Author: Route 2 FI, Cryptocurrency Researcher

Translation: Felix, PANews

Ethena Labs, the developer of the Ethereum stablecoin USDe, recently announced the launch of its public mainnet and introduced the "Shard Incentive" to encourage users. Currently, the annual interest rate of the stablecoin USDe is 27%. How sustainable is Ethena? This article provides an in-depth analysis of Ethena.

What is Ethena?

Ethena is a synthetic dollar protocol based on Ethereum, providing a native cryptographic solution for currencies that do not rely on traditional banking operations.

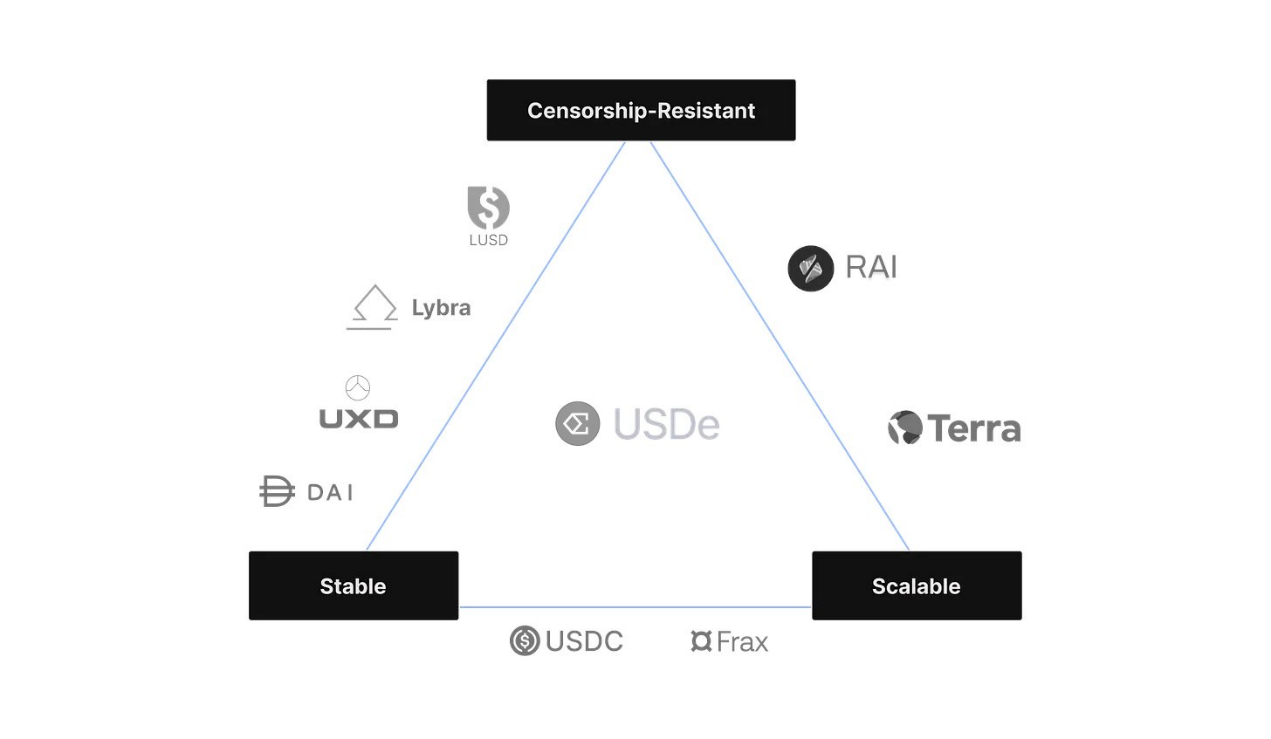

Ethena's synthetic dollar USDe provides the first anti-censorship, scalable, and stable cryptographic native solution by using Ethereum as collateral for Delta hedging.

The "Internet Bond" will combine income from staked Ethereum and funds and basis from perpetual and futures markets.

Why is Stablecoin So Important?

All major trading pairs in spot and futures markets in centralized and decentralized venues are priced in stablecoins, with over 90% of order transactions and over 70% of on-chain settlements priced in stablecoins.

This year, stablecoins settled on-chain exceeded $12 trillion, accounting for over 40% of TVL in DeFi, making it the most used asset in decentralized currency markets to date.

AllianceBernstein, a global asset management company with assets under management of $7,250, predicts that the market value of stablecoins will reach $3 trillion by 2028. Currently, the market value of stablecoins is $138 billion, with a peak of $187 billion, leaving a potential growth space of 20 times.

The goal of USDe is to meet this demand through anti-censorship, scalability, and stability (hopefully).

How Does Ethena Work?

