原文作者:Frank,PANews

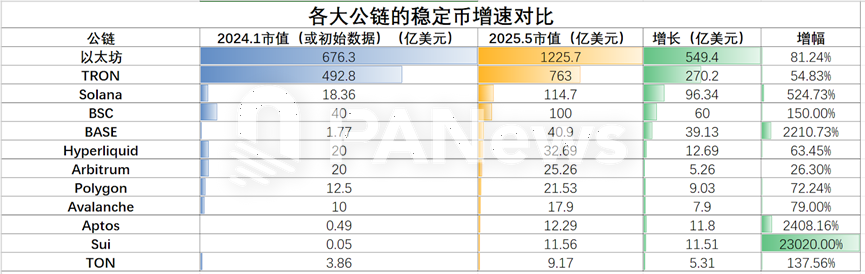

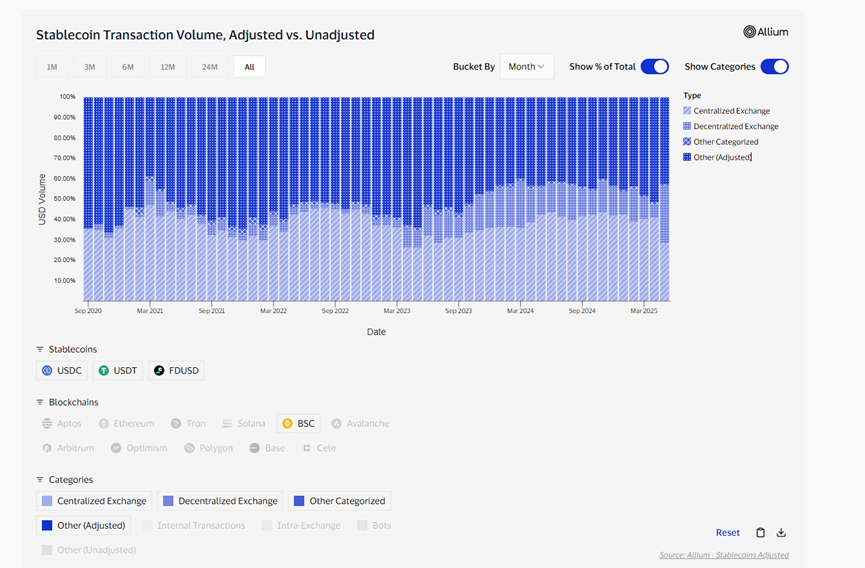

2025年,稳定币成为加密市场最受关注的领域,截至5月22日,稳定币总市值已经突破2450亿美元。在稳定币高速增长的背后,是各个公链竞争暗自竞争的战场。稳定币作为资产沉淀的最主要的形式之一,不仅是资产流动的变化指标,更是公链在市场认可度的重要衡量指标。PANews针对目前排名靠前的12个公链的稳定币数据进行了分析,试图勾勒出公链稳定币发展的全景图。

以太坊:靠USDC增速守住半壁江山

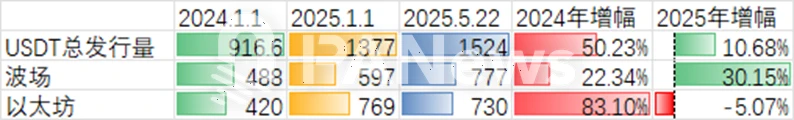

以太坊的稳定币市值1225亿美元,占据所有稳定币发行量50%的份额。在以太坊上占比最高的稳定币还是USDT,占比约为50%。不过从USDT的角度来看,以太坊的发行量在进入2025年后迎来了下滑。据PANews统计,2024年全年USDT在以太坊链上的发行量增长了83.1%,但进入到2025年,截至5月21日,以太坊的USDT发行量则下降了5.07%。这也直接使得波场一跃成为USDT最大的发行公链。

除了USDT之外,以太坊也是USDC的最大发行公链。截至5月22日,UDSC在以太坊上的发行量也已经达到了369亿枚,以太坊发行量占比达到60.82%。而在2024年10月份,USDC在以太坊的发行量还仅有252亿美元,半年左右的时间增长了46.4%。USDC的大幅增长,也成为以太坊得以保住稳定币半壁江山的主要原因。

