Infrastructure Track: Diversified Innovation Lays a Solid Foundation

Evolution of Ethereum: Ethereum is actively addressing network performance bottlenecks through the Shanghai upgrade and the upcoming Cancun upgrade in 2023. The focus is primarily on increasing throughput and reducing transaction costs. The landmark upgrade, The Merge, will transition Ethereum's consensus mechanism from POW to POS, laying the foundation for Ethereum's future development.

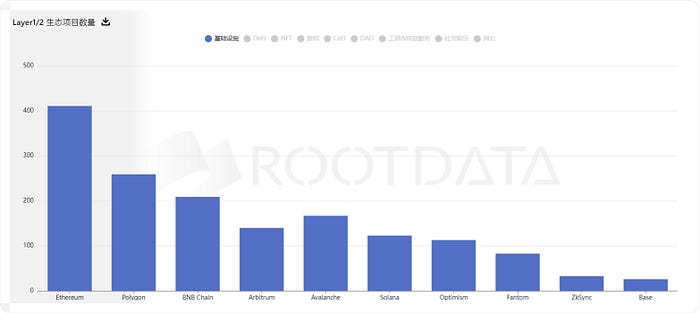

Flourishing of Layer 2: In 2023, Layer 2 networks experienced rapid development, especially led by Optimistic Rollup and ZK Rollup. Key issues in this area include whether the data growth reflects genuine network prosperity and the sustainability of projects after airdrops and token incentives end. However, there is optimism about the future development of Layer 2, especially with the advancement of EIP-4844.

Innovative Modular Technology: Modular blockchain technology garnered significant attention in 2023, particularly in the development of data availability layers. Projects such as Mantle and Celestia explored modular technology, bringing greater flexibility to blockchain applications and Layer 2, albeit also introducing complexity and security issues.

Emergence of Application Chains: Application chains, as a solution to alleviate network congestion and enhance autonomy, gradually gained attention in 2023. The successful deployment of dYdX on Cosmos set a precedent for application chains, bringing advantages such as performance improvement, cost reduction, and increased autonomy. However, the development of application chains also faces challenges such as liquidity isolation and security.

Account Abstraction Enhances User Experience: The concept of account abstraction received significant attention in 2023. Smart contract wallets implemented social logins, social recovery, and gas fee delegation through integrating account abstraction, providing users with a more convenient experience. Despite facing technical complexity and security challenges, account abstraction is expected to open the door for large-scale Web3 applications.

Overall, the diversified innovation in infrastructure in 2023 has laid a solid foundation for building a more robust, secure, and efficient blockchain network, providing abundant development opportunities for the future of the cryptocurrency market.

DeFi Track: Increased Specialization and Professionalization

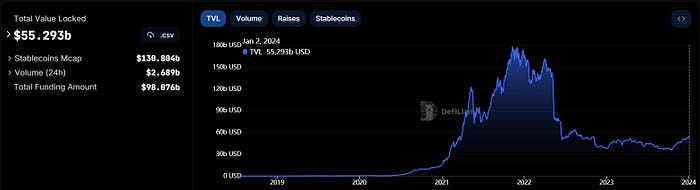

In 2023, the decentralized finance (DeFi) market entered a relatively stable development period, contrasting sharply with the multiple rug pull incidents in 2022. The market became more specialized and professionalized.

Steady Growth of DeFi Protocols Market: The DeFi market in 2023 exhibited steady growth, with a total locked value exceeding $55 billion, a 23.6% increase from the end of 2022 when it was $38 billion. Ethereum still dominates with a 56% share, followed by TRON at 16%. Lido, Maker, and Justlend were the top three projects in terms of locked value, with Lido accounting for 41% of the total.

Diversification of Revenue Sources and Protocol Types: Maker topped the list with a daily income of $500,000, and among the top twenty income-generating projects, eight were exchanges or derivatives exchanges, and three were lending protocols. The DeFi market showed a trend of diversified revenue sources, with exchanges and lending still being the main protocol types, leading to intense market competition.

