Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.13 trillion, with BTC accounting for 58.7%, or $1.83 trillion. The market capitalization of stablecoins is $30.91 billion, which has increased by 0.49% over the past week. Stablecoins have seen positive growth for three consecutive weeks, with USDT making up 60.21%.

Among the top 200 projects on CoinMarketCap, most have declined while a few have risen. Specifically, BTC has decreased by 0.14% over the past week, ETH has increased by 2.34%, SOL has decreased by 1.52%, M has increased by 25.79%, and ZEC has increased by 16.26%.

This week, the net inflow for the U.S. Bitcoin spot ETF was $286.2 million; the net inflow for the U.S. Ethereum spot ETF was $209 million.

Market Forecast (December 15 - December 21) :

The current RSI index is 46.17 (neutral range), and the fear and greed index is 28 (higher than last week, generally in the fear range). The altcoin season index is 35 (neutral, slightly lower than last week).

It has been observed that after the Federal Reserve announced a rate cut on December 11, the market reacted mildly except for gold. This is not due to a single reason but because the market had fully priced in a 25 basis point rate cut before the meeting, leading to profit-taking after the positive news was exhausted. Additionally, Powell's hawkish remarks, combined with macroeconomic uncertainties, have put pressure on risk assets like cryptocurrencies. Next week, cryptocurrencies are expected to maintain a range-bound fluctuation.

BTC core range: $86,000 - $94,200

ETH core range: $3,100 - $3,400

SOL core range: $125 - $145

For short-term traders: It is recommended not to chase prices near the key resistance levels (such as BTC $94,200, ETH $3,400, SOL $140) and to wait for a clear breakout or a pullback after encountering resistance. Lightly test near key support levels (such as BTC $86,000, ETH $3,190, SOL $125). Be sure to set a narrow stop-loss.

For medium-term swing traders: Reduce trading frequency and patiently wait for prices to break out of the current "December opening range." Consider a "staggered layout" approach, where small positions are built in strong support areas (such as $120-$130 for SOL), using effective breaks below support as stop-loss or observation signals. At the same time, closely monitor whether the inflow of U.S. ETF funds can be sustained, as this will be an important indicator of market sentiment.

Understanding Now

Review of Major Events This Week

On December 7, Matt Huang, co-founder of crypto investment firm Paradigm, posted on social media, "I don't know who needs to hear this, but this moment is the 'Netscape moment' or 'iPhone moment' for cryptocurrency. Its operational scale is unprecedented, larger than we could ever imagine, accelerating development at both the institutional and cypherpunk levels;"

On December 10, the draft of the CLARITY Act is expected to be released this week, with hearings and voting scheduled for next week;

On December 10, Bloomberg reported that SpaceX is expected to go public in mid-2026, with an estimated valuation of about $1.5 trillion, raising funds that could far exceed $30 billion, potentially becoming the largest IPO in history. The specific timing will depend on market conditions;

On December 9, as the year-end approaches, Wall Street banks are on high alert, preparing to respond to rising pressures in the money market. Analysts suggest this may prompt the Federal Reserve to consider measures to rebuild liquidity buffers in this $12.6 trillion market;

On December 10, according to Decrypt, SEC Chairman Paul Atkins stated at the Blockchain Association's annual policy summit that various types of ICOs should be considered non-securities transactions and therefore not subject to SEC regulation;

On December 12, the Southern District of New York Federal Court announced that Terraform Labs founder Do Kwon was sentenced to 15 years in prison for fraud related to the collapse of the Terra and Luna tokens.

Macroeconomics

On December 11, the Federal Reserve lowered the benchmark interest rate by 25 basis points to 3.50%-3.75%, marking the third consecutive meeting of rate cuts, in line with market expectations, totaling a 75 basis point reduction for the year;

On December 11, the number of initial jobless claims in the U.S. for the week ending December 6 was 236,000, the highest since the week of September 6, 2025. This figure exceeded the expected 220,000, up from the previous value of 191,000;

On December 12, according to the Federal Reserve's rate observer, the probability of a 25 basis point rate cut in January is 24.8%.