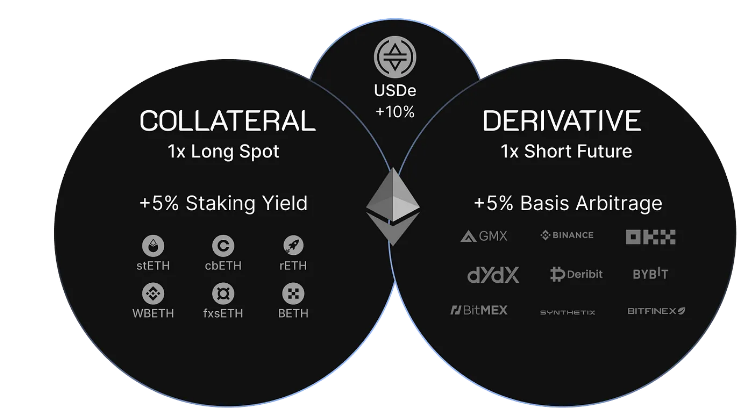

- Assuming a user deposits 1 ETH = $3000 worth of stETH and automatically receives approximately $3000 worth of USDe.

- Ethena establishes corresponding short perpetual positions on derivative exchanges with approximately the same value.

- The received assets are transferred to an "off-chain settlement" provider. Supported assets are held on-chain and off-chain servers to minimize counterparty risk.

Ethena generates two sustainable sources of income from deposited assets. The returns given to users come from:

- Consensus and execution layer rewards from staked Ethereum (annual interest rate of 3.5%)

- Funds and basis from delta hedging derivative positions (annual interest rate of 0-20%). The annual interest rate is variable and may be negative (detailed explanation below).

For more detailed information on returns, please visit: https://ethena-labs.gitbook.io/ethena-labs/solution-overview/yield-explanation/historical-examples

If the protocol incurs losses due to funds or other reasons, they will be covered by Ethena's insurance fund rather than the staked contract.

- When users mint USDe, Ethena establishes a short position.

- When users redeem USDe, Ethena closes the position.

- Ethena cross-exchange closes/opens positions to realize unrealized gains and losses.

If the value of USDe on the external market is lower than that on Ethena (assuming the external market price is $0.95 and the price on Ethena is $1), users can:

- Purchase 1x USDe from Curve using USDC.

- Exchange the purchased 1x USDe for ETH on Ethena Labs.

- Sell the received ETH for USDC on Curve.

- Profit.

If the value of USDe on the external market is higher than that on Ethena, users can:

- Mint USDe using ETH on Ethena Labs.

- Sell USDe at a price higher than $1 on the Curve pool, exchanging for USDC.

- Purchase ETH with USDC on Curve.

- Profit.

5 Risks of Ethena

1. Funding Risk: Related to the possibility of continuous negative funding rates

Ethena can generate income from funds but may also incur losses (= lower protocol income).

Ethena's insurance fund operates similarly to the reserve fund of the Anchor Protocol.

2. Liquidation Risk

Ethena uses staked Ethereum assets (such as Lido's stETH) to collateralize short ETHUSD and ETHUSDT perpetual positions on CeFi exchanges.

Ethena uses assets different from the underlying asset ETH for derivative positions: stETH.

The price difference between ETH and stETH must deviate by 65%, but this has never happened before, with the historical maximum being 8% (LUNA unpegging event in May 2022).

3. Custody Risk

As Ethena Labs relies on "off-chain settlement" providers to custody protocol-supported assets, it depends on the operational capability of the provider.

The ability to deposit, withdraw, and delegate from exchanges by Ethena. Any unavailability or delay of these functions will hinder trading and USDe redemption.

4. Centralized Exchange Risk

Ethena Labs uses derivative positions to hedge the delta of digital asset collateral. These derivative positions are traded on CeFi exchanges such as Binance, Bybit, Bitget, Deribit, and Okx. These exchanges carry centralized risks (refer to the FTX incident).

5. Collateral Risk

Discovery of critical smart contract errors in LST may lead to user loss of confidence in LST. In this case, users may attempt to unstake or switch to alternative collateral from LST.

A run on Lido and other protocols may lead to excessively long queues for validators and depletion of liquidity in DeFi and CeFi exchanges.

Advantages and Disadvantages of Ethena

Some Advantages:

- The current APR of the stablecoin is 27.6%.

- LSD ETH yield + Short ETH funding rate = sUSDe yield.

- Airdrop is coming (named Ethena Shards), mining lasts for 3 months, or when USDe supply reaches $1 billion.

- Providing LP + locking LP tokens = 20x Shards/day.

- Buying and holding USDe = 5x Shards/day.

- Staking and holding sUSDe = 1x Shards/day.

