Author: PAUL TIMOFEEV

Translation: DeepTechFlow

The Revival of Solana

Solana is a proof-of-stake (PoS) layer 1 blockchain optimized for high performance and throughput to provide fast execution speeds and lower transaction costs. Its unique architecture, different from EVM chains, allows developers to focus on building plug-and-play applications using Rust. Solana currently supports 121 protocols in its ecosystem, maintained by 2156 validators (second only to Ethereum), and ranks fifth in total value locked (TVL) in DeFi across blockchains, reaching $1.38 billion.

In its brief but eventful history, Solana has faced and overcome many challenges, such as network instability and the risky relationship with SBF and Alameda leading to significant loss of users, developers, and liquidity. Nevertheless, co-founder Anatoly Yakovenko has maintained close contact with the user and developer community, demonstrating Solana's resilience and willingness to adapt and overcome adversity, even at its lowest point.

In 2023, as the price of Bitcoin rose in anticipation of SEC approval for spot ETF, the crypto market finally saw a rebound after a long period of consolidation. The price of $SOL followed suit, rising from $9.98 on January 1, 2023, to $101.51 on January 1, 2024, with a return rate of 917.134%. As SOL continues to maintain a strong upward trend in the market, MadLads was launched, and the team announced a points program and airdrop, attracting attention from users, investors, and developers with a new narrative designed around "applications that can only be built on Solana."

Performance of Solana DeFi in 2023

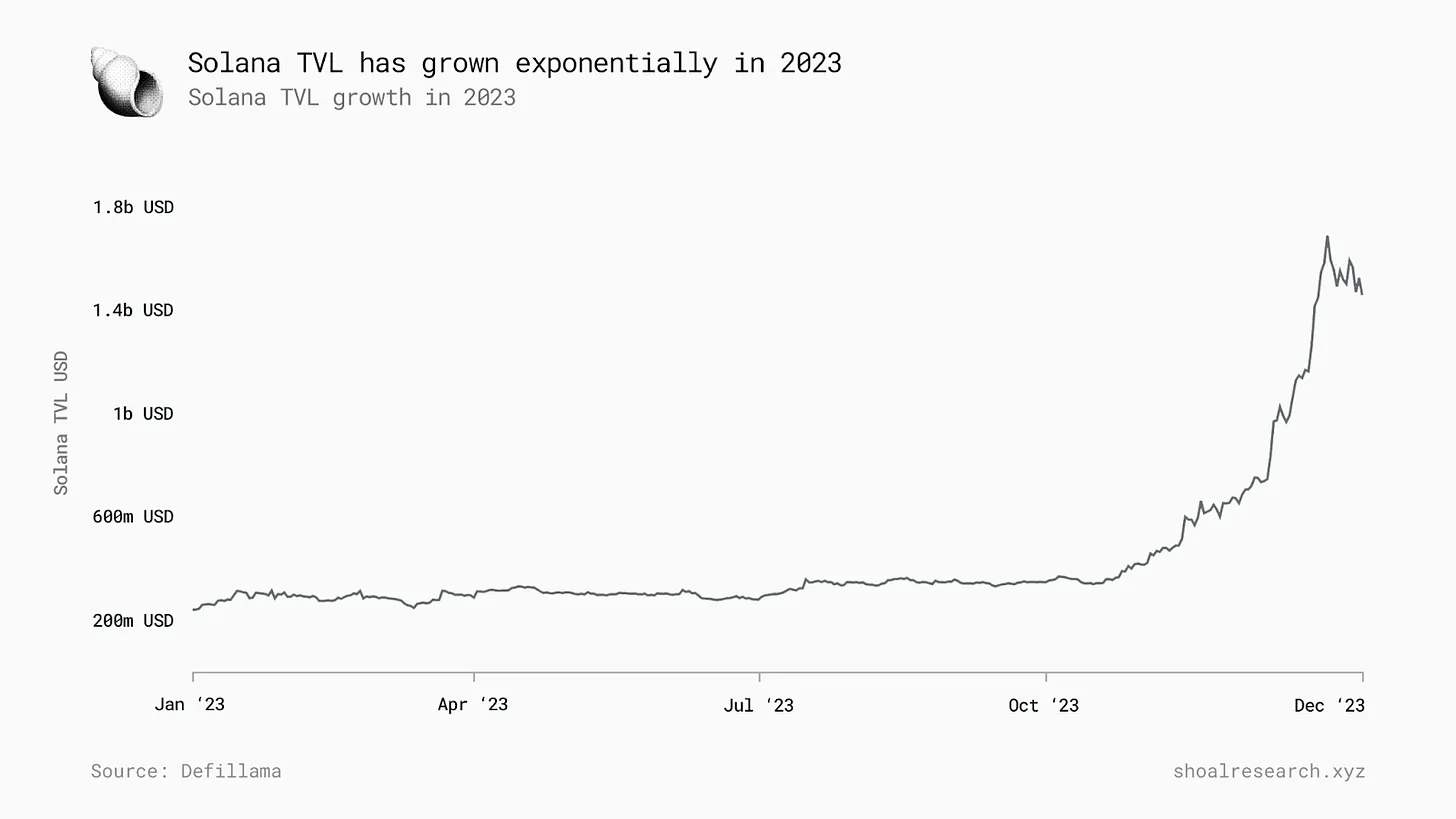

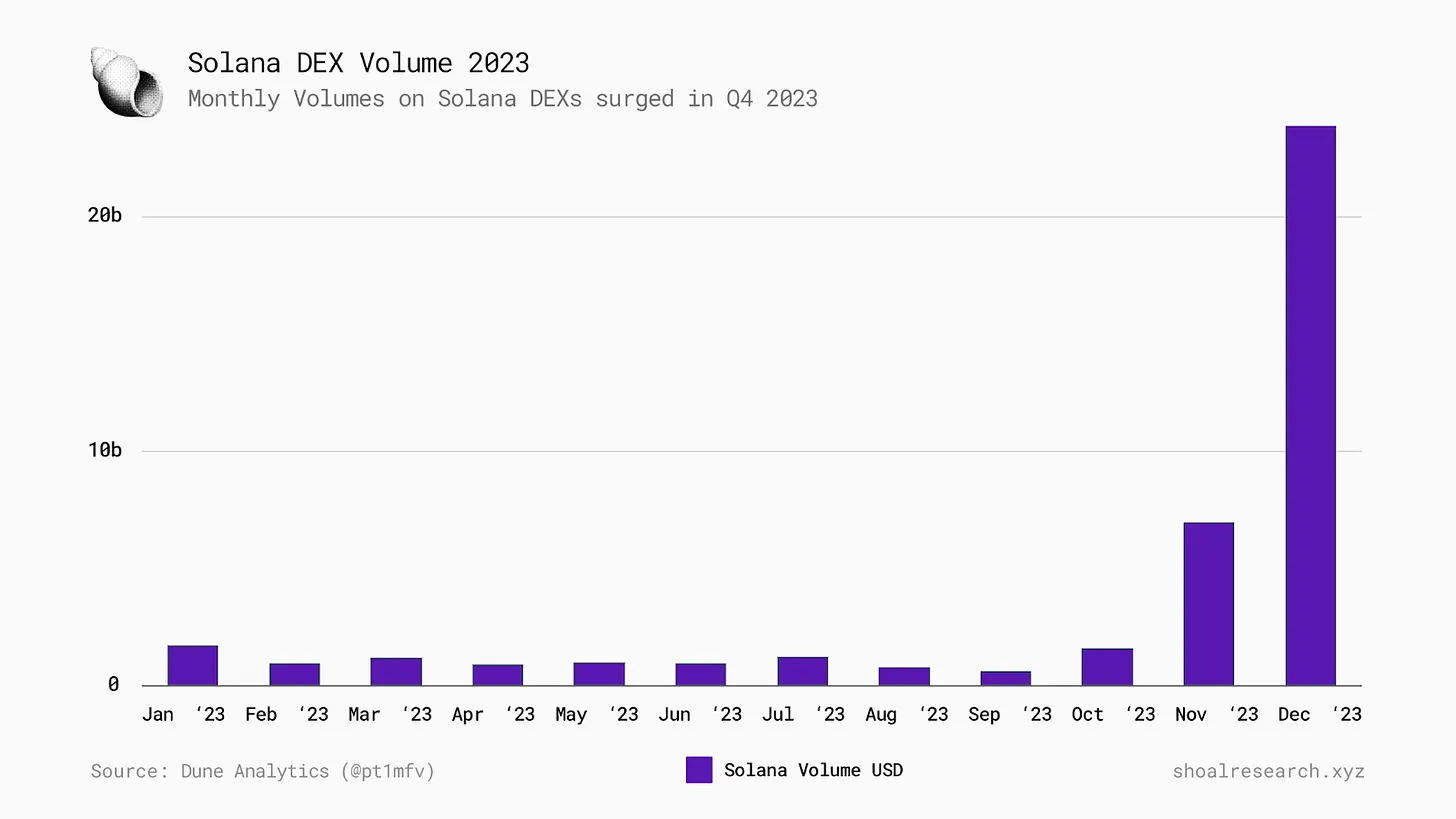

From January 1, 2023, to January 1, 2024, Solana's TVL and on-chain transaction metrics saw significant growth. This period marked an important stage in Solana's development, with a significant increase in trading value and volume despite a decrease in TVL after the FTX collapse.

