Project Name: Picasso Network

Project Type: Cross-chain, Restaking.

Codename: $PICA (Native Cross-chain Token)

Cryptocurrency Ranking: #489

Market Cap: $67 million

Fully Diluted Valuation: $149 million

Circulating Supply: 4.53 billion (45.34%)

Total Supply: 10 billion

Project Overview

In recent technological advancements and collaborations in the blockchain field, Picasso Network has demonstrated its role as a cross-chain communication hub. Initially launched in the Kusama ecosystem, Picasso's mission is to facilitate interoperability across ecosystems and establish robust infrastructure within the Polkadot network. Concurrently, the development of Composable Cosmos aims to expand the capability of cross-chain asset transfers, breaking the limitations of a single ecosystem.

Composable Cosmos has made significant strides in simplifying the process of establishing IBC connections with Cosmos chains. Previously, this task was complex and time-consuming, but Composable Cosmos now acts as a bridge, enabling Cosmos chains to swiftly participate in cross-ecosystem IBC activities without the need for upgrades or modifications.

This chain is designed to be compatible with any Cosmos chain that adopts the Tendermint consensus mechanism and enables IBC. It has been integrated with Picasso and Ethereum, making it a central hub for IBC activities. It focuses on governance rather than user-facing operations, utilizing Picasso's native token PICA instead of a separate token.

A notable feature in the Composable Cosmos ecosystem is its validator set, which is capped at 100. The Composable Foundation plays a crucial role, representing Picasso in staking PICA tokens and managing validator rewards. Within this framework, Picasso leverages its native token PICA to establish a growth foundation covering the Picasso parachain on Kusama and the Composable Cosmos chain on Cosmos.

This research provides an in-depth analysis of the current status of the project, particularly its integration with other ecosystems such as Ethereum and Solana. It particularly focuses on the restaking feature launched on Solana through the Picasso-Solana IBC connection. This development is a key step for Picasso to strengthen its cross-chain interactions and expand the application scope of PICA in the blockchain field. Recently, Picasso announced the launch of restaking services for SOL on January 28th.

Cross-chain Communication Protocol (IBC) Connection between Picasso and Solana

At the recent Solana Breakpoint conference, the Composable Foundation's collaboration with the University of Lisbon showcased significant progress in technical cooperation. Highlights of the presentation include:

Integration of Solana with IBC: With support from Picasso, Solana can now join a wide-ranging IBC network, including Polkadot, Kusama, Cosmos, and the upcoming Ethereum, enabling new opportunities for practicality and participation across different blockchain networks, including innovative applications like restaking within interconnected ecosystems.

Seamless liquidity exchange: This integration is expected to seamlessly connect Solana's large user base and liquidity with other chains in the IBC network.

This series of integrations by the Picasso Network not only reflects its pursuit of innovative technology but also further deepens its influence in the field of cross-chain interoperability for digital assets, bringing new growth opportunities to decentralized financial services in the blockchain sector.

Technical Aspects

Client Blockchain Solutions: At the forefront of blockchain technology, the Picasso Network is overcoming a series of technical challenges faced by blockchains such as NEAR, Solana, and TRON through its cutting-edge client blockchain solutions. These chains originally did not naturally conform to the IBC standard, such as the ICS-23 specification. This solution has been directly deployed on Solana, introducing a verifiable storage mechanism, paving the way for interaction based on IBC, and achieving trust-minimized bridging between chains that were not naturally compatible with IBC.

Validator Participation Mechanism: In terms of validator participation, Picasso has adopted an innovative mechanism where entities aspiring to become validators on client blockchains must participate through a staking process with custodial client contracts. Once successfully staked, participants can join the candidate validator pool. Upon each epoch transition, the contract selects new validators from this pool, prioritizing those with the highest staked amount.

