Project Name: Jupiter

Network: Solana

Project Type: Decentralized Exchange Platform (DEX)

Token Symbol: $JUP

Cryptocurrency Ranking: 98th

Market Cap: $7.186 billion

Fully Diluted Valuation (FDV): $52.9 billion

Circulating Supply: 1.35 billion tokens (13.50% of total supply)

Total Supply: 10 billion tokens

Introduction

On January 15, 2024, a report released by the Binance research team showed that the crypto market experienced a significant recovery in 2023, with the total market cap growing by 109%. At the same time, the decentralized finance (DeFi) sector also saw strong growth, with the total locked value (TVL) increasing by 38.9% to reach $53.4 billion.

With the launch of the JUP token on January 31 and the overall recovery of the DeFi sector, Jupiter has gained a significant position in the DeFi space on the Solana blockchain.

Project Overview

The Jupiter project was initially launched as an experimental project by a team dedicated to enhancing the stablecoin functionality within the Solana ecosystem. By integrating with Mercurial and Serum, they successfully launched the first cross-protocol liquidity exchange feature on Solana. This initial success inspired the team to officially launch Jupiter as an independent project in November 2021.

In brief, DEX aggregators like Jupiter aim to simplify the trading process. By aggregating liquidity from multiple decentralized exchanges, it seeks to find the best exchange rates for users. This model differs from traditional DEXs that rely on a single liquidity source. By horizontally comparing quotes from multiple platforms, DEX aggregators can minimize slippage and trading fees, making the trading process more efficient and user-friendly. This innovation effectively addresses the fragmentation of the DeFi market, ensuring that users can operate under the best trading conditions.

Jupiter's goal is to build the most comprehensive and reliable trading infrastructure on Solana to meet the needs of individual users and projects. To achieve this goal, Jupiter has introduced several innovative trading features:

- Dollar-Cost Averaging: This feature enables automated investment, allowing users to spread their investments over time to mitigate the impact of market volatility.

- Cross-Chain Bridge Service: It provides bridge services for assets to transfer between Solana and other blockchains, expanding users' ecosystem access.

- Perpetual Contract Trading: It supports perpetual contract trading, allowing users to speculate on asset price movements and use leverage without expiration limits.

Source: Jupiter

These features demonstrate Jupiter's commitment to optimizing a smooth and advanced trading experience on the Solana blockchain.

Jupiter LFG Launchpad

Jupiter's LFG Launchpad Beta takes an innovative approach to support new projects, emphasizing a community-driven and transparent model. The platform differs from traditional launchpads by adopting an open market and community participation approach, abandoning complex incentive structures and isolated price discovery mechanisms.

The core of the LFG Launchpad lies in its extensive community support, customizable launchpad to prevent bot manipulation, user-friendly design tools for liquidity management, and comprehensive trading features. This setup ensures that users can discover fair prices and immediate liquidity, while providing enterprise-level support for technical aspects.

The innovative mechanisms of the LFG Launchpad, including a fair airdrop system and Dynamic Liquidity Market Maker (DLMM), provide stable entry points for new tokens into the market. By allowing community DAO voting to participate in project selection, it ensures that the launched projects receive strong support and a clear path to success.

Source: Jupiter

Token Economic Model

While Jupiter's JUP token plays a core role in ecosystem governance, granting holders the voting rights on important platform development matters, according to its founder Meow's multiple statements, the value of JUP is not primarily driven by its utility. Meow recently stated in a post:

"I think the narrative that utility drives value is a myth, created to explain the value of things, or proposed by founders who are eager to explain why their token has value. I believe most people are not really concerned about utility, but about value." Meow further discussed this concept on the Lightspeed podcast.

"We certainly hope that over time, JUP holders will be able to use their JUP more widely, including participating in key ecosystem projects, but this cannot be conflated with the value of JUP," he added.

