Author: Xiyu, ChainCatcher

Editor: Marco, ChainCatcher

The cryptocurrency market ended 2023 with a thriving scene, but the exchange industry experienced ups and downs throughout the year, with waves of layoffs and continuous negative news such as regulatory compliance and hefty fines, even the industry's leading players seemed to have encountered significant setbacks.

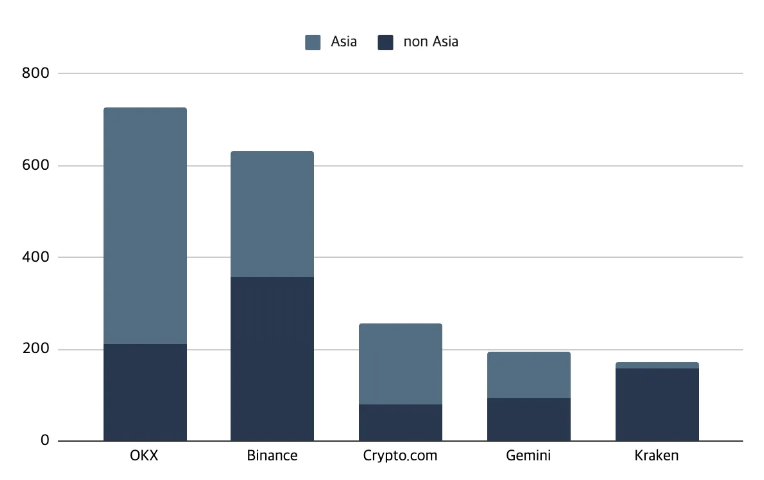

On the same track, OKX took a different path in this year. Not only did it have the largest number of recruits in the CEX rankings, but its market share also continued to rise. Spot and derivative trading have been promoted to become one of the top three exchanges globally. According to the "2023 Web3 Recruitment Market Trends" released on January 5, OKX recruited more than 700 people in 2023, surpassing Binance and ranking first among global CEX.

In addition, according to data from The Block, OKX's market share has increased from 4.9% at the beginning of 2023 to 9.4%.

In 2023, OKX can be said to be the biggest winner in the exchange race, not only steadily increasing its market share, but also making its Web3 wallet a model product in the industry.

At the same time, the price of OKB has been continuously reaching new highs, making it the best-performing asset in the annual exchange platform coin race.

OKX's victory is the result of years of focus on product development. While adhering to the stable and steady route of core business, it has also made early layouts in the Bitcoin ecosystem, ultimately achieving great success in the new hot track.

Market Share Doubled, OKX Upgraded to the World's Second-Largest Trading Platform

With the approval of Bitcoin ETF and the approach of the halving narrative, the cryptocurrency market seems to have completed the cycle of bull and bear, entering a new round of rebuilding. As the entrance for users to enter the crypto world, cryptocurrency exchanges are also experiencing a reshuffle in the market structure, and the landscape of centralized exchanges has undergone a significant structural change in 2023. OKX not only stabilized its leading position in this change, but also continuously increased its market share in core trading business, doubling year-on-year.