- TVL is growing rapidly: currently over $300 million.

- Ethena has raised $14 million in funding, with investors including Binance, Arthur Hayes, Bybit, Mirana Ventures, Lightspeed, Franklin Templeton, and angel investors DCF GOD, cobie, Ansem.

- All stablecoin pools are currently full (looking forward to removing the limit).

- Lower smart contract risk, but higher centralized risk (funds on CEX), and most effective when users adopt high leverage (when everyone wants to go long on ETH).

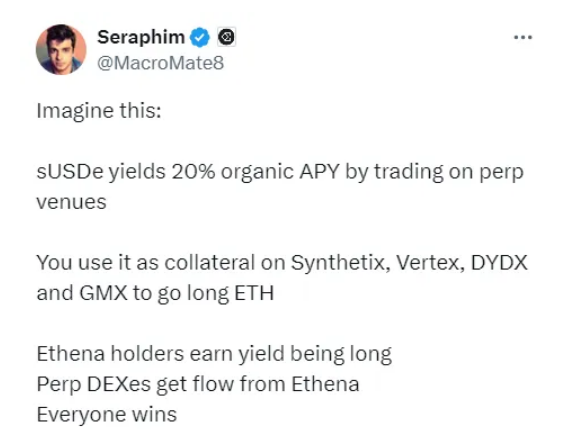

- Users will soon be able to use your sUSDe in DeFi, see the example below from Seraphim (Ethena Labs Growth Director):

Some Disadvantages:

Ethena is more or less a basis trading. When the yield reverses, the incentive factor no longer exists. The current funding rate for ETH is 0.01 - 0.02%, with long ETH paying fees to short ETH. This situation may persist for a long time, especially in a bull market. But at some point, the yield will reverse.

Now suddenly Ethena has to bear this cost. Although there is an insurance fund to temporarily address the issue. But with the decrease in sUSDe yield, there is reason to suspect that users may want to exit. But this is not a death spiral, just that users may seek returns elsewhere.

Using th as collateral provides a safety margin relative to negative interest rates. This means that Ethereum only cares about days when Ethereum financing is more negative than Ethereum yield. However, RMB liquidity is crucial for the pegged exchange rate. If there is not enough stETH liquidity, USDe cannot expand to $100 billion.

Using stETH as collateral provides a safety margin compared to negative interest rates. However, stETH liquidity is crucial for targeting. If there is not enough stETH liquidity, USDe cannot expand to $100 billion.

In the event that users want to exit:

1) User redemption.

2) Payment can be made using the insurance fund. According to Ethena, for every $1 billion of USDe, there is $20 million that can withstand almost all pessimistic funding rate predictions.

3) The biggest risk for Ethena may not be a collapse, but the possibility that no one is willing to lock funds in a non-yielding token when there are "trusted" alternatives available to users. (Here, "trusted" refers to stablecoins like USDT or USDC—not that they are better, perhaps they have greater risks, but because they have been around for a long time, they are more trusted).

4) Counterparty risk from centralized exchanges and smart contracts may be one of the biggest issues. According to @tbr90, the long-term risk is slow erosion, as negative interest rates will inevitably deplete the insurance fund, then force a slow decoupling.

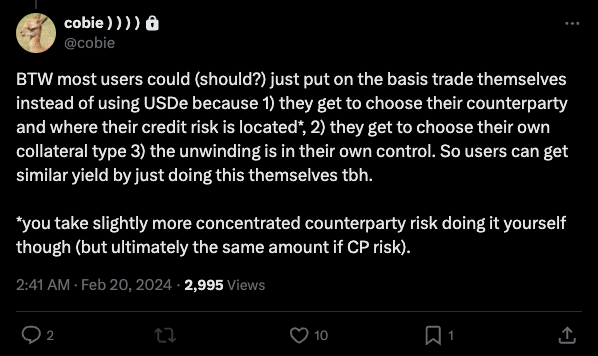

5) As Cobie pointed out, users can do this trade themselves.

For example, shorting ETHUSDT and depositing funds every 8 hours, longing stETH or mETH (to get higher temporary returns). No need to wait 7 days, risk is chosen by oneself.

6) The founder of Ethena also agrees with this, but points out that "the creation of Ethena is not to save users the trouble of arbitrage execution. He said, "What is exciting is being able to tokenize this asset, give it extremely high liquidity through DeFi and CeFi, and then allow new interesting use cases to be built on top of it, combining different currencies together."

7) As mentioned by @DeFi Made Here in the post: People confuse luna/ust, leverage/Ponzi, decentralized/centralized stablecoins. Ethena is not like UST, with a stable decentralized algorithm.

Related reading: Using futures and spot hedging, how does Ethena build a stablecoin flywheel?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。