ETF

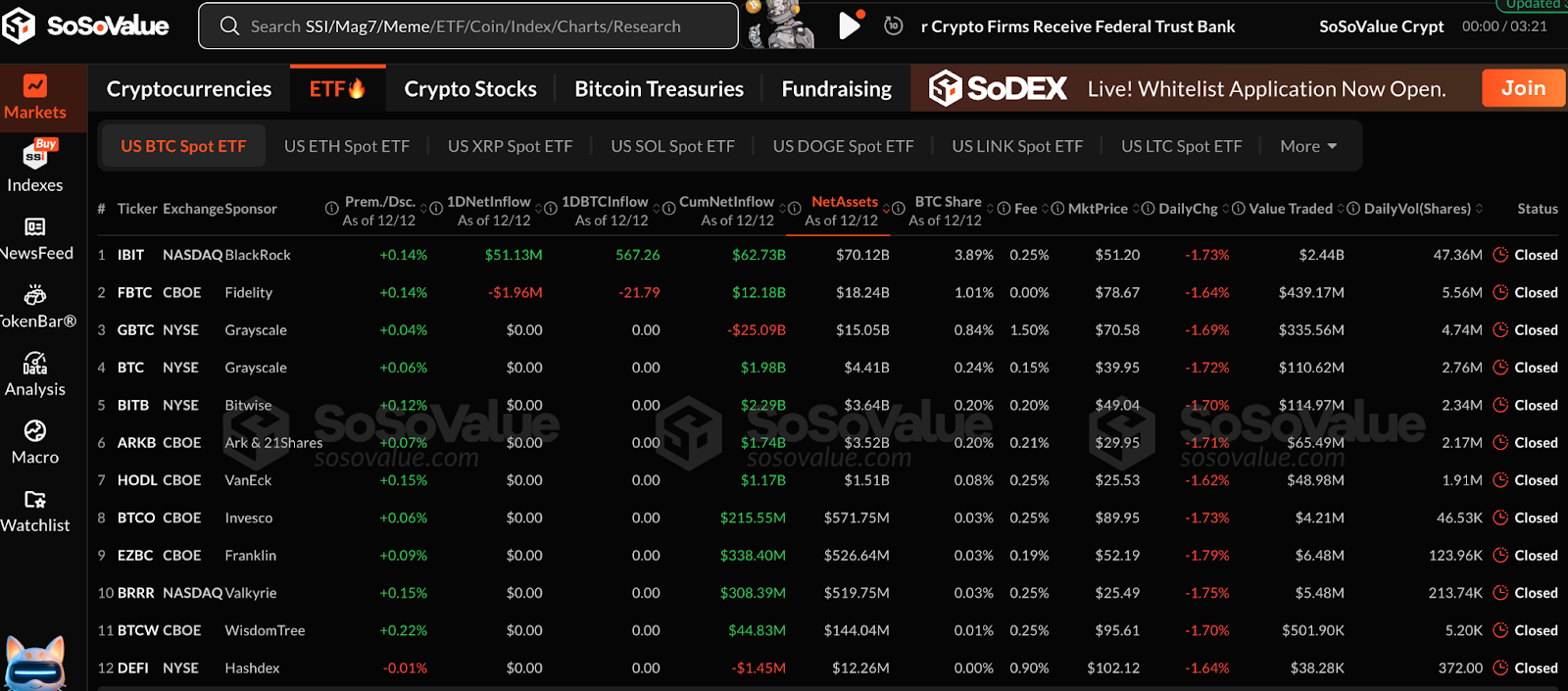

According to statistics, from December 8 to December 12, the net inflow for the U.S. Bitcoin spot ETF was $286.2 million; as of December 12, GBTC (Grayscale) had a total outflow of $25.039 billion, currently holding $15.061 billion, while IBIT (BlackRock) currently holds $70.093 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $120.07 billion.

The net inflow for the U.S. Ethereum spot ETF was $209 million.

Envisioning the Future

Project Progress

Yala announced that all native BTC under the institutional model will be withdrawn from the Yala protocol, with a complete redemption plan and timeline to be announced on December 15;

The second season airdrop claim window for deBridge will close on December 19;

PayPal has launched a Bitcoin lottery for U.S. users, with the deadline for participation set for December 21.

Important Events

On December 16 at 21:30, the U.S. will release the adjusted non-farm payrolls for November (in ten thousand);

On December 18 at 20:00, the UK will announce the central bank interest rate decision as of December 18;

On December 18 at 21:15, the Eurozone will announce the European Central Bank deposit facility rate as of December 18;

On December 18 at 21:30, the U.S. will release the unadjusted CPI year-on-year rate for November and the initial jobless claims for the week ending December 13 (in ten thousand);

On December 19 at 23:00, the U.S. will release the core PCE price index year-on-year for November.

Token Unlocking

Connex (CONX) will unlock 1.32 million tokens on December 15, valued at approximately $21.35 million, accounting for 1.61% of the circulating supply;

Starknet (STRK) will unlock 12.7 million tokens on December 15, valued at approximately $14.15 million, accounting for 5.07% of the circulating supply;

Arbitrum (ARB) will unlock 9.265 million tokens on December 16, valued at approximately $18.98 million, accounting for 1.9% of the circulating supply;

ZKsync (ZK) will unlock 17.3 million tokens on December 17, valued at approximately $5.64 million, accounting for 3.26% of the circulating supply;

Melania Meme (MELANIA) will unlock 2.625 million tokens on December 18, valued at approximately $2.93 million, accounting for 4.79% of the circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Select" (AI + expert dual screening), we identify potential assets and reduce trial-and-error costs. Each week, our researchers will also interact with you live, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。