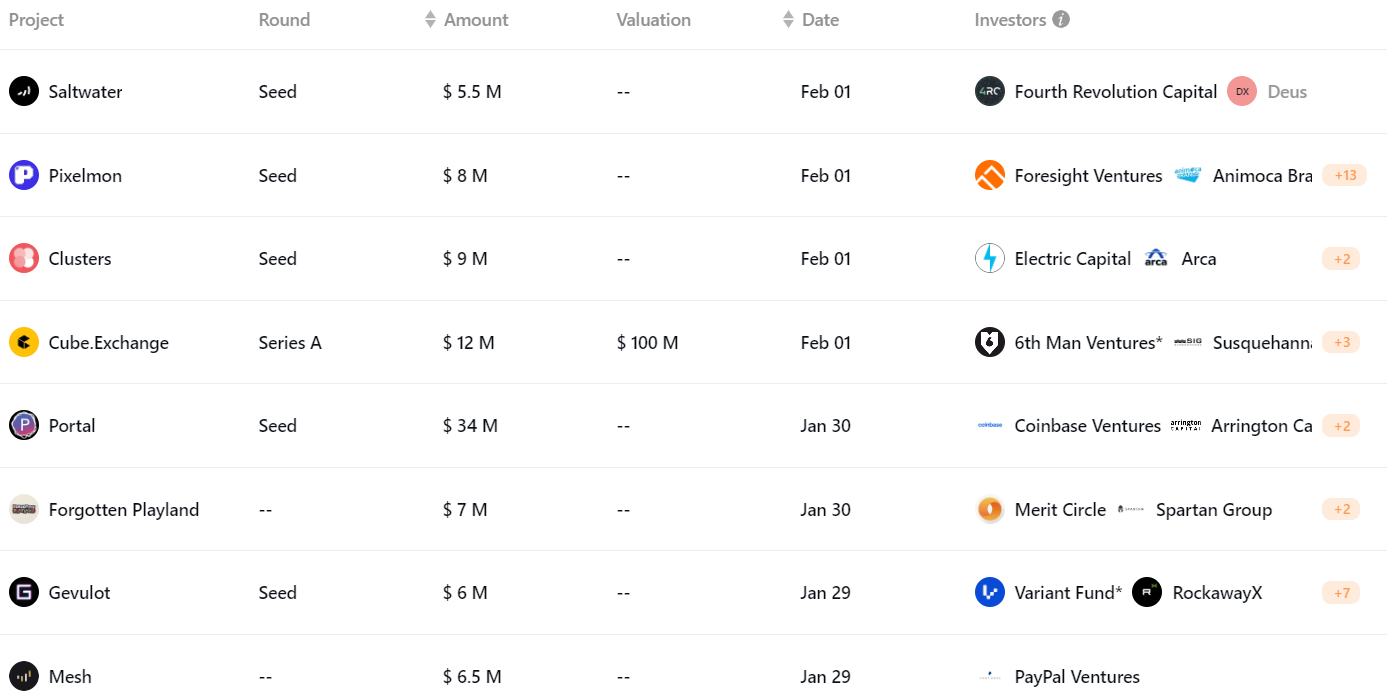

During the period from January 29th to February 4th, 8 blockchain projects raised over 5 million US dollars in financing.

Authored by: TechFlow of Deep Tide

According to RootData, 34 blockchain startups announced raising a total of 119.9 million US dollars during the period from January 29th to February 4th.

Projects raising over 5 million US dollars include:

Web3 gaming company Saltwater completed a $5.5 million seed round financing;

RPG NFT game Pixelmon announced the completion of an $8 million seed round financing;

Cross-chain domain service Clusters announced the completion of a $9 million seed round financing;

The hybrid trading platform Cube.Exchange, which integrates traditional finance and blockchain technology, completed a $12 million Series A financing;

The cross-chain DEX project based on Bitcoin, Portal, has secured $34 million in seed funding;

Web3 social gaming developer Forgotten Playland announced the completion of a $7 million financing;

Zero-knowledge proof blockchain project Gevulot completed a $6 million seed round financing;

Cryptocurrency payment company Mesh received a $6.5 million investment from PayPal Ventures.

