Restaking (or re-staking) is an innovative process of re-staking the same encrypted assets on Ethereum and other blockchain platforms, providing a new way to establish trust between different networks and enhance the security of the encrypted economy. Despite facing competition from other public chains and threats from decentralized application platforms, Ethereum remains one of the most innovative and developer-rich cryptocurrency platforms.

For example, EigenLayer is a protocol based on the Ethereum blockchain, known for its revolutionary approach to enhancing the security of the encrypted economy. EigenLayer's uniqueness lies in allowing new projects to leverage Ethereum's robust security to validate new application networks through Restaking. This not only strengthens the integrity and resilience of the Ethereum ecosystem but also helps reduce the startup costs of the Ethereum network. The Restaking mechanism in the EigenLayer protocol incentivizes ETH holders to actively participate in extending the security of the encrypted economy to various network applications.

Different from traditional staking mechanisms, EigenLayer's Restaking introduces a more dynamic approach, allowing users to continuously participate in network security. Through Restaking, EigenLayer encourages users to actively adapt and extend the security of the encrypted economy to emerging applications, creating a more robust ecosystem. This mechanism helps validate and promote new applications on the Ethereum blockchain.

Recent data shows that EigenLayer has experienced high transaction volume in the past few months, and the Restaking platform has attracted a large number of active users since its launch in June 2023. According to DefiLlama's statistics, its Total Value Locked (TVL) has grown from $13.3 million in June 2023 to $226.5 million in September 2023.

In this promising field of cryptocurrency, investors and holders are paying close attention as it represents an opportunity to redefine staking. This innovative approach brings more security to the Ethereum ecosystem and provides investors with more opportunities for returns. Apart from the EigenLayer project, the Restaking race also features a series of representative high-quality projects, which will be introduced below.

Kelp DAO: Liquid Restaked Token (LRT) Solution Built on EigenLayer

Kelp DAO, founded by Amitej G and Dheeraj B, who previously established the multi-chain liquidity staking platform Stader Labs, is a new attempt to create a Liquid Restaked Token (LRT) solution based on EigenLayer. The core of Kelp DAO is rsETH, which operates as follows:

- Users stake liquidity staking tokens (LST, such as stETH) and mint rsETH tokens.

- The rsETH contract allocates the deposited LST to node operators collaborating with Kelp DAO.

- rsETH holders can enjoy various rewards from the protocol, including rewards from the LST protocol itself and other Restaking protocols.

In addition, rsETH holders can exchange their rsETH tokens for other supported tokens through AMM or choose to redeem their original assets through the rsETH contract. This versatility makes rsETH a gem in the DeFi world. Besides the core mechanism, Kelp DAO has two notable features:

- Users staking with Kelp can earn Kelp points, indicating the potential release of Kelp's own token. This will bring more incentives and opportunities to Kelp DAO's community members.

- The Kelp team stakes their Ethereum with EigenLayer and distributes points to community members. This means that Ethereum deposits through Kelp will receive a small portion of EigenLayer points and Kelp DAO points as rewards.

Through collaboration with Stader, Kelp DAO has gained support. Although it does not have its own token, we can expect potential synergies between the SD token and Kelp token in the future, such as airdrops. This also explains why deposits through Kelp to EigenLayer have accounted for over 10% of all EigenLayer deposits.

