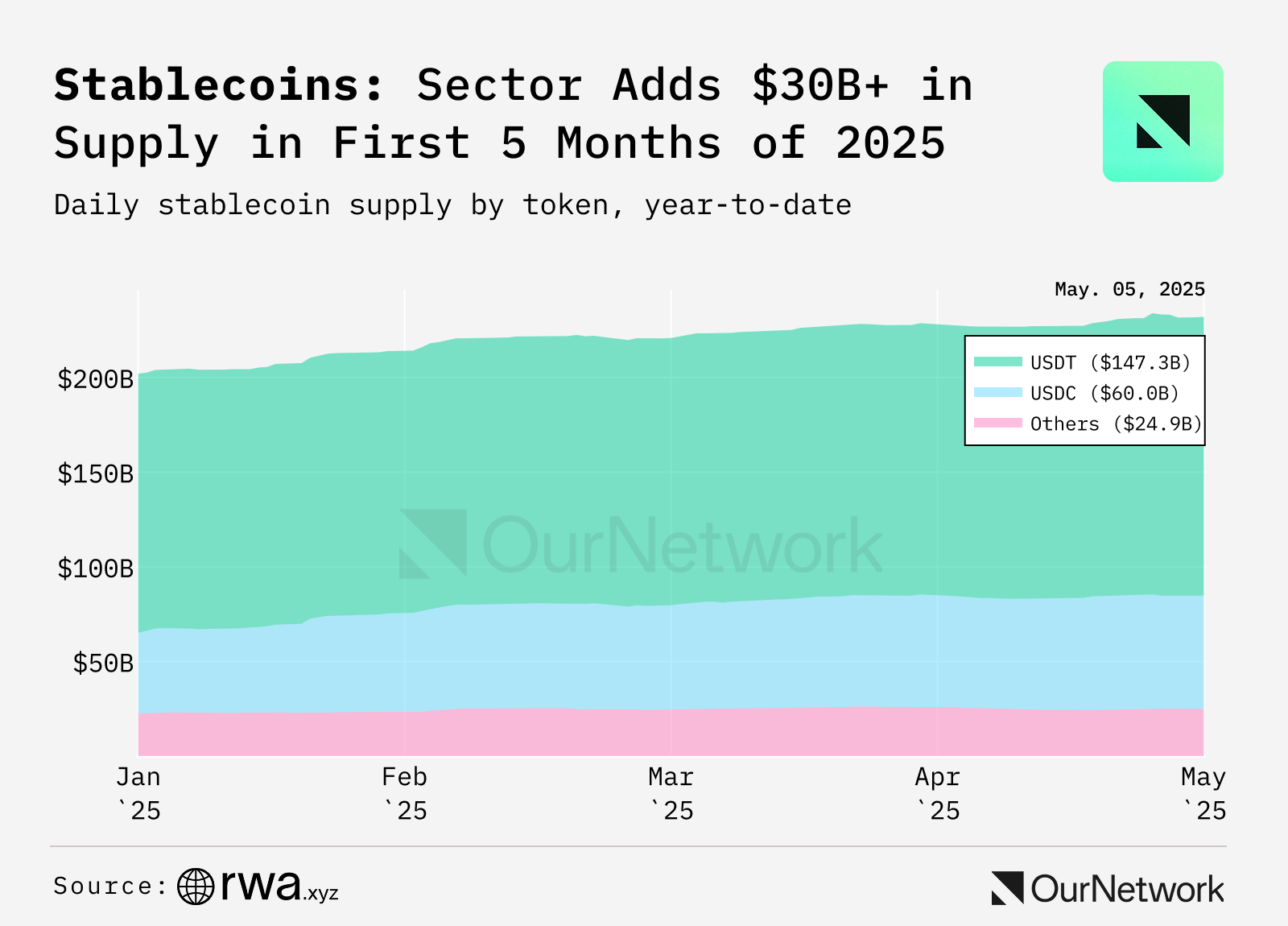

USDT and USDC still dominate, with a combined market share of 89%.

Author: OurNetwork

Translation: ShenChao TechFlow

Editor’s Note:

In this article, we will focus on another giant with a market cap exceeding $10 billion, USDC, and update the latest developments of Ethena's dual stablecoin products—USDe and USDtb. Additionally, analysts from OurNetwork will provide insights into the current state of stablecoins on Solana, infrastructure updates (account abstraction is coming soon), and reports related to USR. USR is an emerging dollar-pegged asset with a market cap exceeding $250 million and employs a delta-neutral support mechanism.

If there were any doubts before, it is now clear that stablecoins have become an essential part of the financial landscape. Tether achieved over $1 billion in operating profit in Q1 2025. The issuer of USDC, Circle, has also submitted a listing application. Even the World Economic Forum estimates that the trading volume of stablecoins reached $27.6 trillion in 2024, surpassing the combined total of Visa and Mastercard.

Next, let’s delve deeper.