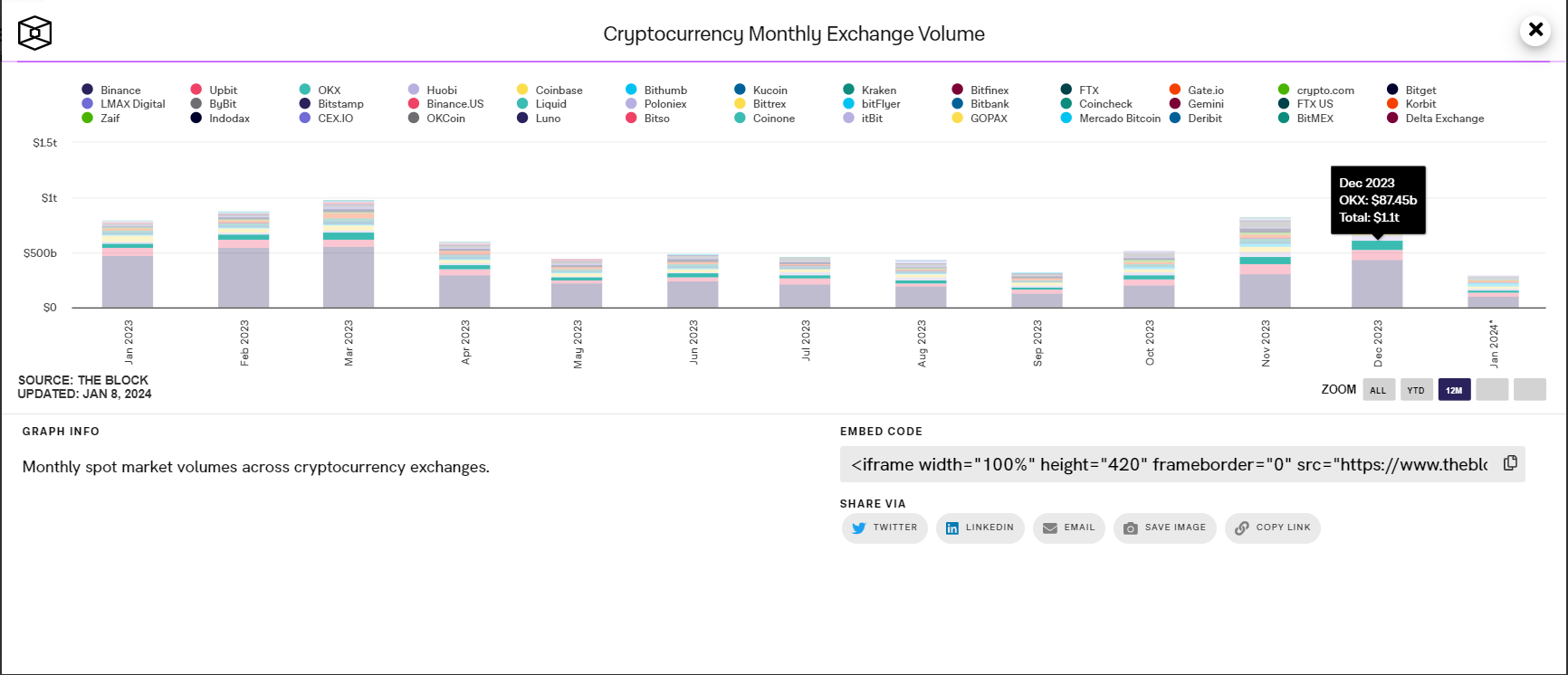

According to the latest data from The Block platform, the monthly spot market trading volume of cryptocurrency exchanges in December 2023 was $1.1 trillion, with OKX's monthly spot trading volume reaching $87.45 billion. However, in December 2022, OKX's monthly spot trading volume was only $38.29 billion, representing a 128% year-on-year growth in trading volume.

