Real-world combat testing of encryption.

Original Title: "DePIN: An Emerging Narrative"

Authors: JieXuan Chua, Brian Chen

Translation: Kate, Mars Finance

Key Points

- In the past few months, the field of decentralized physical infrastructure network (DePIN) has become a prominent focus due to its vast potential market and extensive potential.

- DePIN refers to infrastructure-related projects that utilize blockchain technology and cryptoeconomics, aiming to incentivize individuals to allocate capital or underutilized resources to create a more transparent, verifiable network, with the goal of achieving a more efficient expansion trajectory than centralized networks.

- DePIN is a broad field consisting of several sectors, each playing a different role in decentralizing network infrastructure. In this report, we will introduce the development in the fields of computing networks, wireless networks, storage, and sensors.

- With the continuous development of this industry, we expect a surge in DePIN projects in the coming years. However, their long-term viability and success will ultimately depend on real-world applicability and still require combat testing.

I. Overview

Among the various terms that have gained attention in recent months, the field of decentralized physical infrastructure network (DePIN) has become a prominent focus. Due to its vast potential market and the ability to expand infrastructure networks in a decentralized manner through a bottom-up growth strategy, the industry is considered to have enormous growth potential. Some even believe that DePIN represents a paradigm shift in global resource allocation (including physical and digital) and a transformative approach to expanding large-scale infrastructure.

In this report, we explore this emerging narrative. We first outline the basics of DePIN and how it works. Then, our analysis transitions to a top-down industry view, providing an ecosystem map and dissecting the landscape of various sub-industries. Finally, we examine the challenges faced by adopting DePIN, identify key market themes, and provide insights into the future prospects of this industry.

II. What is DePIN?

DePIN refers to infrastructure projects that utilize blockchain technology and cryptoeconomics to incentivize individuals to allocate capital or underutilized resources, creating a more transparent, decentralized, and verifiable infrastructure network.

These projects can be broadly categorized as physical or digital resource networks, each encompassing different domains. Regardless of their focus, these projects typically operate under similar operational models, emphasizing collective ownership and prioritizing distributed systems over centralized market structures.

Figure 1: Conceptual diagram of centralization and decentralization

Source: Binance Research

How DePIN Works

DePIN projects typically involve several key components:

1. Target Resources: Specific resources intended to be provided to consumers by the project. Common resource types include storage capacity and computing power.

2. Hardware: Necessary equipment used by network contributors to collect data or resources for network operation and product. Depending on the resource type, the cost, manufacturer, and usage of these devices may vary.

3. Incentive Mechanism: Pre-determined mechanisms that reward token to suppliers for contributing resources, thereby incentivizing them to contribute resources and provide reliable services. Some projects may also implement penalties to prevent malicious activities.

4. Suppliers of Resources: Individuals or entities providing unused or underutilized resources to the network. In return, they typically receive token rewards.

5. Consumers: End users participating in the network to use the services provided by DePIN projects.

DePIN projects first identify the specific resources they aim to provide. These resources vary widely, including storage capacity, computing power, bandwidth, and hotspot deployment, among others. The core of these projects' operations is the incentive system, designed to encourage active contribution and deter harmful behavior. The system primarily utilizes native token rewards for compliant behavior.

For example, Filecoin is a leading DePIN project in cloud storage, compensating storage providers with its native token FIL. These providers typically have to stake collateral as a security measure. If they fail to provide reliable services or engage in malicious activities, they will face penalties such as reward withholding, collateral reduction, or removal from the network. Conversely, consumers use the project's token to pay for service fees, such as paying storage fees on Filecoin using FIL.

Suppliers of resources are an integral part of DePIN projects, as the network relies on them to provide services. In Filecoin, they are storage providers, while in projects like Helium and Hivemapper, they are individuals setting up the required hardware devices to provide wireless coverage or mapping data.

