The airdrop of JUP once again brought a wave of heat to the Solana main chain. On the day when JUP started the airdrop claim, the transaction volume on the Solana chain reached 14.6 billion US dollars, an increase of 71% from the previous day.

By Frank, PANews

At 10 a.m. on January 31 (Eastern Time), the Jupiter airdrop claim began. The snapshot for this airdrop was taken until November 2, 2023, and 955,000 wallets that directly interacted with Jupiter were eligible to participate in the first JUP airdrop.

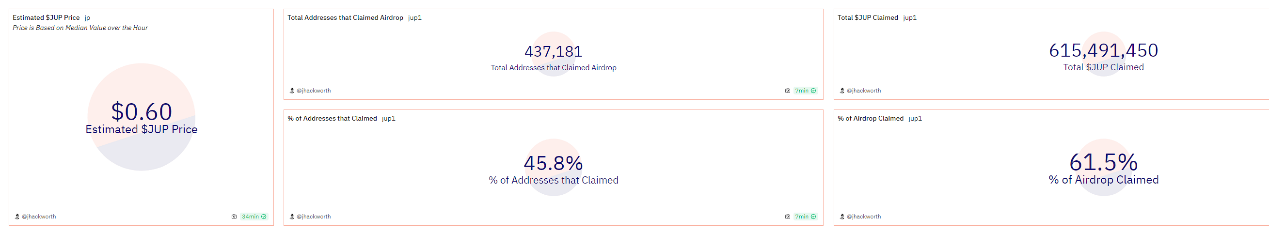

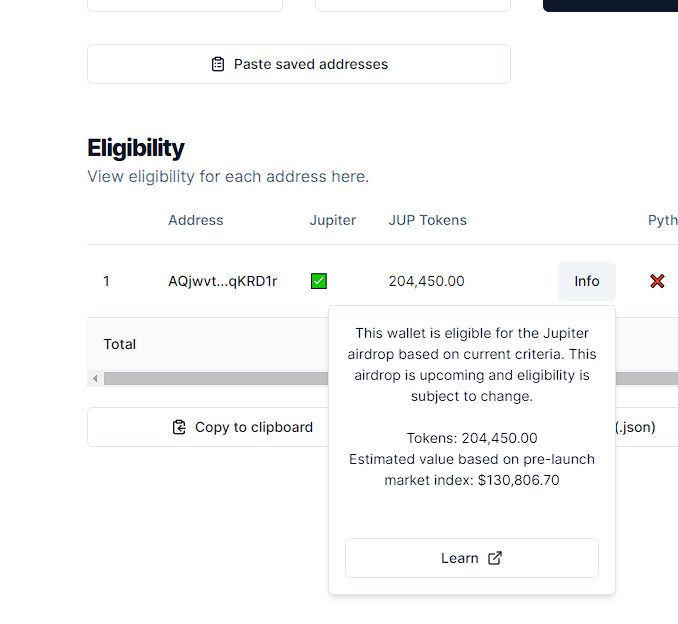

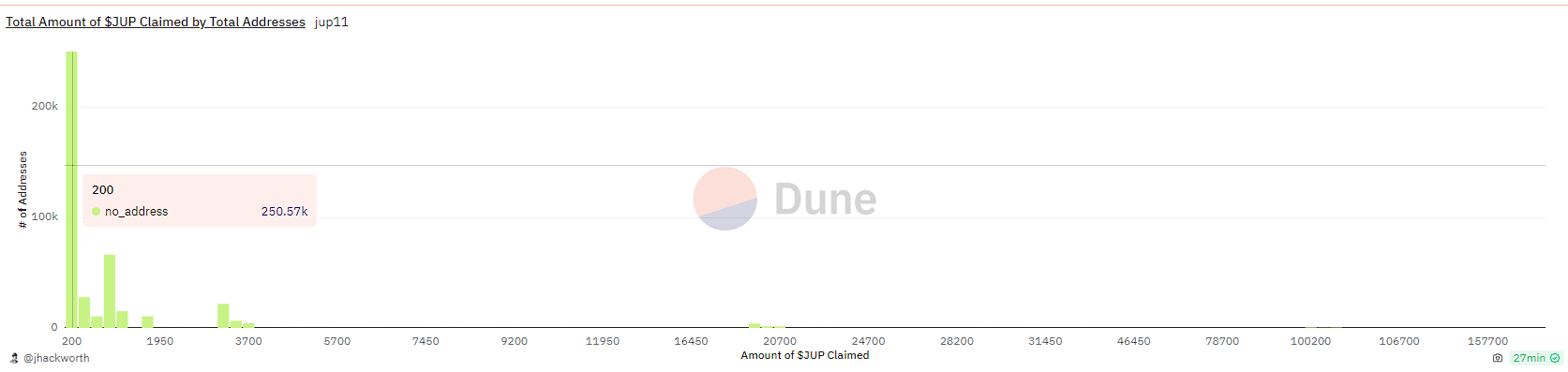

As of February 1, the number of JUP airdrop claim addresses reached 430,000, with nearly half of the users (250,000 claimed) receiving 200 JUP, worth 127 US dollars. The highest single address can claim 204,450 JUP, worth about 130,000 US dollars. Calculated at a unit price of 0.62 US dollars at the time of submission, the peak total amount of the JUP airdrop in this round reached as high as 8.7 billion US dollars, making it the largest airdrop since the beginning of 2024. Through this airdrop, the circulating market value of JUP has reached 8.37 billion US dollars, ranking 77th in total market value (Coinmarketcap ranking).