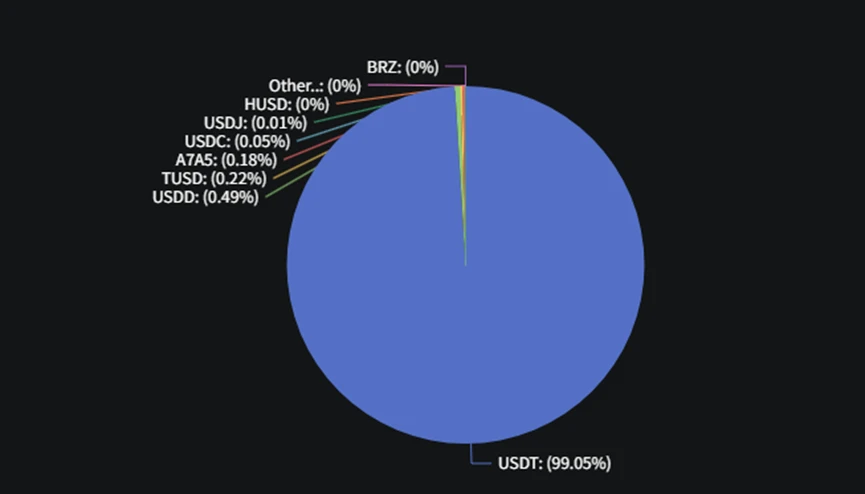

波场:USDT最大发行公链,最繁忙的链上美元“集散港”

Tron的稳定币主要来自于USDT,占比超过99%,目前也已经成为USDT最大的发行公链。Tron在全球稳定币市场总份额约为31.3%。根据CryptoQuant的数据显示,Tron的USDT日均交易量达到240万笔左右,而以太坊这一数据仅为28.4万。

从交易量方面,Tron网络平均每日处理价值200亿美元的USDT转账,占全球所有稳定币交易额的近29%。用户活动方面,每日有超过100万个独立账户在波场上进行USDT交易,占所有区块链活跃稳定币钱包地址的28%。

增长趋势上: 波场上的USDT供应量从2024年的488亿美元增长到597亿美元。2025年,Tether在波场上增发180亿美元的USDT,使波场上的USDT总供应量达到777亿美元。究其原因, 波场的低费用和高交易速度使其成为大量USDT交易的首选网络,尤其受到散户用户和新兴市场的青睐。

此外,由于波场创始人孙宇晨与特朗普家族的密切合作,也为Tron的稳定币前景提供了更多可能。5月份,特朗普家族项目WLFI(World Liberty Financial)联合创始人ZackWitkoff表示,WLFI发行的美元稳定币USD1亦将原生发行于Tron链上。孙宇晨也在今年1月透露,希望能够大幅降低交易费用,最终实现免费转账。但截至目前,该计划的下一步行动还未透露。

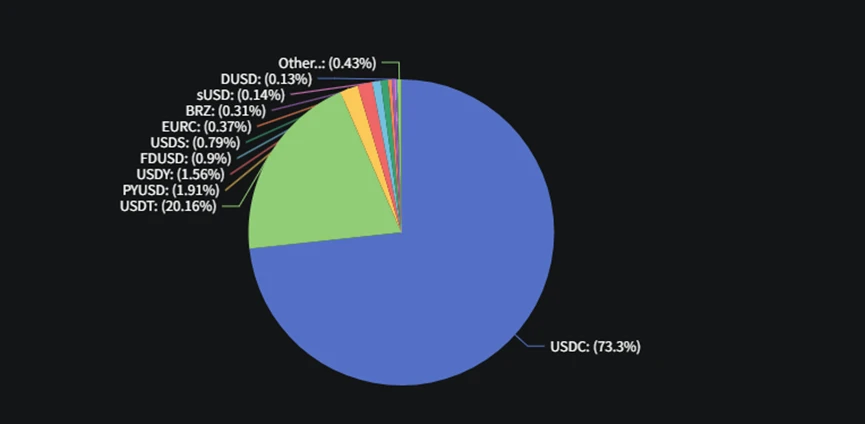

Solana:高TPS下的加速引擎

作为近两年来最热门的公链,稳定币也是Solana链上有着大幅增长的选项之一。从2024年的初的18亿美元,增长至5月份最高131亿美元,增幅达到627%。无论是体量上,还是增速方面,Solana都是稳定币领域最不可忽视的新兴势力。

