The cryptocurrency market is fluctuating at a high level following the U.S. stock market. The approval of spot ETF marks a watershed for the cryptocurrency market.

By: Mike

A. Market Perspective

I. Macro Liquidity

Currency liquidity has improved. The December U.S. retail data exceeded expectations, showing a strong U.S. economy, which dampened the recent interest rate cut expectations. It is unlikely for a rate cut in the first half of the year, and Federal Reserve officials have guided for three rate cuts for the whole year, while the market previously expected six rate cuts. The decline in U.S. stocks has widened, and the short-term rise in the U.S. dollar index. The approval of spot ETF marks a watershed for the cryptocurrency market, and mainstream adoption is about to begin.

II. Overall Market Trends

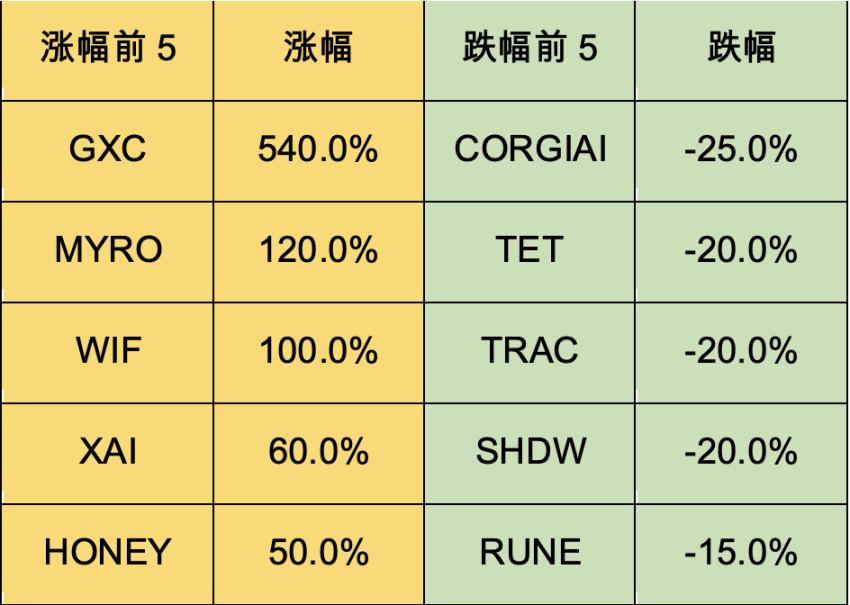

Top 100 market cap gainers:

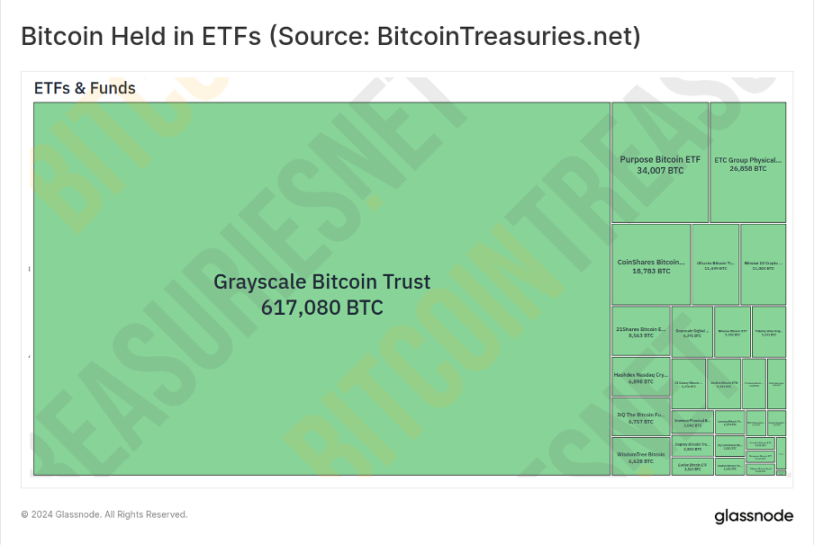

BTC has continued to weaken this week, showing a trend where positive news leads to negative market sentiment. After BTC was listed on the U.S. stock ETF, similar speculation on altcoins has emerged. It will take several months of decline, washing out, and turnover before the second wave of the main uptrend. It is expected that Grayscale will have a selling volume of $10 billion, and based on the current net outflow of $100 million per day, it will take approximately over 3 months. The market focus is mainly on SUI and meme, and the chaotic movement of dog coins signifies the start of the second half of the market.

SUI: It is a high-performance single-chip public chain, and the founding team comes from the original Facebook development platform. SUI is built using the Move language and is considered a sister public chain to APT. SUI has recently incentivized the ecosystem with subsidies, and TVL lockups are growing rapidly. SUI is Jump's market-making, and a large unlock is planned for May this year.

