Authors: Lisa, Jaden, LD Capital

I. DEX

1. RDEX

RDEX is a BRC20 Orderbook DEX, supported by a combination of the Ordinals protocol, PSBT technology, Bitcoin script, and the Nostr protocol. According to the official roadmap, the project also plans to launch a launchpad in 2024Q1.

Note: PSBT (Partially Signed Bitcoin Transaction) is a standard format used to simplify the processing of partially signed Bitcoin transactions, allowing wallets and other tools to exchange Bitcoin transaction information and complete the signatures required for transactions that have not yet been finalized. PSBT was introduced in 2019 through BIP 174 and is widely used in multi-signature transactions, offline wallet transactions, and other Bitcoin transactions that require multiple steps.

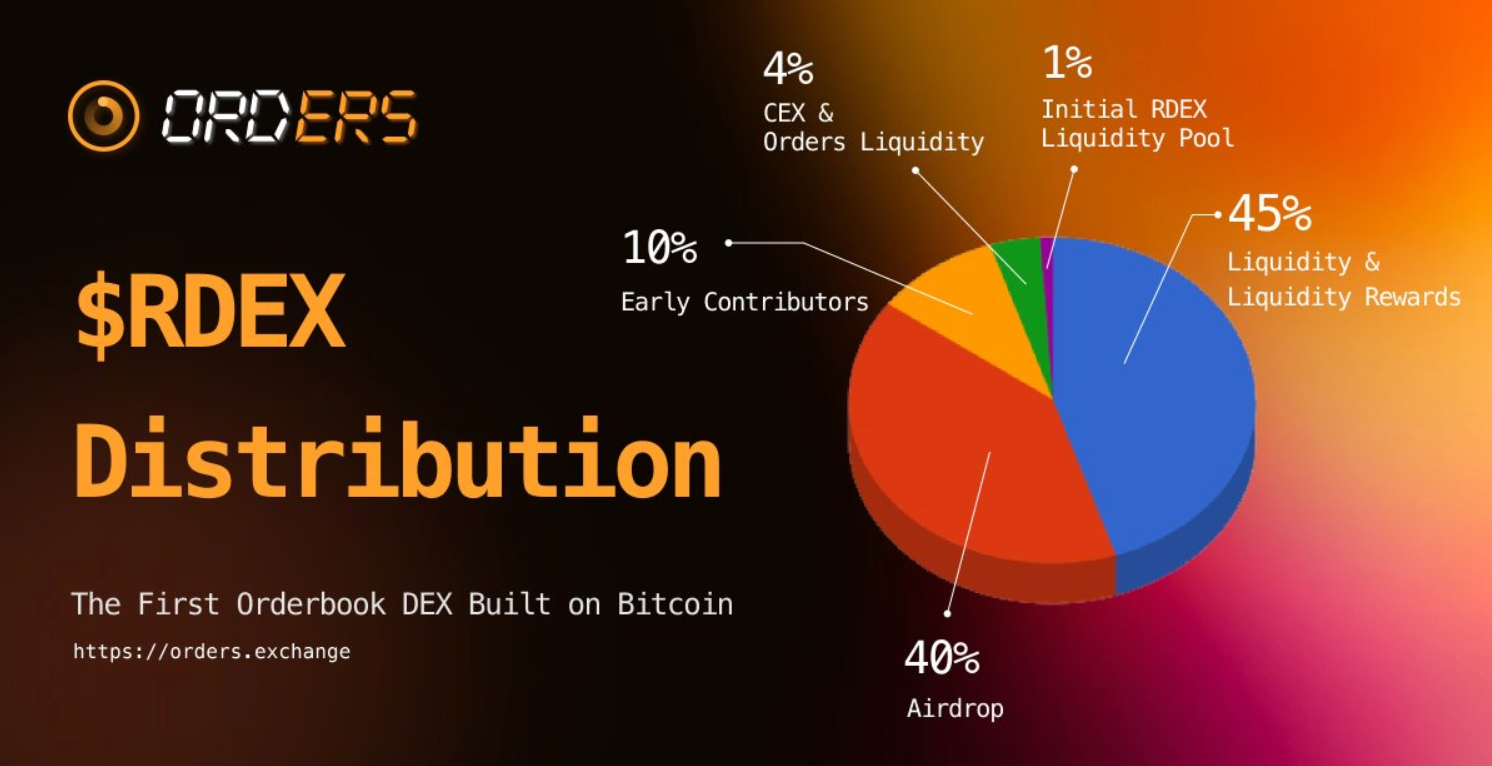

The total supply of RDEX is 100 million, with the following distribution:

2. DotSwap

DotSwap is currently the best AMM DEX experience for BRC20. The latest DotSwap V2 utilizes PSBT and secure asset pools to achieve BRC20 native AMM swaps. Founder Lin Zheming has over ten years of Bitcoin investment experience and seven years of Bitcoin mining pool management experience. He has previously developed the DotWallet and Ordinals marketplace TierTop.