Rise of Real-World Assets (RWA): In 2023, the DeFi market introduced the concept of real-world assets (RWA), focusing on bringing real-world assets onto and off the chain to realize on-chain transfer of off-chain assets and their returns. MakerDAO's US Treasury RWA scale has reached $2.8 billion, and Avalanche has developed the RWA ecosystem, providing an on-chain platform for traditional institutions.

Emergence of Decentralized Stablecoins: Concerns about the risks of centralized stablecoins drove the development of decentralized stablecoins. Although USDT and USDC hold over 90% market share, USDC's off-peg incident prompted a reevaluation of centralized stablecoins. In 2023, over 120 types of over-collateralized stablecoins were introduced to the market, and DeFi protocols also launched native decentralized stablecoins.

In summary, the DeFi market in 2023 exhibited a more mature and diversified trend, with emerging areas such as RWA and decentralized stablecoins injecting new vitality into the future development of the DeFi industry.

SocialFi Track: Rising Popularity and Emerging Investment Potential

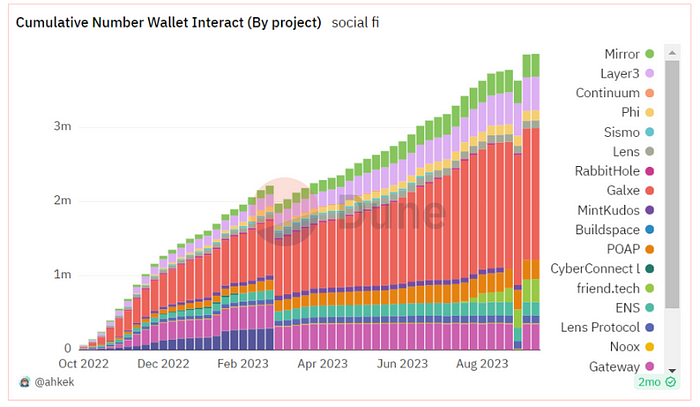

Rise of SocialFi: The SocialFi track, similar to the social and entertainment attributes of blockchain games, has attracted attention from users in the cryptocurrency field since 2021. In 2023, this track experienced significant development, with innovative gameplay and designs attracting a large influx of Web3 new users. The cumulative wallet interactions of mainstream projects approached over 4 million, and new projects such as Galxe, Friend.Tech, and Sismo also gained considerable traffic.

Concentration of Interactions in Mainstream Projects: Interactions of SocialFi projects are mainly concentrated on the Polygon and Base chains, while other chains have relatively less traffic in the social domain. Polygon successfully attracted a large amount of traffic by providing a stable network, fast computation, low interaction costs, and developing gaming and NFT applications over the past 1-2 years. Base, driven by Friend.Tech, currently occupies a significant portion of the SocialFi track's traffic, while other chains such as Ethereum and BNB experienced relatively slower growth in social traffic.

Three Mainstream Directions Leading the Trend

Social Infrastructure: Projects such as Galxe, Lens, and CyberConnect reduce user entry barriers by providing unified, simple, and convenient infrastructure, becoming the traffic entry points and interfaces for the Web3 SocialFi track.

Social Dapps: These include various types of projects such as post forums, fan platforms, video streaming media, social games, and identity authentication. Among them, Friend.Tech achieved remarkable results in ecosystem development, successfully achieving a breakthrough in traffic.

Social Bots: These include trading bots, yield farming bots, and question-answering bots, such as Unibot and Banana Bot. These projects, originating from Web2 social platforms, significantly lower user entry barriers, effectively expanding the user base of cryptocurrencies.

In conclusion, with the launch of projects and token issuance, the SocialFi track market has gradually gained momentum, attracting increasing attention.

