The launch of parallel EVM in Sei V2 has brought a new narrative.

1. Fundamental Analysis

1. Basic Information

Sei is built on Cosmos SDK and Tendermint Core, and is a Layer 1 blockchain targeting the DeFi field, aiming to bring the order book model onto the chain, thereby narrowing the speed gap between DEX and CEX, and becoming the "crypto Nasdaq".

Sei is a general-purpose chain focused on trading, rather than an application-specific chain. In other words, Sei is a blockchain optimized for trading, achieving this positioning through features such as order matching system, native matching engine, Twin-Turbo consensus, and transaction parallelism:

(1) Core - Order Matching System and Native Matching Engine:

As a "born for trading" Layer 1, Sei does not solely adopt any one of AMM or traditional order book mechanisms when processing transactions, but instead chooses a set of compromise solutions - Central Limit Order Book (CLOB). CLOB constructs an order matching engine at the lower level of the chain structure, attempting to solve this problem by "embedding" the order book in the chain (Sei does not manage the order book, but only provides an order matching framework). Various DeFi protocols built on top of Sei can utilize this order matching engine. One major problem in the existing DeFi ecosystem is the fragmented liquidity of each DeFi protocol, but with Sei, all DeFi protocols share an order matching engine that can provide deep liquidity.

To illustrate, suppose there are "Red Dex" and "Blue Dex" on SEI. If user A submits an order to sell 1 ETH at a price of $2,000 on Red Dex, and user B submits an order to buy 1 ETH at market price on Blue Dex, Sei's order matching engine will match these two orders. Generally, the DeFi network suffers from fragmented liquidity because each DeFi protocol tends to maintain its own liquidity. However, with Sei, it provides a very deep liquidity pool, consolidating all liquidity related to the matching engine, thereby minimizing users' financial losses due to slippage and other associated impacts.

(2) Twin-Turbo Consensus: Twin-Turbo consensus includes two functions: 1) Smart block propagation for efficient block propagation; 2) Optimistic block processing to improve scalability by reducing block time.

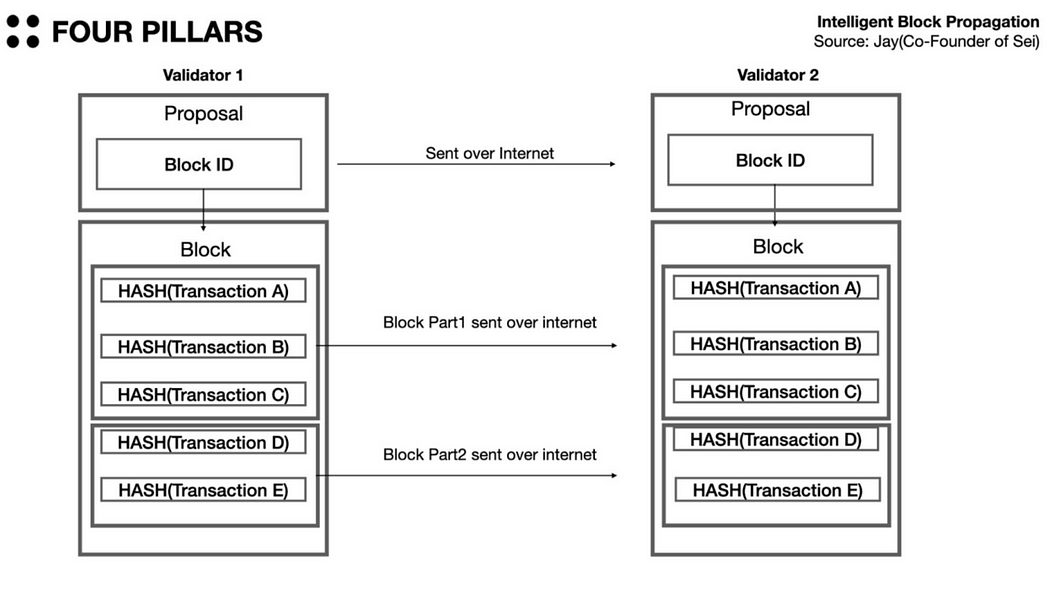

1) Smart block propagation: In a typical blockchain network, block proposers collect transactions in their local memory pool, form them into a block, and propagate it to the network. During this process, a single block containing all transaction data is propagated to the network, meaning that even if full nodes already have almost all transactions, conventional blockchain networks still propagate blocks with the same transaction data. This is a waste of bandwidth.

In Sei, block proposers do not include transaction data in block proposals, but rather the hash value of the transactions, along with the block ID, which is a reference to the block. The hash value of the transactions is a summarized hash function of the existing transaction data, thus having the advantage of small volume. Block proposers first propagate the block proposal to the network, as shown in the figure below, and then divide the complete block into smaller blocks for propagation. If a validator receives a block proposal from a block proposer and already has all the transactions corresponding to that hash value in its local memory pool, they will reconstruct the block from their local memory pool, rather than waiting for the complete block to arrive. If a specific validator loses a transaction in its local memory pool (very unlikely), it can wait for the entire block to arrive.