Highlight Projects

NAVI Protocol

Introduction: NAVI Protocol is a native one-stop liquidity protocol on Sui, allowing users to participate in the Sui ecosystem as liquidity providers or borrowers. Its innovative features include automatic leverage libraries and isolation mode, enabling users to leverage assets in a way that minimizes risk to seize new trading opportunities. NAVI's design supports digital assets with different risk levels and ensures the protection of user funds and the reduction of system risk through advanced security features.

Investment Institutions: The first native one-stop liquidity protocol on Sui, NAVI Protocol, raised $2 million, with OKX Ventures, dao5, and Hashed leading the investment, and participation from Mysten Labs, Comma3 Ventures, Mechanism Capital, GeekCartel Capital, Nomad Capital, Coin98 Ventures, Cetus Protocol, Maverick, Viabtc, Assembly Partners, Gate.io, Hailstone Labs, Benqi, and LBank Labs.

Features:

A total of 1 billion NAVX tokens, 45.8% of which are used to incentivize TVL growth, activities, and airdrops, including early supporter rewards;

NAVI Protocol's IDO on February 4th was oversubscribed by 2000% in 20 minutes, and the IDO will continue until February 7th;

Its TVL has exceeded $160 million, with over 800,000 users, both reaching historical highs.

Puffer Finance

Introduction: Puffer is a decentralized native liquidity re-staking protocol (nLRP) built on EigenLayer. It introduces native Liquid re-staking tokens (nLRT) that accumulate PoS and re-staking rewards. Nodes within the protocol utilize Puffer's anti-dilution technology to reduce risk and increase capital efficiency, while increasing rewards through native re-staking.

Investment Institutions: Binance Labs announced investment in the Ethereum liquidity staking protocol Puffer Finance.

Features:

Puffer plans to operate its upcoming Layer 2 as EigenLayer AVS to increase network effects and enhance rewards for non-custodial validators, contributing to the decentralization of Ethereum.

Puffer's remote signing tool, Secure-Signe, previously received funding from the Ethereum Foundation, which helps validators reduce the risk of dilution while enhancing the capital efficiency of the Puffer protocol;

Puffer Finance has opened staking activities, allowing users to deposit stETH and wstETH to earn Puffer + EigenLayer points, with double points available until February 9th.

Stride

Introduction: Stride is a blockchain that provides liquidity for staked tokens, allowing users to use Stride to move staked tokens from any Cosmos chain. With Stride, users can earn staking and DeFi rewards within the Cosmos IBC ecosystem.

Investment Institutions: The Cosmos ecosystem liquidity staking protocol Stride announced the completion of a $4 million strategic financing round, led by DBA, with participation from 1confirmation, Road Capital, Modular Capital, Imperator, and Chorus One. This round of financing aims to drive Stride's development in the Celestia ecosystem.

Features:

Stride has announced the new LST asset stTIA, and will airdrop 5 million STRD tokens (5% of the maximum supply) to early stTIA holders within 150 days;

Stride claims that stTIA holders may receive the first potential airdrop based on the ZK Move-EVM L2 network Movement;

In the future, it will support Sei (stSEI), Penumbra (stUM), Namada (stNAM), Berachain (stBERA), Kujira (stKUJI), Akash (stAKT), Secret (stSCRT), and others.

