Author: Deep Tide TechFlow

With the approval of the Bitcoin spot ETF, the market has embarked on a downward path in the short term as the news is realized.

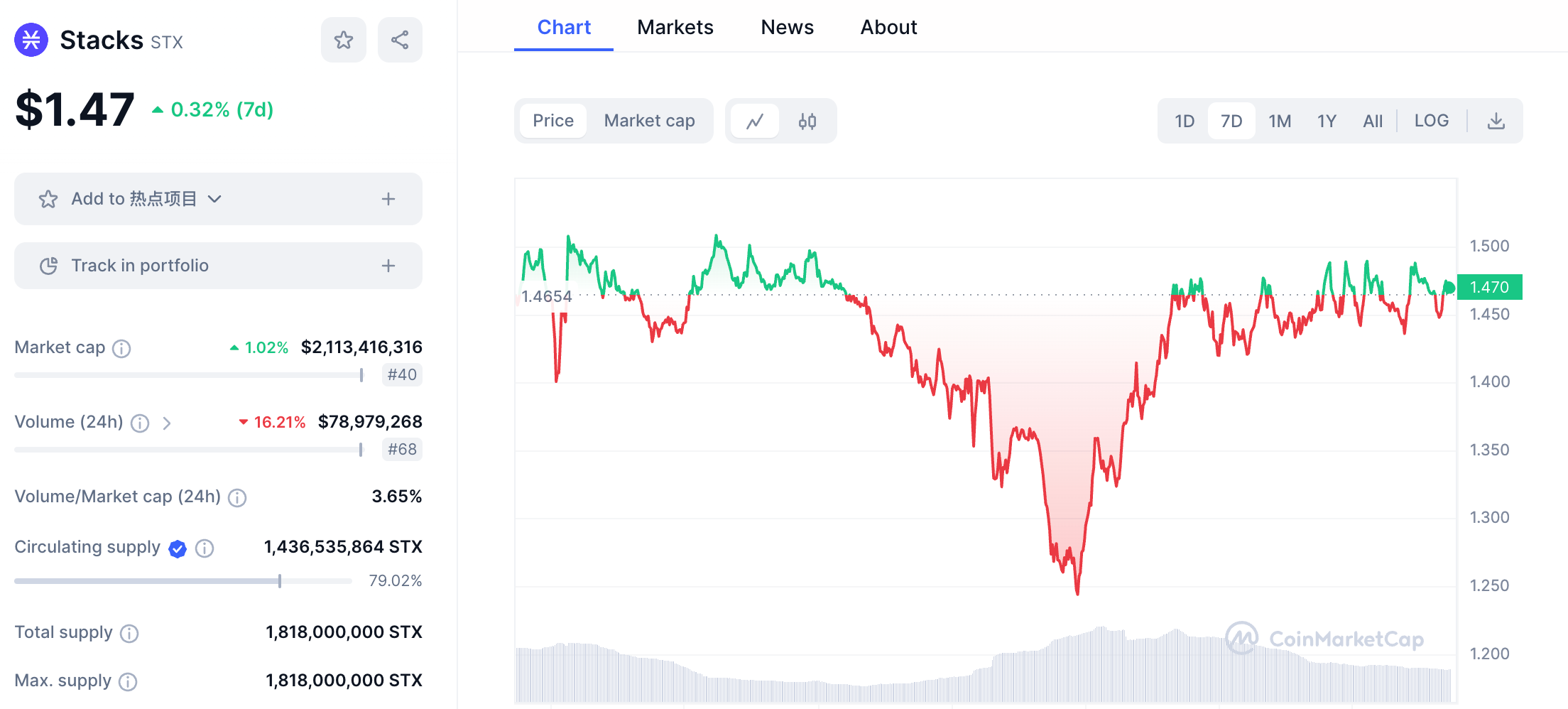

However, with the halving expectation, projects related to the Bitcoin ecosystem continue to be the focus of attention this year. Among them, the leading project of Bitcoin L2, Stacks ($STX), has rebounded in the market performance in the past week.

For those who are bullish on STX, it is a good choice to gradually accumulate by selling high and buying low, especially with the expected boost from the Nakamoto upgrade in Q1.

However, with the price fluctuations come uncertainties in returns. Are there any other ways to earn additional income while holding STX?

Don't forget that the original design goal of Stacks is to bring DeFi possibilities to BTC.

What most people may not know is that holding STX currently allows for pooling in different products, single staking, providing liquidity staking, and even becoming a key player in the Stacks ecosystem for airdrops.

But compared to Ethereum and other chains, STX's staking-related interactions are not as mainstream.

If you have STX and want to maximize your returns, the following will take stock of and explain all possible income strategies, and there is always one suitable for you.

