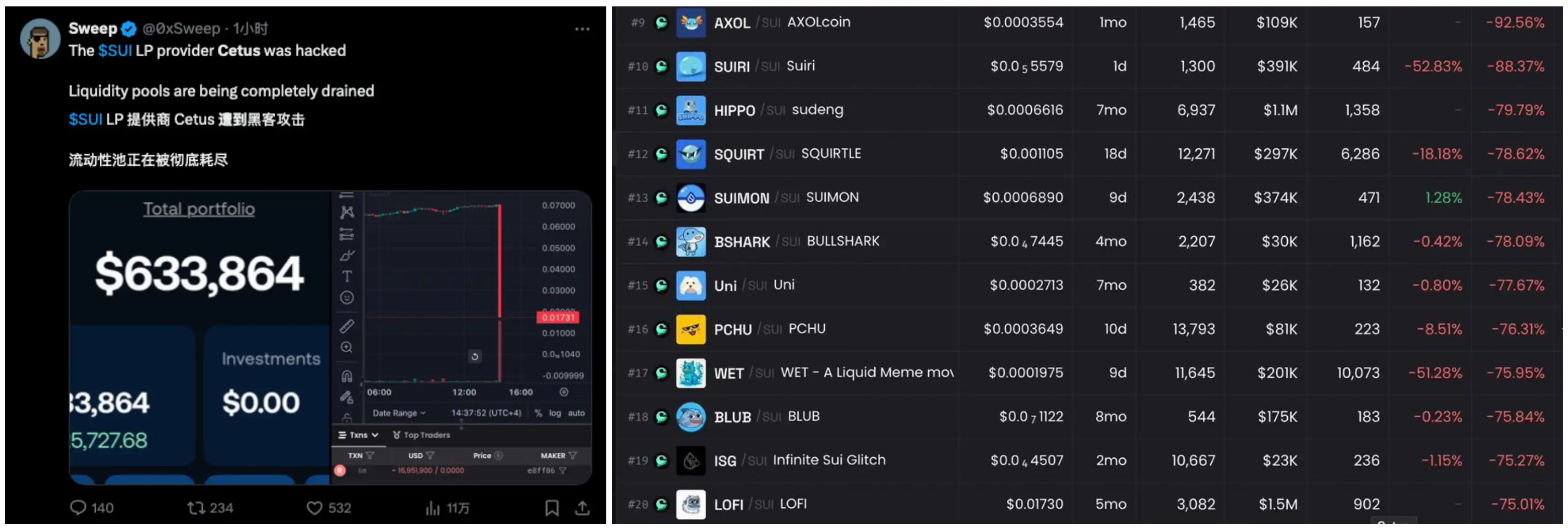

5 月 22 日下午,Sui 链上龙头 DEX 流动性协议 Cetus Protocol 代币 CETUS 突然发生大幅下跌,价格几乎「脚斩」,而 Cetus 上多个代币交易对也出现了急剧下跌的情况。随后,不少 KOL 在 X 上发帖表示,Cetus 协议 LP 池遭到了黑客的攻击。

据链上监测显示,Cetus 攻击者似乎控制了所有以 SUI 计价的 LP 池,截至撰稿时窃取金额已超 2.6 亿美元。目前,黑客已开始将资金转换为 USDC 并跨链至以太坊主网兑换为 ETH,已有约 6000 万枚 USDC 完成跨链转移。

