To enhance the project's visibility and promote community development, Noahswap launched an activity on December 15th to participate in the airdrop. After its launch, the activity has gained tremendous market attention, and as of the time of writing, the number of participants in the activity has exceeded 210,000.

In the current hot market, how did Noahswap break through and attract high market attention?

I. Breakthrough Strategy: Leading the Narrative of "Non-Performing Assets" to Transform the Trillion-dollar Market Direction

1.1 Core Investment Logic

According to relevant data, the global market size of non-performing crypto assets is close to trillions of US dollars. As the world's first synthetic platform for non-performing assets, Noahswap has attracted numerous investors with its unprecedented platform positioning, unique business model, and market performance. In just a few months, the platform token NOAH's market value and trading volume have steadily increased, which is rare in the current bear market environment.

1.2 Project Valuation and Token Valuation

1.2.1 Noahswap Project Valuation

As of the time of writing, Noahswap has listed over 200 project tokens, and the team members come from well-known financial institutions and technology companies. Based on this, this report predicts that Noahswap's project valuation will steadily increase. With its innovation, community support, and trading volume performance, leading blockchain industry media and some institutional experts predict that Noahswap's project valuation growth rate in 2024 is expected to be one of the fastest.

1.2.2 NOAH Token Valuation

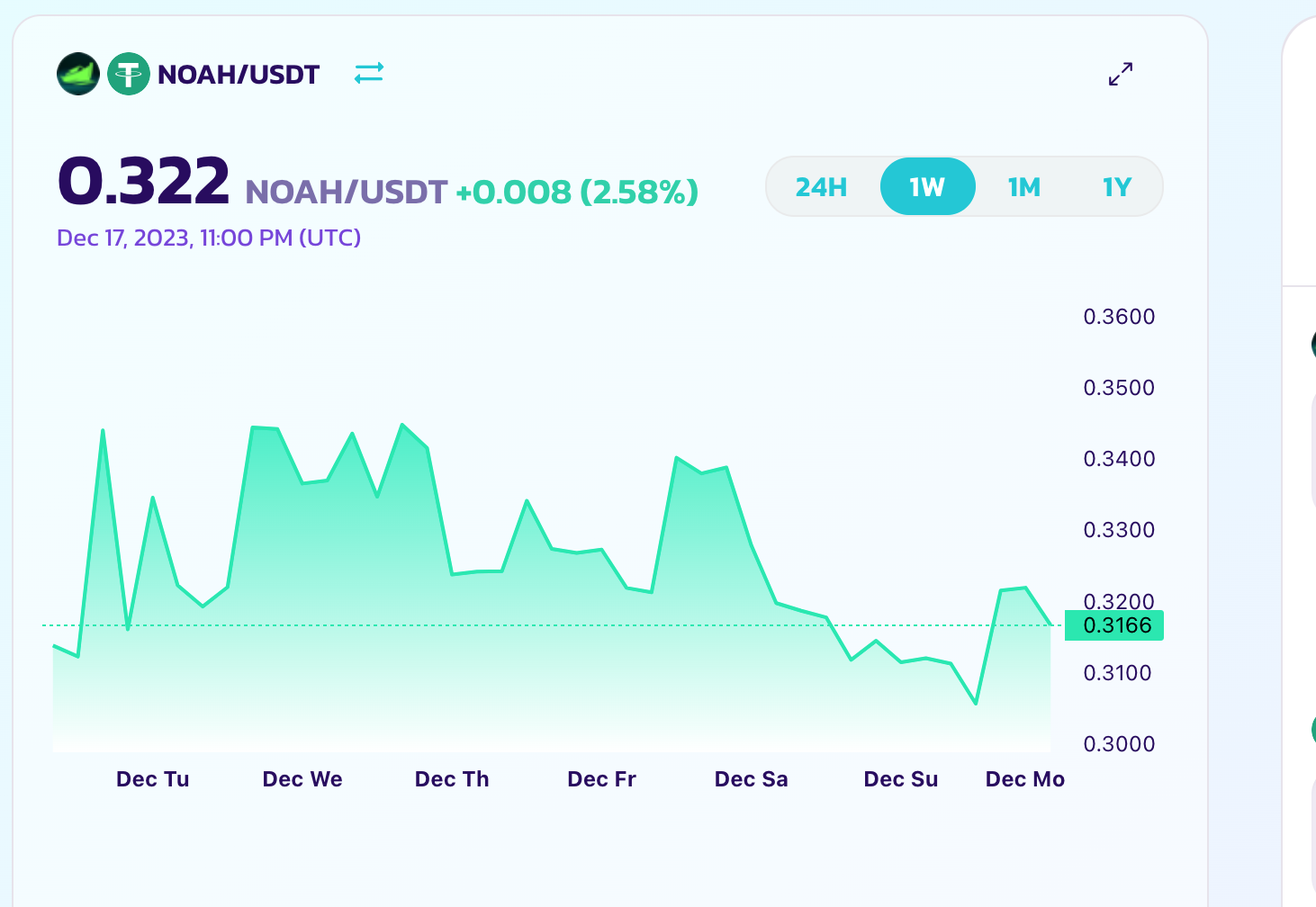

According to the latest data from CoinGecko, the total supply of NOAH tokens is 500 million, with a circulation of over 5 million, and the current market value is $1.79 million. At the time of writing, the NOAH/USDT price on PancakeSwap was $0.322 per token, showing a strong upward trend, with an increase of over 32 times from the issuance price. (Statistics time: 2023/12/18 14:00 UTC+8)

NOAH 30D increase (Data source: CoinGecKo.com)

NOAH 24H price (Data source: PancakeSwap.finance)

Win-Win Matrix: Connecting Project Parties and Investors, Building a Trust Win-Win Triangle

2.1 Project Business Scope

The service targets include investment institutions, project parties, and 320 million digital currency investors worldwide, especially those who have suffered losses.