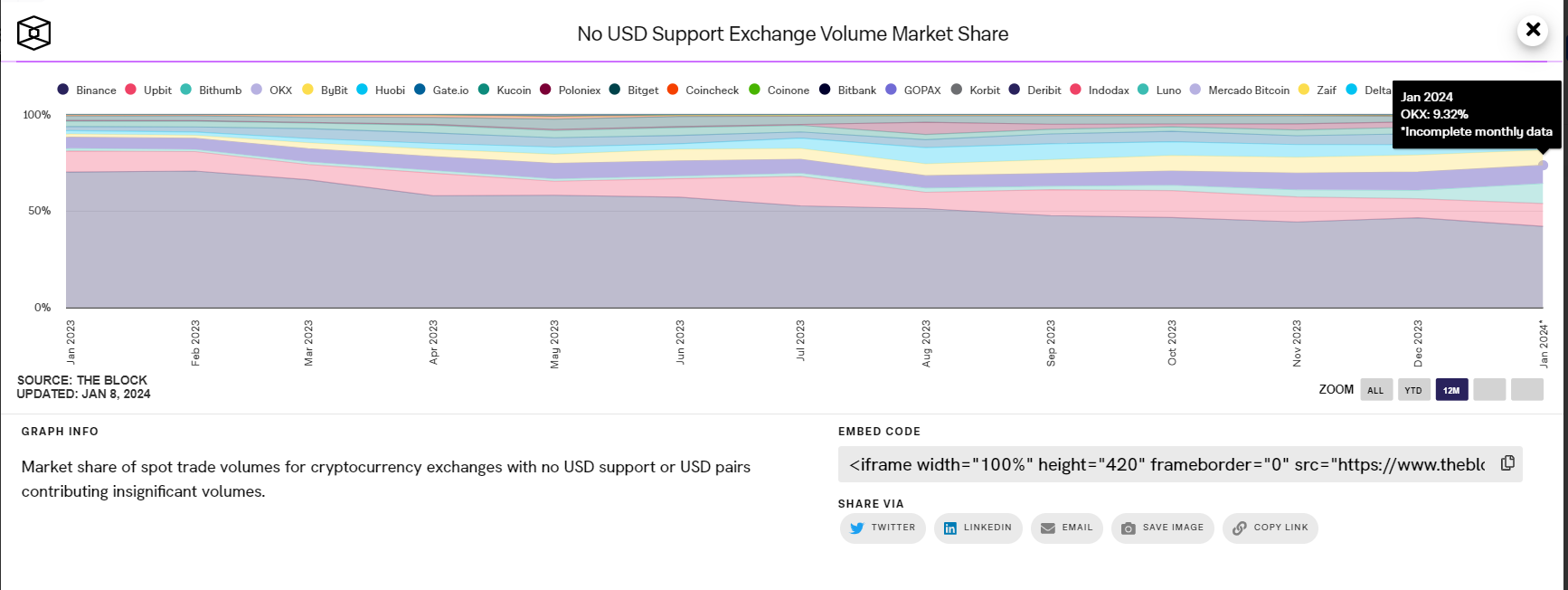

In addition, in the Asian market (non-USD supported market), OKX's market share has increased from 4.93% in January 2023 to the current 9.42%, an increase of about 5 percentage points compared to the same period last year, nearly doubling.

In terms of spot trading volume, OKX has long been firmly established as the world's third-largest cryptocurrency exchange, with Binance and Upbit ranking first and second, respectively.