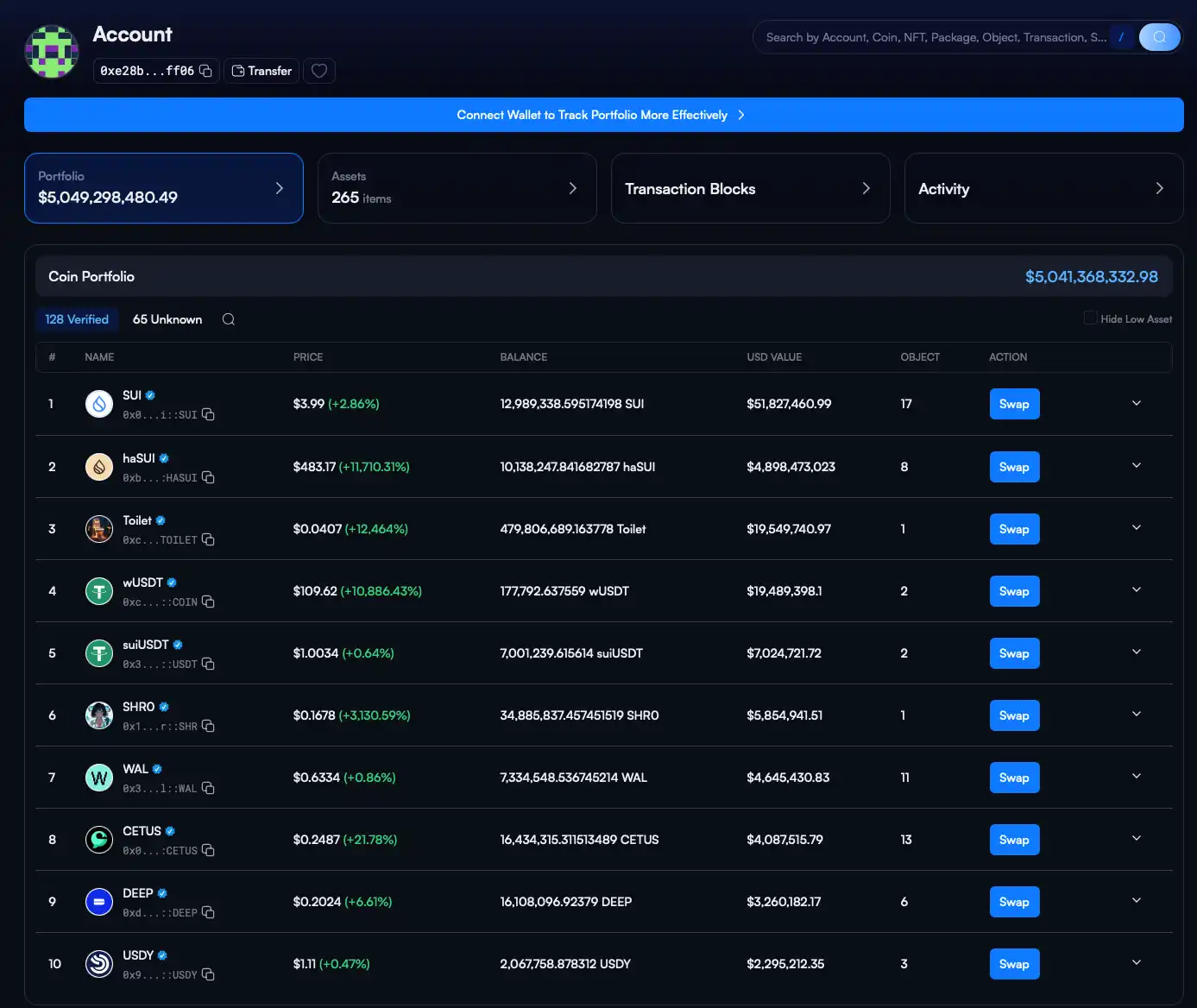

黑客链上地址为:0xe28b50cef1d633ea43d3296a3f6b67ff0312a5f1a99f0af753c85b8b5de8ff06。当前该地址中最主要资产仍以 SUI 和 USDT 为主,但 CETUS、WAL、DEEP 等 Sui 生态主流代币也包含其中,可见此次黑客攻击范围极广。