Below are the specific financing information for each project:

DeFi

Infrared Finance, the liquidity proof protocol of the Berachain ecosystem, announced the completion of a $2.5 million seed round financing, with Synergis leading the investment, and participation from NGC Ventures, Tribe Capital, CitizenX, Shima Capital, Dao5, Signum Capital, Ouroboros Capital, Decima, OakGrove Ventures, DoraHacks, TenzorCapital, AlexShin, AlbertChon, CharlesLu, Mr.Block, ChrisSpadafora, DCFGod, and others. Infrared aims to support liquidity staking in the Berachain ecosystem under the background of Proof-of-Liquidity (PoL). These funds will be used to advance its infrastructure development, including validator networks, PoL insurance pools, and native liquidity staking tokens (LST) iBGT.

The native DEX project of the Berachain community, Kodiak Finance, announced the completion of a $2 million seed round financing. The Kodiak Finance team stated that this round of financing will enable them to further accelerate the expansion of Kodiak and continue to provide native trading products for the Berachain ecosystem.

The decentralized derivatives trading platform, BBO Exchange (BBOX), completed a $2.7 million Pre-Seed round financing, with Hashed and Arrington Capital co-leading the investment, and participation from Consensys, CMS Holdings, Flow Traders, Manifold Trading, Mask Network, Laser Digital (Nomura Group), Arcane Group, Draper Dragon, Vessel Capital, Aulis Venture, Formless Capital, Press Start Capital, One Piece Labs, and others. BBOX is also one of the 12 projects from the 6th batch of the Binance Labs incubator. BBOX has now opened registration for the testnet, and the community can apply for registration through BBOX Twitter or the official website.

Binance Labs has invested in the Ethereum liquidity staking protocol, Puffer Finance. Puffer Finance is a protocol built on EigenLayer and has been supported by several well-known investors, including Brevan Howard Digital, Jump Crypto, and Lightspeed Faction. The invested funds will be used for the development of Puffer's open-source technology, nLRP, and new Active Validation Services (AVS), which are part of Puffer's vertical infrastructure, including Layer 2 (L2). Puffer will bring its native liquidity re-staking tokens (nLRT) to BNB Chain users to enable them to earn Ethereum PoS and re-staking rewards.

The open-source smart contract-based financial strategy tool, Doubler Pro, announced the completion of a seed round financing, with Youbi Capital leading the investment, and participation from Bixin Ventures, Mask Network, Comma3VC, Pivotlabs, Continue Fund, Sanyuan Capital, Waterdrip Fund, DWF Ventures, Gate Labs, Formless Capital, MTCapital US, Catcher VC, and others. The specific amount has not been disclosed. Doubler Pro also announced the launch of the testnet and integration with the Blast Layer 2 network, with the new funds accelerating development and enhancing user experience.

The first native one-stop liquidity protocol on Sui, NAVI Protocol, raised $2 million to expand its innovative integrated lending, borrowing, and LSDeFi platform. OKX Ventures, dao5, and Hashed co-led the investment, with other participating investment institutions including Mysten Labs, Comma3 Ventures, Mechanism Capital, GeekCartel Capital, Nomad Capital, Coin98 Ventures, Cetus Protocol, Maverick, Viabtc, Assembly Partners, Gate.io, Hailstone Labs, Benqi, and LBank Labs.

The decentralized perpetual contract protocol, Zeepr Labs, announced the completion of a financing round led by Celestia ecosystem incubator Cincubator, with the specific financing amount undisclosed and a post-investment valuation of $1.5 billion. Zeepr is a decentralized perpetual contract protocol that supports both coin-based and U-based perpetual contracts, aiming to provide a slippage-free, funding-free on-chain perpetual contract trading experience.

The composable options protocol, Ithaca Finance ("Ithaca"), announced the completion of a $2.5 million pre-seed financing led by Cumberland and Wintermute Ventures. Other participants in this round of financing include Room40 Ventures, Ghaf Capital Partners, as well as angel investors, DARMA Capital co-founder Andrew Keys, Stan Miroshnik, TenSquared Capital managing partner, and Axelar co-founder Georgios Vlachos. In addition, Ithaca Finance has launched on the Arbitrum testnet and is set to fully launch later this quarter, initially inviting invitees to start the mainnet.