Token Supply and Distribution

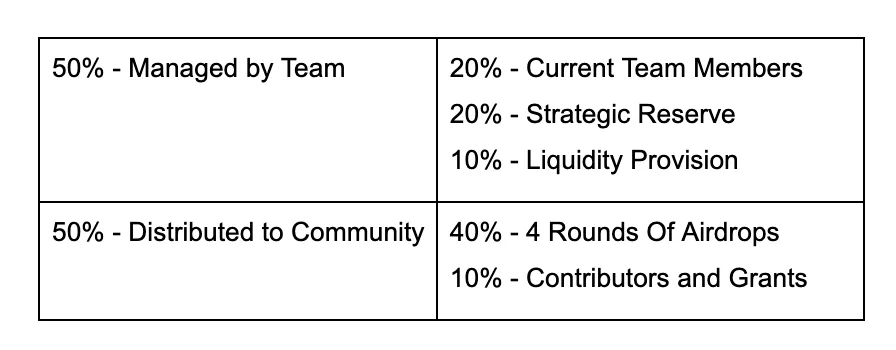

The total supply of JUP tokens is set at 10 billion tokens.

Team Allocation (50%)

- Team Members (20%): 20 billion JUP tokens are reserved for current team members, with gradual unlocking starting two years after the token generation event (TGE), emphasizing the team's long-term commitment.

- Strategic Reserve (20%): Another 20 billion tokens are allocated to future team members, strategic investors, and stakeholders in historical initiatives, stored in a secure team cold multi-signature wallet, which requires majority agreement to execute transactions. These tokens are locked for at least one year and require at least six months' notice before any liquidity event.

- Liquidity Provision (10%): 10 billion tokens are specifically allocated for providing liquidity, managed through a team hot multi-signature wallet.

Community Allocation (50%)

- Airdrop (40%): 40 billion tokens will be distributed to the community through annual airdrops, with the first airdrop distributing 10 billion tokens. The remaining 30 billion tokens will be stored in a community cold wallet controlled by a 4/7 multi-signature wallet.

- Community Contributor Grants (10%): 1 billion tokens are reserved for community contributors, managed through a community multi-signature wallet, with Jupiter DAO responsible for overseeing the distribution.

Source: Jupiter Research

Initial Circulating Supply

At the initial launch, the circulating supply of JUP tokens was adjusted to 1.35 billion tokens, compared to the originally planned 1.7 billion tokens. This adjustment covers token allocations for community airdrops, launch pools, market makers' loans, and liquidity provision.

Growth Potential Outlook

The rapid expansion of the DeFi market, coupled with the technological advancements of Solana, provides a favorable environment for Jupiter to capture a larger market share.

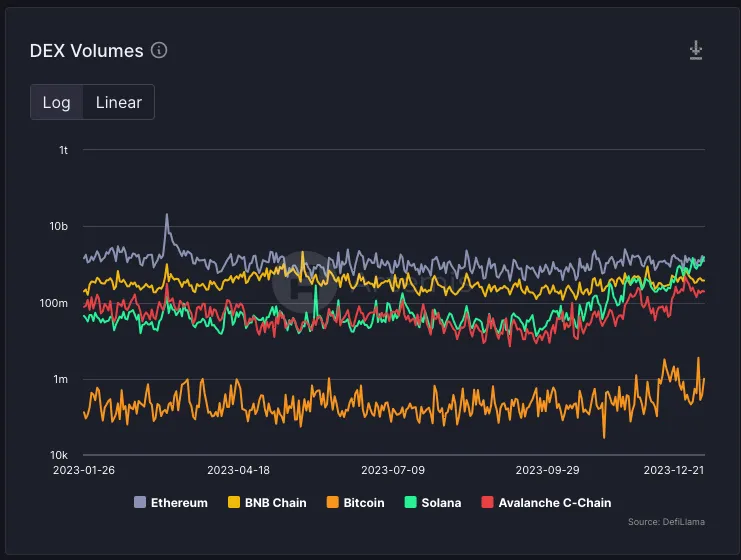

Of particular note is Solana's achievement in December 2023, surpassing Ethereum to become the leader in weekly DEX trading volume, a milestone that cannot be overlooked. As the first on-chain exchange aggregator on Solana, Jupiter is in a very favorable position, not only because well-known projects such as Render, Helium, and Hivemapper are migrating to it, but also because its DEX trading volume has exceeded that of Ethereum (Solana reaching $10 billion, while Ethereum is at $8.8 billion), demonstrating strong market momentum.