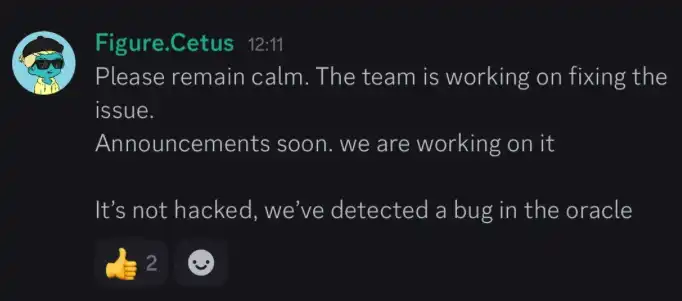

22 日晚,Cetus 团队一名成员在项目 Discord 群聊中表示,Cetus 协议并未被盗,而是出现了「预言机 Bug」。但链上数据不说谎,根据统计,Cetus 协议 LP 池的损失在被盗事件发生后 1 小时内就已超 2.6 亿美元,超过协议 TVL(2.4 亿美元)及市值(1.8 亿美元)。

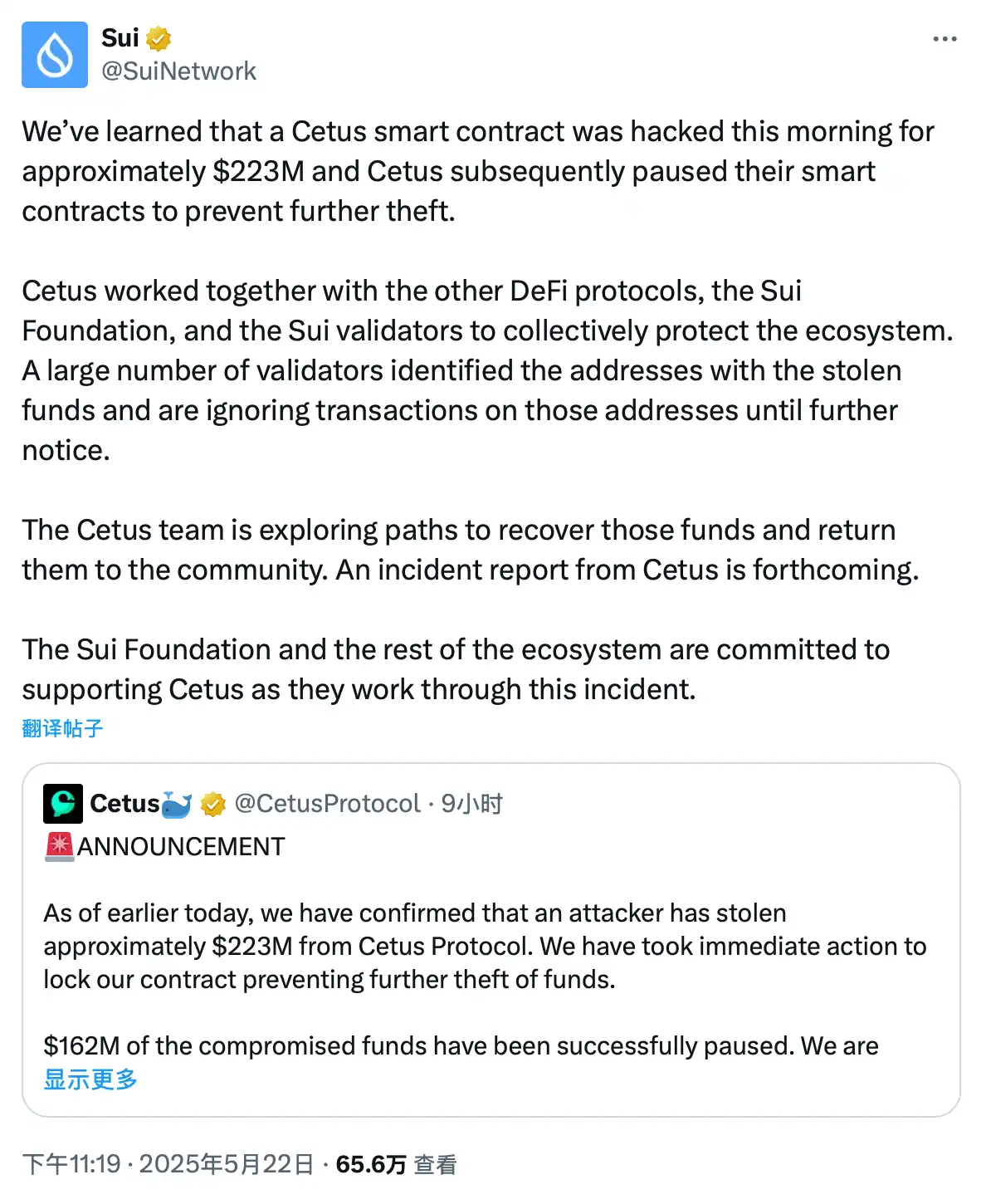

23 日上午,Cetus 官方在社交媒体上发布其本次被盗事件的最新进展表示,该团队已找到了漏洞的根源并修复了相关软件包,并聘请了专业的反网络犯罪组织来支持我们的资金追踪以及有关资金安全返还的谈判。目前正在与执法部门交涉,并正在安排进一步的援助。

值得注意的是,官方表示其已确认今日早些时候攻击事件的黑客所控制的以太坊钱包地址,并已就返还客户资金事宜与其进行协商。已提出以白帽黑客的名义支付未偿余额,但时间有限。如果黑客接受条款,将不再采取进一步的法律行动。