The 2024 roadmap shows that the project will integrate more UTXO assets, further expand DEX's one-sided liquidity customization, liquidity fees, impermanent loss thresholds, advanced trading including spot price orders, and launch additional products such as launchpad, cross-chain, oracle, flash loans, NFT staking, and shorting, forming a complete ecosystem.

$DSWP is the official token of DotSwap, with a total supply of 1,200,000,000 (of which 22.76% is burned), and the current circulating supply is 27,379,620, accounting for only 2.292%. Apart from the burned and initially circulating portions, the remaining tokens will be unlocked over the next 4 years. The largest proportion of LP rewards will be released in the future through an LP mining plan.

DotSwap draws on Curve's economic model, allowing users to lock $DSWP to obtain veToken, which grants voting rights. veDSWP holders can use their voting power to decide which trading pairs should receive LP rewards.

DotSwap, as the first officially launched BRC20 native swap, has a first-mover advantage due to its smooth user experience. If it can further attract attention through the launch of high-quality projects and optimization of the economic model, cultivate user habits, and accumulate TVL in a brief window of time, it has the opportunity to establish a barrier to future competitors and become the leading DEX in the ecosystem.

3. Ordiswap

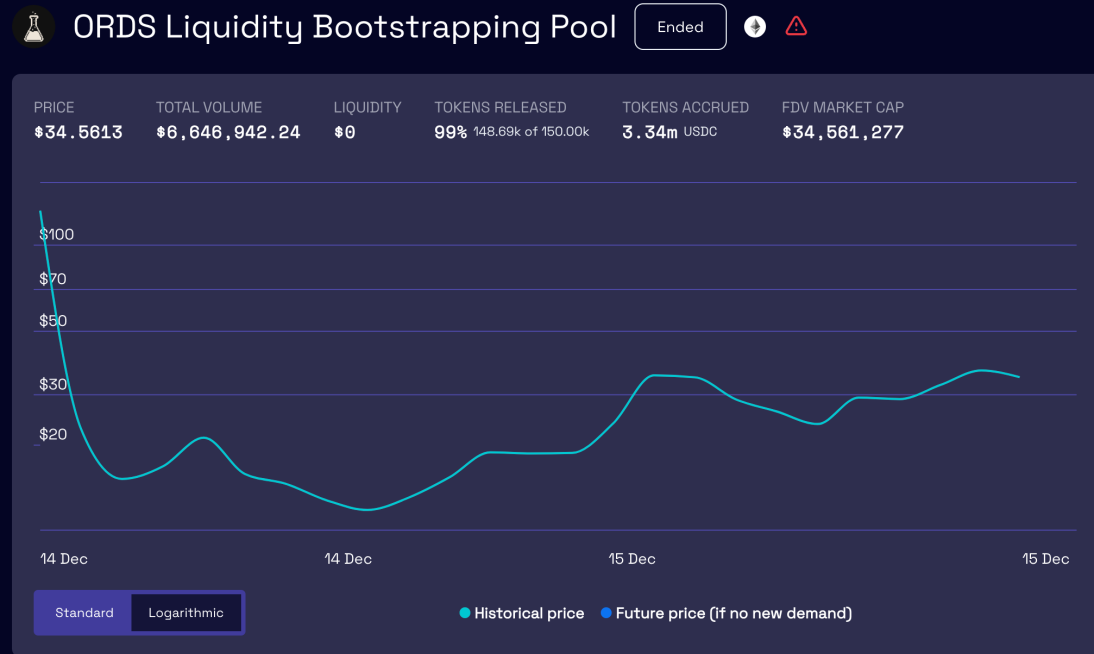

Ordiswap's products include swap, bridge, and the stablecoin BTSD (Ordiswap’s Bitcoin Standard Dollar), which has not been officially launched yet. Ordiswap completed its Public Sale on December 15th at fjord foundry.

