Author: Wintermute

Compiled by: Felix, PANews

The cryptocurrency market in 2023 experienced a series of peaks and valleys. From the rebound at the beginning of the year, to the volatility in the middle of the year, it ultimately ended with an optimistic market sentiment (driven by the expectation of the approval of spot ETFs). As market activities slowed down, the industry narrative shifted towards Build. Last year, Wintermute focused on expanding its OTC business and developing new products.

The latest milestones include the integration of Wintermute Asia with CME, significant upgrades to OTC options products, and the development of more derivative products. Since its launch in November last year, Wintermute Asia's options trading volume has reached $210 million, and the demand from counterparties for this product has grown exponentially.

At the beginning of the new year, Wintermute shared its business dynamics and reflected on some trends observed through OTC in 2023.

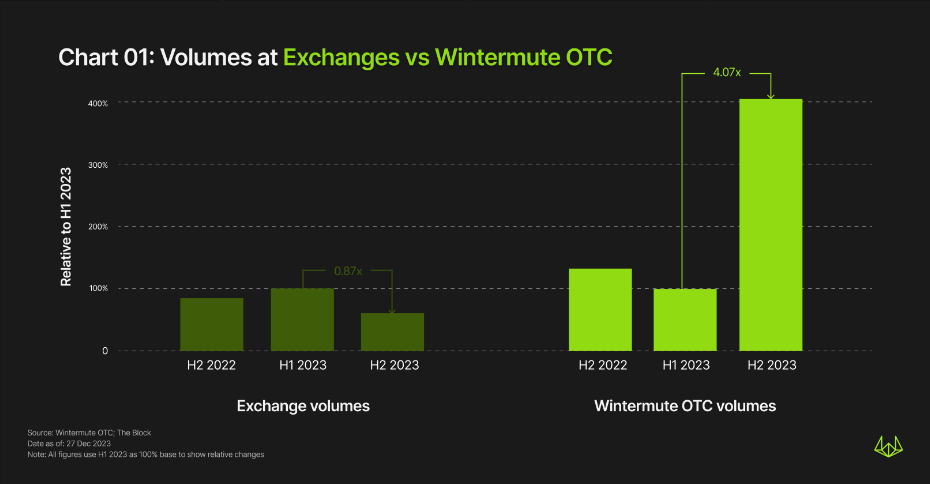

As trading volume shifts to OTC, OTC trading volume grew by over 400% in the second half of 2023

Despite the market downturn in 2023, all of Wintermute's vertical businesses continued to grow. In the spot market, while the total on-exchange trading volume decreased by about 13% from the first half of the year to the second half, the off-exchange trading volume grew by over 400% during the same period.

Although the off-exchange trading volume in the first half of 2023 was comparable to that of the second half of 2022, there was initially a decline in off-exchange trading volume in the first half of 2023. This indicates that despite the decrease in trading volume, counterparties' strategies for crypto trading remained firm. With the market warming up in the second half of 2023, trading activity significantly increased, with the number of trades growing by over 6 times, exceeding 29 million transactions. During this period, the highest off-exchange trading volume in a single week exceeded $2 billion.