Source: Four Pillars, Jay-Sei Labs

The benefit of this smart block propagation process is that it significantly reduces the time required for validators to receive blocks. According to co-founder Jay, this process has been proven to increase Sei's overall scalability by 40%.

2) Optimistic block processing:

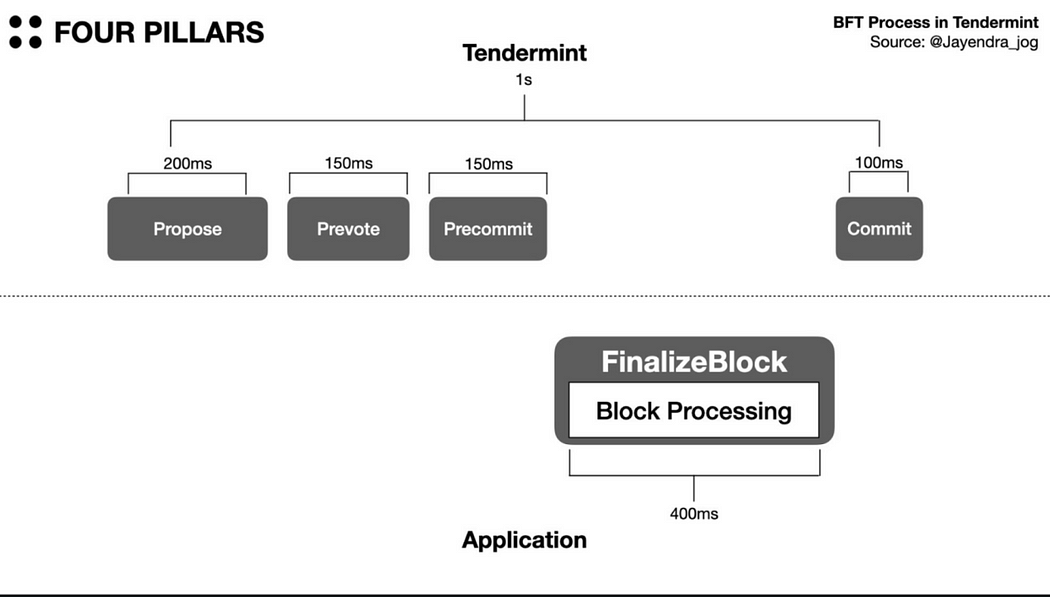

Sei uses Tendermint Core, but has made some modifications to significantly reduce block time and improve scalability. Tendermint Core is a consensus engine that combines Delegated Proof of Stake (DPoS) and PBFT consensus algorithms. The Tendermint BFT consensus process is: Propose — — Prevote (2/3 consensus) — — Precommit (2/3 consensus) — — Commit