The platform token ORDS has a total supply of 1,000,000, with a private round price of $3.50 and a seed round price of $2.00. The TGE circulation is 437,500 ORDS, with a current price of $16, MC7m, and FDV16m.

II. Lending

1. Bitlend

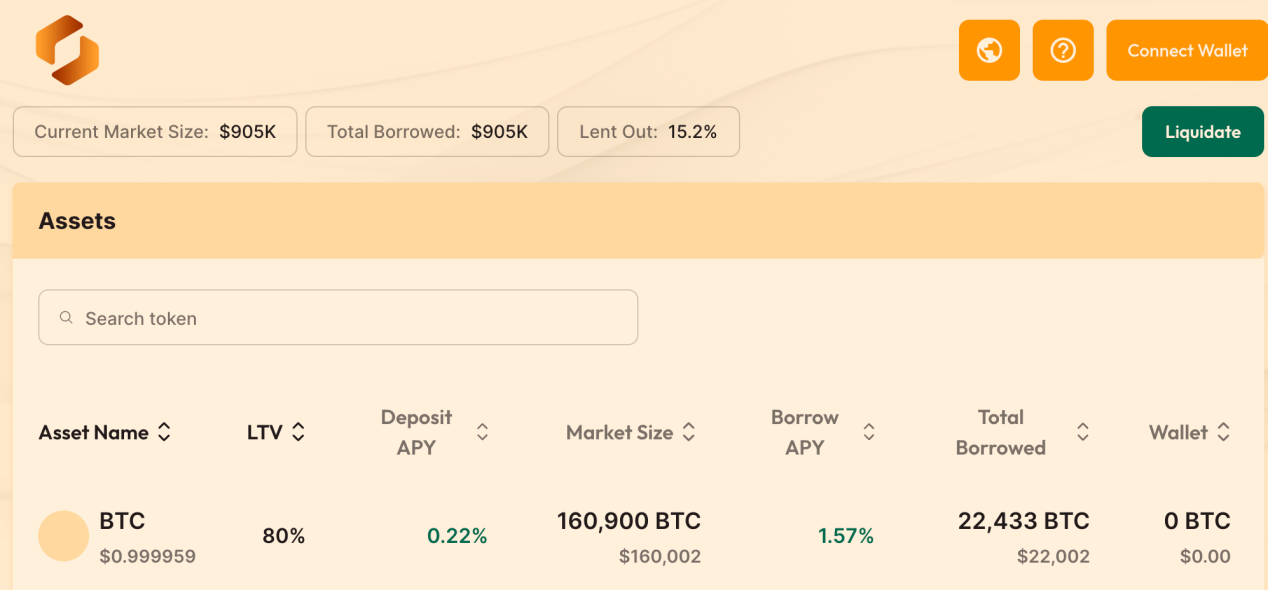

The whitepaper v1 was released on November 8th, aiming to create an algorithmic decentralized lending protocol running on the BTC network, where users can participate as lenders or borrowers in lending pools. It aims to fully unleash the potential of Bitcoin Layer 1 and establish a high-speed lending market for BTC native BRC20 assets using the Ordinals protocol, PSBT technology, and Bitcoin script. Users can earn deposit interest through a unified margin account and borrow from shared liquidity pools using collateral.

The product is expected to support BTC, ORDI, SATS, NALS, RATS, ROUP, and TURT.

The project's product is currently in the testing phase, and OG pass cards and Light pass cards are being sold.

The total supply of OG cards is 500, priced at 0.001218 BTC, and sold fairly.

The total supply of Light cards is 1000, priced at 0.000813 BTC, and sold exclusively through whitelisting.

Pass card benefits include:

1) $BTL inscription airdrop 2) Rights to use the beta version of the application 3) Additional benefits (not specified) 4) 50% fee reduction

5% of BTL tokens are airdropped to OG card holders, and 3% are distributed to all Light card holders. However, it should be noted that the team will take 5 random snapshots between December 18th and January 18th, and holders need to be included in the list at least 3 times to be eligible for the airdrop.

2. DOVA

The Dova protocol's product has not been launched yet. The protocol aims to enable users to seamlessly transfer BRC-20 tokens across chains through the MultiBit cross-chain bridge and support users in using BRC-20 tokens for collateralized loans. The team plans to launch the product in the first quarter of 2024.