2.2 Project Business Categories

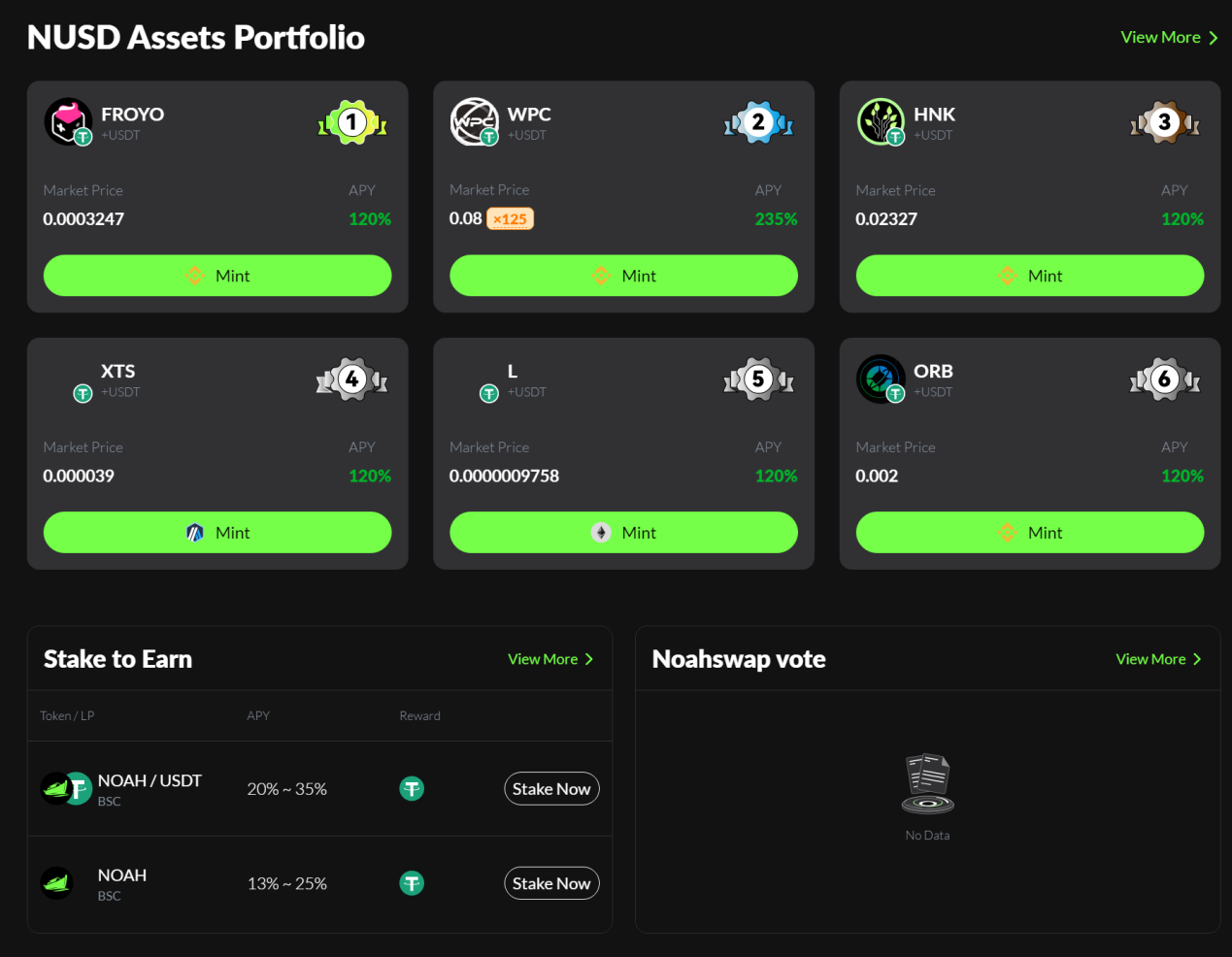

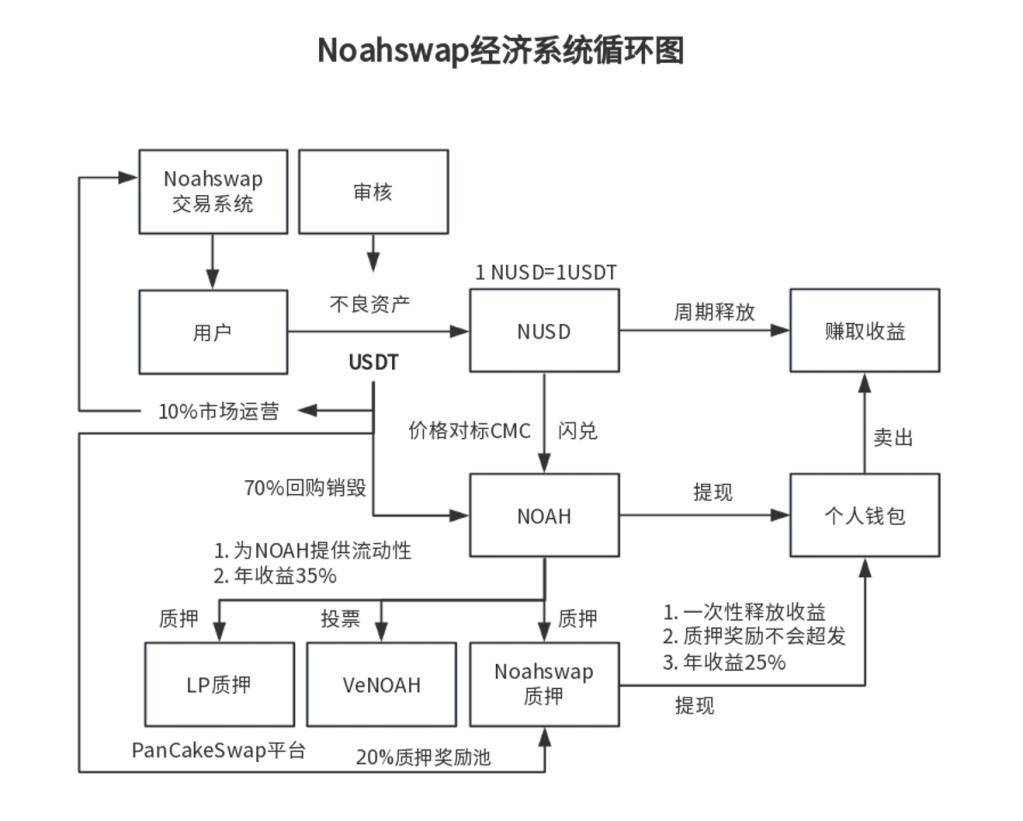

Synthetic Asset Minting: With a unique synthetic asset minting mechanism, investors combine crypto assets with USDT to generate NUSD synthetic assets, where 1 NUSD is equivalent to 1 USDT.

Synthetic Asset Flash Swap: Users can flash swap NUSD for NOAH tokens, providing a more convenient liquidity method and increasing profit opportunities.

Liquidity Management: Through a liquidity mining model, users are incentivized to provide liquidity to the platform by staking NOAH tokens to earn rewards. In addition, Noahswap also provides new liquidity management options for crypto projects.

Decentralized Trading: As a decentralized autonomous organization (DAO), Noahswap provides secure, transparent decentralized trading services.

Oversold token minting business and NOAH staking (Image source: Noahswap.io)

Noahswap economic system cycle diagram

2.3 Project Development Roadmap and Current Development Status

According to Noahswap's whitepaper development roadmap, the 2023-2024 goals are:

- Support 180+ crypto assets, including mainstream, niche, and oversold tokens, totaling 1,000 types of crypto asset minting.

- Become the world's largest and most professional platform for oversold token asset processing.

- Achieve a $1 billion asset scale by 2024.

Noahswap has already completed platform basic function optimization, supporting various crypto asset synthetic minting, providing a simple, secure, and efficient trading experience. Additionally, it has collaborated with multiple well-known projects to expand platform liquidity and opportunities. In the future, Noahswap will continue to achieve development goals according to the development roadmap.

2.4 Financing Situation and Investor Introduction

According to public information, Noahswap has undergone an independent round of financing.