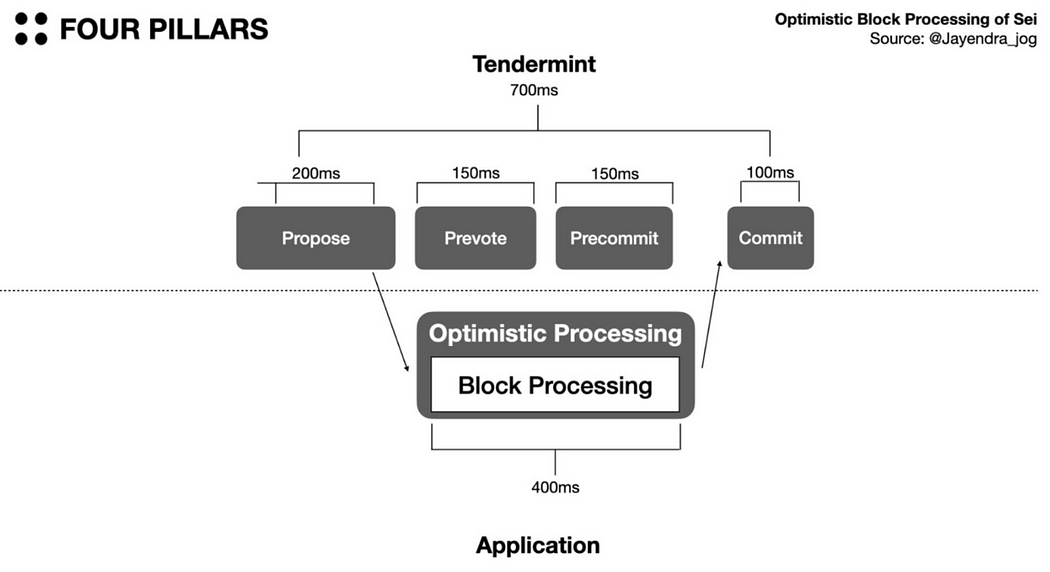

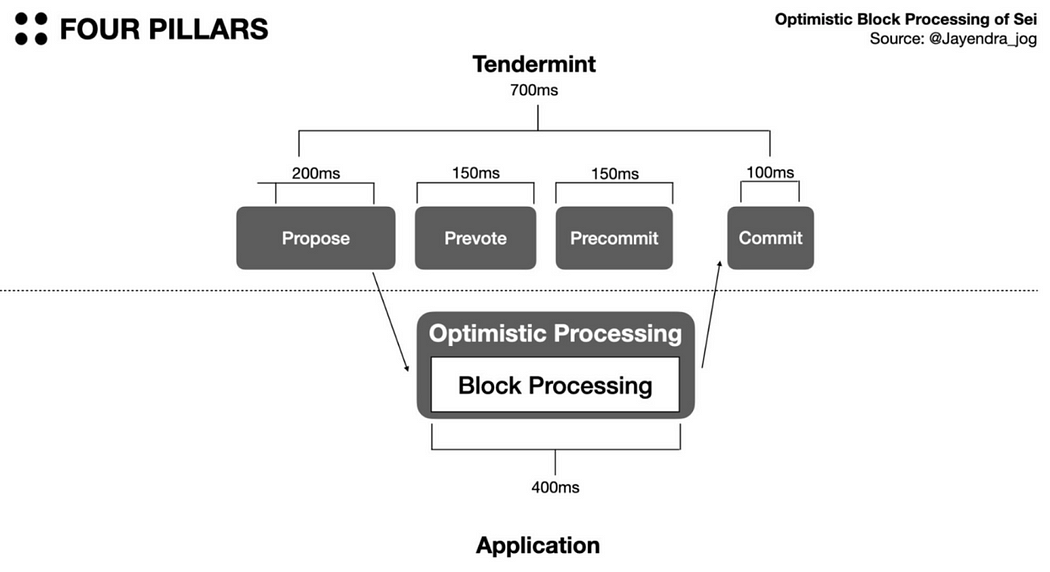

Sei's Optimistic Block Processing modifies the BFT process, inserting a block processing step between Precommit and Commit in the general BFT process. Assuming that malicious nodes are rare, validators have already received the data required for computation in the Propose stage during the Prevote stage. Therefore, to further reduce block time, Sei begins parallel processing with Prevote. By reducing block time through optimistic block processing, it should not be a problem, as most of the time the block's validity is not in question. However, if the block is rejected by the network during the Prevote and Precommit process of executing the computation, it can simply be discarded.

Source: Four Pillars, Jay-Sei Labs

Taking a set of Sei data, according to the normal Tendermint BFT method, the total block time is 200+150+150+400+100, which is 1000ms. If optimistic block processing is performed, it would save 300 milliseconds of Prevote and Precommit time, reducing the block time to 700 milliseconds. If the block size remains the same, the reduction in block time from 1000ms to 700ms means there are approximately 1000/700 blocks in the same time, an increase of about 1.43 times, improving scalability by 43%.

(3) Transaction Parallel Processing:

Another method Sei uses to enhance scalability is transaction parallelization. The Ethereum Virtual Machine (EVM) is the most popular virtual machine in the blockchain industry, and it processes transactions sequentially, which fundamentally limits scalability. By default, the Cosmos SDK, on which Sei is based, also processes transactions in a serial manner. In Cosmos application chains, when a block is received, validators execute BeginBlock logic, DeliverTx, and EndBlock logic in sequence, while Sei modifies DeliverTx and EndBlock to process transactions in parallel.

First, the DeliverTx process handles token transfers, governance proposals, and smart contract calls, ensuring that parallel processed transactions do not reference the same key. For example, two transactions where A sends X tokens to B and C sends Y tokens to D can be processed in parallel, but two transactions where A sends X tokens to B and B sends X tokens to C cannot be processed in parallel, and thus they will be processed consecutively.

To parallelize multiple transactions, it is necessary to ensure that they do not reference the same keys. To achieve this, Sei constructs a Directed Acyclic Graph (DAG) to check the dependencies between transactions before executing them. In the figure below, assuming the DAG shows R3 in the middle depends on R2 in the first column, and R3 in the third column depends on W1 in the middle. As a result, the transactions will be processed as shown in the right figure.

Source: Four Pillars, Jay-Sei Labs

1. In the last part of the block, EndBlock, transactions related to the matching engine are executed by the native order matching engine. Similarly, transactions related to the matching engine are not processed in sequential order, but are processed in parallel after confirming that they are unrelated.

By default, the network is designed to assume that all transactions are unrelated and processes them immediately. If there are related transactions, only those transactions will fail. Therefore, application developers based on the Sei order matching engine must first filter out which transactions are related and which are unrelated. Experimental data on parallelization on Sei shows a performance improvement of 60-90% in block time, TPS, and other aspects compared to non-parallelized scenarios.

2. New Narrative of Parallel EVM

Since the official launch of Sei's public mainnet Pacific-1 on August 16, 2023, and the release of the Sei-V2 version plan on November 29, 2023, which will support the first parallel EVM.

Sei currently allows the use of Cosmwasm smart contracts written in Rust. As Sei continues to attract more developers' interest and expand its ecosystem, the developers' biggest request is for Sei to support execution environments with higher flexibility. With support for parallel EVM, Sei is available for global EVM developers to use.