TROLL: It is the meme dog coin with the highest recent increase, originating from a change in Musk's Twitter profile, and the last token to receive this treatment was DOGE. Now, the meme trend is reviving the retro style, such as the 100-fold increase in TROLL and ZUZALU this week, both of which have been listed for over half a year and are close to zero old coins, and then they are being manipulated by Chinese capital. The reason behind this is that new coins are easily targeted by new robot snipers.

CHZ: It is the leader of football fan coins and is about to launch a new token economy. The European Cup will be held in June, and the market is speculating in advance. Historically, the trend of football fan coins is less affected by the overall market and often rises against the trend of the overall market. The main reason is that 70% of the holding addresses are fans of the team.

III. BTC Market Trends

1) On-chain Data

Spot ETFs are launched, and long-term holders are selling. Long-term BTC holders have sold 75,000 BTC for profit since November. Such events occur relatively infrequently and usually coincide with strong resistance levels in the upward trend.

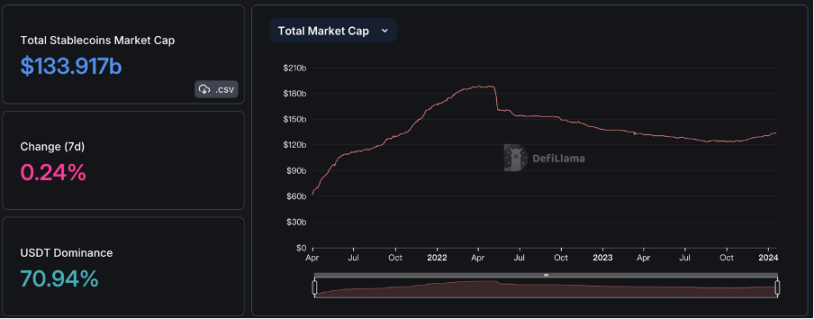

Stablecoin market value remains stable. The total value of stablecoins in the TRON series, such as USDT, TUSD, USDC, USDD, and USDJ, has exceeded $50 billion.

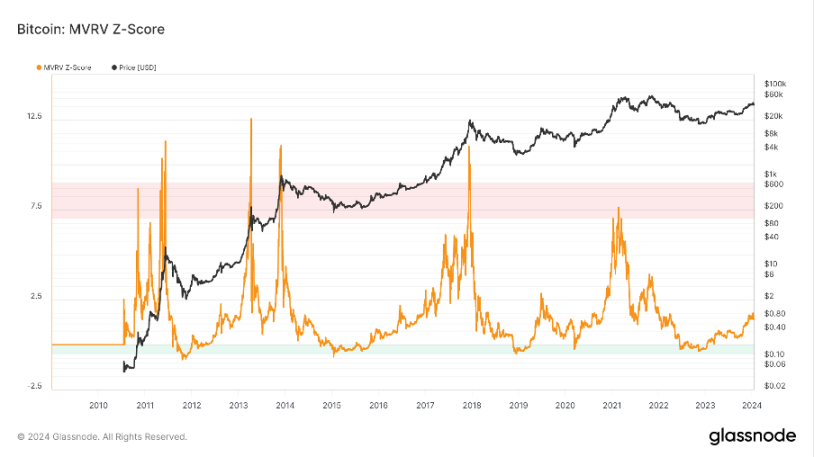

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is in the top range; when the indicator is less than 2, it is in the bottom range. MVRV has fallen below the key level of 1, and holders are generally in a loss-making state. The current indicator is 1.72, entering the recovery phase.