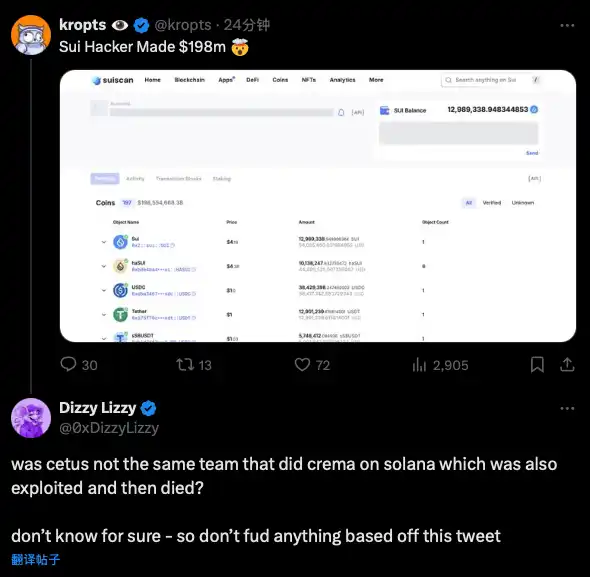

社区舆论指出团队「被盗前科」

有意思的是,在 Cetus 引发 SUI 生态暴跌之际,有不少社区成员也在推特上指出,Cetus 与此前 Solana 生态 DeFi 协议 Crema Finance 为同一团队开发,而 Crema 就曾发生过被盗事件。

2022 年 7 月 3 日,Crema Finance 同样因遭黑客使用 Solend 闪电贷攻击,LP 资金池被抽干,损失超 800 万美元。随后在 7 月 7 日,黑客在与团队协商后归还价值 760 万美元的被盗加密货币。根据双方谈判协议,黑客被允许保留 45,455 SOL(165 万美元)作为赏金。

回看 Cetus 此次被盗事件,协议也是因攻击者控制了 LP 池而遭受损失,同时团队也是提出以白帽黑客的名义支付未偿余额的方式与黑客进行协商。目前暂无公开信息证明 Crema 与 Cetus 确为同一团队开发,但就目前看,无论是从被盗原因还是后续处理方式来看,二者的确是一致的。

