From "software cheat code" to "crypto cheat code", a16z's transformation is in line with the times.

Author: Jian Shu

a16z, short for Andreessen Horowitz (abbreviated as a16z because there are 16 letters between the first letter "a" and the last letter "z"), was founded by two founders, Marc Andreessen and Ben Horowitz, in 2009. Later, it became a top-tier venture capital institution in Silicon Valley, alongside big names like Sequoia and Benchmark, due to its investments in well-known internet companies such as Facebook, Twitter, Github, Instagram, and Airbnb.

a16z currently manages assets exceeding $35 billion, with investments covering artificial intelligence, biotech and health insurance, consumer, cryptocurrency, enterprise operations, fintech, gaming, and companies that promote the development of the United States. a16z has established specialized funds for different fields, and this article will focus on a16z crypto, a fund specifically set up for the cryptocurrency industry.

I. Entering the Cryptocurrency Field

a16z's earliest involvement in cryptocurrency investment was in 2013, when the cryptocurrency industry was still being questioned by many traditional venture capitalists. a16z took the lead in investing $25 million in Coinbase's Series B financing, and subsequently made 7 follow-up investments. Its bet on Coinbase not only made a16z profitable when Coinbase went public, but also propelled it to become a star in the cryptocurrency investment field.

To better invest in the cryptocurrency field, a16z established a specialized fund for the cryptocurrency field in 2018, called a16z crypto. This fund has been raised a total of 5 times, with assets under management exceeding $7.6 billion:

- The first fund was launched with a size of approximately $300 million;

- In April 2020, the second fund was launched with a size of approximately $515 million;

- In June 2021, the third fund was launched with a size of approximately $2.2 billion, setting a record for the fundraising scale of cryptocurrency funds at that time;

- In May 2022, the fourth fund with a size of approximately $4.5 billion and a $600 million Web3 gaming fund were launched.

It is reported that a16z is currently planning to raise approximately $3.4 billion for its next core early-stage and seed fund, mainly for investments in the cryptocurrency field, biotech, and emerging growth opportunities.

II. Team Situation

a16z's investment team operates on a full-partner basis, without hierarchical relationships, and each specialized fund will recruit professionals as investment partners.

Chris Dixon is the founder of a16z crypto. Despite joining a16z in 2012, many of a16z's important investments in the cryptocurrency field (such as Ripple, Coinbase, Dapper Labs) were led by Chris Dixon. In 2022, he secured the top spot in Forbes' list of "Global Best Venture Capitalists".

Before joining a16z, Chris Dixon was an entrepreneur and investor. He previously founded the internet security company SiteAdvisor and the technology recommendation company Hunch, as well as the venture capital fund Founder Collective, and made multiple personal angel investments in various tech companies.

Undoubtedly, with the booming development of the cryptocurrency industry, Chris Dixon has become a key figure at a16z, just like the company's iconic founders Marc Andreessen and Ben Horowitz.

According to public information on a16z's official website, the total number of employees is 546, with the largest number responsible for the cryptocurrency field, totaling 99, accounting for 18% of the workforce. This also reflects a16z's emphasis on the cryptocurrency field. In line with a16z's consistent emphasis on post-investment services, among these 99 people, only 15 are specifically responsible for investments, while the remaining 80% are responsible for post-investment work such as marketing, recruitment, legal, and technology.

III. Investment Characteristics

Established in 2009, a16z not only successfully invested in many well-known internet companies in the Web2 era, but also became a leading venture capital institution in Silicon Valley. In the Web3 era, it has invested in multiple high-value enterprises (such as Coinbase, Opensea, Dapper Labs, Uniswap, dYdX, Lido, Yuga Labs), becoming a benchmark in the cryptocurrency investment field. How has a16z been able to achieve such investment performance in both industries?

As a specialized fund of a16z, a16z crypto also inherits a16z's investment style and logic. The following are several investment characteristics of a16z crypto summarized by the author.