Picasso's Introduction of On-chain Restaking on Solana

Picasso has also introduced the concept of restaking in the Solana ecosystem, a mechanism initially developed for Ethereum (ETH) by EigenLayer. Restaking allows for engaging in other financial activities while maintaining assets in a staked state. This method has gained widespread adoption in Ethereum and demonstrates significant expansion potential in networks with mature staking cultures such as Solana.

In the Solana domain, Picasso is promoting restaking of SOL and receipt tokens from various SOL staking platforms. Through the implementation with Solana-IBC bridging validators, this strategy heralds a new chapter in blockchain integration. Users can deposit assets into staking contracts via the trustless.zone platform, which are then allocated to validators specifically built on client blockchains to bridge the gap between IBC and Solana. This innovative restaking approach supports the PoS consensus mechanism of client blockchains and enhances the security of Solana-IBC connections.

Picasso is expanding its Solana-IBC validator investment portfolio to include assets such as SOL, mSOL from Marinade Finance, jitoSOL from Lito, LP tokens from Orca, and bSOL from Solblaze, significantly expanding the staking options offered to users. The Solana > IBC initiative of the network is undergoing rigorous third-party security audits to ensure the robustness and security of its system. Upon completion of the audit, the results will be publicly released, providing necessary transparency and assurance.

Token Economics

Market Cap: $67.56 million

Fully Diluted Valuation: $149 million

Circulating Supply: 4.53 billion (45.34%)

Total Supply: 10 billion

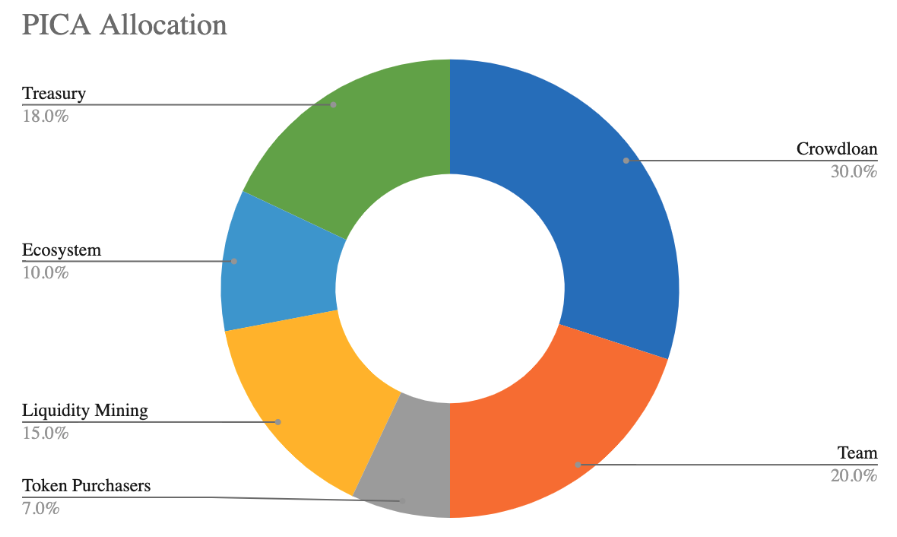

Token Distribution:

- Crowdloan: Total 30% (Unlocked 18.1%, Locked 11.9%)

Details: 50% released during the Token Generation Event (TGE), with the remaining portion unlocking over the following 48 weeks. The entire balance is available for governance; unclaimed tokens are allocated to the treasury after 3 months.

- Treasury: Total 18% (-/-)

Details: Initially managed by the Council, funded by 75% of network fees, and subsequently managed by PICA holders.

- Liquidity Mining: Total 15% (-/-)

Details: Rewards for participating in liquidity programs.

- Team: Total 13.7% (Fully Locked)

Details: Allocated over two years, with an initial six-month lock-up period.

- Ecosystem: Total 10% (-/-)

Details: Rewards for network activities, such as running an oracle.

- Series A Funding: Total 7% (Fully Locked)

Details: 3-month lock-up period, with a 2-year vesting schedule.

- Partners & Advisors: Total 6.35% (Fully Locked)

Details: Allocated over 2 years, including a 6-month lock-up period.