CEX Staking: Convenient Option

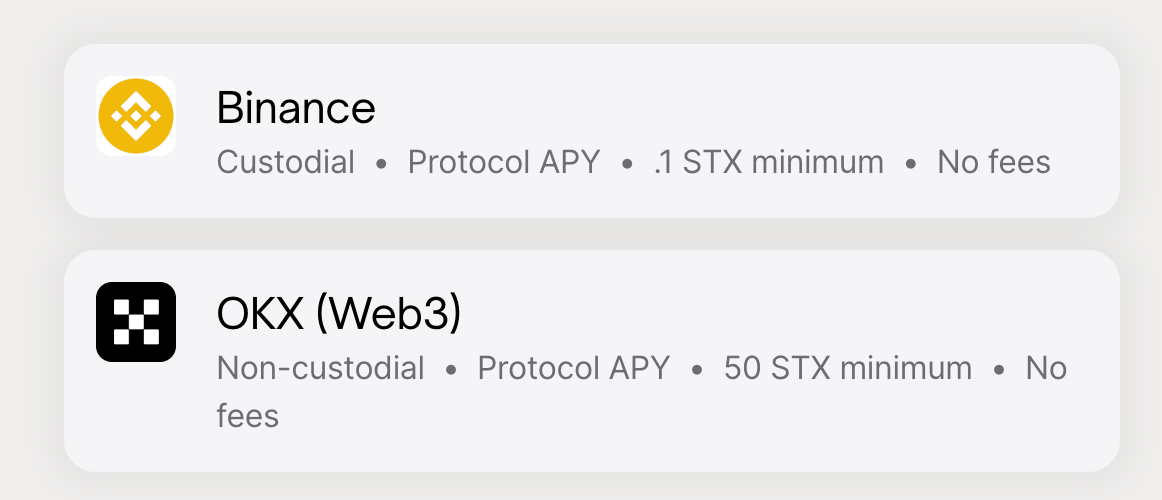

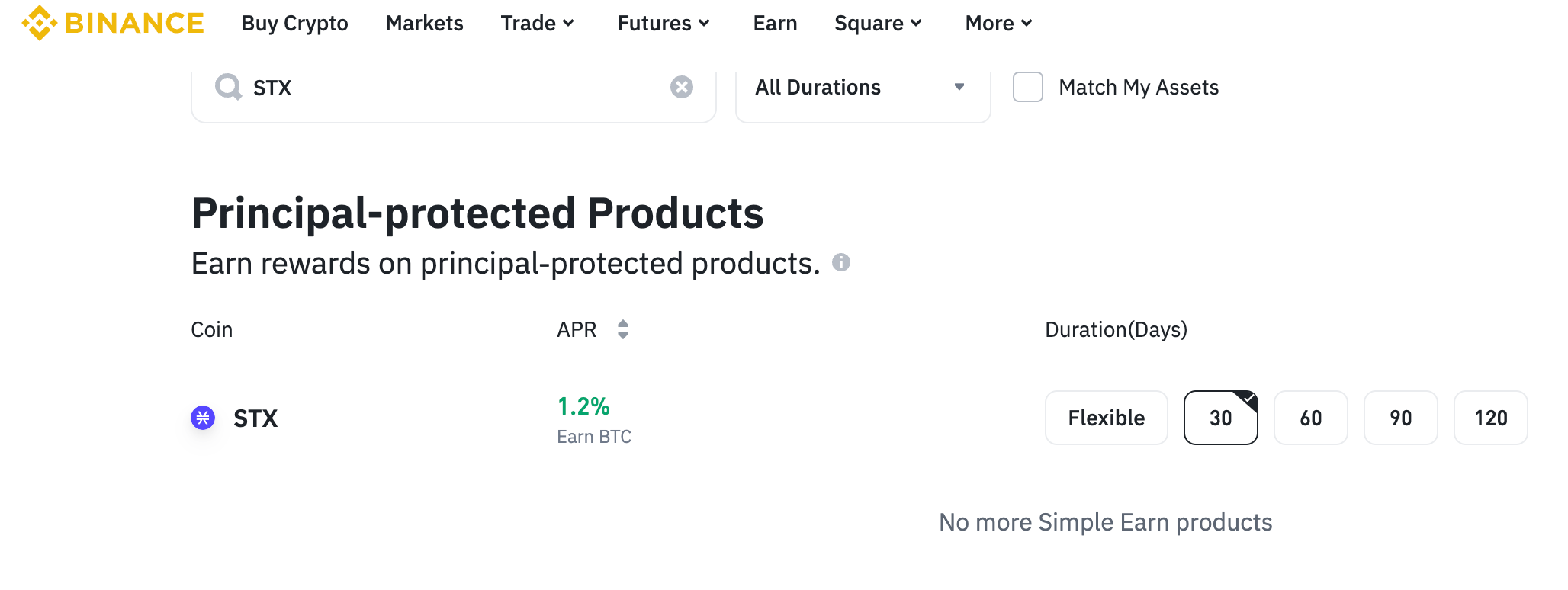

Currently, there are options to stake STX for returns directly on Binance and OKX.

For newcomers unfamiliar with on-chain operations or those looking for convenience, entrusting staking to CEX is also a good choice.