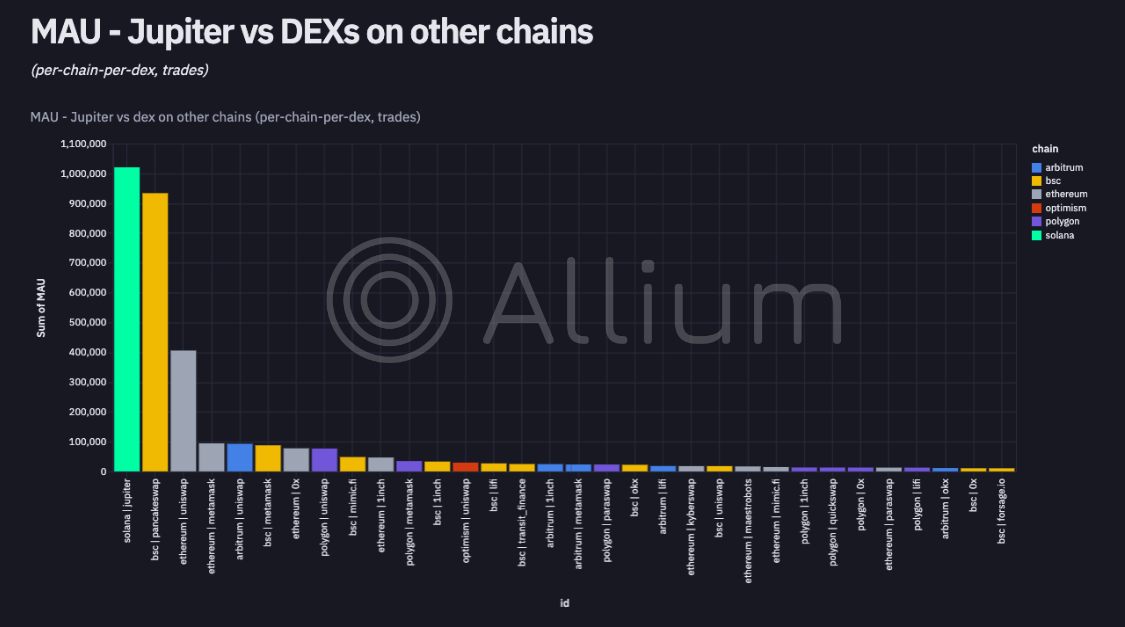

Accounts for 80% of the total trading volume on Solana

Jupiter is positioned as the liquidity infrastructure for Solana, currently accounting for 80% of the total trading volume on the Solana chain. This is similar to the role of Uniswap on Ethereum. In addition, with the surge in data on the Solana chain, Jupiter has become the blockchain DEX with the highest monthly active users. Its daily trading volume is second only to Uniswap, ranking second.

Compared to traditional DEX tools like Uniswap, Jupiter has several advantages in product design. In addition to the traditional Swap trading mode, Jupiter has introduced Dollar-Cost Averaging (DCA), which allows users to execute more trading strategies. Furthermore, Jupiter has also launched LP-Traders perpetual contract exchange, which is functionally closer to CEX, while retaining the independent characteristics of DEX. With the increasing trend of users preferring to use Telegram bot robots for on-chain operations, Jupiter's openness and innovation can better meet new demands.

The largest wealth-creating airdrop in history?

Before JUP, Arbitrum and Optimism created a "wealth-creating" effect with their airdrops, which also made the public re-evaluate the charm of airdrops. In comparison, the largest single address on Arbitrum could receive 10,250 ARB, worth about 13,800 US dollars at the opening, and on Optimism, the largest single address could receive 32,432 OP, worth about 45,000 US dollars at the opening. In this round of airdrop, the largest single address seen for JUP can claim 204,450 JUP, worth up to 130,000 US dollars at the opening. From the perspective of the highest profit address, JUP has become the most wealth-creating "king of airdrops".

However, looking at the profit situation of the majority of addresses, about 80% of addresses on Optimism made a profit of around 700 US dollars, and about 70% of addresses on Arbitrum made a profit of around 1,350 US dollars. The majority of JUP claims were for 200 JUP, worth about 127 US dollars. From this perspective, the wealth-creating effect of JUP is not very significant for ordinary interacting users.

Is it the season of airdrops on Solana?

The JUP airdrop once again brought a wave of heat to the Solana main chain. On the day when JUP started the airdrop claim, the transaction volume on the Solana chain reached 14.6 billion US dollars, an increase of 71% from the previous day.

In addition to JUP, in the past three months, airdrop projects on Solana have repeatedly become shining stars. In November 2023, the oracle project Pyth on Solana provided an airdrop of 2.5 billion tokens, distributing over 77 million US dollars to early users. In December, the liquidity staking protocol Jito on Solana distributed 100 million tokens, peaking at a value of about 450 million US dollars.

The cost of interaction on Solana is much lower than on Ethereum, so the threshold for interaction on Solana is relatively lower. This will also attract more projects to turn to Solana and open airdrop programs. Subsequently, Drift Protocol, Kamino Finance, Tensor, and MarginFi are worth paying attention to for their airdrop status.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。