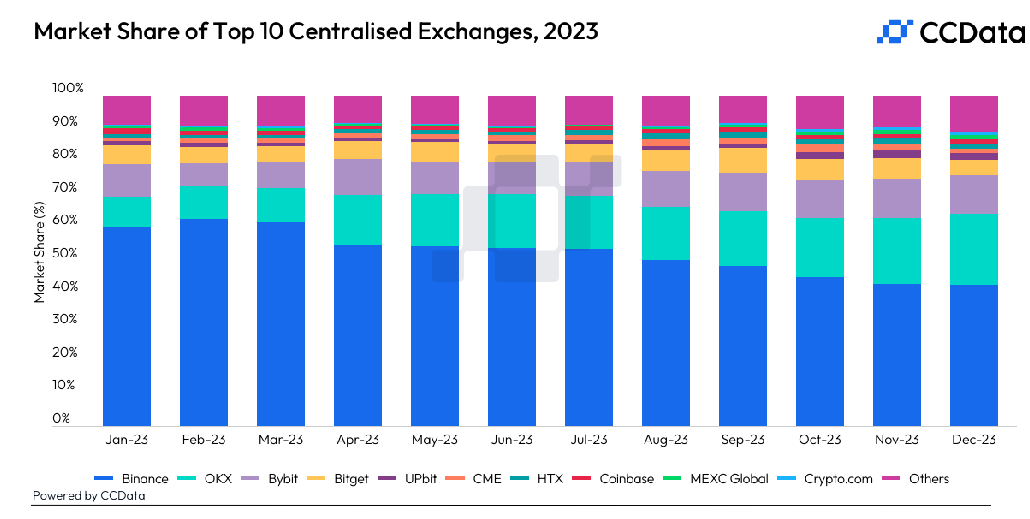

In the derivative market, according to CCData statistics, OKX's derivative trading volume in November 2023 was $660 billion, a 53.8% increase month-on-month, making it the best-performing trading platform of the month. Looking at the comprehensive spot and derivative trading data, Binance's market share has decreased from 60% to 42%, while OKX's market share has increased from 9% to 21%.

Looking at the comprehensive spot and derivative trading volume, OKX is now truly the world's second-largest cryptocurrency asset trading platform.

The Growth of OKX's Trading Data: Focus on Fund Security, Upholding User Priority

Behind the growth of OKX's trading data, part of it has benefited from the decline in market share of its competitors. According to CCData, OKX and Bybit are the two biggest beneficiaries of the decline in Binance's market share. In November 2023, after an 8-month legal battle and hefty fines, Binance's market share dropped to around 30% as hedging funds began to flow out.

During this period, OKX and Bybit's data growth was quite significant, with market shares rising to 20.2% and 11.9% respectively, reaching historical highs. OKX's market share in spot and derivative trading increased from 9% to 20.2%. Clearly, both platforms absorbed the outflow of users and funds from Binance, with OKX emerging as the main winner.

OKX's ability to attract such a large amount of outflowing funds and users is due to the high recognition and trust from its users, which is inseparable from OKX's continuous investment in technological innovation and its commitment to prioritizing the security of user assets.

OKX regularly discloses Proof of Reserves (POR) data to users, which can verify whether user assets are 1:1 reserved in the cryptocurrency exchange, demonstrating its solvency and ample liquidity to users.

As of December 13, 2023, OKX has released 14 POR reserve fund proofs, covering as many as 22 currencies, with each period's fund reserve ratio exceeding 100%.

On January 3, OKX released the 14th POR reserve fund proof, showing that as of December 13, 2023, the reserve fund ratios for OKX's assets were: BTC: 103%, ETH: 104%, USDT: 103%.