Tokenomics

The total token supply is 21 billion, with 10% allocated to IDO, 60% to mining, 10% belonging to the team, and 10% for airdrops, liquidity pools, and treasury, each accounting for 5%.

III. Stablecoin

1. BSSB

I. DEX

1. BitStable Protocol

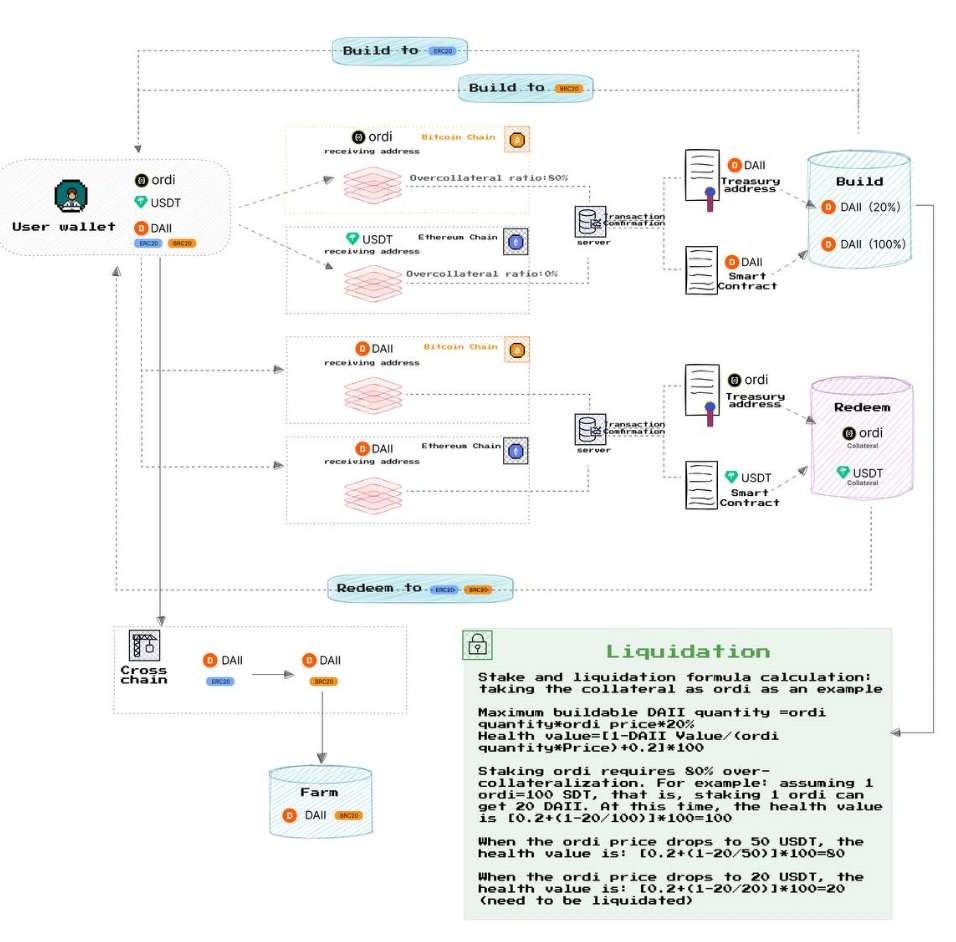

The BitStable protocol aims to build a framework for creating, trading, and managing synthetic assets in the Bitcoin ecosystem, using a cross-chain and dual-token economic model.

Protocol Framework

The BitStable protocol supports the collateralization of ORDI or BTC/BTCB on the Bitcoin network, Ethereum network, and BNB chain to obtain the stablecoin DAII. DAII minted on the Bitcoin blockchain can be bridged to Ethereum, where users can exchange it for stablecoins like USDT at a 1:1 ratio, and then cross-chain it back to the Bitcoin network. The collateralization ratio for ORDI is 500%. The protocol documentation also details the implementation process of the liquidation module on the Bitcoin network. When users need to redeem collateral on the Ethereum network, they need to redeem DAII on the BitStable platform.

Tokenomics

The total supply of BSSB is 21 million. 50% will be publicly sold on Bounce Finance, the team will hold 5% (with a 6-month lockup period and linear unlocking over 15 months), airdrops will account for 3.5%, staking rewards for 36.5%, and LP for 5% (unlocked). On Bounce Finance, 60% will be obtained through AUCTION staking, and 40% through auctions.

