Investors have been using these stocks as substitutes for Bitcoin.

By Hal Press

Translated by DeepL TechFlow

With the approval of ETFs, speculation by cryptocurrency market participants has increased, and stock investors have also begun to seek cryptocurrency investments, especially Bitcoin investments. However, without spot ETFs, investing in Bitcoin is challenging because most investors either do not like futures ETFs or are not allowed to directly own cryptocurrencies. This has driven the demand for proxy assets, leading to a large influx of funds and a re-rating of cryptocurrency stocks after extreme increases. We believe that once ETFs are approved and available for trading, these fund flows will experience a one-time reversal as investors shift from these less-than-ideal tools to the spot Bitcoin exposure they initially desired.

As a result, there are now several attractive hedging trades using long-term spot BTC exposure to hedge overvalued cryptocurrency substitute stocks. Our favorite way to trade the three alternative cryptocurrency stocks is MicroStrategy (MSTR), Marathon Digital Holdings (MARA), and Coinbase (COIN). While each stock has its own characteristics, they all share one thing in common—investors have been using these stocks as substitutes for Bitcoin, and once a real Bitcoin tool is available, we believe the mispricing of these stocks will be corrected downward.

Due to strong demand for leverage in the market, there is an opportunity to achieve an annualized 10-30% effective risk-free return by going long on Bitcoin and shorting futures contracts on the CME (classic basis trading). As mentioned above, due to the lack of direct channels for investing in Bitcoin, we have reason to believe that some traditional investors have already used these alternative assets as substitutes for trading Bitcoin.

On December 28, during the pricing window of the Chicago Mercantile Exchange (CME) roll date, there was a significant sell-off of these proxy assets, which may have already shown preliminary signs (Note: Roll date is a term specific to the futures market, referring to the process of switching futures contracts from one delivery month to the next, during which investors need to switch the dates of the contracts they hold). If this is indeed the case, it will bring additional adverse factors for two reasons. We not only expect the permanent weakening of the CME basis premium, as the approval of ETFs now provides investors with direct Bitcoin exposure, but this compression will require the closure of existing trades that have already occurred. This closure will include buying short futures and selling cryptocurrency stocks used to express long exposure.

Microstrategy (MSTR)

Microstrategy is often seen as a substitute for Bitcoin, and most people believe that their trading prices have a reasonable premium of 5-10% relative to the company's book value (operating company + held Bitcoin). However, if the number of their shares is properly adjusted, a much larger discount of about 25% will be found, reaching a high point of 50-60% recently. These calculations assume an EBITDA multiple of around 15 times for their software business, which is generous considering that the business has not grown for many years. Bulls have given two reasons to explain why this premium should continue: leverage and no management fees. However, neither of these reasons holds water. Given that the conversion in December 2025 is in-the-money, it should be considered as equity, so the proportion of leverage to enterprise value is less than 20%, even if the in-the-money conversion is considered as debt, this figure is only 27%, and a natural deleveraging effect will occur as BTC trading rises. Considering the premium for related operating companies and BTC holdings, there is actually a negative leverage effect, meaning that the value of 1 MSTR is less than the value of 1 BTC. The argument for management fees also lacks weight, as MSTR issues approximately 150,000-200,000 shares of SBC on average each year. This actually amounts to charging shareholders about 130 basis points in management fees, far higher than the 0-25 basis points charged by spot ETF competitors. In this scenario, MSTR is extremely vulnerable, and given the uncertainty of SBC and BTC unlocking, as well as more attractive spot ETF alternatives, we believe there is no reason for MSTR not to trade at a price lower than its BTC.