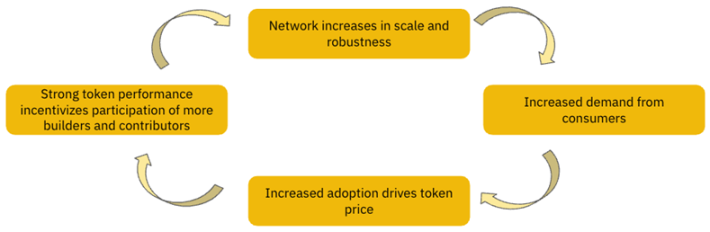

Figure 2: DePIN projects aim to promote a self-reinforcing cycle to sustain their continuous growth

Source: Binance Research

Having a self-reinforcing growth cycle will contribute to the sustainable development of DePIN projects. Token rewards serve as a useful incentive measure to overcome the "cold start" challenge for supplier participants. As the network scales and consumers begin using network services, demand should pick up. Given that service payments typically occur in the form of network tokens, increased adoption should translate into higher token prices, further incentivizing contributors. With synchronous growth of demand and supply, this virtuous cycle can continue, sustaining the project's continuous growth.

III. DePIN by Industry

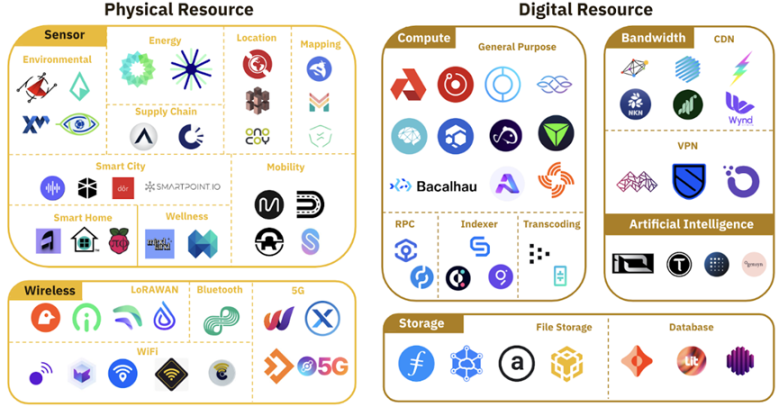

The origin of DePIN can be traced back several years, even before the formal creation of this term. This is not surprising, as the fundamental principles of DePIN are closely related to the spirit of the crypto industry. However, the industry initially did not gain as much attention or traction as it does now, hindered by factors such as immature infrastructure development, limited public awareness, and a relatively small crypto user base. Despite these challenges, projects related to DePIN have been steadily building for years, leading to the current diversified landscape of the industry, as shown in Figure 3 below.

It is important to note that the map only shows a small part of DePIN projects. According to DePINscan by IOTeX, approximately 160 DePIN projects have been recorded. The categorization of these projects may also vary depending on how DePIN projects are defined. Regardless of these subtle differences, it is still evident that the industry continues to grow and expand.

Source: IOTeX, Binance Research

As shown in the ecosystem map above, DePIN is a broad field consisting of several sectors. Each sector plays a different role in decentralizing network infrastructure and providing motivation for different use cases. In this section, we will delve into each of them in more detail, share how they work, and focus on relevant case studies.

Please note that mentioning specific projects does not constitute an endorsement by Binance. Instead, the cited projects are used for illustrative purposes.

Computing Networks

Decentralized computing networks utilize distributed computing resources to perform complex computing tasks. These may include analyzing large datasets, running complex artificial intelligence (AI) algorithms, or any other tasks requiring computing power. By connecting idle systems to systems in need of computing, decentralized computing networks act as a bridge between computing resource demand and supply.