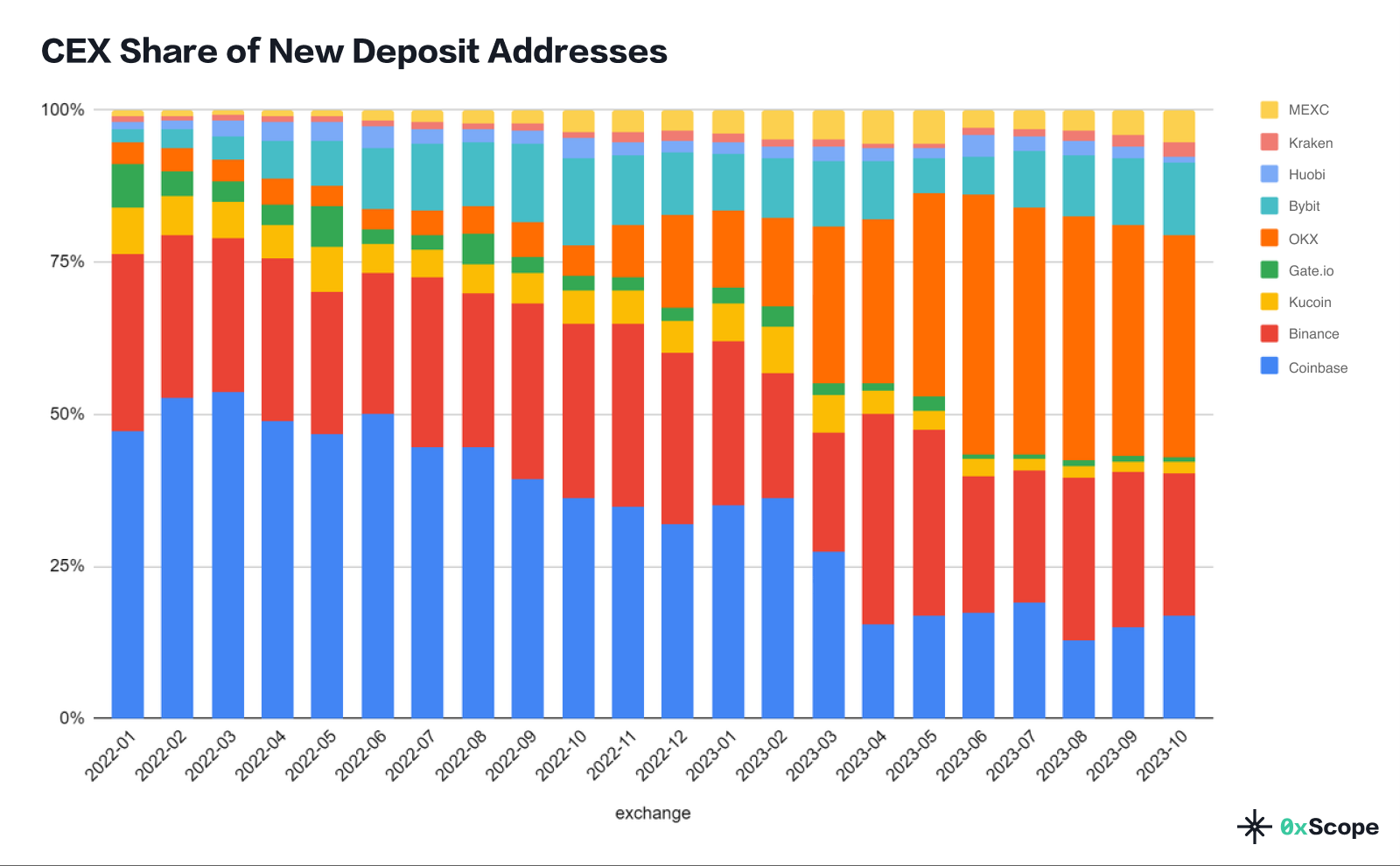

In terms of user experience, OKX adheres to user-oriented and user-centric principles, closely following market developments and constantly innovating. It has been referred to by users as "the most user-friendly trading platform." For example, when airdrops were prevalent at the beginning of 2023, OKX quickly launched the function of batch address account generation for users. According to the "2023 CEX Market Report" released by 0xScope, OKX has rapidly increased the number of new deposit addresses since 2023, which may be related to its function of generating multiple deposit addresses for each account.

In addition, according to OKX's 2023 review data, it has launched more than 10 new features and products last year, such as Shark Fin, Snowball, Seagull, Yield Hunter, Strategy Copy Trading, Spot Copy Trading, and Reverse Opening, covering structured finance, strategy trading, and other business lines, creating different types of product matrices to help users with different risk preferences increase their asset returns.

In terms of expanding business regions and compliance, OKX has been actively deploying externally.

With the clarification of regulatory policies in Hong Kong, OKX first established its Hong Kong company in March 2023, marking the beginning of the license application process. It was revealed that OKX has entered the final stage of obtaining the Virtual Asset Service Provider (VASP) license in Hong Kong and is expected to receive the final approval of the VASP license between March and June this year. In June 2023, OKX's Middle East branch has obtained the MVP provisional license issued by the Dubai Virtual Asset Regulatory Authority (VARA).

From OKX's recruitment, it can also be seen that it is expanding its market in the Asian region. According to the "2023 Global Web3 Market Recruitment Trend" statistics from Tiger Research, OKX ranks first in the number of recruits globally among CEX this year, with the most recruits in Asia, covering expansion markets including Hong Kong, China, India, South Korea, Australia, Thailand, and Malaysia.