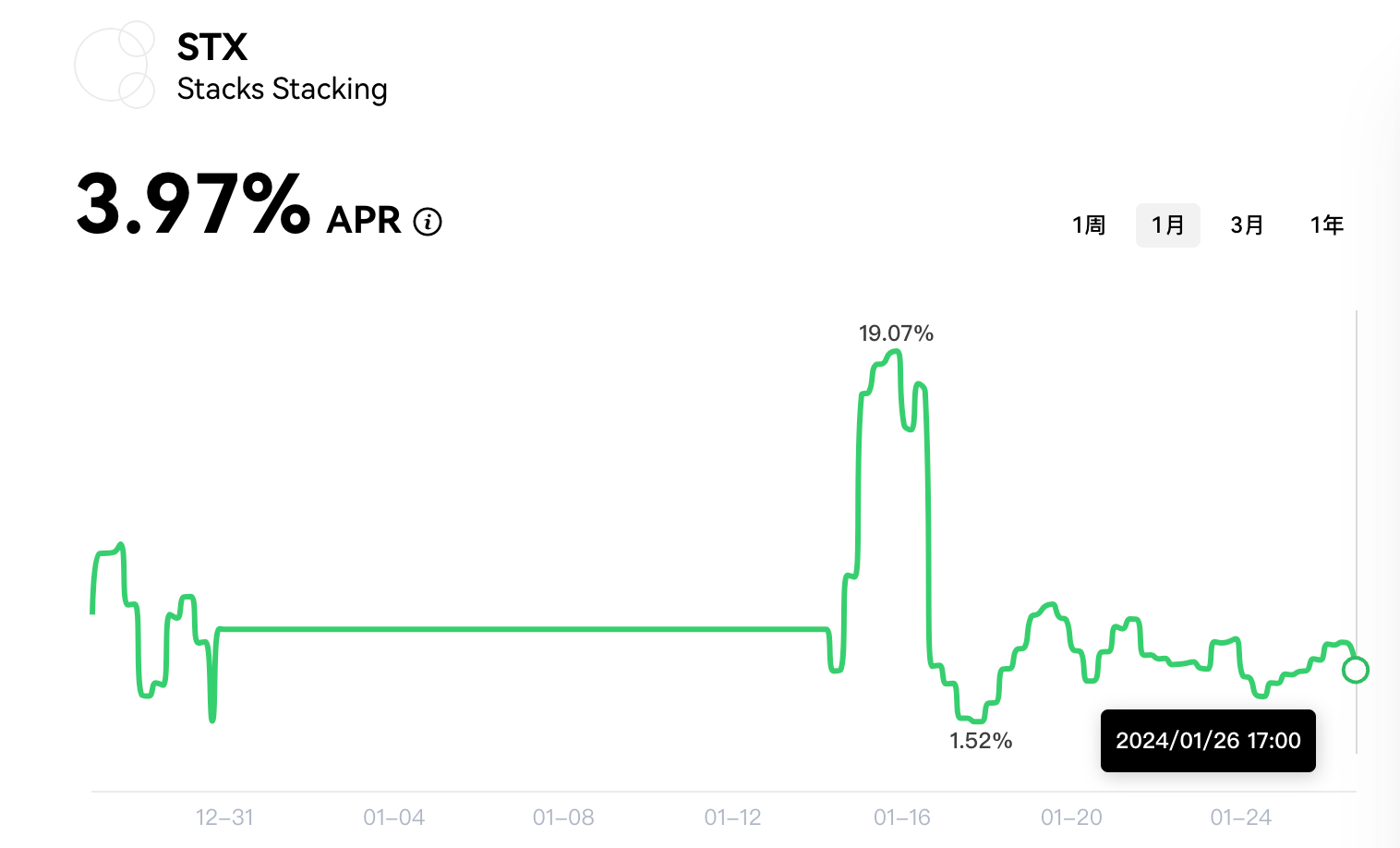

The entry thresholds for both CEX platforms are not high, with Binance requiring a minimum of 1 STX and OKX requiring 50. As for returns, as of the time of writing, the estimated APR for staking STX for 30 days is 1.2% for Binance and 3.97% for OKX.

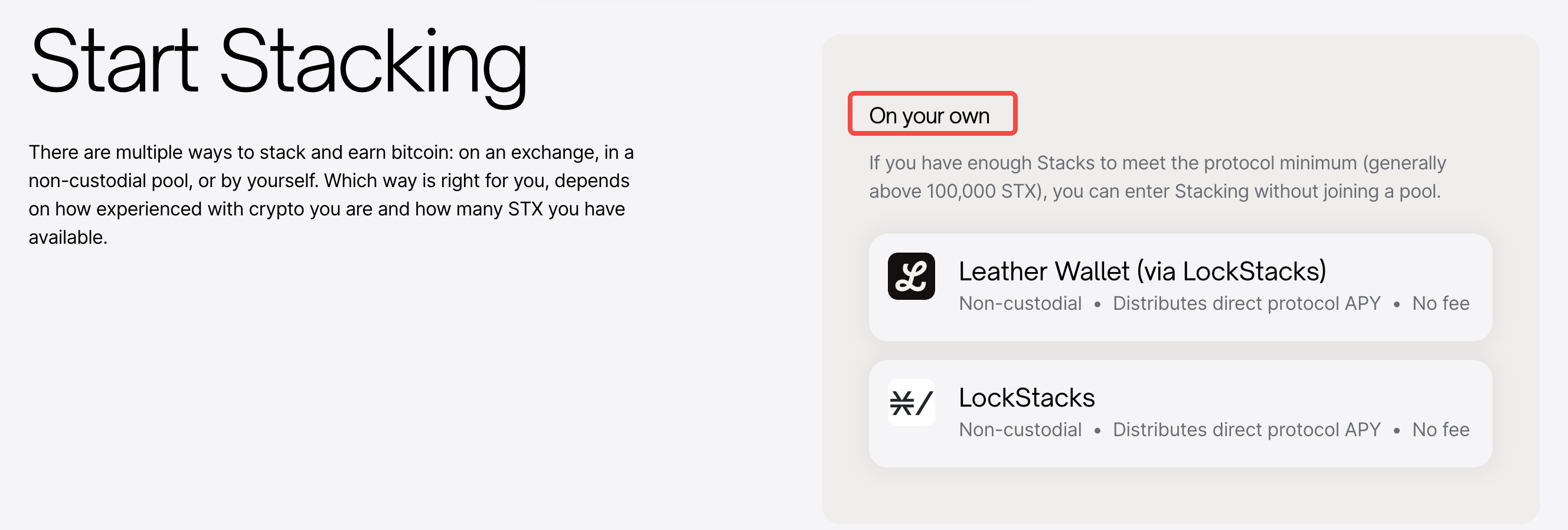

On-Chain Single Staking: Choice for Large Holders

For on-chain players, STX may be more stored in their own wallets. For those who wish to directly interact with the Stacks protocol without dealing with staking service providers, direct staking would be a better choice.

The recommended method given by the Stacks official is the Leather Wallet + LockStacks.

The former is a self-custody wallet that can send and receive STX and BTC, while the latter provides an entry for users to stake STX directly without dealing with service providers.