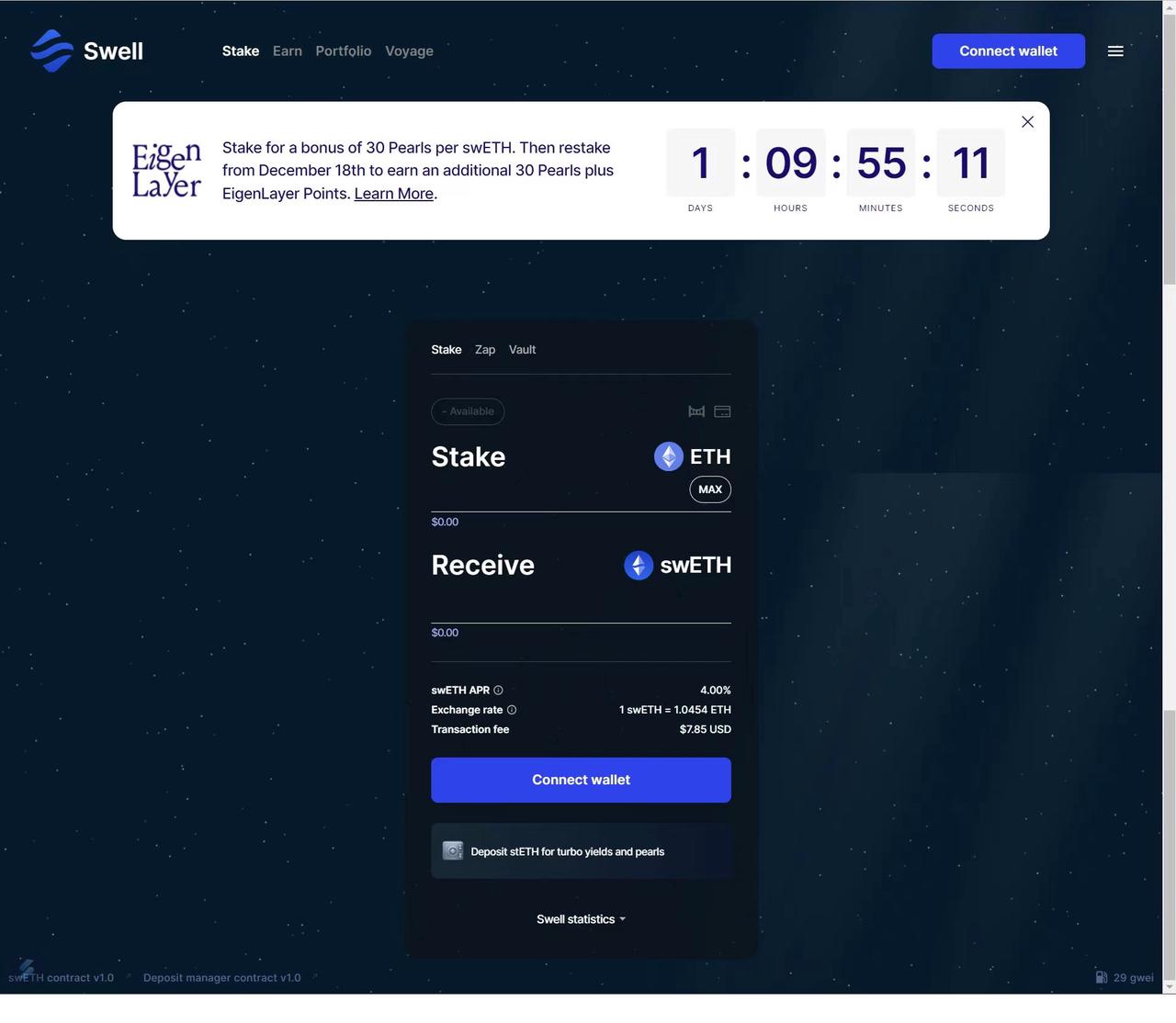

Swell: Attracted Over 140,000 ETH and Offers Restaking Mechanism for Increased Points

Initially, Swell was a protocol similar to Lido for Ethereum staking, aiming to provide a convenient way for users to stake Ethereum. However, with the development of the crypto market and changing trends, Swell has undergone a significant evolution, shifting its focus towards the Restaking field. This transformation not only changed the project's core objectives but also brought more opportunities and value to users and holders.

The core innovation of Swell is swETH, a token closely related to Restaking and LST. The success of swETH cannot be ignored, as it has become the third-largest TVL token on the EigenLayer network, following stETH (from Lido) and ETH, with a staking volume exceeding 110,000 ETH. To better compete in the Restaking field, Swell also introduced a Restake version of swETH, named rswETH. Additionally, Swell established the Liquid Restaking Committee, attracting projects like AltLayer and InfStones to further drive its development in the Restaking ecosystem.

Currently, the Swell protocol has attracted over 140,000 ETH, demonstrating its significance in the crypto world. Although Swell has not issued its own token, it offers a restaking mechanism, providing users with the opportunity to increase their points and incentivizing community members to actively participate in the project.

Initially focused on Ethereum staking, Swell has taken a leading position in the Restaking field on the EigenLayer network as it shifted its focus when EigenLayer opened its deposit doors.

ether.fi: To Release Tokenomic Model in March and V3 Mainnet in Q2

Similar to Swell, ether.fi is another project that has evolved from an LSD protocol to the Restaking field. However, unlike Swell, ether.fi currently focuses on the development of eETH, a token directly staked on EigenLayer without involving other LSD tokens.

According to ether.fi's official introduction, eETH is Restaked through EigenLayer, meaning that the platform's ETH staking has no hard cap limit. eETH obtained from staking ETH not only enjoys ETH staking rewards but also earns ether.fi points and EigenLayer points, providing users with multiple incentives.