(1) What is Parallel EVM?

Parallel EVM (Ethereum Virtual Machine) is a concept aimed at improving the performance and efficiency of the existing EVM, which is the core of Ethereum, responsible for running smart contracts and processing transactions. The current EVM has a very important feature: transactions are executed sequentially.

Sequential execution ensures that transactions and smart contracts can be executed in a deterministic order, making it easier to manage and predict the state of the blockchain. This design choice prioritizes security and reduces the potential complexity and vulnerabilities associated with parallel execution, but it may lead to network congestion and delays under high loads.

Parallel EVM can significantly increase the TPS, alleviate network congestion, and improve scalability by allowing the EVM to process more transactions at the same time.

(2) Key Achievements of Sei V2

Backward compatibility of EVM smart contracts - Allows developers to deploy audited smart contracts from EVM-compatible blockchains without changing the code, supporting the reusability of familiar and widely used applications and tools (such as Metamask).

Optimistic parallelization - Allows the chain to support parallelization without developers defining any dependencies.

Interoperability with existing chains - Allows seamless integration between EVM and any other execution environment supported by Sei.

SeiDB - Improvements to the storage layer to prevent state bloat, improve state read/write performance, and make it easier for new nodes to synchronize state.

(3) Significance of Parallel EVM

For developers, blockchain development has always been quite unfriendly. Every time a different virtual machine or language is used, builders must adapt to a new environment. The EVM ecosystem is currently the most active, and parallel EVM can solve this problem.

Sei V2's support for EVM does not mean abandoning WASM. It plans to support both virtual machines simultaneously, and even support interoperability between the two, providing a seamless development environment. If V2 is successful, Sei V2 may become the most successful integrated blockchain supporting multiple virtual machines.

Jay, co-founder of Sei Labs, stated on social media that Sei V2 will enable EVM and Cosmwasm contracts to call each other through the use of stateful precompiles and chain-level message scheduling. After the audit is completed, this upgrade will be released on the public testnet in the first quarter of 2024 and deployed on the mainnet in the first half of 2024.

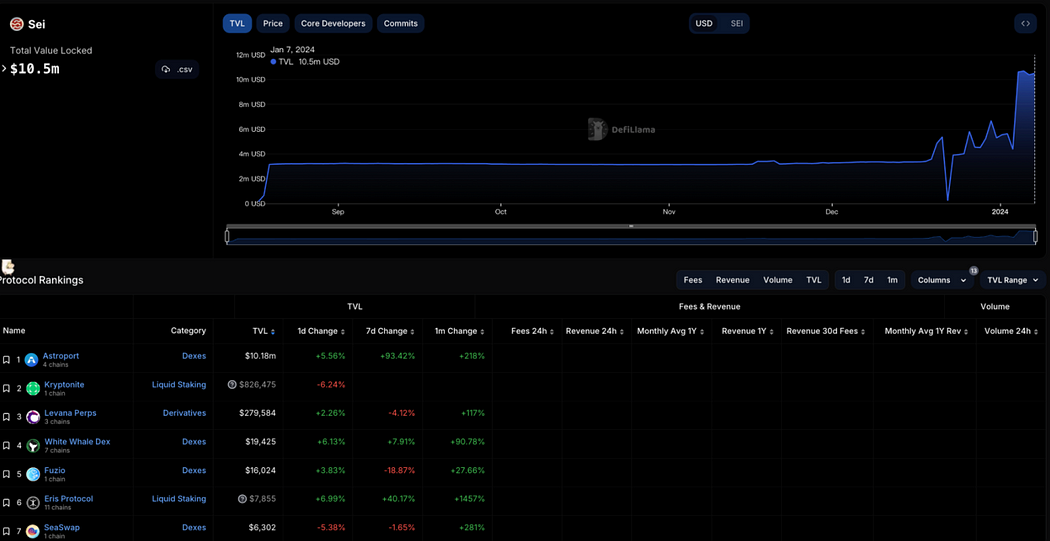

3. On-Chain Ecosystem Development

In the past 30 days, Sei Mainnet has seen a total transaction volume of 728,000, with 62,500 independent users, averaging 23,500 transactions per day, showing an increasing trend in transaction volume and user numbers.

Source: Flipside

In the past 30 days, the current user and transaction volume on Sei Mainnet are relatively high, and the top four active applications are Astroport, Tatami, Dagora, and Webump.

Source: Flipside

Astroport (Dex): Astroport's vision is to become the mainstream next-generation AMM, providing deep liquidity pools and huge trading volume for the Cosmos ecosystem. Better pricing will attract more liquidity to Astroport, creating a self-reinforcing cycle. Ultimately, Astroport aims to operate as the foundational liquidity layer for Cosmos. Currently, Astroport operates on four chains: Sei, Neutron, Terra2, and Injective.