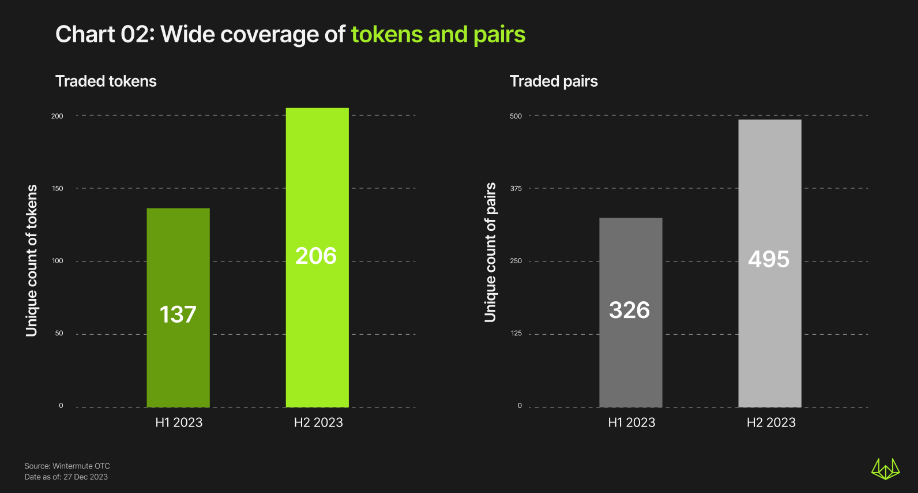

In 2023, Wintermute provided OTC trading for 206 assets and 495 trading pairs. The following are the overall asset trading trends observed by Wintermute.

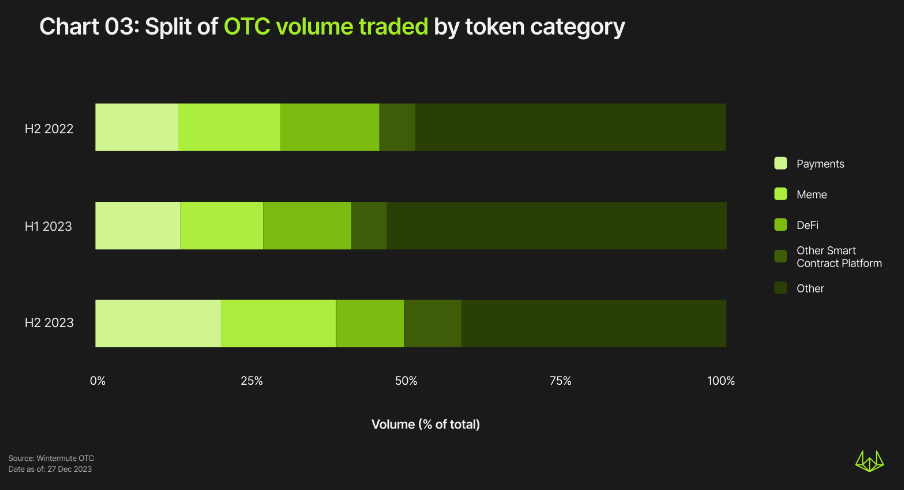

Payment-related assets are the largest category of cryptocurrency trading volume, second only to BTC and ETH

Excluding BTC and ETH (which consistently maintained the top two positions), the trading volume and market share of payment-related assets were the highest. The market share of payment-related assets increased from 13% in the second half of 2022 to 20% in the second half of 2023.

The outcome of the SEC-Ripple case to some extent drove the growth of payment-related assets.

Other categories in the second half of 2023 included Meme, DeFi, and other smart contract platforms. These categories maintained strong market shares, accounting for 37% and 38% in the second half of 2022 and 2023, respectively.

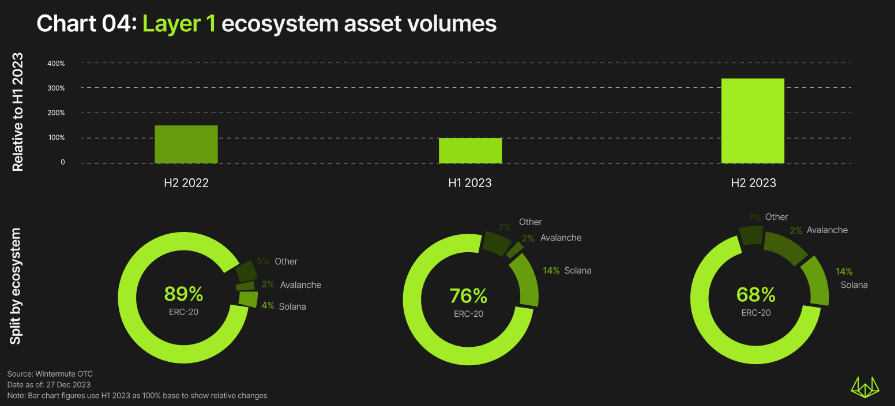

L1 and L2 trading volume continued to grow, with ETH and MATIC leading the way

The off-exchange trading volume of L1 assets followed the overall trend, decreasing by about half from the second half of 2022 to the first half of 2023, and then soaring by 350% in the second half of 2023. Ethereum had the largest trading volume, accounting for 68% of the market share.