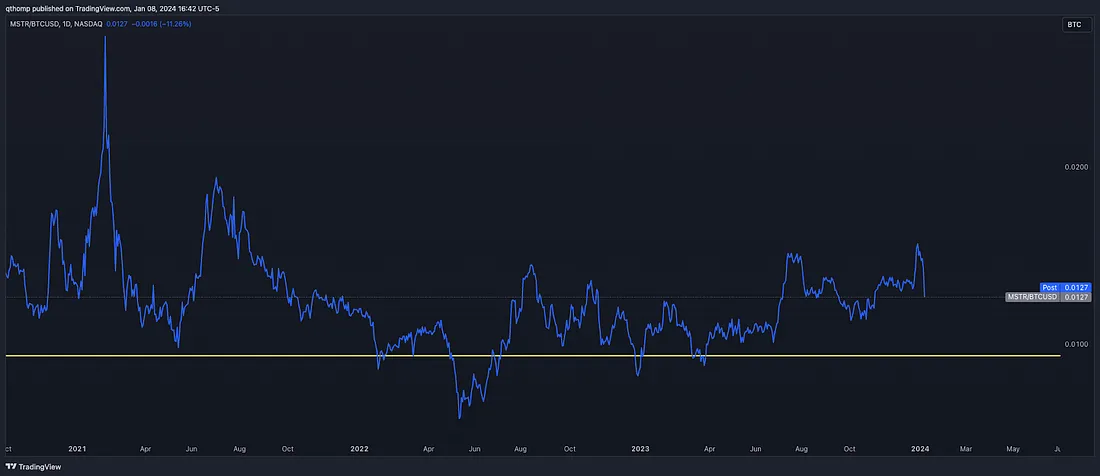

Not to mention, compared to ETFs, investing in BTC through MSTR gives less governance rights, and the cost of leverage is higher due to its higher capital cost. In addition, Saylor (CEO of Microstrategy) has recently started selling his own stock, further adding downward pressure to the stock. GBTC has also experienced similar situations, as it has traded at a significant premium while being used as a proxy ETF for several years, but when the asset is no longer favored due to better alternatives and deteriorating sentiment, its trading price has reversed and a discount has appeared. As can be seen from the chart below, at the end of January 2021, Grayscale stopped issuing new GBTC shares, marking the beginning of the decline of GBTC. Although the premium is still high, MSTR has not yet launched its latest ATM shelf product, indicating that they have recognized this issue.

Faced with these realities, the expansion of MSTR's premium relative to net asset value is difficult to justify. Although the historical premium rate is between 30-50%, a discount rate of 5-10% may be more appropriate from a fundamental perspective. We estimate the "face value" to be approximately 0.0094 MSTR/BTC, and it is possible to adjust it downward from this basis.

It is reasonable for Saylor not to want to sell any BTC, but there may be a situation where a sustained discount is seen as damaging to the company. Although he controls the majority of the voting rights, if the discount widens to a significant extent, there may be an opportunity for more hostile investors to start accumulating positions and assume potential fiduciary responsibilities. Saylor may personally buy discounted MSTR shares, but this may mean liquidating his personal BTC to provide funds. Although unlikely, there is a non-zero possibility that MSTR will eventually be forced to sell a portion of its BTC holdings (worth $8 billion) in the worst-case scenario, in an attempt to close the discount by selling BTC and repurchasing MSTR shares, which could have a reflexive negative impact on the cryptocurrency market.

Marathon Digital Holdings (MARA)

The argument against Marathon Digital Holdings is slightly more complex, but equally negative, as it is a company engaged in cryptocurrency mining.

Publicly traded MARA has been seen as a substitute for Bitcoin, but once spot ETFs are available, it will no longer be a substitute for Bitcoin. In addition, the halving is imminent, which will overnight lead to a 50% decrease in revenue. This creates a powerful double whammy, as both ETFs and the halving benefit BTC while harming miners' interests.

The most basic explanation for the challenges facing MARA is as follows. The following is a chart of the LTM hash price, which measures the expected income of miners per unit of hash power. As a broad generalization, let's assume that most public miners need a hash price of about 90+ PH/s to be a "good" business. The chart shows that even during the recent surge in trading activity, this level has not been reached. Under the same conditions, this figure will halve in April, reaching a historical low, far below the record set at the end of 2022.

The two offsetting factors for this decline are the decrease in hash rate due to unprofitable miners shutting down (short-term) and increased trading activity (long-term). Based on past experience, when mining machines are shut down, the hash rate decreases by about 20-30%, but then quickly recovers within 1-3 months, indicating that shutting down machines can only temporarily increase profitability by about 25-40% at most. Given that this will occur on the basis of a new low of 40-45 PH/s, the short-term relief at best is equivalent to the level of 50-60 PH/s, barely reaching the low point before 2022. Due to the significant negative impact of this halving, it is conservatively assumed that the duration of this hash rate decline may be longer than in the past, which may be fair, but this will lead to miners rushing to deploy new machines and increase their importance. We do not expect this, as all signs indicate that these listed companies will have tens of thousands of new machines delivered and put into operation throughout the year.