Tatami (Gaming): Tatami meets a prominent need in the Web3 space - a dedicated game publisher. With countless games scattered across various chains, Tatami provides users with a unique position to play games, collect assets, and complete tasks on a single platform, bringing a unique fusion of game development, market integration, and launchpad services, aiming to change the way games are experienced, created, and distributed in the Web3 space.

Dagora (NFTs): Dagora is a multi-chain NFT marketplace in the Coin 98 ecosystem, supporting BNB Chain, Polygon, Sei, and others. Dagora's features include Marketplace (NFT trading market), Launchpad (NFT launch platform), and Hot Drops (free minting section). Additionally, Dagora allows C98 token holders to participate in auctions, launchpads, and hot drops.

Webump (NFTs): Webump is dedicated to supporting development teams and creator communities on the Sei blockchain and collaborates with Lighthouse to provide open-source smart contracts designed for seamless NFT creation on Sei. Lighthouse is its open protocol and toolkit that enhances the NFT creation process, making it easier for NFT creators and developers to access and be more efficient.

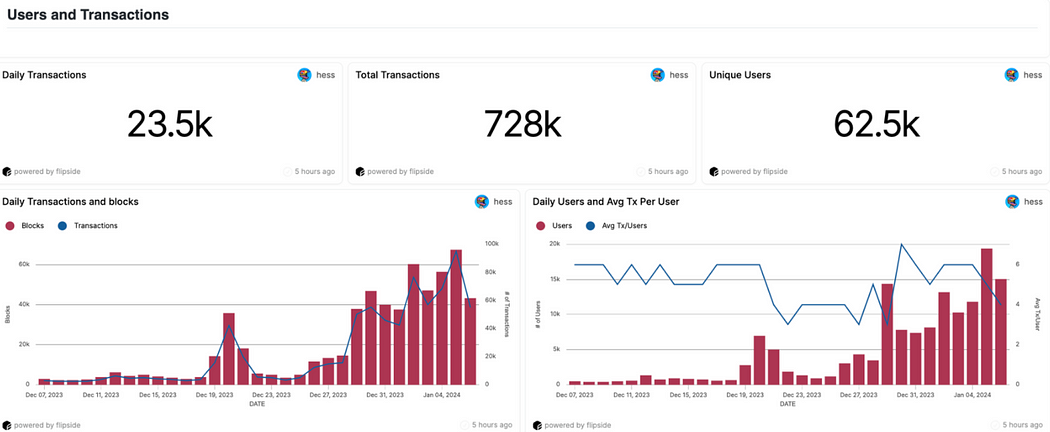

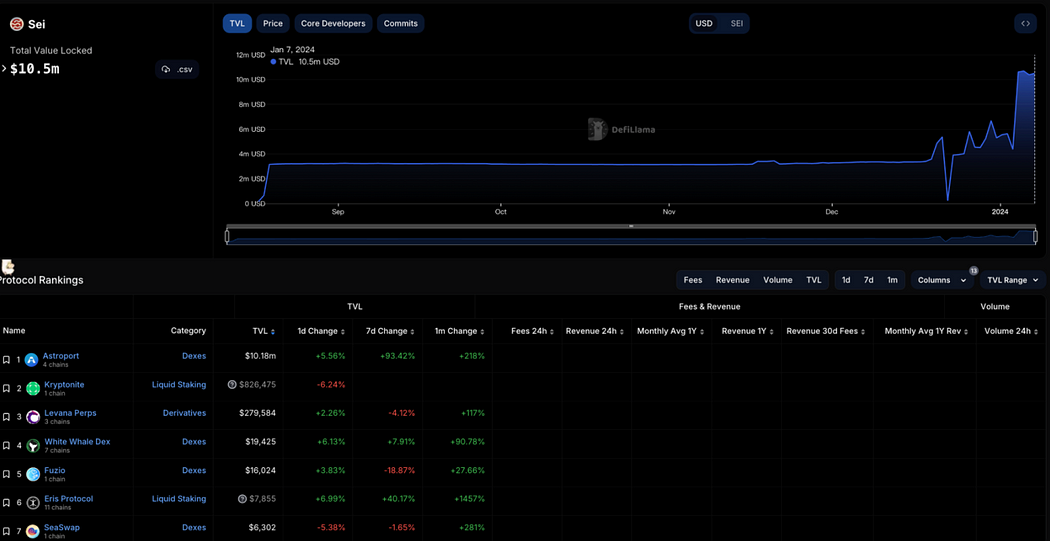

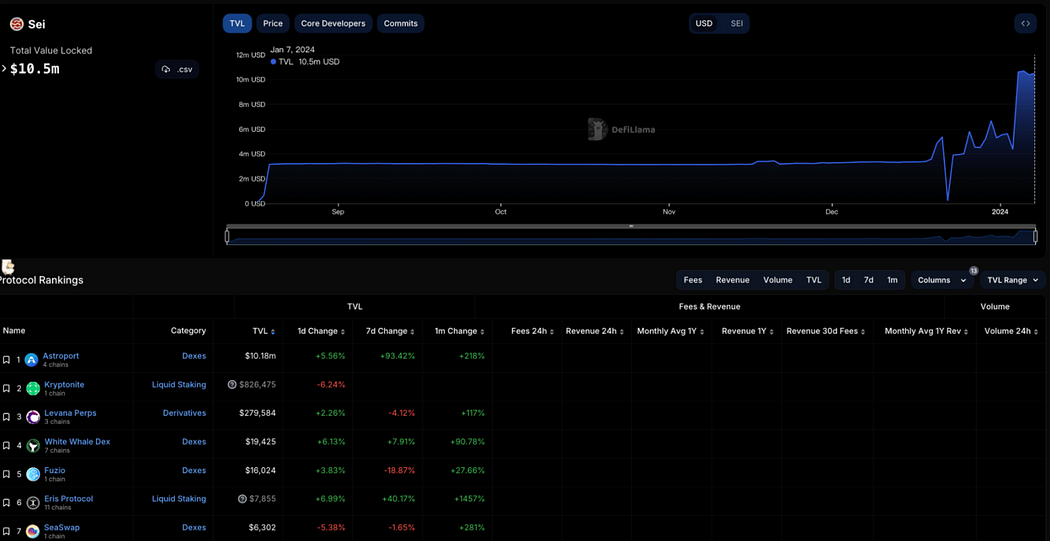

Sei, as a blockchain focused on providing high-performance DeFi, is currently in the early stages of on-chain DeFi TVL, both in overall and individual project data performance and product development.

Source: Defillama

Kryptonite: Kryptonite is a decentralized AMM and staking protocol based on Sei, compatible with any bAssets on the Cosmos blockchain and other blockchains, aiming to bring a powerful native currency market to the Cosmos ecosystem, driving financial innovation and flexibility. Users can stake Sei Network token SEI and receive liquidity staking token bSEI, which can then be used as collateral to mint stablecoin kUSD at a 200% collateral ratio.

Levana Perps: A perpetual contract trading platform on Sei, supporting up to 30x leverage. Currently, Levana supports leveraged contract trading for BTC, ETH, ATOM, and OSMO.

Yaka Finance: A native Dex set to launch on Sei, currently available for interaction on the official website, with potential future airdrops.

Sushiswap and Vortex Protocol: In February 2023, Sushi announced the acquisition of derivative Dex - Vortex and collaboration with Sei, planning to launch a decentralized derivative exchange on Sei in the future. However, there have been no new developments disclosed for this project since February 2023.

II. Team, Financing, and Partnerships

1. Team Background

Sei Network was founded by Jeff Feng and Jayendra Jog in 2022. Jeff Feng is a co-founder of Sei Labs, a graduate of the University of California, Berkeley, and worked in the TMT investment banking department at Goldman Sachs from 2017 to 2020. He co-founded Sei Labs with Jay in 2022.