In October 2023, it successfully received a $3 million investment from Coinstore Labs, the blockchain innovation lab under the well-known centralized exchange Coinstore.com in Singapore.

2.5 Profit Situation

Noahswap's profit mainly comes from the following aspects:

- Firstly, NOAH achieves market value appreciation through real-time repurchase and burning.

- Secondly, when users mint assets on the Noahswap platform, the platform puts these assets into the liquidity pool for other users to trade. In this process, the platform can earn a portion of the transaction fee income. In addition, some token projects themselves provide mining income, from which Noahswap can also benefit.

- Thirdly, selling tokens in a good market situation can generate higher returns. Therefore, Noahswap seizes the opportunity to sell tokens for profit based on market conditions.

- Fourthly, as the platform's business grows, more and more project parties and investors choose to use Noahswap, and fee income will gradually increase, bringing substantial revenue to the platform.

- Fifthly, the current platform listing fees are completely waived, but in the future, certain fees may be charged, which will serve as another source of income.

III. Growth Driver: Super Currency Contraction Strategy Driven by Burning USDT to Boost NOAH Price

3.1 Industry Space and Potential

The crypto asset market where the Noahswap project is located has tremendous potential and development space. With the development and popularization of blockchain technology, crypto assets are gradually becoming an important asset category for global investors. However, due to the high market volatility, investors often find it difficult to seize suitable investment opportunities. Therefore, the emergence of the Noahswap project provides investors with a new investment platform with significant market potential.