Key highlights:

- TVL growth: Solana's TVL increased from $2.1008 billion to approximately $14.7 billion, a growth of 574%.

- Total swaps: 314,556,244 swaps were executed on the network.

- Total trading volume: The platform's total trading volume reached $420,366,925,060.

Solana's DEX monthly trading volume in December reached $23.8 billion, setting a new annual high in 2023.

Introduction to Jupiter

Jupiter was launched as a DEX aggregator on Solana in September 2021, aiming to provide Solana users with a better trading experience by delivering liquidity from multiple sources, rather than a single source. While Jupiter initially started as a trading engine, the protocol has evolved to become an important liquidity layer offering a variety of products for different users and has become a key component of the Solana ecosystem.

Jupiter's business model is driven by three core pillars:

- Providing the best user experience

- Maximizing the potential of Solana's technology

- Improving the overall liquidity of Solana

2023 was a busy year for the Jupiter team, as they launched several new core products, including new DCA functionality, limit orders, and perpetual contract trading. The core protocol also underwent multiple upgrades and optimizations, including upgrading algorithms (Metis), bridging comparison tools, instant staking of SOL > SOL exchanges, and more development tools, including the release of the Jupiter terminal and two major API upgrades.

Review of Jupiter's 2023 Trading Volume

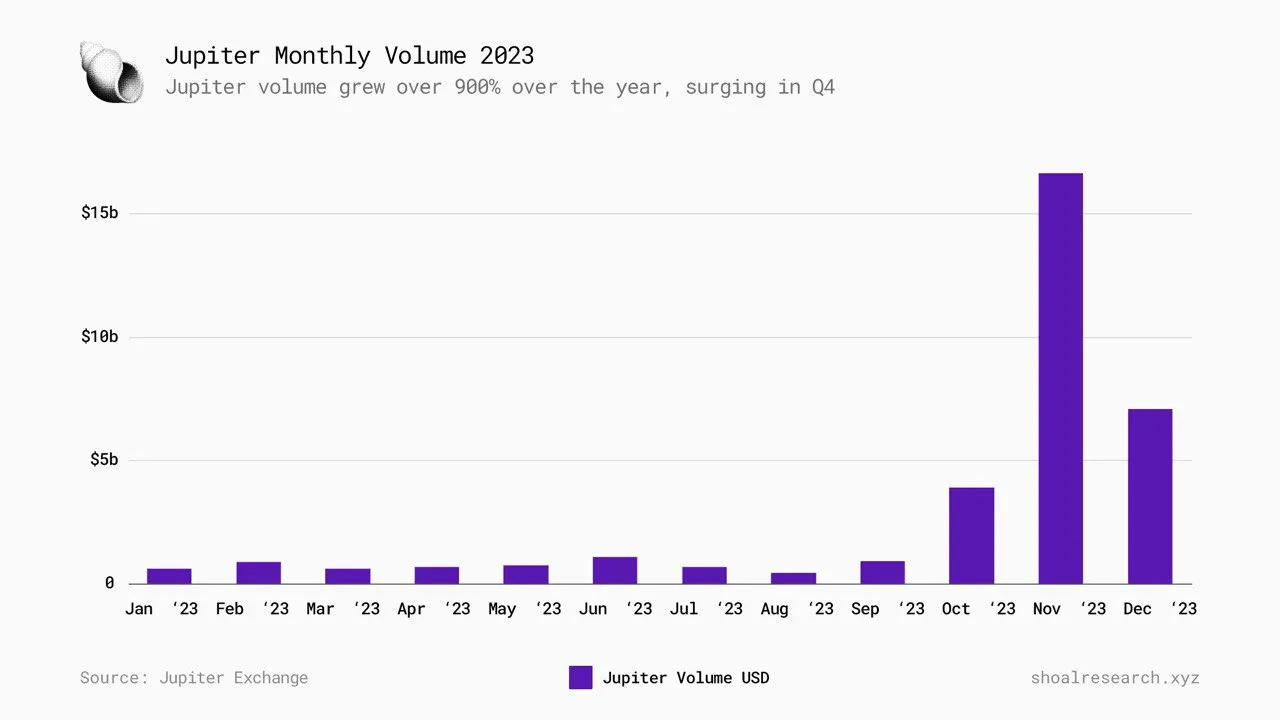

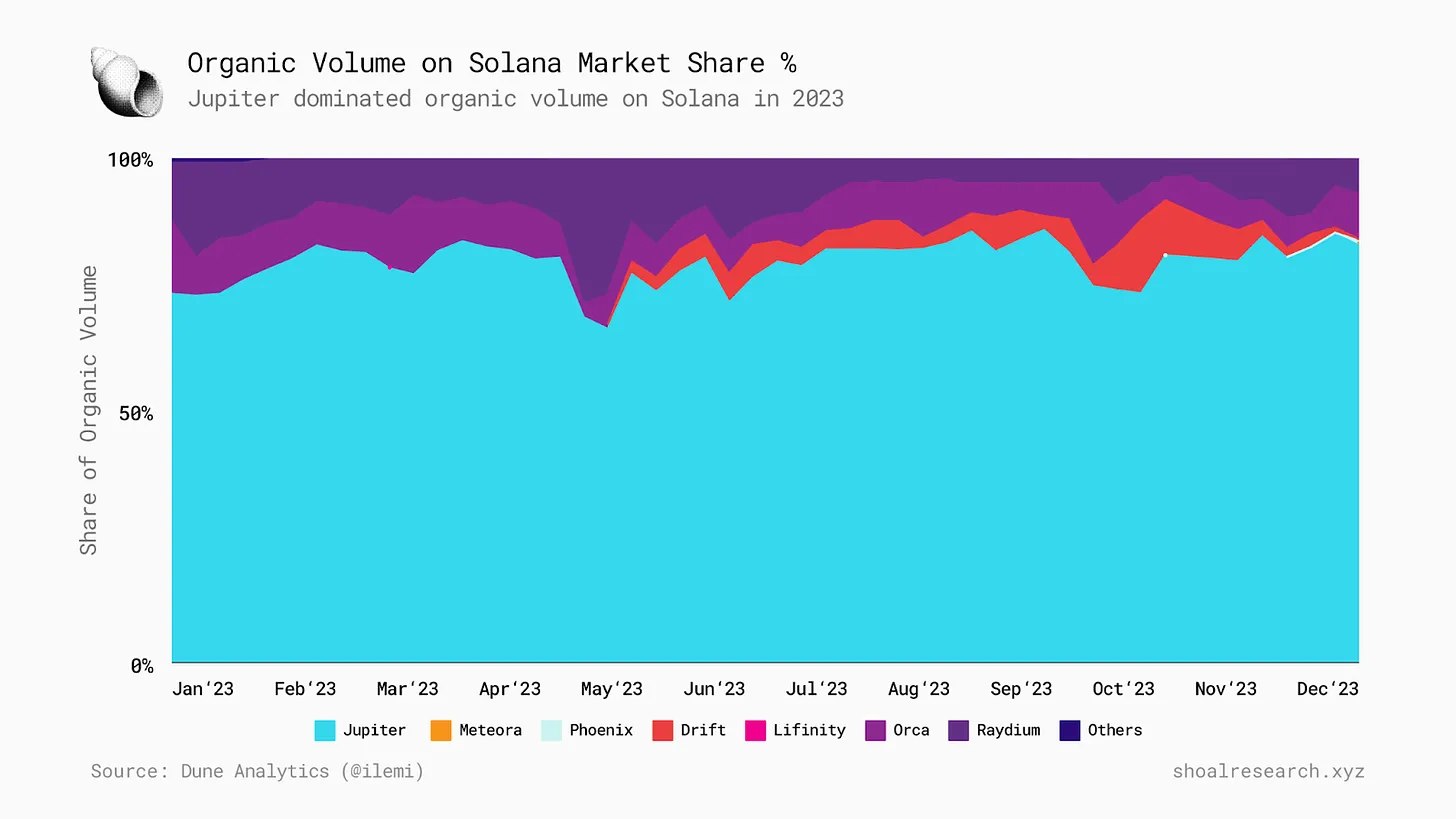

Jupiter's total trading volume reached $62,816,562,781, accounting for approximately 60% of all Solana DEX trading volume.

Jupiter's monthly trading volume increased from $649,258,200.00 in January 2023 to $7,106,000,000.00 in December 2023, a growth of 994.48%. After Breakpoint announced $JUP, the trading volume in November exceeded $16 billion, setting a new monthly trading volume record. Impressively, this increase in trading volume, mainly in the fourth quarter, was primarily driven by organic trading activity.

In this report, we will analyze Jupiter's product line and future plans, and explain the logic behind our investment approach.

AMM and Aggregator

Automated market makers (AMMs) have been a novel innovation in the digital asset space in recent years. On traditional exchanges (such as Coinbase or Binance), third-party entities operate to provide liquidity, allowing traders to have a counterparty for their trades. These counterparties, known as market makers, "create" a market for traders to transact and charge a spread (fee) on each trade to remain profitable.

With the emergence of AMMs, traders can deploy digital assets markets based on mathematics and code rather than relying on complex intermediaries. By using AMMs, traders can enter and exit positions even in cases of extremely low liquidity. A drawback of low liquidity is that traders may encounter slippage, the difference between the expected and executed trade value. Traders may also lose value in trades due to asymmetric information in the public mempool, such as being front-run or sandwiched by complex participants deploying MEV bots.