The primary function of the BSSB token is for governance voting, determining parameters such as the selection of collateral assets, setting excess collateralization ratios, and fee collection.

In addition, the Multibit platform supports BSSB addresses to earn BDID.

IV. Launchpad

1. Bounce

Bounce is a decentralized auction platform launched in September 2020. In February 2023, Bounce V3 was introduced, which brought Auction as a Service (AaaS), providing on-chain auction tools for both Web3 native space and traditional space while maintaining a traditional user experience. Investors include Coinbase Ventures, Binance Labs, Pantera Capital, Blockchain Capital, and others. Bounce will also launch BTC Layer 2 BounceBit in the future.

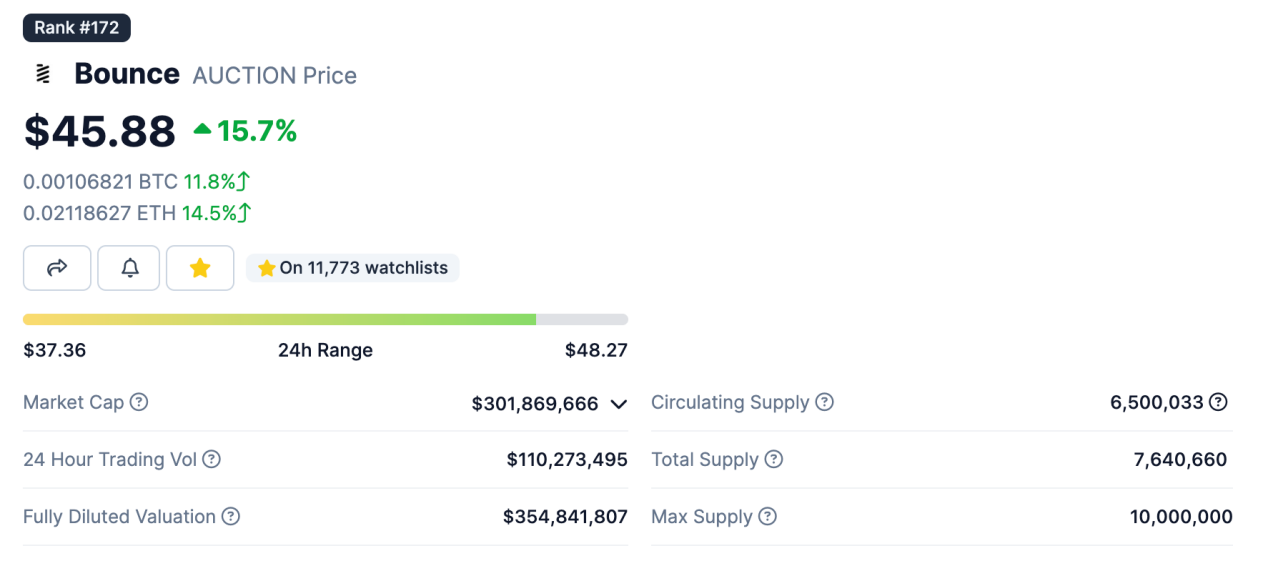

The platform token for Bounce Finance is AUCTION, used for governance voting, trading medium, exclusive auction focus (staking for platform promotion), obtaining Bounce V3 membership, and staking for dividends.

Max supply is 10,000,000, with a total supply (excluding burn) of 7,640,660 and a circulating supply of 6,500,033, expected to be fully released by August 2024.