The cross-chain trading and liquidity routing protocol, Squid, announced the completion of a $4 million strategic financing round, with Polychain Capital leading the investment, and participation from Nomad Capital, North Island Ventures, Maelstrom, Chorus One, XYZ, Breed, Binary Builders, and Typhon Ventures, among others. This funding will be used to accelerate development to achieve more complex trade sequence bundling and more efficient asset routing. Additionally, the team is integrating with more interoperable networks and plans to introduce Squid into more blockchain ecosystems beyond Ethereum and Cosmos.

DeFi project Nibiru Chain announced the completion of a strategic financing round, with participation from Oddiyana Ventures, and the specific investment amount has not been disclosed. It is reported that Nibiru Chain previously completed an $8.5 million seed round financing at a valuation of $100 million last year, with joint leading investment from Tribe Capital, Republic Capital, NGC Ventures, and Original Capital.

Cryptocurrency trading startup [Velar](https://twitter.com/VelarBTC) announced on Thursday that it has raised $3.5 million in venture capital to build a set of decentralized financial (DeFi) tools for the emerging Bitcoin DeFi scene. CEO Mithil Thakore stated that Velar plans to launch the first perpetual swap exchange utilizing the Bitcoin network.

DePIN

-----

DePIN provider [Hivello](https://www.hivello.com/) announced the completion of a $1.5 million new round of financing, with participation from Blockchange, Cypher Capital, MH Ventures, Primal Capital, Contango Digital Assets, Candaq, NGC, Blockchain Founders Fund, and IDG, in addition to the $1 million financing completed in December 2023, bringing the company's total financing to $2.5 million to date. The company intends to use the new financing to expand its technical capabilities, accelerate product development, and strengthen its market position in the DePIN field.

AI

--

Web3 AI data infrastructure [PublicAI](https://twitter.com/PublicAI_) completed a $2 million seed round financing, with participation from IOBC Capital, Foresight Ventures, Solana Foundation, Everstate Capital, and several renowned academic professors in the field of artificial intelligence. The funds raised will be used to accelerate the launch and commercialization of its training network. PublicAI is dedicated to using blockchain technology to scale the production of high-quality training data, addressing all the challenges faced by artificial intelligence to date, and enabling all of humanity to participate in and share the benefits of artificial intelligence co-creation.

Web3 underlying protocol focused on AI, [KIP Protocol](https://twitter.com/KIPprotocol/), completed a strategic round of financing, with Animoca Ventures leading the investment, and participation from B.Army (Vietnam), CSP DAO (Europe, Middle East, and Africa), MQdao, Spicy Capital (Latin America), Skyvision Capital (Hong Kong), and Purechain Capital (UK). KIP Protocol is a decentralized underlying protocol built by AI model, application, and data owners, enabling secure transactions and monetization in Web3. KIP ensures that valuable knowledge and data can be protected and monetized as knowledge assets, ensuring interaction with artificial intelligence without losing ownership.

Decentralized cloud computing service provider [Exabits.ai](https://twitter.com/exa_bits) announced the completion of a seed round financing, with participation from Protocol Labs, Outlier Ventures, Jabre Capital Partners, Valkyrie Fund, Big Brain Holdings, Blockchain Builders Fund, Taisu Ventures, Fortified Ventures, LBank Labs, Paramita Capital, Moonhill Capital, IoTeX, and 1nvest, with the specific amount undisclosed. Exabits.ai has also received support from Stanford Blockchain Accelerator, Harvard Innovation Lab, OV Base Camp, Berkeley Blockchain Xcelerator, and Google Cloud.