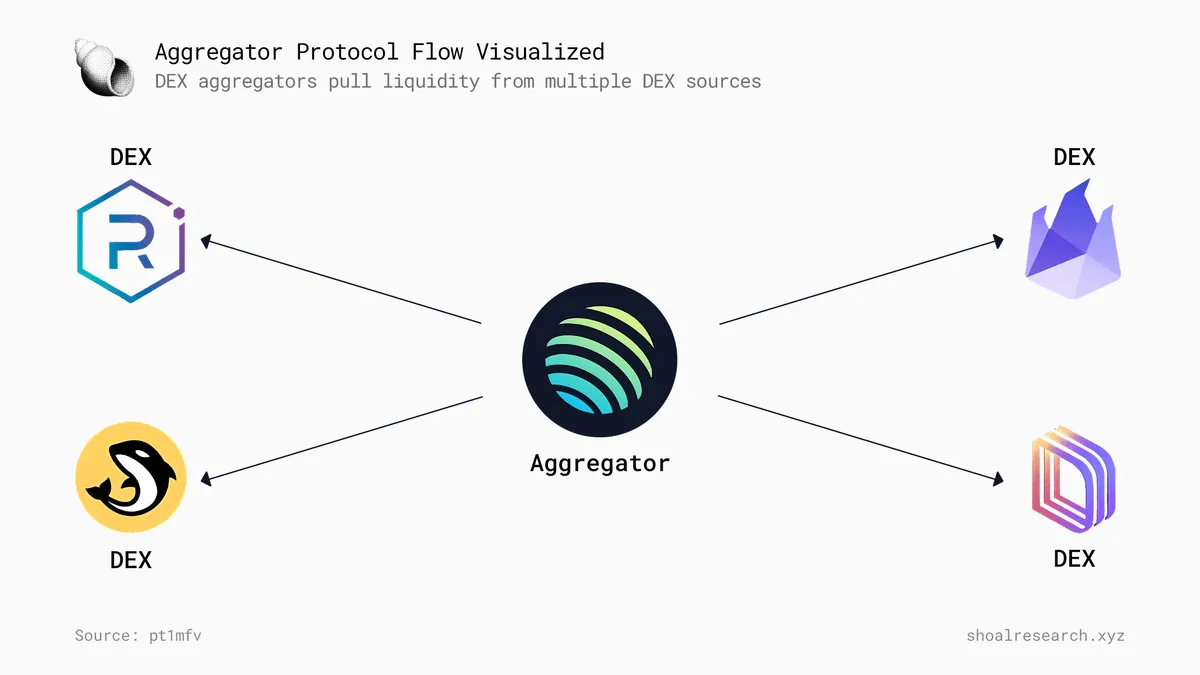

The emergence of on-chain aggregators aims to mitigate the impact of low liquidity trading, allowing traders to place orders and deliver liquidity from multiple sources rather than a single source. Liquidity can be sourced from various places, including AMMs; although some teams have built solutions to enable market makers to utilize off-chain liquidity (i.e., CEX positions) and help settle trades.

The main benefits of doing this are better pricing, as:

- Transfers within CEX do not incur any gas costs, while on-chain transfers do

- Trades are not affected by MEV extraction

Overall, aggregators aim to provide a better user experience. Large content platforms like Meta or YouTube act as aggregators of content, allowing users to view videos and images from many different websites without leaving the interface. Google aggregates information from many different websites on the internet related to your search query to provide the best matches in order of relevance. Similarly, Jupiter and other DEX aggregators source liquidity across multiple exchanges to offer better trading prices.

Built on SVM

It is very important to understand the role of Solana Virtual Machine (SVM) and how it affects the protocol design choices that developers must make in order to better understand Jupiter as a protocol.

The virtual machine can best be described as a single entity maintained by thousands of interconnected computers running specific chain (such as Ethereum) validation clients, providing the environment in which all smart contracts and accounts actually exist. To this day, most DeFi and other on-chain activities are conducted through the Ethereum Virtual Machine (EVM). However, despite being no longer in the spotlight, we believe that SVM also has a robust architecture and will certainly continue to attract more developers seeking to build consumer-oriented applications optimized for speed and performance.