当然,Solana目前的稳定币总市值约为114亿美元,与波场和以太坊仍有着较大的差距,尤其是和以太坊有着超过10倍的差距。不过,考虑到Solana的DEX交易量已经超过了以太坊,但稳定币的发行量还和以太坊有着巨大差距来看,Solana的生态内对于稳定币的应用普遍程度还不算高。

从内部结构来看,USDC是Solana上的首选稳定币,占据Solana上73%的市场份额 。USDT在Solana上的份额约为20%。PayPal发行的PYUSD在Solana链上目前有2亿美元的市值,仅次于以太坊,占比约为24.36%。Solana现在是不少新型稳定币的优先选项之一。

BSC:零 Gas 与 USD1 双驱动

截至2025年5月,BSC约占全球稳定币市场份额的2.4% 。BSC链的稳定币市值从2024年经历了几个跃进式的台阶增长,从40亿美元增长至目前的约100亿美元,增幅约为150%。其中两次集中的增长,一次是2024年11月到2025年1月份,从50亿美元左右增长至70亿美元。第二次是从2025年4月底到5月份,从70亿美元的阶梯快速提升至90亿美元。从分析结果来看第一次增长可能主要源于BSC链推出的零GAS费活动。第二次则是受到USD1稳定币在BSC链上发行的推动。近期火热的USD1,目前99.26%的发行量在BSC链上,总发行量约为21亿美元。

而BSC此前主推的BUSD和FUSD的占比则下降至合计3%左右。USDT的发行量占比则约为59%,USD1占比约为21%。

Visa Onchain Analytics数据显示,随着近期币安钱包的热度提升,BSC链上的稳定币DEX交易占比从4月的不到10%提升至28%,与中心化交易所占比几乎相同。

此外,5月份,BSC在稳定币的交易笔数方面占到了所有链38.1%,排名第一。而在USDT的累计交易量上,BSC以3580亿美元仅低于Tron和以太坊。可以说,在稳定币赛道,BSC和Solana已成为最有竞争力的新势力。

Base:Coinbase 赋能的增速冠军

Base作为由Coinbase孵化的以太坊L2,在这个周期各方面数据都实现了大幅增长,在稳定币领域同样如此,在稳定币的市值方面,Base自2024年1月的1.77亿美元增长至40.9亿美元,增长率达到2210%,是稳定币市值前五的公链中增幅最大的。

USDC是Base链最主流的稳定币,占比达到了97.8%。Base也是USDC除了以太坊之外累计交易量最大的公链。

Hyperliquid:衍生品巨鲸的新金库

作为巨鲸们的博弈新阵地,Hyperliquid的推出时间虽然不长,但却展现出巨大的潜力。不到半年的时间内,其稳定币市值就达到了32.6亿美元。领先于Arbitrum、Polygon、Avalanche等老牌公链。

从生态应用来看,Hyperliquid作为去中心化衍生品交易所,主要使用USDC作为交易对象。因此,USDC是Hyperliquid上最大的稳定币币种,占比达到97.8%。不过,值得关注的是,作为一个公链,Hyperliquid近期也在稳定币的种类方面新增了feUSD、USDT、USDe。虽然目前的发行量和交易量并不高,但也为公链生态的应用打开了一些新的端口。

Arbitrum:激励断档后大跳水

Arbitrum作为备受关注的以太坊L2,其稳定币市值在这轮周期内迎来了大起大落,在2024年全年,Arbitrum的稳定币市值从20亿美元增长至最高69亿美元。但在2025年初,Arbitrum的稳定币市值则经历了大跳水,一月份快速下跌至27.3亿美元。1月2日,单日的流出量就减少了20亿美元。