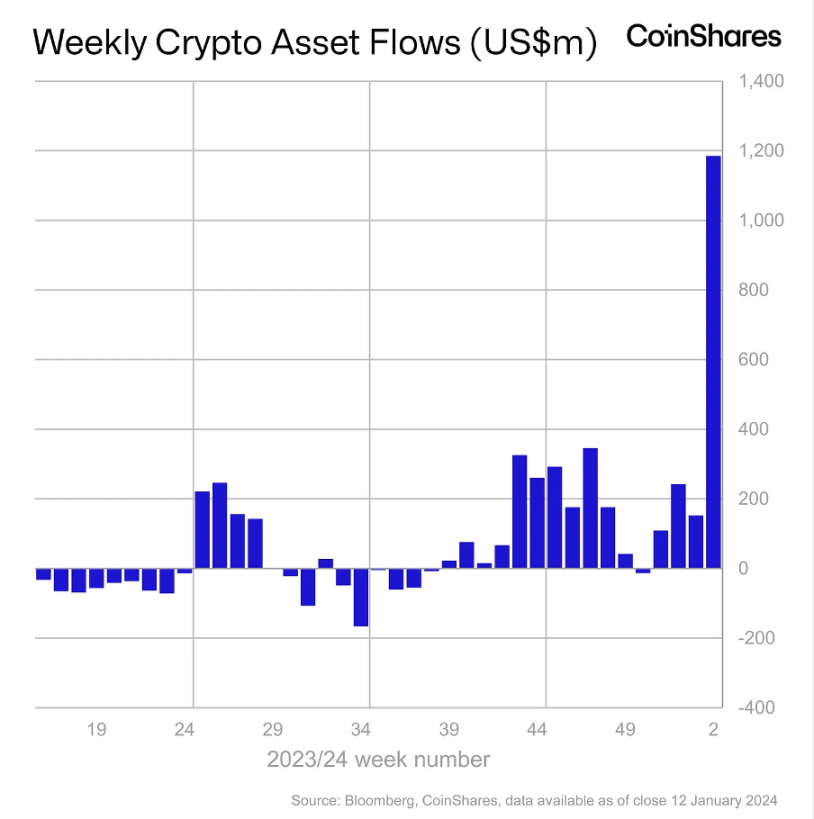

Institutional inflows into cryptocurrency investment products have significantly increased, indicating strong interest in the mainstream market. This is mainly influenced by the BTC spot ETF, but it has not broken the record set by the BTC futures ETF.

2) Futures Market Trends

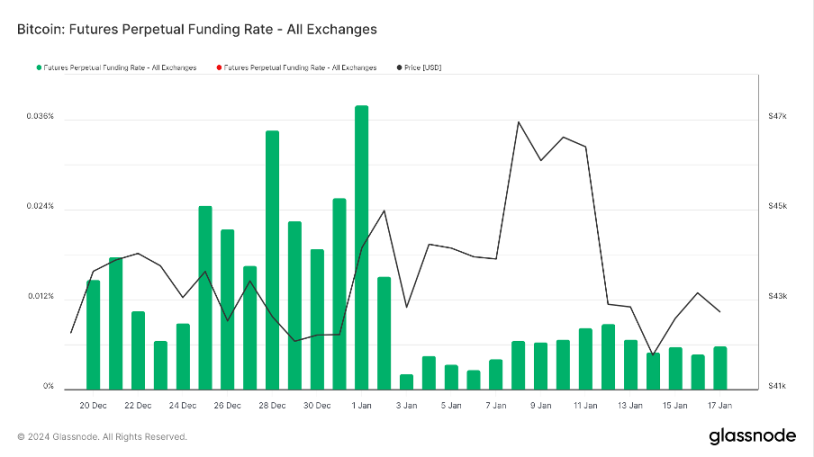

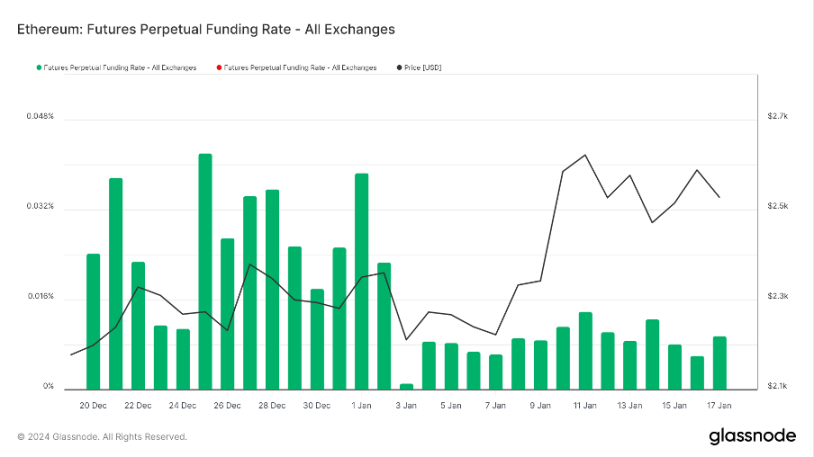

Futures funding rate: The rate has returned to normal this week, and the market sentiment is neutral. A rate of 0.05-0.1% indicates a majority of long leverage, which is a short-term market top; a rate of -0.1-0% indicates a majority of short leverage, which is a short-term market bottom.