2. Turtsat

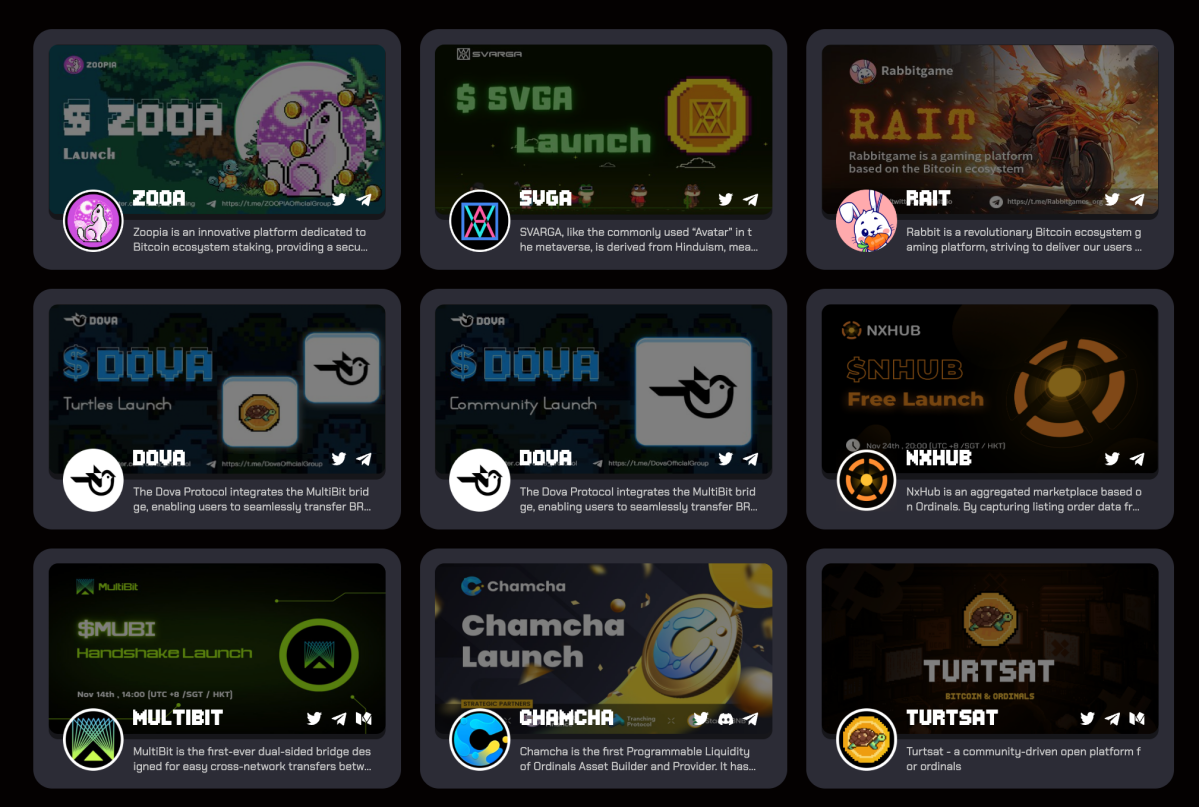

Turtsat is a community-driven open platform built on Ordinal, aiming to become the Gitcoin of Ordinals. The image below shows projects that have completed fundraising through Turtsat.

The official $TURT is an experimental BRC-20 MEME with a total supply of 1 billion tokens. The token distribution is as follows:

Early holders of $TURT can qualify for whitelisting. On December 7, 2023, Turtsat issued a new asset called EGGS, which users can obtain by staking $TURT. EGGS can be exchanged for whitelist access to launch projects, and in the future, EGGS may be used in more scenarios, including but not limited to project launch voting and direct exchange for collaborative token packages. The current $TURT staking amount is 313.4 million.