这种大幅下降可能主要源于三个原因,一是12月17日,上一轮的Incentives Detox激励终止,约50家协议的流动性补贴一次性“断流”,做市资金在奖励到期后集中撤离。二是Tether宣布 1月29日起把 Arbitrum 上的USDT迁移至新跨链标准“USDT0”。还有就是高收益竞争链Blast存款合约对USDC/USDT承诺 5% 年化+Airdrop Points,自11月底上线后持续吸纳 L2 资产。

Polygon:USDC迁移与支付试验田

2024年到目前,Polygon 稳定币市值由12.6亿升至约21.5亿美元,年增近七成。关键推力来自 Circle原生USDC落地以及Visa、Mastercard 等巨头在PoS链试点法币和稳定币结算,带来企业级增量。

目前,Polygon链上的稳定币份额由USDT和USDC两种主导,分别各占有40.79%和47%的市场。

Avalanche:费用降低未能实现爆发式增长

Avalanche在近一年来的增长显得有些平淡。虽然总体上稳定币市值也增长了79%,但从图表上来看,这种增长从2024年5月之后就有些停滞。始终在10亿美元到20亿美元之间震荡。2024年底,Avalanche 9000 升级使 C-Chain 基础费用降 96%,稳定币小额转账与批量结算成本大幅降低。不过这种利好也没能持续给Avalanche提供动力,或许只有生态整体活跃度提升,才能真正带动稳定币的发展。

Aptos:Move 生态的冲量黑马

Aptos上的稳定币总市值在2025年第一季度首次突破10亿美元 ,从2024年以来的增幅来看,截至5月份的整体增幅达到了2408%,也是增长最快的公链之一。作为MOVE生态的公链,Aptos和Sui在都属于新兴崛起的竞争者。Aptos链上的稳定币主要由USDT和USDC构成,其中USDT占比约62.39%,USDC占比约32%。鉴于原生USDC在2025年1月才开始在Aptos上线,这种增长的进展已经很快。

Sui:230倍增长的高速成长链

Sui的稳定币增长是所有公链中最大的,2024年初,Sui网络的稳定币市值仅为500万美元左右,到了2025年5月,这一数据增长至11.56亿美元,增幅达到夸张的230倍。目前,USDC是Sui网络发行占比最高的稳定币种,占比约为75%。

不过,Sui生态的稳定币目前的体量还不算太高,发行的种类也较少。如何吸引更多大资金入场是Sui生态面临的增长主要问题,且5月22日发生的Cetus被盗事件也会一定程度产生对其安全性能的动摇,也算是机遇与隐忧并存的局面。

TON:Telegram 社交支撑增长乏力

TON同样作为2024年才加入战场的新兵,在一年的时间里也取得了较快的增长。2024年4月份,Tether宣布在TON链同步发行 USDT与 XAUT,成为其第15条支持网络,目标是把 Telegram 9亿用户直接引入链上美元支付生态。上线后,wallet及各类Telegram交易Bot迅速集成,新用户零门槛用手机号即可收付 USDT。这也为稳定币在TON生态的增长提供了基础。到2024年6月,TON上的USDT发行量就达到了5.19亿美元。

不过,TON生态的稳定币增长在经历短时间上涨后也开始在2025年回落,目前从年初的14亿美元跌至9亿美元左右。这其中,可能与TON生态在点击小游戏之后再没有明显热点有关系。

结语

目前来看,公链的稳定币竞争格局仍在高速的变化当中。虽然以太坊、波场等公链仍具有较大的先发优势。但Solana、BSC等几条热门公链的崛起也在逐渐蚕食头部的市场份额,加上USD1等新稳定币的发行也不再局限于以太坊。而Apots和Sui的MOVE生态公链则作为更新的公链,虽然稳定币的铸造时间较短,但增速上却有着明显的优势。

可以预见的是,稳定币的竞争将更加激烈。对老牌公链来说,是守住市场的前提下继续增长的双重压力。而对新公链来说,则是迎来市场野蛮生长的快速扩张期。随着全球各地稳定币法案逐渐落地,稳定币的故事,才刚刚开始。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。