Jayendra Jog is a co-founder of Sei Labs, a graduate of the University of California, Los Angeles, and previously worked as a software engineer at Robinhood from 2018 to 2021.

Phillip Kassab is the Growth and Marketing Director of Sei Network, a graduate of the Stephen M. Ross School of Business at the University of Michigan. He previously served as the Marketing Director for Trader Joe and Swim.

Other team members have worked at companies such as Google, Amazon, Airbnb, and Goldman Sachs.

2. Financing History

In August 2022, the team behind Sei Network, Sei Labs, completed a $5 million seed round of financing, led by Multicoin Capital, with participation from Coinbase Ventures, GSR, and others.

In February 2023, Sei announced a $400 million Series A financing round and mentioned an airdrop plan. In April, Sei Network announced a $30 million financing at an $800 million valuation, with participation from Jump Capital, Distributed Global, Multicoin Capital, Bixin Ventures, and others. This round of funding was used for development and market expansion in the Asia-Pacific region. In the same month, Sei Labs' ecosystem fund completed a $50 million new round of financing, including OKX Ventures, Foresight Ventures, and others.

In November 2023, Circle made a strategic investment in Sei Network, supporting the launch of native USDC on the network.

Source: Rootdata

3. Operations and Partnerships

(1) Testnet Activities and Airdrops: During the Atlantic 2 testnet phase, Sei explicitly stated that token incentives would be distributed to reward early members of the Sei community using the chain. Upon the public release of Pacific-1 mainnet, the rewards were open for claiming, encouraging user interaction on the network.

(2) Sei Ambassador Program: The Sei Marines ambassador program was launched, designed to reward ambassadors with different levels and gradient rewards for their contributions, stimulating promotional activities in relevant regions.

(3) Sei Launchpad Accelerator Program: The sei/acc program was introduced to invest in and support on-chain ecosystem projects by providing resources, guidance, and incentives. A product manager will be assigned to assist in developing a strategic roadmap and collaborating with key members of the Sei Foundation team.

(4) Expansion Promotion in the Asia-Pacific Region: In December 2023, Sei sponsored Binance's event in the Maldives; on December 21, Sei announced a strategic partnership with KudasaiJP to expand its market share in Japan; in January 2024, the Korean research firm Four Pillars indicated that Sei is preparing various initiatives to further expand its influence and cooperation in the Korean market.