Source: DeFiLlama

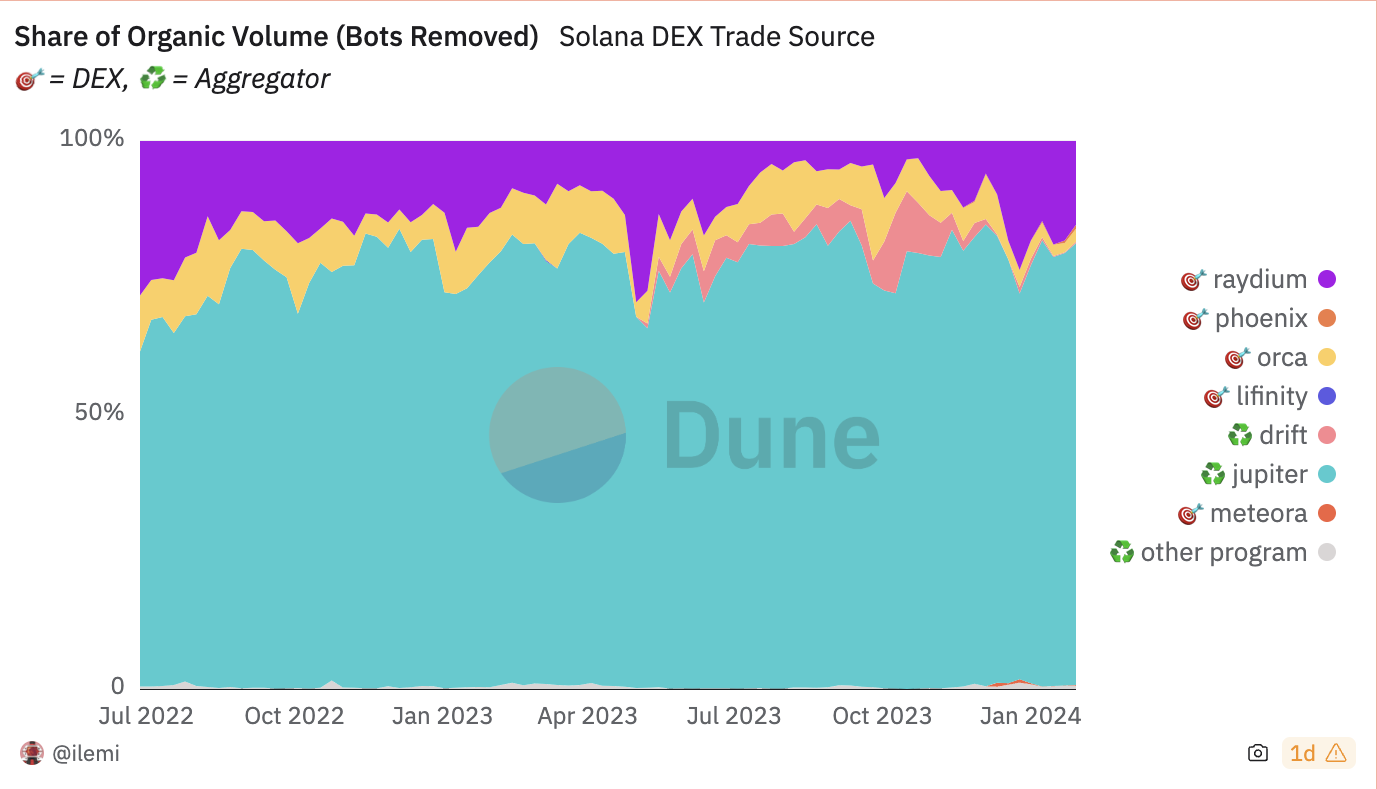

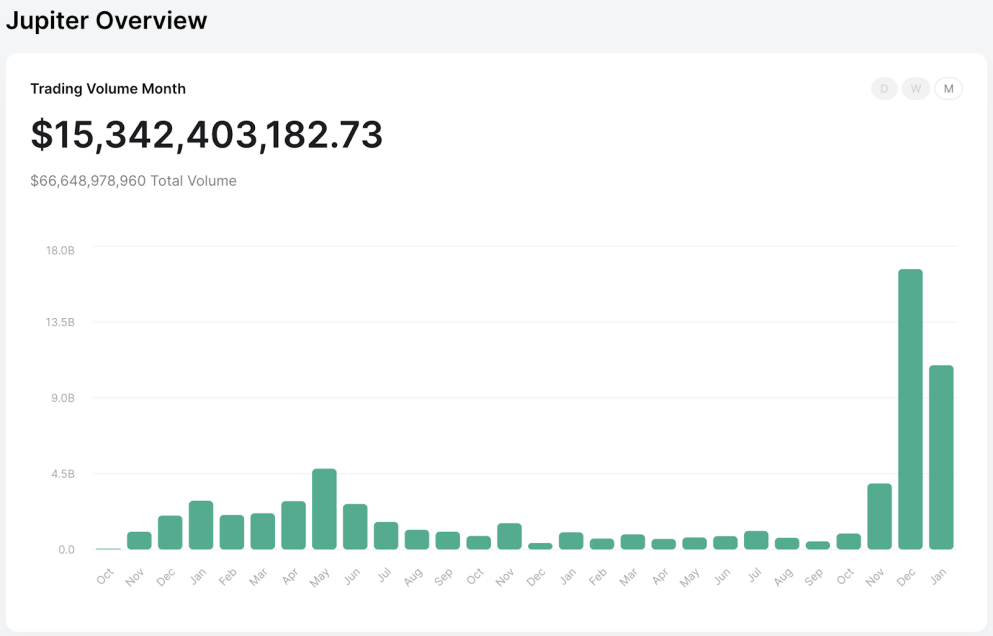

As one of the most popular DeFi trading platforms among independent wallet users across all major blockchains, especially on the Solana network, Jupiter leads 80% of the trading volume and accounts for 65% of the total volume, establishing its core position within the ecosystem.

Source: Dune Analytics

Source: Jupiter Station

It can be reasonably inferred that Jupiter's success is closely linked to the widespread adoption of Solana. According to the latest Solana report by Messari, several key growth metrics are highlighted:

- Solana's Solana Virtual Machine (SVM) and its technical stack are gaining attention and adoption from external developers.

- The minting volume of Compressed NFTs (cNFTs) grew by 316% quarter-over-quarter.

- The total locked value (TVL) of DeFi has risen to $3.68 billion.

- Despite potential concerns, the market cap grew by 17% to reach $8.4 billion.

For more Solana metrics, please refer to the full Messari report.