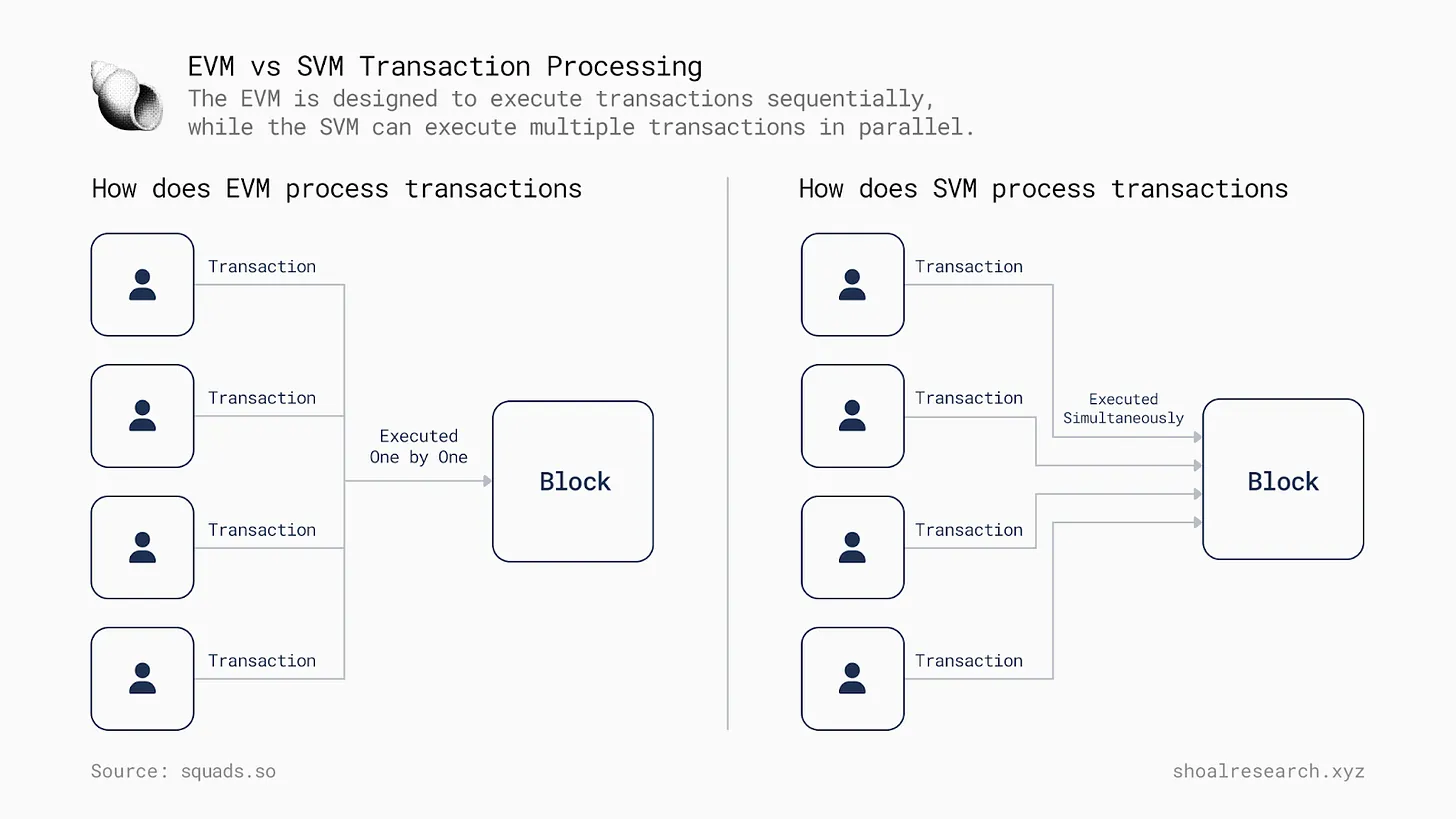

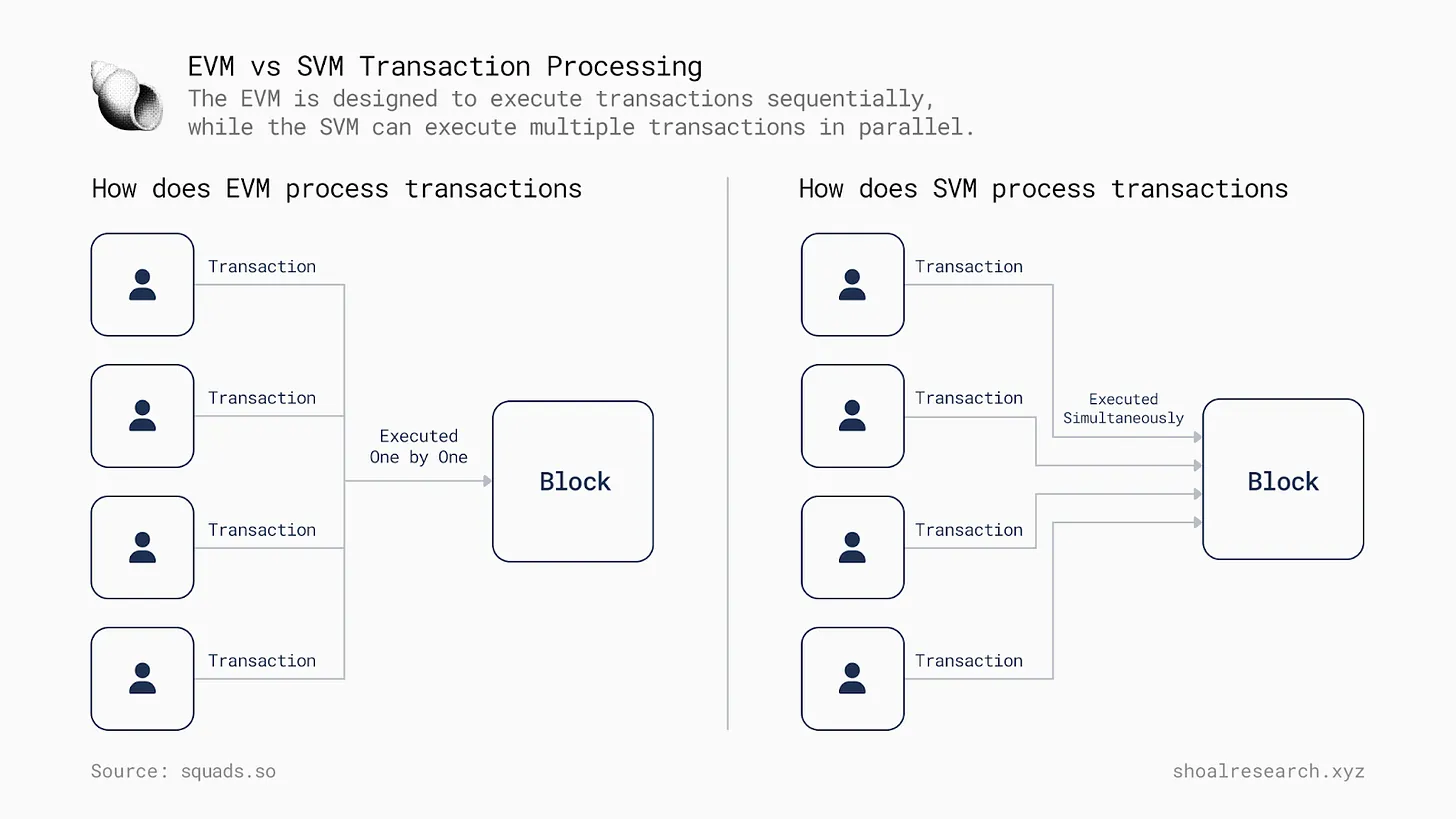

Smart contract code written in Rust, C, and C++ is compiled into BPF bytecode by SVM. The Sealevel engine is a key component on Solana for implementing parallel processing; with the integration of state access lists in Solana transactions (containing detailed information about specific states to be accessed), non-conflicting transactions can run simultaneously, resulting in faster overall performance.

While EVM is a "single-threaded" execution environment, meaning it can only process one contract at a time, SVM is multi-threaded and can process more transactions in a shorter period of time. Each thread contains a queue of transactions waiting to be executed, and transactions are randomly assigned to the queues.

The emergence of Layer 2 solutions like Eclipse and Nitro utilizing SVM execution demonstrates further potential adoption of SVM. Earlier this year, Rune Christensen of MakerDAO proposed the vision of developing a MakerDAO application chain using the Solana codebase, sparking much debate on Twitter.

One of the most common complaints about Ethereum is that gas fees increase with user activity, often leading to an unpleasant user experience, especially during bull markets. Regardless of how high gas fees are, traders simply demand the best possible prices. Aggregators like 1inch aim to provide better prices for users by sourcing liquidity from multiple sources rather than a specific DEX. However, conducting trades on Ethereum, such as sourcing liquidity from multiple different pools, is an expensive task and may actually exacerbate the problem it aims to solve, making trades on Uniswap, which sources liquidity from a single place, potentially more advantageous.

In contrast, on Solana, gas costs are negligible by default, costing less than a penny. The cost of sourcing liquidity from multiple sources is almost the same as sourcing from a single source, making DEX aggregators more practical and beneficial on chains like Solana compared to EVM chains. As a leading aggregator on Solana, we believe that Jupiter is more likely to achieve significant growth and adoption in the long term, while aggregators on EVM chains face higher costs and greater competition.

The same principle applies to use cases beyond simple A-to-B swaps, such as providing structured Dollar Cost Averaging (DCA) or Time-Weighted Average Price (TWAP) products for users, which will be further elaborated below. The fundamental principle remains that low gas costs bring great flexibility for application developers on Solana, and Jupiter is the best example of this.

Product Overview

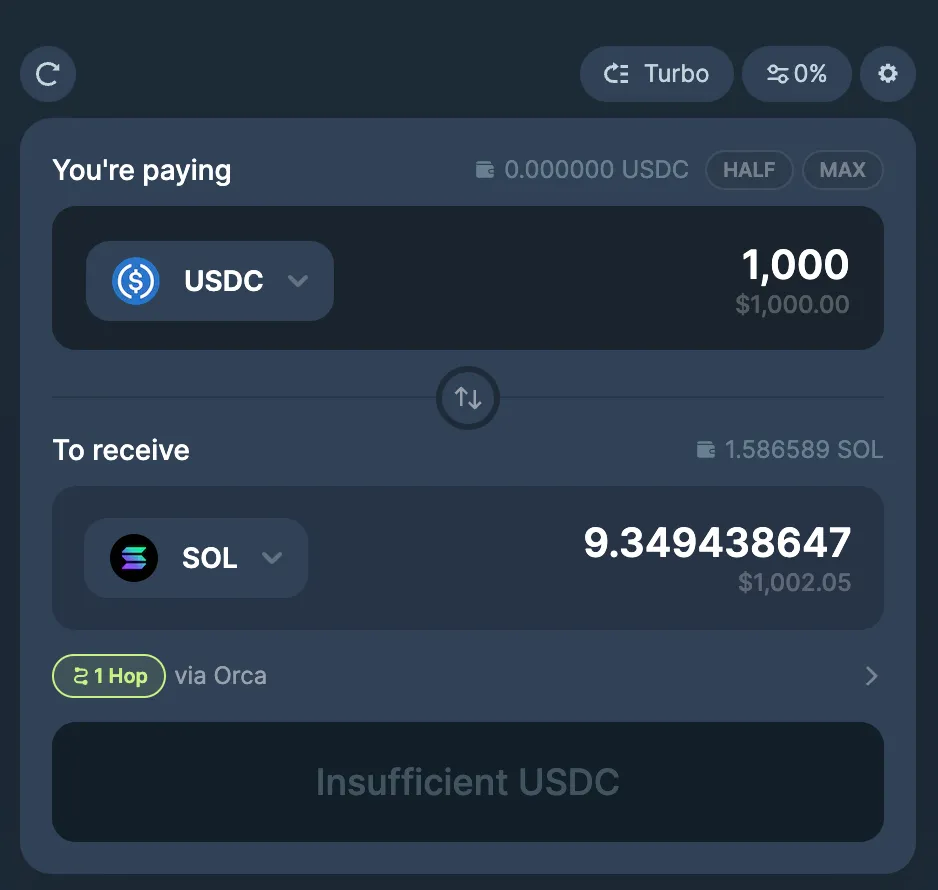

Jupiter Swap

Like any other decentralized exchange, the most common use case on Jupiter is the simple exchange of token A and token B. Users can exchange their favorite assets at competitive prices. Slippage and priority fee settings are fully customizable, allowing users to choose direct liquidity routes, use wSOL instead of SOL, and use versioned trades (using updated, better routing algorithms).

Developers can also integrate Jupiter's routing algorithm natively into their dApp using the Swap API. For example, Kamino Finance uses Jupiter's Swap API to enable features such as unilaterally depositing assets into their CLMM repository (Autoswap).

While we believe that the continued growth and sustainable adoption of Jupiter and Solana DeFi will eventually lead to JUP DAO voting to implement fees, currently, Jupiter does not charge any additional swap protocol fees other than basic gas fees and related DEX fees. Considering the increase in network activity driving the demand for block space and costs, as well as the potential restructuring of the Solana fee market, how this decision will be affected will be interesting. Currently, the 1inch aggregator on Ethereum does not charge swap fees, while CowSwap recently proposed a fee conversion, charging swap fees with the goal of achieving financial self-sufficiency while maintaining user incentives.

Limit Orders

If traders believe that the price of an asset will change in the near future, they can place limit orders instead of buying the asset at the current market price. Limit orders are signed messages with explicit trade execution guidelines or "intent," providing traders with flexibility and other benefits, such as better price settlement due to protection against slippage caused by MEV. This model benefits both retail traders and institutions, and Jupiter now provides a venue for traders to place limit orders on Solana.

When a user places an order to purchase $WIF worth 1 SOL, the order is ultimately matched by a keeper, a trusted protocol participant responsible for monitoring prices and executing orders. The function of the keeper is similar to the solver on CoWSwap or the filler on UniswapX. After the order is executed, the specified assets will appear in the user's wallet.