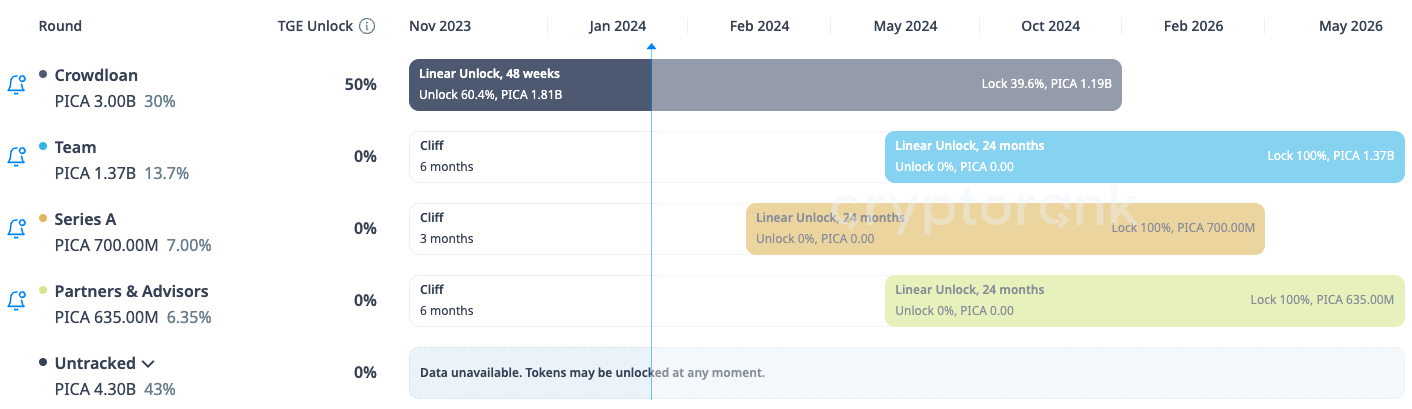

Allocation Schedule

Source: Cryptorank.io

Throughout 2024, the PICA token will undergo a series of unlocking events, impacting its total supply and market cap. This pattern includes:

Regular Crowdloan Unlocks: Nearly 31.26 million tokens (approximately 0.31% of the total supply) will be unlocked almost every week. These ongoing releases are intended to support crowdloan participants.

Larger-scale unlocks at significant milestones: At several key moments throughout the year, significantly larger-scale unlocks will occur, releasing 108 million tokens each time (approximately 1.08% of the total supply). These tokens will be allocated to different stakeholders:

Team: Partial release of the team's allocation to reflect their ongoing contributions to the project.

Series A Investors: Unlocking of Series A investors' investments, reflecting their early support for the project.

Partners & Advisors: This group, crucial for providing strategic guidance and building partnerships, will also receive a portion of the tokens.

Token Use Cases

The PICA token plays a crucial role in the Picasso and Composable Cosmos ecosystems, covering various functionalities:

Fragment Staking on Picasso: 25% of Picasso fees will be used to reward fragment creators for block production, with the remainder flowing into the community governance reserve.

Oracle Staking via Apollo: Users can run Oracle nodes by staking PICA tokens, enhancing the security of network data.

Composable Cosmos Staking: PICA tokens are used to maintain the security of the Composable Cosmos chain, demonstrating dual utility in the Kusama and Cosmos ecosystems. The network requires 1 billion PICA tokens for validator staking to provide network security and achieve an approximately 10% annualized return.

Polkadot Liquidity Staking: Composable introduces Liquid Staked DOT (LSDOT), generating returns for PICA token holders through liquidity staking fees.

Gas Token in the Picasso Ecosystem: PICA tokens are used to facilitate transactions and dApp operations, with fees dynamically adjusted based on network load.

Primary Trading Pair on Pablo DEX: PICA tokens are one of the primary trading pairs on Pablo DEX, incentivizing liquidity provision.

Governance: PICA tokens play an important role in governance within the Picasso and Composable Cosmos ecosystems, supporting decentralized decision-making.