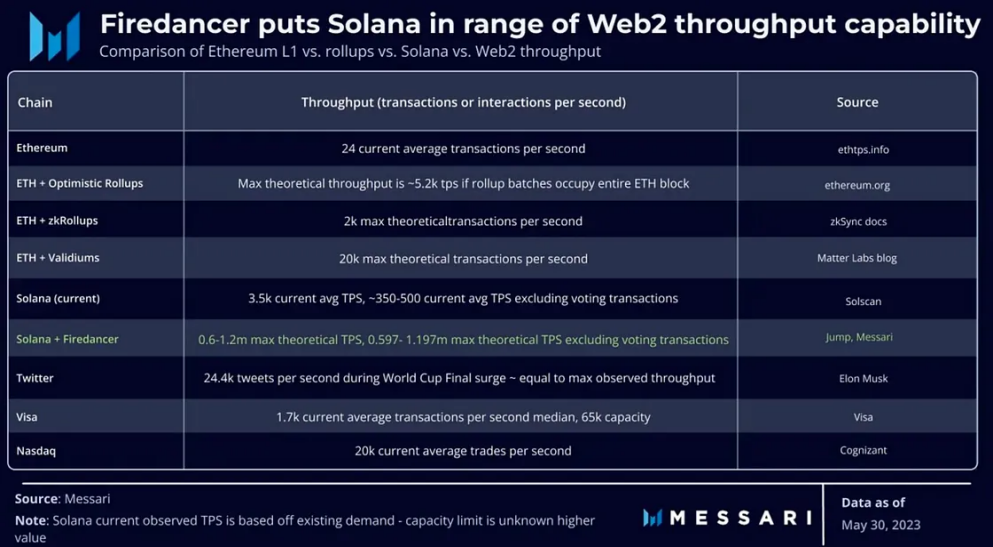

Additionally, the Firedancer client developed by Jump Crypto is researching how to achieve up to one million transactions per second, which will significantly enhance Solana's scalability and performance.

Source: State of Solana Q3 2023

These developments, along with the traction gained by the platform's technical stack among new users, indicate that with effective management, Jupiter has the potential to achieve significant growth in the coming years, leveraging Solana's technological advancements and increasing market influence.