Jupiter's limit order feature offers a wider selection of tokens, as long as there is sufficient liquidity in the market, for trading token pairs. Additionally, users can specify an expiration time for orders, after which any unfilled orders will be canceled and refunded to the user's wallet.

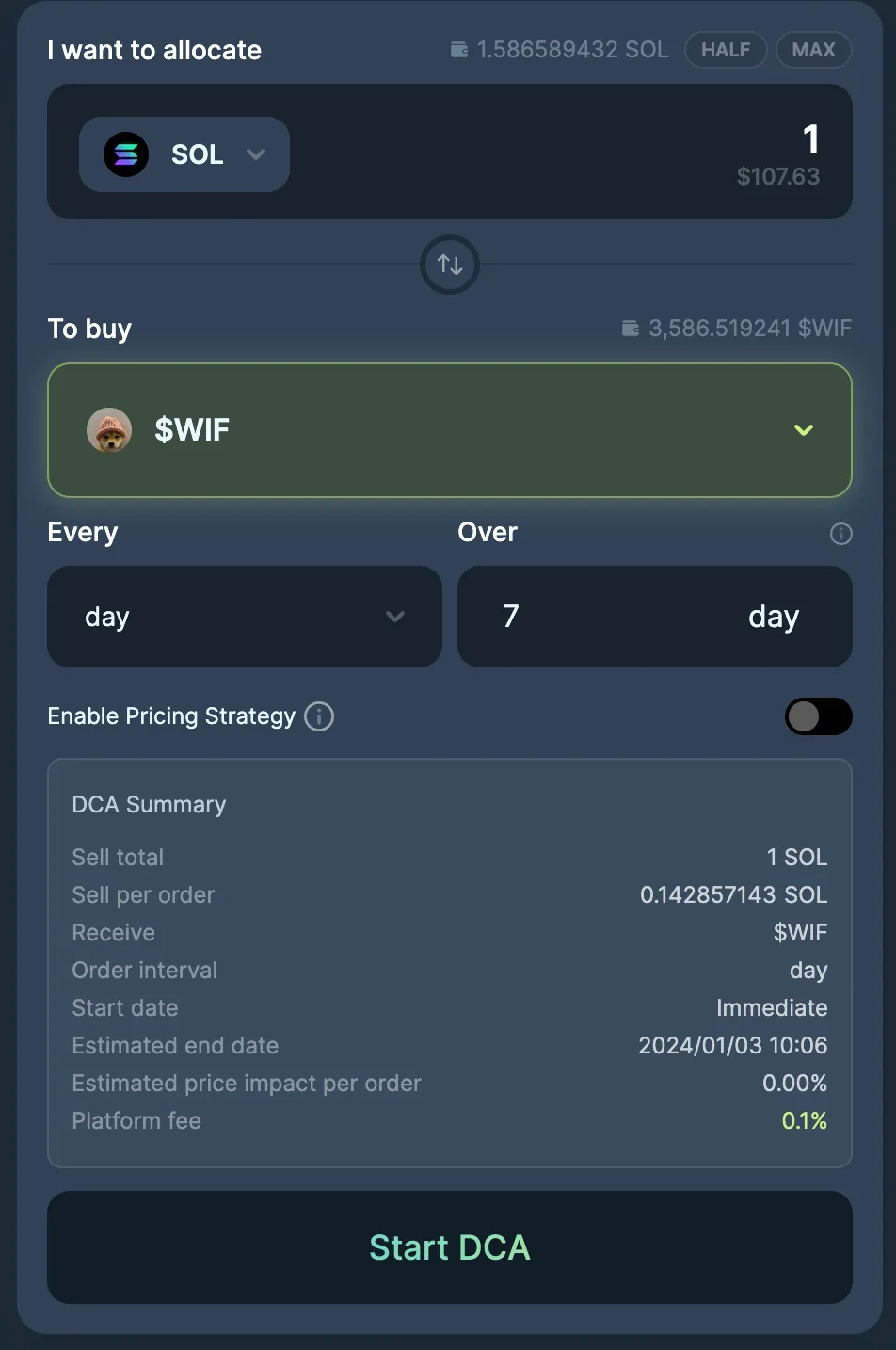

DCA

Dollar Cost Averaging (DCA), also known as regular investment, is a common investment strategy that involves splitting capital allocation into multiple trades rather than a single trade; this is particularly suitable for long-term investors who are not concerned with short-term volatility (e.g., buying $500 worth of SOL continuously for 5 days). DCA is very useful for accumulating assets in a bear market, with the principle being to average one's entry price to mitigate volatility and achieve greater returns over time and changing market conditions. Similarly, DCA can also help in profiting during a bull market, as opposed to immediately selling one's position entirely, DCA can help in diversifying sales to capture any additional upside potential during the closing period, rather than selling the position entirely immediately.

Traders can also execute a Time-Weighted Average Price (TWAP) strategy to buy or sell assets. Similar to DCA, TWAP is often used for large orders that need to be split into smaller parts to prevent price impact (slippage) caused by a single large purchase. Since orders are executed over a period of time, they are similar to the DCA strategy, i.e., purchasing a "x" quantity over a certain period.

Due to Solana's high-throughput architecture, Jupiter is one of the few platforms that enables users to execute frequent time-based strategies on-chain. DCA trading on a low time frame on Ethereum (e.g., daily) could result in hundreds of dollars in trading fees, while on Solana, it would only cost a few cents. Even on L2, if a trader wants to execute 10 trades within an hour, the costs would quickly add up.