Second Article in the Stablecoin Series

Stablecoin market cap surpasses $23.2 billion in 2025, growing 15% year-to-date

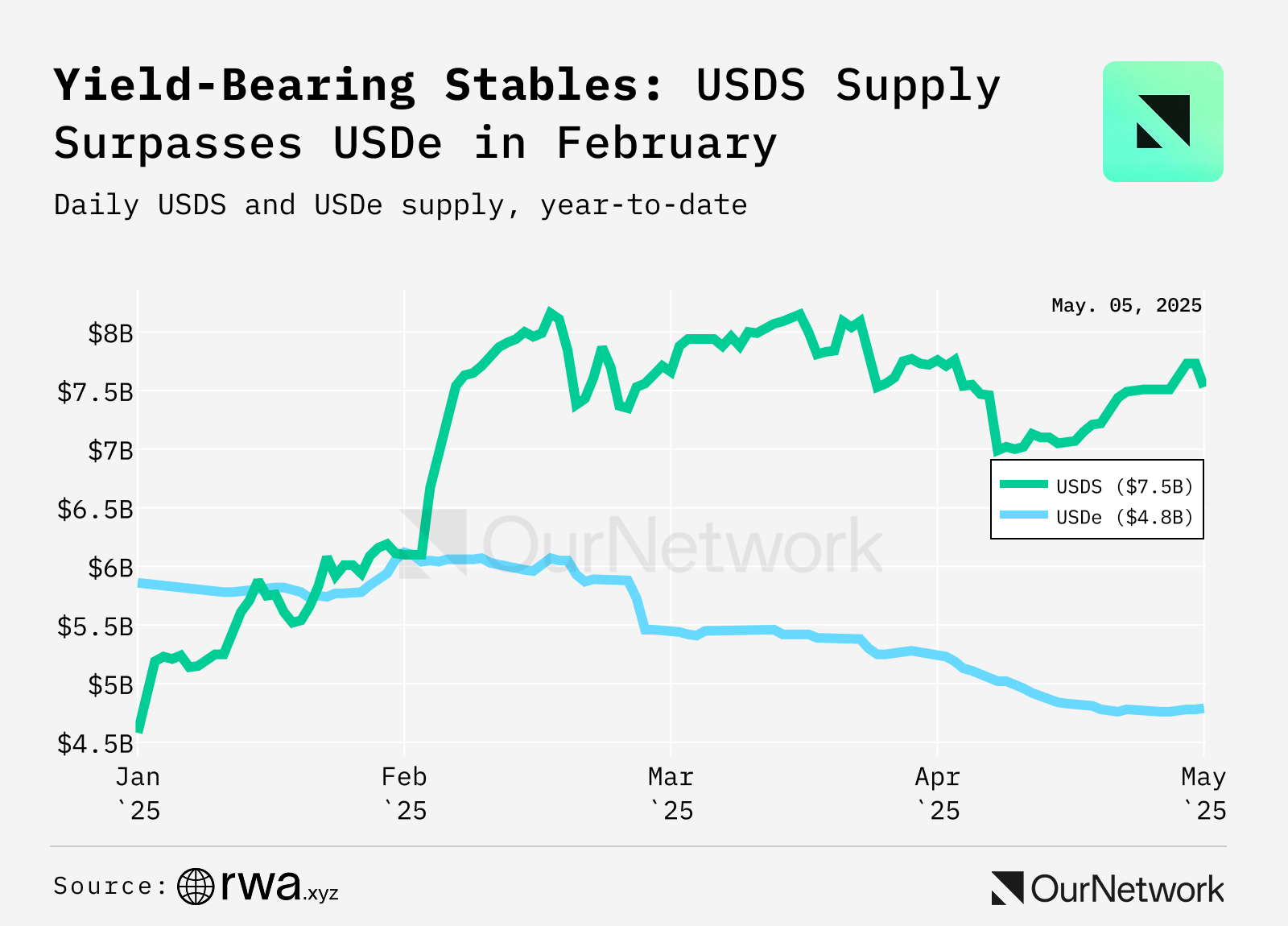

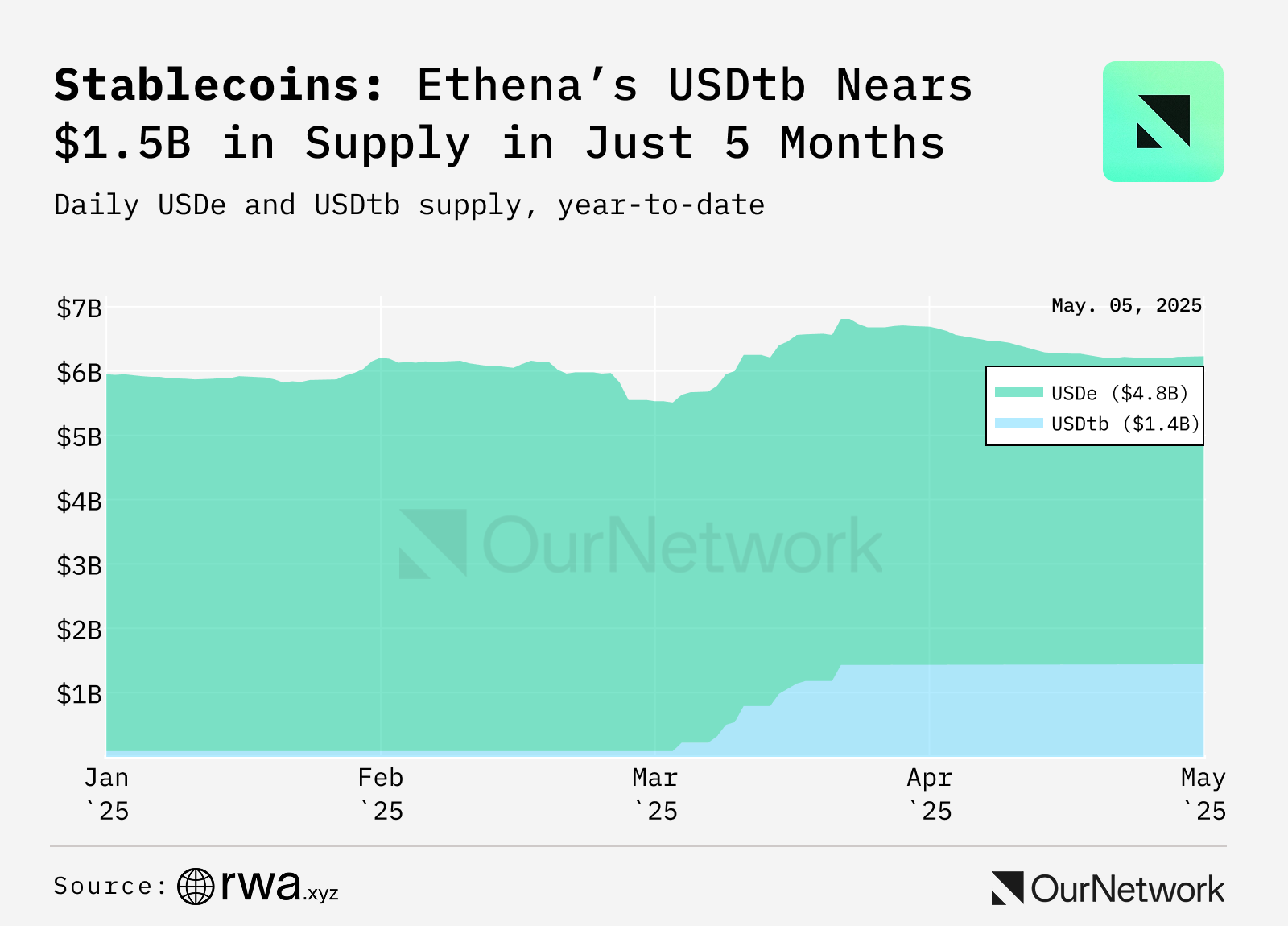

In 2025, the stablecoin market grew by $3 billion, reaching a total market cap of $23.2 billion. USDT and USDC still dominate, with a combined market share of 89%. However, due to delisting events related to MiCA (the EU's Markets in Crypto-Assets Regulation), USDT's market share dropped from 68% to 62%, while USDC rose to 26%. Sky's USDS and USDtb, issued by Ethena and backed by U.S. Treasury bonds (primarily BlackRock's BUIDL fund), performed exceptionally well among yield-bearing stablecoins, growing by over $4 billion. The market cap of USDtb surged from $8.9 million to $1.4 billion, reflecting its important role as a safer choice during market volatility within the Ethena ecosystem.

Sky's USDS surpassed the supply of Ethena's USDe in February. As market conditions worsened and the yield from staking USDe dropped from double-digit highs to single digits, the supply of USDe decreased by over $1 billion. Meanwhile, the supply of USDS grew by nearly $3 billion, benefiting from its more stable and predictable returns.

Although both assets are issued by Ethena, USDtb is backed by BlackRock's BUIDL fund, making it a safer alternative to USDe. When the funding rate for perpetual contracts turned negative, Ethena closed its delta-neutral positions and transferred assets to USDtb. The supply of USDe decreased by 18%, while USDtb surged by 1510%.