As of January 4, 2024, the ether.fi platform has successfully attracted over 47,000 ETH, demonstrating its popularity in the crypto field.

ether.fi has also announced its development roadmap for the first half of 2024, which includes the following key plans:

February: Release DAO framework to lay the foundation for community governance.

March: Release tokenomics document to increase transparency of the token economic system.

April: Conduct Token Generation Event (TGE) to drive project development and community participation.

In addition, the V3 mainnet is planned to be released in early Q2, which will include special features such as the ability for users to run personal nodes using a 2 ETH Bond. These plans demonstrate ether.fi's active efforts to continuously provide more features and opportunities to meet the needs of users and holders, while actively participating in the innovation and development of the crypto field. The vibrant development of ether.fi signifies its importance and potential in the crypto world.

Restake Finance: RSTK Token's Recent Surge Approaches 20x, Attracting Various Major Investors

Restake Finance is the first protocol to introduce modular liquidity staking for EigenLayer. Its core token rstETH is a decentralized 1:1 stETH-anchored rebase token, serving as a yield token that re-stakes holders' stETH through EigenLayer. The modular infrastructure allows holders to choose specific modules (AVS) from which they wish to earn rewards. Currently, Restake Finance has issued 2073 rstETH tokens.

Notably, Restake Finance is one of the few projects that have already released tokens. Previously, Restake Finance conducted an LBP IDO through Fjord Foundry, with the RSTK token's price ranging from approximately $0.21 to $0.55 during the process, and the current price of RSTK has reached $1.79.

Restake Finance focuses on re-staking operations related to EigenLayer.

Additionally, Restake Finance has its native token RSTK, built on Ethereum, with governance, staking, and yield-enhancing functions:

Governance: RSTK holders can participate in the selection process of node operators and AVSs to contribute to the security of Ethereum-related components.

Yield Enhancement: RSTK can be staked to increase the yield generated by EigenLayer. 5% of the accumulated EigenLayer re-staking rewards on the Restake Finance platform will be distributed to stakers, while earning a share of the Restake protocol's income.

Overall, the token's design revolves around staking to earn additional yield, showing outstanding performance in the market. The recent surge of the RSTK token approaches 20x, and although its market value is only $38 million, smart funds are purchasing varying amounts of RSTK daily, demonstrating high market attention and recognition. Restake Finance plays an important role in the Restaking field, providing users with more choices and opportunities through modular liquidity staking, making a positive contribution to the development and growth of the EigenLayer network.

RenzoProtocol: Supports More LSD Tokens, Offers Native ETH Rewards, EigenLayer Points, and ezPoints Rewards

RenzoProtocol announced the official launch of the Renzo ezPoints rewards program on January 4, 2024, aimed at incentivizing and rewarding users who contribute to the protocol. The first way to earn Renzo ezPoints is through minting ezETH tokens, and in the future, as the re-staking ecosystem matures, Renzo will release more ways to earn points.

RenzoProtocol was initially launched in October 2023 as a re-staking protocol based on EigenLayer. Its core token ezETH aims to simplify users' re-staking process, allowing users to automatically earn rewards and maintain liquidity. ezETH not only enables user participation in DeFi activities but also retains re-staking rewards.

RenzoProtocol is part of the EigenLayer ecosystem, focusing on providing Liquid Restaked Tokens (LRT) and a strategy management platform to support the security of Actively Validated Services (AVS) and offer higher yields than ETH staking.

The operation of RenzoProtocol is similar to Kelp DAO mentioned earlier, but it supports more LSD tokens and provides native ETH rewards, EigenLayer points, and ezPoints rewards.

According to a report on December 20, 2023, RenzoProtocol and Rio Network (Rio is a platform specialized in liquidity re-staking, accepting all EL LSTs and ETH in exchange for the platform's LRT reETH) are jointly committed to addressing the challenges faced by EigenLayer. They have adopted a structured approach to select high-quality node operators and AVS service providers to enhance network security and reduce the barriers to user participation.

In the fields of LSD and Restaking, security audits and strategic partnerships are crucial. RenzoProtocol has collaborated with partners such as Figment, Gauntlet, Biconomy, Balancer, and Wormhole, which is one of the reasons for its sharp increase in staking volume. The launch of Renzo ezPoints will further incentivize users to actively participate in the re-staking ecosystem, contributing to the growth and development of the EigenLayer ecosystem.

Babylon: Completes $18 Million Financing, Integrates 39 Chains, and Will Launch Scalable Restaking Feature

On December 7, 2023, the Bitcoin staking protocol Babylon announced the successful completion of an $18 million financing round, led by Polychain Capital and Hack VC, with participation from Framework Ventures, ABCDE Capital, IOSG Ventures, Polygon Ventures, and OKX Ventures.