Given the importance of computing in today's digital age and the rise of emerging technologies such as blockchain and artificial intelligence, the demand for computing resources has been steadily increasing. Additionally, the surge in the development of artificial intelligence has led to a high demand for these chips by cloud computing companies, resulting in long waiting lists, with wait times of up to nearly a year in some cases. This is where decentralized computing networks come into play. They provide an alternative to existing solutions dominated by centralized cloud providers and hardware manufacturers. In this regard, decentralized computing networks are leading the shift of power away from centralized cloud providers (such as Amazon Web Services and Google Cloud) and introducing competition through open markets operated by numerous providers.

In a broad sense, decentralized computing networks incentivize computing power suppliers to provide idle computing resources to those who need them by establishing a bilateral market. Additionally, the pricing of decentralized computing networks is competitive, as there are no significant additional costs for suppliers to provide computing power to the network.

Case Study: Akash Network

Akash Network enables users to deploy their own cloud infrastructure or sell idle cloud resources to others. Akash compares itself to Airbnb for server hosting.

It has established a marketplace that allows users to rent computing resources with spare capacity from others. This allows Akash to tap into the global market estimated to have 8.4 million data center idle and underutilized resources.

Currently, the network offers over 8.9K central processing units (CPUs), 171 graphics processing units (GPUs), 45 TB of memory, and over 583 TB of storage. In fact, Akash's users can use the network for any general computing function.

Akash caters to two key markets' demand for computing in an open and permissionless manner by pushing underutilized computing resources to the market:

- High-performance chips: Essential for complex computing tasks such as AI training, but with limited market supply.

- Consumer-grade chips: Used for general tasks and places with a large amount of unused computing power.

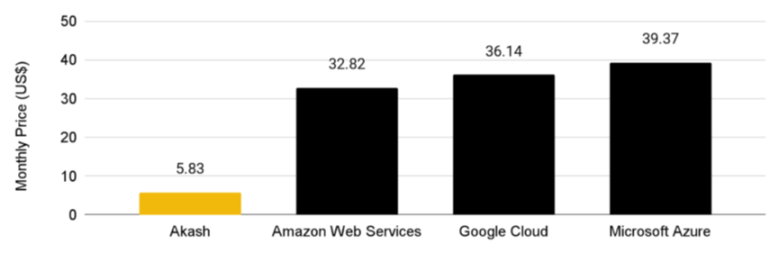

It is worth noting that the pricing for using Akash's services is highly competitive, often only a fraction of other centralized cloud providers. A key contributor is its "reverse auction" system, which allows customers to submit the price they want and lets suppliers compete for the business.

Figure 4: Competitive pricing of Akash Network

Source: Cloudmos, as of January 25, 2024

Note: Pricing is for 1 CPU, 1GB RAM, and 1GB disk

As studied in our recent report on the intersection of artificial intelligence and cryptocurrencies, in addition to growth driven by competitive pricing, decentralized computing networks like Akash are also riding the wave of artificial intelligence growth and seeing increased activity on their platforms. High-performance GPUs are crucial in many machine learning and AI applications, and the widespread adoption of large language models has led to a surge in demand for them. In the past year, active leases on the Akash Network have more than doubled compared to early 2023. Leases represent the rental of computing resources.

Figure 5: Surge in active leases on the Akash Network in Q4 2023

Source: Cloudmos, as of January 25, 2024

Wireless Networks

Decentralized Wireless (DeWi) networks support the deployment of 5G, WiFi, Low Power Wide Area Network (LoRaWAN), and Bluetooth networks using encrypted incentives.

Considering the substantial funding required to build wireless network infrastructure, this field has been traditionally dominated by a few participants with the necessary scale and financial strength, primarily large telecom companies. DeWi networks provide an alternative where many independent entities or individuals coordinate the deployment of wireless infrastructure with the help of encrypted incentives.

In a broad sense, there are currently four types of decentralized wireless networks:

- Cellular 5G: 5G offers high download speeds and low latency.

- WiFi: WiFi networks provide connectivity to a specific area.

- LoRaWAN: Widely used for communication in the Internet of Things (IoT).

- Bluetooth: Bluetooth can transmit data over short distances.