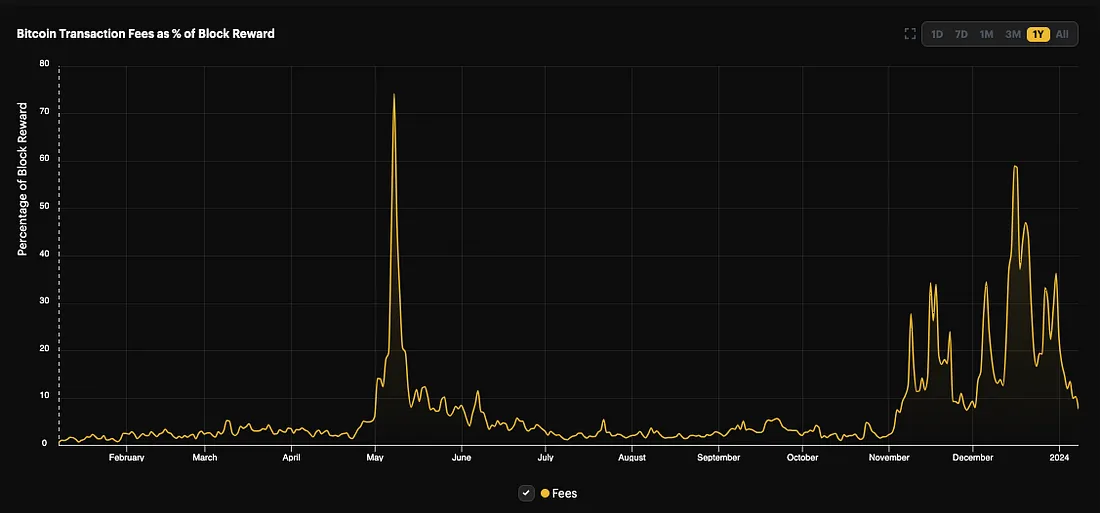

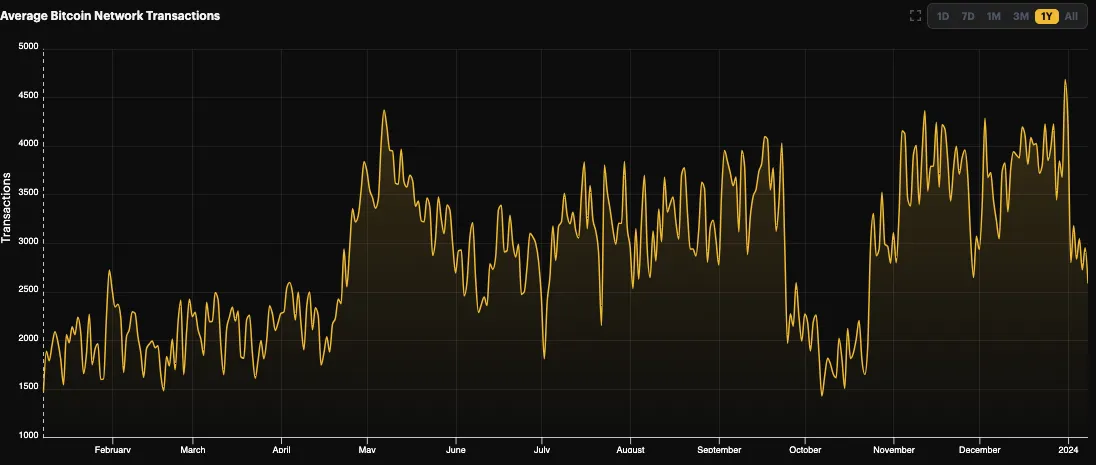

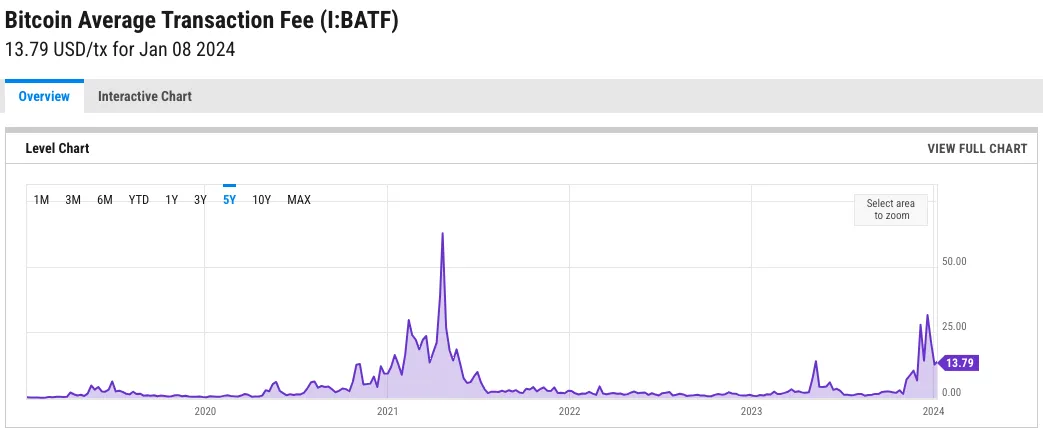

The second potential mitigating factor for MARA is the rise of Ordinals, Inscriptions, and NFTs built on the Bitcoin network, which brings increased fees and trading activity. However, this trading activity has strong cyclicality and often marks a local peak in sentiment, and we believe it has now reached a mid-term peak. The chart below supports this view, as both transaction fees and total network transactions have doubled.

In recent months, the average transaction fee on the BTC L1 network has ranged from $10 to $30, equivalent to the peak levels in 2021, and has become daunting, indicating that further upside is unlikely to continue.

For MARA, the third and final factor is a long-term structural issue, but one that still needs to be kept in mind. Since miners cannot differentiate themselves on output and production (1 BTC = 1 BTC), the only competitive advantage is in cost. As global governments continue to loosen monetary and fiscal policies, inflation remains stubborn, and energy costs may have reached a local bottom. While producers like RIOT and CIFR have secured contracted power agreements, most miners face the risk of price fluctuations, especially MARA, whose electricity costs are the highest in the industry.

This also affects the broader interest rates and capital costs of these companies. The debt market for these companies has been completely closed, and even if debt is available, most of them cannot afford the cost of leverage. This makes equity financing the only way to extend their survival, and they will inevitably be forced to do so. It should be remembered that the worst thing miners can do is to shut down machines due to lack of profitability, because if they do, they have no business to do, and most machines are worth next to nothing when liquidated. But their second worst action is to issue stock, leading to dilution of existing shareholder equity. This occurs at every local peak, and this time it has already begun, as evidenced by Cleanspark's recent issuance. Similar to the period from July to September 2023, we believe there will be more such cases in the future.