Layer 1

-------

Zero-knowledge proof blockchain project [Gevulot](https://twitter.com/gevulot_network) completed a $6 million seed round financing, with Variant leading the investment, and participation from RockawayX, Volt Capital, Stake Facilities, as well as individual investors including Polygon Labs CEO Marc Boiron and Manta Network founder Shumo Chu. Gevulot did not disclose its valuation. Gevulot plans to use the funds to launch its Layer 1 blockchain, enabling developers to utilize ZK proofs and delegate computational tasks to advanced hardware operator networks.

Cosmos ecosystem liquidity staking protocol [Stride](https://www.twitter.com/stride_zone) announced the completion of a $4 million strategic financing round, with DBA leading the investment, and participation from 1confirmation, Road Capital, Modular Capital, Imperator, Chorus One, and others. The financing round aims to drive Stride's development in the Celestia ecosystem. Stride stated that it will distribute 5 million STRD tokens as an airdrop to users holding stTIA within the next 150 days, accounting for 5% of Stride's maximum token supply.

RWA

---

RWA ecosystem [TProtocol](https://twitter.com/TProtocol_) announced the completion of an angel round financing, with participation from Summer Capital, Matrixport Venture, Spark Digital Capital, with the specific financing amount undisclosed. The new financing will be used to drive TProtocol's development into a comprehensive blockchain RWA aggregator. TProtocol aims to empower RWA issuers to achieve on-chain, cross-chain, and asset onboarding within the TProtocol platform.

GameFi

------

Developer of "Solana Hunger Games" [GG](https://twitter.com/ggdotzip) announced strategic investment from Delphi Digital to build an online game that integrates augmented reality and SocialFi.

Web3 social game developer [Forgotten Playland](https://twitter.com/ForgotPlayland) announced the completion of a $7 million financing round, with participation from Merit Circle, Spartan Group, C2 Ventures, and Paper Ventures, among others. The game of the same name was showcased during a community event at Merit Circle DAO last May and is expected to be officially released in the first quarter of this year.

Blockchain game platform [Yooldo](https://twitter.com/YooldoPlatform) announced the completion of a $1.5 million financing at a valuation of $13 million, with participation from Bedrock Ventures, Double jump.tokyo, Edimus, Hyperithm, Klaytn Foundation, Manta Network, Neopin, Planetarium, Presto Labs, Vista Labs, and grant sponsors including Aptos Foundation, BNB Chain, Immutable X, and Oasys. The new financing will be used to enhance the platform's technology, bring more games to the platform, and develop its community. Yooldo has been included in the Consensys Scale Program and Google for Startups Program.

RPG NFT game Pixelmon announced the completion of an $8 million seed round financing, with participation from Animoca Brands, Delphi Ventures, Foresight Ventures, Amber Group, 9GAG founder Ray Chan, and Immutable co-founder Robbie Ferguson, among others. The team plans to use the newly raised funds to promote the development of its casual and core game portfolio. Pixelmon is currently developing four games, including Arena (PVP survival competition), Hunting Grounds (open-world RPG), Kevin the Adventurer (casual game), and PixelPals (casual game). In addition to games, Pixelmon also plans to empower its IP series through merchandise, trading card games (TCG), animation series, comic books, and more.

Web3 game company Saltwater completed a $5.5 million seed round financing, led by crypto investment firm Deus X and Fourth Revolution Capital (4RC). Saltwater plans to use this funding to increase its staff, invest in new technologies, and expand its business into new areas. This financing comes after Saltwater's acquisitions of game developers Maze Theory, Nexus Labs, and Quantum Interactive, which have developed games such as "Doctor Who" and "Gangster Empire".

Gamified social platform SoulLand announced the completion of its financing round, with participating institutions including Foresight Ventures, Redline DAO, Zonff Partners, MEXC, Mandala Ventures Limited, Stratified Capital, Basics Capital, and Onemax Capital. SoulLand is a gamified social subscription platform with over 500,000 registered users globally and over 35,000 daily active users.