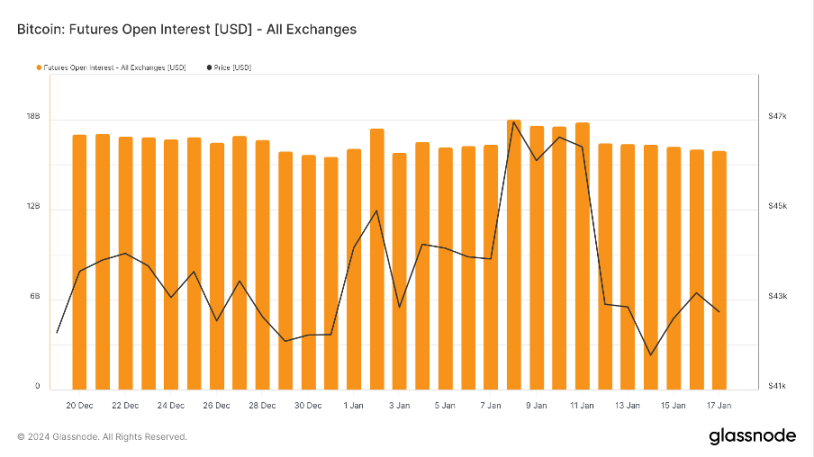

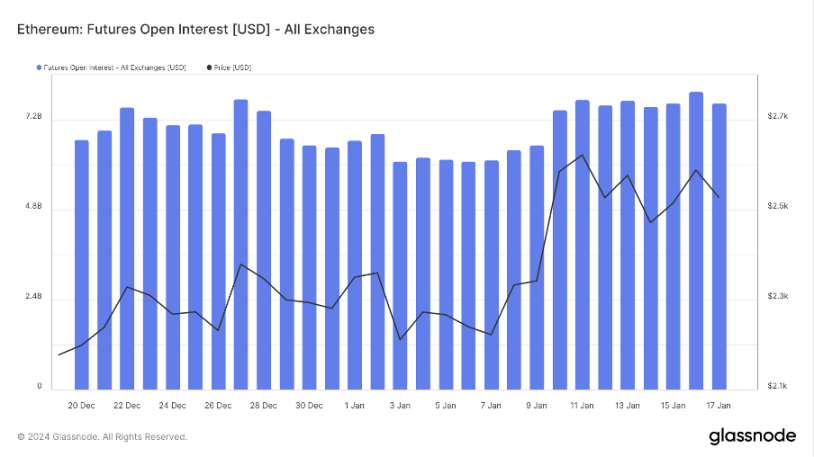

Futures open interest: BTC open interest has decreased this week, while ETH open interest has increased, indicating that the market's focus has shifted to long ETH positions.

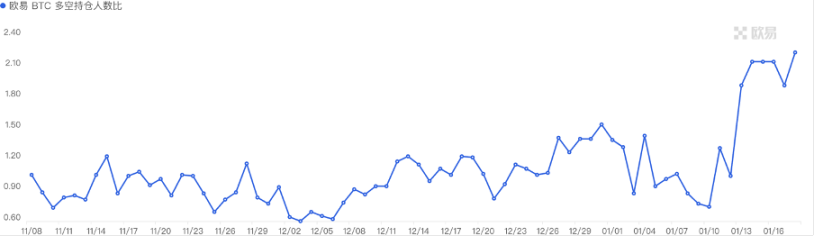

Futures long/short ratio: 2.0. Retail investors are showing a FOMO sentiment. Retail sentiment is often a contrarian indicator, with below 0.7 being quite fearful and above 2.0 being quite greedy. The fluctuation of the long/short ratio data weakens its significance.

3) Spot Market Trends

BTC is fluctuating at a high level and may form a right shoulder rebound. The ETH/BTC exchange rate has broken through on the weekly chart, signaling the arrival of the altcoin season led by ETH, expected to last for about a month. The average realized price of short-term BTC holders is 32,000, and based on historical experience, it may pull back to this range. The fourth halving cycle is approaching and is expected to occur on April 23, 2024, with a cost of around 37,000 after halving. After the last two halvings, BTC has increased by 5-7 times within a year, with significant fluctuations along the way, not without challenges.