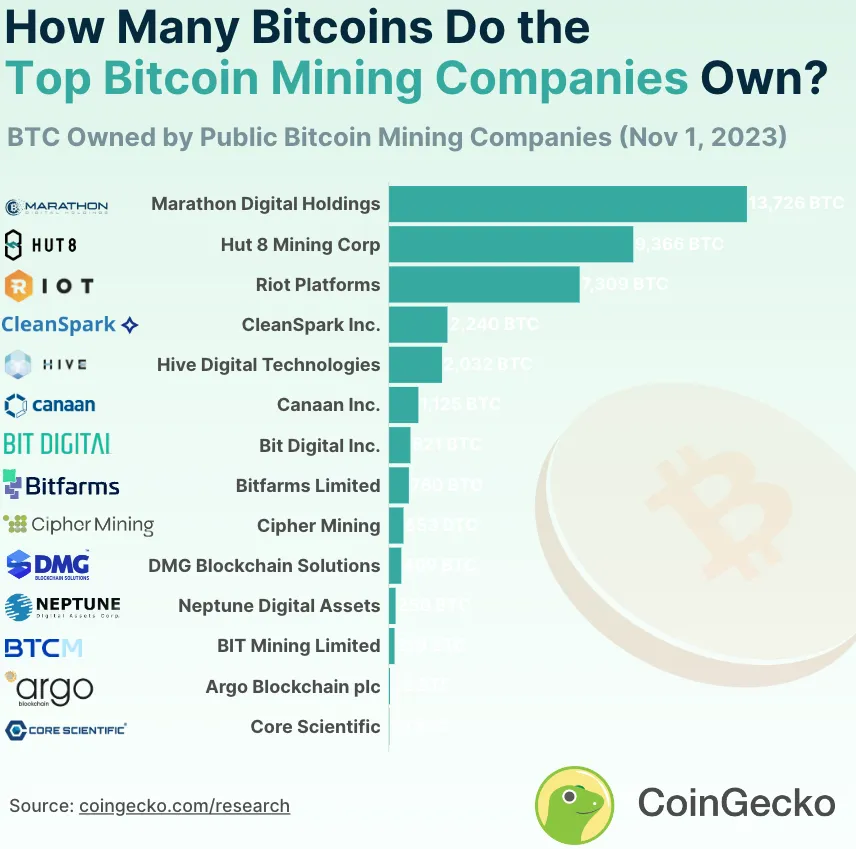

The balance sheets of Bitcoin miners may also have an impact on the broader market. The largest listed miners collectively hold nearly $2 billion in BTC on their balance sheets. If it is expected that the operating environment of these companies will significantly deteriorate and the public market re-evaluates the premium of these proxy assets, miners will face greater pressure to sell Bitcoin to fund their operations. In times of historically tight profitability, miners almost always sell the BTC they produce first, and only resort to using the BTC they hold in desperation. This balance sheet sale may occur earlier, as their businesses face more severe threats after the halving, after all, oil and gas producers do not hold the commodities they produce (Bitcoin) to increase leverage and speculation in anticipation of future price increases.

In the mining field, we believe MARA is the best shorting target. MARA has the highest breakeven operating cost among its peers and may lose to competitors who can achieve profitability with a smaller increase in BTC price. We believe that MARA's valuation of over $5 billion is too high from both a relative and absolute perspective.

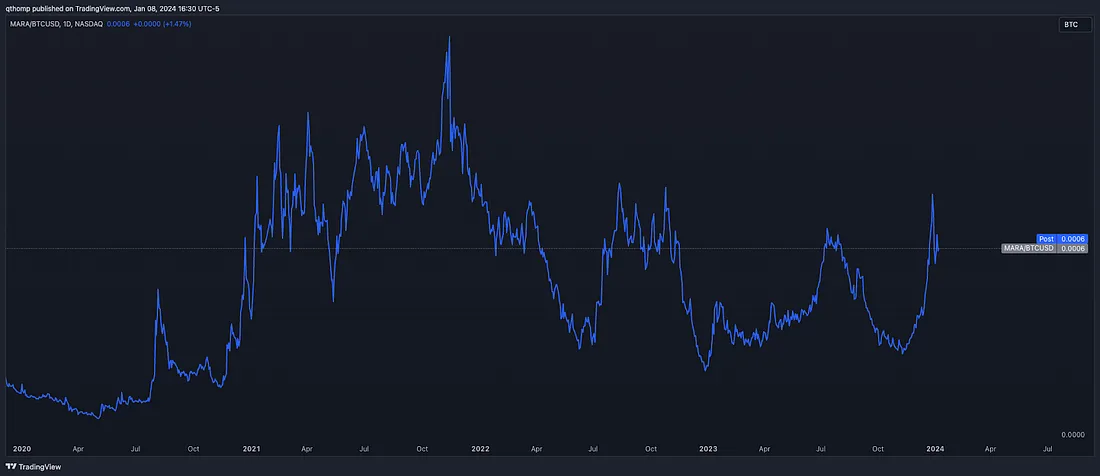

In the long term, the MARA/BTC chart should follow the hash price, not the Bitcoin price. After the halving, we estimate that miners will need a BTC price of over $75,000 to restore current profitability levels. Considering the price increase required to restore profitability, we believe that directly owning BTC commodities is economically advantageous, and we expect the MARA/BTC ratio to return to or reach new lows.

Coinbase (COIN)

The arguments about Coinbase are also straightforward and apply to the ETF views of the other two ideas.

Furthermore, there is a claim that ETFs will benefit COIN because COIN will be used as a custody solution. Further research reveals a more uncertain equation. While COIN will benefit from custody fees of about 5-15 basis points, they may lose higher-margin business, as some retail volume will inevitably shift from Coinbase to ETFs. These retail businesses generate over 100 basis points of revenue per transaction. Therefore, COIN will actually replace business of over 100 basis points per transaction with business of about 5-15 basis points per year.

In addition, low-fee ETFs will put pressure on COIN's overall fee structure. As ETF issuers begin to compete to lower ETF fees, we have already seen this potential erosion manifesting. In our view, most importantly, once BTC and ETH spot ETFs are listed, the enthusiasm of retail users to open Coinbase accounts will decrease, which may harm user trends. Finally, COIN's current valuation is quite high, at about 35 times 12-month EBITDA, which we believe may be lower than expected and appears very susceptible to a downturn in cryptocurrency sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。