### 3. Token Situation

1. Basic Information

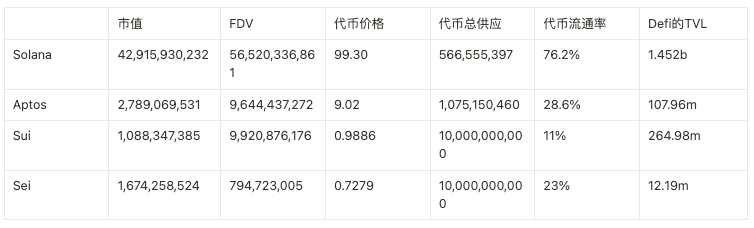

SEI's current market value is $16.74 billion, with a fully diluted valuation of $79.47 billion. The total supply is 10 billion, with a circulation rate of 23%. The 24-hour trading volume is $793 million, with the main trading venues being Binance (26.91%), Upbit (25.85%), and Coinbase (8.37%).

Compared to other new public chains, Sei's market value is lower than Aptos and higher than Sui, accounting for 0.5% of Eth's market value and approximately 3.9% of Solana's market value. In terms of TVL in Defi applications, Sei is much smaller than Sui and Aptos, with only 12.19 million, indicating it is in the early stages.

Source: LD Capital

2. Token Economics

SEI's token use cases include:

- Network fees: Paying transaction fees on the Sei blockchain.

- DPoS validator staking: SEI holders can delegate their assets to validators or stake SEI to run their own validators to secure the network.

- Governance: SEI holders can participate in the future governance of the protocol.

- Native collateral: SEI can be used as collateral for native asset liquidity or applications built on the Sei blockchain.

- Fee market: Users can pay fees to validators for priority processing of transactions, which can be shared with users delegating to the validator.

- Transaction fees: SEI can be used as fees for exchanges based on the Sei blockchain.

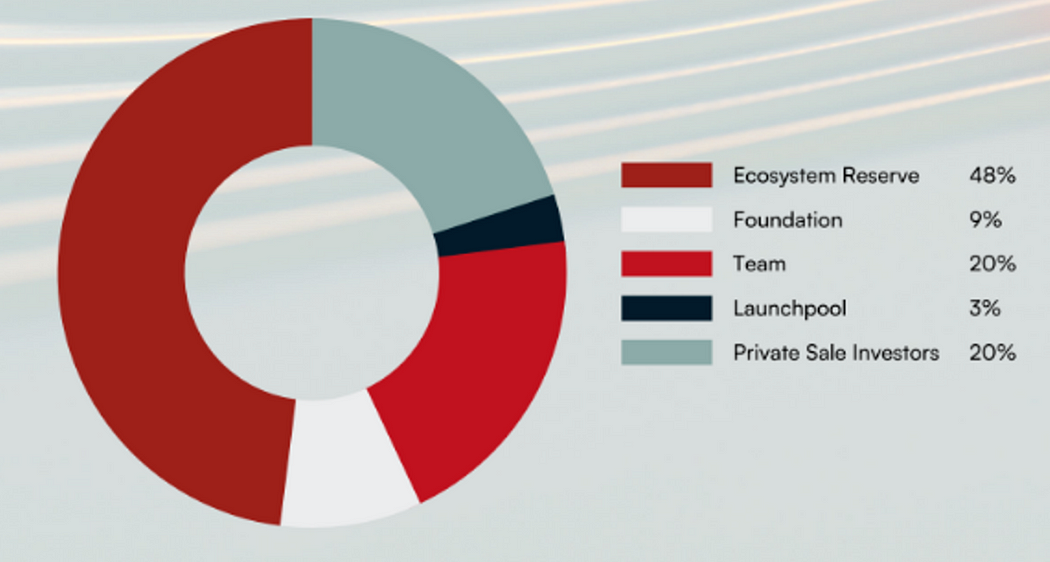

The total token supply is capped at 10 billion, with 51% allocated to the community, 48% to the ecosystem reserve, 9% to the foundation, 20% to the team, 3% to the launch pool, and 20% to private sales. Of the 48% ecosystem reserve, it will be allocated as follows:

Staking rewards

As part of Sei's decentralized proof-of-stake mechanism, validators are responsible for securing the Sei blockchain and ensuring its accuracy. Validators run programs called full nodes, allowing them to verify every transaction on the Sei network. Users can stake their SEI to validators and receive staking rewards, while validators can set fees to compensate for their important role. Validators also play an important role in the governance of the Sei protocol.

Ecosystem initiatives

SEI tokens will be distributed to contributors, builders, validators, and other network participants who contribute meaningfully to Sei through grants and incentive measures.

Sei airdrops and rewards:

A portion of SEI supply is allocated to airdrops, incentive testnet rewards, and ongoing programs aimed at distributing SEI quickly to users and the community.