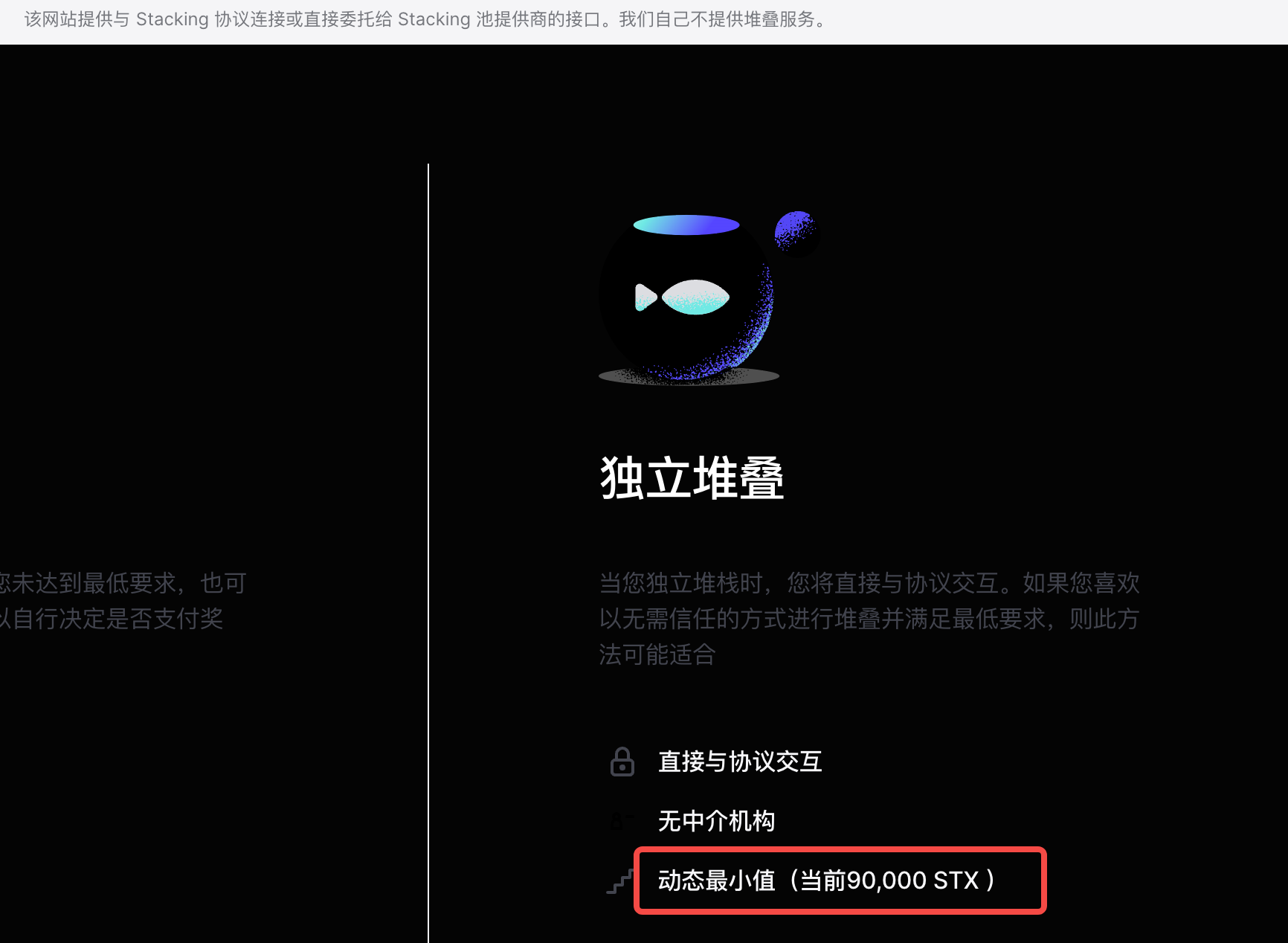

However, the premise for doing so is that you must be a large holder.

LockStacks explicitly states on its page that only users holding 90,000 STX are eligible for single staking. Although this threshold may change, it is unlikely to decrease significantly, similar to the basic requirement of staking 32 ETH for Ethereum nodes.

According to the calculation data provided by Twitter user @Mezma00, the APR for this type of staking is around 7%.

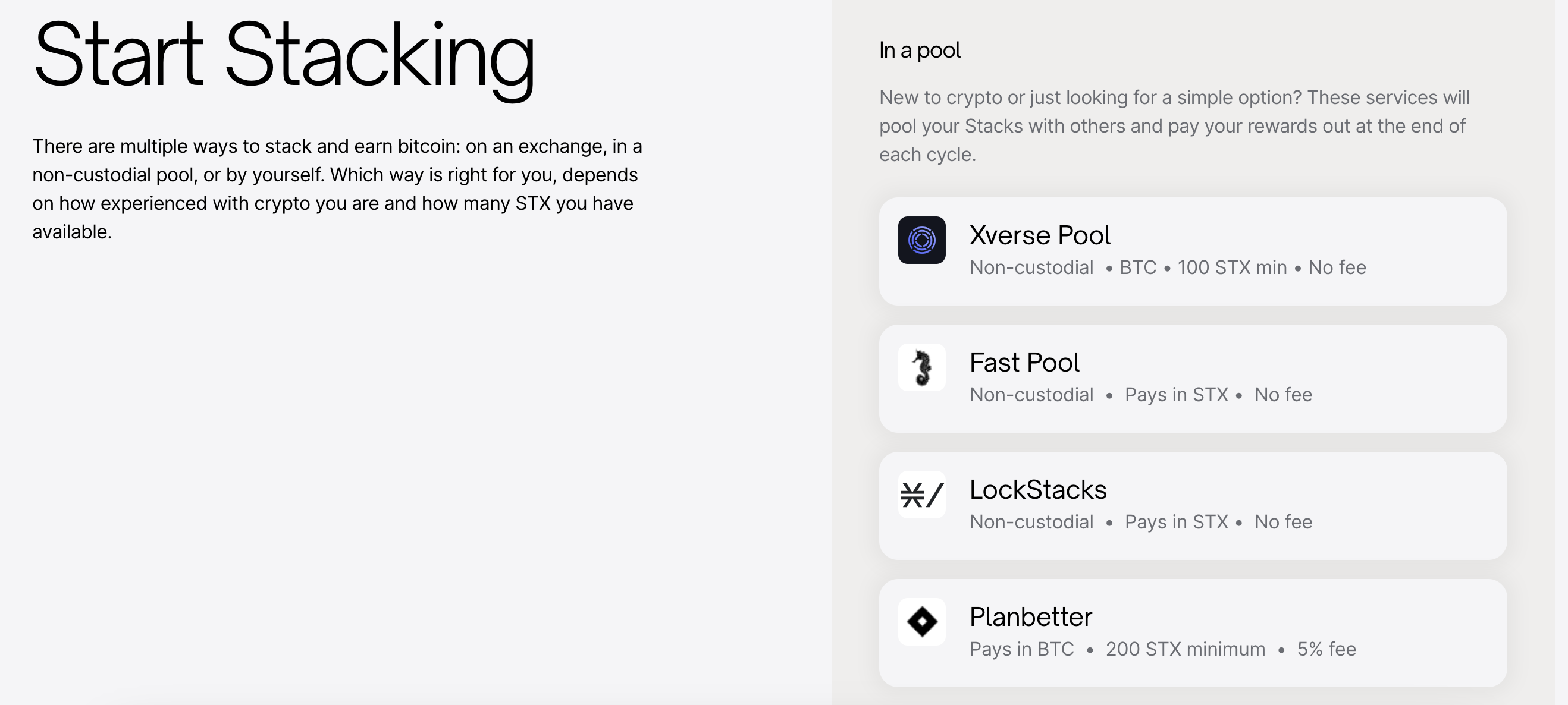

On-Chain Delegated Staking: Choice for the Masses

If you are not a large holder, that's okay. Stacks also provides a mechanism for delegated staking, where service providers pool everyone's STX for staking.