Sui 官方出面冻结黑客交易,「链上审查」行为引中心化质疑

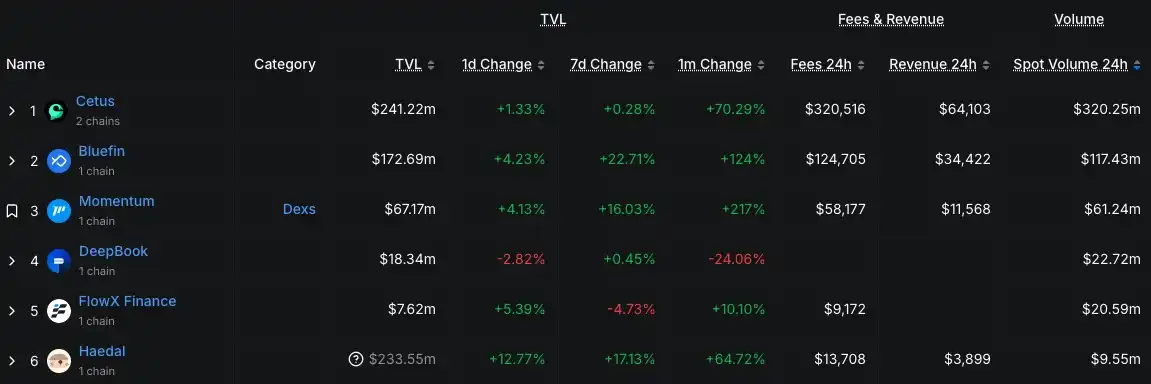

根据 DeFiLlama 数据,Cetus 此前一直是 Sui 生态的龙头 DEX 和流动性聚集地交易量占整个生态的六成以上。此次「清仓式」攻击无疑直接破坏了生态的流动性中心,换做任意一条「二线公链」来说,这都是毁灭性打击。

自去年 3 月以来,Sui 生态链上交易量一直呈总体上涨趋势,CETUS、DEEP、WAL 等生态主流代币价格也一路高歌猛进,被社区普遍视为本轮周期最具回报率潜力的公链以及「下一个 Solana」。