Solana Stablecoins

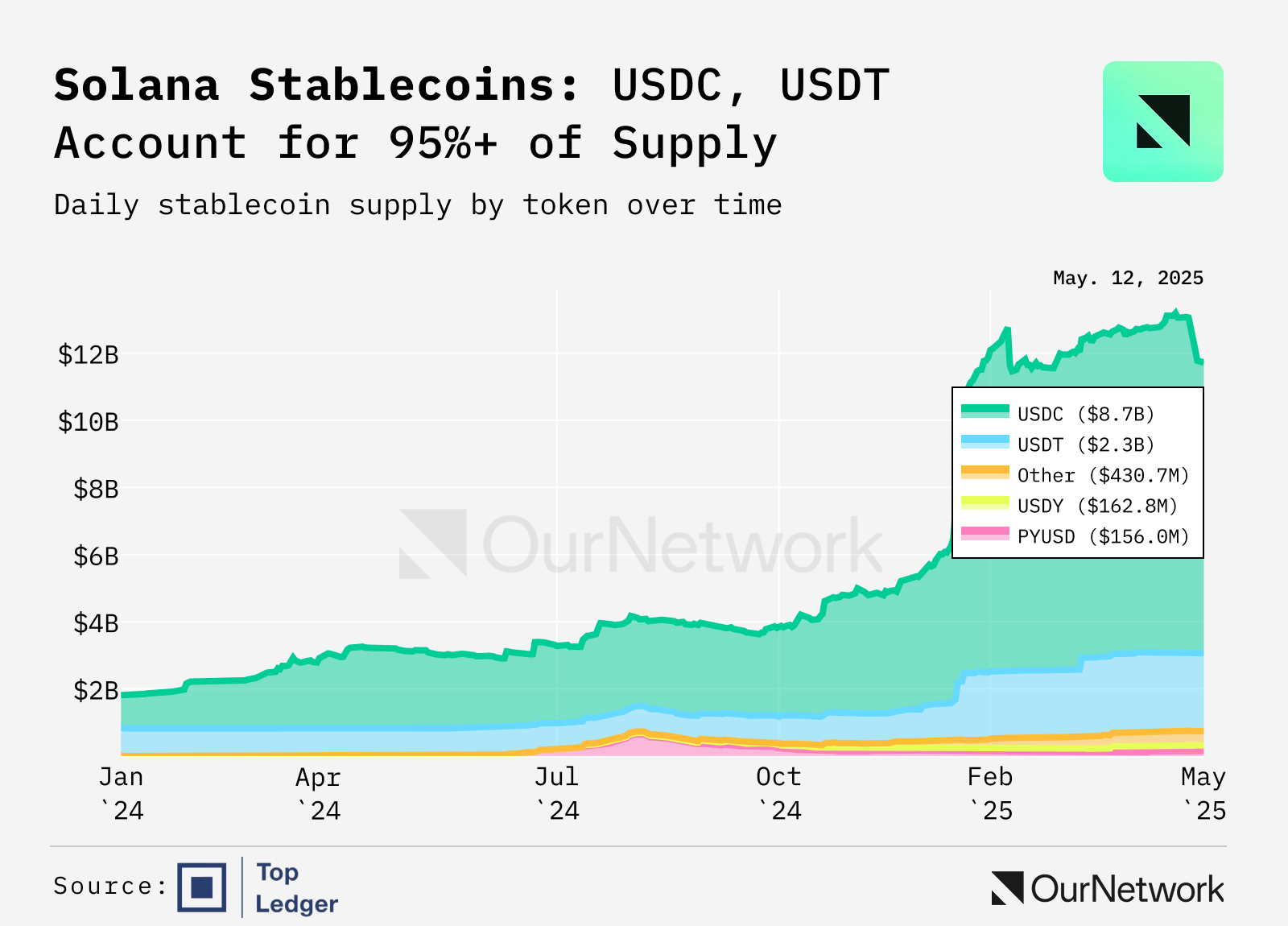

Slight decline in Solana stablecoin supply since January peak, but peer-to-peer trading volume remains active, reflecting faster liquidity and a healthy DeFi ecosystem

Circle's USDC dominates the Solana stablecoin market, holding nearly 80% market share.

USDC, USDT, PYUSD, USDY, USDS, FDUSD, and AUSD are the most popular stablecoins on Solana, all pegged to the U.S. dollar. As of March 14, the total value of U.S. dollar-pegged stablecoins on Solana exceeded $11.7 billion.