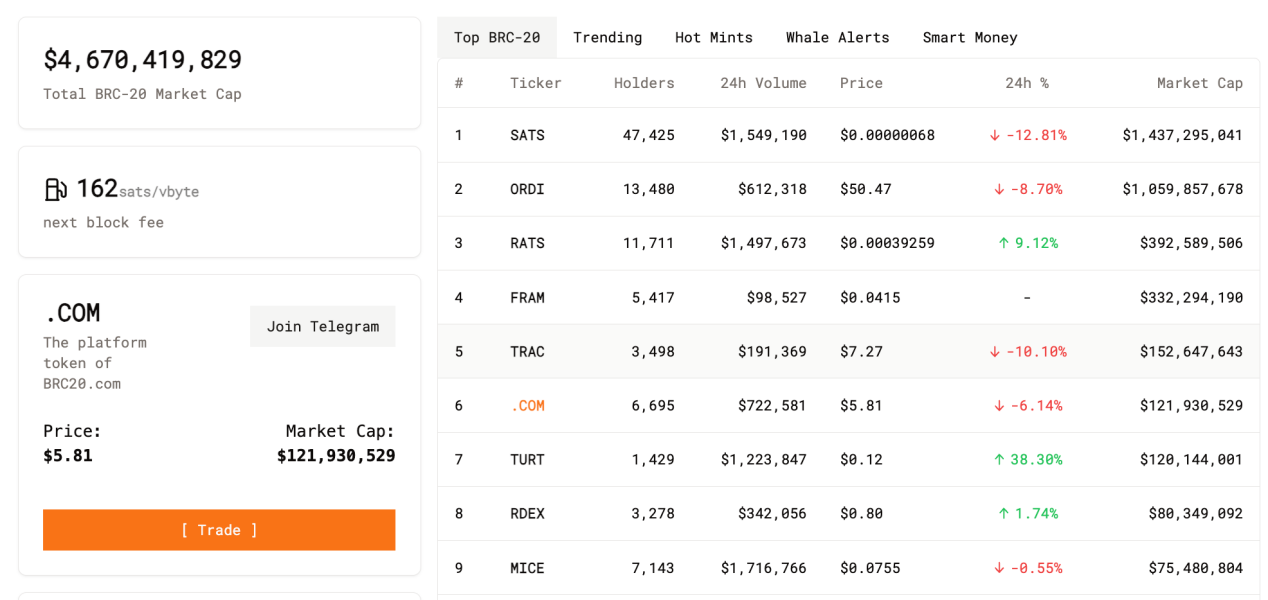

3. BRC20.COM

The project's vision is to create a comprehensive Bitcoin network ecosystem Super App, including a wallet, DEX, cross-chain bridge, staking, and other DeFi solutions. The platform has released products such as a DASHBOARD platform similar to Coingecko, primarily used for users to track related BRC20 market tokens.

The platform will also launch its first Initial Farming Offering (IFO) project on December 26, where users will be able to participate using the no-gas staking infrastructure with .COM tokens (for now, this is categorized as a launchpad project).

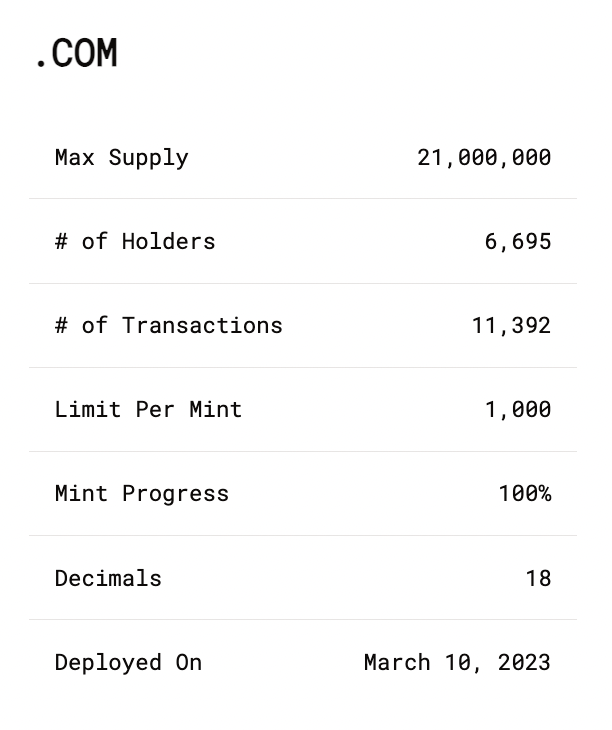

The platform token .COM has the following basic details:

V. Cross-Chain

1. Multibit

Multibit aims to achieve token transfers between the Bitcoin network and EVM network, currently providing cross-chain bridge services for BRC20 tokens and tokens on the ERC20, BSC, and Polygon networks.