In terms of mechanisms, DeWi networks typically use token incentives in the initial stages to encourage operators to invest in and deploy hardware. These token rewards provide operators with monetary support and a small return on investment, even if the network has not generated enough fees from users, incentivizing them to continue operations. Over time, with the growth of the network and the realization of economies of scale, theoretically, the combination of lower unit economics and better coverage will help attract more users to the network, creating more revenue for operators. The ultimate goal is to achieve a self-sustaining network where user fees can exceed operating costs and any additional investment required for network development.

Case Study: Helium

Helium is a global decentralized wireless infrastructure project that provides wireless coverage for LoRaWAN Internet of Things devices and cellular devices. Its flagship product, the Helium Hotspot, was launched in 2019 to provide wireless access for IoT devices. Since then, Helium has expanded its product range to include 5G coverage.

1. Helium IoT Network

The Helium IoT Network is a decentralized network that uses the LoRaWAN protocol to provide internet connectivity for IoT devices. Use cases include car diagnostic tools, environmental monitoring, and energy usage monitoring, among others.

2. Helium 5G Network

The Helium 5G Network is supported by thousands of user-operated nodes. Helium envisions the future of mobile networks as a combination of large carriers and crowdsourced 5G hotspots. This is due to consumer expectations for higher bandwidth and lower latency, as well as the need for more dense networks and more nodes, which increases site acquisition costs. The crowdsourcing model of the Helium 5G Network eliminates site acquisition costs, allowing users to participate in providing high-bandwidth coverage. Interested operators can purchase FreedomFi gateway hardware to participate in the network, enabling them to provide cellular coverage.

Operators will receive MOBILE tokens as a reward.

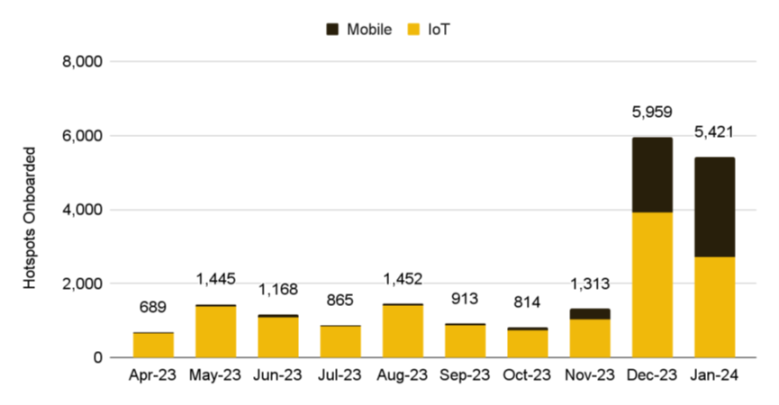

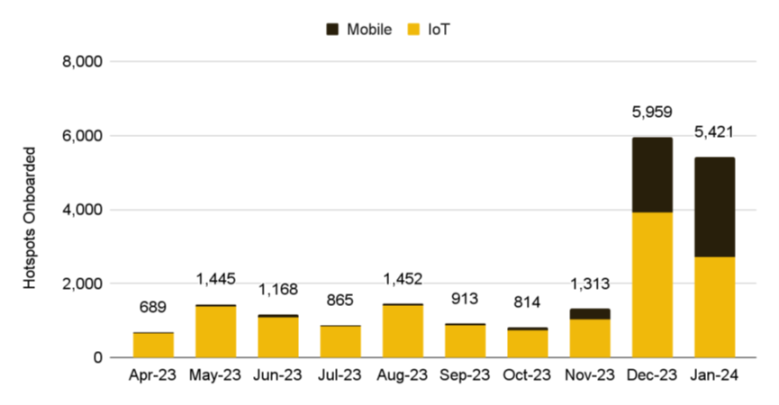

Following the nationwide launch of Helium Mobile's $20 per month unlimited data, text, and talk plan and the surge in sales of Solana Saga smartphones (with a free 30-day subscription to Helium Mobile), the Helium Network has witnessed a surge in new hotspots in recent months.