Currently, there are 4 service providers offering delegated staking services, each with different requirements and reward methods:

- Xverse Pool: Requires a minimum staking amount (100 STX) and rewards are settled in BTC;

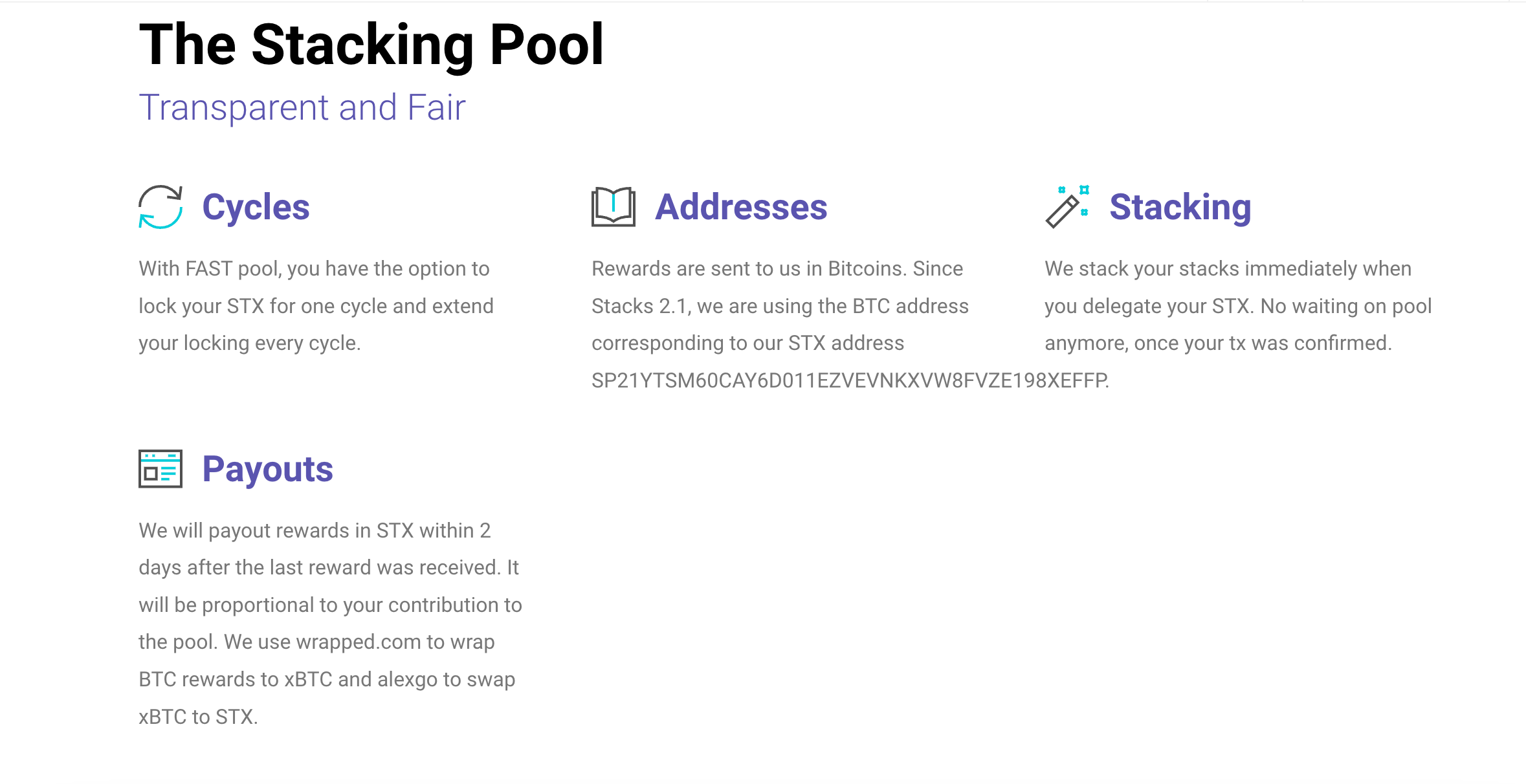

- Fast Pool: No staking amount requirement, and rewards are settled in STX;

- LockStacks: As mentioned earlier, it can be used for both single and delegated staking. There is no staking amount requirement for delegated staking, and rewards are settled in STX;