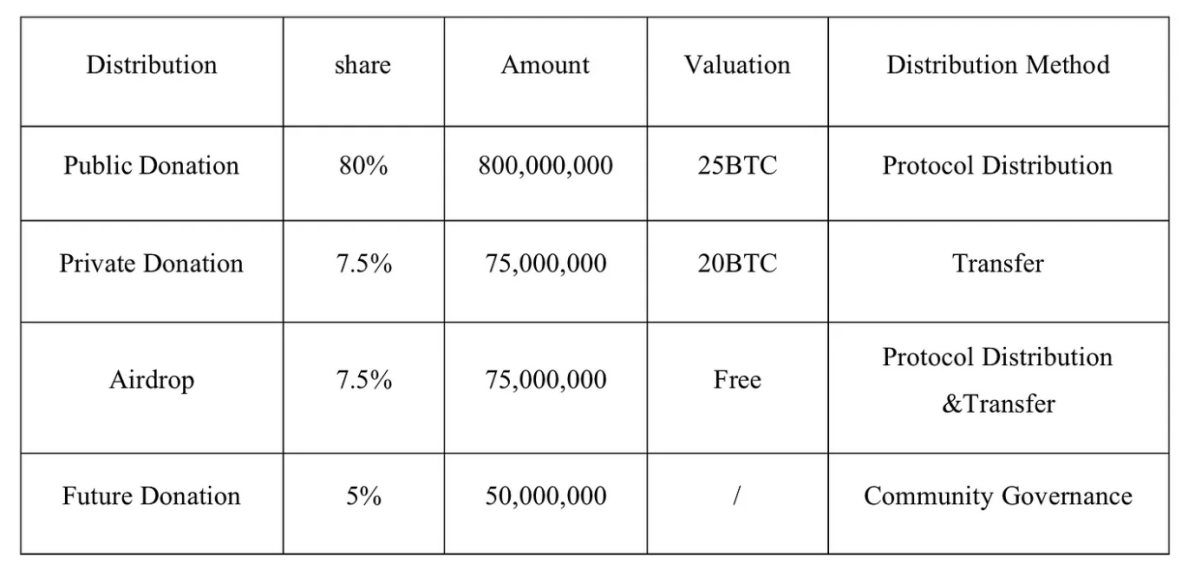

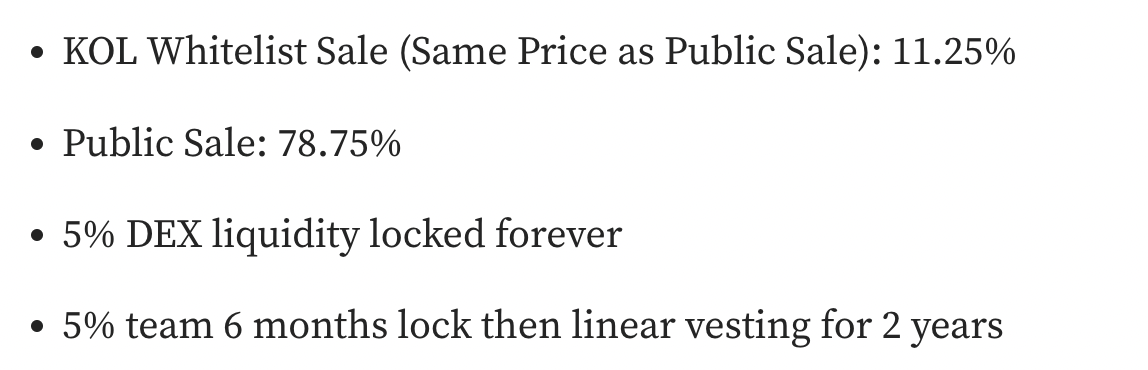

The $MUBI token was publicly sold on Bounce on November 12, with the token distribution as follows:

2. ROUP

Rolluper (ROUP) uses the BRC201 cross-chain solution of the MAP Protocol and was officially launched on December 20, 2023, enabling cross-chain from brc20 to MAP layer2. ROUP is the BRC20 platform token of Rolluper, with a total supply of 21 billion tokens, limited to 10,000 tokens per minting. The protocol's service income will be used for the repurchase and destruction of $ROUP. Rolluper also empowers MAPO as the platform token, but the proportion of MAPO tokens in the repurchase and destruction activities will not exceed 10%.

3. Ordinfinity

Ordinfinity is a cross-chain, swap, multi-chain lending, and launchpad DeFi platform based on ordinals. $ONFI (BRC20) is the native utility token of Ordifinity, providing holders with governance rights, cross-chain fee reductions, whitelist access, and staking rewards. The total supply is 2,100,000,000, and the current market value is approximately 8.7 million.

4. TeleportDAO

TeleportDAO is an untrusted cross-chain bridge that connects Bitcoin to the EVM. It currently has two products: teleordinal, a cross-chain Ordinals trading market, and teleswap, a cross-chain DEX that only enables BTC to cross-chain on Polygon and BSC. The platform token TST is not yet live, and two rounds of TeleportDAO incentive programs have been conducted on coinlist to distribute TST rewards to users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。