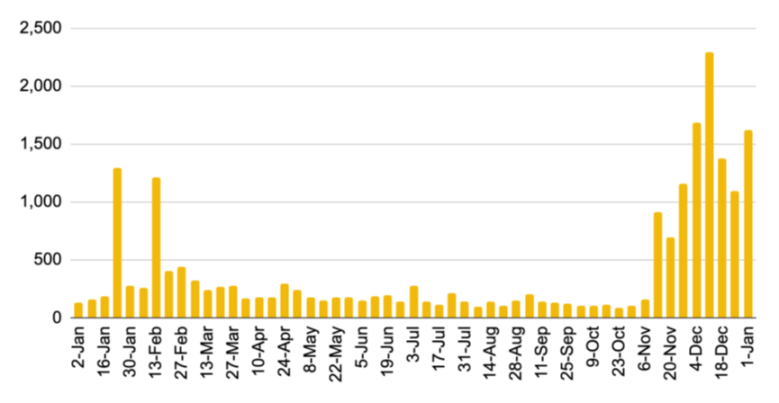

Figure 6: Surge in new Helium hotspots in recent months

Data Source: Dune Analytics (@helium-foundation), Binance Research, as of January 25, 2024

Helium's ecosystem is supported by several tokens:

- HNT: This is the native token of Helium and is crucial for incentivizing network usage as it is used to burn "data credits" for data transmission. Hotspot hosts can also exchange network tokens (e.g., IOT, MOBILE) for HNT.

- IOT: This is the protocol token for the Helium IoT network, mined by LoRaWAN hotspots through data transmission rewards and coverage proof.

- MOBILE: This is the protocol token for the Helium 5G network, rewarded to those providing 5G wireless coverage and Helium network validation.

Additionally, Data Credits (DC) are the only acceptable payment method for data transmission on the Helium network, priced at 0.00001 USD. For example, in IoT networks, users pay 1 DC for every 24-byte data packet transmitted. As more data is transmitted and more data credits are burned, subnets (e.g., IoT networks) receive more HNT tokens, rewarding and incentivizing their activity.

Overall, the above tokens serve as utility tokens for services within the network and provide incentives for operators to maintain and operate necessary infrastructure. Since its launch, Helium has expanded its network to over 970K hotspots, enabling decentralized coverage for countless IoT and mobile devices.

Storage

Decentralized storage systems operate on a peer-to-peer (P2P) network model, where user-driven storage providers (SPs) or miners allocate unused computer resources and earn rewards in the project's native tokens. Unlike centralized systems where a single entity manages data, decentralized storage encrypts and shards data across the network, enhancing accessibility and ensuring data redundancy.

Figure 7: Conceptual diagram of centralized and decentralized storage systems

Source: Binance Research

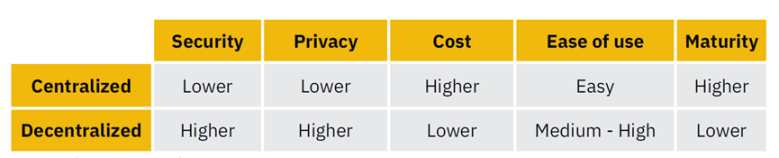

The difference between centralized storage and decentralized storage primarily depends on two aspects: security and cost.

Centralized storage systems store data with a single entity or a few servers, posing potential single point of failure risks. This could lead to issues such as data breaches and potential system outages, jeopardizing customer data. Additionally, user privacy is at risk. The infamous "Facebook-Cambridge Analytica data scandal" serves as a clear reminder of these concerns. In contrast, decentralized storage systems can reduce security risks and enhance data resilience by dispersing data across a global network.

