Project Name: EthenaLabs

Network: Ethereum L1

Current Total Value Locked (TVL): $4.1 billion

Project Type: CDP (Collateralized Debt Position)

Code: $USDe & $ENA

Cryptocurrency Ranking: #NA

Market Cap: NA

Fully Diluted Valuation (FDV): NA

Circulating Supply: NA

Total Supply: NA

Introduction

Following the collapse of Terra and its related UST and Anchor protocol in 2022, interest in decentralized stablecoins has plummeted. However, with the continuous development of web3, sectors are constantly rotating and evolving. Currently, the Greythorn team sees projects like Prisma, Liquity, and Lybra at the forefront of innovation in the LSD/CDP field. Meanwhile, Maker and Curve maintain their Total Value Locked (TVL).

Source: Defillama

Many experts are questioning whether EthenaLabs' new project USDe can maintain its ~27% annualized yield (APY) while avoiding a situation similar to Anchor that deterred investors.

After announcing its funding on July 12, 2023, EthenaLabs reignited the enthusiasm for DeFi by creating a digital currency pegged to the US dollar using LST (stETH). This raises the question of whether it will fully utilize Ethereum's Layer 1 and Layer 2, or if it will follow in the footsteps of LUNA, becoming the next major failure in the crypto market.

Why are USDe and Stablecoins Important?

Stablecoins have become key participants in the decentralized currency market, significantly influencing market dynamics. They play a crucial role in supporting trading and increasing market stability in both spot and futures markets, whether on centralized or decentralized platforms, especially in the backdrop of continuous fluctuations in the crypto market.

In the past two years, the stablecoin sector has experienced significant growth, with on-chain transaction volumes this year exceeding $9.4 trillion; accounting for over 40% of the Total Value Locked (TVL) in DeFi among the top five assets. They dominate trading, with data showing that over 90% of order book trades and over 79% of on-chain transactions involve stablecoins.

Source: X: Route2FI

AllianceBernstein, a globally leading asset management company with $725 billion in assets under management (AUM), predicts that the stablecoin market could reach $2.8 trillion by 2028. This forecast indicates a significant growth opportunity from the current $138 billion market value (previously reaching a peak of $187 billion).

The increasing acceptance of stablecoins and their consistent performance in both centralized and decentralized environments demonstrate their indispensable role in the crypto ecosystem. Optimistically, their potential for race track growth is as high as 2000%, presenting significant opportunities for investors and market participants to interact with projects like EthenaLabs' USDe.