Persistence in "All-Weather" Investment

The so-called "all-weather" investment means maintaining continuous investment regardless of market conditions and cryptocurrency trends. a16z crypto has demonstrated this with its actions. From a distance, a16z crypto's first two funds were launched during the cryptocurrency bear market of 2018-2020, accumulating management of over $800 million. Looking closer, in the current cryptocurrency winter, compared to cryptocurrency funds like Paradigm that have tightened their investments, according to Rootdata, a16z has made over 30 investments in the past year, with 11 of them being lead investments.

High Ratio of Lead Investments to Follow-up Investments

According to Rootdata, a16z crypto ranks first in the cumulative lead investment institutions, with a historical lead investment round count of 109.

At the same time, from the well-known cryptocurrency projects previously invested in by a16z crypto, it can be seen that a16z Crypto also loves to make follow-up investments, demonstrating a determined commitment to projects it believes in.

Generous and Extensive Investments

Since its establishment, a16z crypto has invested in over a hundred cryptocurrency projects, covering almost all sectors of the cryptocurrency industry. a16z's generous investments are well-known in Silicon Valley. A typical example is the Silicon Valley bidding war for Github in 2011, where a16z announced that it would lead a $100 million investment, and with various post-investment benefits, Github ultimately chose a16z.

Proficient in Media Promotion and Packaging

In 2010, The New York Times described a16z as follows: "A new generation of venture capitalists represented by a16z is trying to shake up an industry that needs change." The implication of this statement is that a16z has pioneered a new operating model different from traditional venture capital institutions, with the most significant feature being promotion and marketing through self-built media channels.

When you open a16z's official website, it feels like you've opened a media platform because the homepage is filled with various reports and articles. Marc Andreessen, the founder of a16z, once stipulated that every investment partner should establish their own media platform to share and communicate investment ideas with the public, promoting industry information flow and knowledge education.

This habit has also been inherited by a16z crypto. Chris Dixon has repeatedly advocated for the cryptocurrency industry in various public forums and even wrote a book about Web3 titled "Read Write Own", which is scheduled to be published in January 2024. Chris Dixon has been dubbed the "most influential advocate of Web3" because of this.

In addition, a16z also places great emphasis on packaging the projects it invests in. It has borrowed the operating model of Hollywood's top talent agency, CAA, to build a large and professional talent system, providing marketing, legal, and lobbying support to the invested companies. Therefore, a16z is also known as a "media company that profits through investments".