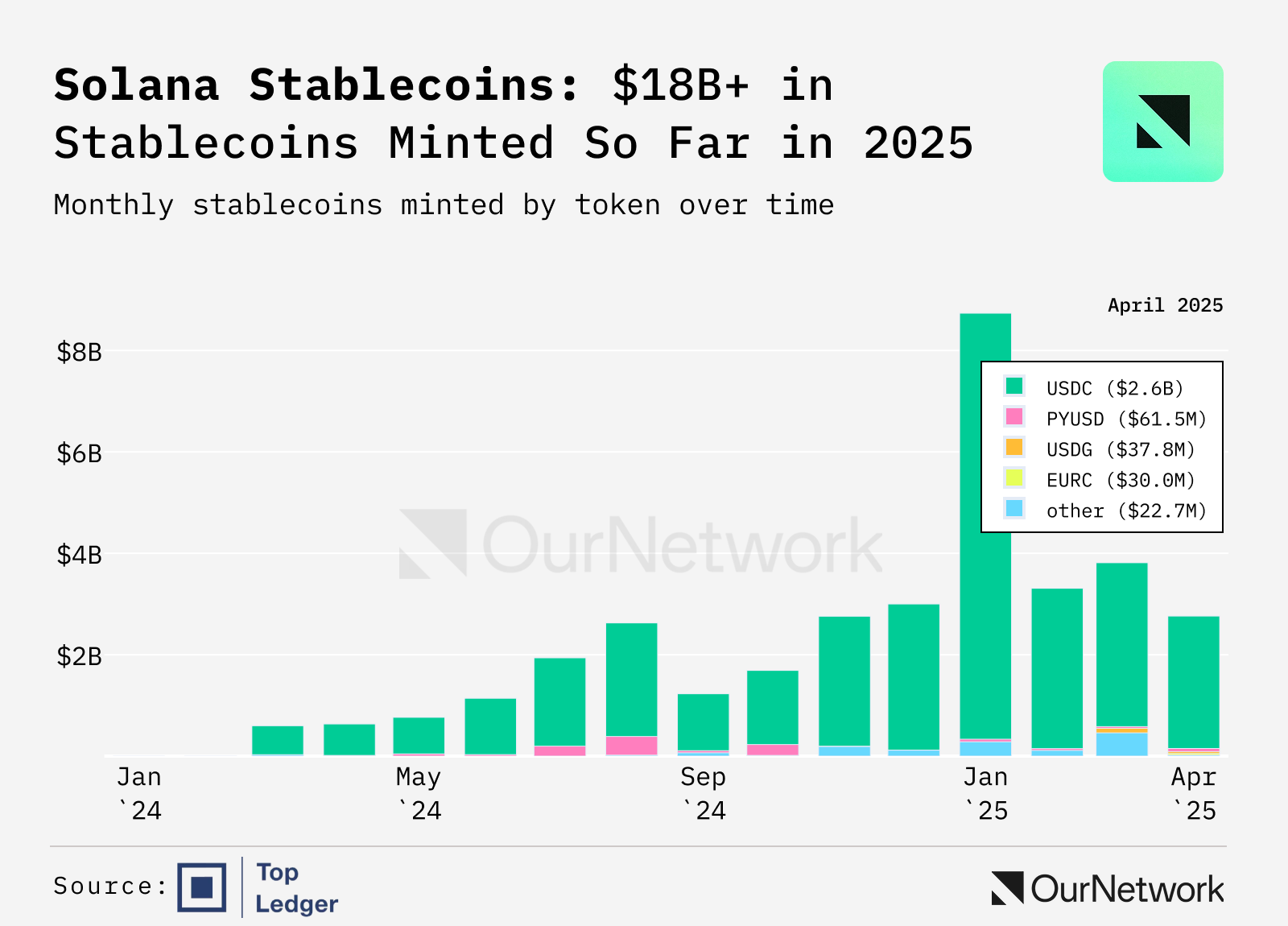

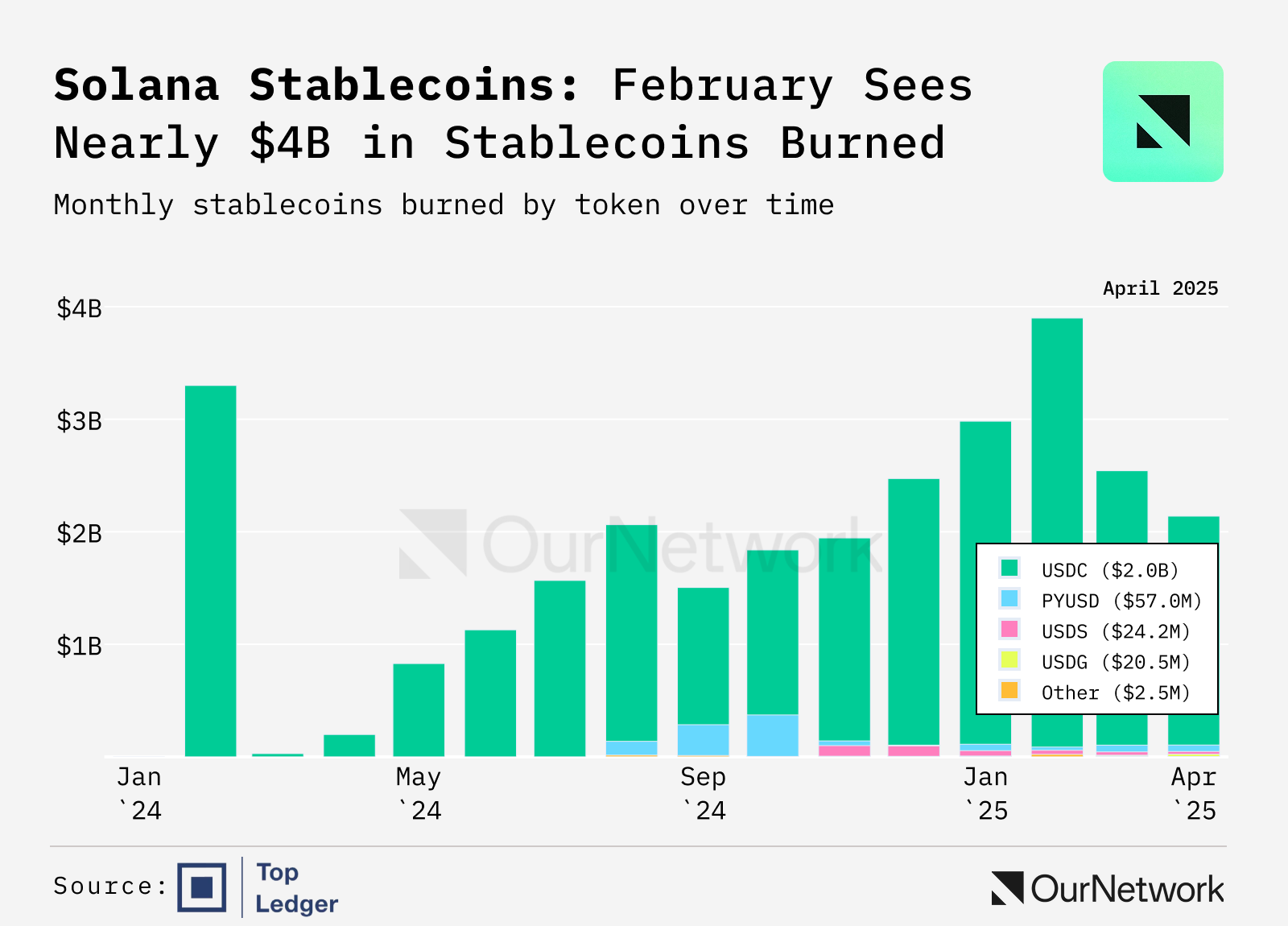

The following chart shows the monthly burn and mint activities of stablecoins. It can be observed that January 2025 was a breakthrough month, with minting activity being twice that of burning activity.

Stablecoin Infrastructure

Robust payment infrastructure drives increased use cases for stablecoins

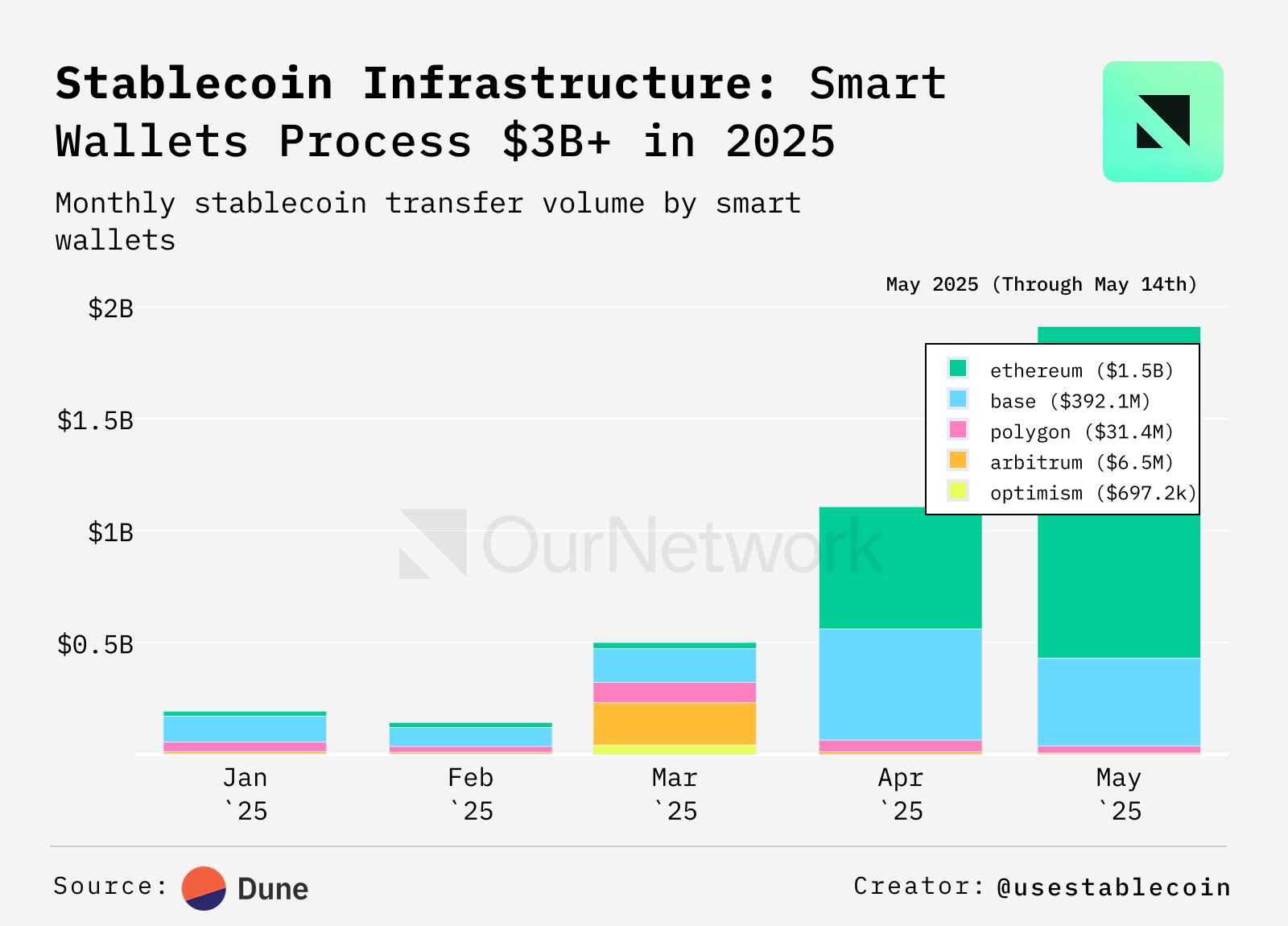

Since 2025, wallets supporting Account Abstraction have processed over $2.4 billion in stablecoin transactions, involving 4.46 million transactions. These smart wallets simplify user experience through gasless transactions, key management, and recovery modules. Among them, Base leads with over $1 billion in transaction volume and the highest number of active wallets, while Polygon has the highest transaction volume (193,000), indicating strong performance in microtransactions or application-driven activities.