B. Market Data

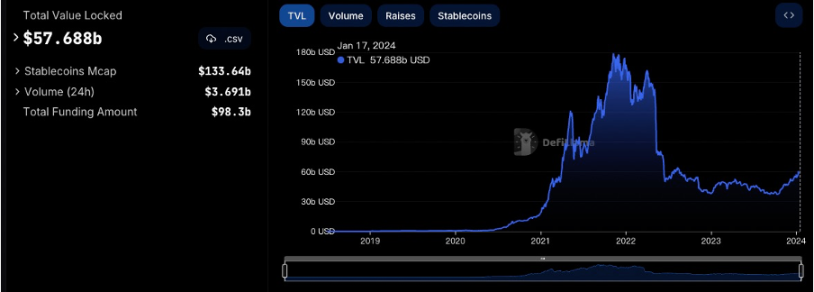

I. Total Lockup Amount of Public Chains

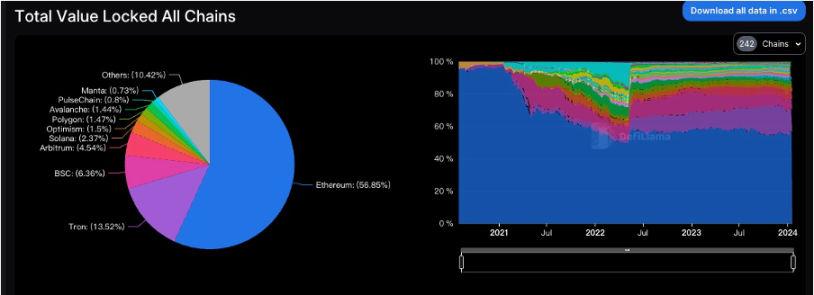

II. Proportion of TVL for Each Public Chain

The total TVL this week is $57.7 billion, an overall increase of $1 billion, about a 0.2% increase. BTC experienced a correction of about 15% this week but is currently holding above $40,000. The TVL of mainstream public chains has all declined this week, with ETH, TRON, SOLANA, OP, and POLYGON chains all decreasing by about 7%. It is worth noting that the TVL of PulseChain has increased by 127% and has successfully entered the top ten public chains in terms of total TVL. PulseChain is the first hard fork to include the complete state of the Ethereum blockchain. Its goal is to fully replicate all DApps in the Ethereum ecosystem, establishing a complete ecosystem from the beginning and helping to reduce network congestion for Ethereum. PulseX, as the main protocol in the ecosystem, is also the main DEX in the PulseChain ecosystem and has issued the governance token PLSX. PulseChain raised nearly $1 billion in less than six months.