Data Source: Web3Jobs, Tiger Research's "Global Web3 Job Postings Analysis"

Although the competition in the exchange race is fierce, OKX, with years of technical accumulation and a user-first philosophy, continues to refine its products, closely follow market developments and user trends, and launch diversified trading varieties and innovative tools to meet the various investment preferences and trading methods of users.

At the same time, OKX has always prioritized user experience and security. These measures have won the trust and recognition of users, helping to attract more users and traders. This has also led to the steady growth of OKX's exchange business, consolidating its position as the second-largest exchange for spot and derivative trading.

OKX Web3 Wallet Actively Embraces the Bitcoin Ecosystem, Creating a "One-Stop Web3 Gateway"

If you were to ask, "What was the most outstanding product of OKX this year?" The answer would undoubtedly be: the OKX Web3 Wallet. While OKX's core trading business was steadily advancing in 2023, the OKX Web3 Wallet was a product that helped it pull ahead of its competitors.

The decision to integrate the exchange and wallet into the same application has made OKX a true "DeFi+CeFi" and a one-stop gateway platform for the on-chain and off-chain worlds, successfully building its moat.

OKX Web3 integrates DEX, NFT markets, yield farming, Dapp exploration, and other Web3 features into a one-stop gateway, embedded within the exchange app. This allows users to access both centralized and decentralized worlds on the OKX platform.

As of December 31, the number of public chains integrated into the OKX Wallet has exceeded 80, covering 120,000 digital assets, and the plugin wallet has exceeded 400,000 downloads.

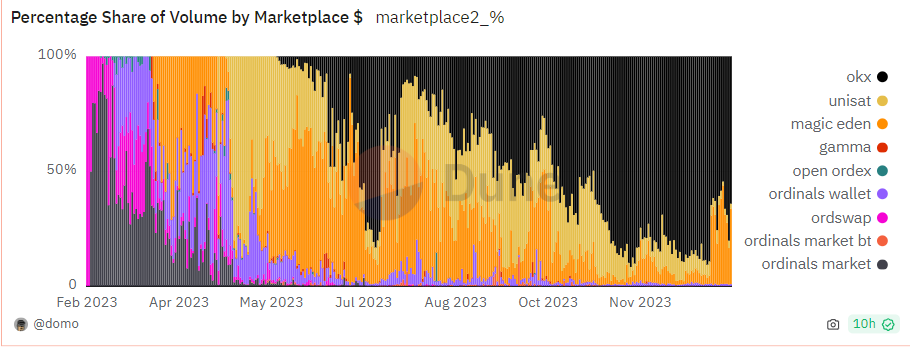

According to Dune data, since the OKX Web3 Wallet NFT platform announced its integration with the Oridinals market in May of last year, supporting inscription minting, engraving, sending, receiving BRC-20, and BTC NFT, its market share in the Oridinals market has continuously increased. After the second surge of the Bitcoin ecosystem in November, OKX's Oridinals market share has consistently remained above 80%, with a daily trading market share exceeding 90% on November 9, almost monopolizing the Bitcoin Oridinals ecosystem.