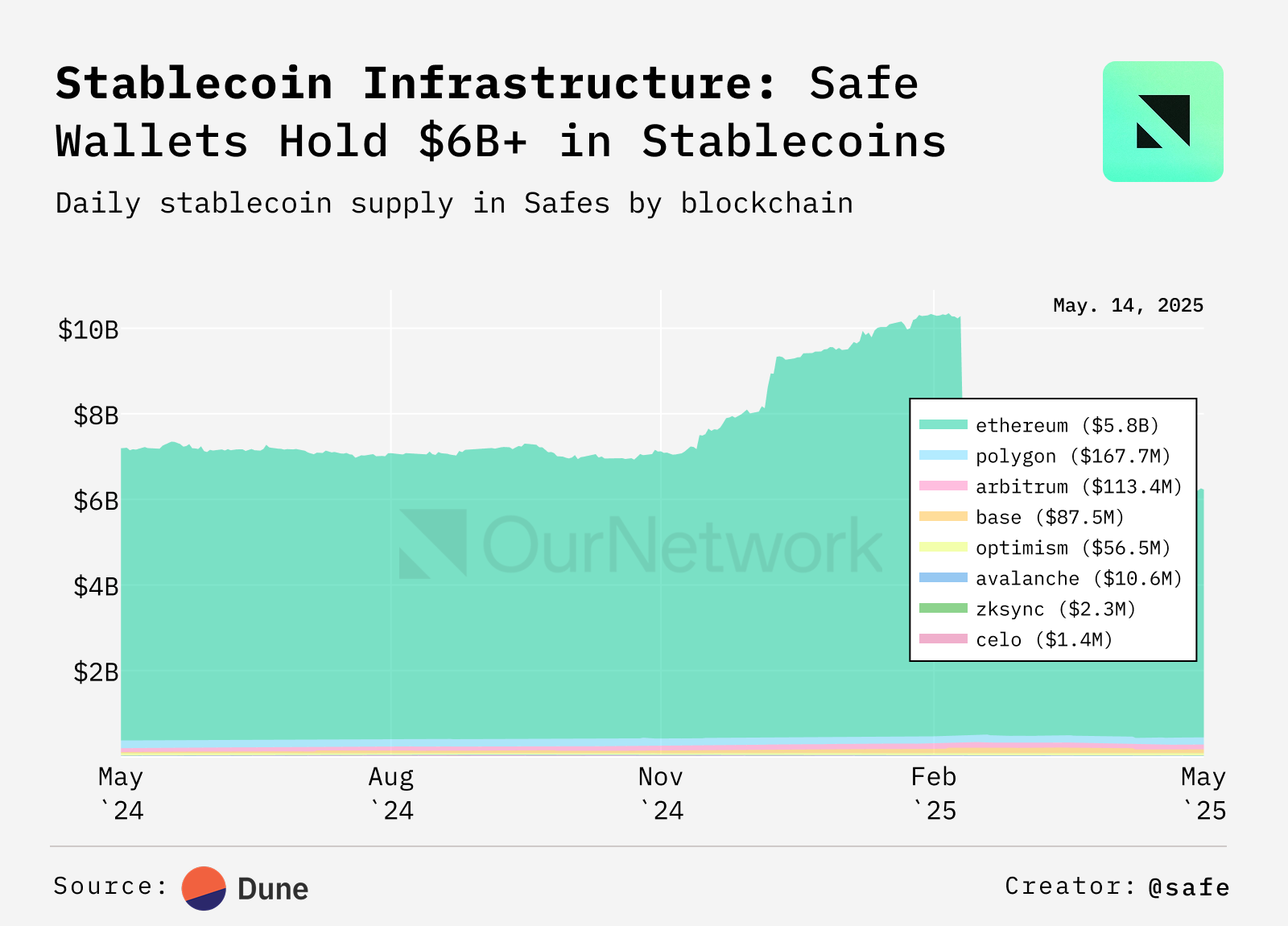

In the Ethereum ecosystem, Safes are the most widely adopted smart accounts. To date, they have stored approximately $6.2 billion in stablecoins and processed over $30.3 billion in stablecoin transactions across 17 blockchains since 2024.

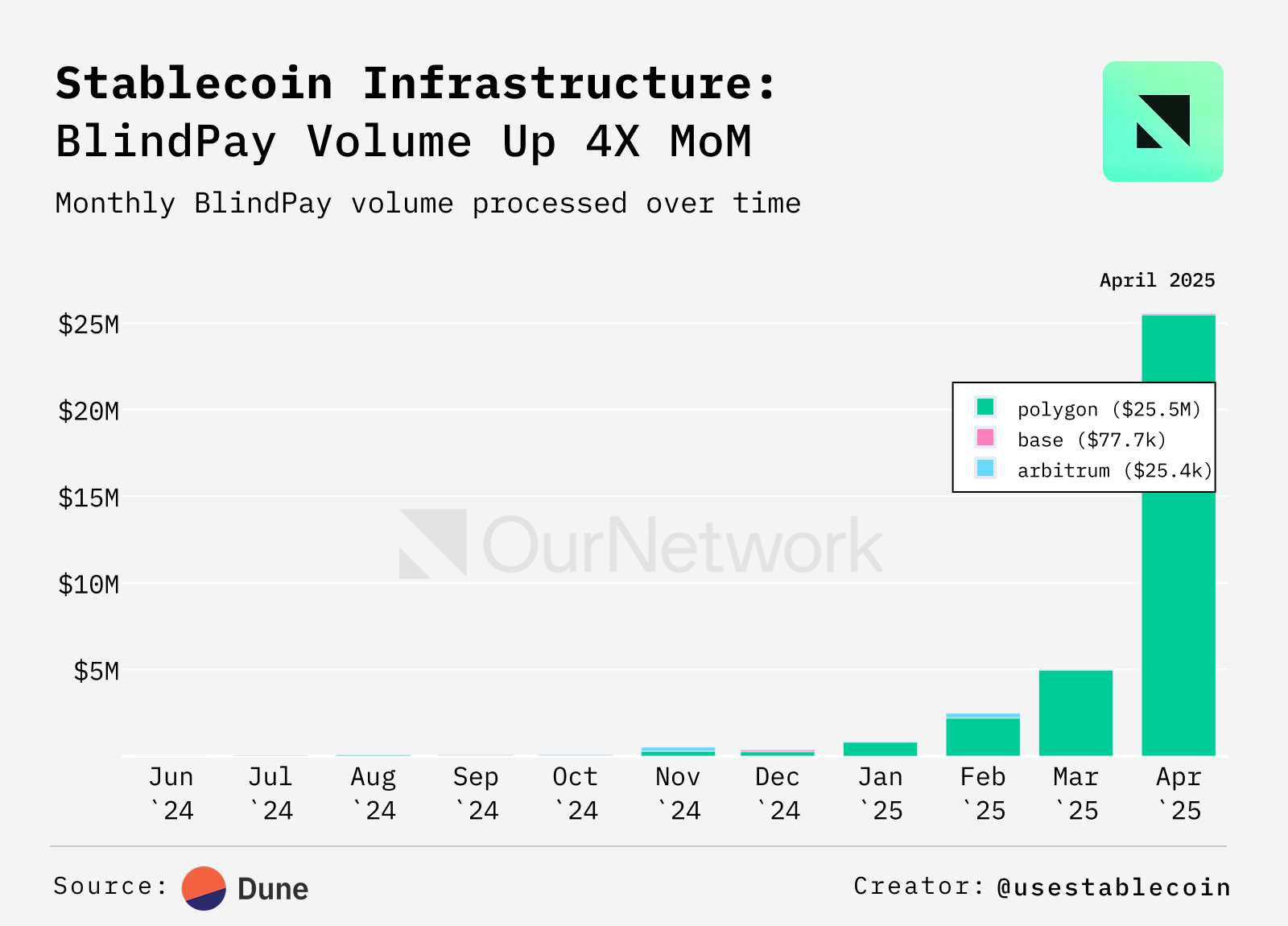

The YC-backed startup Blindpay offers a unified multi-track payment API. It has processed $39 million in USDC and USDT, with 95% of transactions occurring on Polygon. Growth was rapid in 2024, with April's transaction volume being 30 times that of January.