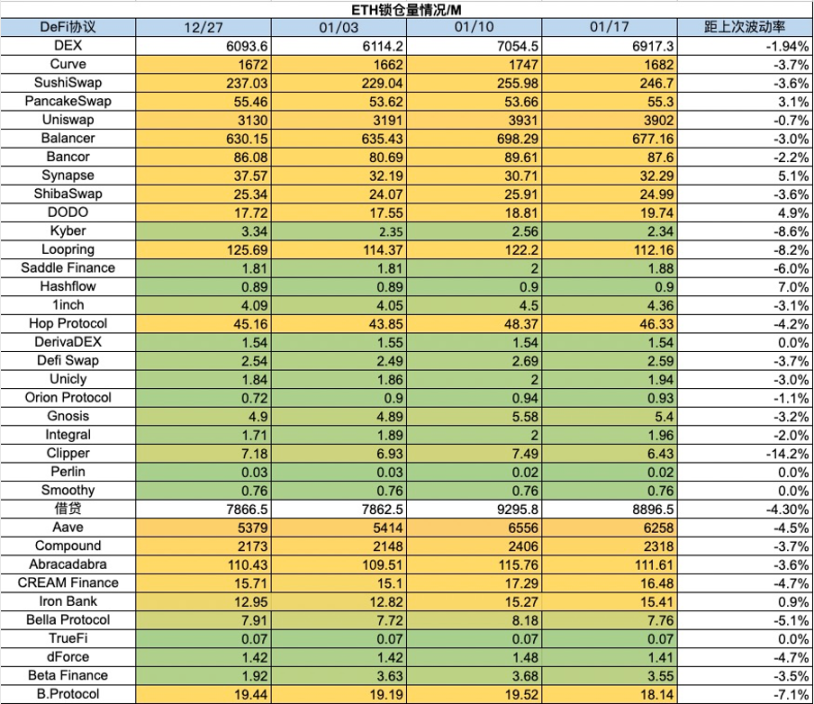

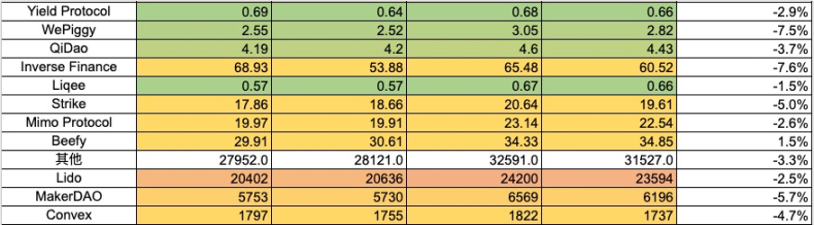

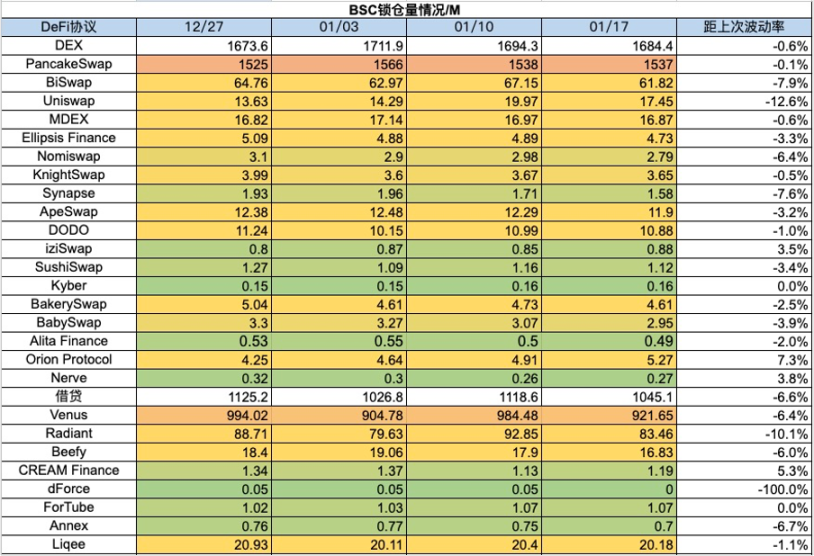

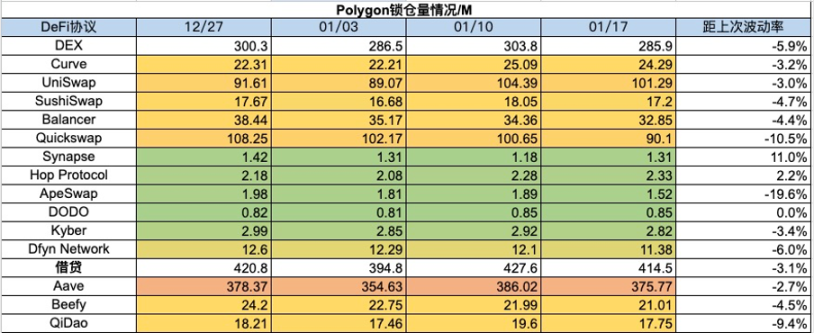

III. Lockup Amount of Protocols for Each Chain

1) ETH Lockup Amount

2) BSC Lockup Amount

3) Polygon Lockup Amount

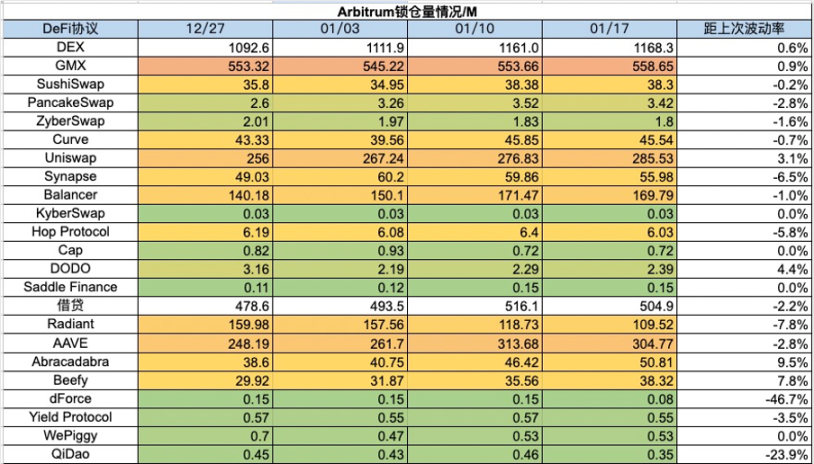

4) Arbitrum Lockup Amount

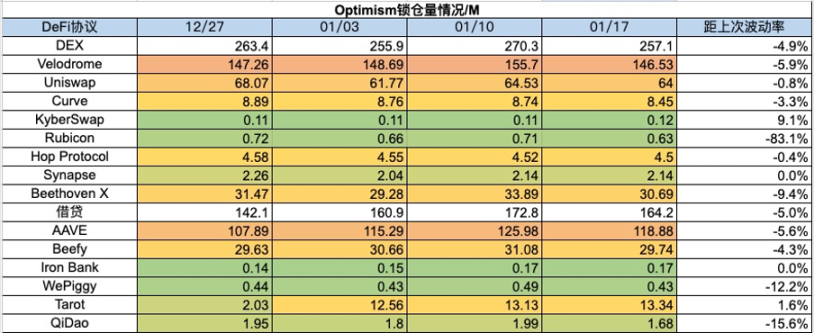

5) Optimism Lockup Amount

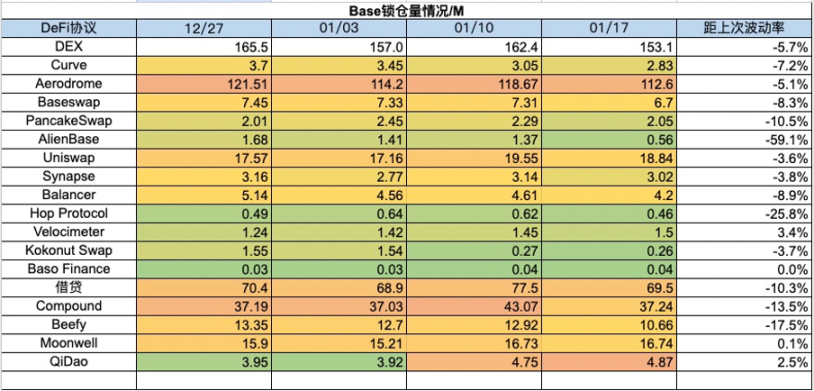

6) Base Lockup Amount

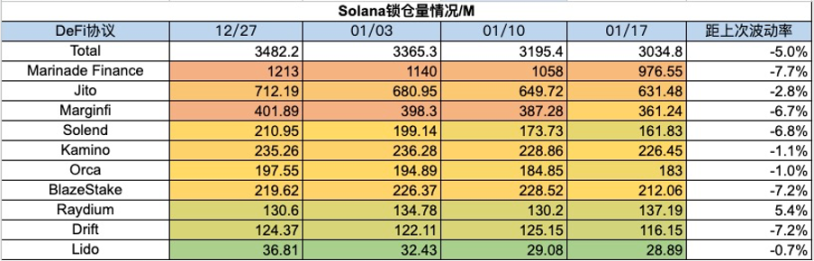

7) Solana Lockup Amount

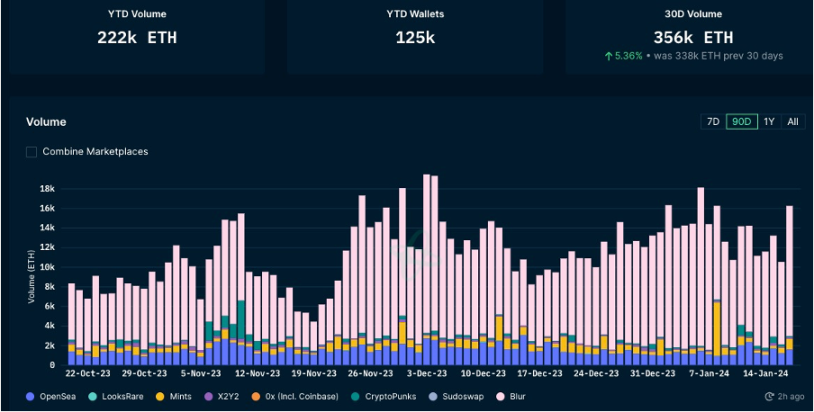

IV. NFT Market Data Changes

1) NFT-500 Index

2) NFT Market Situation

