Oval operates on the Ethereum mainnet, supporting protocols to use OEV (Oracle Extractable Value) as a form of income and contribute to the sustainable development of DeFi.

Author: Hart Lambur, Co-founder of UMA

Translated by: Jinse Finance xiaozou

Note: Recently, after UMA announced the launch of the oracle extractable value tool Oval on January 17th, its price surged more than 2.5 times within 5 days. On January 23rd, UMA officially launched Oval on the Ethereum mainnet, and UMA co-founder Hart Lambur explained Oval in a post.

Key points:

- When the price update of a lending protocol triggers liquidation, Oracle Extractable Value (OEV) is generated, which is a form of MEV.

- Lending protocols have lost billions of dollars on OEV.

- Oval operates on the Ethereum mainnet, supporting protocols to use this OEV as a form of income and contribute to the sustainable development of DeFi.

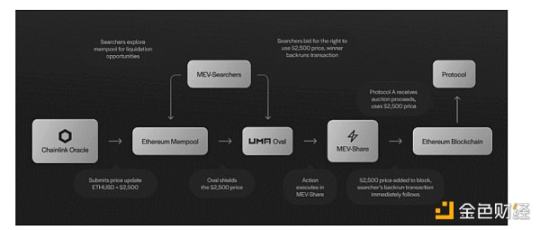

- Oval achieves this by packaging Chainlink price updates and using Flashbots' MEV-Share to auction OEV.

- Oval leverages proven Chainlink and Flashbots infrastructure to minimize integration costs and trust assumptions.

- Oval does not require code integration and can capture 90% of oracle MEV.

On January 23, 2024, UMA released Oval, the Oracle Value Aggregation Layer, on the Ethereum mainnet. Oval generates lending protocol revenue by capturing a type of MEV called OEV (Oracle Extractable Value).

Leading DeFi protocols on Ethereum create billions of dollars in OEV annually. Since their launch, Aave and Compound have each created well over $100 million in OEV. This value has been thrown into the MEV supply chain without benefiting the protocols.

Oval is not an oracle oracle. Oval is a mechanism integrated with lending protocols to reclaim the value generated by Chainlink price updates.

Oval wraps existing Chainlink Data Feeds. To extract OEV, searchers must participate in auctions through Flashbots' MEV-Share, and the auction proceeds will flow into the protocol.

Oval redirects up to 90% of OEV back to its creating protocol. The re-captured revenue by Oval can make DeFi protocols and oracle infrastructure more sustainable.

1. What is Oracle Extractable Value (OEV)?

Oracle Extractable Value (OEV) is a form of MEV created when a protocol receives price updates from oracles.

Take Aave, a lending protocol, for example: Aave markets can create OEV from price updates from Chainlink Data Feed, causing over-leveraged positions to face liquidation. To ensure the smooth operation of Aave, liquidators can profit risk-free by quickly closing out positions.

Lending protocols offer substantial liquidation bonuses to ensure collateral can be sold quickly, allowing anyone (referred to as "searchers" in MEV) to repay debts and claim collateral at a discounted price. For example, liquidations on Aave offer a 5-10% discount. These discounts must be significant to ensure assets can be sold quickly even in highly volatile situations.

This liquidation discount represents the theoretically largest OEV, and Oval can capture 90% of it.

Robert Leshner, CEO of Superstate, said, "MEV protection, especially MEV capture, is at the forefront of Ethereum research. Personally, I am pleased to see UMA collaborating with Chainlink and Flashbots to seek to capture the billions of dollars of MEV flowing out of lending protocols, and I am also pleased that Oval is expected to bring broader new sources of income to DeFi protocols."

To obtain liquidation fees, MEV searchers compete with each other, offering high "fees" to block producers to include their transactions in blocks. Then, block producers pay a significant portion of the value to block proposers to add the transactions to the blockchain. All parties profit from OEV, but in reality, they contribute nothing to the value created by the protocol.

2. Oval Operation Mechanism

Oval captures OEV by packaging Chainlink price updates and aggregating searcher participation in auctions. The auction uses MEV-share, a protocol for order flow auctions operated by Flashbots.

Oval attaches repayment instructions to the searcher's data packets, requiring any excess value to be repaid to the protocol. Without Oval, this excess value would be lost. We estimate that Oval can recover billions of dollars in value.

As a precaution, if there is any delay related to Oval or MEV-share, Chainlink prices will be automatically published. This ensures that liquidations can always proceed quickly.

3. MEV Research Frontier

Oval was closely developed by its team in collaboration with the Flashbots team, using the existing order flow auction infrastructure of MEV-share.

Flashbots estimates that over 415,000 ETH in value has been extracted since Ethereum's major merge in September 2022. In the MEV supply chain, this value is extracted from protocols and unsuspecting users, with most of the value flowing into the pockets of Ethereum block producers and validators. This is the current situation that we seek to change.

As a tool for capturing MEV, Oval disrupts the MEV supply chain and returns up to 90% of OEV extracted from lending protocols to the protocol as revenue.

By doing so, Oval enables protocols to create new revenue streams and potentially bring new mechanism designs and business models to DeFi.

"At Flashbots, we have always believed that dapps can greatly limit the amount of MEV they expose," said Hasu, strategic lead at Flashbots. "The key insight is that protocols should not blindly broadcast transactions to the public mempool, but should auction off the right to execute transactions to a competitive market of searchers. Oval is based on this insight and ultimately returns OEV to DeFi protocols and their users. We look forward to helping them in this process."

4. Safety First

Oval's design does not introduce any additional risk to the underlying infrastructure of Chainlink Data Feeds. To ensure this, Oval has been audited by Open Zeppelin.

Since Oval uses Chainlink Data Feeds, blue-chip protocols that integrate this solution can continue to obtain prices from the oracle provider most widely used in DeFi.

Oval also has a similar bug bounty program, covering all audited contracts behind UMA, such as UMA Optimistic Oracle, oSnap, and Across Bridge.

Tarun Chitra, CEO of Gauntlet, said, "Oval has a very compelling value proposition for major protocols like Aave—start earning a lot of MEV revenue that was previously unattainable by updating contract addresses. Gauntlet is excited to work with leading DeFi protocols like Aave and Compound, and we look forward to how Oval can create additional sources of income for their products."

5. How to Integrate?

At the contract level, Oval operates in the same way as Chainlink Data Feed, providing price to protocols without affecting the end-user experience.

Existing protocols can easily integrate Oval through a simple governance vote. No code changes are required.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。