Cost is another key factor in the comparison. An analysis released in May 2023 emphasized that decentralized storage is on average about 78% cheaper than centralized storage. This price difference is even more pronounced in enterprise-level data storage, where costs could be up to 121 times higher. This difference can be attributed to factors such as the significant capital investment required for centralized storage infrastructure and associated indirect costs. In contrast, decentralized storage leverages the availability of surplus computing resources globally. Additionally, while the centralized storage market is an oligopoly dominated by a few tech giants influencing pricing, the decentralized storage market is largely driven by open market forces.

Despite potential security vulnerabilities and higher costs, centralized storage still performs well in certain areas, particularly in user experience and product maturity. These systems typically offer more user-friendly interfaces for ordinary users and are complemented by comprehensive product suites to meet various computing needs, not just storage. The fusion of user-friendly design and all-encompassing solutions has contributed to its continued dominance.

Figure 8: Centralized storage vs. decentralized storage

Case Study: BNB Greenfield

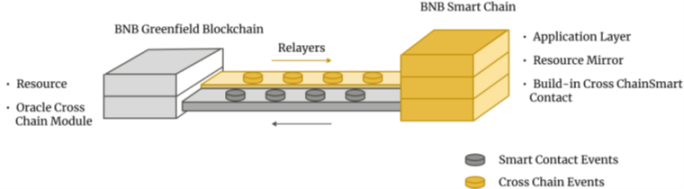

BNB Greenfield is the third blockchain in the BNB Chain ecosystem, focusing on storage and supported by a series of SPs. Greenfield aims to serve as the foundational storage for the BNB ecosystem and EVM-compatible addresses, distinguished by its inherent integration with the BNB Chain. This unique connection enables it to leverage the vast DeFi ecosystem of the BNB Chain and its large developer community.

BNB Greenfield operates on a two-tier architecture: a PoS-based blockchain protected by BNB staking validators and a storage network maintained by storage nodes. The role of validators is to store metadata on-chain, verify data availability, and protect Greenfield. In contrast, SPs handle the actual storage of data and provide various storage services.

A key feature of BNB Greenfield is its cross-chain programmability, allowing users to integrate their data with financial applications in the BSC ecosystem. The cornerstone of this cross-chain functionality is native cross-chain bridges, coupled with relay systems bridging Greenfield and the BNB Chain. These components collectively facilitate interaction between the two ecosystems.

Figure 9: Cross-chain architecture of BNB Greenfield

Decentralized storage services like BNB Greenfield have a wide range of applications.

Their use cases extend beyond blockchain-related scenarios to include various real-world applications. Examples include:

- Blockchain data storage: Layer-1 blockchains contain a large amount of historical data. This data can be efficiently stored on BNB Greenfield to reduce latency on L1 and enhance data accessibility. Additionally, BNB Greenfield provides a cost-effective solution for storing Layer-2 transaction data.

- Decentralized social networking: Decentralized social networks can leverage BNB Greenfield, allowing creators to maintain ownership of their content and data.

- Personal cloud storage: Users can transfer encrypted documents, images, and videos across devices. Access to these files is maintained through individual private keys.

- Website hosting: BNB Greenfield can be used by users as a tool in their website deployment toolkit.

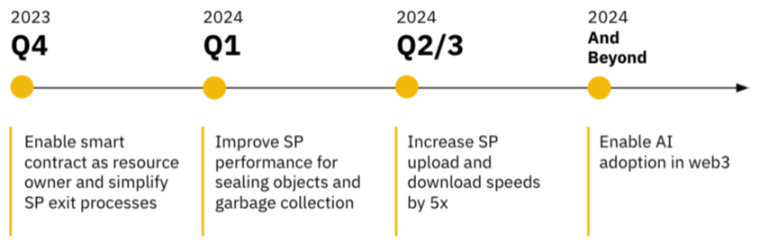

Looking ahead, BNB Greenfield is undergoing several developments aimed at improving user experience and advancing the utility of decentralized storage. In the recently released roadmap, users can expect enhanced performance, cross-chain support, and adoption of artificial intelligence, among others.