3.2 Token Model Economic Analysis

3.2.1 Token Total Supply and Distribution Situation

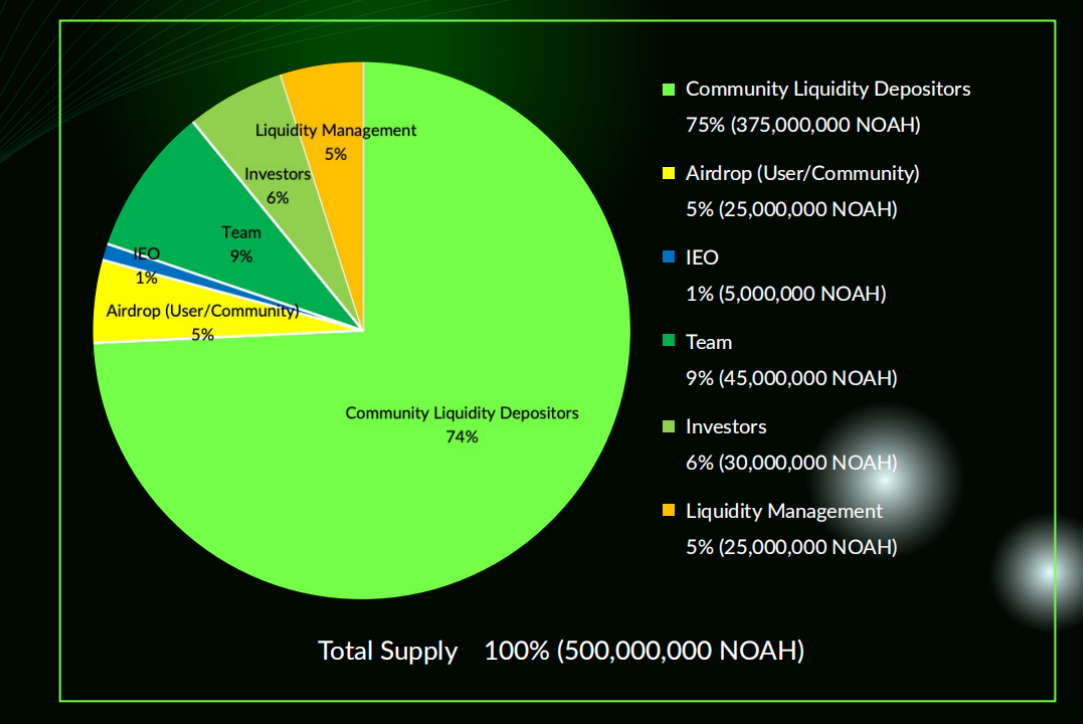

NOAH token is the token of the Noahswap platform, deployed on the BSC chain and compliant with BSC standards. According to public information from Noahswap, the total supply of NOAH is 500 million, with 75% allocated to community liquidity providers, 5% for airdrops, 9% for the team, 1% for IEO, 6% for investors, and 5% for liquidity management.

Distribution of NOAH tokens (from public information of Noahswap)

3.2.2 Token Value Capture Mechanism

Currently, the price of NOAH is rapidly increasing, and if investors exchange minted NUSD for NOAH tokens or stake NOAH, they have the opportunity to earn additional income.

3.2.3 Core Demand and Application Scenarios of Tokens

Use of NUSD synthetic assets:

- Minting method: Users mint synthetic NUSD by combining non-performing assets with USDT.

- Flash swap for NOAH: Easily swap NUSD for NOAH.

Use of NOAH tokens:

- Regular staking and liquidity staking: Staking NOAH on the Noahswap platform, where higher staking amounts result in higher user earnings. Staking NOAH also provides liquidity for NOAH trading on the PancakeSwap platform, with liquidity staking currently yielding 10 percentage points higher than regular staking.

- Payment method: NOAH can be used as a payment method for platform fees.

- Listing voting: NOAH holders can earn veNOAH voting power by staking NOAH.

- Trading demand: Project parties and investors can obtain liquidity and earnings through NOAH tokens.

Use of minted USDT:

- 70% for buyback and burn: Purchasing NOAH tokens and burning them in the market to increase scarcity and drive up prices.

- 20% as staking rewards: Rewarding users for the income generated from staking NOAH tokens to increase participation.

- 10% for market operations: Incentivizing market promotion, operations, and maintenance to ensure the platform's continuous development.

3.2.4 Token Model Summary and Evaluation

The allocation of USDT for minting plays a central role in the economic model of NOAH tokens and will provide significant income advantages for investors. The 70% USDT allocated for minting will be used for buyback and burning of NOAH tokens to ensure their continuous increase, significantly increasing the potential return on investment for investors.