Source: Sei Labs

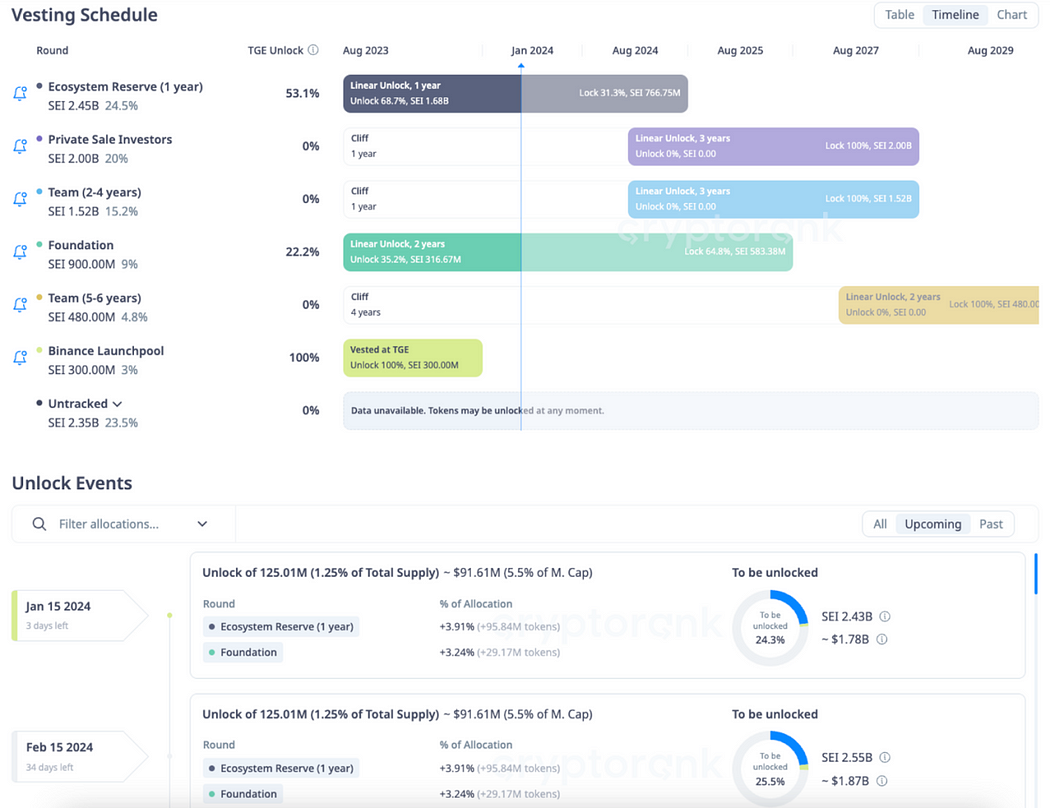

Unlocking Schedule

On August 15, 2024, the first large unlock for private investors and the team occurred. Regular unlocks occur on the 15th of each month, mainly for ecosystem releases and foundation unlocks, with a monthly unlock amount of 125 million tokens, approximately $91.61 million.

Source: CryptoRank

3. Recent Trading Situation

Since its launch on August 15, 2023, SEI's price has been continuously declining for about 3 months. However, starting from November 22, the price significantly rose from around $0.14 to a recent high of $0.88. On January 3, the price touched the upper Bollinger band and then retraced, with a slight decrease in daily trading volume.

Source: Binance

In terms of contract performance, with the recent price increase, both long and short contract liquidations have significantly increased, while the contract open interest has decreased. The difference between active buying and selling volume has been negative recently, and the long/short ratio has been increasing.

Source: Binance

### 4. Summary

Fundamentals: Sei's core difference from other chains lies in its order book-based underlying architecture, which is well-suited for building Defi. However, in terms of on-chain ecosystem, its overall applications and TVL are in the early stages, lacking outstanding Defi applications. The introduction of parallel EVM in Sei V2 has provided a new narrative, but many other chains and L2 may gradually support parallel EVM in the future. If the launch of SeiV2 can effectively attract funds, high-quality projects, and users to Sei, it will have a certain first-mover advantage. The V2 upgrade is scheduled to be released in the public testnet in the first quarter of 2024 and deployed on the mainnet in the first half of 2024.

Team Background and Recent Developments: The core team is young but has a strong background, and the funding is robust. There has been continuous effort in promotion and operations in the Asia-Pacific region.

Token Economics: The total token supply is capped at 10 billion, with 51% allocated to the community and 40% to the team and investors. In terms of market value compared to other new public chains, Sei is lower than Aptos and higher than Sui, accounting for 0.5% of Eth's market value and approximately 3.9% of Solana's market value. The first large unlock for private investors and the team occurred on August 15, 2024, with regular monthly unlocks mainly for ecosystem releases and foundation unlocks, totaling 125 million tokens per month, approximately $91.61 million.

Recent Trading Situation: Since the price started rising from around $0.14 on November 22 to a recent high of $0.88, the price has retraced after touching the upper Bollinger band on January 3, with a slight decrease in daily trading volume and contract trading volume.

After the recent token unlock, the first quarter will see the V2 parallel EVM upgrade, which may be favorable for ecosystem development and price.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。