Perpetual Contracts

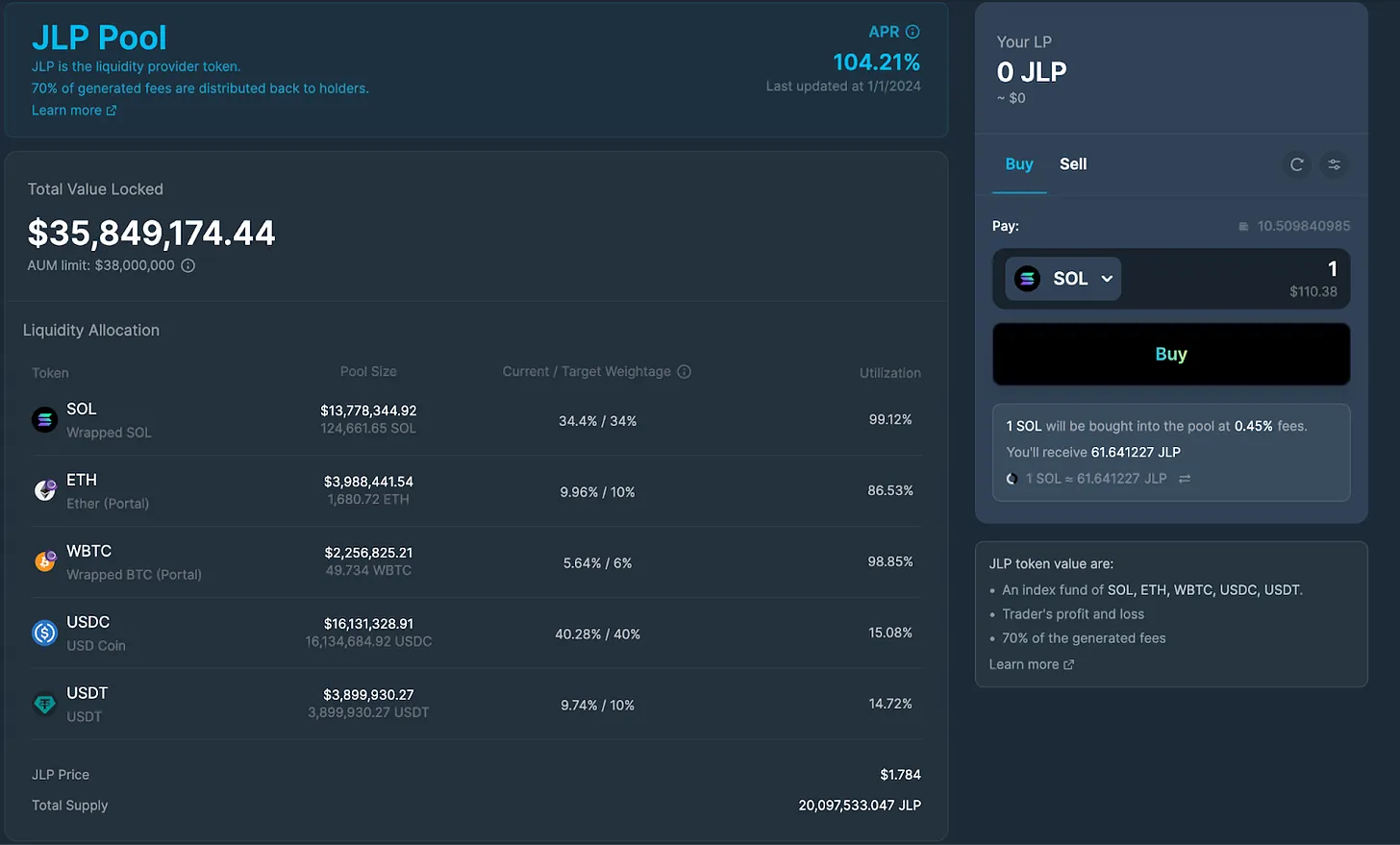

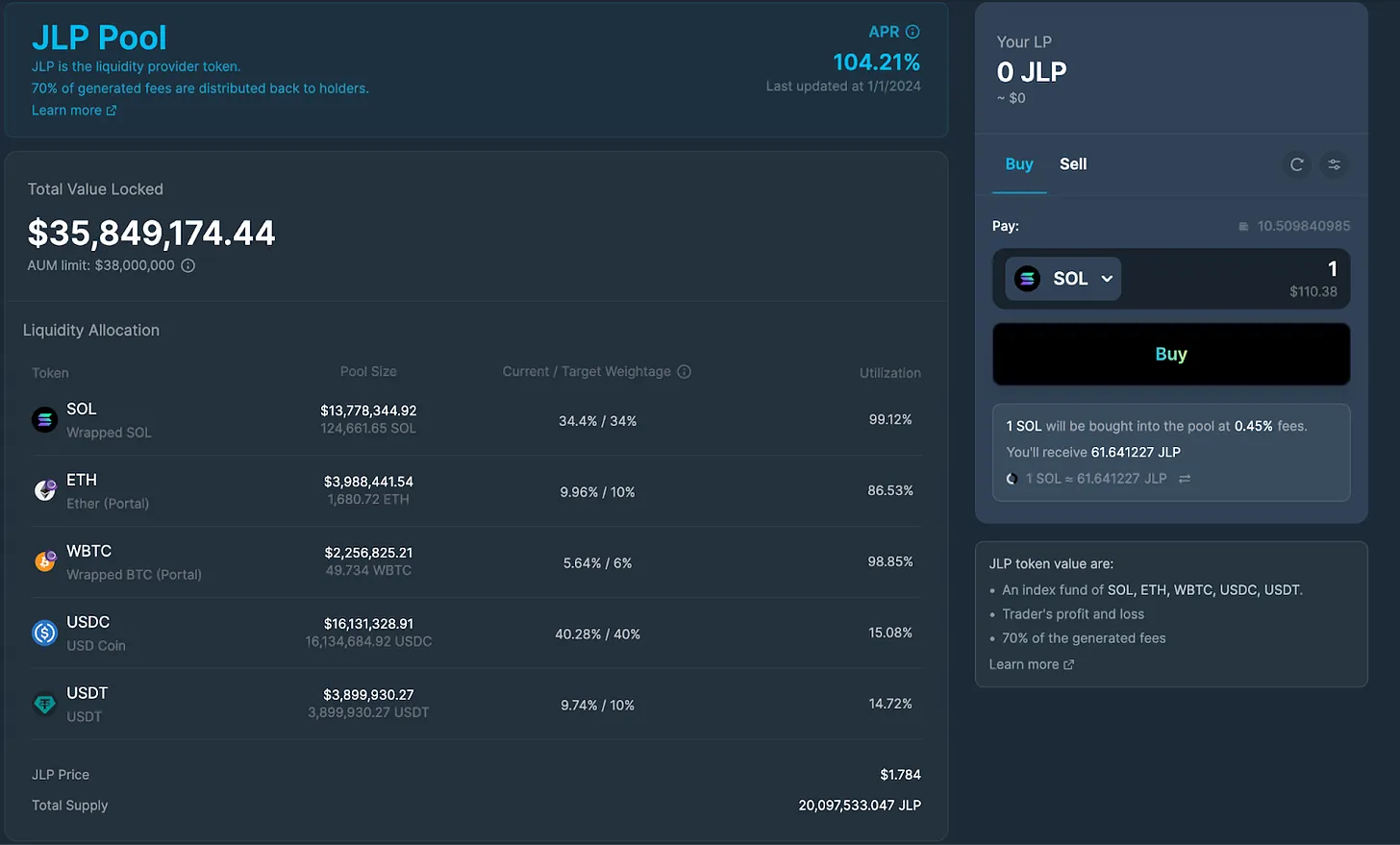

To further enrich its wide range of products, Jupiter also launched an LP-Traders perpetual contract exchange earlier this year. While still in the testing phase, traders can trade SOL, ETH, and wBTC perpetual contracts with leverage of up to 100x, while LPs can provide capital to earn fees.

Perpetual contracts are derivative contracts similar to traditional futures contracts, allowing traders to take larger positions with less capital allocation (leverage) to take advantage of future price fluctuations.

On Jupiter, traders can use almost any supported Solana token as collateral to open long or short positions on SOL, ETH, and wBTC. Long positions require the corresponding underlying asset (e.g., a long SOL-USD position requires SOL collateral), while short positions require stablecoins as collateral. Traders can leverage their positions by borrowing assets from the liquidity pool - by borrowing 1x SOL from the JLP pool, the leverage ratio for a SOL-USD position can reach 2x.

Similar to the dynamic of the GLP pool on the perpetual contract exchange GMX, Jupiter Perps utilizes the JLP pool, which includes SOL, ETH, WBTC, USDC, and USDT. Providing liquidity simply involves depositing any supported Solana token into the JLP pool in exchange for an equivalent amount of $JLP tokens. The JLP pool receives 70% of the fees generated by Jupiter's perpetual contracts, and the price of $JLP tokens grows in sync with the value of the underlying pool.

The JLP pool also benefits the larger Solana ecosystem, as Jupiter Swap is natively integrated into the perpetual contract exchange, meaning not only can any token be used as JLP collateral, but Solana traders can benefit from the liquidity added to the JLP pool, obtaining better trade prices.

Unlike the aforementioned features, the perpetual contract exchange on Jupiter charges higher fees for both traders and LPs. Traders pay fees to the pool based on the hourly borrowing fee or funding rate, which is based on the hourly borrowing rate, position size, and token utilization rate, and can be expressed as:

Funding rate = (Borrowed tokens / Tokens in the pool) * 0.01% * Position size

LPs also need to pay their share of fees for opening/closing positions and exchanging different assets within the JLP pool.

Regarding the JLP pool, it should also be noted that any logic that moves the token ratio away from the target proportion for the pool incurs higher fees, while logic that moves the ratio towards the target incurs fee discounts.

Decentralized perpetual contract exchanges such as GMX and dYdX, while still relatively underdeveloped compared to their CEX counterparts, have significant room for growth and adoption. Another example of low-latency applications for perpetual contracts, it benefits from Solana's fast execution and low transaction costs, although Jupiter will face competition from mature participants in the Solana Perps space (such as Drift Protocol, 01 Exchange, Zeta Markets, Mango, etc.).

Growing the Pie: Jupiter's Vision

As the pie grows, everyone can get a bigger slice.

As an integral part of the Solana ecosystem, Jupiter benefits from helping as many new users and developers as possible join the ecosystem. In addition to providing value through outstanding products, Jupiter's goal is to empower its community and the broader Solana ecosystem through several new initiatives:

$JUP: The governance token for the new DAO (more on this below)

Jupiter Start: Balancing openness to innovation and objective criticism of poor application design is essential for a sustainable ecosystem, and Jupiter Start aims to be a platform between the Jupiter community and the broader Solana ecosystem to "help review, debate, understand, and highlight great new projects." This includes the Jupiter launchpad to help guide new projects, pre-listing trading availability for new tokens, and Atlas, a new public seed funding program that allows the community to invest in early-stage projects, as well as various community-centered educational project initiatives.

For more information about Jupiter Start, we recommend reading this blog post.

- Jupiter Labs: A collective effort between the Jupiter team, community, and DAO aimed at developing innovative products and tools for Solana DeFi. While these initiatives will start from Jupiter, they are ultimately designed to be launched and operated independently on Solana. Jupiter users will have priority access to early product testing and will be rewarded for it, with a portion of the rewards allocated to JUP DAO.

The first product launched is the perpetual contract exchange, which is already live in the testing phase, and a proposal has been put forward for sUSD, a stablecoin backed by SOL (similar to LUSD: ETH), which uses leveraged LST to generate returns.

More About JUP

Jupiter announced the $JUP token at a watershed moment for Solana, a strategic decision made after the protocol reached many key milestones, including a broad and active user base, several major platform upgrades and new products, a series of ecosystem projects, and of course, a belief in the future rise of Solana activity.