USDC

Circle's supply increased by 80% year-on-year

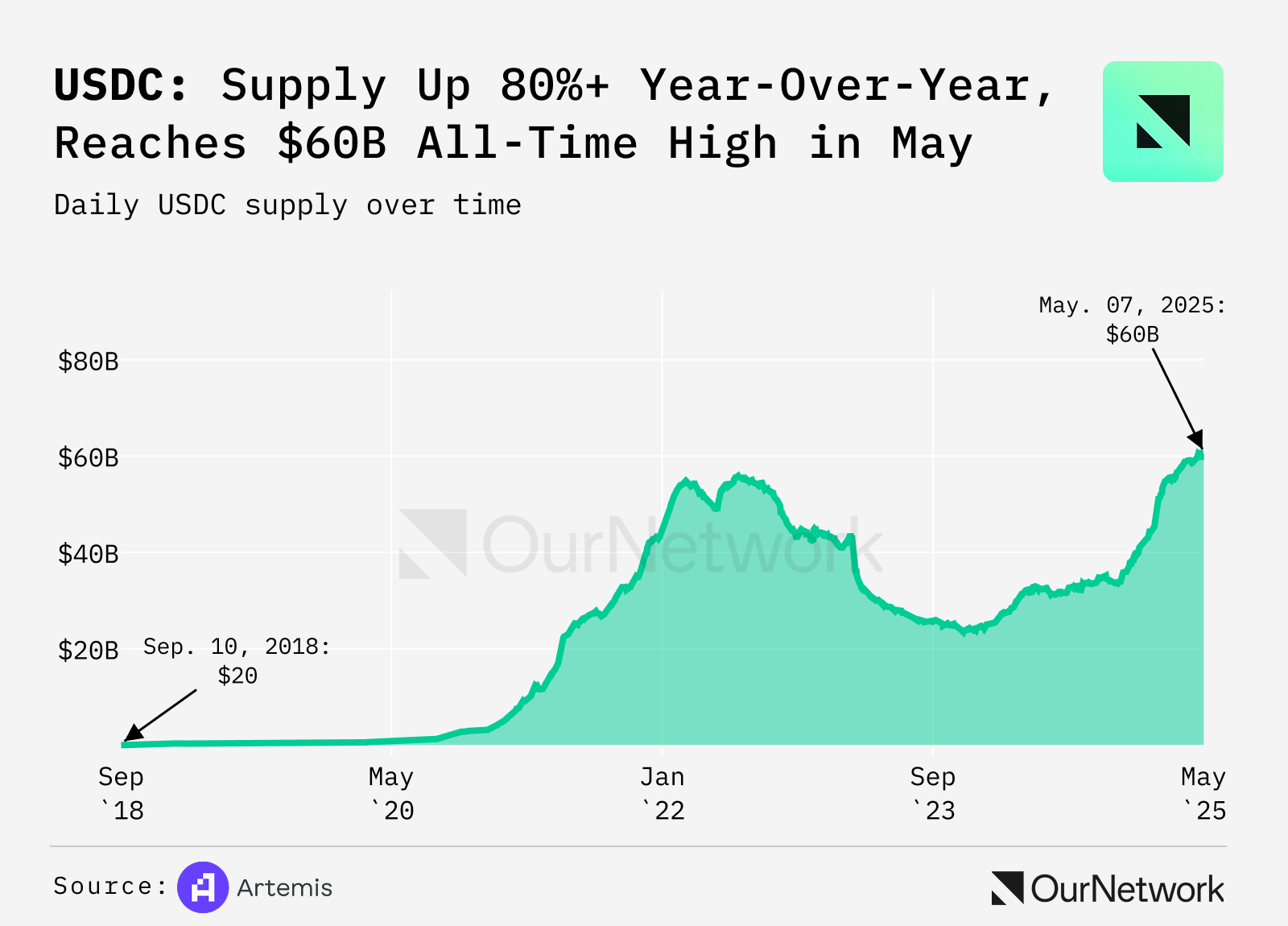

With the growing popularity and use cases of stablecoins, Circle's USDC has accelerated its growth, with supply exceeding $60 billion, up 80% year-on-year. USDC's market share in the stablecoin market has steadily increased from 20% in April 2024 to 25% in April 2025. This growth is attributed to significant expansions in ecosystems (such as Layer 2 like Base) and exchanges (like Binance).

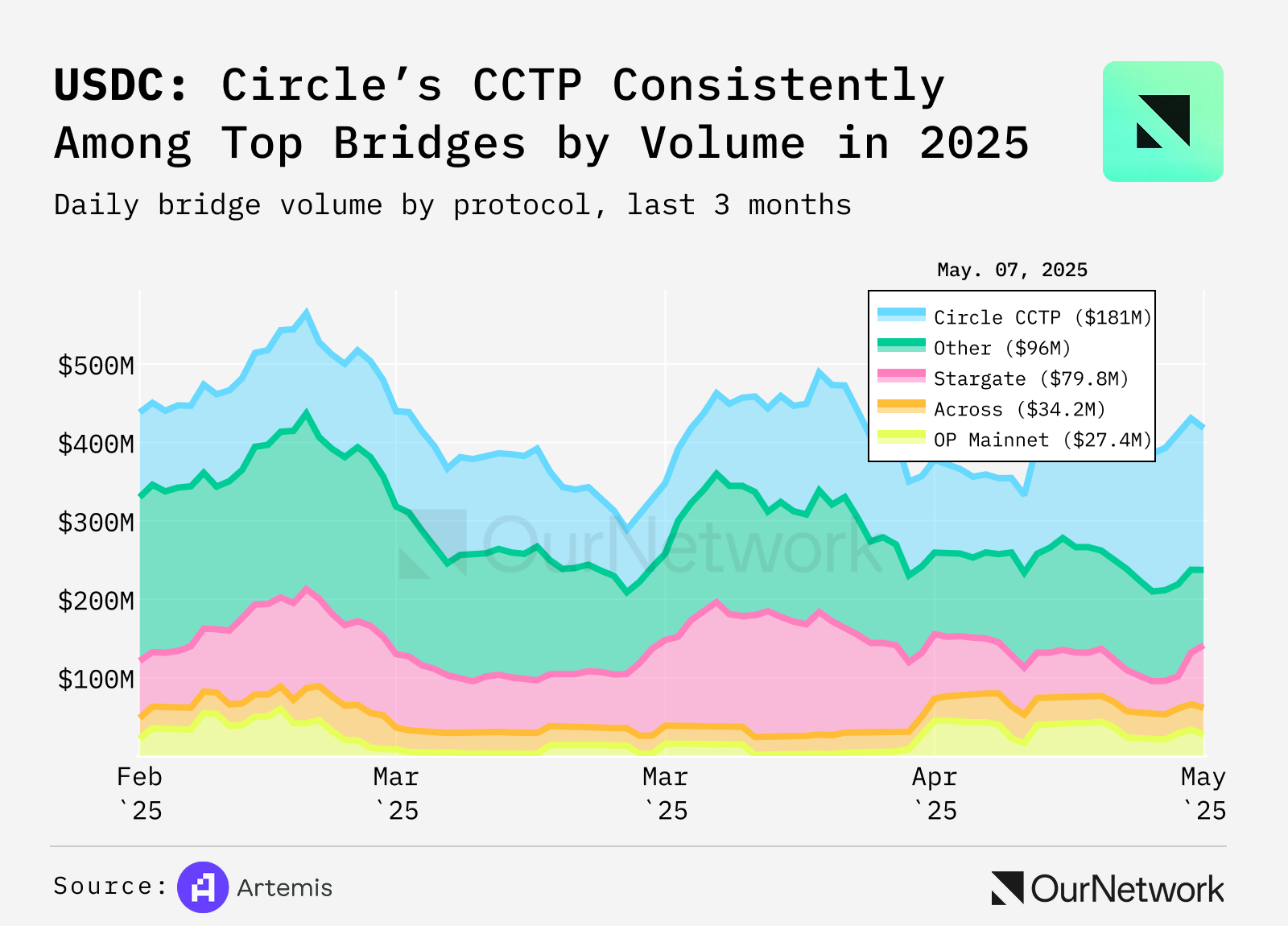

Circle's CCTP (Cross-Chain Transfer Protocol) is one of the key factors driving USDC's growth. According to Artemis data, its transaction volume consistently ranks at the top of cross-chain bridges. CCTP allows users to transfer USDC across chains, and its weekly transaction volume has reached a three-month high, exceeding $200 million.