It is worth noting that Ethereum's market dominance gradually declined from the second half of 2022 to the second half of 2023.

In the second half of 2023, the trading volume of Solana, Avalanche, Cardano, and Polkadot entered the top 5. Compared to Ethereum, most other L1 assets maintained strong trading volume in the first half of 2023, with Polkadot being an exception, experiencing a slight decrease in the first half of 2023.

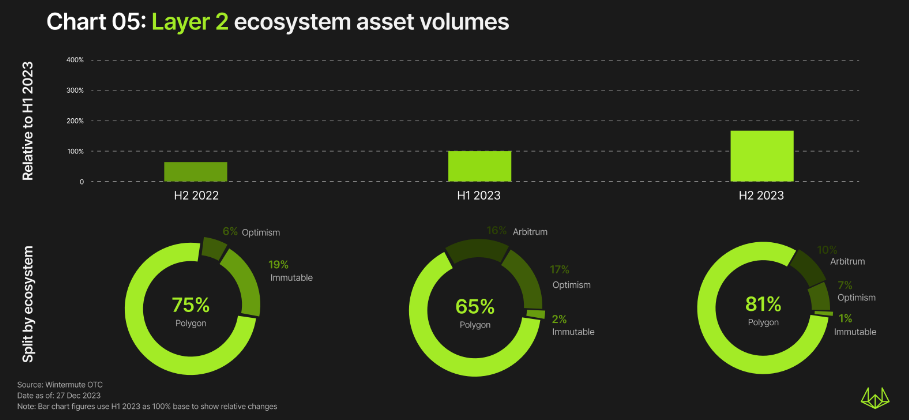

Compared to L1, the trading activity of L2 decreased by about 30 times, with Polygon, Arbitrum, and Optimism experiencing the most significant declines. However, the overall trading activity of L2s continued to grow, increasing by about 160% from the second half of 2022 to the second half of 2023.

DeFi remains strong, with a slight increase in market share and a significant increase in nominal trading volume

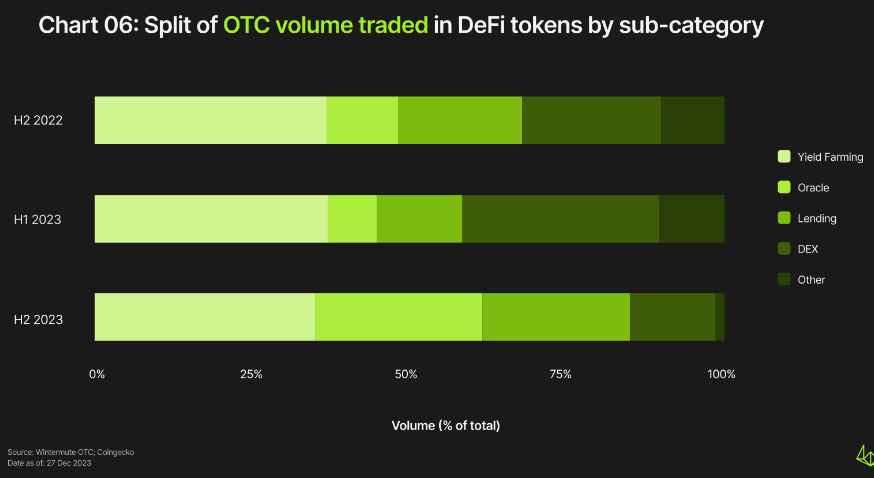

Although the nominal trading volume of DeFi increased by about 7 times from the second half of 2022 to the second half of 2023, the market share decreased from 16% to 11%. Within DeFi, Yield Farming had the largest trading volume, followed by oracle, lending, and DEX assets.