Competitive Analysis

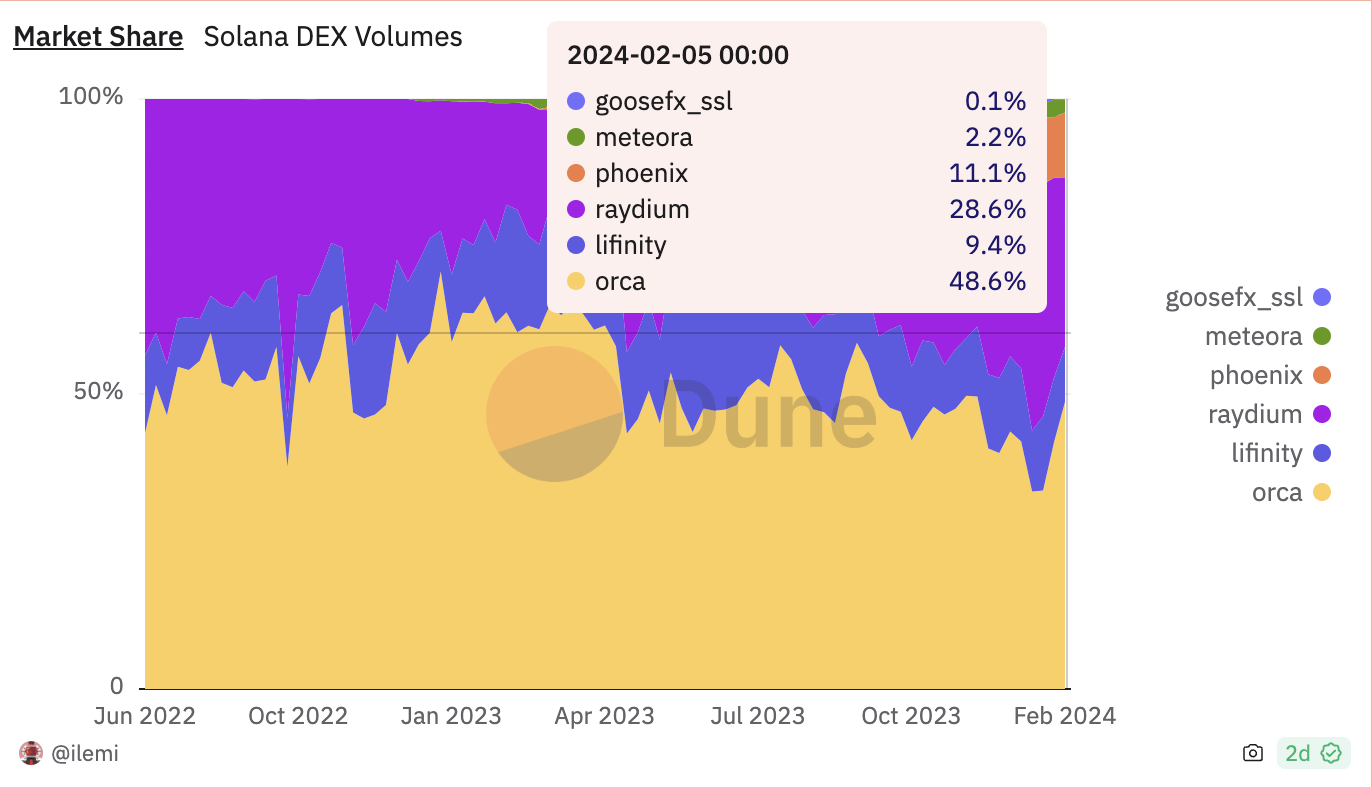

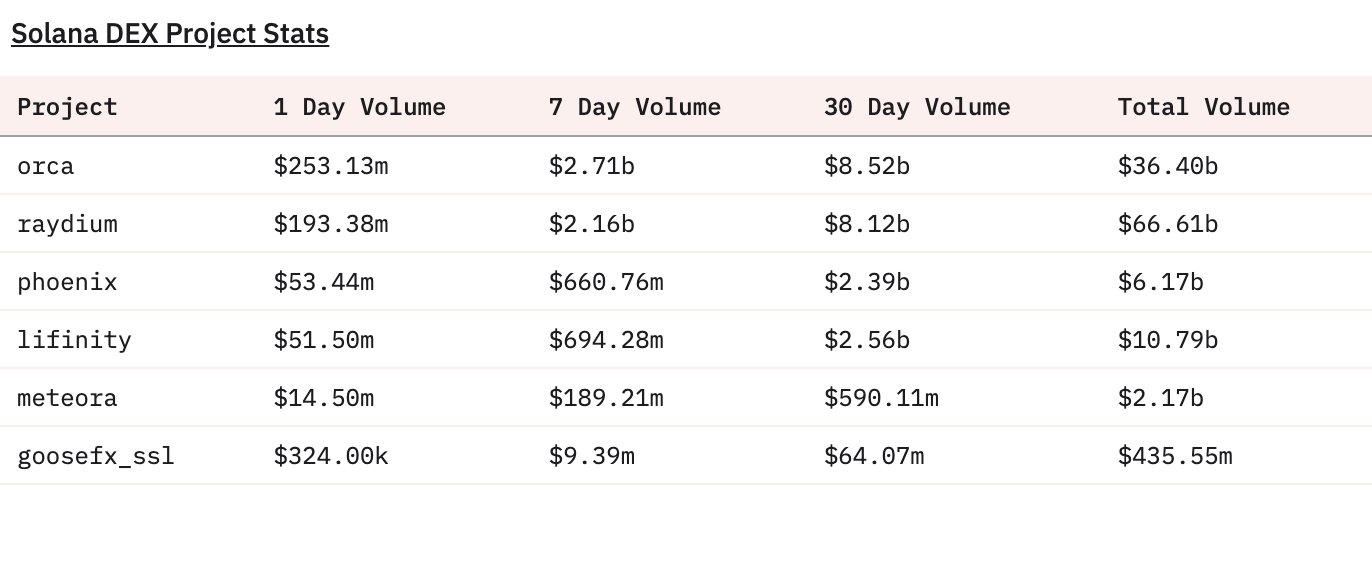

Jupiter is not the only successful trading platform within the Solana ecosystem; Orca and Raydium have emerged as its main competitors, both being decentralized exchanges (DEX) built on Solana.

Raydium:

- Market Capitalization: $2.6011 billion

- Ranking: 188th

- Fully Diluted Valuation (FDV): $5.6427 billion

- Circulating Supply: 255.76 million (46.08% of total supply)

- Total Supply and Maximum Supply: 555 million

Orca:

- Market Capitalization: $203 million

- Ranking: 227th

- Fully Diluted Valuation (FDV): $411.1 million

- Circulating Supply: 49.38 million (49.38% of total supply)

- Total Supply and Maximum Supply: 100 million

Orca has built a reputation in the Solana DeFi space through its user-friendly interface and the introduction of "Whirlpools." These innovative liquidity pools provide concentrated liquidity, offering higher returns for liquidity providers and better pricing and minimized slippage for traders.

Relative to Raydium, it serves as both an automated market maker (AMM) and a liquidity provider for Serum, facilitating the integration of AMM liquidity with Serum's centralized order book. This integration expands the possibilities for trading and enhances liquidity on the platform.