Babylon's uniqueness lies in using Bitcoin as an economic security token to support blockchain consensus mechanisms using proof of stake. Traditionally, proof of stake chains would use native tokens for staking, which could lead to security issues if the native tokens on the chain are not popular. Babylon's solution maximizes the value of Bitcoin for purposes beyond store of value.

Babylon first entered the testnet in January 2023, has integrated 39 chains, and is set to launch a scalable restaking feature. The project aims to unlock the earning potential of 21 million Bitcoins, extending Bitcoin's security to more POS decentralized worlds, making Bitcoin a productive asset rather than just a hard currency.

The first phase of staking has been successfully completed, and the development progress of the second phase is highly anticipated. Babylon plans to launch the mainnet before the Bitcoin "halving" event, depending on the security audit results of the Babylon testnet.

Additionally, Babylon is committed to extending the security of Bitcoin to the data availability layer and Layer2 of Bitcoin. The Bitcoin DA protocol will utilize Bitcoin's block space to provide additional security for proof of stake chains. Babylon's Layer2 will provide higher efficiency and lower transaction fees for the entire ecosystem.

In summary, as a new force in the Bitcoin ecosystem, Babylon not only develops Bitcoin staking into an important earning method but also expands the Bitcoin ecosystem, providing more opportunities and returns for Bitcoin holders. Through continuous innovation and expansion, Babylon will drive the development of the Bitcoin ecosystem, bringing new opportunities and possibilities to the entire cryptocurrency industry.

LiNEAR: Liquidity Staking Protocol on the Near Chain, Achieving an Annualized Yield of 8.35%

LiNEAR is a liquidity staking protocol built on the Near Protocol. The Near Protocol mainnet was launched in August 2020 and is a sharded, proof-of-stake-based Layer 1 blockchain. Its core design includes sharding technology, dividing the network infrastructure into several parts to allow nodes to process only a portion of network transactions.

The key advantage of LiNEAR is its ability to automatically monitor and adjust validators' delegations to ensure competitive and stable overall returns, currently achieving an annualized yield of 8.35%.

The restaking strategy involves three tokens: $NEAR, $LiNEAR, and $bLiNEAR. Users can stake $NEAR to receive $LiNEAR tokens, which can be further used in various DeFi protocols within the Near and Aurora ecosystems, significantly improving the capital efficiency of $NEAR stakers. $bLiNEAR is a derivative token for liquidity restaking introduced by LiNEAR, where users stake $NEAR into the $bLiNEAR staking pool to receive $bLiNEAR, representing their restaking of $NEAR.

$bLiNEAR can be used in various DeFi protocols, including restaking lending and providing liquidity. Its significant advantage is the ability to quickly convert back to $NEAR, avoiding the usual long lock-up and unstaking delays.

As the governance token of the protocol, users can deposit $LNR into the insurance fund, and stakers will receive $sLNR, representing their share in the fund. $sLNR holders have the right to set staking pool fees, manage authorization strategies, oversee the protocol treasury, and share a portion of the protocol's income, which will increase with the development of the ecosystem.

Currently, LiNEAR is preparing for an airdrop of $LNR tokens for existing $LiNEAR users and early $bLiNEAR holders. Users can lock $NEAR before a specific date and automatically receive $bLiNEAR upon expiration. Locking in early will result in receiving more $LNR tokens, increasing potential returns.

Picasso Network: Enabling Asset Restaking Across Multiple Chains and Supporting Multiple Layer1 Ecosystems

Picasso Network is a multi-chain ecosystem support platform focused on facilitating cross-chain communication (IBC) between ecosystems such as Polkadot, Kusama, Cosmos, and plans to expand to other networks like Ethereum and Solana. However, the project's current focus is on enabling liquidity restaking opportunities within the Solana ecosystem through IBC functionality.

Amidst intense competition in the liquidity restaking field on Ethereum, the Solana ecosystem may provide an alternative, with Picasso Network being one of the alternative projects.

The goal of Picasso Network is to support multiple Layer1 ecosystems primarily through cross-chain communication between ecosystems such as Polkadot, Kusama, Cosmos, and plans to expand to other networks like Ethereum and Solana. However, the project is currently focused on filling the gap in the liquidity restaking field within the Solana ecosystem through IBC functionality.

Picasso Network recently launched LST$DOT and $lsDOT tokens, which will be used for restaking to ensure security. Specifically, Picasso Network is introducing a Restaking Vault program similar to EigenLayer on Solana. The execution is as follows:

Provide Solana validators through Picasso's Solana>IBC connection.