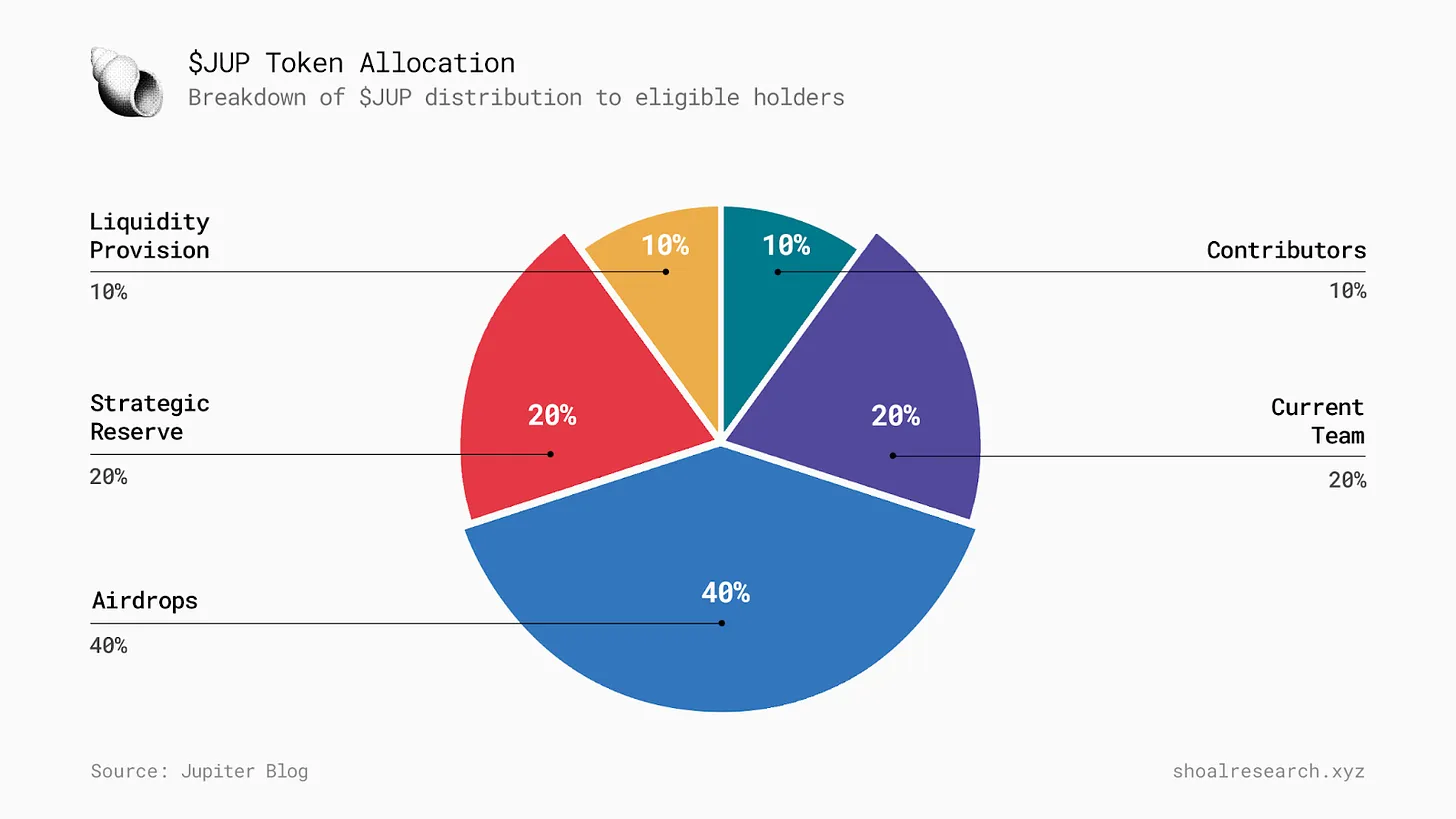

JUP has a maximum supply of 10 billion tokens, with the tokens distributed evenly between 2 cold wallets - the team wallet and the community wallet. The team wallet will be used for distribution to the current team, treasury, and providing liquidity, while the community wallet will be used for airdrops and various early contributors.

From day one, 15% - 17.5% of the tokens will start circulating, with 10% - 7.5% in hot wallets and 75% in cold wallets.

There will be a retrospective airdrop for the 955,000 early users of Jupiter (as of November 2, 2023), as well as initiatives aimed at attracting new users and liquidity. Then, the DAO will vote on token unlock data, with the tokens being initially locked and the unlock date set by the DAO. JUP holders will be able to vote on various key aspects of the Jupiter protocol and the role of the token, including the timing of initial liquidity provision, future emission schedules, and the projects to be showcased on Jupiter Start, among others.

"The initial value of JUP will become a symbol of Jupiter and DeFi 2.0, just as the value of UNI is a symbol of Uniswap DeFi 1.0."

Key Investment Catalysts

We have discussed the components of the Jupiter protocol, and now we can explain the long-term investment opportunities we envision.

Betting on Solana

Solana's roadmap is ambitious and exciting, and we expect ecosystem activity to continue growing in the fourth quarter of 2023, building on the momentum from 2023. We believe in this for several reasons:

More Airdrops: The launch of incentive programs by Marginfi and other DeFi teams earlier in the summer of 2023 ignited a frenzy in the Solana ecosystem. The JTO airdrop intensified the existing momentum on Solana, creating a wealth effect that left many jitoSOL holders satisfied but also left many looking for the next big opportunity. From Jupiter ($JUP) onwards, other projects worth watching include Kamino, Marginfi, Drift, Tensor, and more.

Firedancer: Jump Crypto's highly anticipated validator client, referred to as "Solana 2.0" by Toly himself. With the expansion and development of the network, Firedancer is expected to be a long-term move favorable to Solana's performance and throughput, marking an important milestone for Solana as it increases client diversity, reducing the risk of network single points of failure. Low-latency applications will become even faster, which is an attractive selling point for both users and developers. With Firedancer likely to go live in 2024, we expect a lot of speculation and growing interest around this milestone.

DePin: This is a new area in the cryptocurrency space, showcasing how tokenized assets can help decentralize real-world business models. Solana has successfully attracted many projects, including Helium and Hivemapper. Interest in DePin as an emerging area has brought more positive attention to Solana, as the network demonstrates its practicality for serving more specific use cases.

Payments: Solana Pay is now integrated with Shopify, meaning merchants can accept Solana payments, allowing JTO airdrop recipients to buy over 2000 cups of coffee on average with their earnings. While there are still obstacles to overcome for shoppers to make payments in Solana Pay, the collaboration with one of the largest e-commerce platforms is a good start. Additionally, earlier this year, one of the world's largest payment networks, Visa, announced plans to pilot stablecoin settlements using Solana, testing blockchain settlement capabilities to build new products for business and currency flow. Solana's high throughput, fast finality, low transaction costs, and node availability are all positives for Visa, just as Visa's brand can bring a lot of attention to Solana. If successful, we believe the stablecoin settlement pilot will mark a significant milestone in the development of real-world crypto use cases, and Solana as the actual network to achieve this goal will benefit.

The last noteworthy development is the Saga phone. While Solana's phone may not have been very successful in the first year, considering the impact of mobile integration on social media and payment applications, driving a mobile-friendly crypto environment and applications could be an exciting development in the long run. Recently, the Solana phone airdropped BONK tokens to buyers, and the team has announced the 2.0 version of the phone, including a lower price ($450 to purchase) and a referral leaderboard to drive more user participation.

Challenges for Solana

While we remain bullish on Solana's long-term growth, we expect the core Solana team and developer community to address several key issues in the short and long term, which we will closely monitor:

Fee Market: While Solana has now introduced priority fees, there is no native mechanism to determine "market" priority fees to help effectively limit spam senders (similar to EIP-1559). With the increasing demand for block space on Solana, more users are experiencing failed transactions, further indicating the need to upgrade the network's current fee market structure. Proposed solutions involve dynamic account fees and multi-dimensional EIP-1559, with fees exponentially increasing for accounts touching the same hotspots.

EVM Competition: While we believe that in the long term, SVM and EVM will not be a zero-sum game, and different networks will focus on their respective categories, today Solana is still competing for market share and users in the EVM space, a huge gap that needs to be bridged (a difference of $140 million and $3 billion).

EIP-4844 aims to significantly reduce the cost of L2 (80-90%) and make it easier to use/deploy, which could solidify the leadership position of Arbitrum, Optimism, and Base. Similarly, Celestia offers L2 developers more flexibility and lower costs, which could attract talent and users away from Solana.

Re-staking narrative is likely to be one of Ethereum's biggest catalysts and could bring in a significant amount of capital. Setting aside security risks, investors seeking higher returns for native L1 assets will seek opportunities for higher returns, providing an opportunity for Ethereum stakers to re-stake.

Parallel L1s: The popularity of parallel L1 chains (MoveVM, Sei, Monad) is on the rise, optimizing for speed and performance similar to Solana, but they are still young and not yet mature. Monad, built by team members with a background in high-frequency trading, aims to bring Solana-like performance to the EVM environment, theoretically combining "the best of both," with transaction speeds of up to 10,000 transactions per second. However, these chains not only face the challenge of overcoming Solana itself but also have to compete with Neon EVM, which achieves Solana compatibility through an Ethereum-native environment. Aave recently posted a proposal on its governance forum discussing whether to deploy its V3 protocol on the Neon mainnet. Considering all this, we believe Solana's resilience is its greatest strength and long-term catalyst, demonstrating its ability to overcome macro challenges (such as FTX's collapse) or technical shortcomings (such as network outages).

Betting on Solana = Betting on Jupiter

The Jupiter Green Paper states, "Our vision for the future is closely tied to the growth and prosperity of the Solana ecosystem. Our belief drives us to believe that a thriving Solana ecosystem will bring collective benefits to all stakeholders. In short, when the pie grows, everyone gets a bigger slice."

We believe that Jupiter's key role in the Solana DeFi space makes it a viable bet for both short-term and long-term adoption on the network. The viewpoint is quite simple. More users on Solana = more users on Jupiter. The initial prosperity of Solana lasted for about a year (2021), during which protocols like Saber and Serum dominated the DEX space. Jupiter gained traction shortly after its launch, aiming to utilize on-chain liquidity of DEX, rather than stealing market share, to provide a better user experience and better pricing. However, it wasn't until the decline of the once dominant Solana DEX Serum that Jupiter became the market leader it is today.

In 2023, Jupiter has consistently accounted for over 60% of the DEX trading volume on Solana.