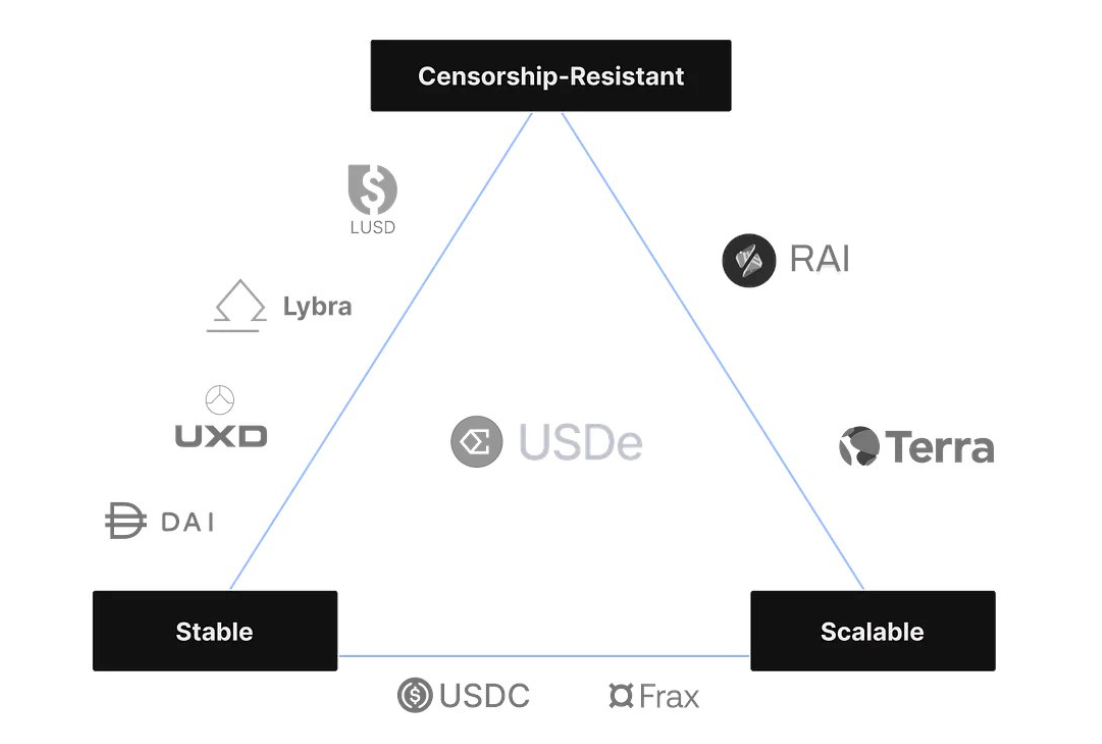

Specifically, USDe is aiming to meet the growing demand by providing an anti-censorship, scalable, and stable market option.

Project Overview

Inspired by Arthur Hayes' "Dust to Crust" article, EthenaLabs is dedicated to creating a derivative-backed stablecoin to address the significant issues of crypto's reliance on traditional banks. Their goal is to provide a decentralized, permissionless savings product for a wide audience. EthenaLabs' synthetic dollar USDe aims to be the first crypto-native, anti-censorship, scalable, and stable financial solution achieved through Delta hedging of collateralized Ethereum.