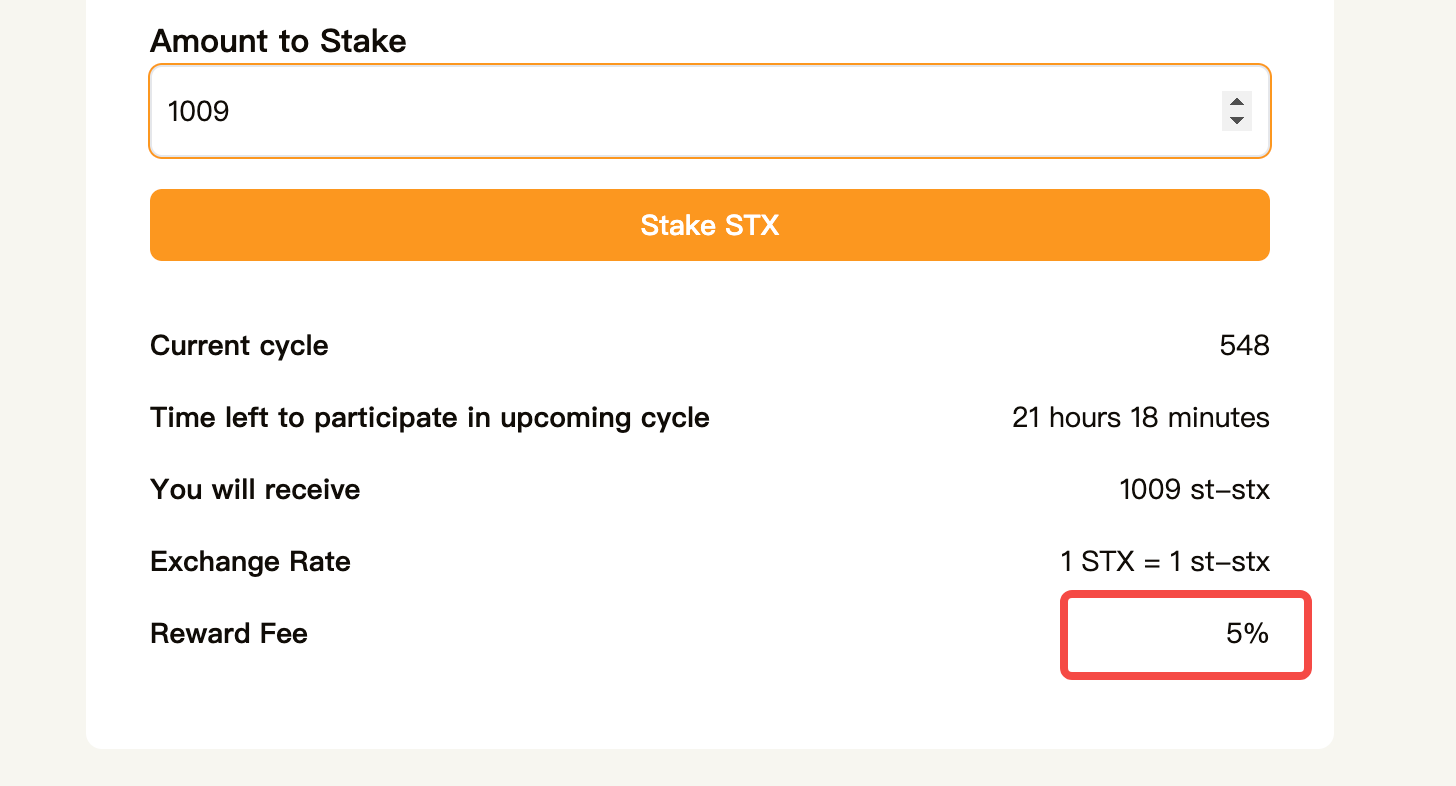

- Planbetter: Requires a minimum staking amount (200 STX) and charges a 5% staking fee, with rewards settled in BTC.

Overall, the APR for these platforms, calculated in BTC, is around 9%, and around 7% when calculated in STX.

Considering the interface, staking requirements, and costs, Fast Pool and LockStacks offer better value for money.

Liquidity Staking: Choice for Maximizing Capital Efficiency

Staking STX locks up liquidity, which also incurs a certain opportunity cost.

In the neighboring Ethereum ecosystem, this issue has long been understood by liquidity staking players—staking to receive LST (liquidity staking tokens, such as stETH), and then using the LST to seek more returns.

In the Stacks ecosystem, this method also works.

One of the more mature options is StackingDAO, which focuses on providing liquidity staking services within the Stack ecosystem.

