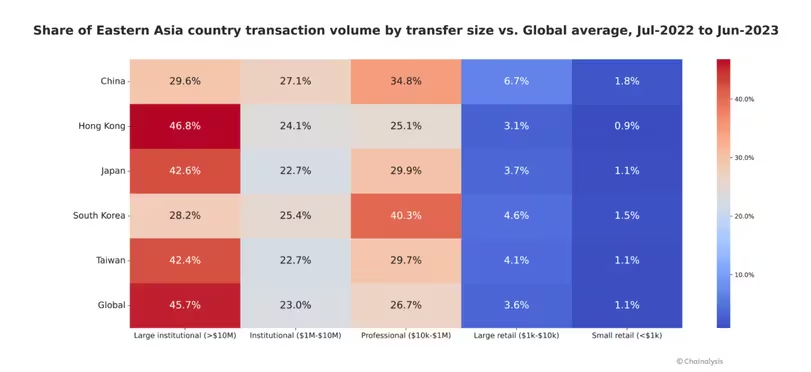

Data source: HKEX, ETFdatabase

It seems that the people of Hong Kong also have a higher enthusiasm for Bitcoin. When the European Cloud Chain Research Institute conducted in-depth research in the Hong Kong virtual asset OTC market at the end of last year, it found that as of January this year, there were at least 200 physical cryptocurrency OTC exchange shops in the Hong Kong virtual asset market. According to our calculations, the average annual trading volume through exchange shops alone exceeds 10 billion USD. Before the introduction of ETFs through this channel, Chainalysis also estimated the Hong Kong market: despite having a much smaller population than the United States, the active over-the-counter cryptocurrency market in Hong Kong during the bear market last year (June 2022 to June 2023) drove a trading volume of 64 billion USD. Compared to other regions in Asia, Hong Kong dominates in large-scale institutional cryptocurrency trading. In the annual virtual asset trading in Hong Kong, 46.8% are institutional trades exceeding 10 million USD, higher than the global average for similar trades.

Data source: Chainalysis

In addition, in terms of redemption mechanisms, due to Hong Kong's comprehensive regulatory system in the virtual asset market, the physical redemption mechanism will be more favorable for "crypto-native" investors. The four methods of coin in and money out, coin in and coin out, money in and coin out, and money in and money out are more flexible and offer arbitrage opportunities than the cash redemption mechanism in the United States (the last one). In addition, we believe that for Hong Kong investors who already hold BTC and ETH, the probability of obtaining illegal funds when exchanging Bitcoin for fiat currency is reduced to a greater extent, thereby protecting investors' assets.

As for the Ethereum spot ETF, although the market value of Ethereum is 371.7 billion USD, compared to the market value of Bitcoin at 1.25 trillion USD, it is more motivating for the issuer to promote it. Because in addition to the profit brought by the price increase, the Ethereum spot ETF also has additional yield brought by staking. As early as February 7, 2024, Ark Invest submitted an updated S-1 amendment application, adding "the sponsor may from time to time pledge a portion of the trust assets to one or more trusted third-party staking platforms."

For qualified investors in Hong Kong, especially those making large transactions, as far as we know, the management fees in Hong Kong are not advantageous. However, there are other factors to consider for the inflow of funds. For example, for the current fund with a fee rate of 0, FBTC is not ranked first in terms of fund inflow, which may be related to the fact that FBTC adopts a self-custody form rather than a third-party (coinbase, gemini) custody form.

Data source: The Block, Public Info

The strategic move of Hong Kong to lay out Web3 and open up the more well-known ETF channel is not only a favorable adjustment for financial institutions due to the overall "shrinking" of assets on the balance sheet, but also a strategic move for staying at the "table" or even dominating the new financial table. With the favorable fundamentals such as the Bitcoin halving, we look forward to the future potential of the Hong Kong virtual asset spot ETF!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。