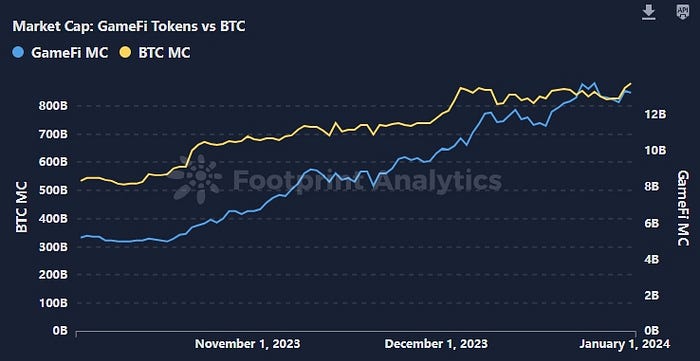

GameFi Track: Steady Construction and Capital Involvement

Active Track, Favorable to Capital: The game track experienced vigorous development in 2021, attracting a large amount of traffic and capital. However, the industry cooled off in 2022, with the wealth effect weakening, and game projects relying on gold farming faced challenges in user growth. In 2023, the overall game track performance remained relatively stable. As an emerging traffic-oriented track in the current bull market, game projects on issued chains maintained a certain level of activity throughout the bear market period. It is expected that the game track will continue to benefit from traffic effects and project performance in the current cycle.

Overview of Digital Data: In 2023, game projects continued to grow, with over 2600 chain game contracts in the market, the total market capitalization of issued coin projects exceeding $6.5 billion, daily trading volume surpassing $6 million, and the number of daily active addresses exceeding 1 million. The overall market maintained a certain level of activity during the bear market.

Traffic Concentration and Chain Ecosystem: The absolute traffic of the market's daily active addresses is mainly concentrated on the Wax chain, benefiting from its low interaction costs and efficient settlement experience. Wax maintained the highest market share position after experiencing both bull and bear markets, while other public chains such as Near, Celo, and Polygon also held a certain market share.

Deployment of Ecosystem Projects: In 2023, game projects benefited from the development and maturation of entrepreneurial projects in the previous bull market, showing an overall increase compared to 2022. BNB still has the most game projects in its ecosystem, followed closely by Polygon, Ethereum, and Wax, all possessing a certain market share in the deployment of game ecosystem projects.

In conclusion, the game track as a whole showed a trend of steady construction in 2023, and is expected to perform well in the next bull market.

Outlook for the Development of the Cryptocurrency Market in 2024

- Concept Tokens of Public Chains Leading the Market

In 2024, concept tokens of public chains are expected to continue leading the cryptocurrency market. Particularly, attention should be paid to the development of Avalanche and Solana, as these two projects may become new market focal points. Investors should closely monitor the performance of these projects in terms of technology, ecosystem, and community development.

- Emergence of New Protocols in the DeFi Field

The DeFi field may see the emergence of more new protocols, and investors should pay special attention to the performance of new projects. As DeFi continues to evolve, new financial tools and protocols are expected to bring new innovations to the market, potentially impacting the industry landscape.

- Arrival of New Active Projects in the NFT Market

The NFT market may see the arrival of new active projects, and investors need to closely monitor the market value and actual transaction prices of these projects. The development of the NFT field still holds great potential, and new creativity and technological applications may drive market growth.

- Caution Needed in the Game and Social DApp Fields

The performance of the game and social DApp fields is unstable, and the activity of projects may fluctuate significantly. Investors should focus on the launch and performance of new projects to avoid potential risks. The industry's development may require more time to stabilize, and cautious investment decisions are crucial.

Conclusion:

In 2023, the cryptocurrency market experienced a year of great diversity in the development of projects in different fields. It is expected that the cryptocurrency market will continue to be vibrant in 2024, with opportunities emerging in various fields. Investors need to stay alert, monitor market dynamics, and adjust strategies in a timely manner to cope with the constantly changing cryptocurrency market environment.

Hotcoin Community

Official Chinese Group: https://t.me/hotcoinglobalcn

Official English Group: https://t.me/HotcoinEX

Official Korean Group: https://t.me/hotcoinkorea

Discord: https://discord.gg/aQg4h52c

Facebook: https://www.facebook.com/HotcoinExchange

Twitter: https://twitter.com/HotcoinGlobal

Hotcoin Official Website: https://www.hotcoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。