Figure 10: BNB Greenfield roadmap

Source: BNB Greenfield, Binance Research

For more information on decentralized storage networks and BNB Greenfield, please refer to our previous report "Traversing Decentralized Storage".

Sensors

Decentralized sensor networks help monitor and capture data from various environments in a secure and transparent manner. These networks consist of device grids equipped with sensors that can collect a range of data, from traffic and weather conditions to local street maps. By adopting a decentralized and bottom-up approach, decentralized sensor networks enhance data integrity and reliability while reducing the potential for data manipulation or tampering.

In a world where countless devices continuously generate data around us, decentralized sensor networks optimize the utilization of our data-rich environments.

The field has several subdomains, each involving different forms of data collection:

- Environment: Monitoring and analyzing air quality, weather conditions, water levels, and other environmental conditions.

- Energy: Measuring energy-related data such as production and consumption.

- Location and map drawing: Collecting geographic information for use in urban planning, navigation, and other location-based services.

- Supply chain: Collecting and verifying sustainability claims, production material sources, and other information to increase supply chain transparency.

- Smart environment: Monitoring data such as traffic patterns, pollution levels, or foot traffic.

- Mobility: Collecting traffic-related or vehicle-related data.

Case Study: Hivemapper

Hivemapper is building a global decentralized mapping network that collects the latest high-resolution data in a permissionless manner. Hivemapper relies on a community of contributors using vehicle dashcams to collect 4K street-level images. These contributors range from rideshare drivers to delivery drivers and enthusiasts. Additionally, a group known as "AI trainers" use Hivemapper's Map AI engine to participate in image analysis and convert it into valuable information needed by clients.

As payment for data consumption, the network's native HONEY token is used by consumers of map data (e.g., companies). Contributors also receive HONEY token rewards for their services, incentivizing them to expand the network. In essence, contributors share in the value created by the demand for map data.

Figure 11: Illustration of how contributors participate in Hivemapper

Source: Hivemapper, Binance Research

Hivemapper covers over 1,920 areas and maps roads on all continents except Antarctica. Specifically, it has mapped over 112M kilometers of roads, including over 7.2M unique kilometers of roads. The ratio of total kilometers to unique kilometers indicates coverage frequency and is converted to higher accuracy due to repeated data collection. Hivemapper claims that the network views locations 24 to 100 times more frequently than other services like Google Street View.

Hivemapper's extensive coverage benefits from a global network of 38.5K contributors spread across different countries/regions. Similar to trends in other DePIN projects, we have also observed increased activity on Hivemapper in recent months. For example, the number of new contributors per week has recently increased.

Figure 12: Increase in the number of new contributors per week in recent months

Source: Dune Analytics (@murathan), as of January 17, 2024

The opportunity in the digital mapping market is significant, estimated to reach $18.3 billion in 2023 and projected to reach $73.1 billion by 2033.

By providing the latest maps, Hivemapper also unlocks new use cases that existing solutions cannot achieve. This includes using Hivemapper to access the latest data on external house conditions for home insurance companies and providing developers of autonomous vehicles with the latest road information and construction area awareness. Hivemapper's Bursts feature also allows users of map data to request new data on demand, further enhancing the network's utility.

IV. Key Themes and Challenges

In this section, we will explore the potential future trajectory of DePIN projects and discuss some of the challenges they must overcome to achieve broader adoption.

Key Themes

Looking ahead, we expect several noteworthy developments.

Coexistence of DePIN with traditional infrastructure participants: Considering the latter's substantial capital resources and mature infrastructure, DePIN is unlikely to replace traditional networks in the short term. Nonetheless, DePIN can enable a sharing economy driven by idle resources and allow for last-mile coverage in financially unfeasible situations for traditional participants, expanding the current landscape. Therefore, the more likely scenario is the coexistence of DePIN networks with traditional infrastructure participants, supplementing any last-mile coverage and providing solutions that allow smaller entities or individuals to participate in infrastructure construction.