3) NFT Market Share in Trading Market

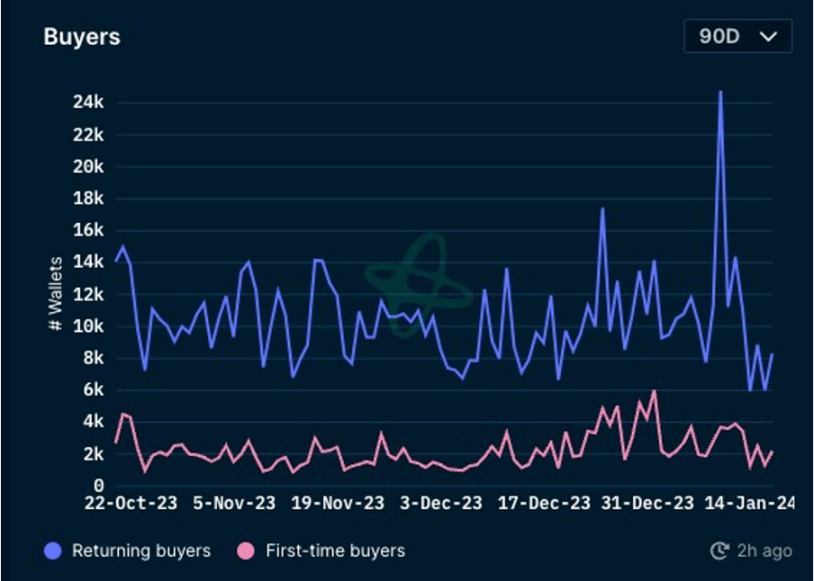

4) NFT Buyer Analysis

NFTs saw a rebound this week, with the floor prices of all top blue-chip projects in the NFT market experiencing significant increases. MAYC rose by 15%, BAYC by about 9%, DeGods by 13%, Azuki by about 8%, CloneX by 18%, Pudgy Penguins surged by 67%, and LilPudgys skyrocketed by 107%. The trading volume in the NFT market has increased in the past week, with Azuki's trading volume surpassing BAYC and MAYC by about 50%, and Pudgy Penguins' trading volume keeping pace with BAYC and MAYC. The NFT market is currently in a state of fluctuation, with volatility gradually increasing.