Fundraising Status

Seed Round (July 2021): Composable successfully completed its seed round fundraising, raising $7 million, marking an important initial stage in their financial journey.

Series A (March 2022): This fundraising round was a significant step, raising over $32 million. The investor lineup includes prominent names such as Coinbase Ventures, Blockchain Capital, Figment Capital, Fundamental Labs, GSR, Jump Capital, New Form Capital, NGC Ventures, and Krypto Ventures, reflecting strong confidence in the project and support from strategic networks.

Additionally, Composable recently established partnerships with two strategic partners to enhance its capabilities and promote cross-ecosystem growth: DAO5 and Santiago Santos.

About DAO5: DAO5 is an emerging cryptocurrency fund transitioning to a DAO structure, aiming to collectively manage assets by portfolio founders. Led by important leaders in the crypto field such as Tekin Salimi and supported by several advisors, detailed information can be found on their website.

About Santiago Santos: Santiago R. Santos is a prominent expert in finance and crypto, known for significant contributions to investment firms and influential presence in the crypto field. He co-hosts "The Empire Podcast" with Jason Yanowitz from Blockworks, providing crucial insights into industry trends.

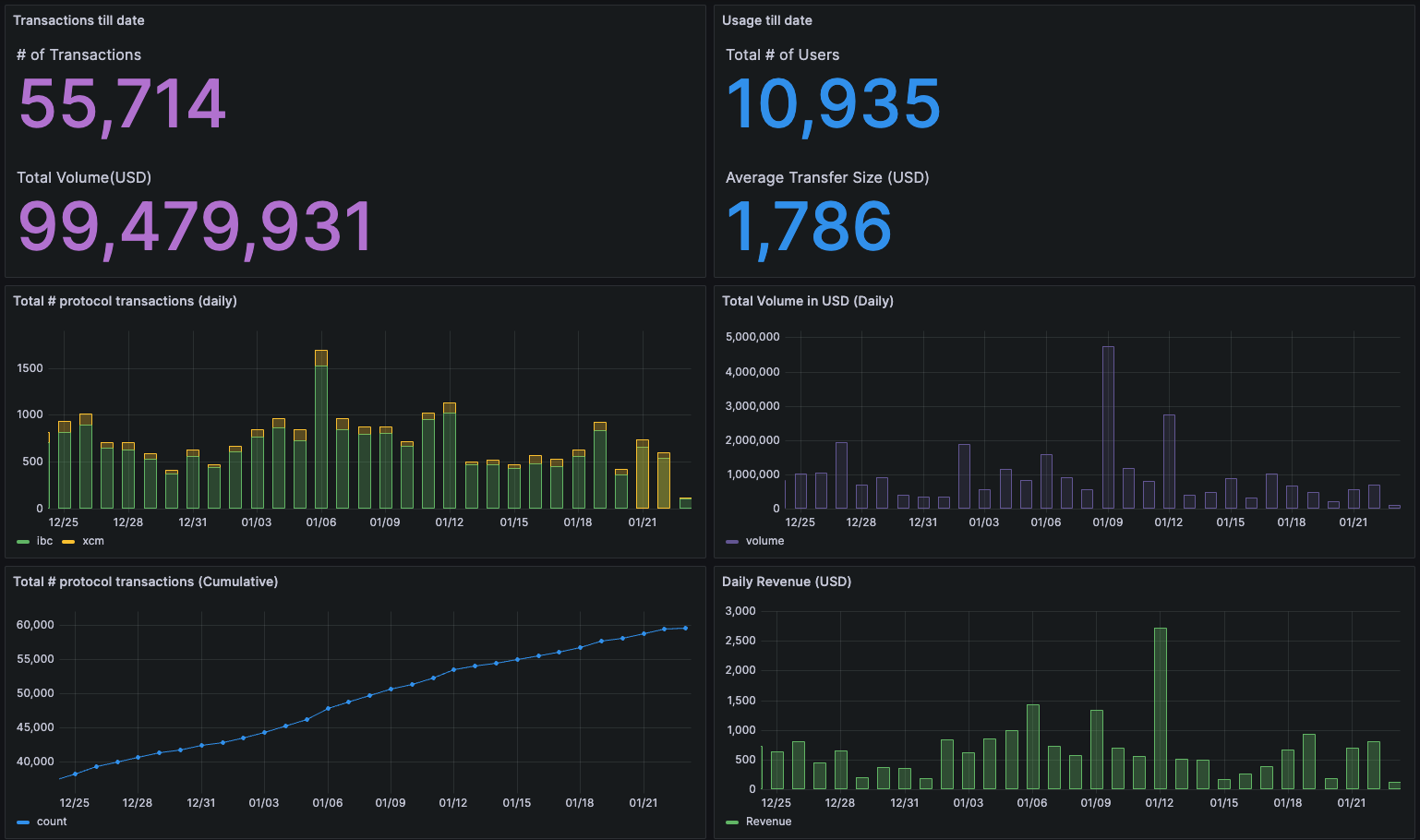

Statistical Data:

As of January 23, 2024:

A quick review of the statistical data shows relatively high network activity, with an average of over 500 transactions processed daily and an average transfer amount of $1.7 thousand. With integrations with Solana and Ethereum, these metrics may change, presenting an interesting observation point.

Current Integrations:

Picasso has successfully achieved interoperability with the following ecosystems, enabling seamless data transfer, asset movement, and smart contract interactions between Picasso and these ecosystems. The sources for the relevant ecosystems are as follows:

Table Source: Picasso Asset List

Bullish Factors:

As Solana integrates with Polkadot, Cosmos, Kusama, and Ethereum through IBC, these connections are expected to enhance the value for $PICA token holders, positioning PICA at the core of a continuously growing cross-chain landscape.

Strong partnerships and successful fundraising rounds, including a $7 million seed round and a $32 million Series A round, reflect investor confidence in the project and support from strategic networks.

The multi-faceted role of the PICA token in staking, governance, and liquidity within the ecosystem enhances its intrinsic value and attractiveness.

The team's ongoing exploration of new functionalities, particularly in interoperability and trustless DeFi, demonstrates a commitment to evolving and adapting to the changing demands of the blockchain industry.

Bearish Factors:

The project's utility and technical complexity may be overly complex for new and average users, potentially leading to reduced participation. This risk may increase if competitors launch similar but more user-friendly functionalities. While there are currently no related restaking projects for SOL, this market may soon attract competitors.