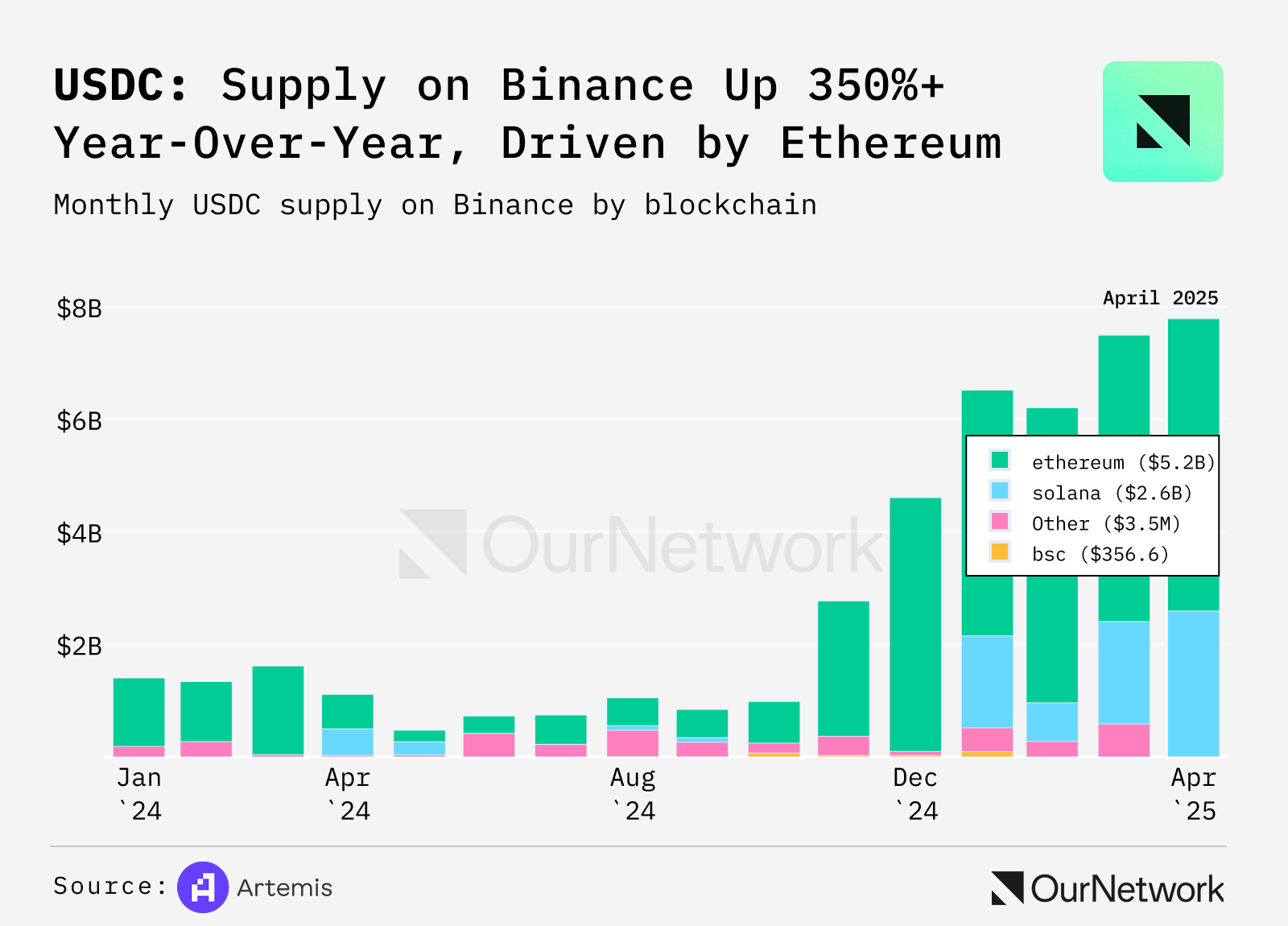

Since Circle and Binance announced their partnership last year, the supply of USDC on Binance has quadrupled. Solana and Ethereum have become the main networks used by Binance. Additionally, USDC trading pairs have secured a stable position among the top 10 trading pairs on Binance for the first time.

USR

The success of Resolv proves the feasibility of a fully on-chain, delta-neutral stablecoin architecture

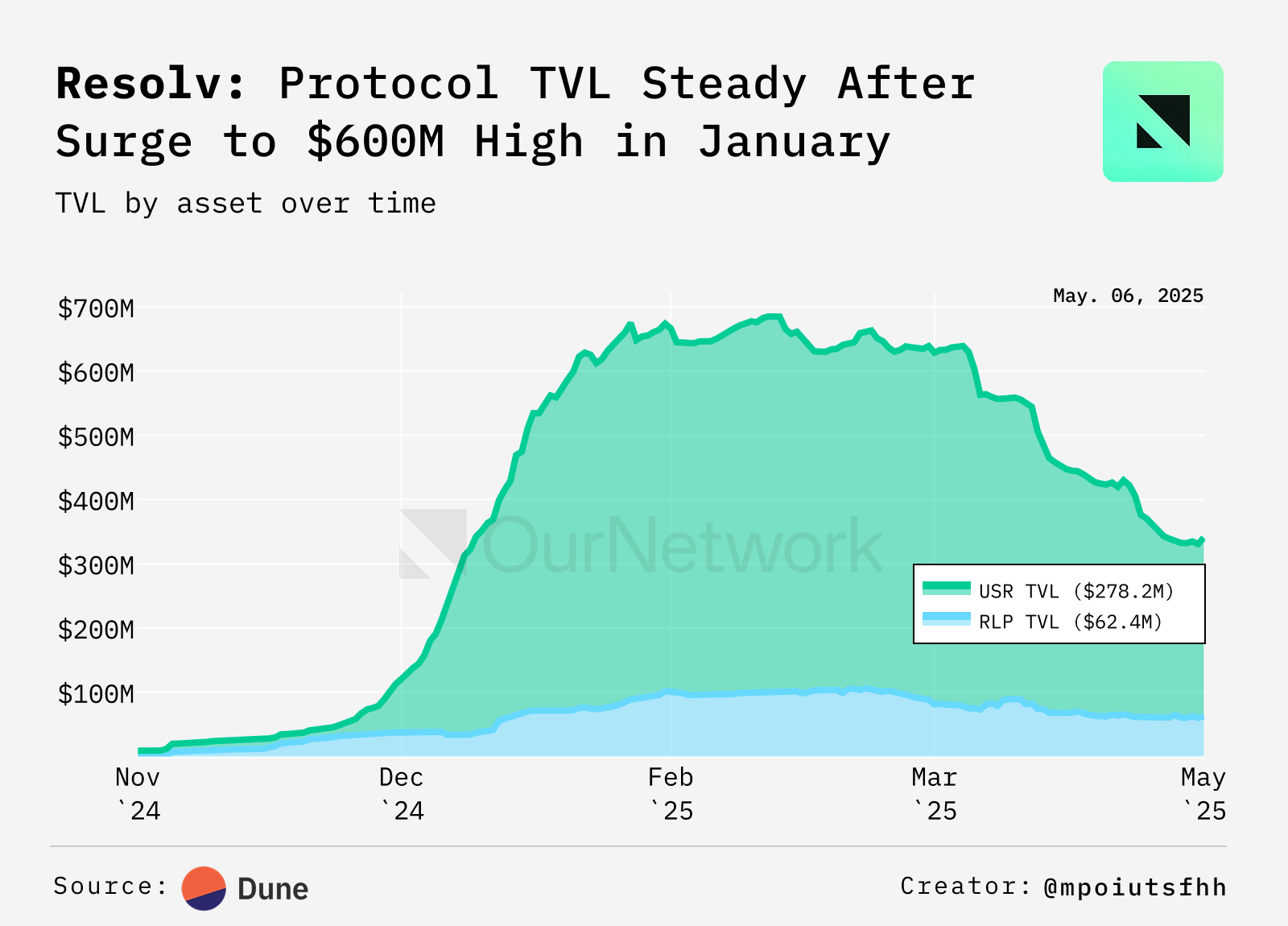

Resolv is a crypto-native stablecoin protocol that issues USR, a token pegged to the U.S. dollar, supported by crypto assets and hedged through short perpetual contracts to maintain a delta-neutral state. Market and hedging risks are borne by the high-yield token RLP, thereby maintaining the stability and capital efficiency of USR. This structure has driven rapid growth—Resolv's total value locked (TVL) skyrocketed from $10 million at the end of 2024 to over $600 million at the beginning of 2025, but had fallen below $400 million by mid-year. This peak reflects strong market confidence in the delta-neutral stablecoin design.

