Recently, the airdrop activity of Starknet has once again brought a wave of wealth to many people, but there are also many users who regret missing this opportunity for wealth because they did not have enough funds in their wallets. Of course, from the frenzy of airdrop activities to the present, it is actually very difficult for many users to achieve a proportional return on investment, due to the high uncertainty of the airdrop conditions. It is often easy to find cases where one has worked hard for half a year, only to miss the opportunity due to a small condition not being met, and with various costs, there is also a certain probability of negative returns.

It is for this reason that more people are beginning to turn their attention to transparent airdrop incentive activities, because the conditions for such airdrop activities are certain, and therefore participants will also receive a certain return. At the beginning of this month, Lista DAO (formerly Helio Protocol) on the BNB Chain released a series of transparent airdrop activities, which are not too intense at the moment.

Lista DAO has received a $10 million investment from Binance Labs and belongs to the BNB Chain's native decentralized stablecoin and liquidity staking project, which has received support from Binance Labs. Judging from the performance of previous projects invested in by Binance Labs, the expectations for this airdrop activity are very high, and since it is a transparent airdrop, it is very worthwhile for participants to join.

Lista DAO Airdrop Details

Helio Protocol is the largest decentralized stablecoin protocol on the BNB Chain. The project strategically merged with Synclub in July 2023 and announced an upgrade and rebranding to Lista DAO in December 2023. Recently, Lista DAO announced its own airdrop incentive activity, where users can earn points by interacting with officially designated projects, and later receive $LISTA token airdrops based on these points.

This activity is divided into multiple seasons, with the first season running from February 5th to February 29th, 23:59 (UTC+0), and the second season to follow shortly after, with 2% of the total token allocation. During the activity, users can participate in 6 types of tasks to collect stardust points, mainly including:

- Providing TVL on Lista (20% weight)

- Borrowing lisUSD on Lista (5% weight)

- Depositing BNB on Synclub and minting slisBNB (40% weight)

- Providing lisUSD (15% weight)

- Providing liquidity for the slisBNB pool (20% weight)

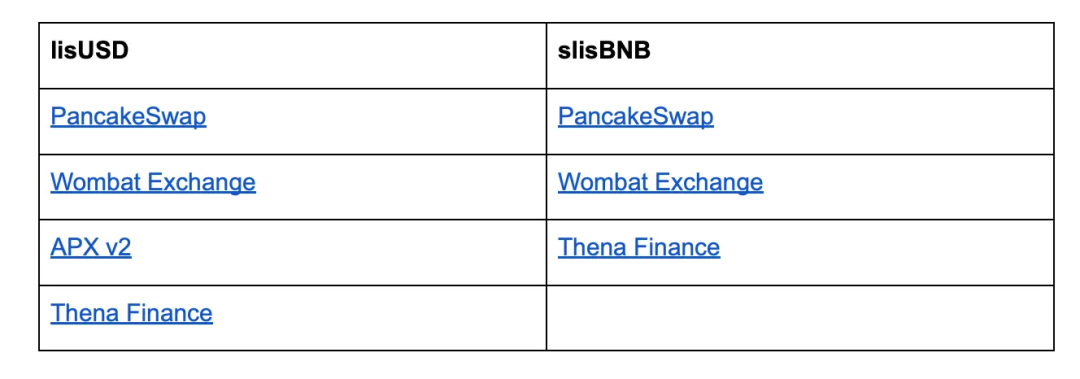

- Generating lisUSD and slisBNB trading volume, including on Pancakeswap, Wombat Exchange, APX V2, Thena Finance. Users will earn 1 stardust for every $1 of trading volume generated, with a total allocation of 0.2%. On APX, users need to deposit lisUSD as collateral to participate in trading to generate eligible trading volume.

From the above rules, it can be seen that the first 5 interactions will require a relatively large amount of funds and time, which may not be friendly to ordinary users, except for those with sufficient funds. Therefore, the 6th activity is relatively more cost-effective and suitable for accumulating points through trading, and overall, task 6 should be prioritized.

APX Offers the Best Cost-Effectiveness

APX V2 is a decentralized contract futures platform that can generate more trading volume in a short period of time, with higher efficiency and lower fees, and can achieve zero slippage trading. Pancakeswap, Wombat Exchange, and Thena Finance are all spot DEX, with low trading efficiency, high fees, and most importantly, relatively high slippage, resulting in more wear and tear. In comparison, using APX for trading is the most suitable option. In extreme cases, using 1001x leverage with $100 can generate $100,000 in trading volume at once, with very high efficiency. In addition, with futures contracts, it is convenient to hedge long and short positions, so its wear and tear costs are also very low, making it advantageous to use APX V2 for trading to earn Lista airdrop points.

If Lista opens with an initial circulation of 8%, based on the scale of a $10 million project financing, an initial circulation of 50 million USD is not excessive. Calculated at close to 0.2% for APX airdropping Lista (APX's trading volume efficiency is much higher than other projects), it is equivalent to providing APX with an airdrop of nearly $1 million in tokens, which is quite competitive.