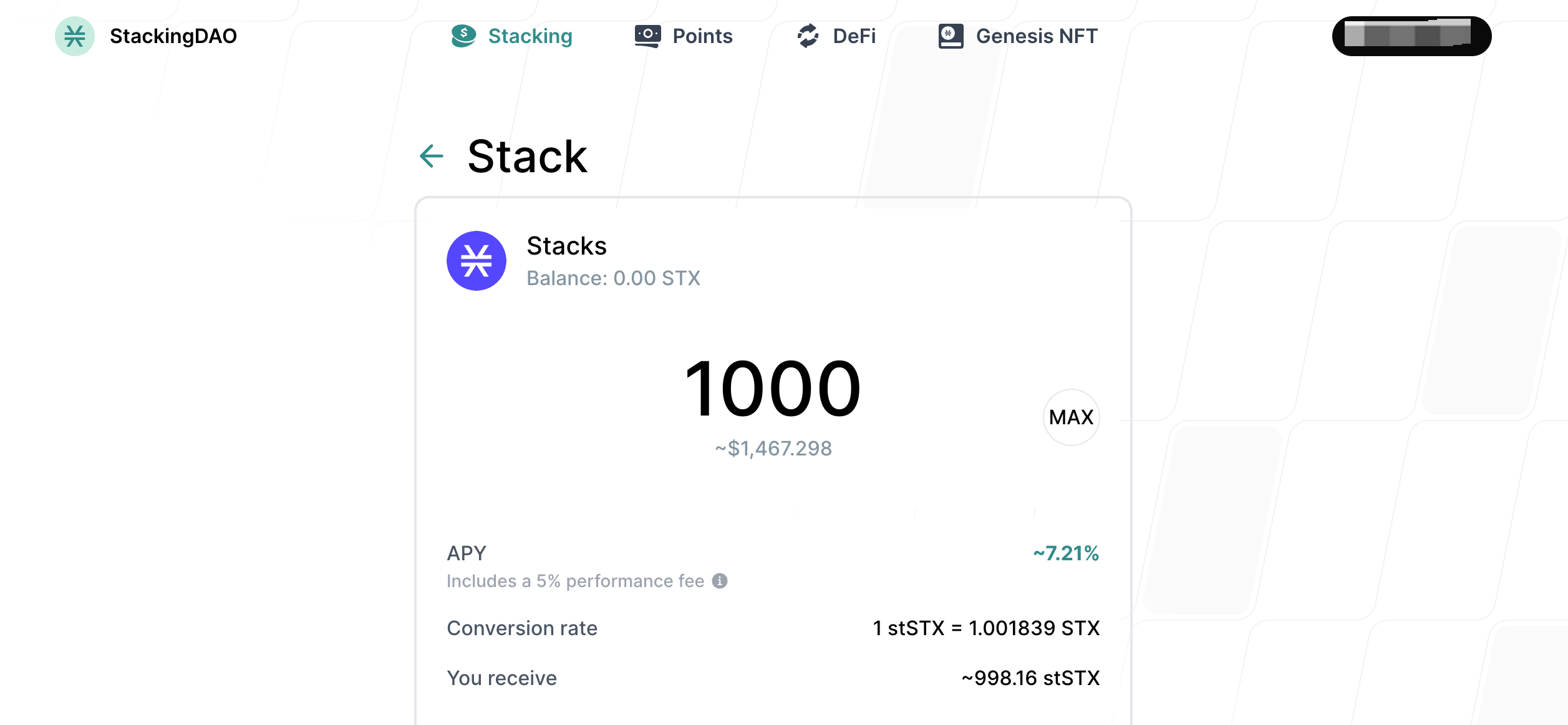

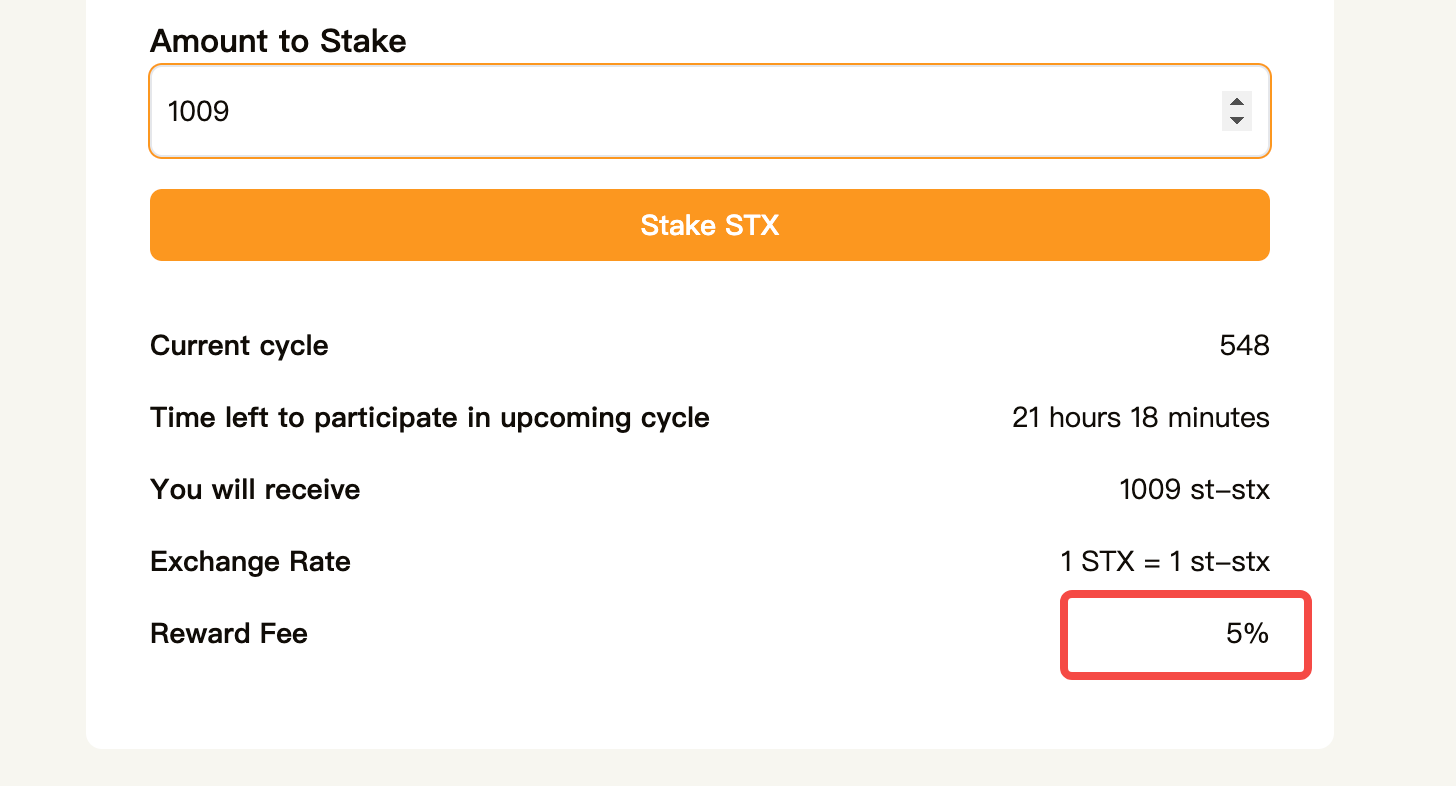

As shown in the figure below, you can deposit STX to exchange for stSTX and enjoy an APY of around 7.21%. However, it is important to note that you still need a wallet that supports depositing STX and BTC, such as the Leather Wallet mentioned earlier.