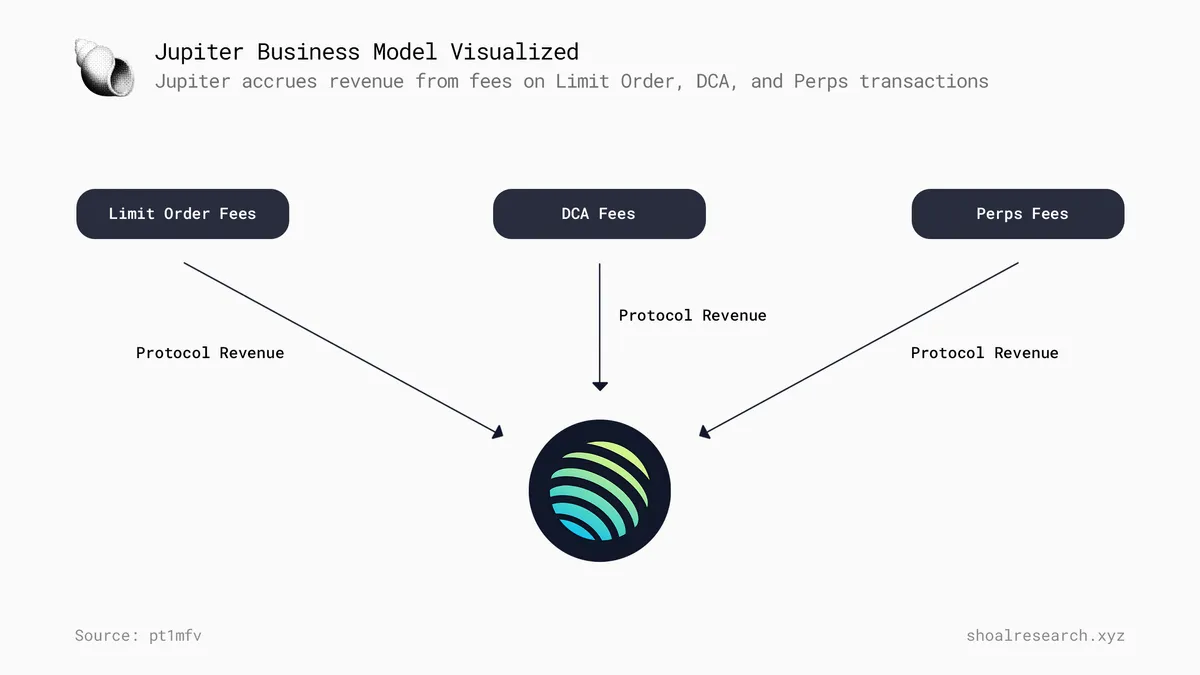

Analysis of Jupiter's Business Model

Initially, Jupiter's core product was just an exchange engine optimized for better pricing, without charging additional fees to traders. As the project grew, with increasing trading volume and traders, the team introduced some new products, which now serve as organic revenue sources for the protocol through fees. We believe that the JUP DAO will naturally find ways to ensure that $JUP holders receive a certain percentage of revenue from these fees, as well as future opportunities from Jupiter Start and Jupiter Labs.

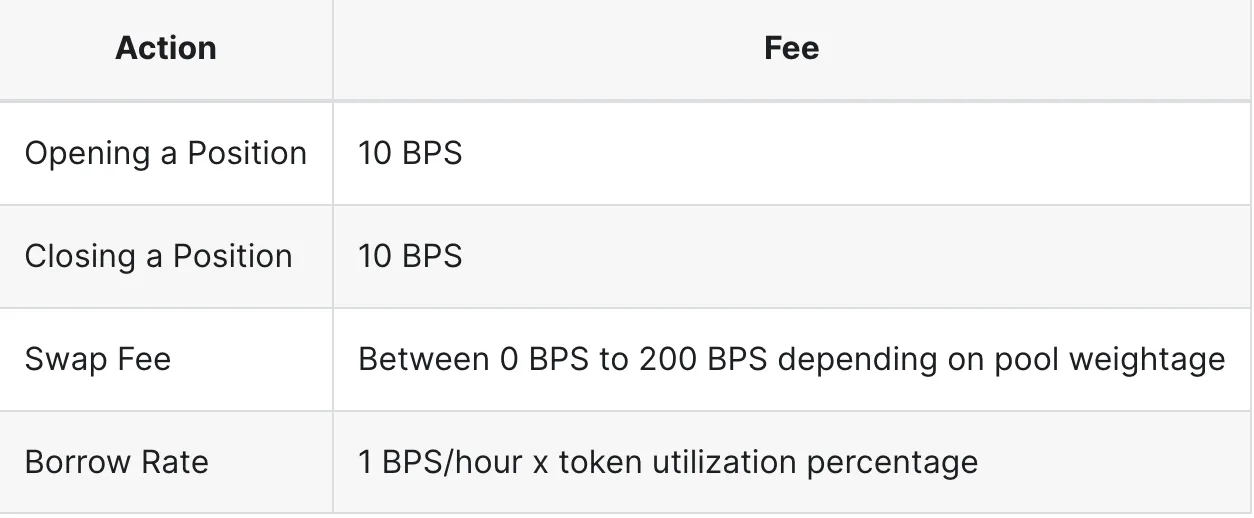

Limit Orders: 30 BPS

DCA: 10 BPS

- This is a unique product, and I believe Jupiter can further capitalize on it by increasing fees (around 20 BPS).

Perpetual Contracts

Opening/Closing: 10 BPS

Exchange Fee: 0 - 200 BPS (varies based on pool weight)

Borrowing Rate = 1 BPS/hour * token utilization %

JLP pools receive 70% of the fees generated by Jupiter perps.

External Protocols

- If a protocol integrates Jupiter's architecture into its software and charges its own fees, Jupiter will also ensure they receive a portion of the fees.

Hypothetical Scenarios

Jupiter Start: We believe it would be wise to create additional revenue streams for Jupiter and $JUP holders through the Jupiter Start program (i.e., Launchpad and Atlas).

Launchpad: Establish a trading flow for projects incubated or operated by Jupiter Launchpad, where a portion of the project's revenue goes to the JUP DAO.

Atlas: Create an effective model to collect revenue from realized gains of public seed fund programs and distribute it to participating holders and investors.

Jupiter Labs - As demonstrated by perpetual contract trading, Jupiter Labs supports protocols that can bring additional revenue to Jupiter.

Another proposal for sUSD is in the works.

An interesting question to consider here is how these initiatives will eventually be independently launched and operated, and how doing so will affect specific revenue streams, as described in Jupiter's documentation.

Exchange Fees

Jupiter's exchange engine has been the core product familiar and beloved by Solana users. However, as the fee dynamics on Solana continue to evolve, and with more smart contracts competing for less block space, trading will undoubtedly become more expensive. Jupiter has positioned itself to allow traders to pay priority fees for faster execution, and if this feature continues to be adopted from this point on, it is reasonable to charge additional fees for the services provided by Jupiter (there is no native method to calculate "base" priority fees).

Competition for Jupiter

Overall, we believe that Jupiter is in a unique position as an aggregator, as there is currently no direct competition with any trading protocol on Solana. Nevertheless, as the Solana DEX ecosystem continues to evolve and the demand for low-latency trading applications grows, Jupiter will naturally face the challenge of keeping up with the latest innovations and developments. Ultimately, traders want better settlements, and they will act accordingly in such a scenario.

Additionally, Jupiter faces greater competition in its other products (such as perpetual contract trading), often incentivizing teams to recreate DCA products or similar products.

The landscape of DEX on Solana is constantly evolving and becoming more competitive. Outside of Solana, the competition is even fiercer.

Jupiter's competitive advantage lies in providing price settlement to users; if a protocol emerges to provide better pricing, users are more likely to go there.

- Exchanges remain the primary use case; exchange engine performance is crucial.

Niche products (Perps, limit orders, DCA) face stronger competition, with competitors able to offer lower fees.

Recommendations for Jupiter

More transparency on fees and revenue, as well as product performance data dashboards, would be helpful for investors.

JUP holders should be the primary beneficiaries of Jupiter's revenue streams (limit orders, DCA, Perps, Jupiter Start + Labs).

Consider leveraging off-chain liquidity (i.e., CEX LP inventory) as well as on-chain liquidity routing models to provide better pricing for users. Similar to 1inch Fusion, Matcha by 0x, CoWSwap, etc.

- This would apply to exchanges, limit orders, and DCA.

Ensure that $JUP holders receive a portion of the revenue generated by Jupiter Labs products and services.

- Ensure that Jupiter Start, whether through launching platform incubations or teams supported by public seed funds, allocates a portion of the fees collected on their protocols to $JUP holders.

Ensure that large-scale airdrop distributions do not dilute the quality of participants representing the JUP DAO.

Future Outlook

Given its unique position in the ecosystem, we believe that Jupiter is a viable bet for both short-term and long-term adoption on Solana.

As network activity on Solana continues to increase, we expect Jupiter to capture a significant amount of liquidity through its established ecosystem presence, various product suites, and sustainable revenue models, which should benefit $JUP holders in the long run.

As Larry Fink begins to talk about tokenization of financial assets, and L1 blockchains like Solana continue to seek product-market fit and explore new practicality and innovation, it's not too far-fetched to imagine Jupiter accommodating various new asset classes over time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。