Some people may think that contract trading carries a high risk, but in fact, for trading volume accumulation, as long as we do not hold positions for too long, and use long and short hedging strategies, the risk can be controlled very low. The main cost is the fees charged by APX, so overall, using APX to accumulate Lista DAO airdrop points has certain advantages. For those unfamiliar with leveraged trading, they can start with a small amount of positions, understand the profits and losses and risks, and then open more positions.

Airdrop Tutorial

1. Obtain $lisUSD

There are various methods to obtain $lisUSD, such as staking BNB in Lista DAO and borrowing $lisUSD, or purchasing on Pancakeswap. It is recommended to use stablecoins for purchases on Pancakeswap, mainly due to the high utilization of funds. If staking is done, attention needs to be paid to the staking rate and the price volatility of BNB, and the utilization of funds is relatively low. Under normal circumstances, it is preferable to directly purchase on Pancakeswap.

2. Open a Position

Open the official website. Log in using the Metamask wallet, select the BNB Chain network, choose the desired trading pair, and then set the corresponding position opening parameters, including principal, leverage, take profit and stop loss lines, slippage, and mode (Dumb mode, Degen mode, or the classic mode without selecting either).

In the classic mode, we need to set the take profit and stop loss lines and leverage, similar to opening positions on a normal exchange.

Degen mode allows for higher leverage, up to 1001x, zero slippage trading, and lower fees. It is mainly used to open positions at appropriate prices and leverage, and set take profit.

In Dumb mode, the focus is on setting the expiration time after opening a position, which will automatically close and settle when the time is up. A 6% fee is charged upon winning (greater than the opening price), and all principal is lost upon failure (less than or equal to the opening price).

The calculation in Dumb mode is a bit more complex. We will illustrate with a simple example:

For example, if we choose to open a long position on BTC at a price of $51,537.5 with an expiration time of 5 minutes, if the price of the coin is greater than $51,537.5 at the end of 5 minutes, we can earn 80% profit and a 6% fee. If it is less than or equal to $51,537.5, we will lose all the principal.

3. Closing Position

When closing the position, you can select "Close Position" in the position column.

After opening a position, you can close it a few minutes later and repeat the operation. It is worth noting that when we open the website, we need to make sure to operate on APX V2. There are no rewards in V1. When operating, we need to change the invested funds to lisUSD, USDT, or other coins for trading to be eligible for rewards.

The position fees for opening and closing cryptocurrency positions on the BNB Chain are 0.08%, and for forex positions, it is 0.02%. There is an execution fee of $0.5 when opening a position, so for each trade, we will be charged 0.08% + 0.08% + $0.5.

Point Accumulation Techniques

Overall, in this incentive task, the risk level in Dumb mode is relatively high, so it is not suitable for our trading volume accumulation purpose in this case. Degen mode has a higher risk level due to the higher leverage, so it can be considered to some extent. It is preferable to prioritize using the classic mode. Users with a high risk preference can consider Degen mode, but should avoid Dumb mode.

You can prepare two wallet accounts, one for long positions and one for short positions to hedge and reduce risk. The leverage ratio in the classic mode is relatively low, and setting take profit and stop loss can facilitate holding positions. The holding time can be 5 minutes or slightly longer to reduce the probability of liquidation. You can also use the method of hedging futures and spot, which means shorting contracts on APX V2 and then using lisUSD to buy the corresponding leveraged amount of tokens on Pancakeswap.

Do not pursue excessively high leverage. Generally, a leverage ratio of 3-10x is sufficient. High leverage positions must be hedged, and positions should be opened when the market is stable, and should not be held for a long time. Degen mode can provide a higher leverage ratio, but we need to pay attention to price fluctuations. It is generally advisable to trade tokens like BTC or ETH, which have relatively small price fluctuations. Additional margin can only be added in the classic mode, not in Degen mode.

Forex trading (similar to stablecoin exchange) is also supported on APX V2, such as EUR/USD, JPY/USD, AUD/USD, etc., with relatively low volatility, so it can be considered to increase the leverage ratio and prioritize trading in this category.

However, the forex market is not open 24/7. The specific trading hours are open all day from Monday to Thursday, closed at 23:00 (UTC+0) on Friday and Sunday, and closed all day on Saturday. You can select forex in the variety column, and currently, due to the low volatility, trading can be considered.

About APX

APX (apollox.finance) is a decentralized derivatives DEX that supports multiple chains. APX received an investment from Binance Labs in 2022 and supports BNB Chain, Arbitrum, opBNB, zksync, Manta Network, and Base Chain, among others. As of now, APX's TVL has exceeded $45 million, and the number of users is close to 180,000.

The main advantages that attract users to APX are as follows:

- Classic perpetual contracts can reach up to 250x leverage, and in Degen mode, it can provide leverage of up to 1001x.

- Low slippage, with slippage as low as 0.01%, and in V2 Degen mode, the slippage is 0.

- High trading performance, used by over 30 partners including Pancakeswap.

- Position isolation, so if one position is closed, it will not affect other positions.

Currently, APX is the largest decentralized derivatives exchange on the Binance Chain, and the security of assets traded on APX is relatively high. With the support of Binance Labs, it naturally receives more attention, which is another major factor that attracts users to APX.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。