https://dune.com/domo/ordinals-marketplaces

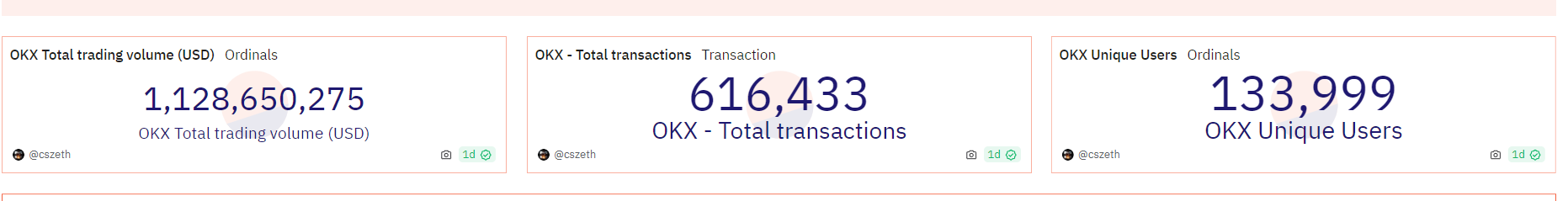

As of January 9, the total transaction volume completed in the OKX Web3 Wallet Oridinals market has reached $1.13 billion, accounting for approximately 45% of the total transaction volume of the Oridinals protocol, which is $2.15 billion. In addition, other data from the OKX Oridinals market is also very impressive, with 134,000 unique addresses and a total of 616,000 transactions.

https://dune.com/cszeth/ordinals-marketplace-okx

In terms of market share, the OKX Web3 Wallet has become the largest BRC20 inscription and BTC NFT trading market within the Bitcoin Oridinals ecosystem, with approximately 16,000 BRC-20 and Oridinals assets available for trading.

In the wake of the success of the OKX Web3 Wallet, exchanges have even started a trend of integrating built-in wallets, with competitors such as Binance and Bitget also announcing the launch of integrated Web3 wallets.

From the current operational results and user experience, it is clear that the OKX Web3 Wallet is the most successful product in the exchange wallet race. However, this also demonstrates that the success of the OKX Web3 Wallet is not a result of a single effort, but rather the result of continuous market cultivation, rooting, refinement, and timely user feedback.

OKX Web3 product managers Kyle Chen and Jason Wang have stated in interviews that seizing the market opportunity is not just the result of the past year's efforts, but is based on the continuous development and infrastructure construction over the past few years.

They explained that although the Web3 Wallet was established just over two years ago, the technical architecture was deployed five years ago. In addition to continuous technical development, based on years of experience in the exchange business, OKX has accumulated its own efficient methods in user interaction, product optimization, and iteration. From discovering the Bitcoin ecosystem to reporting to senior management and finally making the decision, OKX took only one or two weeks.

Furthermore, the reason why OKX's Web3 team was able to quickly capture market trends is due to the large number of crypto OG users within the team, who are not only product users but also product managers and developers.

This is also confirmed by the personal 2023 work summary posted by OKX Web3 product manager Kyle Chen on social media.

In his summary, he wrote: "Every week, the product manager will review all the product updates of competing products, listen to technical colleagues share the technical principles of 2-3 new protocols, and discuss product design plans and technical implementation paths together. Many members of the team are Web3 degen and OG users, who truly participate in the market and promptly discover hotspots and opportunities, bringing them back to the team and product design in a timely manner. OKX's product managers are active users in various communities, truly empathizing with frontline users, and continuously improving OKX's product experience."

It is for this reason that the OKX Web3 Wallet dared to make the correct predictions about the development prospects of the Bitcoin ecosystem and chose to support BRC-20 tokens and deeply cultivate the Oridinals ecosystem at the first opportunity.

The innovative initiative to integrate the exchange and wallet into the same application not only reduces the entry barriers for traditional users to enter the Web3 world and simplifies the operation steps, but also allows OKX to embark on a new growth curve beyond the exchange business, becoming one of the most popular user entry products in this wave of the Bitcoin ecosystem, ushering in new traffic growth dividends, and also serving as a significant driving force behind the significant growth of OKX's data.

OKB's Annual Increase Ranks First Among Platform Coins, Application Scenarios Continuously Expanding

As an investment target capturing the value of cryptocurrency exchanges, the trend of platform coins can to some extent reflect the development and performance of the exchange. The growth of the exchange business and the success of the OKX Web3 Wallet are naturally reflected in the trend of OKB. With a 136% annual increase, OKB was one of the best-performing assets among all platform coins in 2023.