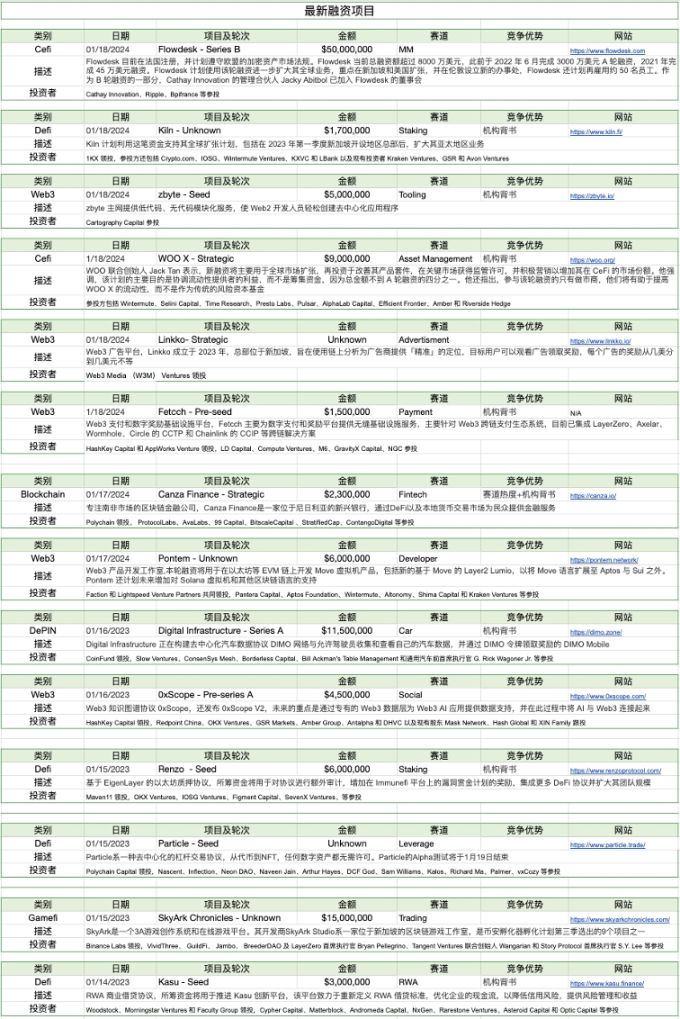

V. Latest Project Financing Situation

VI. Post-Investment Dynamics

1) SPACE ID - Decentralized Domain Name Service Protocol

The first community-driven ZK L2 network, ZKFair, has announced a collaboration with SPACE ID to launch .zkf domain name services. The whitelist activity is now open, and eligible community users can mint .zkf domain names for just 1 USDC. Public Mint is expected to go live at the end of this month, at which time registered users can use the domain name in all protocols integrated with SPACE ID. ZKFair uses a 100% fair token distribution model and is supported by the ZK-RaaS platform Lumoz for technical and computational support. ZKFair uses USDC as the Gas token, and after its mainnet went live on December 20, the TVL surged to a peak of $324 million, currently ranking 12th in the L2 rankings.

SPACE ID is a decentralized domain name service protocol where users can bind their identities across multiple chains, and the community can build their top-level domain name services through the SPACE ID network.

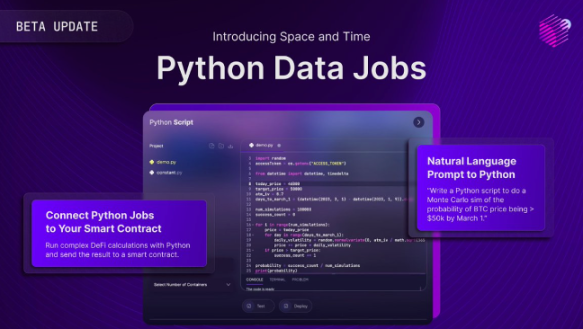

2) Space and Time - Decentralized Data Platform

Space and Time has released a beta version of Python Data Jobs, which will solve two problems.

- First: Enable users to extract and transform data from existing databases using Python and load the data into Space and Time in the simplest and fastest way possible without actually writing code. Second: Connect Python jobs to smart contracts in a cryptographically secure manner.

- WalletConnect - Universal Protocol

WalletConnect has launched the Web3Inbox app, a Web3 messaging application that allows users to stay updated on the latest Web3 developments anytime, anywhere. Web3Inbox enables users to connect directly to other Web3 applications through their wallets without relying on Web2 messaging tools. Currently, Web3Inbox is compatible with over 350 wallets and can be used on both desktop and mobile devices. Details: http://web3inbox.com/launchapp

- Aspecta AI - AI Digital Identity

Aspecta AI, Conflux, and UHack have announced a collaboration to use Aspecta's groundbreaking artificial intelligence identity solution to bring new narratives to the developer ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。