Yield Farming maintained a dominant position throughout 2023, accounting for around 35% of the overall DeFi trading volume, while the nominal trading volume increased by over 9 times during the same period.

From the second half of 2022 to the first half of 2023, the trading volume (decreased by about 30%) and market share (decreased from 11% to 8%) of oracle-related assets slightly declined, but rebounded in the second half of 2023, accounting for 26% of the overall DeFi trading volume. This was mainly at the expense of DEX assets. Although the nominal trading volume of DEX assets increased by over 3.4 times, the market share within DeFi significantly decreased during the same period (from 31% to 13.5%).

From the first half of 2023 to the second half of 2023, the market share of lending-related assets increased by 10 percentage points (from 13% to 23%).

From the second half of 2022 to the first half of 2023, the nominal trading volume of derivative assets initially soared by 10 times, and the market share increased from 0.6% to 6.9%. However, the market share of derivative assets decreased to 0.5% by the second half of 2023.

TradFi resurgence and shift towards meme coin trading

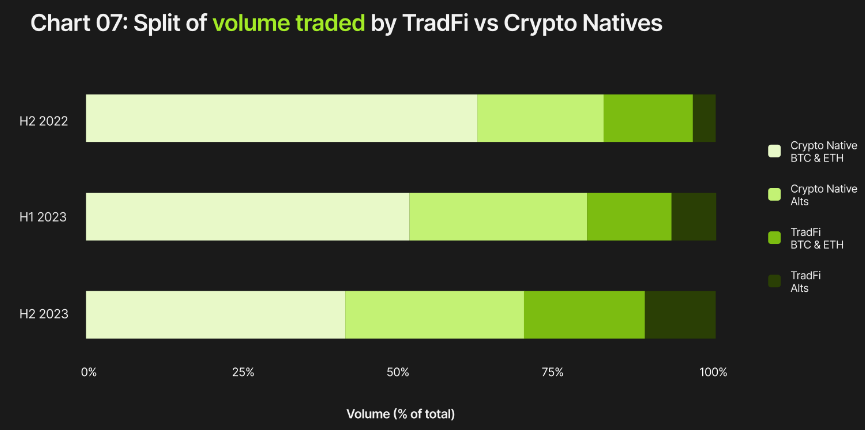

In terms of the overall trading volume between Crypto Native and TradFi, the market share ratio was 81%:19% in the second half of 2022. In the second half of 2023, TradFi reemerged, adjusting the ratio to 72%:28%. This indicates a renewed interest in TradFi in the second half of 2023, and this interest is expected to continue growing into 2024.

In each period, BTC and ETH dominate the trading volume in both TradFi counterparties and Crypto Native counterparties.

However, a closer look reveals some interesting phenomena. In the second half of 2022, the dominance of BTC and ETH in these two counterparties categories was evident, with a combined trading volume market share of 82.7% for Crypto Natives (BTC at 44.9%, ETH at 32.8%) and 94% for TradFi (BTC at 62%, ETH at 32%).

This phenomenon changed in the second half of 2023, with the market share of BTC and ETH in both counterparties categories decreasing by over 15%. The trading volume market share for Crypto Natives is 65.3% (BTC at 49.9%, ETH at 15.4%), while TradFi experienced a larger decline, at 72.1% (BTC at 50.3%, ETH at 21.8%). The proportionate growth of non-BTC, non-ETH trading volume indicates an increasing market interest in meme coin trading.

These trends indicate that not only is there a resurgence of interest in TradFi, but that interest is becoming more diversified.

In addition to BTC and ETH, Solana and payment-related assets saw the fastest growth in trading volume for Crypto Native counterparties. In contrast, DeFi-related assets saw the fastest growth for TradFi counterparties.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。