Users can restake Solana liquidity staking tokens (such as Marinade, Jito, Orca, Blaze, etc.) to the validators.

Earn restaking rewards while securing the network.

It is worth noting that the liquidity staking rate on Solana is lower than on Ethereum, with approximately 8% of SOL still not staked, indicating potential growth opportunities in the liquidity restaking field.

Considering that the Solana ecosystem has not performed as well as Ethereum-related projects in the past week, Picasso Network has a relatively high market value of around $100 million. However, due to its IBC features and primary focus not limited to liquidity restaking, its market value cannot be directly compared to similar projects on Ethereum.

Given that the Solana ecosystem has not attracted as much market capital as Ethereum-related projects in the past week, Picasso Network can be considered as an alternative investment choice. It is important to observe whether market capital will flow into the Solana ecosystem before making any decisions.

Layerless: Launching Testnet in Q1 Based on Omnichain Multi-Chain Application System

With the support of EigenLayer and LayerZero, Layerless is an innovative Omnichain Liquid Restake protocol. To better understand Layerless, let's first briefly understand the background of Omnichain assets.

Omnichain is a multi-chain application ecosystem built on LayerZero, aiming to separate the underlying multi-chain architecture from application layer products, allowing end users to seamlessly interact with the entire blockchain ecosystem without worrying about the complexities of different public chains. In the Omnichain ecosystem, user assets will have greater consistency and security, as well as crucial composability.

Assets on Omnichain can be divided into two categories based on their fungibility: Omnichain Fungible Tokens (OFT) and Omnichain Non-Fungible Tokens (ONFT).

Layerless is dedicated to creating an Omnichain Restaked Token (ORT) as part of the Omnichain ecosystem. When users deposit LSTs (such as stETH, cbETH, or rETH) into EigenLayer, they will receive a corresponding amount of ORT, representing their share in EigenLayer. This gives ORT liquidity, composability, and the ability to be used in various DeFi protocols.

To ensure that ORT tokens can be used across multiple chains, Layerless adopts the LayerZero OFT (Omnichain Fungible Token) standard. In addition to Ethereum, Layerless also supports the application of ORT tokens on other chains such as L2 Arbitrum, Optimism, Base, Metis, zkSync, Linea, and more.

Currently, Layerless plans to launch a testnet in the first quarter, providing users with the opportunity to experience and participate in this innovative Omnichain Liquid Restake protocol.

Assessing the Risks of the Restaking Track, Considerations for Participating in Corresponding Projects

Restaking, as an emerging concept in the crypto space, is providing stakers with more opportunities to join different networks and increase their returns. EigenLayer claims to be the "Airbnb of decentralized trust," highlighting the attractiveness of this opportunity. However, restaking is not without risks and introduces a range of potential issues that require careful consideration.

Risk 1: Staking the original asset (ETH or LST) makes the token illiquid.

Risk 2: Smart contract risks in EigenLayer.

Risk 3: Protocol-specific slashing conditions.

Risk 4: Liquidity risk.

Risk 5: Centralization risk.

The key issue with restaking is that it combines existing staking risks with additional risks, creating multi-layered risks. This also makes the development of new projects more complex and challenging.

In addition to the risks faced by individual stakers, the Ethereum developer community also has concerns about restaking, as it introduces new risk pathways for Ethereum, using a portion of ETH to secure other chains. This could lead to issues, especially when other protocol rules have vulnerabilities or low security, potentially leading to their deposits being slashed.

Restaking projects are seeking a way to coordinate and ensure that Ethereum is not weakened by these technological advancements. Meanwhile, restakers need to manage risks, so many projects allow users to audit and select which validators to stake with to reduce the likelihood of malicious network attacks.

The emergence of restaking opens up new use cases for Ethereum as a financial instrument. However, the concerns raised by Vitalik and others need to be taken seriously, as they involve the security model of the Ethereum mainnet.

Furthermore, the decision of whether restaking is worth participating in is a personal one. This field involves collusion risks, slashing risks, single points of failure, and centralization risks, requiring careful consideration. Institutions are also showing interest in restaking, but they may stake through custodians rather than risk using services that could increase slashing risks.

Ultimately, the restaking field holds great potential but also requires caution and risk management. It may change the game rules in the crypto market, but a thorough analysis of potential risks and returns should be conducted before deciding to participate. Restaking represents a constantly evolving narrative theme in the crypto market, and the importance of liquidity in this field will never diminish.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。