3.3 Noahswap Competitive Landscape Analysis

3.3.1 Overview of Industry Market Structure and Main Competitors

Noahswap holds a leading position in the decentralized finance field, with its innovative narrative track of "non-performing assets (NPA)" leading the industry in a new direction, drawing investors' attention to the overlooked asset value and bringing a fresh perspective to the market. However, the competitive market environment also presents challenges for Noahswap, such as the well-known decentralized trading platform Uniswap. Once the goal of surpassing Uniswap is achieved, Noahswap will occupy an important position in the DeFi ecosystem and bring new possibilities to the Asian cryptocurrency market.

3.3.2 Project Competitive Advantages and Uniqueness

The world's first crypto asset synthetic minting platform: By breaking free from traditional DeFi constraints through an innovative synthetic asset minting mechanism, Noahswap injects new vitality into the market and provides new financial tools.

Project disputes and investor trust issues: Noahswap's unique economic model and burning mechanism provide a third possibility for many DeFi projects, helping investors resolve disputes and recover some losses.

Burning USDT for NOAH's legendary rise: Real-time burning of USDT stabilizes the market and injects unlimited power into the future rise of NOAH, using real resources to drive up the price.

Aiming high, benchmarking Uniswap to build a traffic empire: Noahswap aims to become the Asian version of Uniswap, dedicated to creating an open, efficient, and secure decentralized trading platform, bringing new possibilities to the Asian cryptocurrency market.

Evergreen Sustainability: Upholding Noahswap's Three Core Values to Continuously Expand the Ecosystem

4.1 Core Issues Determining Value

- The unique business model of Noahswap. Noahswap's narrative track of non-performing assets (NPA) and its unique synthetic asset minting mechanism break free from traditional DeFi constraints, making it highly competitive and with growth potential in the decentralized finance field.

- The strong economic model of Noahswap. Noahswap's economic model is also unique. Through real-time burning of real resources, Noahswap not only stabilizes the market but also injects unlimited power into the future rise of NOAH, providing strong support for the project's long-term development.

- The ecosystem development of Noahswap. The entry of Noahswap's ecosystem partners will provide support and security for Noahswap's long-term development, continuously enhancing its competitiveness and market share for sustainable development.

4.2 Conclusion

Through research on Noahswap's business model, economic model, competitive landscape, and risk analysis, we can preliminarily assess the investment value and development potential of the Noahswap project. Noahswap has unique innovation and foresight, with broad prospects for future development, making it worthy of investor attention and participation.

V. Ultimate Goal: Benchmarking the Asian Version of Uniswap, Building a DeFi 2.0 Traffic Empire, the Future of Noahswap is Promising!

Noahswap's ambition is not limited to the field of non-performing assets but is also committed to creating the Asian market's version of Uniswap. With the mission of being a hub for traffic, Noahswap is dedicated to creating an open, efficient, and secure decentralized trading platform. This goal will position Noahswap as an important player in the DeFi ecosystem and open a new chapter for the Asian cryptocurrency market. In the wave of DeFi 2.0 revolution, Noahswap is not just a witness but a leader in the industry. With innovative technology, a strong economic model, and a forward-looking strategic vision, Noahswap will inject new vitality and opportunities into the DeFi industry.

From the perspective of development strategy and current layout, Noahswap has strong competitiveness in its innovative non-performing asset minting track. The next challenge lies in expanding its business, attracting more oversold token projects to join the minting options, and improving customer acquisition capabilities. Whether through the team's own efforts or by drawing on the successful case of Uniswap, Noahswap's development status will be a touchstone for testing the team's actual operational capabilities.

In terms of valuation, now is an ideal time to purchase NOAH tokens. If larger oversold projects can be introduced, Noahswap's staking business will significantly improve, and NOAH tokens will undoubtedly attract the attention of investors.

This report mainly references the official website, whitepaper, contract code, and other relevant materials of the Noahswap project. It also refers to professional reports and research within the industry, including industry reports in the DeFi field and the development trends of decentralized exchanges, to more accurately assess the investment value and development potential of the Noahswap project.

Reference Links:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。