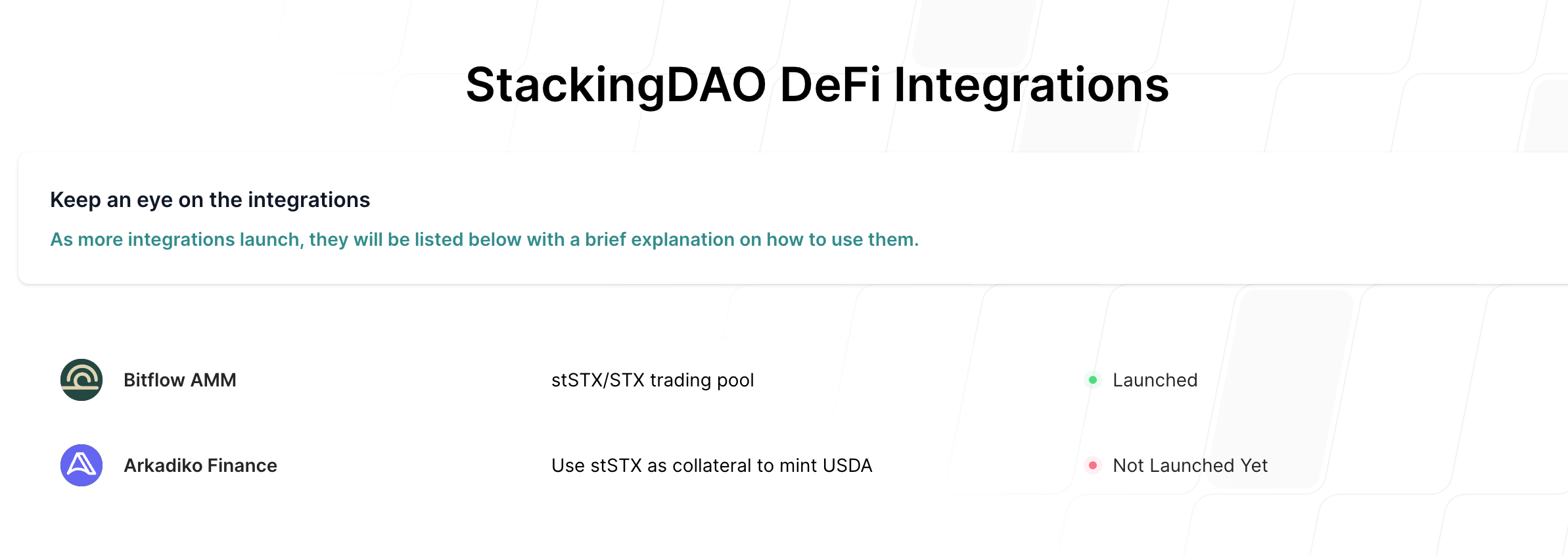

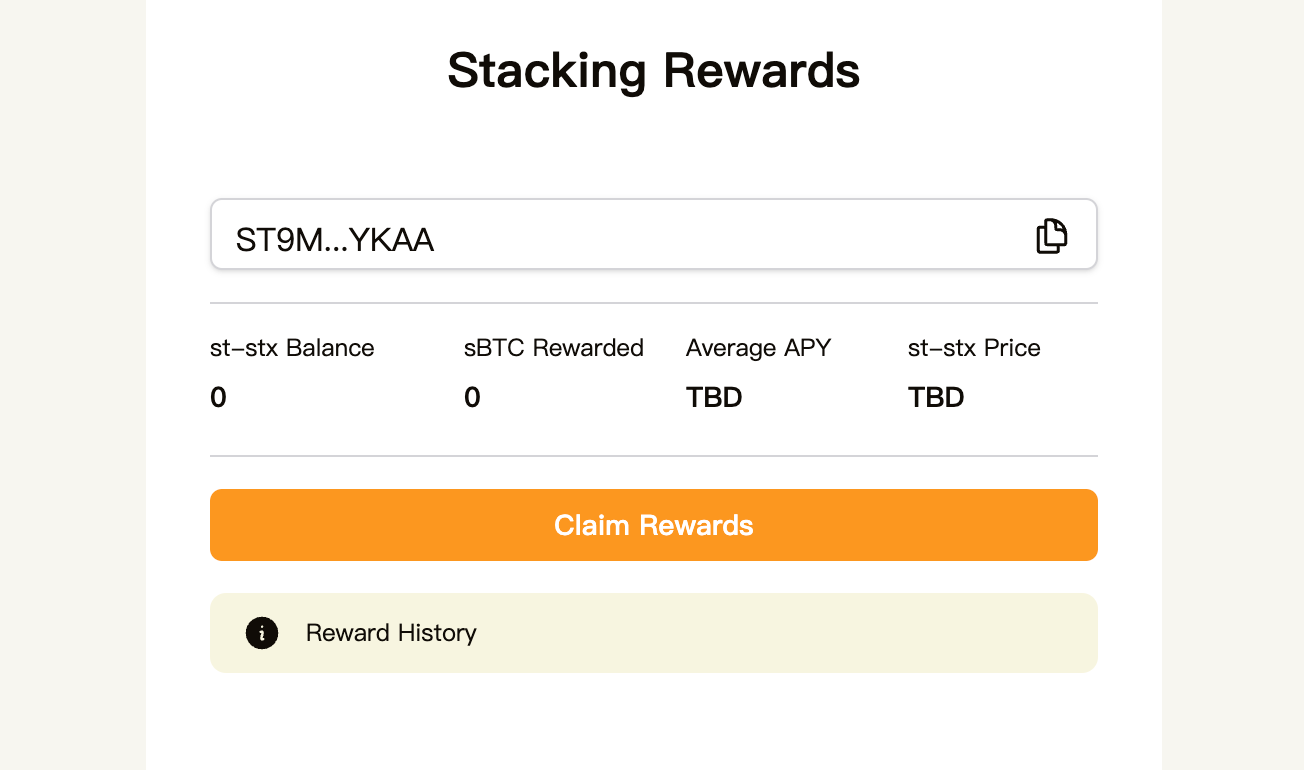

After staking to obtain stSTX, StackingDAO also provides related DeFi functions. For example, its Bitflow AMM project in the ecosystem has already been launched, allowing users to engage in common DeFi practices such as swapping/pooling/earning interest using LP tokens with the stSTX/STX trading pair.

Additionally, there is a stablecoin project called Arkadiko that has not yet launched, which will allow the minting of the stablecoin USDA using stSTX, similar to the gameplay of Lybra Finance and Prisma.

Interactions during the testnet phase: Choice for Airdrops

Similarly, in the Stacks ecosystem, there are two projects related to liquidity staking that are easily overlooked but may generate future airdrop returns—Papaya and LISA.

First, let's look at Papaya.

The project also provides liquidity staking services, but currently, it has low Twitter attention and relatively high potential.

The v1 testnet of Papaya is already live, and users can visit its platform to stake STX for liquidity and receive stSTX, with a liquidity staking reward of 5%.

In addition to this income, Papaya also provides additional BTC returns. After staking STX for a period, users will also receive rewards in sBTC, a token that corresponds 1:1 with the value of BTC. However, since the testnet has just launched, the current APY is unknown.

The author speculates that sBTC can also be used to seek returns in other projects within the ecosystem, but the gameplay and acceptance are yet to be observed.

Furthermore, the project's official documentation clearly states that participants can receive liquidity mining rewards by staking sBTC or STX with Papaya, and they will also receive PAPA tokens. The amount of PAPA tokens received by individuals is directly proportional to the liquidity they provide.

However, PAPA tokens do not have a specified TGE (Token Generation Event) time, so there is a possibility of obtaining PAPA tokens during the testnet phase interactions.

Another liquidity staking project worth paying attention to is LISA.

Currently, the official website of LISA is still in the conceptual stage, and specific liquidity staking services and the testnet are under development. The reason for the high expectations is that the official team behind LISA has already indicated that they come from ALEX Lab, a strong builder in the Bitcoin ecosystem.

Both official Twitter accounts interact frequently, and the LISA official website also features slogans indicating ALEX's involvement in the project's development.

Considering that the latter has rich resources and experience in gameplay, from establishing the first oracle for Bitcoin to launching a Launchpad, and the ALEX token has also had very good market performance previously; if this team enters the field of liquidity staking, it is foreseeable that they will vigorously market and promote it. As a pioneering project, LISA will naturally benefit from this, further increasing the expectation of a potential LISA token airdrop.

However, since the liquidity staking of LISA has not yet officially launched, it is recommended that players go to the LISA website to register their email and follow the project's progress and performance.

Overall, in the wave of the Bitcoin ecosystem's explosion, Stacks has carved out its position, and the blossoming of related ecosystem projects has provided players of different sizes, experiences, and preferences with choices for obtaining different returns.

In the bullish market expectations, project development, ecosystem development, and player participation mutually achieve success, and sometimes an interaction that is not intentional may lead to unexpected returns.

With an attitude of seizing opportunities early, finding the correct posture for maximizing returns, and welcoming the arrival of the next opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。