The Vega protocol has attracted widespread attention with its innovative approach to creating and trading derivatives on a fully decentralized network.

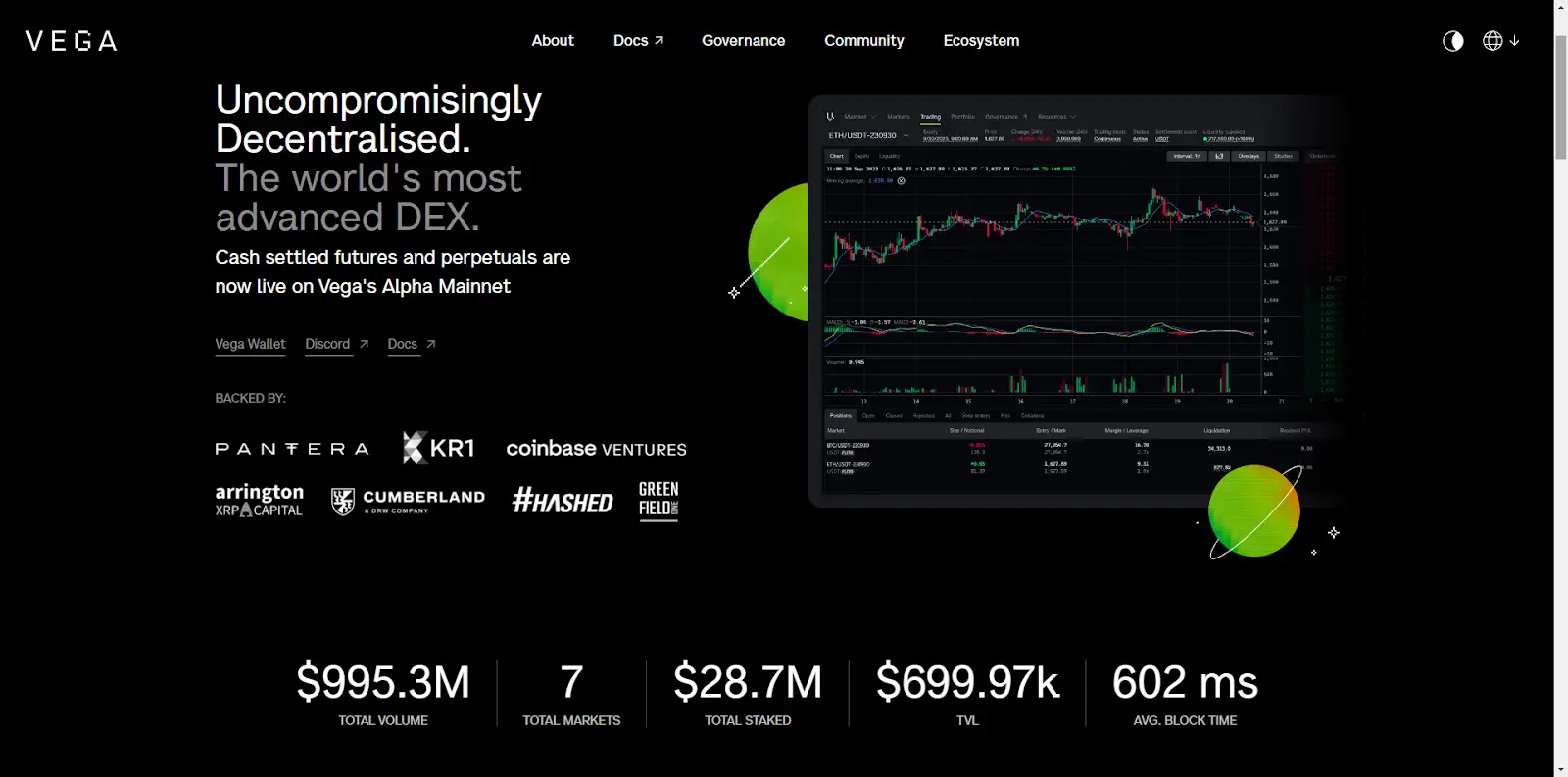

On March 12, 2024, Vega launched the world's first "points" futures market, sparking attention. Prior to this, in May 2023, Vega completed a $2 million seed round of financing. According to reports, Vega Protocol is a protocol for creating and trading derivatives on a fully decentralized network.

Using the Vega Protocol, anyone can create products, create markets, and trade. The project focuses on optimizing DeFi and trading systems, locking user assets in multi-signature addresses, and then generating corresponding assets on the Vega Protocol network to solve cross-chain asset issues while ensuring the security of user assets.

The following sections introduce the Vega Protocol project from multiple dimensions.

How Vega Builds a More Ideal Financial System Through Decentralized Trading Environment

The Vega protocol aims to address many issues in traditional financial markets, such as reliance on centralized third parties, high costs caused by intermediaries, and the structure and organization that limit market accessibility and innovation, while paving the way for financial product innovation.