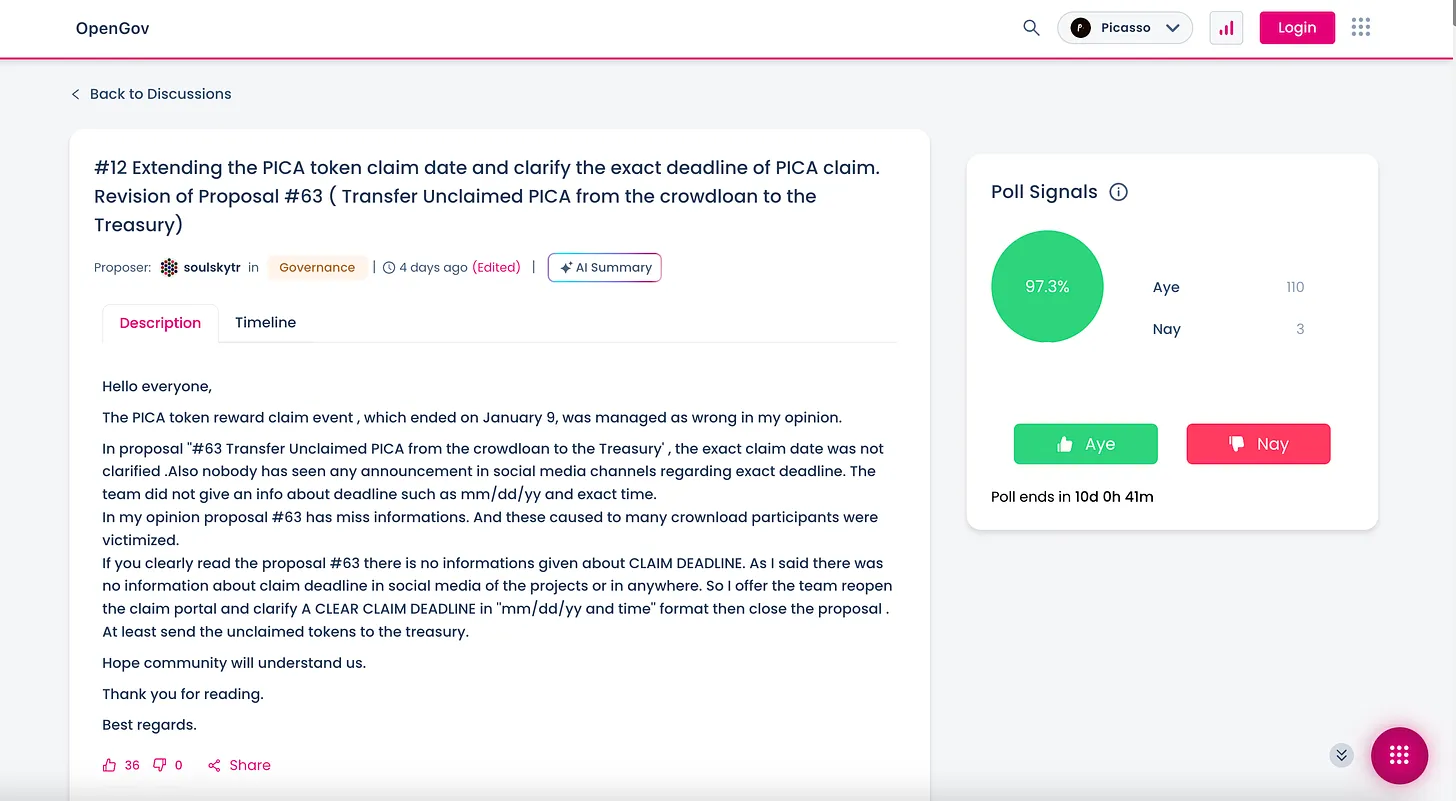

Poor management of unclaimed $PICA tokens by crowdloan participants is mainly due to inadequate communication of the claiming deadlines, leading to dissatisfaction among contributors. The Picasso OpenGov forum community is pushing back on the decision to allocate these tokens to the treasury, which is a key issue affecting the project's community relations stance.

CEO Omar Zaki's past disputes with the U.S. SEC and associations with controversial projects such as Bribe Protocol have brought reputation challenges. This issue is significant enough to have led to the departure of some key team members, including former CTO Karel Kebab.

The anticipated large-scale token unlocks are expected to exert significant downward pressure on the market.

References:

Picasso Protocol (n.d.). Picasso Protocol. Picasso. Retrieved January 23, 2024, from: https://picasso.xyz/

Picasso X Account. (n.d.). Picasso - Company Socials. Retrieved January 23, 2024: https://twitter.com/Picasso_Network

Composable Finance (n.d.). stats.composable.finance - Retrieved January 23, 2024, from: https://www.composable.finance/

Picasso Statistics. (n.d.). Picasso - Company Socials. Retrieved January 23, 2024: https://stats.composable.finance/d/b7ec4077-af14-4ac9-8abc-327ce6adecb3/composable-finance-stats-v1-1?orgId=1&refresh=1h&from=now-30d&to=now

Picasso Documents and tokenomics: https://docs.composable.finance/networks/picasso-parachain-overview/

Picasso medium page: https://medium.com/@Picasso_Network

Picasso Vesting Schedule and Unlock Events: https://cryptorank.io/price/picasso/vesting

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。