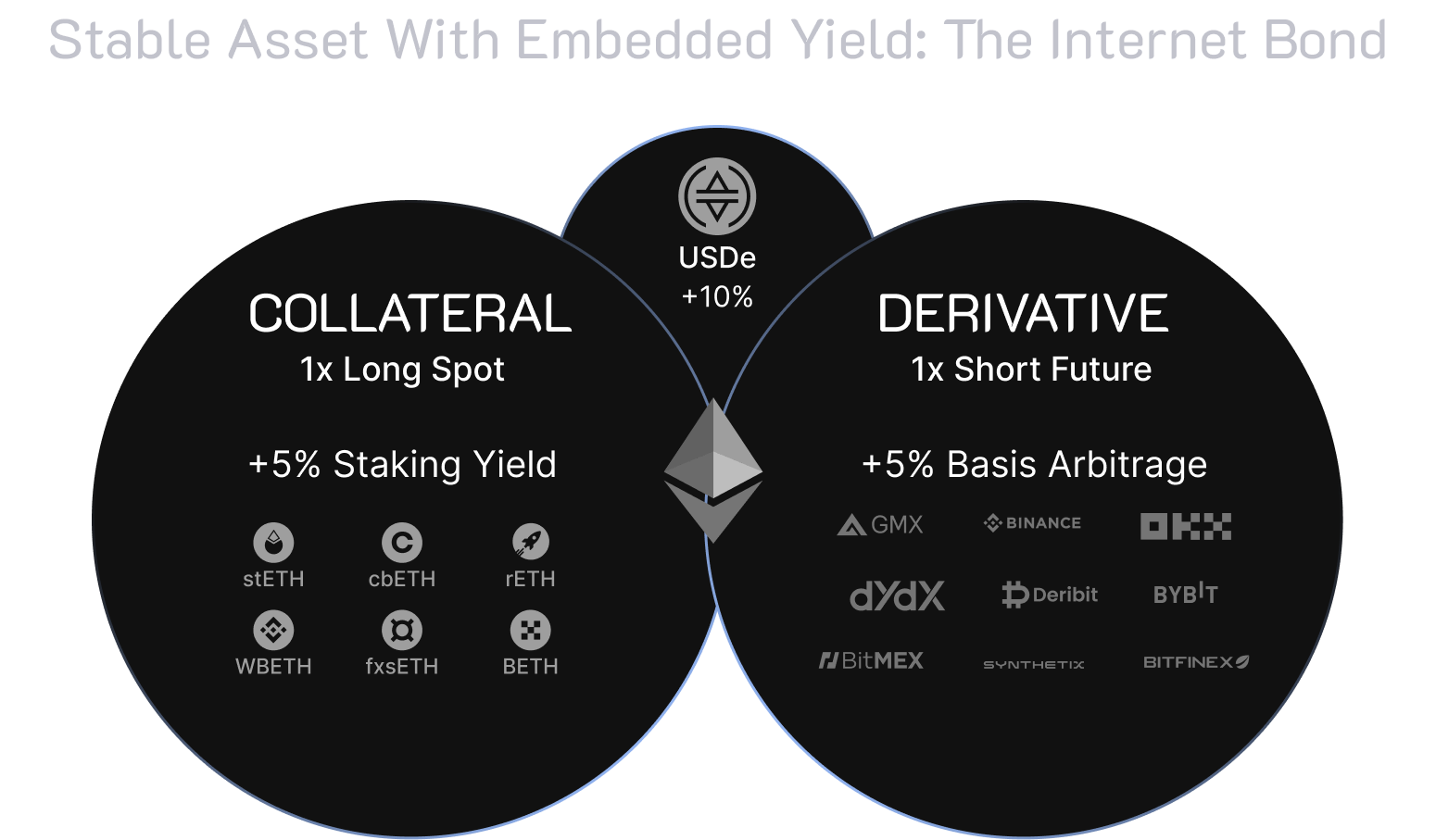

EthenaLabs plans to introduce a product called "Internet Bond" alongside USDe. According to the EthenaLabs Gitbook, this will be a crypto-native, yield-generating, USD-denominated savings tool based on collateralized Ethereum returns and the utilization of funding and basis differentials in perpetual contracts and futures markets.

EthenaLabs stands out with its unique mission and innovative approach. Unlike other CDP projects such as Maker's DAI, Liquity's LUSD, and Curve's crvUSD, USDe from EthenaLabs generates its USD value and yield through two main strategies:

- Utilizing stETH and its inherent yield.

- Taking ETH short positions to balance Delta and utilize perpetual/futures funding rates.

This strategy allows the protocol to synthetically create a Delta-neutral CDP, combining spot deposits of stETH with corresponding short positions established through collaborations with CEXs like ByBit and Binance.

Holding sUSDe (collateralized USDe) essentially becomes a basis trade, balancing the spot stETH position with short ETH positions in the market. This setup provides users with exposure to the yield differential between these positions, currently generating approximately a yield of ~27%.

Source: EthenaLabs Gitbook

USDe: Key Risks and EthenaLabs' Mitigation Measures

Before delving into the risk and return analysis of collateralized USDe, it is important to address several potential risks associated with EthenaLabs:

Custodial Risk

EthenaLabs uses Over-the-Counter Escrow Settlement (OES) providers to custody assets, creating a dependency on the operational capabilities of these providers. Challenges in executing critical functions such as deposits, withdrawals, and exchanges could impact the protocol's efficiency and the minting/redemption functions of USDe.

Mitigation Strategy: Diversified Custodial Providers: EthenaLabs effectively manages concentration risk by diversifying collateral across multiple OES providers to minimize risk.

Centralized Exchange (CEX) Risk

The protocol uses derivatives on centralized exchanges (e.g., Binance, Bybit) to balance the collateral's Delta. The risk arises if the exchanges suddenly become unavailable.

Mitigation Strategy: Diversified CEX Channels: By diversifying the exchanges holding the assets, EthenaLabs reduces the risk of any single exchange failure.

Collateral Risk

The difference between collateral assets (stETH) and the underlying assets (ETH) in perpetual futures positions introduces "collateral risk." Significant errors in LST could lead to liquidity issues.

Mitigation Strategy: Active Monitoring and Partnerships: EthenaLabs actively monitors the on-chain integrity of stETH and maintains contact with liquidity sources, ready to replace collateral when necessary.