- Specially built proof-of-stake blockchain: Through fully decentralized high-performance peer-to-peer network transactions, Vega sets new standards for decentralized financial trading;

- Low fees, no cost for placing orders: Similar to the fee structure of centralized exchanges (CEX), Vega's platform does not require payment of gas fees for each transaction, significantly reducing transaction costs;

- Transparent and open trading: All source code and trading data of Vega are public, ensuring the transparency and openness of the platform;

- Capital-efficient margin trading: Vega supports leverage trading with fully cross-margin, improving the efficiency of capital utilization;

- Rich CEX-style order book and API: Vega provides a fully decentralized limit order book (dCLOB) and historical data API, providing users with a similar experience to centralized exchanges;

- Decentralized liquidity incentives: The Vega protocol fairly rewards liquidity providers from trading fees, incentivizing decentralized liquidity provision;

- Permissionless market creation: Vega supports the creation of markets on any basis through on-chain governance without any permission, greatly promoting market innovation and diversification.

Analysis of the Liquidity Incentive Mechanism in the Vega Protocol: Rewards and Penalties, Dynamic Adjustment of Interest Rates

The development of decentralized derivative markets, especially in attracting and maintaining liquidity, faces significant challenges. The Vega protocol provides effective solutions to this problem through a series of innovative incentive mechanisms. The following are the main features and mechanisms of Vega's liquidity incentives.

- Multi-dimensional quantitative indicators: Vega protocol comprehensively evaluates market liquidity by introducing multi-dimensional indicators, including order book depth, distance between orders and market mid-price, and order duration. The comprehensive use of these indicators makes liquidity assessment more accurate and provides a solid quantitative basis for incentive allocation;

- Dynamic liquidity demand response: The protocol dynamically adjusts the liquidity demand assessment standards in real time by analyzing market conditions to ensure effective matching of liquidity supply and market demand. This flexible response mechanism improves market adaptability and efficiency;

- Contribution-based reward system: Vega protocol adopts a reward mechanism based on the actual contribution of liquidity providers to market liquidity, ensuring that liquidity providers receive rewards matching their contributions. This mechanism incentivizes market makers to provide higher quality liquidity and encourages early market participation;

- Penalty system: To ensure the execution of liquidity commitments, the Vega protocol designs a mechanism to penalize participants who fail to fulfill their liquidity provision commitments. This penalty system further ensures stable market liquidity supply;

- Application of consensus mechanism: The Vega protocol uses a continuous consensus mechanism to coordinate market maker behavior and achieve optimal allocation of liquidity supply through consensus. This consensus mechanism not only promotes information sharing and cooperation among market participants but also enhances overall market efficiency and security;

- Dynamic market adjustment: Through continuous consensus, the Vega protocol can dynamically adjust incentive measures to adapt to market changes. This flexible adjustment mechanism ensures effective attraction and maintenance of required liquidity under different market conditions.

The Birth of the First Points Derivatives Market in the DeFi Industry, Can Vega Lead the Industry's Transformation?

On March 12, Vega brought unprecedented innovation to the DeFi industry with its pioneering permissionless infrastructure—the birth of the first points derivatives market. The launch of the Vega protocol enables anyone to propose new derivative market ideas and turn them into reality through on-chain voting, democratizing market access and opening the door to previously unimaginable market types. Since the mainnet launch in May 2023, Vega DEX has seen a total trading volume of nearly $1 billion, and the newly launched Palazzo feature further strengthens its position as the preferred decentralized trading platform for sophisticated traders.

Of particular note, through proposals and voting in the Vega community, the EigenLayer points derivatives market successfully went live, becoming the first market of its kind in the cryptocurrency field. This innovation not only promotes price discovery but also provides EigenLayer users with a way to hedge the value of their points, while also offering the entire cryptocurrency community an opportunity to explore the future value of this ecosystem.

The rise of the points system has changed the incentive form of cryptocurrencies, and Vega's points market provides users with a new way to test and realize the value of points. At the same time, the potential value and inherent advantages of points have become the focus of the cryptocurrency industry. Through the mechanism of permissionless market creation, the Vega protocol provides liquidity, risk management, and hedging opportunities for points holders and promotes price discovery through the market.

Vega is not only a protocol that supports DeFi application chains, but also defines key market parameters in a community-driven manner, challenging the conventional practices of the traditional cryptocurrency and pre-issued token markets. Leveraging UMA's Optimistic Oracle, Vega provides an innovative solution for the points market, ensuring transparency and fairness in trading.

The engineering team of Vega also provides sample smart contract code, demonstrating how to achieve on-chain settlement, further proving Vega's leading position in driving DeFi innovation. With the launch of the Vega points futures market, we can expect Vega to continue unlocking new DeFi use cases and leading the market in exploring and responding to these new products.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。