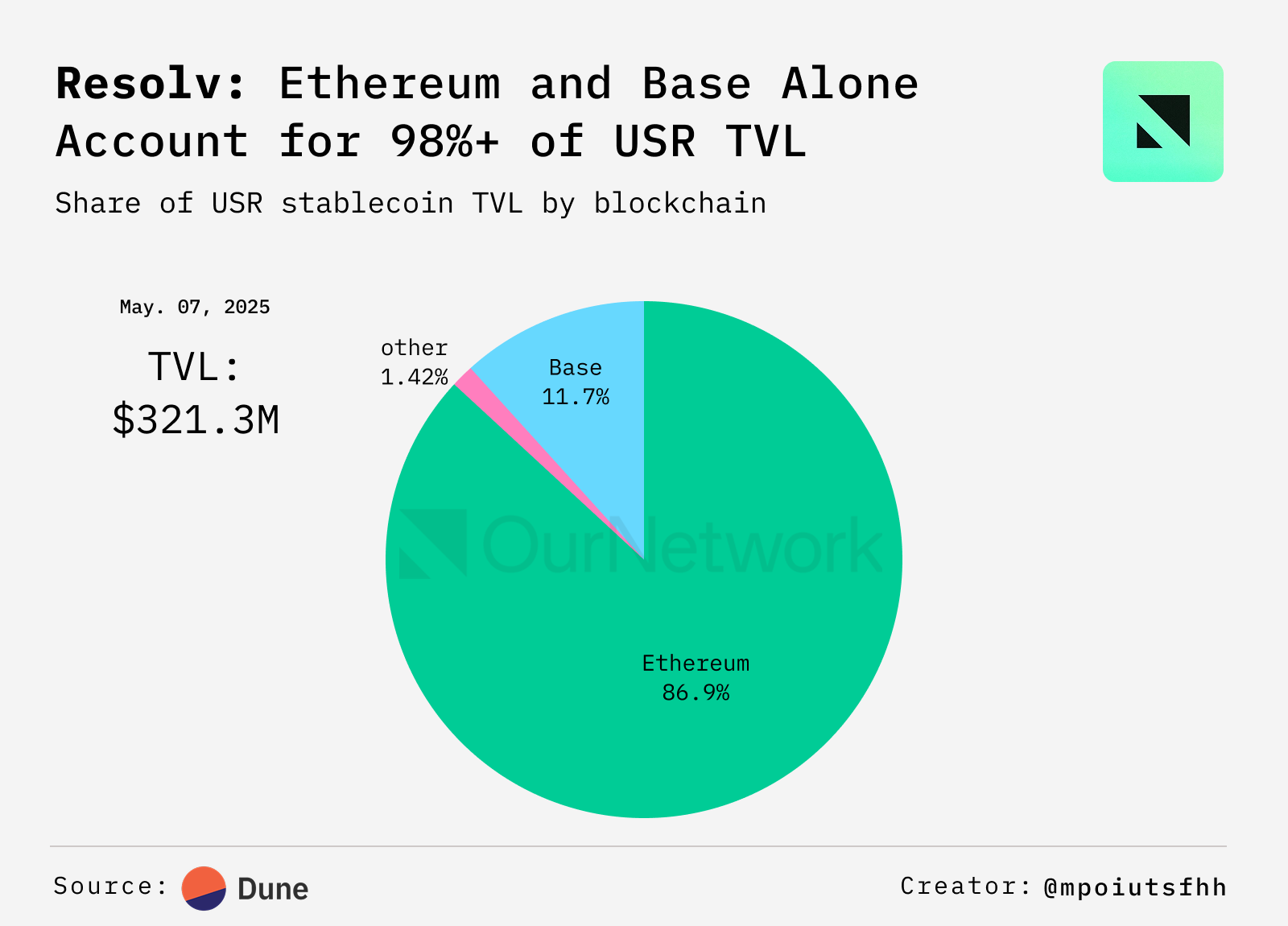

The supply of Resolv's USR stablecoin remains largely concentrated on Ethereum, indicating strong demand and deep integration within DeFi infrastructure. At the same time, Resolv is expanding to Base, Arbitrum, BNB Chain, and Berachain, showcasing its strategic efforts to enhance cross-chain interoperability.

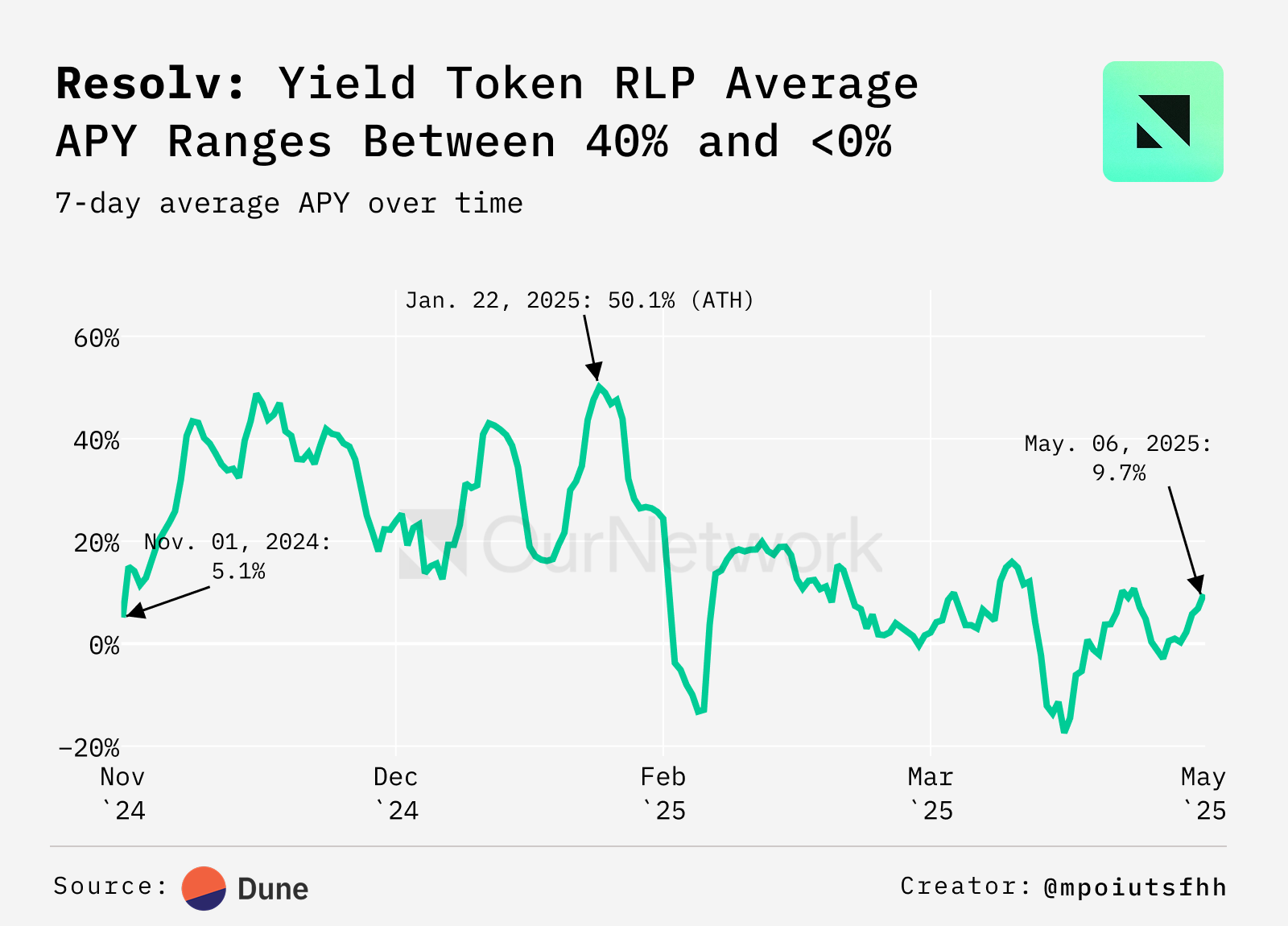

The annual percentage rate (APR) of RLP exceeded 40% at the end of 2024, then fell below 0% in April 2025. This volatility reflects RLP's role in absorbing systemic shocks and providing yield. Negative yields indicate that the delta-neutral strategy has failed due to market changes and negative funding rates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。