Liquidation Risk

Collateralizing stETH in short ETHUSD and ETHUSDT positions introduces liquidation risk if the price spread between ETH and stETH significantly widens.

Mitigation Strategy: Systematic Collateral Management: EthenaLabs has processes in place for rebalancing collateral, transferring assets, and utilizing insurance funds to mitigate liquidation risk.

Systematic Collateral Rebalancing

Ethena systematically delegates additional collateral in any risk scenario to improve the margin position of our hedged positions.

Asset Transfer and Recollateralization

Ethena can temporarily recirculate collateral between exchanges to support specific situations.

Insurance Fund Deployment

Ethena has the capability to swiftly deploy insurance funds to support hedged positions on exchanges.

Protecting Collateral Value

In extreme scenarios, such as critical smart contract flaws in collateralized Ethereum assets, Ethena will take immediate action to mitigate risk, solely motivated by protecting the value of the collateral. This includes closing hedged derivative positions to avoid liquidation risk becoming a concern, and converting affected assets into another asset.

Funding Risk

Sustained negative funding rates could reduce Ethena's returns.

Mitigation Strategy: Insurance Fund as Yield Protector: The insurance fund acts as a safety net when overall returns are negative, ensuring the stability of collateral.

Collateral Withdrawal Queue/Slashing Risk

ETH withdrawals may result in long queues, which could have a negative impact on stETH.

Mitigation Strategy: This primarily depends on the performance of stETH and Lido, and EthenaLabs does not have a direct mitigation strategy.

Regulatory Risk

Concerns about regulatory control over USDT, USDC, and DeFi could impact the growth of USDe in Total Value Locked (TVL), including difficulties in user attraction and retention.

Mitigation Strategy: EU-based Operations and MiCA Licensing: By operating in accordance with EU's MiCA regulations, EthenaLabs positions itself to effectively adapt to regulatory changes, reducing the impact of potential legal changes.

EthenaLabs has developed a comprehensive approach to manage various risks in its operations, emphasizing the importance of diversification, active monitoring, and strategic planning in protecting the protocol and its users.

Comparison with Anchor: Are the Returns Worth It?

Encouraging investors to conduct their own research, especially when considering USDe, which offers approximately a 27% high stablecoin yield. This yield rate is comparable to the situation with the Anchor protocol, highlighting the systemic risk in the market, where the failure of a single protocol could lead to broader financial turmoil.

The decline of Anchor is primarily due to inherent risks in the design of UST, which depend on reflexive mechanisms related to the price of Luna. A significant drop in the price of Luna poses the risk of catastrophic devaluation of UST. Anchor provides UST (or aUST) yields to borrowers based on a fixed Terra ratio, regardless of market conditions, with a promised annualized rate of 19.45%.

Additionally, the "real yield" from collateralized bAssets in Anchor is only about 5.81%, significantly lower than the payout rate. This difference, coupled with its reliance on Luna's performance, sets the stage for financial crises.

For those interested in learning more about the collapse of Luna and UST, including the Anchor mechanism, we have previously detailed this in articles titled "Demystifying Anchor" and "The Collapse of Anchor."

For USDe, how its returns are generated, the risks involved, and its marketing strategy are significantly different from Anchor.

Transparent Marketing: Unlike the "risk-free" returns promoted by Anchor, the marketing of USDe directly outlines the risks and returns. Its source of yield from perpetual contracts (perps) and collateralized Ethereum (stETH) is clearly communicated, setting realistic expectations.

Real Returns: sUSDe does not promise unsustainable high deposit rates. Instead, it provides actual returns from its underlying assets, avoiding the trap of incentivizing borrowers with rates that cannot be supported by asset returns.

Avoiding Self-Collateralization: Unlike models that use their own tokens as collateral, sUSDe relies on stETH. This shift from the project's own token to a more stable asset like stETH significantly changes the risk dynamics. The focus shifts from speculative risks associated with project tokens to more manageable liquidity risks of ETH and stETH, as well as other mentioned risks.