Orca is primarily focused on simplifying the DeFi experience to make it more user-friendly for the average user. In contrast, Raydium targets advanced traders and liquidity providers, offering a suite of complex tools and features to meet their needs.

As of now, Orca holds a larger market share in Solana DEX trading volume at 48.6%, while Raydium's market share is at 28.6%. However, Raydium leads in total trading volume, reaching $66.6 billion, while Orca generated $36.4 billion. It is worth noting that as a relatively new project, Orca has shown impressive growth, generating $852 million in the past 30 days, compared to Raydium's $820 million.

Source: Dune Analytics

Source: Dune Analytics

Jupiter differentiates itself from other platforms by integrating liquidity from leading projects such as Orca, Raydium, and Drift. This strategy allows Jupiter to provide optimized trading strategies, ensuring users get the best exchange rates. Additionally, Jupiter offers a wide range of trading options and financial tools through a simple and user-friendly platform, perhaps more convenient and efficient than Orca or Raydium.

Outside the Solana network, Uniswap is known as the largest DEX, with high trading volume and a large user community. Recently, Jupiter has attracted attention by surpassing Uniswap v2 and v3 in daily trading volume, adding $10 million.

Despite Jupiter's impressive performance, Uniswap remains a leading DEX in the Ethereum network and DeFi, known for its abundant liquidity and extensive user base. Uniswap's founder, Hayden Adams, emphasizes the platform's significant influence with a daily trading volume of $700 million. He believes that Jupiter's recent increase in trading volume reflects short-term trading trends rather than a sign of lasting value.

Currently, Jupiter and Uniswap have similar market values, with fully diluted valuations (FDV) ranging from $5 billion to $6 billion.

Bullish Fundamental Factors

- The DeFi market share increased from 4.1% to 4.5% in 2023, combined with the recovery of DeFi token prices, creating favorable conditions for Jupiter to further expand its trading volume in 2024.

- Jupiter's trading volume on CoinGecko is second only to Uniswap, far exceeding PancakeSwap, consolidating its position as the second-largest decentralized exchange (DEX).

- Solana's role as a blockchain known as the "Ethereum killer" and its significant impact in the DeFi space, given Jupiter's position as the primary DEX aggregator, strengthens its growth potential.

- The LFG Launchpad demonstrates Jupiter's commitment to innovation, attracting diversified projects and community participation, further boosting trading volume and engagement.

- Jupiter's founder, Meow, with rich experience in the DeFi space, has provided consulting for major projects such as Kyber and Blockfolio and co-founded wBTC, indicating a strong and diverse network of collaborations with various projects for the Jupiter team.

Bearish Fundamental Factors

- The functionality and reputation of the Solana blockchain, on which Jupiter relies, are crucial. Frequent network interruptions, including today's major outage and the nearly 20-hour downtime in February 2023, raise questions about its claim as a robust platform, affecting Jupiter's ability to ensure success in the competitive DeFi market.

- Given the dynamic and highly competitive nature of the DeFi space, there is uncertainty about the long-term sustainability of Jupiter's technology.

- Airdrops often lead to a surge in speculative trading, exacerbating market volatility. This situation is further complicated by industry heavyweights, such as the founder of Uniswap, expressing doubts about the long-term viability of Jupiter's trading volume, believing that the volume is artificially inflated by speculative behavior related to airdrops.

- The emergence of meme coins and speculative airdrops within the Solana ecosystem adds uncertainty to Jupiter's short-term potential, signaling a risky environment.

Conclusion

Greythorn remains committed to in-depth research, focusing on on-chain analytics, liquidity changes, and proprietary data. We invite you to join our community if you find our insights valuable. You can reach out to us via LinkedIn, visit our website, or delve deeper into the world of cryptocurrencies on our Twitter profile.

We also encourage you to stay updated on our latest research, including a comprehensive review of the AI agent detailed analysis supported by Autonolas, Magpie ecosystem, and its latest integration with EigenPie subDAO, as well as our January monthly market update.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。