Empowering Web2 frontends with DePIN: It is undeniable that direct interaction with DePIN may be too complex for the general public and may be a factor in relatively slow adoption compared to existing Web2 services. In addition to focusing on improving user experience and user interfaces, we also hope that DePIN projects can collaborate with traditional players or web2 companies to expand their influence. In fact, users may interact with Web2 frontends without knowing that the underlying backend utilizes DePIN and blockchain technology. This can lower the steep learning curve and the perceived risk associated with cryptocurrencies, making the use of DePIN products as user-friendly as products in the Web2 domain, but with the additional benefits of cost-effectiveness and transparency.

Enhancing token utility and composability: Most DePIN tokens are primarily used as a payment medium for accessing project services. While this provides basic utility, one of the most notable aspects of blockchain technology is its composability in a broader on-chain ecosystem, especially in DeFi. Users can earn additional returns or explore different use cases with the tokens they acquire, further enhancing the attractiveness of participating in DePIN projects.

The Filecoin Virtual Machine of Filecoin and the inherent integration of BNB GreenField with the BNB Chain illustrate this potential. These projects go beyond basic utility of using FIL and BNB for data storage, providing users with opportunities to participate in their tokens in a broader ecosystem. While these extended use cases are still in the early stages, they hint at potential future directions that can stimulate the growth and popularization of DePIN projects.

Challenges

Despite having transparent and verifiable systems, DePIN projects are not without challenges that affect their widespread adoption.

- Price volatility impacting supply-demand dynamics: Inherent token price fluctuations may deter some from participating in DePIN projects. Given that suppliers, contributors, are compensated in the form of the project's native tokens, price volatility introduces uncertainty that could affect their profitability. While hedging strategies may mitigate this issue, it may not be feasible for less sophisticated network participants or tokens with smaller market caps.

This also affects the demand side, considering that tokens are used to pay for network services. Rapid token price surges without corresponding adjustments in service prices may deter potential users. Therefore, well-designed token economics and operational models are crucial in mitigating price volatility.

- User primarily profit-driven: While DePIN projects have a clear value proposition, the performance of their native tokens still plays a crucial role in attracting and retaining users. It is typically easier to attract more users interested in riding an upward trajectory when token prices are on the rise. Conversely, in a bear market, a decline in token prices and profitability may lead network participants to exit the project. This situation is particularly challenging for tokens with smaller market caps and lower liquidity, potentially leading to a downward spiral.

Overcoming this challenge is not easy, but projects that provide valuable services and align with market demand will attract a broader audience, rather than profit-driven ones.

- Lack of public awareness: Awareness is crucial for the adoption of DePIN products. While these projects often offer services that are more transparent and sometimes more cost-effective than centralized alternatives, they are not widely known outside the crypto industry. This limited awareness can be attributed to the general public's unfamiliarity with blockchain technology and the complexity of digital assets. Therefore, only a small fraction of people currently appreciate the advantages of these decentralized services.

V. Conclusion

DePIN projects leverage distributed and transparent systems to enhance the scalability and efficiency of infrastructure. This approach aligns with the principles of the crypto industry. By utilizing token economics, DePIN can forecast crowdsourced resources such as storage capacity and computing power, eliminating the need for large initial capital investments. The potential applications in various fields indicate a huge potential market.

However, there are still challenges in achieving widespread adoption. In the short term, the likelihood of completely replacing centralized counterparts is low, and we are likely to see a middle ground where DePIN coexists with traditional infrastructure providers.

Looking ahead, achieving a more seamless user experience and expanding the on-chain use cases of DePIN tokens are key trends to monitor. While we expect the number of DePIN projects to increase as the industry develops, their ultimate long-term viability and success depend on real-world applicability, which has yet to be thoroughly tested.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。