IV. Investment Landscape of Potential Projects

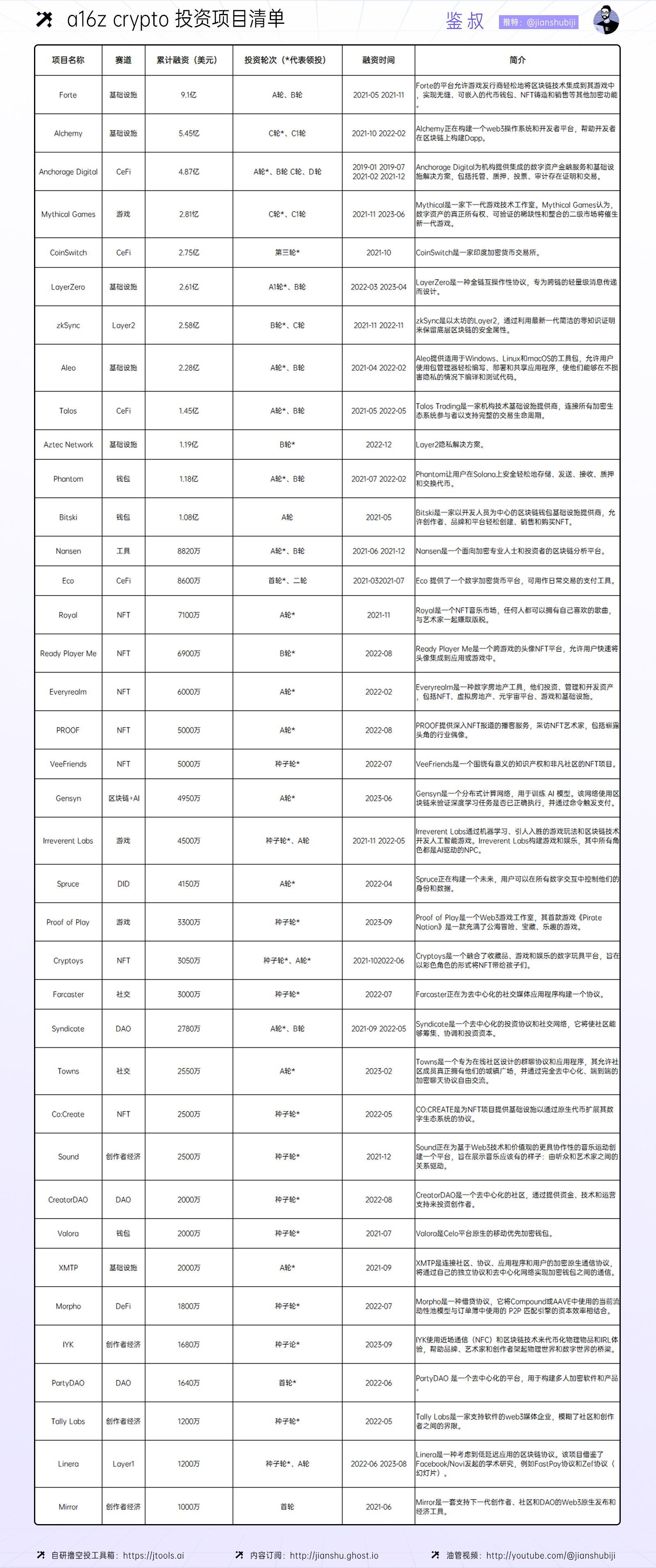

a16z crypto's ability to pick winners is evident. The following are potential projects selected from a16z crypto's investment landscape, excluding those that have already issued coins, rug projects, those with financing amounts below $10 million, and those serving traditional industries (unlikely to issue coins), for readers' reference (sorted by cumulative financing amount):

V. Conclusion

"Software is eating the world" is a16z's most well-known slogan, originating from Marc Andreessen's article "Why Software Is Eating the World" published in The Wall Street Journal in 2011, which firmly established a16z's confidence in investing in internet companies for the next few years.

After a16z invested in Web3 startups like Coinbase, facing skepticism from peers and the media, Marc Andreessen wrote another famous article in The New York Times in 2014 titled "Why Bitcoin Matters". In the article, he regarded Bitcoin as an equally important innovative technology as the personal computer in 1975 and the internet in 1993. This actually laid the foundation for a16z's long-term investment belief in the cryptocurrency industry and prompted many traditional venture capitalists to re-evaluate the cryptocurrency industry.

From "software cheat code" to "crypto cheat code", a16z's transformation is in line with the times. Just as described on the homepage of a16z crypto, there have been three eras of the internet: the first era (1990–2005) did not have a16z, the second era (2005–2020) achieved a16z's success.

We are now in the third era, and a16z wants to continue its success.

References:

[1] a16z: A "Hollywood" Style Victory

[2] How the Legendary Venture Capital Firm a16z Plays with Cryptocurrencies: Illustrated Investment Landscape and Strategies

[3] Web3 Venture Capital Institution a16z Crypto 20,000-word Research Report: Is it a Venture Capital or an Entrepreneurial Service Institution? A comprehensive decryption of its business matrix, investment portfolio, action principles, and future trend analysis

[4] RootData: Which institutions love to lead investments? Which institutions have made the most moves this year?

[5] Having invested in 86 Web3 companies, is a16z a preacher or a big talker?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。