Bitcoin Ecosystem

Bitcoin L2 stablecoin infrastructure Bmaker announced the completion of a $1.2 million Pre-Seed round financing, with participation from C3u Capital, Tangle Capital, Droplet Capital, and others. Bmaker, modeled after MakerDao, aims to provide more liquidity to the BTC ecosystem and plans to conduct a multi-chain IDO on February 2nd.

Cross-chain DEX project based on Bitcoin Portal has secured $34 million in seed funding, with participation from Coinbase Ventures, Arrington Capital, OKX Ventures, and Gate.io. The new funds will be used to develop the company's two flagship products: a decentralized exchange and non-custodial crypto wallet.

RGB protocol infrastructure Bitlight Labs announced the completion of a seed round financing, led by Gate Ventures and HV Capital, with participation from MH Ventures, Fundamental Labs, Oak Grove Ventures, Waterdrip Capital, and others. Bitlight Labs is expected to launch on the Bitcoin mainnet and Lightning Network in the coming weeks, issuing BIT tokens based on the RGB20 standard to cover the entire Bitlight application ecosystem, promoting a sustainable token economy. By introducing tokens, Bitlight Labs will leverage RGB smart contracts to build a Turing-complete native Bitcoin asset issuance and decentralized finance (DeFi) system to drive the development of the Bitcoin Lightning Network ecosystem. It is reported that the BIT token Season 1 Airdrop will be launched soon.

Bitcoin Ecosystem Composability DID protocol BRC-137 announced the completion of a $2.5 million seed round financing. The round was led by Basics Capital, DFG, Gate Labs, JSquare, and other institutions. The funds will be used to accelerate the protocol's development, improve ecosystem growth, and realize a native social universe within the Bitcoin ecosystem. BRC-137 aims to build a more robust DID ecosystem by introducing composable prefixes and suffixes to enhance asset liquidity. Additionally, the protocol introduces a royalty mechanism to promote the development and innovation of on-chain social patterns.

Infrastructure

Cross-chain domain service Clusters announced the completion of a $9 million seed round financing, with participation from Variant, Collab+Currency, Arrington Capital, Mask Network, and Electric Capital. The platform is developed by Delegate Labs and supported by LayerZero.

CeFi and Others

Cryptocurrency payment company Mesh received a $6.5 million investment from PayPal Ventures, with $5 million of the investment in PYUSD and using the Mesh API for on-chain transfers.

NFT art platform Art Blocks announced the acquisition of digital art marketplace Sansa, enabling it to establish a stronger ecosystem to continue serving creators and collectors by integrating Sansa's secondary market and collector experience into Art Blocks. Sansa will continue to operate as an independent application.

The Jubi trading platform has been fully acquired by Exor Digital Holdings Limited and officially rebranded as the Joy Universe digital asset trading platform, abbreviated as JU digital asset trading platform.

The hybrid cryptocurrency trading platform that combines traditional finance and blockchain technology, Cube.Exchange, has completed a $12 million Series A financing, led by 6th Man Ventures, with participation from GSR Markets, ParaFi Digital, Susquehanna Private Equity Investments, and Everstake Capital, among others. It is reported that this financing structure involves equity with token warrants, with a post-investment equity valuation of $100 million. The new funds will be used to expand the cross-functional team and plan to obtain licenses in more jurisdictions. Cube is currently in early access mode and is expected to be publicly released in the coming months. Cube CEO Bartosz Lipinski stated that there are plans to continue collaborating with listed tokens to provide reward pools, with no immediate plans to issue tokens.

The growth equity firm 10T Holdings led by Dan Tapiero and 1RoundTable Partners (1RT) have "partially" acquired cryptocurrency custody infrastructure provider Qredo. The transaction was conducted through a new entity, Fusion Laboratories, based in the UK, and "most" of Qredo's assets have been acquired, with the remaining business entering into administration. As part of the transaction, 10T and 1RT will focus Qredo's business on Fusionchain through Fusion Labs, and following the launch of Fusionchain, the QRDO token will transition to the Cosmos ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。