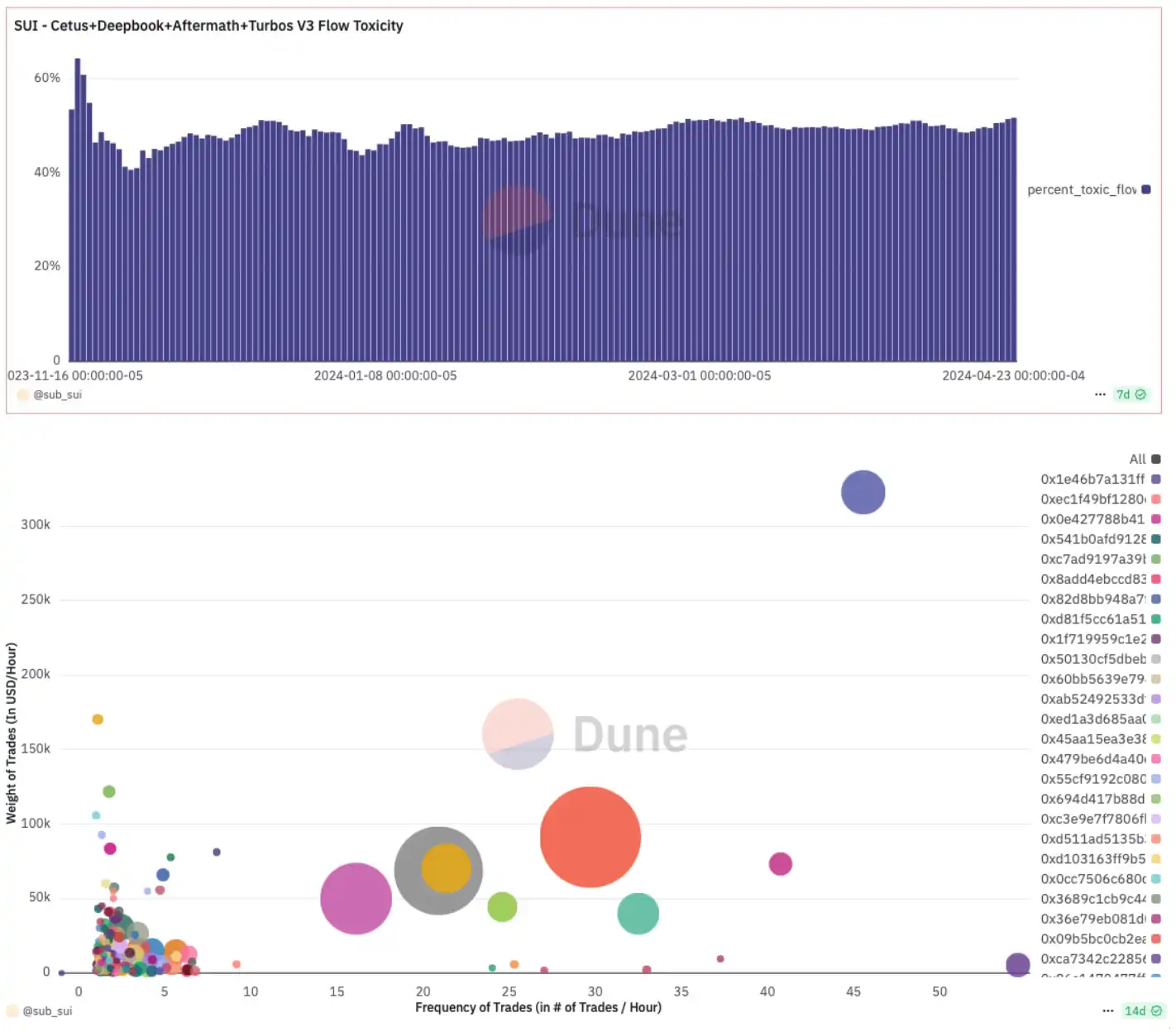

然而有趣的是,根据 Dune 数据显示,Sui 链上一直存在大量刷量交易(Wash Trade),生态流动性毒性(Flow Toxicity)长期接近 50%,这也是社区反馈 Sui 生态「什么东西也没有,就是价格一直涨」的部分原因。

图释:下图中圆半径显示了单一地址的总交易量,可以看到交易量最大的钱包交易频率也很高,表明可能存在洗盘交易;数据来源:Dune Analytics

不过,Sui 的「强庄」人设已然在交易员的心目中设立了许久,在过去一个月的山寨回暖行情中,Sui 也是主流公链中表现最为亮眼的一个。面对此次重大生态被盗,基金会果然不负众望,迅速地给出了回应,再次强化了自己的「强庄人设」。

22 日晚间 11 时许,Sui 官方发布公告称,为「保护 Sui 生态」,大量 Sui 网络验证者用被盗的资金确定了黑客地址并忽视了这些地址的交易。而 CETUS 团队也正在积极探索收回这些资金并将其返回社区的道路,并将很快发布事件报告。

消息一出,社区便炸开锅,「公链审查交易」成为最大争议点。许多 X 用户认为 Sui 的应对措施是对其去中心化定位的破坏,让 Sui 从一个「公链」转变为「集中式许可数据库」。

根据 Sui 官方文档,Sui 网络上的交易被拆分为仅涉及「独占对象」或同时涉及「共享对象」两类,只有涉及共享对象的交易必须进入全网共识,而纯独占对象交易可以走「直接快速路径」(direct fast path),无需全局排序即可执行。只要网络中大于 2/3 总质押的验证者诚实,网络理论上即可同时保证安全性(不会出现双花)与活性(有效交易最终会被执行)。

在 Sui 的委托 PoS + BFT 设计下,要想实现持续、无差别的交易审查,至少需要联合控制超过 1/3 的质押投票权,单个或少数节点的审查只能造成临时性延迟,而且还很容易被视为恶意行为,在下一 epoch 被质押人「投票下线」,这也是官方文档强调的「抗审查性与开放性」。显然,Sui 基金会在此次黑客事件中至少控制了整个网络 1/3 的质押投票权。

Sui网络共识机制交易审查场景对比

有关「中心化公链」的争议自上一轮周期的 Solana 就已开始,也有社区成员指出,「抗审查属性」并不是当前的加密投资者最在乎的属性。在一个仍以回报率为目标与核心的世界,或许「拉盘」就是正义。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。