As the platform coin of OKX, OKB soared from $26 in January 2023 to a peak of $64.89 on November 15, with an annual increase of 135%. Even now, at $54.19, the annual increase still exceeds 100%, making it one of the best-performing platform coin assets of 2023.

The value expectation support for platform coins is usually measured in two ways: one comes from the exchange's trading volume and profit, and the token buyback and burn data directly reflect the platform's current income situation; the other comes from the future market growth space, such as the ability to continuously acquire new traffic, market share, whether the product can lead the Web3 market, and whether the exchange can maintain safe and stable operations.

The OKX Web3 Wallet has brought users and reputation to OKX, and has opened up the market growth ceiling.

Regarding the buyback and burn of platform coins, exchanges usually regularly use profits and income to repurchase or burn a certain amount of platform coins.

On December 14, 2023, OKB completed its 22nd burn, with a burn volume exceeding 10.52 million tokens, equivalent to approximately $630 million. Throughout 2023, there were a total of four burns, with a cumulative burn amount of 27.35 million tokens, totaling nearly $1.5 billion based on the closing price of $54 on January 10.

In addition to the support of performance and the good reputation of product innovation, the application scenarios of OKB are continuously expanding. It can not only participate in IEO subscriptions and fee discounts but will also serve as the Gas token for the Layer2 network X1. In November 2023, OKX announced a collaboration with Polygon CDK to jointly launch the zkEVM Layer2 network X1 and declared that the platform token OKB would serve as the native token of the X1 network, which can be used to pay gas fees on the network.

In the previous bull market, the platform coin BNB rose to become one of the top ten cryptocurrencies due to the empowerment of the BSC chain.

"Exchange + Web3 Wallet" Opens a New Era of Diversified Growth

For a long time, the cryptocurrency trading track has mostly focused on trading business. In recent years, with the development of on-chain applications and the popularity of DeFi, the activities of cryptocurrency users are no longer limited to CEX platforms. Instead, there is an increasing demand for on-chain interactions. As a result, trading platforms are seeking new growth points beyond trading business, actively exploring and deploying various cryptocurrency projects, personally participating in chain creation, wallet development, or incubating popular projects.

In this current market cycle, the integration of OKX's exchange and wallet is undoubtedly the most successful example. The wallet, as the "gateway" to the decentralized world, seamlessly integrates with the exchange, which serves as the hub for CeFi asset activities. This integration not only opens up a growth ceiling for the exchange but also provides convenience for users, as a single application can lead to two different worlds.

Currently, while maintaining the continuous growth of its core trading business market share, OKX's Web3 Wallet's second growth curve is becoming increasingly clear and has grown into a new growth point. Through the "exchange + Web3 Wallet" dual-curve growth model, OKX has further widened the gap with its competitors.

At the same time, OKX's capital arm, OKX Ventures, continues to exert efforts in project layout and asset allocation, actively selecting high-quality projects and assets.

According to the cryptocurrency data platform RootData, in the fourth quarter of 2023, OKX Ventures publicly participated in nearly 30 investment projects, including well-known projects such as LayerZero, Sei, Taiko, DappOS, and Mocaverse, covering areas such as NFT, cross-chain, Layer2, the Bitcoin ecosystem, and DeFi.

On January 9, OKX Ventures also met with Stephen Chow to explore new scenarios combining Web3 with film and entertainment.

OKX has now become a platform that integrates trading, decentralized products, and capital. It is not only the hub of user trading activities and the entry point for on-chain users but also provides high-quality assets.

The current OKX platform has gathered a group of excellent product lines, opening a new era of diversified growth. The various product lines are advancing in unison on the OKX platform, shining brightly in their respective segments.

OKX's achievements in 2023 have not only set a new benchmark for the trading industry but also laid a solid foundation for future development. The main focus in the future will be on internationalization, compliance, and most importantly, security, while continuing to enhance the product roadmap. This will be the magic weapon for OKX to stand invincible.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。