Comparing USDe to the collapse of UST is misleading, as they have fundamental differences in risk structure and operational models. The focus for USDe investors should be on understanding the specificities of perpetual funding, centralized exchange liquidity, and custodial risks, rather than unsustainable high-yield strategies seen in the UST model.

Overall, compared to Terra's UST, USDe presents a more thoughtful and potentially safer option in risk mitigation and product structure. By leveraging native yields and effectively managing risks from derivative sources, USDe stands out not only for its yield opportunities but also for its strategic design and risk management practices.

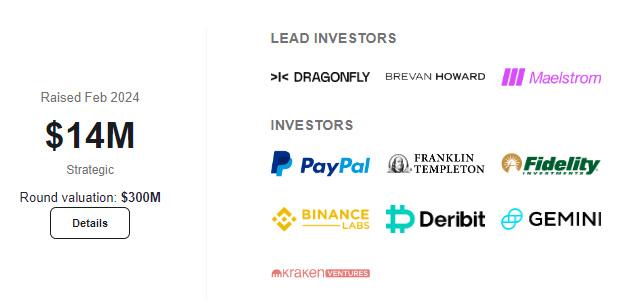

Outstanding Team and Support

Under the leadership of @leptokurtic_, the Ethena team successfully completed three rounds of funding, attracting significant participation from centralized exchanges, market makers, DeFi innovators, and traditional financial institutions. This broad support emphasizes the project's credibility and potential impact on the ecosystem.

Under tight deadlines, the team demonstrated excellent planning and coordination, ensuring the protocol was ready for mainnet release. They prioritized risk management and security, conducting thorough audits before the release.

Source: ICO Analytics: Ethena

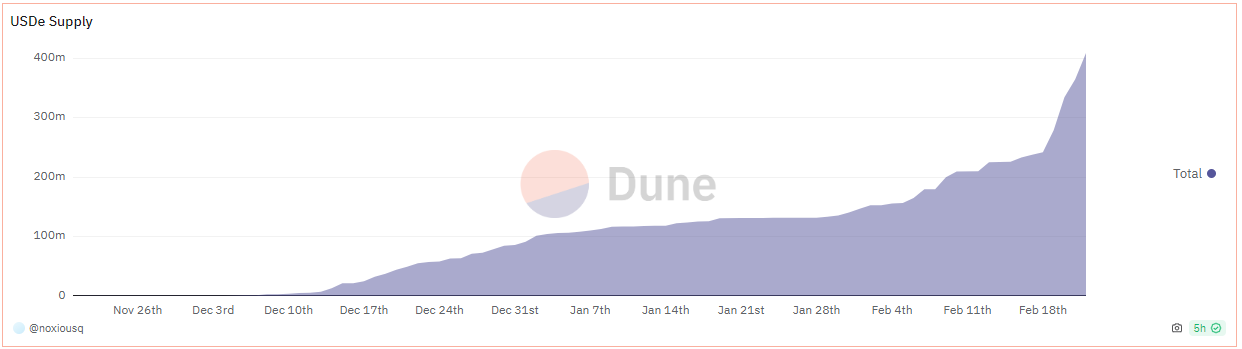

The successful Shard airdrop activity demonstrates the market's interest in decentralized stablecoins. Since early December 2023, the Total Value Locked (TVL) has increased by 135 times, reaching over $410 million, marking an impressive start.

Source: @noxiousq Dune Analytics

This momentum indicates strong demand for products like USDe, attracting not only a significant TVL but also the attention of investors supporting its vision. As USDe moves forward, it aims to introduce the next billion dollars of TVL into the DeFi space, potentially opening up new opportunities similar to those seen during the Luna cycle. It makes one wonder: does this mark the beginning of another transformative phase in decentralized finance?

Conclusion

At Greythorn, we focus on on-chain analytics, liquidity dynamics, and other effective data. If you find our analysis valuable, we would greatly appreciate you becoming part of our community. You can connect with us on LinkedIn, visit our website, or follow our X for a deeper understanding of the cryptocurrency world.

We also recommend staying updated on our latest findings. This includes comprehensive research on DePIN and its ecosystem growth, Bittensor (TAO), and our exploration of HyperOracle on ZKML.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。